Overview

In today’s rapidly evolving financial landscape, the choice between ESB (Enterprise Service Bus) and SOA (Service-Oriented Architecture) is crucial for banking IT managers. We understand that integration challenges are at the forefront of your operational needs. While ESB centralizes communication and streamlines message routing, SOA provides a decentralized framework that enhances flexibility and adaptability. This distinction is vital as we guide you in selecting the architecture that best aligns with your institution’s objectives.

What’s holding your team back from achieving seamless integration? By leveraging ESB, you can benefit from efficient message handling and improved communication across systems. Conversely, SOA empowers your organization to adapt swiftly to changing demands, ensuring that your infrastructure remains resilient in the face of industry shifts.

Ultimately, we are here to support you in navigating these complex choices. Understanding the strengths of each architecture will enable you to make informed decisions that drive operational efficiency. Let us partner with you in this journey, ensuring that your banking institution is equipped to thrive in an increasingly interconnected world.

Introduction

In the rapidly evolving landscape of banking technology, we recognize that the integration of legacy systems with modern applications poses a formidable challenge for IT managers. At the heart of this transformation lie two pivotal concepts: Enterprise Service Bus (ESB) and Service-Oriented Architecture (SOA). While both frameworks aim to enhance system interoperability and streamline communication, they offer distinct approaches that can significantly impact operational efficiency.

Understanding the nuances between ESB and SOA is essential for us as banking professionals seeking to harness the power of digital transformation, optimize service delivery, and navigate the complexities of our integration environments. This article delves into the core definitions, contrasts, and suitability of these architectural models, providing valuable insights for those of us at the forefront of banking IT.

Define ESB and SOA: Core Concepts for Banking IT Managers

The ESB SOA architecture serves as a pivotal architectural pattern that enables seamless communication among diverse applications via a centralized bus. This approach not only facilitates efficient message routing but also supports data transformation and protocol conversion, ensuring smooth interactions between various systems.

Furthermore, the ESB SOA architecture represents a design model that advocates for the use of loosely connected components, thereby promoting interoperability among applications. By emphasizing the development of reusable functionalities that are accessible over a network, SOA significantly enhances flexibility and scalability in application development.

For us, as banking IT managers, understanding these definitions is essential as we confront the challenges of integrating legacy systems with modern applications. This knowledge ultimately propels our digital transformation initiatives, positioning us to thrive in an ever-evolving technological landscape.

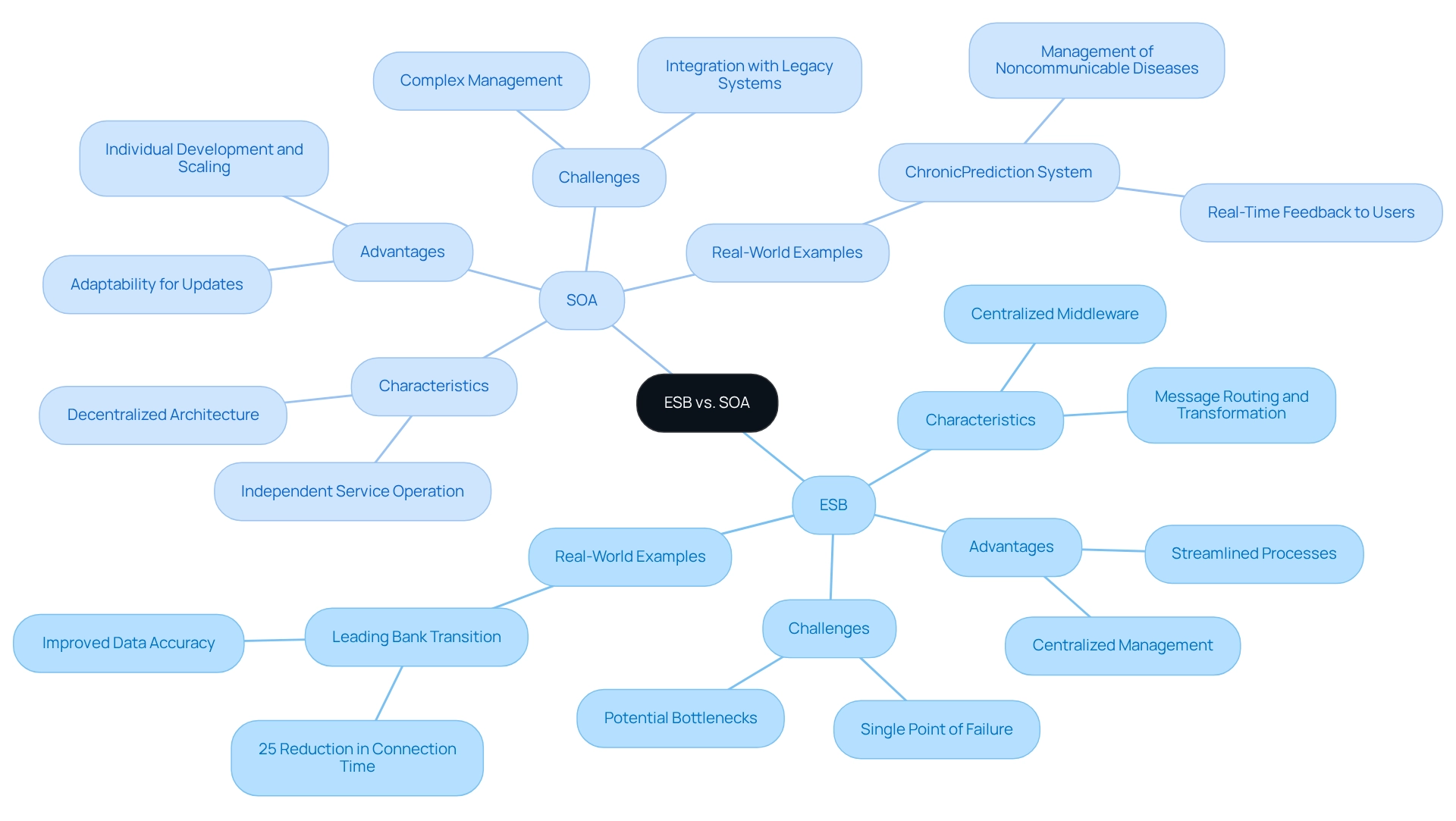

Contrast ESB and SOA: Key Differences and Similarities

While we recognize that both the ESB SOA architecture and SOA aim to enhance connectivity and interoperability, their approaches differ significantly. The ESB SOA architecture functions as a middleware layer that centralizes communication between systems, facilitating message routing and transformation. This centralized model can simplify unification processes, yet it may also create a single point of failure, raising concerns about reliability. In contrast, SOA promotes a decentralized architecture where services operate independently, allowing for individual development, deployment, and scaling. This adaptability enables simpler updates and changes, although it may introduce more complex management challenges.

Despite these differences, both architectures share the common goal of improving system unification and can be effectively combined in a hybrid approach. This is especially pertinent in the banking sector, where organizations frequently navigate a blend of legacy and modern systems. For instance, integrating ESB within a SOA framework can harness the strengths of both models, empowering financial institutions to enhance operational efficiency while mitigating risks associated with outdated technologies. Statistics indicate that the ESB SOA architecture is crucial for transferring information within a Service-Oriented Architecture (SOA), underscoring its importance in achieving seamless unification. Furthermore, expert opinions suggest that while ESB offers advantages such as centralized management and streamlined processes, it also presents challenges, including potential bottlenecks and failure rates linked to centralized models. Conversely, SOA’s decentralized nature can alleviate these risks but may introduce complexities in service management.

Real-world examples from financial institutions illustrate the practical applications of both ESB and SOA connection strategies. For example, a leading bank’s transition to an ESB framework resulted in a 25% reduction in connection time and improved data accuracy across systems. Ultimately, understanding the key differences and similarities between ESB and SOA, along with leveraging our dedicated hybrid connection platform—which provides robust data transformation capabilities and seamless connectivity—is essential for banking IT managers striving to navigate the complexities of modern connectivity landscapes.

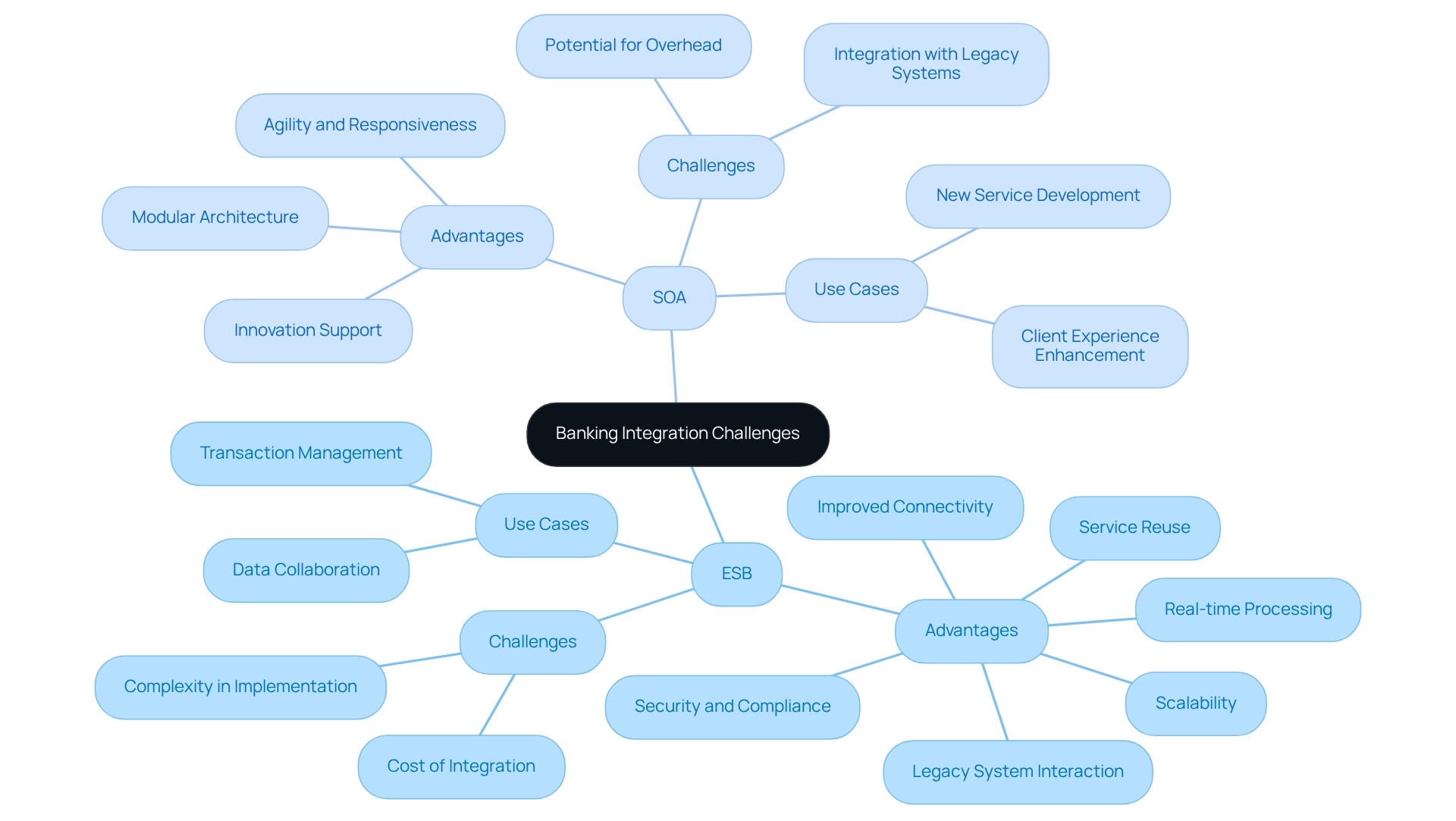

Evaluate ESB and SOA: Suitability for Banking Integration Challenges

In the banking sector, the decision between using ESB SOA architecture poses unique challenges, particularly regarding connectivity. We recognize that the ESB SOA architecture excels in environments demanding swift unification of legacy systems, allowing for rapid connections between disparate applications without extensive reconfiguration. Its robust capabilities in complex message routing and transformation make it particularly effective for real-time processing tasks, such as transaction management, where speed and accuracy are critical.

Conversely, SOA provides significant advantages for banks aiming to innovate and adapt to evolving market demands. Its modular architecture supports the development of new services that can seamlessly integrate with existing systems, fostering agility and responsiveness. This adaptability is crucial in an environment where operational efficiency and client experience are paramount.

Statistics indicate that effective data collaboration in banking can lead to operational cost reductions of 15-28%, underscoring the importance of selecting the appropriate unification method. Expert insights highlight that solutions based on ESB SOA architecture offer improved connectivity capabilities, scalability, security, and compliance, making them suitable for intricate banking environments. Ultimately, the choice between ESB SOA architecture and other solutions should align with our operational needs, regulatory factors, and long-term digital transformation goals. By thoroughly assessing these elements, we can make informed decisions that foster innovation and enhance service delivery. Our services, including enterprise architecture, project management, and technical analysis, position us as a skilled partner in navigating these integration challenges.

Conclusion

Navigating the complexities of digital transformation requires a profound understanding of the differences and applications of Enterprise Service Bus (ESB) and Service-Oriented Architecture (SOA). We recognize that ESB acts as a centralized middleware solution, facilitating communication between diverse applications while streamlining message routing and data transformation. Conversely, SOA advocates for a decentralized approach with loosely coupled services, enhancing both flexibility and scalability. Although both frameworks aim to improve system interoperability, their distinct methodologies present unique advantages and challenges.

Integrating ESB and SOA offers a hybrid solution that leverages the strengths of both models, enabling us to effectively address the integration of legacy systems with modern applications. Real-world examples illustrate that adopting ESB can lead to significant reductions in integration time and improved data accuracy, while SOA’s modular architecture fosters innovation and responsiveness in a rapidly changing market.

Ultimately, our decision to implement ESB, SOA, or a combination of both should be guided by the specific operational needs and regulatory requirements of our banking institution. By making informed choices, we can enhance operational efficiency, drive innovation, and improve service delivery in an increasingly competitive environment. Embracing these architectural models is a pivotal step towards achieving successful digital transformation in the banking sector.