Overview

This article addresses the critical need for effective data integration patterns in banking, showcasing best practices that significantly enhance operational efficiency and ensure compliance. It delves into various integration approaches, including batch processing, real-time connectivity, and event-driven architectures. Supported by compelling case studies and statistics, these strategies are proven to improve customer experiences while meeting stringent regulatory requirements.

How can your organization leverage these integration methods to stay ahead? By adopting these best practices, you not only streamline operations but also position your bank as a leader in customer satisfaction and compliance.

In conclusion, embracing these integration strategies is not just beneficial; it is essential for navigating the complexities of the modern banking landscape. Take action today to transform your data integration processes and reap the rewards of enhanced efficiency and regulatory adherence.

Introduction

In the rapidly evolving landscape of banking, data integration stands as a cornerstone for operational efficiency and enhanced customer experiences. As financial institutions grapple with diverse systems and the pressing need for real-time insights, understanding the various data integration patterns becomes critical.

From batch processing to real-time integration and event-driven architectures, each approach presents unique benefits tailored to the industry’s demands. Furthermore, with the rise of hybrid integration solutions, banks can leverage legacy systems while embracing modern technologies, ensuring they remain competitive in a data-driven environment.

This article delves into essential data integration patterns, compliance challenges, security measures, and future trends shaping the banking sector. It serves as a comprehensive guide for institutions eager to navigate this complex landscape effectively.

Understanding Data Integration Patterns in Banking

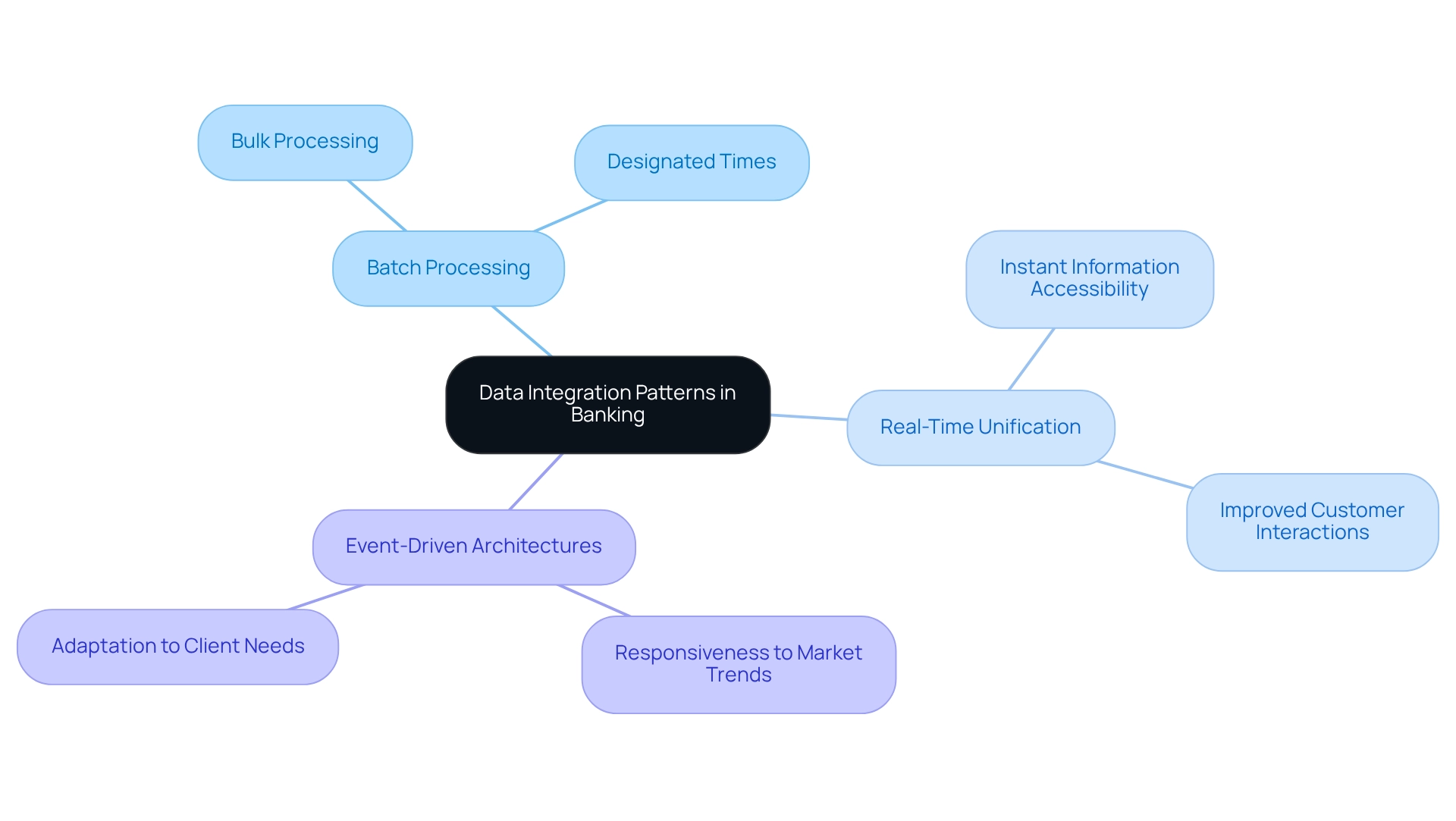

Data integration patterns in banking represent standardized methodologies employed to connect diverse systems and data sources, playing a crucial role in enhancing operational efficiency and data accuracy. These patterns are essential for financial institutions aiming to enhance customer experiences and streamline operations. Common data integration patterns include batch processing, real-time connectivity, and event-driven architectures, each tailored to meet specific operational requirements.

Avato’s hybrid unification platform is designed to maximize and extend the value of legacy systems, simplifying complex connections while significantly lowering expenses. Batch processing is particularly effective for handling substantial amounts of information, enabling financial institutions to process details in bulk at designated times. In contrast, real-time unification guarantees instant information accessibility, crucial for prompt decision-making and improving customer interactions.

Event-driven architectures enhance responsiveness to shifts in information, allowing financial institutions to adapt quickly to market trends and client needs. The significance of these integration patterns is underscored by the fact that 87% of organizations worldwide believe AI technologies will provide them with a competitive advantage. This showcases the growing reliance on interconnected information systems to leverage advanced analytics and machine learning capabilities. For instance, Deutsche Bank has effectively executed data integration patterns that enable information to stream directly into BigQuery, streamlining trade oversight and eliminating the tedious process of information duplication.

Recent trends in 2025 suggest a shift towards more advanced data integration patterns, with banks progressively embracing hybrid models that incorporate on-site and cloud solutions. This approach not only enhances flexibility but also aids in adhering to regulatory standards, particularly in industries like banking where information security is paramount. Avato’s secure hybrid connection platform guarantees 24/7 availability and reliability, positioning it as an optimal solution for complex systems in banking, healthcare, and government.

Case studies illustrate effective information unification methods in banking, highlighting how institutions have tackled complicated connection challenges. For instance, the implementation of SmartEDA, an R package for exploratory analysis, showcases the potential for automation in handling information, streamlining processes that were previously tedious and time-consuming. This case study emphasizes how automation can significantly improve the efficiency of information merging efforts in banking.

Moreover, recent initiatives like Statistics Canada’s Disaggregated Information Action Plan underscore the importance of gathering insights on diverse population groups, which can inform better merging practices and enhance the relevance of information in banking operations.

Optimal approaches for data integration patterns in banking stress the necessity for a robust strategy that aligns with organizational objectives. This involves investing in scalable connection platforms such as Avato’s, capable of adapting to evolving information environments, and ensuring that governance frameworks are established to uphold information integrity and security. By understanding and utilizing these data integration patterns, banking institutions can enhance their operational capabilities and prepare for future growth in an increasingly data-driven environment.

Navigating Compliance and Regulatory Challenges

Adherence to regulations such as GDPR, PCI DSS, and various local laws is paramount for banks, particularly in the context of data integration patterns related to information unification. To safeguard sensitive customer information, data integration patterns must be meticulously designed to comply with these stringent regulations. Implementing robust information governance frameworks is essential; this encompasses:

- Conducting regular audits

- Employing encryption

- Establishing stringent access controls to ensure information integrity

Furthermore, the integration of automated compliance tools can significantly enhance the efficiency of monitoring data integration activities. These tools not only guarantee that all processes remain compliant but also mitigate the risk of data breaches, which can have dire repercussions for financial institutions. In fact, as of 2025, a staggering 77% of corporate risk and compliance professionals underscore the importance of staying updated on Environmental, Social, and Governance (ESG) developments, reflecting the increasing complexity of compliance landscapes.

This is especially significant as 76% of consumers would withdraw their support from companies that mistreat employees, communities, and the environment, highlighting the broader implications of compliance in finance.

Val Srinivas, a senior research leader at the Deloitte Center for Financial Services, stresses the necessity for financial institutions to adeptly navigate these compliance challenges. His insights into the compliance environment can guide organizations in adapting to evolving demands.

Case studies illustrate the hurdles and successes institutions face in implementing compliance strategies. For instance, Vikram, a leader in financial services at Deloitte, emphasizes leveraging technology and analytics to boost business efficiency while reinforcing controls. His tactical approach highlights the imperative for financial institutions to adapt to shifting compliance requirements, particularly in light of GDPR and PCI DSS directives.

As companies confront these compliance challenges, they must also recognize the impact of GDPR on their data integration patterns for information processing procedures. The regulation mandates not only strict information handling practices but also influences how financial institutions manage customer information. By adopting best practices for information governance, such as establishing clear ownership and accountability, banks can better position themselves to meet compliance demands while fostering trust with their clients.

In summary, integrating compliance considerations into information processing is not merely a regulatory obligation; it is a strategic imperative that can enhance operational resilience and customer confidence in the banking sector.

Key Data Integration Patterns for Banking Systems

In 2025, several important information unification patterns stand out as especially significant for banking systems, each offering unique benefits to enhance operational efficiency and responsiveness:

- Batch Processing: This method excels in managing large volumes of information at scheduled intervals, making it essential for end-of-day processing. Although it is cost-effective and scalable, it can introduce delays in critical functions like fraud detection, potentially allowing illicit transactions to go unnoticed until the next analysis cycle. A case study underscores that while batch processing is efficient, it may hinder timely fraud detection, highlighting the necessity for prompt analysis.

- Instantaneous Connection: Crucial for applications requiring immediate information access, real-time connectivity is fundamental for systems such as fraud detection, where timely insights can prevent financial losses. Recent statistics from a white paper on AI innovation in financial services reveal a growing trend toward real-time integration in banking, reflecting the industry’s shift toward more responsive information management. The Hybrid Integration Platform meets this demand by offering real-time monitoring and alerts on system performance, enabling banks to act swiftly to mitigate risks. Moreover, the platform allows institutions to access information and systems in weeks, not months, significantly improving operational efficiency.

- Event-Driven Architecture: This pattern empowers systems to respond to events as they occur, facilitating dynamic information flows that enhance customer interactions and operational agility. By leveraging this structure, financial institutions can improve their responsiveness to market changes and client demands, a capability that the company amplifies through its advanced integration solutions.

- Information Federation: This method allows banks to retrieve and query information from various sources without necessitating physical consolidation. By enhancing agility and minimizing data silos, data federation fosters a more integrated view of information across the organization, aligning with Avato’s goal of maximizing the value of legacy systems while also reducing costs.

- API-Based Connection: APIs enable seamless communication among different banking applications, fostering adaptable and scalable connectivity solutions. This method is increasingly vital as banks strive to modernize their systems and enhance interoperability. The platform, supporting 12 levels of interface maturity, allows institutions to balance the speed of adoption with the complexity necessary to future-proof their technology stack.

The effectiveness of these data integration patterns is illustrated by real-world examples and case studies, showcasing their impact on operational success. For instance, Gustavo Estrada from BC Provincial Health Services Authority noted that the company has streamlined intricate projects, delivering outcomes within expected timelines and financial limits, demonstrating the effectiveness of their solutions regarding these merging patterns. Furthermore, the incorporation of generative AI is revolutionizing customer interaction and operational effectiveness in financial services, further enhancing the functionalities of Avato’s Hybrid Platform.

As the banking sector continues to evolve, implementing a hybrid approach that combines the advantages of both batch processing and real-time connectivity will be crucial for sustaining a competitive advantage.

Ensuring Security in Data Integration Processes

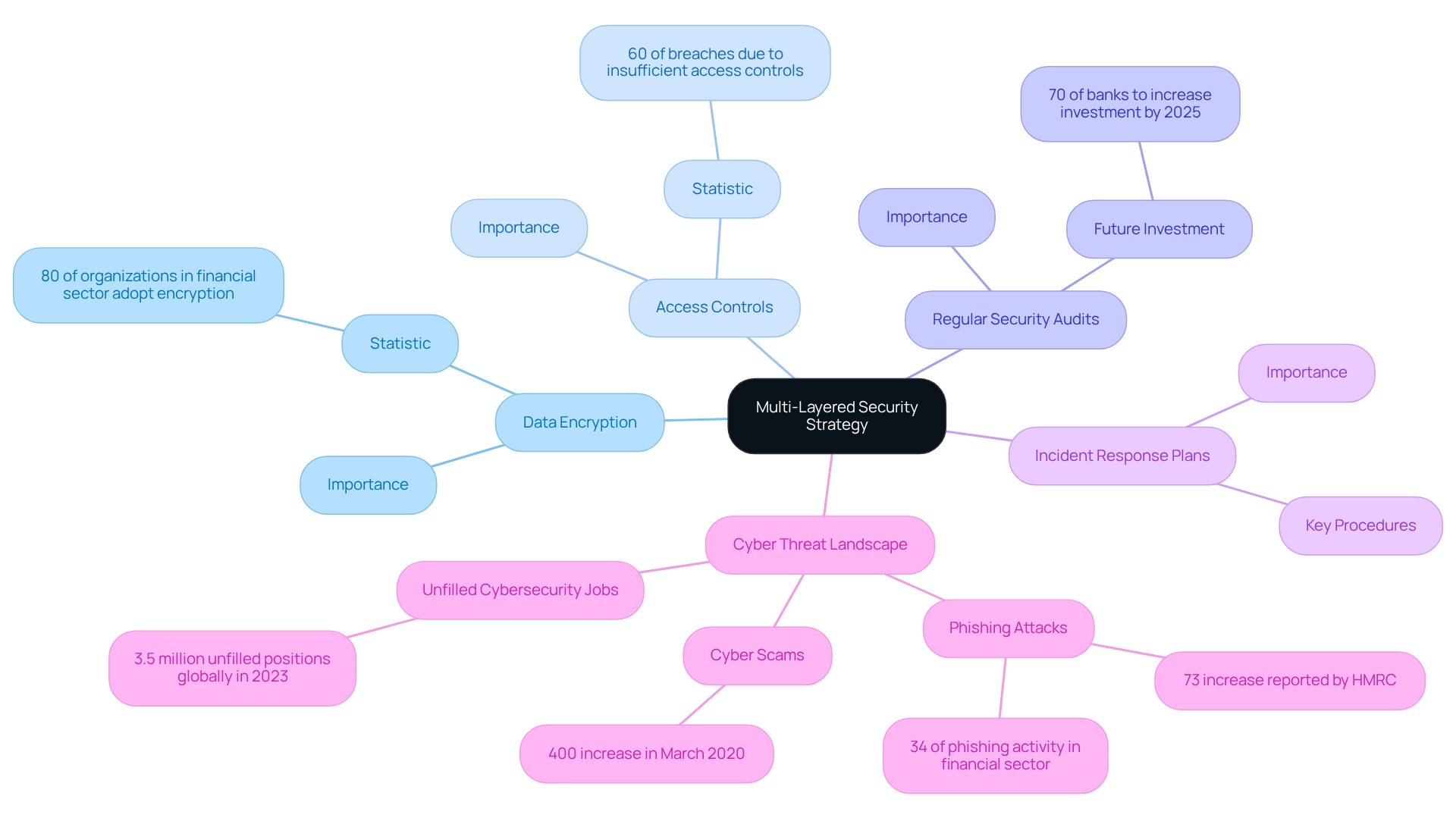

To ensure robust protection in information integration processes, banks must implement a comprehensive multi-layered security strategy. This strategy encompasses several critical components:

- Data Encryption: Encrypting data both in transit and at rest is essential. This practice protects sensitive information from unauthorized access, ensuring that even if data is intercepted, it remains unreadable without the appropriate decryption keys. Recent statistics reveal that 80% of organizations in the financial sector have adopted encryption practices to safeguard their information assets.

- Access Controls: Implementing stringent access controls is vital. This includes defining user roles and permissions to ensure that only authorized personnel can access sensitive information. A study found that 60% of breaches in financial institutions were due to insufficient access controls, underscoring the importance of this measure.

- Regular Security Audits: Conducting routine assessments of information processing methods is essential for identifying and mitigating potential weaknesses. These audits help organizations stay ahead of emerging threats and ensure compliance with industry regulations. Regularly performing security audits and compliance checks is crucial to ensure that modernized systems meet all regulatory requirements. By 2025, it is anticipated that 70% of banks will increase their investment in security audits to enhance their protection strategies. Avato’s hybrid unification solutions are designed to facilitate these audits, providing tools that streamline the compliance process and bolster security measures.

- Incident Response Plans: Developing and maintaining thorough incident response plans is crucial for swiftly addressing any security breaches that may occur during information merging. These plans should outline clear procedures for containment, investigation, and recovery, enabling financial institutions to minimize damage and restore operations quickly.

The urgency of enhancing security measures is underscored by the significant rise in cyber threats. Phishing attacks have surged, with HMRC reporting a 73% increase, and 42% of domains reported for phishing were registered in new generic top-level domains. Additionally, cyber scams increased by 400 percent in March 2020, marking COVID-19 as a significant security threat.

As the financial services sector remains a prime target for cybercriminals, implementing a multi-layered security approach is not just advisable; it is imperative for safeguarding the integrity of data integration patterns in banking. As Rob Sobers, a software engineer specializing in web security, aptly states, “Deploys in minutes,” highlighting the efficiency of these security measures. Furthermore, the ongoing challenge of 3.5 million unfilled cybersecurity positions worldwide in 2023 emphasizes the need for financial institutions to strengthen their defenses against these common attack vectors.

The company’s solutions specifically address these challenges by offering advanced security features and compliance tools that assist financial institutions in navigating the evolving threat landscape.

Implementing Real-Time Monitoring and Alerts

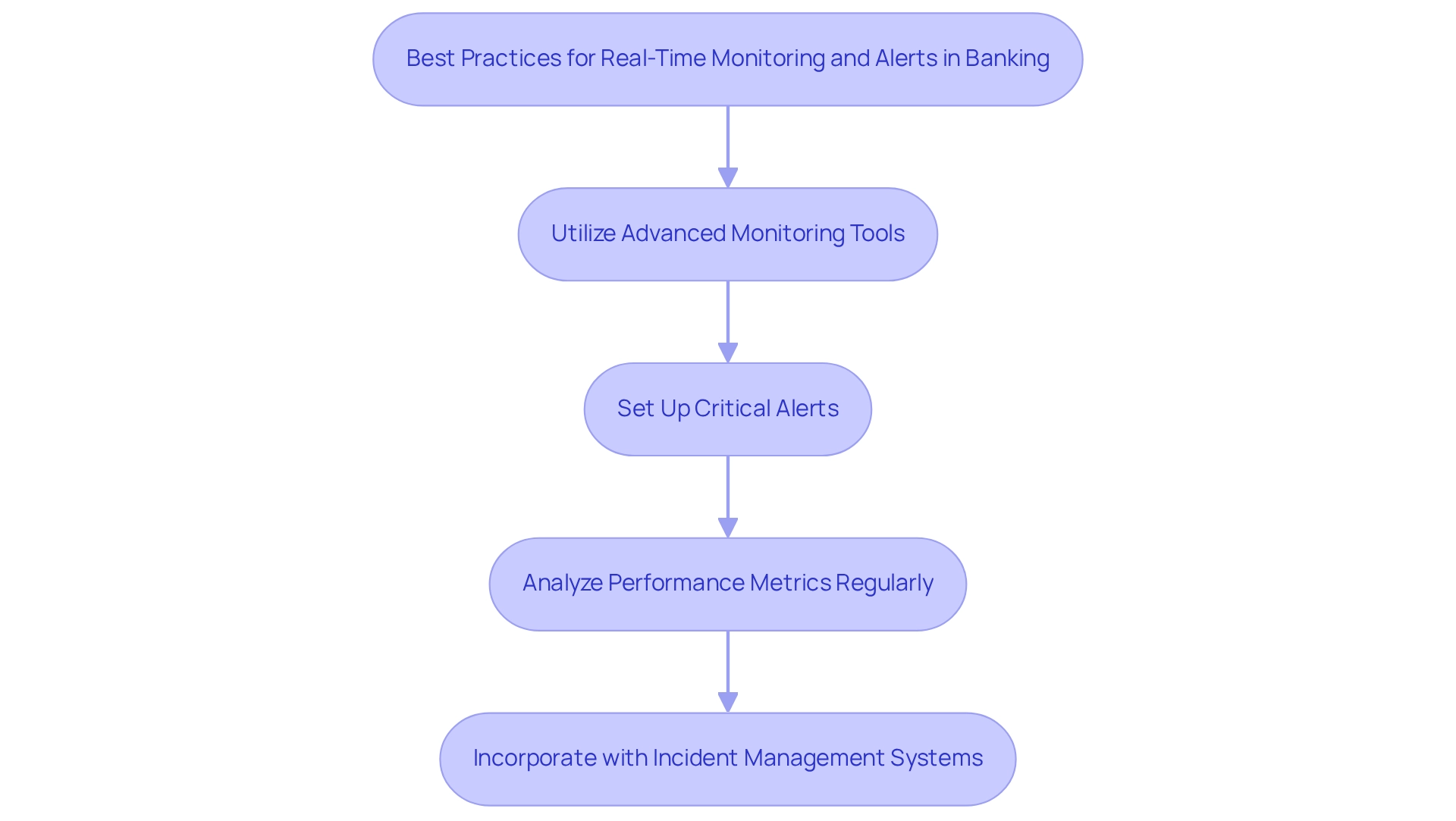

Implementing real-time monitoring and alerts is essential for enhancing the performance of data integration patterns in banking. To achieve this, banks should adopt the following best practices:

- Utilize Advanced Monitoring Tools: Invest in sophisticated monitoring solutions, such as Avato’s Hybrid Integration Platform, which provides real-time visibility into information flows and system performance. These tools are crucial for identifying bottlenecks and ensuring seamless operations while maximizing the value of legacy systems.

- Set Up Critical Alerts: Configure alerts for significant events, such as data transfer failures or performance degradation. This proactive approach enables rapid responses to issues, minimizing potential disruptions and ensuring 24/7 uptime and reliability.

- Analyze Performance Metrics Regularly: Conduct regular analysis of performance metrics to uncover trends and potential issues. This practice allows for prompt modifications to integration processes, thereby improving overall efficiency and business value creation.

- Incorporate with Incident Management Systems: Ensure that monitoring tools are seamlessly connected with incident management systems. This integration streamlines the resolution of any issues that arise, facilitating quicker recovery and maintaining operational continuity.

Real-time monitoring systems are pivotal in enhancing financial security, operational efficiency, and compliance within banking environments. They play a critical role in ensuring that banks can respond swiftly to potential threats and maintain the integrity of their operations. For instance, a Hybrid Integration Platform exemplifies how financial institutions can effectively oversee transactions and prevent fraud. By handling transaction data almost in real time and employing APIs and bots, this system reduces connection expenses while producing immediate alerts and facilitating adjustable thresholds. Such capabilities offer improved transparency and ongoing monitoring, rendering it an essential instrument for contemporary banking.

Furthermore, the platform significantly lowers expenses by optimizing integration processes and eliminating inefficiencies linked to outdated systems. Financial institutions that have adopted Avato’s solutions report a decrease in operational expenses by up to 30%, enabling them to allocate resources more efficiently.

Expert insights underscore the importance of real-time analytics in the finance sector. Industry leaders assert that the stability of a financial institution is closely linked to its cash flows and the security of investments, with real-time analytics being crucial for identifying and mitigating risks. Additionally, statistics indicate that the use of real-time monitoring tools can greatly enhance the performance of data integration patterns, resulting in improved decision-making and operational results.

For example, financial institutions utilizing this platform have experienced a 25% increase in processing speeds, directly connected to enhanced operational efficiency.

By implementing these optimal methods, financial institutions can leverage real-time monitoring and notifications through the Hybrid Connection Platform to enhance their data integration patterns, ensuring they remain competitive and responsive to the continuously evolving financial landscape.

Overcoming Legacy System Integration Challenges

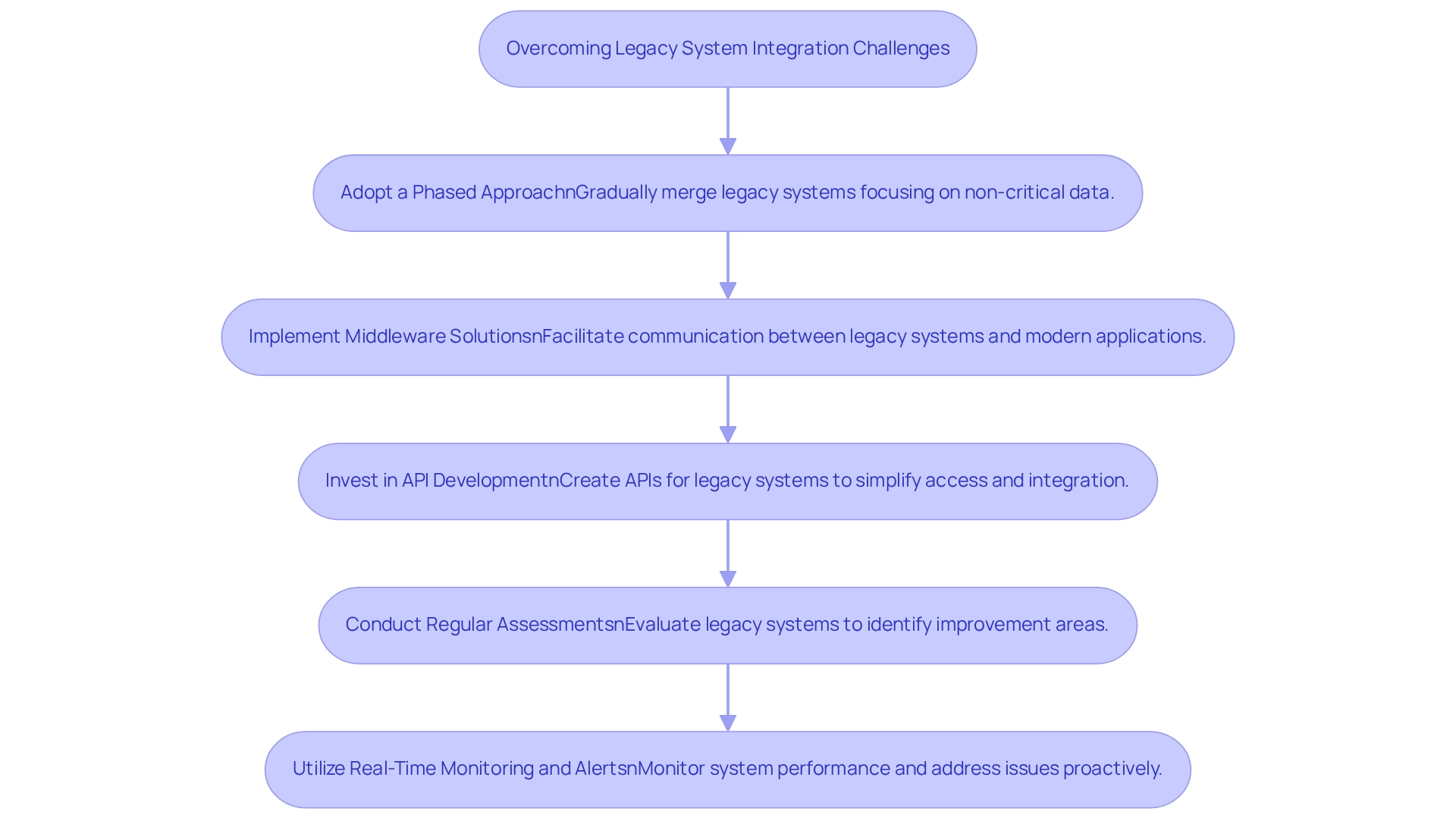

Incorporating legacy systems poses significant challenges for financial institutions, including information incompatibility, reliance on outdated technology, and escalating maintenance costs. To effectively navigate these obstacles, banks can implement several strategic approaches, particularly through the use of a dedicated hybrid platform.

- Adopt a Phased Approach: Gradually merging legacy systems by initially focusing on non-critical data allows banks to implement necessary adjustments while minimizing risks. This method has proven to enhance overall unification success rates by employing data integration patterns, offering a structured pathway for modernization that aligns with the organization’s commitment to simplifying complex connections.

- Implement Middleware Solutions: Middleware can facilitate communication between legacy systems and modern applications, employing data integration patterns to significantly reduce complexity in unification. The hybrid connection platform acts as a bridge, enabling diverse systems to operate cohesively, which is crucial in the highly regulated banking sector. Notably, incorporating a distributed cache solution within middleware frameworks can further enhance source performance, addressing typical issues encountered during integration.

- Invest in API Development: Creating APIs for legacy systems simplifies access and integration with modern technologies. This investment not only boosts operational efficiency but also meets the growing demand for real-time data exchange in banking activities, a vital aspect of the platform’s data integration patterns.

- Conduct Regular Assessments: Continuous evaluations of legacy systems are essential for identifying areas for improvement and prioritizing modernization efforts. By systematically assessing their technology landscape, banks can ensure competitiveness and adaptability to evolving market demands, utilizing data integration patterns and Avato’s expertise in building robust technology foundations.

- Utilize Real-Time Monitoring and Alerts: Avato’s hybrid platform offers real-time monitoring and alerts on system performance, empowering banks to proactively address issues and optimize their processes.

Recent statistics reveal that financial institutions are projected to increase their edge computing investments by 218% by 2026, underscoring the urgency for banks to modernize their systems. Furthermore, organizations that have embraced edge computing solutions report an average 69% reduction in transaction processing times, according to Accenture, highlighting the tangible benefits of adopting contemporary data integration patterns.

Case studies illustrate the effectiveness of these strategies. For instance, a recent study on information synchronization and performance in microservices indicated that implementing a distributed cache solution significantly enhanced source performance, addressing common challenges faced during the transition from monolithic systems. This example demonstrates how targeted solutions, such as those offered by Avato, can greatly improve operational efficiency by utilizing data integration patterns.

By leveraging middleware and adopting a phased strategy, banks can not only overcome the challenges of integrating legacy systems but also position themselves for future growth and innovation in a more competitive landscape, supported by Avato’s hybrid connection platform.

Best Practices for Successful Data Integration in Banking

-

Define Clear Objectives: Establishing clear goals for information unification projects is crucial for aligning with overarching business objectives and developing effective data integration patterns. This clarity not only aids in assessing success but also directs the merging process efficiently.

-

Engage Stakeholders: Involving key stakeholders from various departments is essential for gathering diverse insights and ensuring that merging efforts address the specific needs of the organization. Engaging stakeholders can significantly improve project outcomes; for instance, 24% of supply chain firms report losing over $500K annually due to inadequate connections, underscoring the financial repercussions of neglecting stakeholder engagement.

-

Choose the Right Tools: Selecting information merging tools that align with the bank’s unique needs and connection patterns is vital. Utilizing XSLT, a finely-tuned declarative programming language, simplifies XML transformation tasks, significantly reducing labor and minimizing programming errors through its integration with schemas. The use of schemas not only enhances information quality but also yields considerable cost savings by identifying errors early in the development process. The right tools can elevate the overall effectiveness of data integration patterns in unification efforts.

-

Prioritize Information Quality: Establishing robust information quality controls is essential to ensure that unified information is precise, consistent, and trustworthy. Poor information quality can lead to substantial operational difficulties and compliance issues, highlighting the critical role of data integration patterns in successful incorporation.

-

Continuously Monitor and Optimize: Regular oversight of data integration patterns enables institutions to pinpoint areas for enhancement and optimize performance based on real-time metrics and stakeholder feedback. Avato’s hybrid combination platform excels in this regard, offering tools for continuous monitoring and analytics that ensure compliance and security, particularly in sectors like banking and healthcare. This proactive approach can yield significant efficiency gains. For example, Morgan Stanley’s implementation of a regulatory compliance visualization dashboard reduced their quarterly compliance reporting preparation time from 240 person-hours to 87 person-hours—a remarkable 64% improvement in efficiency—while enhancing the quality and thoroughness of their regulatory submissions.

-

Learn from Successful Examples: Institutions should draw inspiration from successful information amalgamation projects within the banking sector. For instance, First Horizon Bank’s implementation of a branch performance visualization dashboard resulted in an impressive 23% increase in branch profitability within just one year, demonstrating the tangible benefits of effective incorporation.

-

Expert Opinions on Best Practices: Consulting with industry specialists provides valuable insights into optimal methods for information incorporation. Their perspectives can assist organizations in navigating the complexities of unification projects and achieving desired results.

-

Define Objectives for Unification Projects: Clearly defining goals at the outset of unification projects ensures that all efforts are strategically aligned and focused on delivering measurable outcomes. This critical step is essential for the success of any information unification initiative.

Future Trends in Data Integration for Banking

As the banking industry evolves, several key trends are shaping the future of data integration, particularly through Avato’s pioneering hybrid integration solutions:

- Increased Adoption of AI and Machine Learning: Financial institutions are increasingly leveraging AI and machine learning to enhance their data integration processes. These technologies facilitate predictive analytics, enabling financial institutions to make informed choices based on real-time information insights. With a 78% likelihood of legal tasks being handled by AI, the potential for efficiency gains in various banking operations is clear. Furthermore, adopting explainable AI models enhances transparency and trust, addressing challenges related to opaque decision-making processes in financial institutions. Avato’s solutions empower financial institutions to harness these technologies effectively, driving innovation and operational excellence.

- Rise of Open Banking: Open banking initiatives are transforming the financial environment by requiring smooth information exchange between financial institutions and external providers. This trend fosters innovation and competition, as banks collaborate with FinTech companies to deliver enhanced services and customer experiences. Avato’s unification platform plays a vital role in enabling these collaborations, ensuring secure and efficient information sharing.

- Cloud-Based Connection Solutions: The shift towards cloud computing is driving the adoption of cloud-based connection solutions. These platforms provide scalability and flexibility, allowing financial institutions to adjust swiftly to evolving market demands and incorporate various information sources more effectively. Avato’s hybrid unification solutions are designed to assist this transition, offering financial institutions the resources they require to excel in a cloud-focused setting.

- Emphasis on Information Privacy and Protection: With the rising occurrence of breaches, financial institutions are prioritizing security measures in their incorporation strategies. Protecting sensitive customer information is paramount, and institutions are investing in advanced security protocols to mitigate risks associated with cyber threats. Emerging security concerns include the exploitation of AI technology through cyber attacks, which can lead to significant damage. Notably, AI-based solutions are being widely adopted in Saudi banks to combat cyber threats, particularly DDoS attacks, showcasing how banks leverage AI for enhanced security. Avato’s dedication to security guarantees that its connection solutions achieve the highest standards of information protection.

- Incorporation of IoT Data: The increasing utilization of Internet of Things (IoT) devices in banking is stimulating the demand for innovative incorporation methods. Banks must effectively manage and analyze information generated from these devices to enhance operational efficiency and customer engagement. Avato’s solutions are designed to address the challenges of IoT information incorporation, allowing banks to discover new possibilities for customer engagement and service provision.

These trends not only emphasize the current condition of data integration patterns in banking but also set the stage for future advancements. As institutions navigate these changes, the integration of AI and machine learning will play a crucial role in shaping their strategies and enhancing their competitive edge. As emphasized by BoD13, “Vision 2030 is encouraging us to advance our digital capabilities,” indicating the importance of governmental support in accelerating AI and ML adoption in the banking sector.

Conclusion

The exploration of data integration patterns in banking underscores their vital role in enhancing operational efficiency and customer experience. By examining various methodologies—such as batch processing, real-time integration, and event-driven architectures—it becomes clear that each approach serves distinct needs within financial institutions. Furthermore, the rise of hybrid integration solutions empowers banks to modernize while leveraging existing legacy systems, ensuring they remain competitive in a rapidly evolving landscape.

As compliance and security become increasingly paramount, the integration of robust governance frameworks and advanced security measures is essential. Financial institutions must navigate complex regulatory environments while safeguarding sensitive customer data. Thus, strategic compliance emerges as a crucial aspect of data integration efforts. The implementation of automated compliance tools and comprehensive security strategies not only mitigates risks but also fosters customer trust.

Looking ahead, the banking sector is poised for transformation through the adoption of AI, machine learning, and cloud-based solutions. These technologies promise to revolutionize data integration, making it more agile and responsive to market demands. Integrating insights from successful case studies and industry best practices will be integral for banks aiming to enhance their operational capabilities and achieve sustainable growth.

In summary, embracing effective data integration patterns is not merely an operational necessity but a strategic imperative for banks. By prioritizing these integration efforts, financial institutions can navigate the complexities of the modern banking landscape, ultimately delivering superior services and experiences to their customers while positioning themselves for future success.