Overview

In today’s rapidly evolving financial landscape, choosing the right digital banking vendor is crucial for operational success. We examine the features, pricing models, and performance metrics of leading vendors such as:

- nCino

- Finacle

- Avato

Each offering tailored solutions that significantly enhance operational efficiency and elevate the customer experience. Furthermore, we recognize the vital role of:

- Real-time processing

- Robust security measures

- Adaptable pricing strategies

In meeting the ever-changing demands of online financial services. By aligning with the right partner, we can navigate the complexities of the digital banking environment together, ensuring that your organization remains competitive and responsive to customer needs.

Introduction

As we witness a radical transformation in the financial landscape, digital banking stands out as a pivotal force reshaping how institutions operate and engage with their customers. The multitude of vendors offering innovative solutions tailored to diverse banking needs necessitates a thorough understanding of the key players and their unique offerings.

From nCino’s cloud banking efficiencies to Oracle’s data-driven insights, the competition is fierce, and the stakes are high. With mobile payments surging towards unprecedented volumes, the need for robust digital banking platforms becomes increasingly clear.

This article delves into the leading vendors, essential features, pricing models, and performance metrics that define the future of digital banking. We aim to provide valuable insights for institutions seeking to thrive in this rapidly evolving environment.

Overview of Leading Digital Banking Vendors

In 2025, we find ourselves in an online financial services environment shaped by several key participants, each offering tailored solutions to meet diverse financial needs. Notable vendors include:

- nCino: Renowned for its cloud financial solutions, nCino enhances operational efficiency and customer experience through a comprehensive platform.

- Finacle: Created by Infosys, Finacle provides a broad range of financial solutions that facilitate digital transformation across various sectors.

- Temenos: Recognized for its highly customizable and scalable core financial software, Temenos serves both traditional institutions and fintechs.

- Avato: Tightly integrated with Temenos T24, Avato offers a modular, service-oriented architecture that enhances adaptability and scalability for financial institutions. Its error-free track record in the financial services sector solidifies its reliability in addressing common challenges such as channel integration and operational efficiency.

- Backbase: Specializing in customer engagement, Backbase emphasizes providing seamless omnichannel experiences for financial clients.

- Oracle: With a strong focus on data management and analytics, Oracle’s financial solutions empower institutions to leverage data for enhanced decision-making.

Digital banking vendors play a crucial role in advancing the evolution of online finance, delivering innovative technologies and customer-oriented strategies that align with the industry’s growing demands. We recognize Avato’s particular strength in accelerating the integration of isolated systems and fragmented data, laying a secure foundation for digital transformation initiatives. As the global volume of mobile payment transactions is projected to exceed $13 trillion by the end of 2025, the importance of these key players in shaping the future of financial solutions cannot be overstated. Additionally, customer feedback, such as that from Gustavo Estrada, underscores the effectiveness of platforms like Avato in simplifying complex projects and achieving results within desired time frames and budget constraints. Furthermore, regional online finance statistics reveal varying degrees of online service adoption across different areas, highlighting the competitive landscape among these providers. With the digital finance sector expected to manage a total of $22.62 trillion in deposits by 2029, the significance of these vendors in facilitating and expanding these deposits is paramount.

Key Features of Digital Banking Platforms

Digital financial platforms are essential for meeting the ever-evolving needs of financial organizations. We provide a range of critical features designed to enhance user experience and operational efficiency. Consider the following key functionalities:

- Real-time Transaction Processing: This capability is vital for ensuring clients have immediate access to their funds and transaction histories, significantly boosting user satisfaction. By 2025, the emphasis on real-time processing will be paramount, especially as 39% of individuals aged 60-78 primarily utilize online financial services. This statistic underscores the necessity for swift and reliable offerings.

- Omnichannel Support: A seamless experience across mobile, web, and in-branch services is crucial for client retention. Our platform guarantees that users can transition effortlessly between various financial channels, catering to the preferences of younger consumers. Notably, 31% of individuals aged 60-78 also engage in mobile services, highlighting the importance of this feature.

- Advanced Security Measures: As cybersecurity threats escalate, including reported fraud losses in India exceeding 302.5 billion Indian Rupees in 2023, robust security features such as multi-factor authentication, encryption, and sophisticated fraud detection systems are indispensable for protecting sensitive client data. The anticipated global merchant losses due to online payment fraud are projected to exceed $362 billion from 2023 to 2028, emphasizing the urgent need for enhanced fraud detection and cybersecurity measures in the financial sector. Additionally, the Biometric ATM Market is expected to grow from USD 36.3 Billion in 2023 to USD 46.7 Billion by 2032, reflecting the ongoing evolution of security measures in online banking.

- Customizable User Interfaces: Tailoring the customer experience to meet specific demographic needs significantly enhances engagement. Our customizable interfaces allow financial institutions to adapt their offerings to diverse user preferences, ensuring a more personalized experience.

- Integration Capabilities: The ability to seamlessly connect with existing legacy systems and third-party applications is crucial for a smooth transition to online services. Our Hybrid Integration Platform excels in this area, maximizing the value of legacy systems while simplifying complex integrations and reducing costs. This capability not only facilitates modernization but also supports the effective implementation of advanced technologies such as AI and blockchain, which are poised to provide a competitive edge in the online financial sector. Furthermore, real-time monitoring and alerts on system performance are essential for ensuring operational reliability and security, addressing common concerns regarding integration and compliance within the framework of open financial strategies. Collectively, these features enhance customer satisfaction and streamline financial operations, making them vital for any digital banking vendors looking to thrive in the rapidly evolving financial landscape. We invite you to explore how our solutions can empower your organization to meet these challenges head-on.

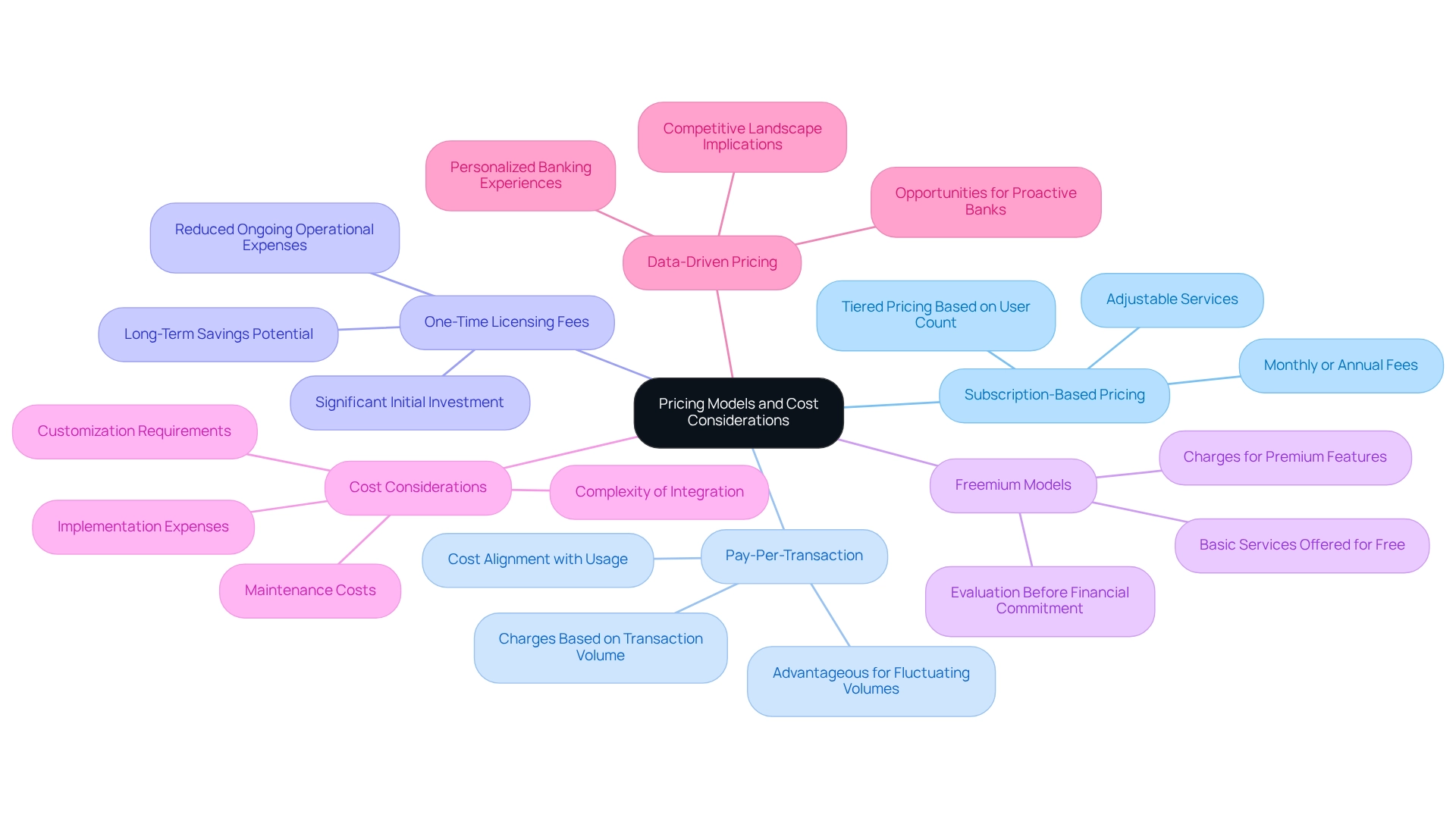

Pricing Models and Cost Considerations

Pricing models for digital banking platforms exhibit considerable variation among digital banking vendors, reflecting distinct offerings and target markets. This variability prompts us to consider: how can we ensure our pricing strategy aligns with our unique needs? The most prevalent pricing structures include:

- Subscription-Based Pricing: Many vendors adopt monthly or annual subscription models, often featuring tiered pricing based on user count or accessed features. This method enables us to adjust our services based on our requirements.

- Pay-Per-Transaction: This model charges us based on the volume of transactions processed, making it particularly advantageous for organizations with fluctuating transaction volumes, as it aligns costs with actual usage.

- One-Time Licensing Fees: Some platforms require a significant initial investment for licensing, which can be offset by reduced ongoing operational expenses, attractive to us as we seek long-term savings.

Certain digital banking vendors provide fundamental services for free through freemium models, charging for premium features or improved support, allowing us to evaluate the platform prior to making a financial commitment.

Cost considerations extend beyond these models to include implementation and maintenance expenses, which can vary significantly based on the complexity of integration and the degree of customization required. As we increasingly leverage Open Banking, the capability to customize offerings through data-driven pricing becomes essential. Based on a detailed report consisting of 250 pages, 208 tables, and 74 charts, this change not only improves our client relationships but also enables proactive financial institutions like ours to take advantage of new opportunities, while those that fall behind may encounter competitive drawbacks. The case study titled “Open Banking Opportunities” illustrates how we can utilize customer-level data for personalized pricing, leading to improved customer experiences and loyalty. The typical expenses of online platform subscriptions in 2025 are anticipated to mirror these trends, emphasizing the provision of value through creative pricing strategies. As Chris Nichols, Director of Capital Markets, notes, this article discusses the foundation of our pricing position, strategies, and tactics when pricing bank products and services, underscoring the importance of data-driven pricing in achieving our business objectives.

Performance Evaluation of Digital Banking Solutions

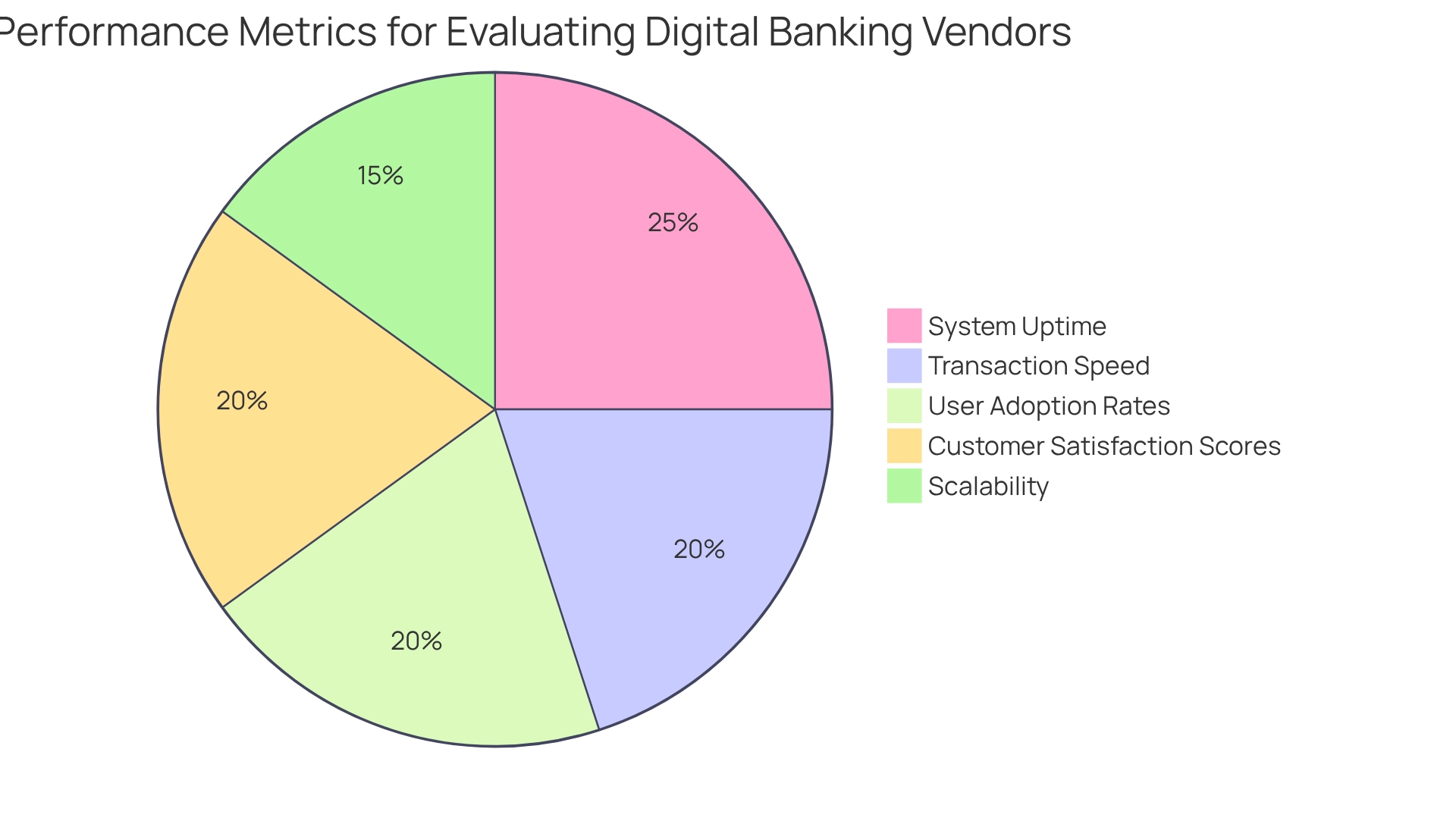

Evaluating the performance of digital banking vendors is vital for understanding their operational efficiency and adaptability to market demands. We recognize that key metrics play a crucial role in this assessment:

- System Uptime: A fundamental measure of reliability, with leading vendors striving for 99.9% uptime to ensure continuous service availability. High uptime is essential for maintaining client trust and operational integrity.

- Transaction Speed: The velocity at which transactions are processed significantly impacts client satisfaction. Our top platforms achieve real-time processing, ensuring users experience minimal delays.

- User Adoption Rates: High adoption rates indicate a user-friendly interface and efficient onboarding processes, both critical for client retention and engagement.

- Customer Satisfaction Scores: We employ regular surveys and feedback mechanisms to gauge user satisfaction, enabling institutions to identify areas for improvement and enhance service delivery.

- Scalability: The platform’s capacity to manage increased loads without performance degradation is vital for growing institutions, ensuring they can expand their services without compromising quality.

These performance metrics not only highlight the operational efficiency of digital banking vendors but also their ability to meet evolving consumer expectations. As illustrated in the case study “Generative AI: The New Frontier in Financial Services,” we have observed a significant rise in the use of generative AI for customer experience, particularly in the development of sophisticated chatbots and virtual assistants. This shift underscores the importance of leveraging technology to enhance service offerings. Furthermore, incorporating insights from industry specialists, such as Gustavo Estrada’s remark that ‘Avato has streamlined intricate projects and produced outcomes within expected timelines and budget limitations,’ reinforces the effectiveness of electronic financial solutions in achieving operational efficiency.

Moreover, we advocate for financial institutions and credit unions to implement a virtual finance metric framework that aligns measurement with strategy. To effectively mobilize stakeholders, it is crucial to engage them early in the process to ensure that requirements are accurately captured. Modeling business processes aids in visualizing the current state and desired outcomes, facilitating smoother transitions. As the digital banking sector continues to evolve, institutions that prioritize these metrics will be better positioned to capitalize on emerging opportunities and maintain a competitive edge.

Conclusion

The future of banking is undeniably digital, and we are at the forefront of this evolution. The landscape of digital banking is increasingly shaped by a diverse range of vendors delivering innovative solutions tailored to the unique needs of financial institutions. Key players like nCino, Finacle, and Oracle are not just enhancing operational efficiencies; they are revolutionizing customer engagement. Platforms such as Avato are further bolstering integration capabilities, enabling banks to modernize effectively. As we anticipate a surge in mobile payment transactions and growing deposits, it is clear that these vendors will play a pivotal role in shaping the future of banking.

Central to the success of digital banking platforms are essential features:

- Real-time transaction processing

- Advanced security measures

- Seamless omnichannel support

These capabilities are not merely enhancements; they are vital to elevating customer satisfaction and streamlining banking operations. For institutions aiming to thrive in this competitive sector, these features are indispensable. Moreover, the variety of pricing models available empowers banks to select solutions that align with their operational needs and budgetary constraints, fostering a more personalized approach to service delivery.

To evaluate the effectiveness of digital banking solutions, performance metrics such as:

- System uptime

- Transaction speed

- User adoption rates

are crucial. Institutions prioritizing these metrics will be better positioned to respond to evolving consumer expectations and capitalize on emerging opportunities. As the digital banking environment continues to transform, we must embrace innovative technologies and customer-centric strategies to maintain a competitive edge and ensure long-term success. The future of banking is digital, and those who adapt swiftly and strategically will lead the way.