Overview

The article emphasizes best practices for implementing digital banking software, underscoring the critical nature of compliance and security within the financial sector.

Financial institutions face a pressing challenge: how to navigate complex regulations while safeguarding their operations. To address this, it is essential for organizations to:

- Conduct regular compliance audits

- Establish robust cybersecurity frameworks

Furthermore, leveraging advanced technology solutions is vital in mitigating security risks. By doing so, institutions can ensure a seamless and secure customer experience, ultimately enhancing their credibility and trustworthiness in the market.

Are you prepared to elevate your digital banking strategy? The time to act is now—prioritize compliance and security to thrive in an increasingly complex financial landscape.

Introduction

In the rapidly evolving landscape of finance, digital banking software stands as a transformative force, reshaping how banks operate and engage with their customers. This suite of technologies not only streamlines transactions and enhances account management but also meets the growing expectations of a tech-savvy consumer base. As institutions increasingly pivot towards digital-first strategies, understanding the functionalities and advantages of these software solutions becomes essential for maintaining a competitive edge.

With significant investments projected in digital banking technologies, the stage is set for a profound shift in how banks address compliance, security, and customer experience. This shift paves the way for a more efficient and customer-centric financial ecosystem.

Understanding Digital Banking Software: An Overview

Digital banking software represents a vital collection of technologies that empower institutions to deliver services online, significantly enhancing user convenience and operational effectiveness. These platforms simplify transactions, facilitate account management, and elevate customer service through online channels, enabling financial institutions to adapt to the growing demands of tech-savvy consumers. As the financial sector increasingly embraces technology-first strategies, it is essential for institutions to comprehend the functionalities and benefits of digital banking software to maintain a competitive edge in a rapidly evolving landscape.

Recent trends reveal a substantial shift in online finance, with average electronic spending per $1 billion in assets skyrocketing from approximately $200,000 in 2022 to nearly $780,000 in 2024. This dramatic surge underscores the urgency for banks to invest in robust technological solutions that not only comply with regulatory requirements but also mitigate cybersecurity threats. While navigating this regulatory complexity poses challenges, it simultaneously opens doors for innovation.

Projections suggest that the adoption of digital banking software and other advanced electronic financial technologies will bolster security, streamline transactions, and potentially save financial institutions up to $12 billion annually by 2024, highlighting the potential for cost reduction alongside improved service delivery.

Key functionalities of electronic platforms encompass:

- Real-time transaction processing

- Enhanced security measures

- Comprehensive client relationship management tools

- Real-time monitoring and alerts on system performance

These features not only streamline operations but also significantly enhance user experience and satisfaction. Successful implementations of online banking applications have been observed across various organizations, illustrating their transformative impact on user experience.

Banks that have embraced these technologies report higher customer satisfaction rates, attributed to the convenience and efficiency of online services.

In this context, Avato’s hybrid integration platform plays a pivotal role in addressing the challenges associated with integrating isolated legacy systems and fragmented data. Organizations leveraging Avato’s solution have simplified complex integration projects, achieving results within desired time frames and budget constraints, thereby enhancing operational capabilities. The platform maximizes and extends the value of legacy systems, enabling financial institutions to manage complex integrations simply and efficiently while significantly reducing costs.

Case studies demonstrate that the use of Avato’s platform has led to substantial improvements in the efficiency of online financial software implementations, unlocking data and systems in weeks and facilitating successful technological transformation.

In conclusion, as the adoption rates of digital banking software continue to rise, understanding the advantages and functionalities of these solutions is crucial for institutions aiming to thrive in a competitive landscape. Expert opinions emphasize that investing in digital banking software, particularly through Avato’s hybrid integration platform, not only enhances security and streamlines transactions but also positions institutions to better serve their customers in an increasingly digital world. Avato’s commitment to streamlining intricate integrations and increasing business value is essential for financial institutions striving to future-proof their operations.

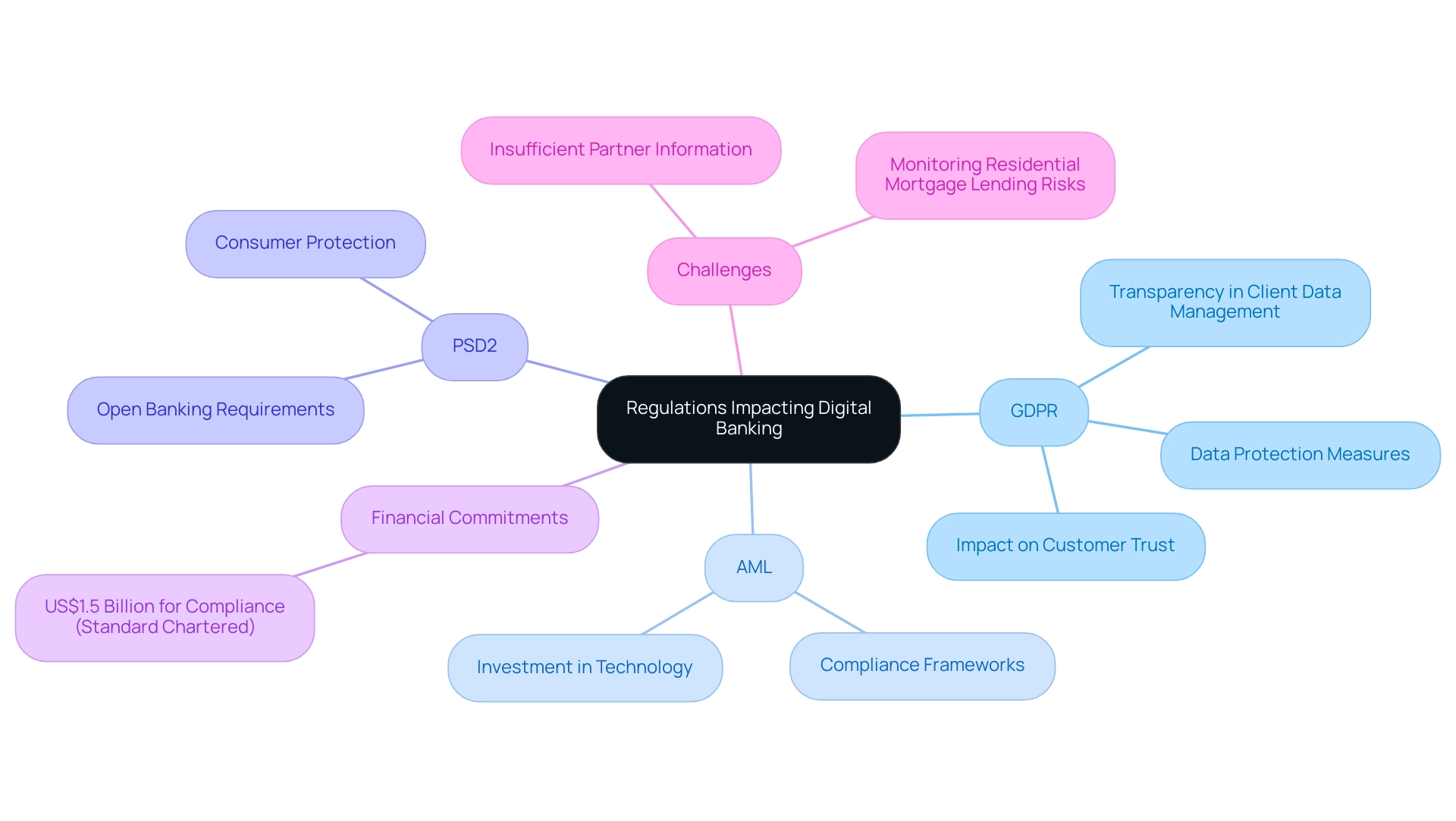

Navigating Compliance: Key Regulations Impacting Digital Banking

Digital finance operates within a complex regulatory landscape designed to safeguard consumers and uphold the integrity of financial systems. Among the most significant regulations are the General Data Protection Regulation (GDPR), Anti-Money Laundering (AML) laws, and the Payment Services Directive (PSD2). Each of these regulations imposes stringent requirements, compelling financial institutions to establish comprehensive compliance frameworks, often necessitating substantial investments in technology and employee training.

Notably, Standard Chartered has allocated US$1.5 billion over the next three years for its ‘Fit for Growth’ initiative. This underscores the financial commitment institutions are making toward compliance and technology.

The impact of GDPR on digital finance is particularly profound, as it mandates strict data protection measures and transparency in client data management. Compliance with GDPR not only influences operational practices but also shapes customer trust and brand reputation. Recent statistics reveal that 61% of compliance officers anticipate an increase in costs associated with senior compliance roles, with 51% expecting a slight rise and 10% predicting a significant increase. This underscores the growing emphasis on adhering to these regulations.

As we look ahead to 2025, financial institutions will encounter additional challenges while navigating evolving regulations. For instance, 52% of compliance experts identify insufficient partner information as a critical risk factor, highlighting the need for improved data management practices. Moreover, as interest rates rise, case studies from the Office of the Superintendent of Financial Institutions (OSFI) demonstrate that monitoring residential mortgage lending activities is essential to mitigate risks associated with variable rate mortgages.

OSFI is actively promoting sound practices to manage these risks, ensuring adherence to prudent underwriting standards.

Proactive adaptation to these regulatory changes is vital for financial institutions aiming to mitigate risks and enhance their market reputation. By staying informed about the latest compliance requirements and implementing robust systems, banks can ensure adherence to regulations while simultaneously enhancing their operational capabilities and customer satisfaction. This strategic approach positions them favorably in an increasingly competitive landscape, where compliance is not merely a legal obligation but a cornerstone of sustainable business practices.

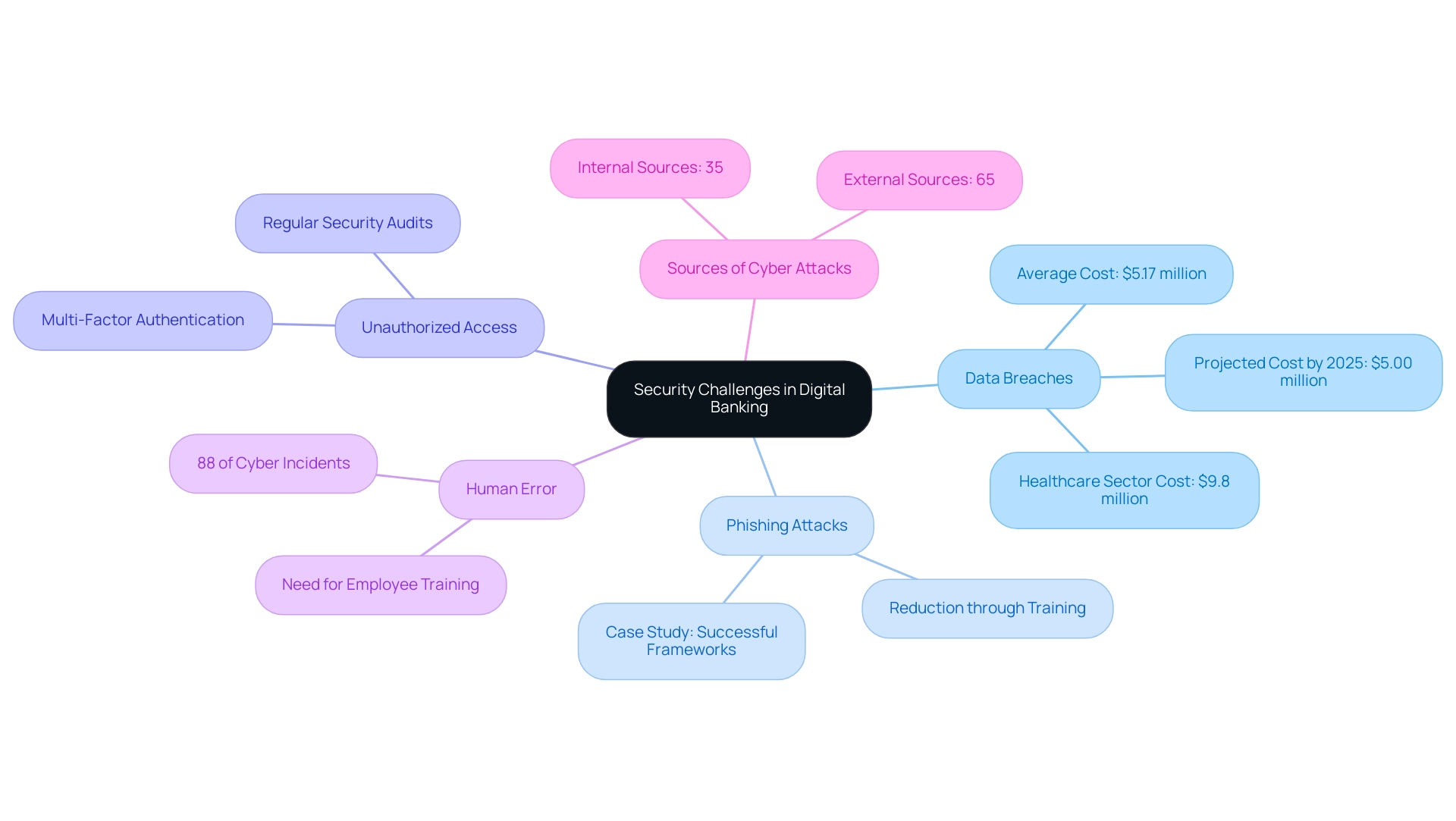

Addressing Security Challenges in Digital Banking Implementation

The implementation of digital financial solutions presents a myriad of security challenges, notably data breaches, phishing attacks, and unauthorized access. In 2025, the financial sector faces an urgent need to adopt a multi-layered security strategy that encompasses:

- Advanced encryption techniques

- Robust multi-factor authentication

- Regular security audits

This comprehensive approach not only strengthens defenses but also addresses the concerning statistic that 88% of all cyber incidents arise from human mistakes, underscoring the critical need for improved employee training on cybersecurity best practices.

Furthermore, as financial institutions prepare for the transition to open systems, it is crucial to integrate these security measures into Avato’s hybrid integration platforms. This includes ensuring that integration solutions comply with the most stringent security protocols, as open finance will demand even tighter security to safeguard sensitive customer data. The financial implications of security breaches are staggering.

Recent data indicates that breaches involving public cloud environments incur an average cost of $5.17 million, with the healthcare sector experiencing even higher costs at an average of $9.8 million per incident. As the complexity of cybersecurity risks escalates, it is projected that by 2025, the average cost of a data breach will rise to $5.00 million, driven by stricter data protection regulations and evolving threats, according to VPNRanks.

To effectively combat these challenges, financial institutions must prioritize cultivating a culture of security awareness among employees. This encompasses ongoing training programs that equip staff with the knowledge to identify and address potential threats, especially in the context of open financial integration. Moreover, case studies demonstrate that financial institutions employing multi-layered security strategies have effectively reduced risks linked to online banking.

For instance, organizations that have adopted comprehensive security frameworks report a significant reduction in successful phishing attacks and unauthorized access incidents. Understanding the sources of cyber attacks is equally crucial. According to Verizon’s Data Breach Investigations Report, 65% of cyber attacks are initiated by external sources, while 35% are internal, involving employees or partners. This highlights the importance of addressing both external and internal threats in security strategies, particularly as financial institutions navigate the complexities of open banking.

In light of these challenges, it is essential for these entities to stay informed about current security threats and continuously adapt their strategies. By proactively addressing these issues and ensuring compliance with regulatory standards, financial institutions can safeguard their systems, protect sensitive customer information, and ultimately build trust in their online offerings.

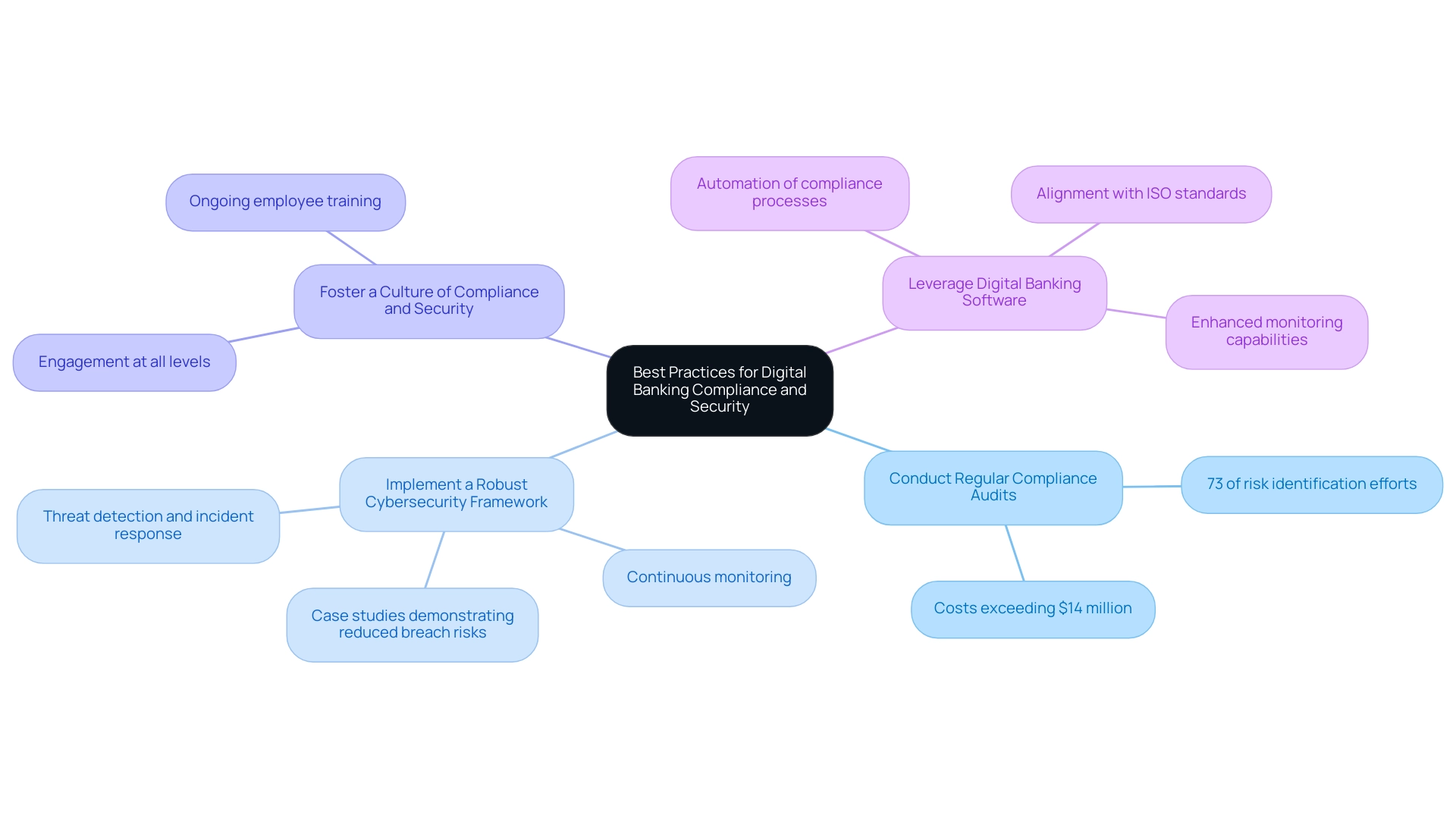

Best Practices for Ensuring Compliance and Security in Digital Banking

To ensure compliance and security in digital banking, banks must adopt the following best practices:

- Conduct Regular Compliance Audits: Regular audits are essential for identifying gaps in adherence to regulations. Statistics indicate that 73% of risk identification efforts are dedicated to due diligence and recertification, underscoring the importance of systematic evaluations to maintain compliance. The financial implications of non-compliance are significant, with costs exceeding $14 million. The use of digital banking software can significantly streamline financial processes, as highlighted in the case study “The Cost of Non-Compliance.”

- Implement a Robust Cybersecurity Framework: Establishing a comprehensive cybersecurity framework is critical. This framework should encompass threat detection, incident response plans, and continuous monitoring to safeguard sensitive data against evolving threats. Successful case studies demonstrate that financial institutions with well-defined cybersecurity strategies significantly reduce the risk of breaches. Avato’s dependable and future-ready technology stack, developed on their hybrid integration platform, can support these frameworks, ensuring that financial institutions can adapt to changing demands while maintaining security. Additionally, Avato’s enterprise architecture and project management services can assist financial institutions in designing and implementing effective cybersecurity measures tailored to their specific needs.

- Foster a Culture of Compliance and Security: Ongoing employee training and awareness programs are vital for cultivating a culture of compliance and security within the organization. Engaging staff at all levels ensures that everyone understands their role in maintaining regulatory standards and protecting customer information.

- Leverage Digital Banking Software: Utilizing technology solutions, such as Regulatory Technology (RegTech), can automate compliance processes and enhance monitoring capabilities. This not only streamlines operations but also enables financial institutions to respond swiftly to regulatory changes, thereby minimizing the risk of non-compliance. Avato’s hybrid integration platform plays a crucial role in this regard, simplifying the integration of compliance-related technologies and delivering a connected foundation that enterprises need to modernize. Furthermore, Avato’s services can aid financial institutions in aligning with ISO standards, ensuring they meet international compliance requirements effectively.

By incorporating these practices into their operations, banks can manage the intricacies of online finance with assurance. As Tony Leblanc from the Provincial Health Services Authority noted, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This sentiment reflects the growing acknowledgment of the need for strong compliance strategies in the financial sector as they adapt to the rising demands of technological transformation.

Furthermore, with ISO implementing 25,729 international compliance standards across 173 countries, the global context of compliance in financial services reinforces the necessity for effective compliance programs.

Integrating Legacy Systems: Bridging the Gap to Digital Banking

Integrating legacy systems with modern digital banking software poses a formidable challenge for financial institutions, particularly in 2025, as they strive to enhance operational efficiency and customer experience. A phased approach to modernization is essential, commencing with the most critical systems to ensure minimal disruption. This strategy enables financial institutions to prioritize their integration efforts effectively, focusing on areas that will yield the highest impact.

APIs play a pivotal role in this integration process, serving as the bridge between legacy and contemporary systems. By facilitating seamless communication, APIs enable smoother data flow and enhance functionality across platforms. Avato’s hybrid integration platform specifically utilizes APIs to streamline these processes, ensuring that data integrity and security are paramount.

Banks must prioritize these aspects during integration to mitigate risks associated with data breaches and operational failures. The challenges of integrating legacy systems are underscored by statistics indicating that a significant percentage of financial institutions struggle with outdated technology. However, successful case studies, such as those involving Avato’s work with Coast Capital, demonstrate that financial institutions can transition from legacy systems to modern financial operations effectively. Since its establishment in 2010, Avato has developed its hybrid integration platform to empower financial institutions to drive sustainable growth while ensuring a smooth transition to modern finance, enabling new use cases without requiring modifications to core systems.

Gustavo Estrada, a customer, noted, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” reinforcing the effectiveness of Avato in addressing these integration challenges.

Expert opinions highlight the necessity of a strategic approach to legacy system modernization. IT managers frequently cite the importance of balancing speed, security, and simplicity in integration efforts. By leveraging robust integration platforms like Avato, financial institutions can achieve 24/7 uptime for critical integrations with digital banking software, ensuring that their operations remain reliable while adapting to evolving market demands.

In conclusion, by strategically managing legacy system integration and embracing modern technologies, banks can significantly enhance their technological capabilities without compromising the reliability of their existing operations. This approach not only positions them for future growth but also ensures they remain competitive in an increasingly digital landscape, reflecting Avato’s dedication to architecting the technology foundation required for rich, connected experiences.

Enhancing Customer Experience Through Digital Banking Solutions

Digital banking software presents a remarkable opportunity to enhance user experience significantly. By leveraging data analytics, financial institutions can personalize their offerings, delivering tailored recommendations and proactive support that align with individual client needs. This strategy not only boosts engagement but also cultivates a deeper connection between banks and their clients.

User-friendly interfaces and seamless navigation across online platforms are critical for elevating client satisfaction. Astonishingly, studies indicate that 90% of clients now prefer online channels for their banking needs, with only 10% relying primarily on branch visits. This shift emphasizes the urgent need for financial institutions to invest in intuitive digital banking software that meets contemporary consumer expectations.

Furthermore, 24% of clients intend to reduce branch visits in the next five years, underscoring the imperative for banks to adapt.

Moreover, providing omnichannel support is crucial for ensuring that individuals can access services through their preferred channels—whether online, via mobile apps, or in-person. This flexibility enhances convenience and fortifies client loyalty. As industry leaders assert, prioritizing user experience is essential for banks striving to excel in the competitive realm of digital banking software.

Gustavo Estrada, a client, emphasized this by stating, ‘Avato has simplified complex projects and delivered results within desired time frames and budget constraints,’ exemplifying the effectiveness of integrating advanced solutions like Avato’s hybrid integration platform. Additionally, Tony Leblanc from the Provincial Health Services Authority remarked, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable,” further validating Avato’s commitment to excellence.

The influence of data analytics on personalizing digital banking software services is profound. Successful implementations have shown that financial institutions utilizing analytics can significantly boost client satisfaction rates. For instance, a recent study revealed that banks employing advanced analytics experienced a 20% increase in client retention.

This illustrates the tangible benefits of integrating data-driven strategies into financial operations, particularly as generative AI emerges as a powerful tool for enhancing customer experience and operational efficiency.

Moreover, while online financial services are on the rise, the case study titled ‘In-Person Transactions’ demonstrates that face-to-face services remain vital for large transactions. Despite the decline in branch visits, satisfaction with in-person services stays high, highlighting its ongoing relevance.

In summary, as online finance continues to evolve, the focus on enhancing customer experience through personalized services, intuitive interfaces, and robust omnichannel support will be critical for institutions leveraging digital banking software to maintain a competitive edge and achieve long-term success. Avato’s support for 12 levels of interface maturity further empowers banks to balance integration speed with the sophistication necessary to future-proof their technology stack.

Future Trends in Digital Banking: What to Expect

The digital financial landscape is undergoing a significant transformation, driven by several pivotal trends that are set to define the industry’s future. One of the most notable developments is the increasing integration of artificial intelligence (AI) and machine learning, which are being leveraged to gain deeper customer insights and enhance service delivery. The AI market in banking is projected to grow from $6.8 billion in 2022 to over $27 billion by 2027, highlighting the sector’s commitment to innovation.

Key players in this market include:

- Amazon Web Services

- IBM

- Microsoft

- SAP

This underscores the competitive landscape that Banking IT Managers must navigate. How can institutions differentiate themselves in this rapidly evolving environment? Avato’s secure hybrid integration platform stands out, designed for secure transactions and trusted by financial institutions, healthcare, and government. Constructed for integration projects where 24/7 availability is necessary, Avato provides a robust foundation for transformation initiatives, ensuring reliability and security in intricate systems.

Furthermore, cybersecurity continues to be a crucial focus as financial institutions navigate the intricacies of transformation. With increasing threats, investments in cybersecurity measures are anticipated to rise, ensuring that user data is protected while maintaining trust in digital services. This is particularly crucial as the demand for personalized financial experiences intensifies, prompting banks to utilize data analytics to tailor services to individual customer needs. Statistics indicate that cybersecurity investments in the financial sector are projected to increase significantly, reflecting the industry’s priorities in safeguarding sensitive information.

In addition, open financial initiatives are gaining traction, fostering collaboration between institutions and third-party providers. A notable example is Tink’s partnership with Enel, which enabled the development of digital financial solutions across Europe. This collaboration not only improved financial management for clients but also highlighted the potential of machine learning in providing personalized financial advice.

As we look towards 2025, the financial industry must remain agile and responsive to these trends. By embracing AI and machine learning, prioritizing cybersecurity, and exploring open financial opportunities, banks can position themselves for success in an increasingly competitive environment. The survey reveals generative AI as the second-most-used AI workload in financial services, marking a significant shift in how institutions approach problem-solving and innovation.

With a 60% rise in its application for client experience, particularly in creating advanced chatbots and virtual assistants, generative AI is optimizing operations and boosting productivity across various departments. Despite worries about job loss, the AI market is anticipated to generate more startups and positions than it eliminates, suggesting a promising future for the financial sector. The future of digital banking software is not just about technology; it’s about creating meaningful, secure, and personalized experiences for customers, which directly impacts the roles and responsibilities of Banking IT Managers in implementing these solutions.

Conclusion

Digital banking software is revolutionizing the financial sector, offering banks a pathway to enhanced efficiency, improved customer engagement, and a robust response to regulatory challenges. As institutions increasingly invest in digital technologies, understanding their functionalities and advantages is paramount. This comprehension is crucial for maintaining a competitive edge, especially as consumer expectations evolve in a digital-first landscape.

The integration of advanced security measures and compliance frameworks is essential for navigating the complexities of digital banking. With regulations like GDPR and AML shaping operational practices, banks must prioritize cultivating a culture of compliance and security. Implementing best practices such as regular audits and leveraging innovative technology solutions will not only mitigate risks but also enhance operational capabilities, ultimately leading to greater customer satisfaction.

As the industry progresses, the focus on integrating legacy systems with modern banking solutions will be vital. The strategic use of APIs and hybrid integration platforms, like those offered by Avato, can bridge the gap between old and new technologies, ensuring a seamless transition that enhances both operational efficiency and customer experience.

Looking ahead, the future of digital banking will be defined by the integration of artificial intelligence, machine learning, and a continued emphasis on cybersecurity. By embracing these trends, banks can create personalized experiences that foster deeper connections with customers while safeguarding their data. As the digital landscape continues to evolve, it is imperative for financial institutions to remain agile, innovative, and responsive to the changing needs of the market. This proactive approach will ensure they not only survive but thrive in the competitive world of digital banking.