Overview

This article addresses the critical best practices for banking IT managers navigating the migration to ISO 20022. It emphasizes the necessity of strategic planning, stakeholder engagement, and the effective use of technology to facilitate a seamless transition. To capture your attention, consider the challenges posed by legacy systems—how can you ensure your organization adapts effectively?

By outlining essential steps such as:

- Conducting comprehensive assessments

- Investing in staff training

- Utilizing integration platforms like Avato’s

this piece highlights how to enhance operational efficiency and compliance. Furthermore, these practices not only alleviate the burdens of outdated systems but also position your organization for future success. In conclusion, the integration of a robust platform is not just beneficial; it is essential for overcoming the complexities of this migration. Are you ready to take action and lead your team through this transformative process?

Introduction

The transition to ISO 20022 is not merely a technical upgrade; it signifies a fundamental shift in how financial institutions execute transactions and manage data. As the banking sector prepares for this pivotal migration, grasping the intricacies of ISO 20022 is essential for IT managers who seek to enhance operational efficiency and customer experiences. Projections indicate that by 2025, a significant majority of high-value payment settlements will depend on this standard, underscoring the urgency for organizations to adapt. This article explores the key components of ISO 20022 migration, examining its benefits, challenges, and best practices, while underscoring the critical role of innovative solutions like Avato’s hybrid integration platform in navigating this complex landscape. As the financial world evolves, embracing ISO 20022 could indeed be the key to remaining competitive and compliant in an increasingly data-driven environment.

Understanding ISO 20022: A Foundation for Migration

ISO serves as a pivotal international standard for electronic data interchange among financial institutions, establishing a unified framework for message development across diverse financial services. This standard significantly enhances the richness and structure of exchanged data, facilitating more detailed and accurate transactions. For banking IT managers, understanding the intricacies of ISO 20022 migration services is essential, as it lays a solid foundation for successful migration efforts.

As the banking sector moves towards full adoption, the significance of ISO cannot be overstated. By 2025, it is projected that 80% of high-value payment settlements will utilize this standard, a shift initiated by the Swift community in 2018. This transition is expected to improve customer experiences through richer information, reduce manual interventions, and enhance overall payment processing efficiency.

The Swift community’s adoption of ISO 20022 is anticipated to yield significant operational improvements. Case studies highlight enhanced capabilities and reduced costs for early adopters, illustrating the standard’s impact on operational efficiency.

Current statistics indicate that orchestrated support for early opt-in institutions will be available by Q2 2025, with a complete transition to Case Management channels anticipated by November 2026. This timeline underscores the urgency for banking IT managers to prepare for the coexistence phase, where both the legacy MT messages and the new ISO MX messages will be operational.

In this context, Avato’s hybrid integration platform emerges as a vital tool for banking IT managers needing ISO 20022 migration services. It simplifies complex integrations, maximizes the value of legacy systems, and significantly reduces costs related to the transition process. Avato’s platform is specifically designed to address the challenges of the coexistence phase, ensuring that organizations can effectively manage both MT and MX messages during this transitional period.

Expert opinions highlight the fragmented nature of the movement process. Ingrid Weisskopf, Head of Institutional Clients Advisory & Analytics, notes that “the migration has been fragmented, resulting in a period in which the ‘old’ MT messages and the new ISO MX messages are both in the mix – the so-called ‘coexistence phase.'” Such insights emphasize the necessity for strategic planning and alignment among stakeholders to fully utilize the advantages of ISO.

Successful implementation examples further illustrate the standard’s potential. Financial institutions that have embraced ISO report enhanced operational capabilities and lowered expenses, positioning themselves to adjust to changing market demands. With Avato’s hybrid integration platform, banking IT managers can ensure a seamless transition to ISO standards by utilizing ISO 20022 migration services, maintaining a competitive edge in the industry.

Testimonials from early adopters highlight the effectiveness of Avato’s solutions in navigating the complexities of this migration, reinforcing the urgency for organizations to act swiftly.

Key Benefits of ISO 20022 Migration for Financial Institutions

Migrating to ISO format using ISO 20022 migration services offers a multitude of advantages for financial institutions, particularly as we approach 2025. One of the most significant benefits is the substantial improvement in data quality. The structured data format of ISO 20022 allows for the inclusion of richer remittance information, which not only enhances customer insights but also streamlines operational efficiencies.

This transformation is crucial as banks increasingly rely on precise data to make informed decisions and tailor services to meet customer needs.

In terms of transaction processing speed, ISO migration has shown remarkable advancements. Financial institutions that utilize ISO 20022 migration services can anticipate faster transaction times, a necessity in today’s fast-paced banking environment. The automation features inherent in ISO facilitate straight-through processing, significantly reducing the need for manual interventions and the associated costs.

This shift not only enhances operational efficiency but also mitigates the risk of errors, further reinforcing compliance with regulatory requirements.

Case studies highlight the tangible advantages of adopting ISO 20022 migration services. For example, Avato’s successful implementation of hybrid integration solutions at Coast Capital illustrates how such transformations can lead to improved transaction processing and enhanced data quality with minimal downtime. Notably, during the transition of Coast Capital’s entire telephone banking and contact center telephony system in June 2016, Avato achieved this with only a 63-second outage, showcasing their capability to manage complex integrations effectively.

The ability to enable significant system changes, as demonstrated in their collaboration with Coast Capital, underscores the competitive advantage that can be gained through this migration.

Furthermore, industry leaders have recognized the benefits of ISO. As Gustavo Estrada noted, Avato simplifies complex projects, enabling banks to achieve results within desired time frames and budget constraints. This sentiment reflects a broader consensus among banking professionals regarding the transformative potential of ISO 20022 migration services. Additionally, Avato’s hybrid integration platform provides a reliable, future-proof technology stack that supports businesses in adapting to evolving demands through ISO 20022 migration services.

Architected for secure transactions and trusted by banks, healthcare, and government entities, Avato accelerates the integration of isolated systems and fragmented data, delivering the connected foundation enterprises require. The platform supports 12 levels of interface maturity, balancing integration speed with the sophistication necessary to future-proof technology stacks. This adaptability is vital for maintaining a competitive edge in an ever-evolving financial landscape.

Overall, the transition to ISO format not only positions financial organizations to meet current demands but also equips them with the essential tools to thrive in the future.

Navigating Challenges: Common Obstacles in ISO 20022 Migration

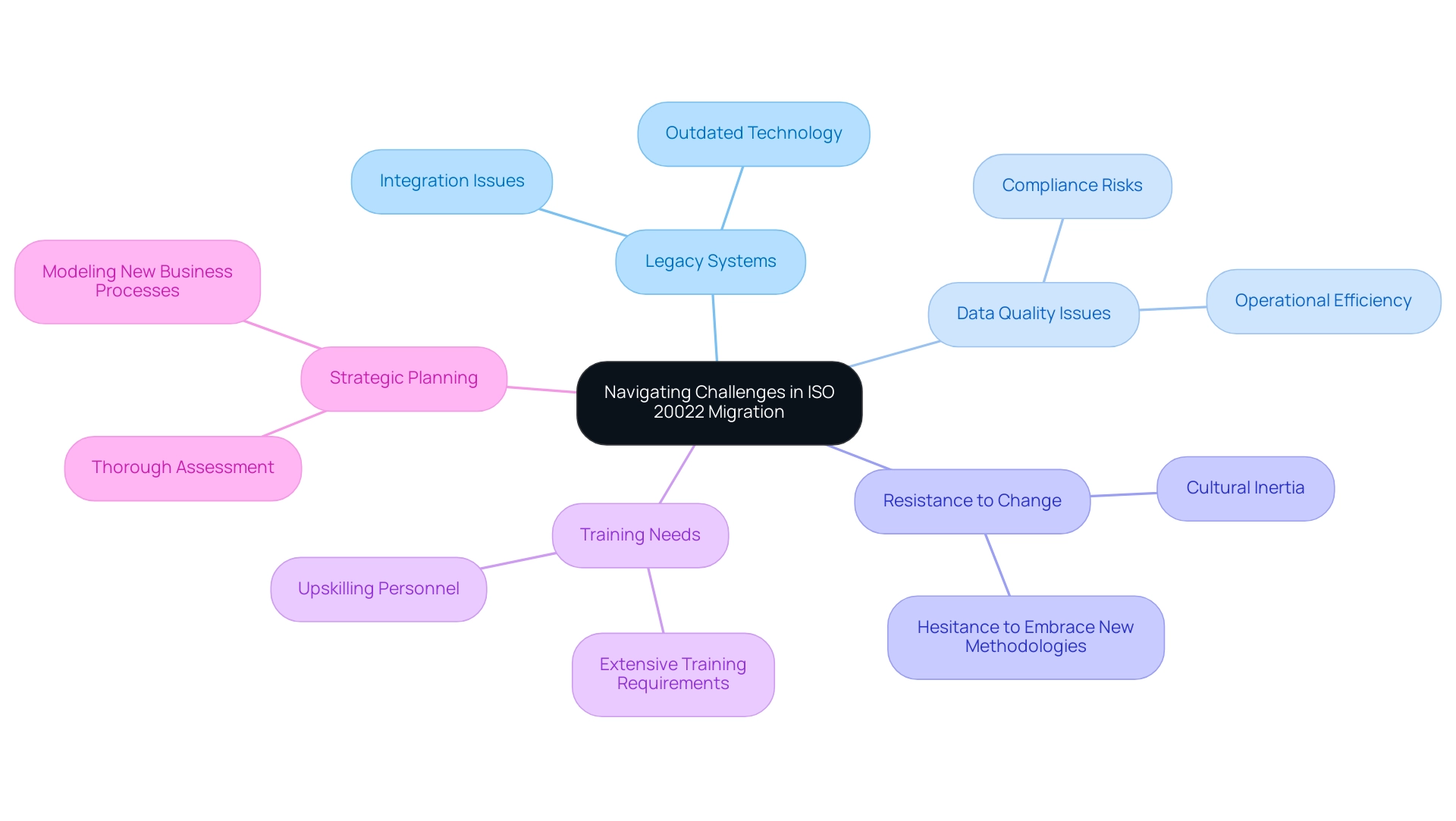

Transitioning to ISO 20022 poses significant challenges for financial organizations, particularly regarding the integration of legacy systems. As we approach 2025, it’s noteworthy that approximately 70% of banks continue to rely on outdated systems, complicating their shift to this modern messaging standard. This statistic underscores the magnitude of the challenge many institutions face.

The intricacies involved in integrating these legacy systems can result in data quality issues, which are critical for ensuring compliance and operational efficiency. Swift provides valuable insights on data quality to facilitate ISO 20022 adoption, emphasizing its importance in the transition process. Furthermore, managing the transition without disrupting ongoing operations is a delicate balancing act that necessitates meticulous planning. Avato’s user manuals highlight the need for thorough assessment and strategic planning aligned with institutional goals, including the modeling of new business processes and activity flows to ensure a smooth transition.

Resistance to change is another prevalent obstacle, as staff members may be accustomed to existing processes and hesitant to embrace new methodologies. This cultural inertia can impede progress and create friction during the transition. Additionally, the requirement for extensive training and upskilling of personnel can strain resources, diverting attention from other critical projects.

Avato’s approach emphasizes essential strategies for staff training and change management, ensuring that personnel are well-equipped to adapt to new systems and processes.

To navigate these challenges effectively, IT managers must proactively identify potential pitfalls and develop comprehensive strategies tailored to their organization’s unique circumstances. For instance, recent case studies, such as the successful transition of XYZ Bank, highlight the introduction of new tools and resources designed to assist organizations in utilizing ISO 20022 migration services during their adoption journey. These resources not only simplify transition processes but also provide practical support for tracking progress, ensuring that organizations can adjust and enhance their strategies as necessary.

Expert opinions underscore the significance of a phased approach to transition, allowing banks to gradually adapt while minimizing disruptions. By addressing these common challenges head-on, financial institutions can enhance their operational capabilities and ensure a successful transition with ISO 20022 migration services, ultimately positioning themselves for future growth and innovation. As noted by Gustavo Estrada, a client, ‘Avato has simplified complex projects and delivered results within desired time frames and budget constraints,’ emphasizing the advantages of efficient project management during the transition.

Avato distinguishes itself from competitors by offering speed, security, and ease of integration, reducing costs while enhancing operational capacities—an essential factor for banks facing these transition challenges.

Best Practices for a Seamless ISO 20022 Migration

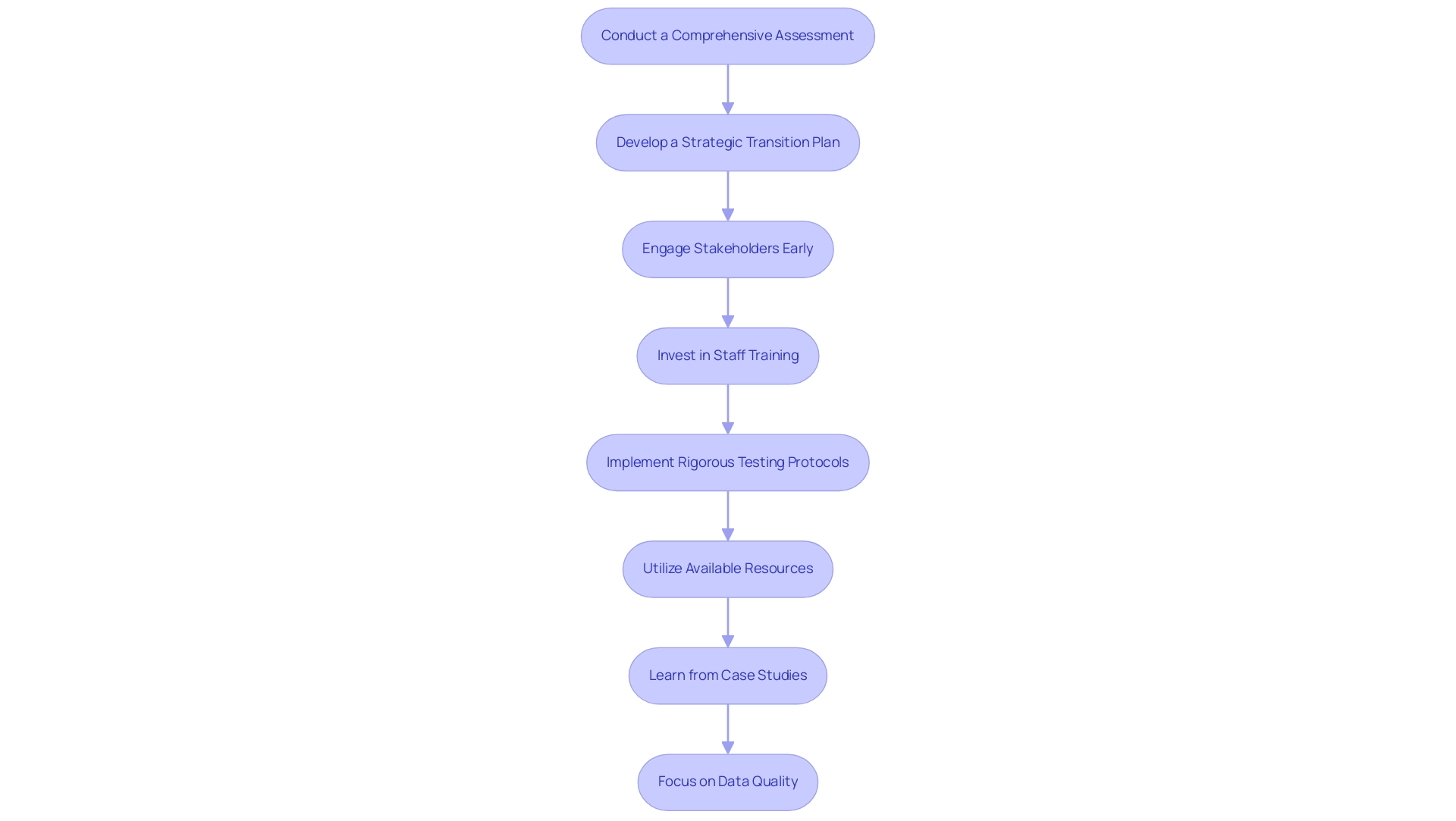

To ensure a successful ISO 20022 transition, banking IT managers must implement best practices that are both strategic and effective.

-

Conduct a Comprehensive Assessment: Begin with a detailed evaluation of existing systems. This foundational step is crucial for pinpointing integration opportunities and identifying potential challenges. Understanding the current landscape prepares the institution for the transition, especially when leveraging Avato’s hybrid integration platform to unlock isolated assets and enhance business value.

-

Develop a Strategic Transition Plan: Create a clear transition strategy that outlines timelines, milestones, and resource allocation. This plan acts as a roadmap, steering the institution through each stage of the transition process, ensuring that the technology foundation is robust enough to support rich, connected customer experiences.

-

Engage Stakeholders Early: Involve key stakeholders from the outset to foster alignment and secure support across the organization. Early involvement addresses concerns and ensures that all parties are aligned with the transition objectives—essential for the successful implementation of Avato’s solutions.

-

Invest in Staff Training: Equip your team with the necessary skills and knowledge to navigate the new standard. Targeted training programs empower staff and facilitate a smoother transition to ISO, particularly in understanding the role of XML technologies and XSLT in data transformation projects.

-

Implement Rigorous Testing Protocols: Before launching, establish strong testing procedures to confirm the transfer. Thorough testing is essential to identify and rectify any issues, ensuring that the new system operates seamlessly and efficiently, thus reducing the risk of programming errors through the use of schemas.

-

Utilize Available Resources: Take advantage of new tools for ISO 20022 adoption, including video segments and a structured transition journey tool. These resources provide actionable insights and guidance throughout the process, helping to leverage Avato’s platform effectively.

-

Learn from Case Studies: Consider the case of TIS, which has successfully integrated hundreds of back-office systems. This emphasizes the importance of engaging with banking partners and reviewing internal systems. A strategic partnership approach enhances the benefits of relocation, showcasing how Avato’s expertise in integration can facilitate similar successes for other banking institutions.

-

Focus on Data Quality: With the upcoming release of the Data Quality Analytics dashboard in January 2025, prioritizing data quality during the transition process is essential to ensure compliance and operational efficiency. Employing XSLT significantly assists in attaining high data quality while lowering expenses related to data management.

By following these recommended practices, banking organizations can considerably boost their chances for a successful ISO transfer with the help of ISO 20022 migration services. This ultimately results in enhanced operational efficiency and compliance. As the Bank of Cyprus states, ‘The future of payments is evolving,’ highlighting the importance of adapting to new standards in the banking sector.

Compliance and Regulatory Considerations in ISO 20022 Migration

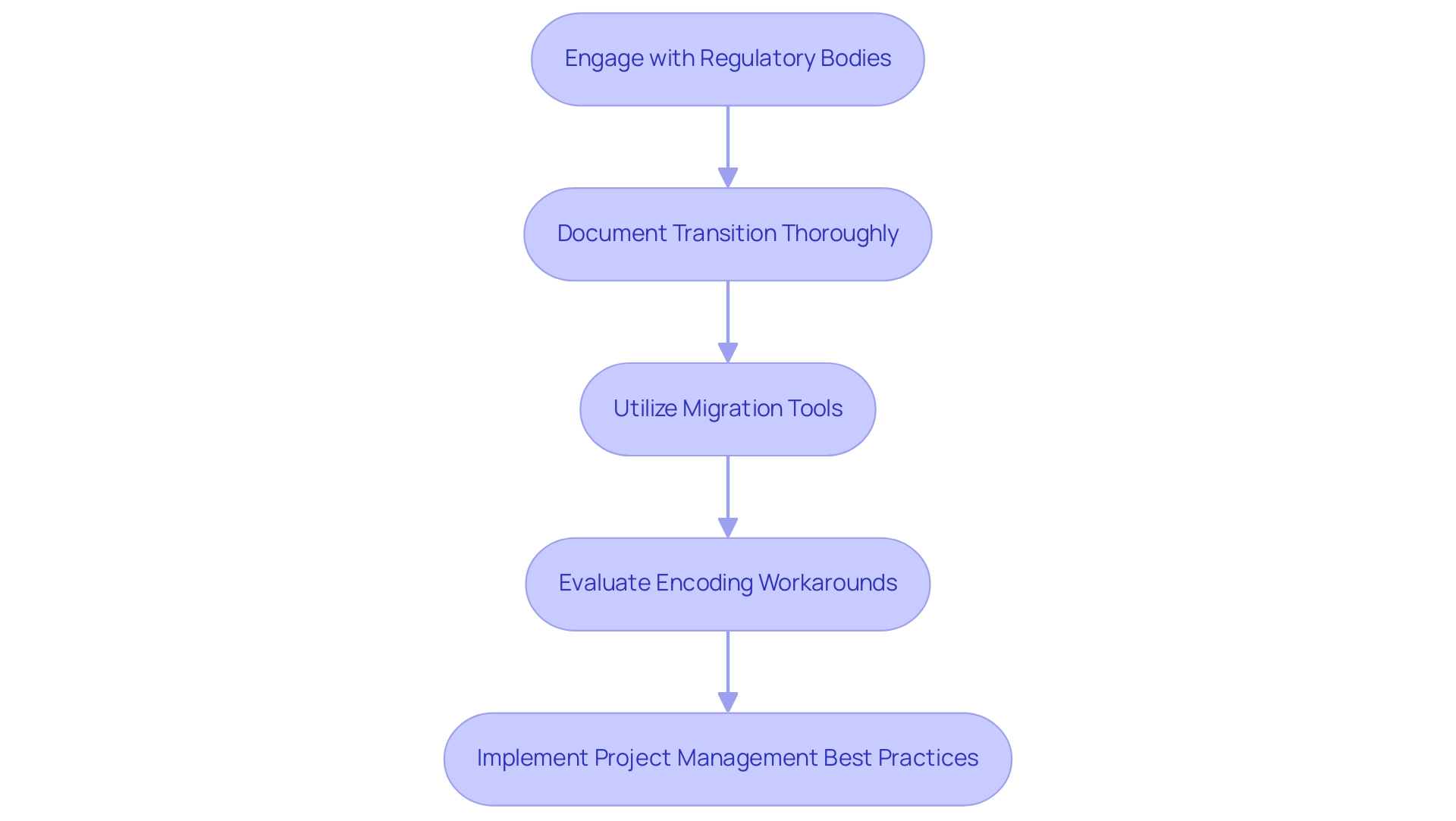

Adhering to regulatory standards is a critical aspect of the ISO 20022 transition process. Financial entities must ensure that their transition strategies align with both local and international regulations, particularly concerning data protection laws and financial reporting requirements. As of 2025, regulatory compliance statistics indicate that a significant percentage of organizations face challenges in adapting to these evolving standards, underscoring the need for proactive measures.

Engaging with regulatory bodies early in the transition process is essential for institutions to grasp the necessary compliance measures and mitigate the risk of potential penalties. This proactive approach not only aids in understanding the regulatory landscape but also fosters a collaborative relationship with regulators, which can be beneficial during audits.

Maintaining meticulous documentation throughout the transition process is another best practice that facilitates audits and demonstrates adherence to regulatory standards. Institutions should contemplate utilizing new tools and resources created to aid with ISO 20022 migration services, which offer practical support such as organized transition tracking and dashboards to oversee compliance progress. Recent case studies show that organizations successfully navigating regulatory challenges during their ISO transition have benefited from employing ISO 20022 migration services alongside comprehensive compliance strategies.

For instance, organizations that utilized structured migration tracking tools reported enhanced visibility into their compliance status, enabling them to address issues promptly and effectively.

Furthermore, organizations must evaluate the effectiveness of current workaround encodings for character sets, particularly considering ISO’s support for Unicode. This assessment is crucial as it directly impacts data integrity and compliance with data protection laws.

As Edwin Oloo, associate director in Protiviti’s Risk and Compliance practice, notes, “Implementing project management best practices and advanced technical insights while identifying opportunities to integrate data-science solutions is essential for navigating compliance challenges effectively.”

In summary, ensuring compliance during the ISO transition requires a multifaceted approach that includes early engagement with regulators, thorough documentation, and the use of innovative tools to track progress. By prioritizing these strategies, financial institutions can navigate the complexities of regulatory compliance and position themselves for a successful transition through ISO 20022 migration services. Additionally, Avato’s dedicated hybrid integration platform plays a pivotal role in simplifying the integration of disparate systems, ensuring 24/7 uptime for critical integrations, and enhancing business value.

Specific features of Avato’s platform, such as automated compliance tracking and real-time data integration capabilities, further underscore the importance of reliability in compliance during this transition.

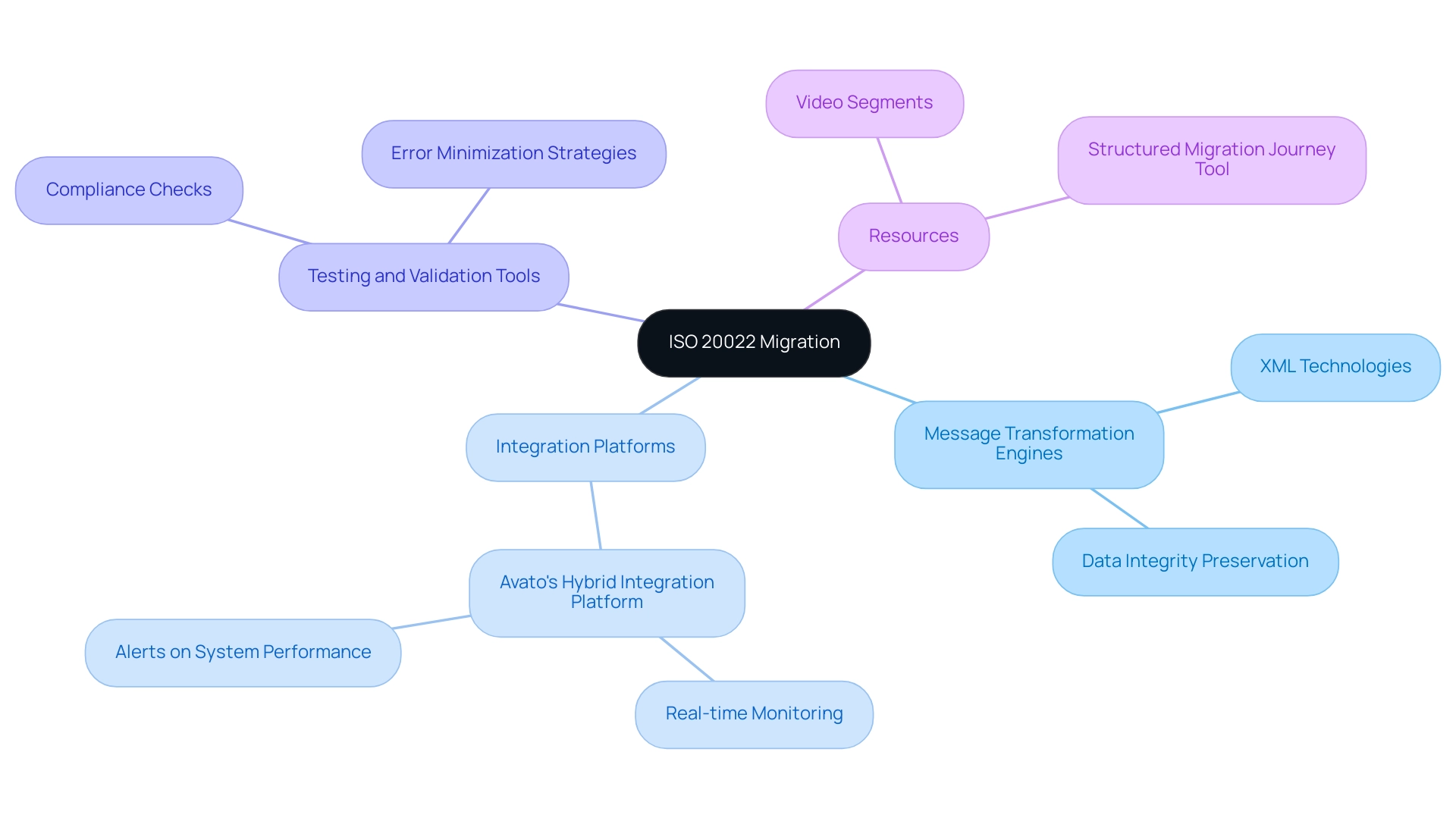

Leveraging Technology: Tools and Solutions for ISO 20022 Migration

To effectively navigate the complexities of transitioning to ISO standards, banking IT managers must strategically leverage ISO 20022 migration services alongside a variety of technology tools and solutions. Central to this endeavor are message transformation engines, which are essential for converting legacy formats into the ISO 20022 standard, supported by ISO 20022 migration services. These engines not only streamline the transformation process but also ensure the integrity of data is preserved throughout the transfer, utilizing the robustness of XML technologies that bolster data interoperability and longevity.

XML’s structure, defined by its use of tags to delineate data elements and their relationships, facilitates clear data representation and validation, making it indispensable for successful transfers.

Integration platforms, such as Avato’s Hybrid Integration Platform, are equally crucial, as they enable seamless connectivity between disparate systems, allowing organizations to unify their operations and enhance data flow. By employing Avato’s platform, which features real-time monitoring and alerts on system performance, institutions can significantly boost their transition efficiency with ISO 20022 migration services, facilitating quicker adaptation to the new messaging standard. As Gustavo Estrada from BC Provincial Health Services Authority notes, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints.”

Moreover, implementing robust testing and validation tools is vital to ensure that the ISO 20022 migration services of migrated messages comply with the required standards before going live. This proactive approach minimizes the risk of errors and ensures a smoother transition.

Recent industry developments, such as the successful pilot of the Case Management service with 31 banks and 5 vendors, highlight the significance of orchestrated support in the transition process, which will be available in Q2 2025. Additionally, new resources, including video segments and a structured transition journey tool, are now accessible to support ISO adoption, providing banking IT managers with invaluable guidance.

As the SWIFT ISO co-existence period concludes, the urgency for effective ISO 20022 migration services and transition strategies becomes increasingly critical. By adopting the right technology tools and integration platforms, particularly Avato’s Hybrid Integration Platform, banking institutions can not only enhance their transition efficiency but also position themselves for future success in a rapidly evolving financial landscape.

Training and Development: Preparing Teams for ISO 20022 Migration

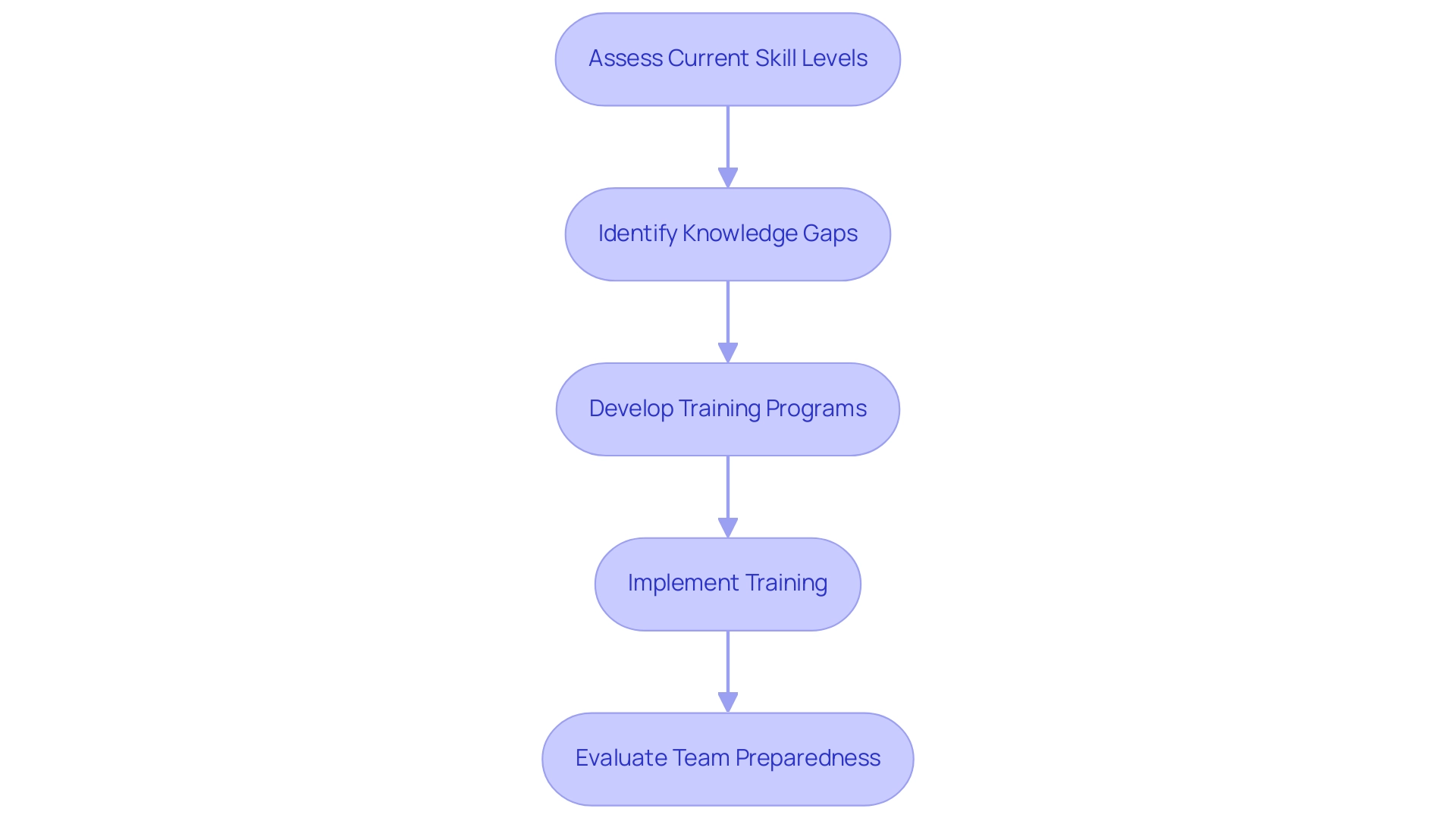

Preparing teams for ISO transition necessitates a strategic approach to training and development. Banking IT managers should commence with a thorough assessment of their teams’ current skill levels, pinpointing specific gaps in knowledge related to ISO standards. This assessment is crucial, as a significant percentage of banking professionals report feeling unprepared for the transition, highlighting a pressing need for targeted training initiatives.

Training programs must encompass both the technical intricacies of the new messaging format and the operational shifts that will follow the migration. This dual focus ensures that teams are not only equipped to implement the new standards but also to adapt to the evolving financial landscape. Furthermore, fostering a culture of continuous learning is essential; it encourages staff to stay abreast of industry developments and enhances their ability to respond to ongoing changes.

Investing in comprehensive training empowers institutions to navigate the complexities of ISO standards effectively. For instance, case studies from banks that have successfully advanced their teams for ISO standards demonstrate that organized training programs significantly enhance both team confidence and operational efficiency. The benefits of achieving ISO 20022 optimization—such as faster real-time payments, cost savings through automation, advanced fraud detection capabilities, and regulatory compliance with global mandates—further underscore the importance of effective training.

As the industry moves towards orchestrated support for early opt-in institutions by Q2 2025, and with a full transition to Case Management channels expected by November 2026, the urgency for effective training becomes even more pronounced. Avato’s hybrid integration platform, featuring real-time data synchronization and automated workflow management, ensures 24/7 uptime for critical integrations, emphasizing the necessity for reliable systems during the transition process. Avato’s commitment to architecting technology solutions simplifies complex projects, enabling businesses to unlock isolated assets and enhance operational capabilities.

A recent client remarked, “Avato’s platform not only streamlined our integration process but also significantly enhanced our team’s preparedness for the ISO transition.”

Ultimately, by prioritizing training and development, banking organizations can ensure their teams are well-prepared to meet the challenges of ISO 20022 migration services, thereby enhancing their operational capabilities and maintaining compliance with global mandates. As Gustavo Estrada noted, Avato simplifies complex projects and delivers results within desired time frames and budget constraints, reinforcing the value of a well-prepared team in navigating this transition.

Future Trends: The Evolving Landscape of ISO 20022

The financial services landscape is undergoing a significant transformation, with ISO poised to become a cornerstone of future payment systems. Key trends, including increased automation, advanced data analytics, and the integration of artificial intelligence, are reshaping how organizations can utilize ISO to gain a competitive edge. The push for real-time payments and the facilitation of cross-border transactions are also accelerating the adoption of ISO standards.

Swift has affirmed its commitment to the November 2025 deadline for MT messages, underscoring the urgency for organizations to transition to ISO format. Banking IT managers must remain knowledgeable and adaptable in response to these developments, ensuring their institutions are strategically positioned to thrive in this evolving environment.

As institutions transition to ISO, the importance of updating data-lineage documentation cannot be overstated. This practice not only enhances testing capabilities but also meets regulatory requirements across various jurisdictions, thereby strengthening compliance programs. For instance, a case study on updating data-lineage documentation illustrates how organizations can trace payment messages to screening solutions, ultimately improving their operational effectiveness and compliance during the migration process.

Looking ahead to 2025, the impact of automation on ISO adoption will be profound. Institutions that leverage automation and generative AI are likely to experience streamlined processes and reduced operational costs, enabling them to respond swiftly to market demands. The recent surge in the use of generative AI for customer experience, particularly in developing sophisticated chatbots and virtual assistants, has seen a 60% increase in its application for document processing and report generation, further enhancing transaction accuracy and security.

This solidifies the role of ISO in modern banking. Additionally, the recent development of four usage guidelines by the CBPR+ workgroup for notification and request use cases for charge messages highlights ongoing advancements in ISO standards. In summary, adopting ISO enhances frictionless transactions and boosts operational efficiency, making it essential for banking IT managers to proactively embrace these changes.

By leveraging Avato’s hybrid integration platform, which provides ISO 20022 migration services for various clients, organizations can ensure they not only adapt to the evolving landscape but also capitalize on the opportunities presented by this transformative standard.

Conclusion

The migration to ISO 20022 represents a pivotal evolution for the financial services sector, heralding enhanced transaction efficiency and superior data quality. Projections indicate that by 2025, a substantial majority of high-value payment settlements will depend on this standard, compelling financial institutions to act decisively. This transition not only modernizes operational frameworks but also enriches customer experiences through more accurate data exchanges.

While challenges such as integrating legacy systems and ensuring regulatory compliance persist, implementing best practices—thorough assessments, strategic planning, and targeted training—can effectively mitigate these obstacles. Avato’s hybrid integration platform emerges as a powerful ally, streamlining the migration process and amplifying operational capabilities.

As the financial landscape undergoes continuous transformation, embracing ISO 20022 is vital for maintaining competitiveness. The integration of automation and advanced data analytics will further magnify the benefits of this standard, empowering organizations to respond adeptly to market demands.

In conclusion, prioritizing the transition to ISO 20022 is not merely advisable; it is imperative for financial institutions aiming to thrive in a data-driven environment. By leveraging innovative solutions and wholeheartedly embracing this migration, organizations can enhance operational efficiency, ensure compliance, and deliver superior customer experiences. The time to act is now; successful adoption of ISO 20022 will undoubtedly shape the future of payments.