Overview

Core modernization in banking is not just beneficial; it is essential for institutions striving to remain competitive in an increasingly digital landscape. Outdated technologies pose significant challenges, hindering operational efficiency and customer satisfaction. We recognize that adopting effective strategies—such as phased implementation and fintech collaborations—can mitigate the risks associated with modernization. Furthermore, these strategies enhance our operational capabilities and improve customer experiences, ultimately positioning us for long-term success.

What’s holding your team back from embracing this critical transformation? By integrating modern solutions, we can not only address current inefficiencies but also unlock new opportunities for growth. The value of a robust modernization strategy is clear: it empowers us to meet customer expectations and adapt to market demands effectively.

We invite you to take action. Let’s work together to navigate the complexities of core modernization, ensuring that your institution is equipped to thrive in the digital age. The time to act is now—embrace modernization and secure your competitive edge.

Introduction

In today’s fast-evolving banking landscape, the shift towards core modernization has transitioned from a strategic choice to an essential imperative. We recognize that legacy systems increasingly hinder operational efficiency and customer satisfaction, compelling us to adopt innovative technologies to stay competitive. The stakes are significant; outdated systems not only escalate operational costs but also expose us to security vulnerabilities and data management challenges.

As we strive to enhance customer experiences and streamline operations, the urgency for modernization becomes clear, with our investments in technology projected to rise significantly. This article delves into the necessity for modernization, effective implementation strategies, and the numerous benefits that modernized systems can deliver, ultimately positioning us for success in a digital-first world.

Recognize the Imperative for Core Modernization

Recognize the Imperative for Core Modernization

Core modernization has evolved from a strategic option into an essential requirement for banking institutions that seek to maintain competitiveness in today’s rapidly evolving digital landscape. Legacy technologies often hinder our operational efficiency, suppress innovation, and fail to meet customer expectations for seamless, real-time services. The urgency for advancement is underscored by the significant risks posed by outdated technology, including escalating operational costs, heightened security vulnerabilities, and the inability to effectively harness data. In fact, 69% of banking professionals identify perceived risks associated with migrating to newer technologies as a major barrier to deployment.

As we strive to improve customer experiences and streamline operations, the need for fundamental upgrades becomes increasingly evident. Investment trends indicate that global banking technology spending is projected to surpass $300 billion in 2023, with a substantial portion allocated to cloud migration and cybersecurity initiatives. Significantly, 41% of banks are incorporating sustainability elements into their fundamental frameworks, indicating a wider dedication to innovation and resilience. According to Gustavo Estrada from BC Provincial Health Services Authority, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” highlighting the importance of effective modernization strategies.

Avato’s hybrid integration platform is crafted to expedite secure integration for banking, healthcare, and government sectors, allowing us to connect legacy frameworks with contemporary expectations. Key features of our platform include:

- Seamless Integration: Connects disparate systems and data sources to create a unified operational framework.

- 24/7 Uptime: Ensures reliability and performance, critical for financial institutions.

- Scalability: Supports growth and adaptation to changing business needs.

- Security: Architected for secure transactions, protecting sensitive data.

We must prioritize advancement not only to survive but to thrive in an increasingly digital landscape, where agility and responsiveness are critical. Case studies show that organizations adopting core updates are better positioned to manage the complexities of the financial sector, ultimately resulting in improved operational capabilities and enhanced customer satisfaction. The surge in investment for core modernization banking, as highlighted by the case study on investment trends, demonstrates that a significant portion of technology budgets is directed towards cloud initiatives and cybersecurity. The way ahead is evident: updating our fundamental frameworks is not merely advantageous; it is essential for achievement in 2025 and beyond.

Implement Effective Strategies for Core System Modernization

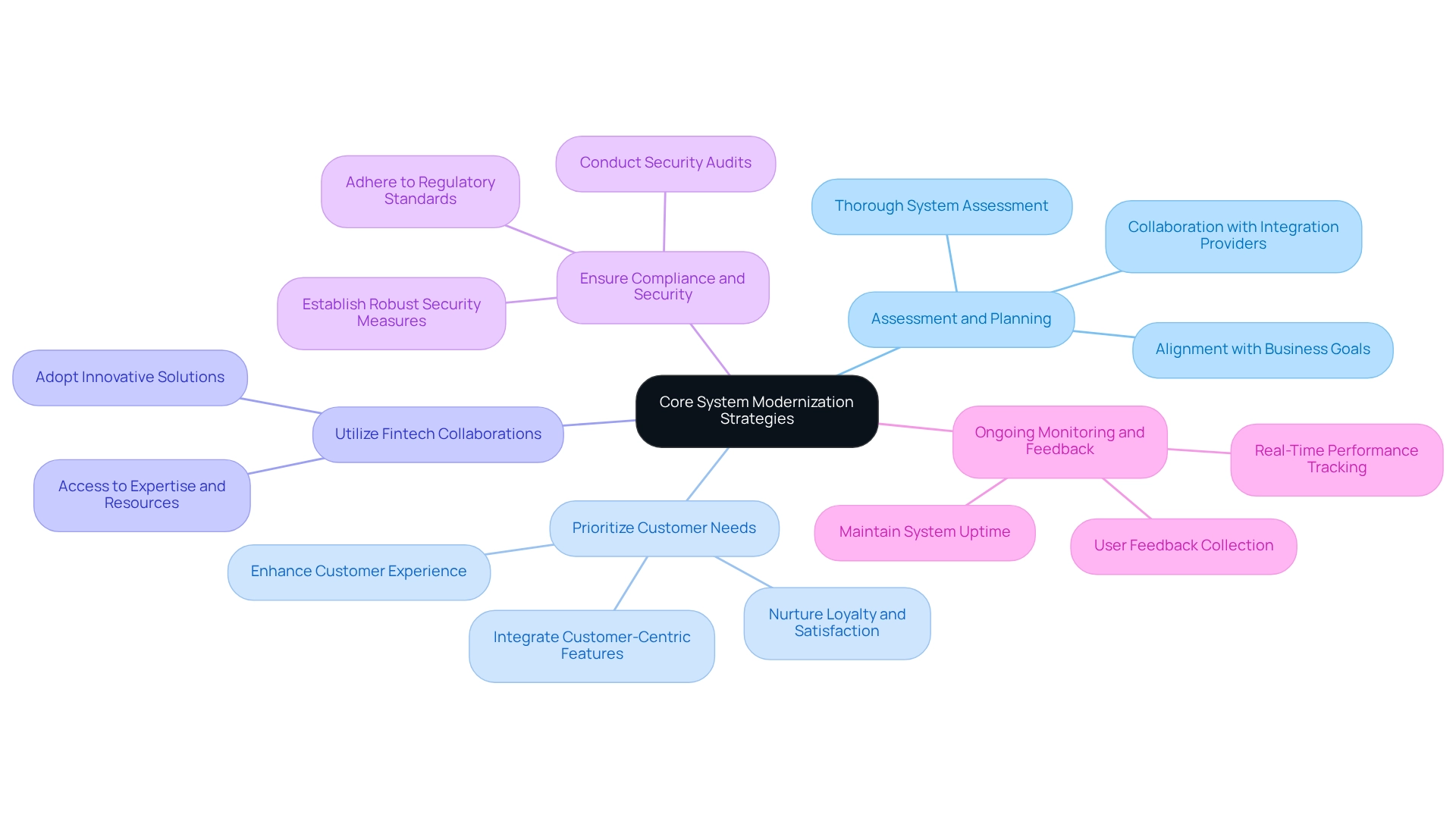

To effectively implement core modernization banking frameworks, we must adopt a phased approach that facilitates gradual updates while minimizing disruption. Our key strategies include:

- Assessment and Planning: We begin with a thorough assessment of our current systems to identify pain points and opportunities for enhancement. Collaborating with our integration solution provider, we create a meticulous upgrade plan that aligns with broad business goals and the evolving requirements of our customers.

- Prioritize Customer Needs: We enhance customer experiences by integrating features that cater to their evolving expectations. This customer-focused strategy guarantees that our improvement efforts yield concrete advantages, nurturing loyalty and satisfaction.

- Utilize Fintech Collaborations: We work together with fintech firms to adopt innovative solutions and technologies that can accelerate our improvement efforts. Such partnerships provide us access to valuable expertise and resources, enhancing our transformation process.

- Ensure Compliance and Security: As we modernize, it is essential to uphold adherence to regulatory standards and establish robust security measures to protect sensitive customer information. Our Hybrid Integration Platform emphasizes the importance of regulatory compliance and security audits, ensuring that we protect data integrity during transformations. Institutions like Citibank exemplify this commitment, achieving a service availability rate of 99.9%.

- Ongoing Monitoring and Feedback: We implement real-time tracking methods to observe the performance of new integrations and collect user input for prompt modifications. Our platform offers real-time monitoring and alerts on performance, which is crucial for maintaining uptime. Organizations embracing contemporary architectural designs indicate a 52% enhancement in the availability of their infrastructure due to efficient monitoring methods. We select a skilled and experienced team for upgrade projects, as this is essential for ensuring efficiency and success during the transformation process. Involving stakeholders from the outset aids in ensuring that requirements are precisely recorded and addressed.

A significant case study is Zions Bank, which implemented a long-term component-based upgrade strategy, transitioning from several core providers to a unified TCS BaNCS solution over 11 years. This methodical approach streamlined operations, significantly reduced deposit products, and enabled the bank to efficiently process Paycheck Protection Program loans during the COVID-19 pandemic. By following these strategies, we can navigate the complexities of modernization while ensuring we remain competitive and responsive to customer needs.

Integrate Legacy Systems with Modern Solutions

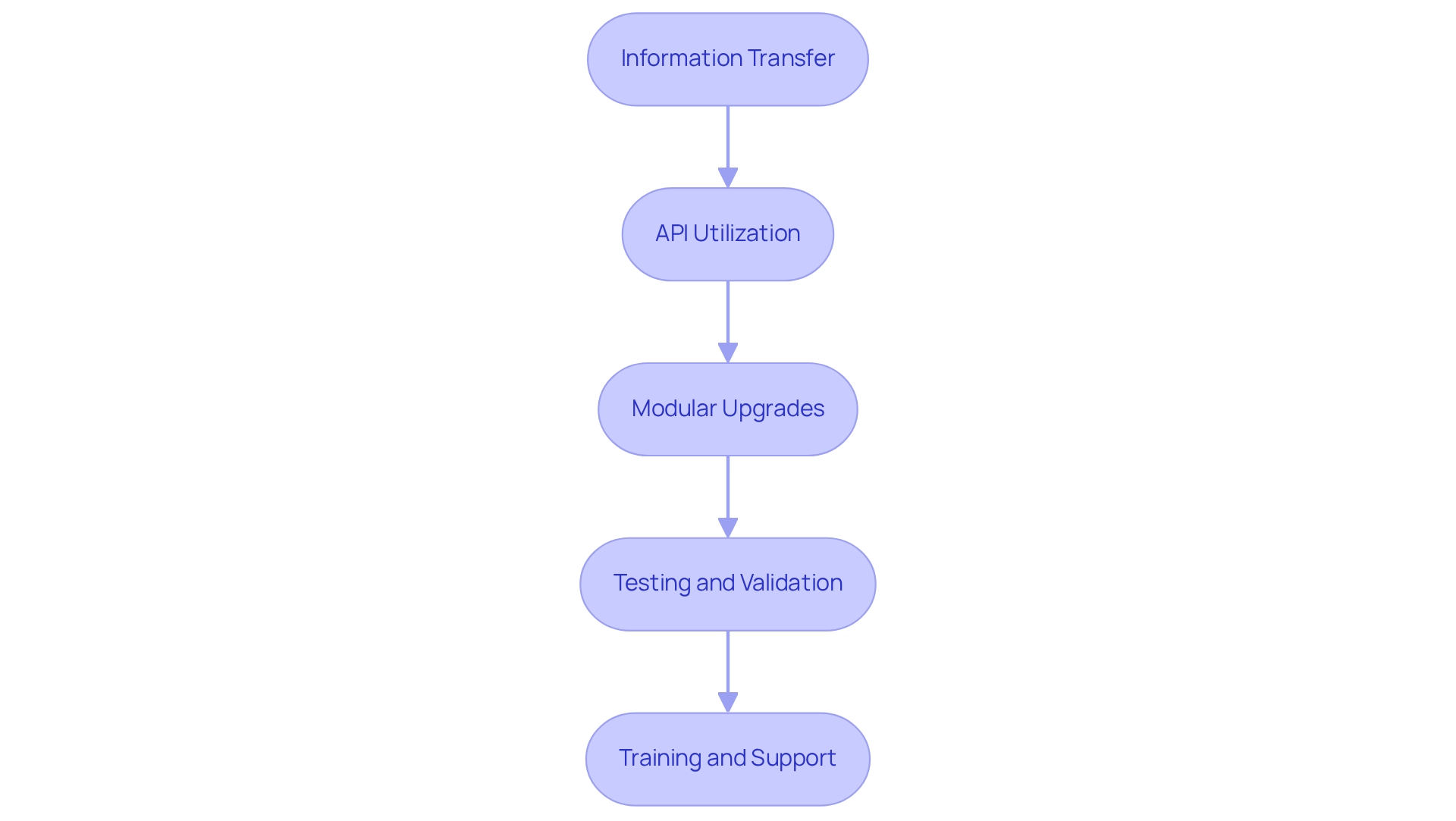

Integrating legacy infrastructures with contemporary solutions is a significant challenge within core modernization banking that requires a strategic framework to ensure compatibility and optimal functionality. We recognize that key considerations include:

- Information Transfer: We must develop a meticulous plan for transferring information from legacy systems to new platforms. This procedure prioritizes information integrity and aims to minimize downtime, ensuring that operations remain uninterrupted during the transition. The demand for skilled information specialists is increasing at a rate of 36%, underscoring the necessity of having qualified personnel to oversee this critical phase of core modernization banking.

- API Utilization: Employing APIs is essential for enabling seamless interaction between legacy platforms and contemporary applications. This unification facilitates effective information exchange and significantly enhances overall functionality, providing real-time insights into operations. For instance, API banking allows businesses to gain real-time visibility into cash flow and simplifies payment processes through centralized dashboards, ultimately improving financial decision-making and operational efficiency. Additionally, utilizing XML technologies can enhance information interoperability, ensuring that legacy infrastructures communicate effectively with new applications and support long-term usability and adaptability. Furthermore, it is vital to ensure that integration solutions comply with regulatory standards and undergo security audits to protect sensitive data.

- Modular Upgrades: Rather than pursuing a total overhaul, we advocate for applying modular upgrades. This strategy enables incremental improvements in core modernization banking, reducing risk while allowing continuous operation throughout the modernization process. By incorporating XML schemas, we can verify data structures and ensure that each upgrade aligns with existing frameworks, thereby enhancing overall integration success.

- Testing and Validation: A thorough evaluation of combined components is essential to detect and resolve any issues before a complete rollout. Validation processes ensure that all components operate cohesively, thereby enhancing the reliability of the setup. This is particularly crucial in the context of open banking, where secure and dependable connections between applications are vital for effective information sharing.

- Training and Support: We must offer comprehensive training for personnel on new procedures and methods to facilitate a seamless transition. Ongoing support is equally important to address any challenges that may arise post-integration, ensuring that our teams are equipped to leverage the new capabilities effectively.

As Carly Fiorina stated, “The aim is to convert information into knowledge and knowledge into insight.” By adopting these strategies for core modernization banking, we can effectively navigate the complexities of legacy system integration, ultimately leading to improved operational efficiency and enhanced financial decision-making. Moreover, leveraging rich transaction data can streamline operations and provide better insights for treasurers.

Leverage Benefits of Modernization for Competitive Advantage

Core modernization banking provides us with a strategic edge that goes beyond mere technological upgrades, delivering substantial competitive advantages. Consider the following key benefits:

- Improved Operational Efficiency: Our contemporary frameworks optimize processes, minimize manual errors, and automate routine tasks, leading to significant productivity gains and cost reductions. For example, a recent transformation in a payments business resulted in a remarkable $300 million increase in revenue and a 30-35% boost in productivity through process reviews and efficiency eliminations. Notably, NVIDIA’s 2025 survey reveals that nearly 70% of companies reported at least a 5% revenue increase linked to AI implementations, underscoring AI’s dual role as both a revenue generator and an efficiency enhancer.

- Enhanced Customer Experience: With upgraded technology, we can offer quicker and more dependable services, greatly boosting customer satisfaction and loyalty. The survey indicates that 52% of financial services professionals are now utilizing generative AI tools, revolutionizing personalized service delivery through AI-powered chatbots and virtual assistants. This shift is crucial; banks that embrace core modernization banking are positioned to create exceptional customer experiences, ultimately driving retention and growth.

- Increased Agility: Our modern platforms empower us to swiftly adapt to market fluctuations and evolving customer demands, facilitating the rapid deployment of new products and services. This agility is essential in a competitive landscape where responsiveness can dictate success. Avato’s hybrid connectivity platform supports this agility by enabling seamless unification of disparate systems, allowing us to respond quickly to changing market conditions.

- Data-Driven Insights: Advanced analytics capabilities enable us to glean valuable insights into customer behavior and preferences, fostering informed decision-making that aligns with market needs. This data-centric approach enhances our strategic planning and operational effectiveness. The incorporation of AI further amplifies this capability, as companies utilizing AI report substantial advancements in their capacity to assess and respond to information.

- Future-Proofing: Investing in modern technology equips us to navigate future challenges and seize emerging opportunities, ensuring long-term sustainability and growth. As noted by Akshay Kapoor, a Senior Partner at McKinsey’s Financial Services Practice, “Driving these changes can help banks deliver outsize, lasting impact, resulting in better productivity, a simpler operating model, and a positive customer and employee experience.” This foundational investment not only supports continuous evolution but also positions us to thrive in an increasingly digital landscape. Avato’s dedication to streamlining intricate connections and boosting business value through our specialized hybrid platform is essential for banks focused on core modernization banking to safeguard their operations for the future.

By leveraging these benefits, we can enhance our operational efficiency and secure a competitive advantage in an increasingly digital landscape. As Tony LeBlanc from the Provincial Health Services Authority states, “Avato accelerates the integration of isolated systems and fragmented data, delivering the connected foundation enterprises need to simplify, standardize, and modernize.

Conclusion

The necessity for core modernization in banking is undeniable. As legacy systems increasingly hinder operational efficiency and customer satisfaction, we recognize the urgent need for financial institutions to transition from outdated technologies to more agile, secure, and integrated systems. By embracing modernization, we can mitigate the risks associated with legacy systems and unlock a plethora of benefits that enhance our competitive edge.

Implementing effective strategies for modernization is crucial. A phased approach that focuses on customer needs, leverages fintech partnerships, ensures compliance and security, and invests in skilled teams facilitates a smoother transition. The importance of integrating legacy systems with modern solutions cannot be overstated; careful data migration, API utilization, and modular upgrades are essential components of a successful modernization journey.

Ultimately, the advantages of core modernization extend beyond mere technological upgrades. Enhanced operational efficiency, improved customer experiences, increased agility, and data-driven insights empower us to thrive in a digital-first world. Investing in modern technology is not just a strategic choice; it is a necessary step towards future-proofing our operations and ensuring long-term growth. As the banking landscape continues to evolve, we must prioritize modernization to be best positioned to meet the challenges and opportunities ahead.