Overview

We recognize that digital banking infrastructure is increasingly viewed as superior to traditional banking systems. This shift is driven by:

- Enhanced efficiency

- Lower operational costs

- Improved customer experiences through automation and real-time data access

Furthermore, the rapid growth of mobile financial services underscores the advantages of digital solutions, which cater to modern consumer demands for convenience and speed. In contrast, conventional banks often present slower, more costly processes.

What’s holding your team back from embracing this transformation?

Introduction

As we witness a seismic shift in the financial landscape, the evolution from traditional banking systems to digital banking infrastructure is fundamentally reshaping how we, as consumers and businesses, interact with our finances. This transformation, driven by technological advancements such as automation, cloud computing, and API integration, promises not only enhanced customer experiences but also significant operational efficiencies.

With the global mobile payment market projected to soar and a growing reliance on digital solutions, understanding the strengths and weaknesses of both banking models has never been more crucial. In this article, we will delve into the defining characteristics of digital and traditional banking systems, their operational frameworks, the pros and cons of each, and the scenarios in which one may be favored over the other, all while highlighting the pivotal role of innovation in navigating the future of banking.

Defining Digital Banking Infrastructure and Traditional Banking Systems

Digital banking infrastructure represents a transformative leap, encompassing a diverse array of technologies and platforms that empower us to offer solutions online through automation, APIs, and cloud computing. This modern framework enables rapid feature deployment and significantly enhances customer experiences. In stark contrast, conventional financial systems remain tethered to physical branches and outdated technologies, leading to slower service delivery and increased operational costs.

The shift towards online banking signals a broader modernization trend within the financial sector, where flexibility and efficiency are paramount. Recent statistics reveal that the global volume of mobile payment transactions is projected to exceed USD 13 trillion by 2025, underscoring our increasing reliance on electronic solutions. Furthermore, a significant 84% of the overall fraud reported in FY24 stemmed from loans, highlighting the urgent need for robust online security measures to protect against vulnerabilities in the digital landscape.

At Avato, we play a pivotal role in this transformation with our dedicated hybrid integration platform, which simplifies the integration of disparate systems and enhances business value. Our platform’s features, including seamless API integration and real-time data processing, are essential for banks aiming to modernize their operations. Experts agree that successfully incorporating new technologies will be crucial for establishing a competitive edge in online finance. As financial author Adam McCann states, “electronic finance encompasses overseeing financial accounts through computers and mobile devices linked to the internet.” This statement reflects the shifting consumer behavior towards online platforms and the imperative for banks to adapt.

Moreover, the biometric ATM market is anticipated to grow from USD 36.3 billion in 2023 to USD 46.7 billion by 2032, illustrating the technological advancements reshaping financial services. Case studies consistently demonstrate the advantages of online financial services, which include enhanced security, convenience, and competitive rates, leading to a marked preference for electronic solutions among consumers. For instance, financial institutions that have implemented Avato’s hybrid integration platform have reported substantial reductions in operational expenses alongside improved customer satisfaction. By 2025, a significant number of financial institutions are expected to adopt electronic transaction technologies, further diminishing the role of traditional systems. The impact of cloud computing on conventional finance is profound; it empowers institutions to optimize operations and enhance service delivery, ultimately fostering a more agile financial environment through digital banking infrastructure. However, conventional financial systems grapple with challenges such as high operational costs and sluggish service delivery, which digital financial solutions adeptly address.

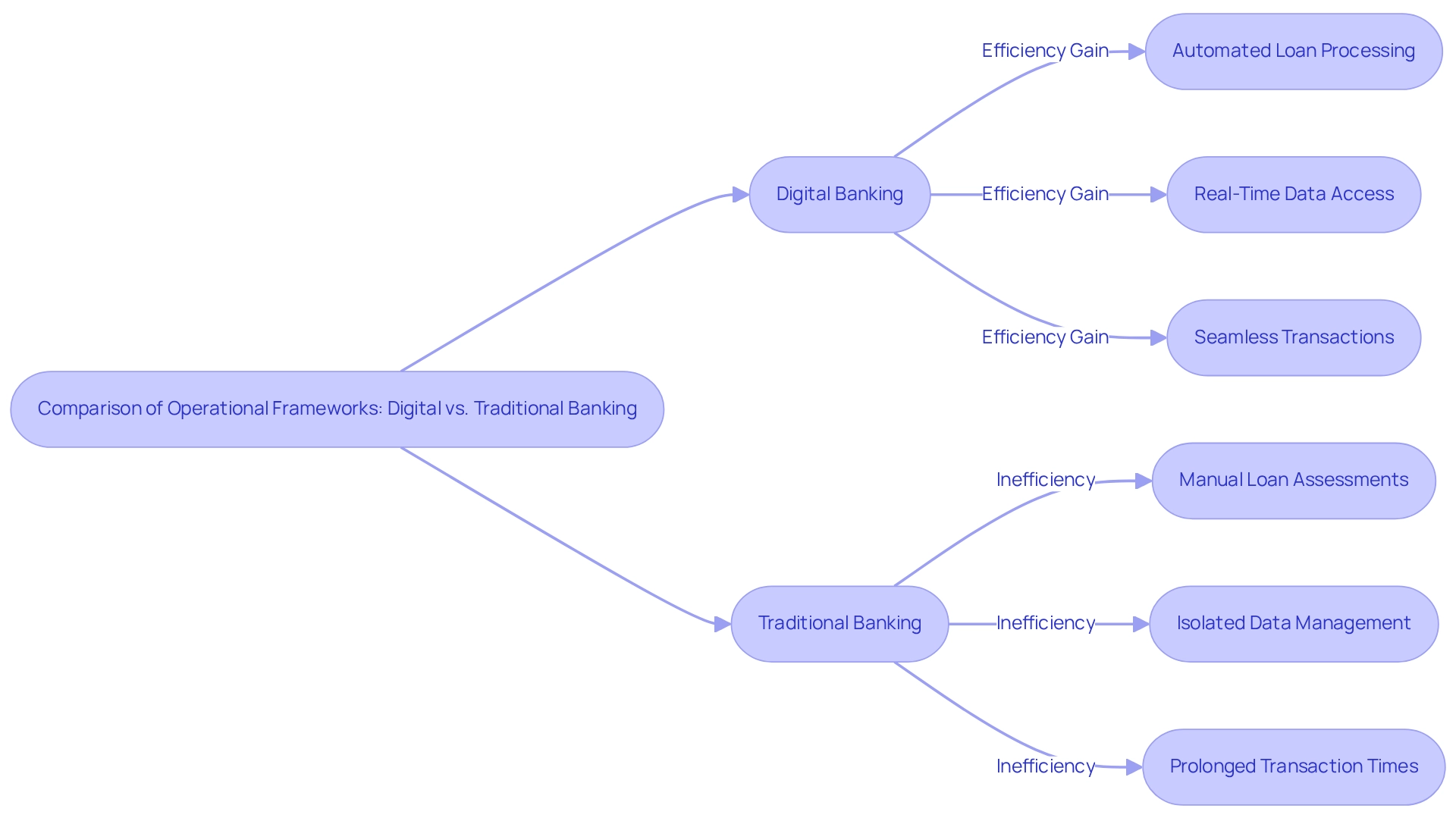

Operational Frameworks: How Digital and Traditional Banking Systems Function

Digital banking infrastructure is built on frameworks that prioritize automation and integration, enabling seamless transactions and real-time data access. By leveraging our Hybrid Integration Platform, we enhance scalability and significantly reduce operational costs while ensuring secure and efficient integration of digital banking infrastructure. In contrast, traditional financial systems often depend on manual processes and isolated data, leading to inefficiencies and prolonged transaction times. For example, we can process a loan request in just minutes through automated processes, whereas a conventional financial entity may take several days due to manual assessments and extensive documentation.

The shift towards online finance is underscored by the remarkable growth in the sector, with the mobile financial market size reaching $6.8 billion in 2021, marking an 88% increase from the previous year, largely driven by the pandemic. Additionally, as digital-only financial institutions like NuBank gain momentum—boasting over 56 million account holders—their digital banking infrastructure demonstrates a clear advantage in transaction efficiency. NuBank’s ability to streamline processes through automation exemplifies how online financial institutions can meet consumer demands for convenience, as 87% of consumers prioritize convenience over security in financial services.

Experts in financial technology assert that automation is a crucial component for modern finance within the digital banking infrastructure, not just a passing trend. As the sector evolves, we anticipate that the typical transaction processing time for online institutions will be significantly shorter than that of conventional institutions by 2025, highlighting the vital role of automation in enhancing customer experience and operational efficiency. Furthermore, the biometric ATM market is projected to grow from USD 36.3 billion in 2023 to USD 46.7 billion by 2032, reflecting a broader trend towards technological advancements in finance that strengthen digital banking infrastructure.

The investment sector is also expected to expand at a 13% CAGR, driven by innovations in digital finance and the strategic deployment of hybrid integration platforms like ours, showcasing the transformative impact of digital banking infrastructure. This growth further emphasizes the necessity for financial institutions to embrace automation to remain competitive and meet evolving consumer expectations. To prepare for open finance, we encourage financial institutions to utilize existing systems and consider integration strategies that enhance their capabilities while ensuring compliance with security protocols.

Pros and Cons: Evaluating the Strengths and Weaknesses of Each System

Digital banking infrastructure presents significant advantages, particularly in terms of reduced operational expenses and enhanced customer experiences. With the ability to swiftly adapt to market demands, we can provide personalized services that resonate with 80% of consumers who prefer customized financial experiences. Our hybrid integration platform, supporting 12 levels of interface maturity, empowers digital banks to leverage technology effectively, thereby enhancing both customer experiences and operational efficiency. Designed for secure transactions, this platform stands as a reliable choice for sectors such as finance, healthcare, and government, where 24/7 availability is crucial.

In contrast, traditional financial systems often evoke a sense of security and trust, especially among older generations. However, they typically come with higher fees and slower service. For instance, while many online banks offer no-fee accounts, traditional banks often impose fees for account maintenance and transactions, which can deter budget-conscious clients.

Nevertheless, we recognize the personal touch associated with conventional finance. Many customers value face-to-face interactions and the reassurance provided by established institutions. As online finance continues to evolve, we must acknowledge both its strengths and weaknesses. While digital banks may lack the personal connection that some customers cherish, they excel in efficiency and accessibility.

Expert insights underline that the ability to rapidly adapt to changing consumer needs and regulatory standards within the digital banking infrastructure will distinguish leaders from followers in the online financial services sector. As William Blake once stated, ‘What is now demonstrated was once merely envisioned,’ underscoring the transformative potential of innovation in finance. With customer satisfaction ratings increasingly favoring digital financial institutions, the ongoing evolution of digital banking infrastructure—including the use of analytics and integrated survey features to enhance offerings—will likely continue to reshape customer experiences. This evolution makes it imperative for traditional banks to innovate and improve their services, drawing on insights from our expertise in hybrid integration.

Suitability and Use Cases: When to Choose Digital Banking Infrastructure or Traditional Systems

Digital financial systems are revolutionizing the way tech-savvy clients and enterprises conduct transactions, offering quick, effective services with 24/7 access. This model resonates particularly with startups and younger demographics, who prioritize convenience and cost-effectiveness. For instance, applications like Chase Mobile and Alipay exemplify the shift towards online finance, showcasing features that meet user needs and highlighting the growing trend of digital solutions in the financial sector.

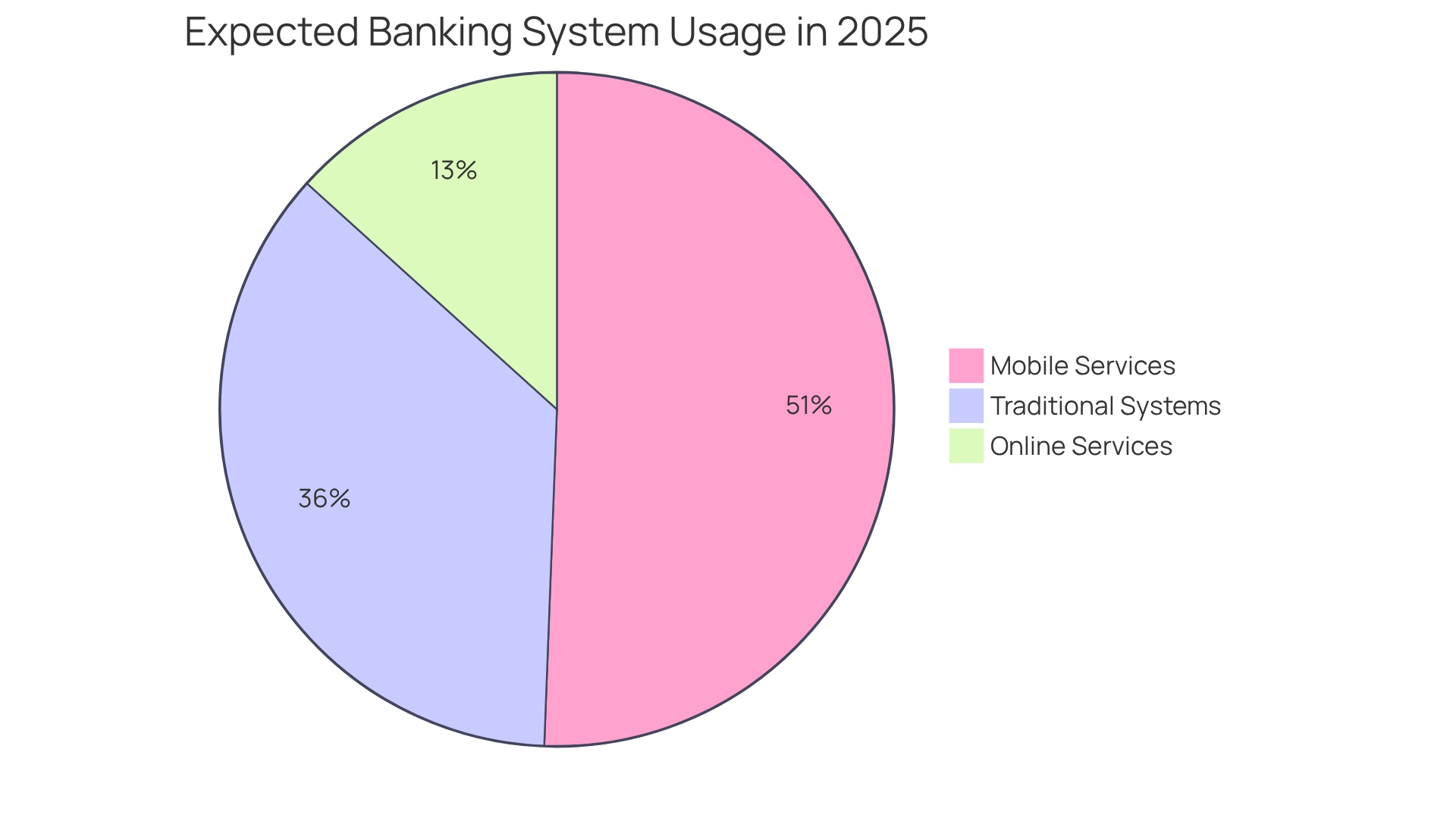

However, traditional financial systems still hold value for individuals and enterprises that appreciate personal interactions and established relationships with their financial institutions. Small businesses seeking loans often prefer traditional banks due to the tailored assistance and trust built over time. Looking ahead to 2025, as electronic finance continues to evolve, we anticipate that:

- 13.3% of Native American or Alaska Native individuals will primarily use online services

- 50.6% will utilize mobile services

This indicates a significant demographic shift towards electronic solutions.

Furthermore, the advantages of digital banking infrastructure—such as enhanced security and competitive rates—are driving its increasing popularity, making it an essential service for managing finances. Case studies reveal that startups leveraging digital banking infrastructure can achieve operational efficiencies and cost savings, reinforcing the suitability of this approach in today’s financial landscape. Notably, advancements in AI are projected to save the financial sector approximately US$1 trillion by 2030, underscoring the efficiency and cost-effectiveness of online financial solutions. As generative AI becomes more integrated into financial services, it enhances customer experiences through sophisticated chatbots and streamlines operations via document processing. This showcases our commitment to transforming digital banking infrastructure and integrating hybrid solutions for legacy systems in regulated industries.

As Steve Jobs aptly stated, “You can’t just ask customers what they want and then try to give that to them. By the time you get it built, they’ll want something new,” emphasizing the need for continuous innovation to meet customer demands. This perspective is particularly relevant as we adapt to the challenges of a rapidly changing digital environment.

Conclusion

The transition from traditional banking systems to digital banking infrastructure represents a pivotal moment in the financial landscape. Digital banking, characterized by automation, seamless integration, and enhanced customer experiences, offers clear advantages over its traditional counterpart, which often grapples with inefficiencies and elevated operational costs. The rapid growth of mobile payment transactions and the increasing demand for online banking solutions underscore the necessity for us to adapt to evolving consumer expectations.

However, we must balance the strengths of digital banking with the enduring trust and personal touch that traditional banks provide. While digital platforms excel in efficiency and convenience, traditional banking systems still hold significant value for those who prioritize face-to-face interactions and established relationships. This duality indicates that both models have their place in the financial ecosystem, catering to diverse consumer needs and preferences.

As innovation continues to shape the future of banking, it is imperative for us to embrace technological advancements and leverage hybrid integration solutions to enhance our service offerings. Insights from Avato’s hybrid integration platform illustrate the potential for us to modernize operations, improve customer satisfaction, and remain competitive in a rapidly changing environment. Ultimately, the choice between digital and traditional banking will depend on individual needs, but the trend toward digital solutions is clear and will likely dominate the financial landscape in the years to come.