Overview

We recognize the critical need for financial institutions to create an ISO 20022 adoption map to facilitate a seamless transition to this new messaging standard. This strategic move not only enhances data quality but also significantly boosts operational efficiency. Our structured approach involves:

- A thorough evaluation of existing systems

- Active engagement with stakeholders

- The implementation of a phased strategy

Furthermore, we leverage Avato’s integration solutions to effectively address challenges and ensure compliance during this transition. By partnering with us, you can navigate this complex landscape with confidence and clarity.

Introduction

As we stand on the brink of a significant transformation in the banking industry, the adoption of ISO 20022 emerges as a pivotal development in financial messaging. This international standard promises to enhance data exchange, improve transaction accuracy, and ensure compliance with regulatory frameworks. However, what challenges lie ahead? We must navigate:

- Legacy systems

- Staff training

- The urgency of implementation

With Avato’s hybrid integration platform offering us a strategic advantage, we have the opportunity to streamline our operations and embrace this new standard effectively. This article delves into the importance of ISO 20022, outlines the steps necessary for a successful transition, and highlights best practices for banks to thrive in an evolving payments landscape.

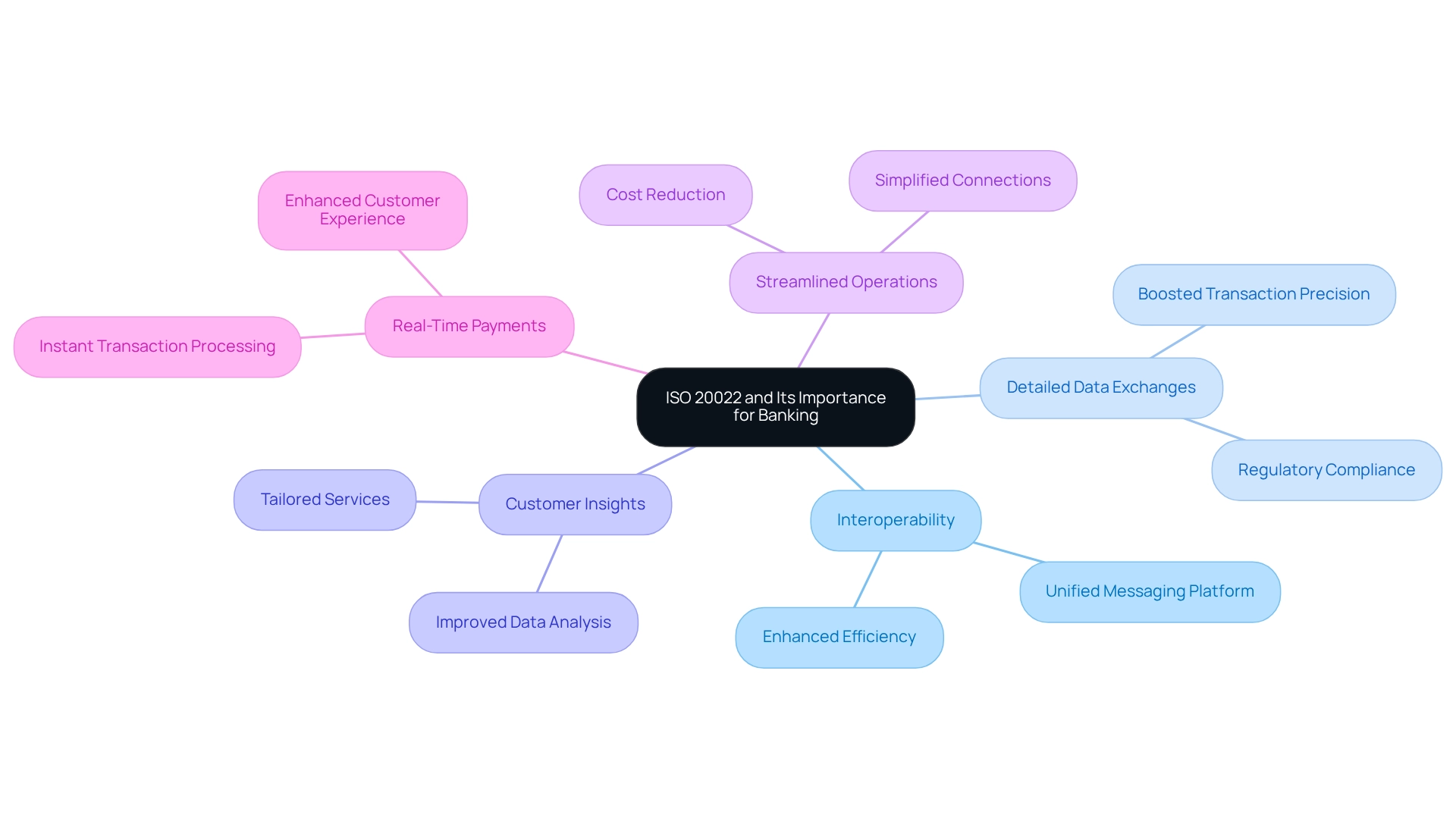

Understand ISO 20022 and Its Importance for Banking

ISO serves as a pivotal international standard for electronic data interchange among financial institutions. It establishes a unified platform for crafting messages applicable across diverse financial services, thereby enhancing interoperability and efficiency. The true significance of the ISO 20022 adoption map lies in its ability to facilitate more detailed data exchanges, which in turn boosts transaction precision and ensures compliance with regulatory standards. For us, the ISO 20022 adoption map translates into improved customer insights, streamlined operations, and enhanced capabilities for real-time payments.

As we navigate this transition, Avato’s hybrid unification platform emerges as a crucial ally, maximizing and extending the value of our legacy systems while simplifying complex connections and significantly reducing costs. What challenges might your team face in this journey? As the industry moves towards this standard, leveraging Avato’s solutions as part of the ISO 20022 adoption map guarantees a seamless implementation process. It is essential for Banking IT Managers to grasp both the framework of ISO and the strategic advantages provided by our platform. Together, we can transform the complexities of financial data interchange into streamlined operations that drive success.

Prepare Your Bank for ISO 20022 Transition

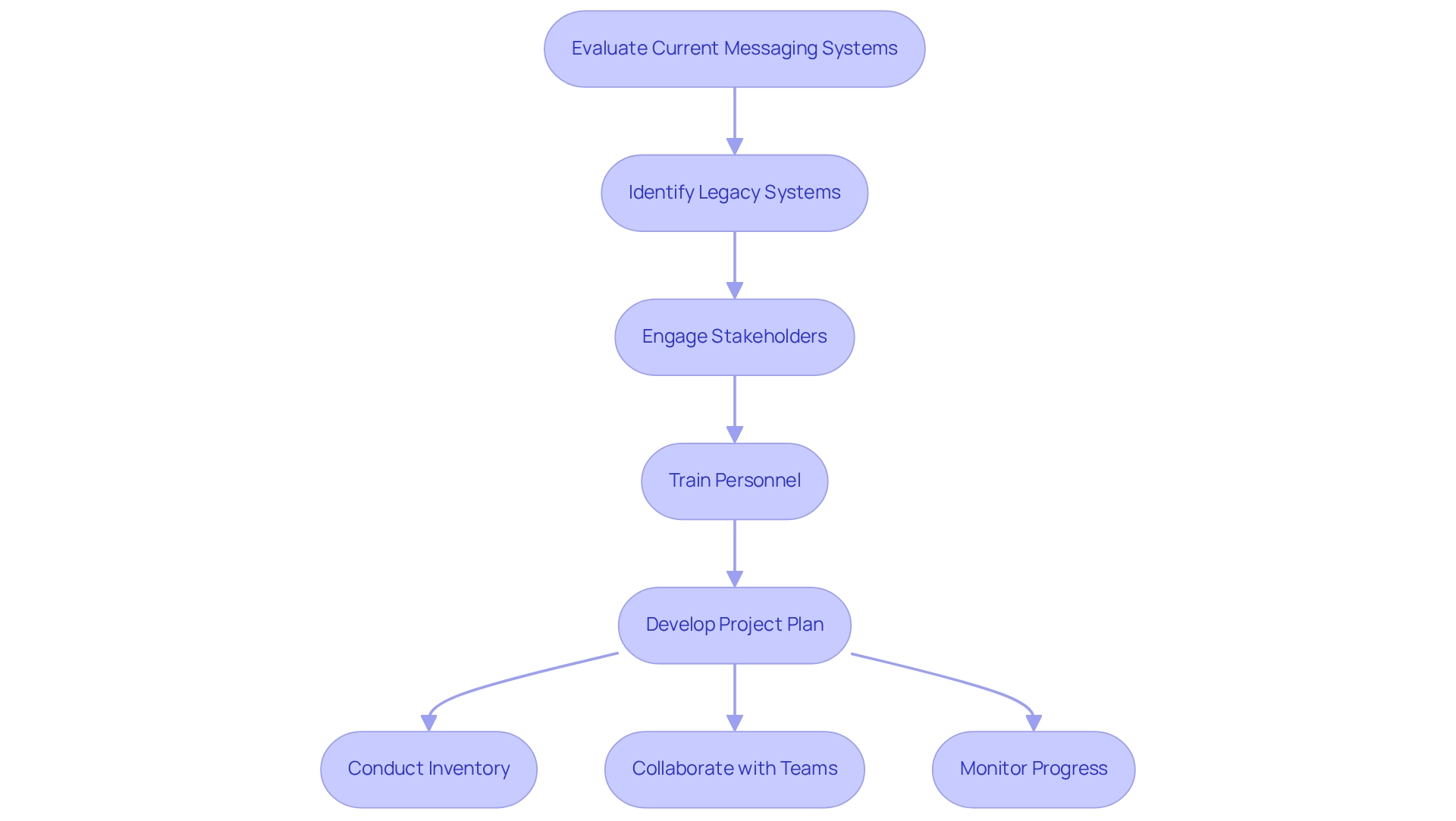

To successfully navigate the ISO transition, we must first conduct a thorough evaluation of our current messaging systems and processes. This crucial step involves identifying legacy systems that require upgrades or replacements to comply with the new standards. Engaging stakeholders from various departments is essential for ensuring alignment on objectives and timelines, fostering a collaborative approach to this significant transition. By collaborating with Avato’s integration solution provider, we can develop a comprehensive plan that aligns with our institution’s goals and the evolving needs of our customers.

Training our personnel on the ISO standard is imperative, as it equips them with the knowledge needed to manage changes and adapt to new workflows seamlessly. Furthermore, developing a detailed project plan is vital; this plan should outline key milestones, resource allocation, and risk management strategies to proactively tackle potential challenges during the transition. Incorporating feedback from various teams into our training programs will effectively address these challenges, ensuring that all staff are well-prepared for the transition. As financial institutions prepare for this pivotal shift, we must recognize that utilizing the ISO 20022 adoption map can enhance effective data processing during the ISO 20022 transition, yielding substantial cost savings by reducing processing costs and minimizing manual touchpoints. Meticulous planning and implementation are critical given the complexities introduced by the new messaging protocols and data points, which present unique challenges for our institutions.

To enhance our evaluation and planning process, we should consider the following best practices:

- Conduct a detailed inventory of existing systems and identify gaps

- Collaborate with cross-functional teams to gather insights

- Utilize Avato’s hybrid connection platform to streamline unification efforts

- Establish clear communication channels for ongoing updates

- Monitor progress against the project plan regularly

Case studies from organizations such as OSME Pacific and BC Provincial Health Services Authority illustrate the effectiveness of a structured approach in managing complex projects related to ISO standards. These organizations have successfully navigated similar transitions, underscoring the importance of timely execution and adherence to budget constraints. As Gustavo Estrada noted, ‘Avato has simplified complex projects and delivered results within desired time frames and budget constraints,’ highlighting the value of a well-planned transition. By following these steps and leveraging Avato’s hybrid integration platform, we can ensure a seamless and effective transition to ISO compliance.

Create Your ISO 20022 Adoption Map

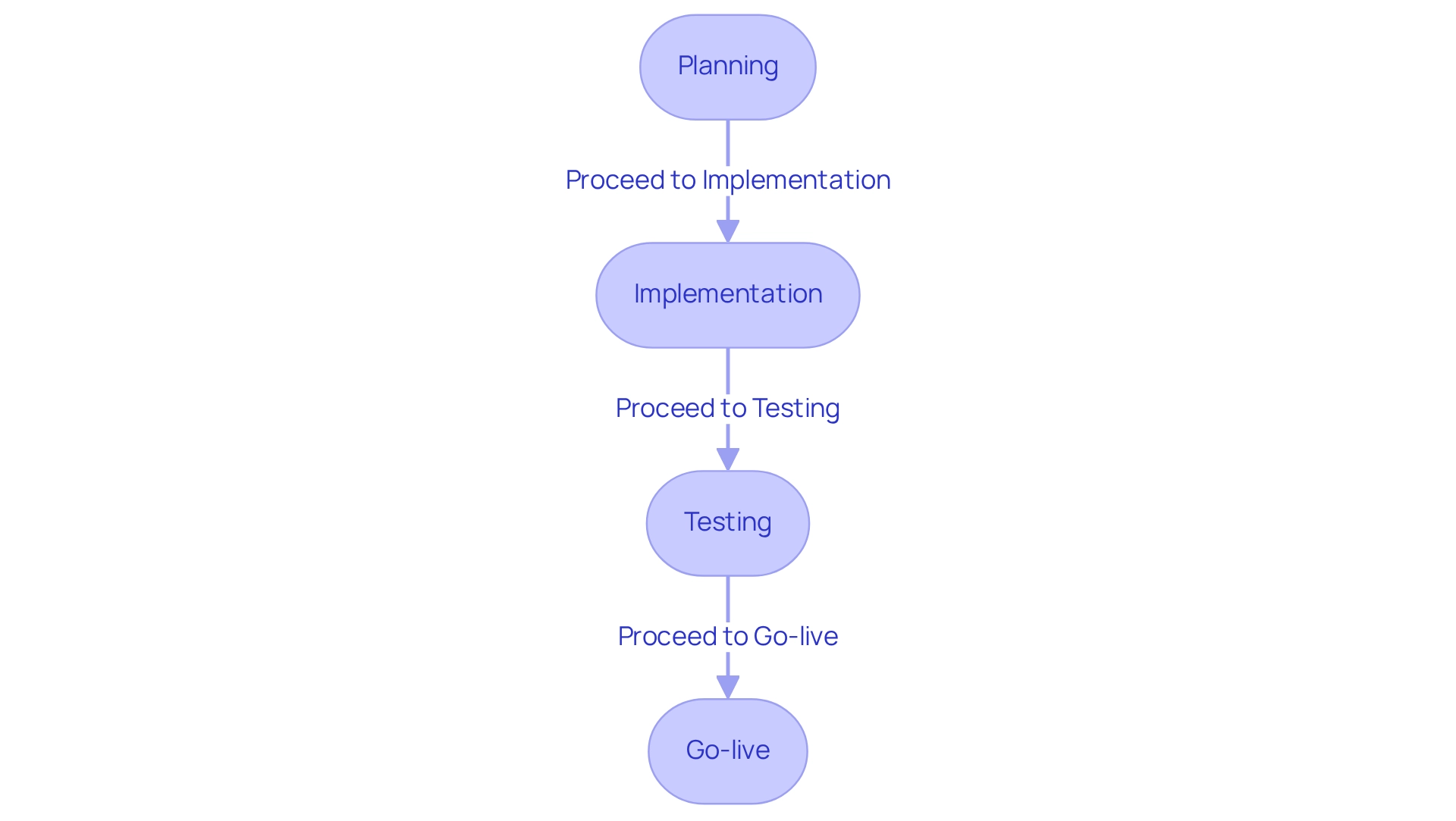

Developing an ISO 20022 adoption map is essential for financial institutions aiming to transition seamlessly to this new financial messaging standard. We begin by evaluating the current state of our messaging systems to identify existing gaps that require our attention. Next, we articulate the desired future state, detailing the functionalities and capabilities that ISO will enable, such as improved data quality and enhanced payment processing.

We establish a comprehensive timeline for the transition, dividing it into distinct phases:

- Planning

- Implementation

- Testing

- Go-live

Each phase outlines specific tasks, assigns responsible parties, and sets clear deadlines. A recent survey conducted by Celent revealed that only 63% of financial institutions worldwide are ready for the ISO rollout, underscoring the urgency of a well-defined strategy and the significant challenges many organizations face in meeting the deadline.

As Swift notes, “With the new standard used in over 70 countries, and forecast to be used in 80% of clearing and settlement of high-value payments by 2025, financial institutions have given Swift the mandate to facilitate the move to this new language of payments.” This highlights the global importance of the transition and the necessity for us to act swiftly.

We regularly review and adjust our adoption roadmap to accommodate any changes in project scope or timelines. This iterative approach not only ensures alignment with evolving business needs but also mitigates risks associated with the transition. By following these best practices, we can effectively navigate the complexities outlined in the ISO 20022 adoption map, positioning ourselves for success in an increasingly competitive payments landscape.

To convert unstructured information into a structured requirements model, we break down the information into simple binary statements. Each requirement can be framed as “The system must ____” with child requirements further refining the details. This organized method is crucial for efficient stakeholder involvement and guarantees all elements of the integration are considered.

Moreover, Avato’s Hybrid Connection Platform illustrates how we can streamline the unification of isolated legacy systems and fragmented data, enabling efficient modernization while minimizing downtime and ensuring 24/7 availability for critical connections. As Gareth Lodge cautioned, the 2025 deadline for ISO implementation is crucial and cannot be delayed indefinitely, making it essential for us to prioritize our transition efforts. To facilitate this process, engaging stakeholders and employing organized requirements management will be vital to ensuring that all facets of the incorporation are addressed effectively.

Obtain your copy now and discover how Avato can assist our shift to ISO format.

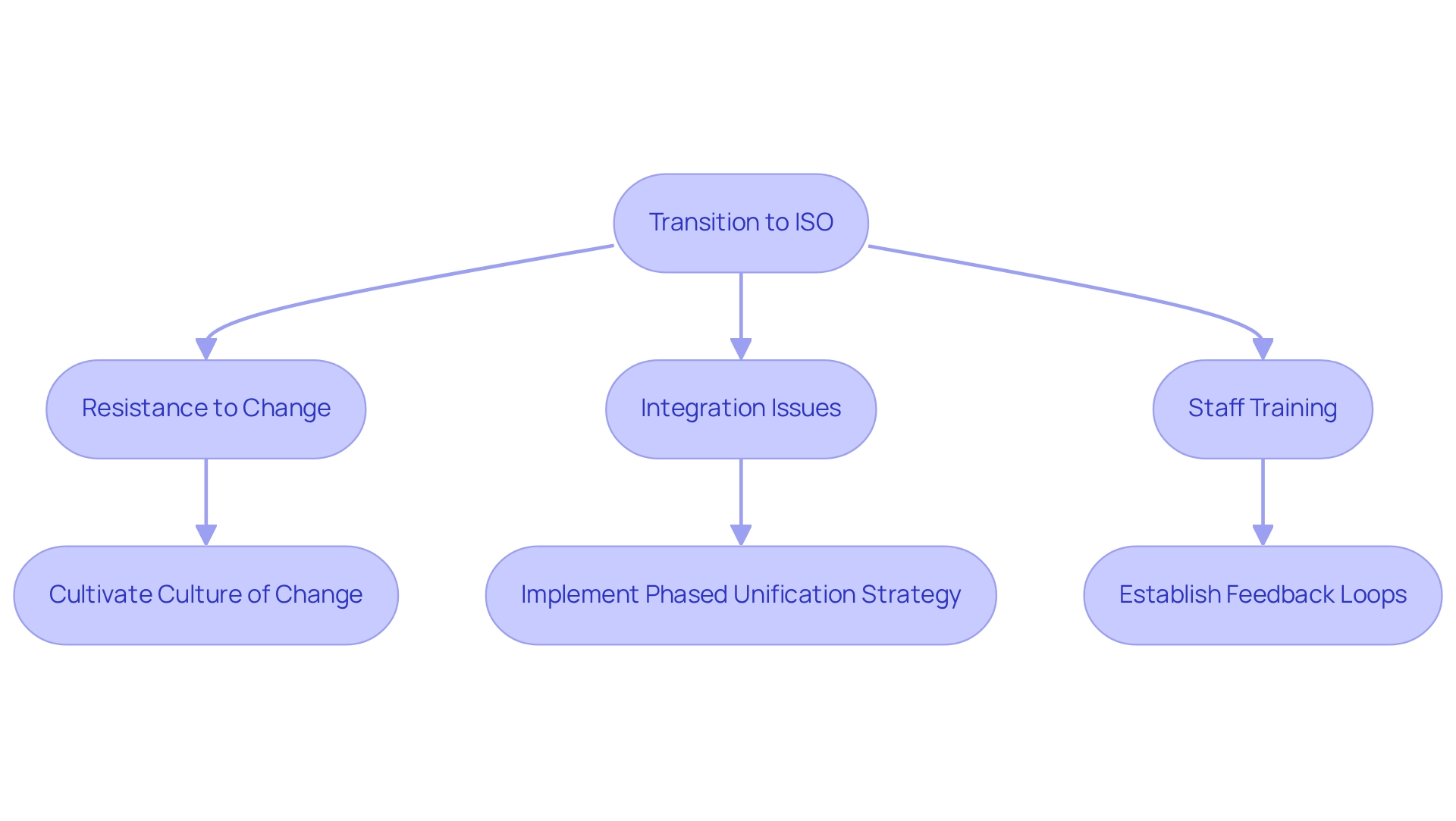

Address Challenges and Implement Solutions

The transition to ISO presents us with a multitude of challenges, particularly resistance to change, integration issues with legacy systems, and the necessity for thorough staff training. Notably, 70% of financial institutions in the US still regard payments as cost centers, which can impede the urgency required for this transition. To effectively navigate these hurdles, we must cultivate a culture of change by clearly communicating the advantages of ISO 20022 to all employees and stakeholders. Mahesh Kini, global head of cash management at Standard Chartered, emphasizes, “By combining the ISO programme with a payment platform uplift we generate a better set of features for our clients, internal operations and compliance teams.” This approach not only fosters buy-in but also aligns our organization towards a common goal.

Implementing a phased unification strategy is essential for mitigating risks associated with legacy systems. This gradual adjustment enables us to tackle consolidation challenges without overburdening our current infrastructure. Avato’s hybrid system streamlines these complex connections, offering a robust foundation that facilitates secure transactions and guarantees 24/7 availability—essential for our banking operations. Importantly, Avato supports 12 levels of interface maturity, allowing us to balance the speed of integration with the sophistication necessary to future-proof our technology stack. Moreover, investing in comprehensive training programs is crucial; equipping our staff with the skills to navigate the new system will enhance confidence and competence during the transition.

We must establish regular feedback loops and support mechanisms to address concerns as they arise. Change management experts assert that fostering a culture of innovation is vital for overcoming resistance to change. By considering payment systems as integral to our innovation strategies rather than separate technical enhancements, we can realize the full potential of ISO. The case study titled ‘The Importance of Innovation in Payment Systems’ highlights that despite recognizing the high costs of maintaining outdated technology, many banks fail to allocate funds for innovation in their IT budgets. This lack of investment stifles the potential benefits of the ISO 20022 adoption map. Successful modernization requires a shift in mindset, where innovation is prioritized in our IT budgets, ultimately leading to enhanced operational capabilities and compliance. Avato, whose name derives from the Hungarian word for ‘of dedication,’ stands ready to support this transformation, committed to architecting the technology foundation required to power rich, connected customer experiences.

Conclusion

The transition to ISO 20022 is not just a shift; it represents a pivotal moment for the banking industry, unlocking significant opportunities for enhanced data exchange, improved transaction accuracy, and regulatory compliance. As we navigate this increasingly competitive payments landscape, understanding the intricacies of this international standard is essential for financial institutions aiming to thrive. By leveraging Avato’s hybrid integration platform, we can adeptly tackle the complexities associated with legacy systems, streamlining our operations and ensuring a smoother transition.

Preparation is paramount for successful ISO 20022 adoption. We must:

- Assess our current systems

- Engage stakeholders

- Invest in staff training

to effectively address the challenges posed by this substantial shift. Developing a structured adoption map will help us identify gaps, set clear timelines, and ensure alignment with our institutional goals. By adhering to best practices and learning from the experiences of others, we can mitigate risks and position ourselves for success.

The urgency of implementing ISO 20022 cannot be overstated. As the deadline approaches, we must prioritize our transition efforts and foster a culture that embraces change and innovation. By viewing this transition not merely as a technical upgrade but as an opportunity to enhance our operational capabilities and customer experiences, we can unlock the full potential of ISO 20022. With Avato’s dedicated support, we are well-equipped to embark on this journey towards modernization and improved financial messaging.