Overview

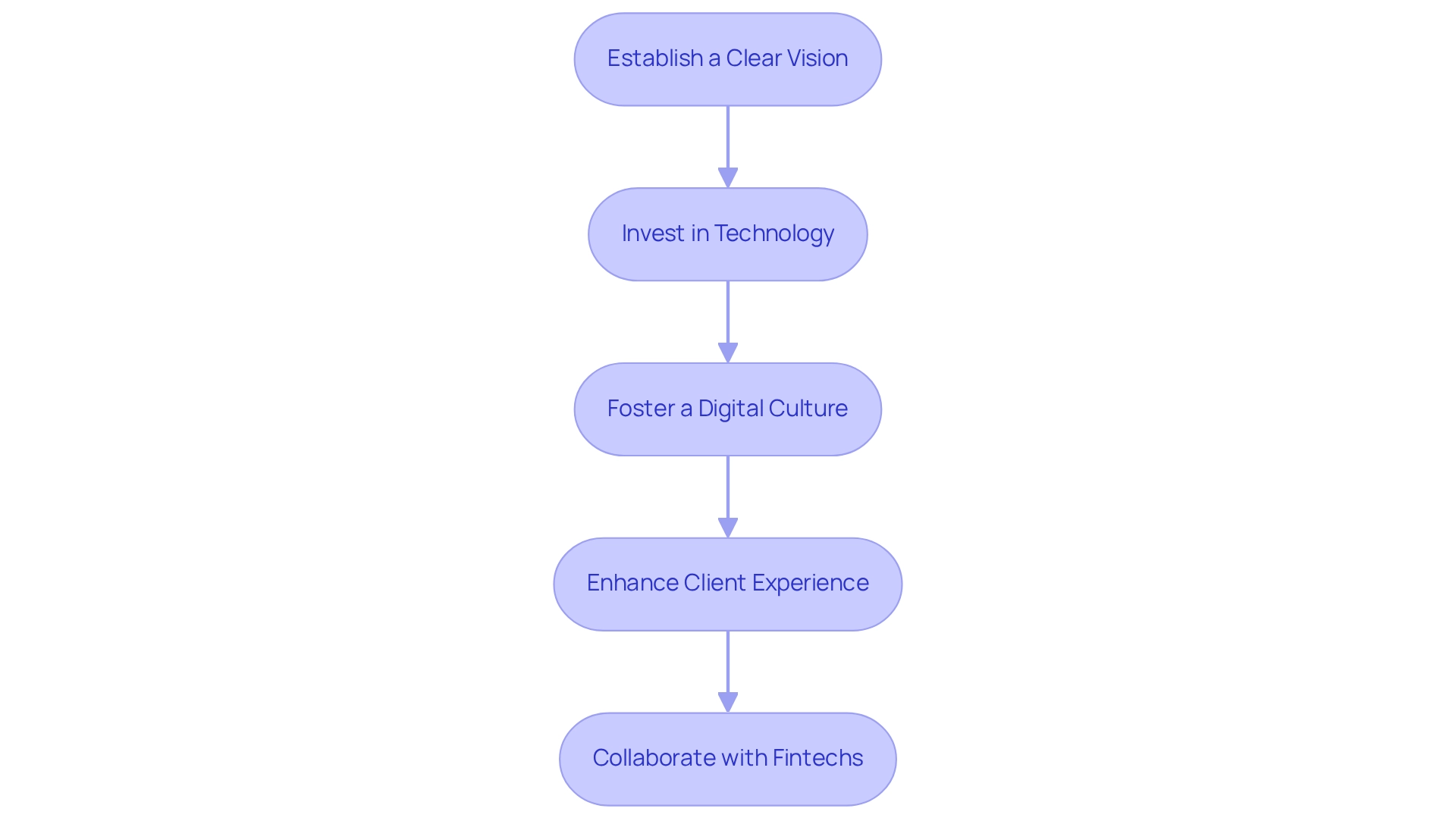

To thrive in today’s competitive landscape, financial institutions must embrace digital transformation by establishing a clear vision. This involves:

- Investing in modern technology

- Fostering a digital culture

- Enhancing client experiences

- Collaborating with FinTech companies

How can these strategies empower banks to adapt to changing market demands? By implementing these practices, banks can improve operational efficiency and ultimately enhance customer satisfaction. This is essential for not only meeting but exceeding client expectations. Furthermore, as institutions integrate these strategies, they position themselves as leaders in innovation and service excellence. In addition, the collaboration with FinTech companies opens new avenues for growth and agility in a rapidly evolving market. As a result, embracing digital transformation is not just a choice; it is a necessity for success in the financial sector.

Introduction

In the rapidly evolving landscape of banking, digital transformation has emerged as a critical necessity for institutions striving to remain competitive and relevant. This transformation transcends the mere adoption of new technologies; it encompasses a fundamental shift in how banks operate, engage with customers, and respond to market demands. As financial institutions face increasing pressure from fintech disruptors and changing consumer expectations, understanding the nuances of digital transformation becomes paramount.

How can banks enhance customer interactions through intuitive applications while automating back-office processes? The journey toward digitization is complex yet essential. With the support of innovative platforms like Avato, banks can navigate this transformative path, unlocking new efficiencies and fostering a culture of continuous improvement.

This article delves into the key drivers, challenges, and strategies that define successful digital transformation in banking, offering insights into how institutions can leverage technology to thrive in an increasingly digital world.

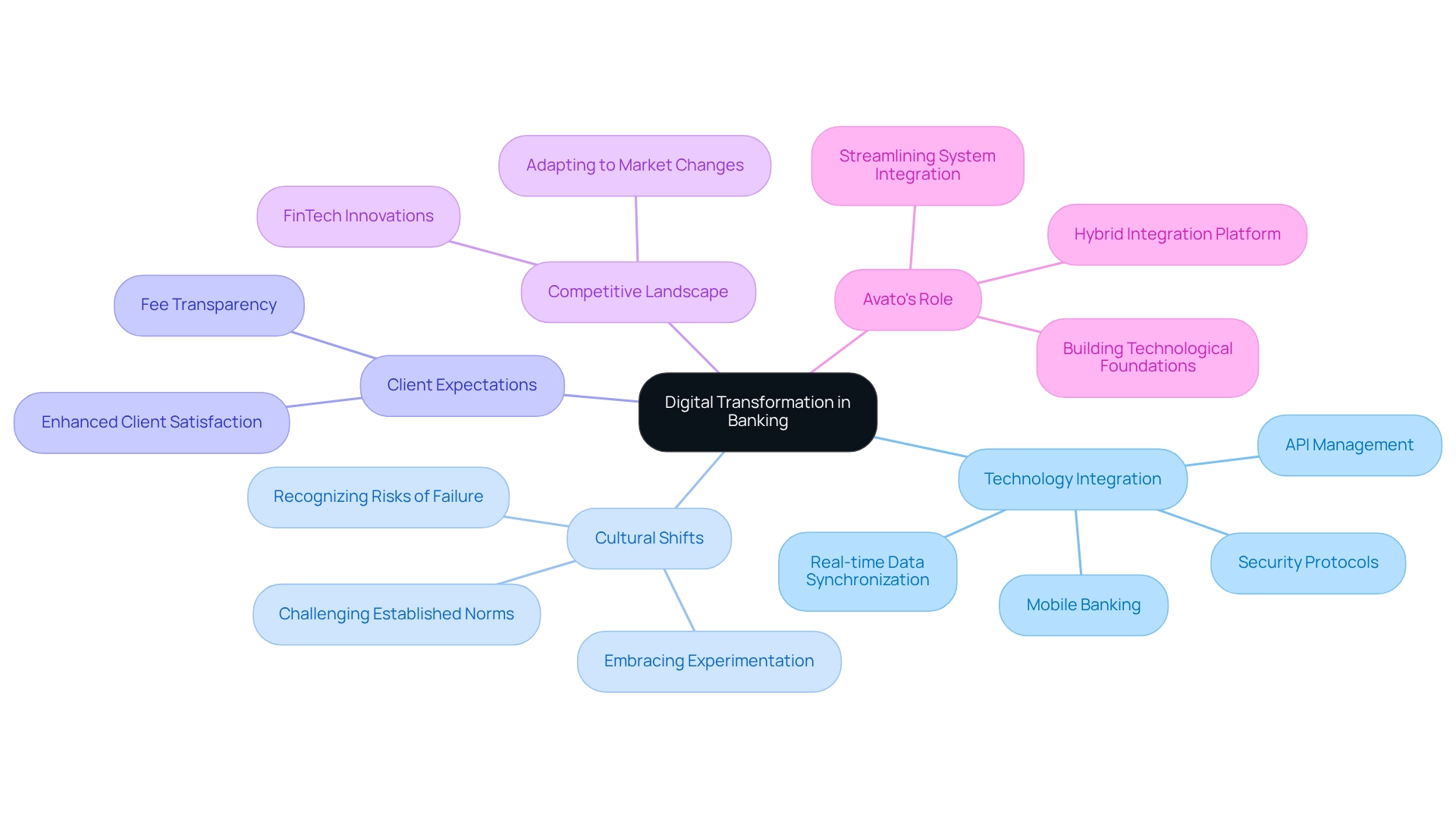

Understanding Digital Transformation in Banking

The shift in banking exemplifies the profound integration of technology through bank digital transformation across all operational dimensions, fundamentally reshaping how financial institutions function and deliver value to their clients. This evolution transcends mere technology implementation; it necessitates a cultural shift within organizations, compelling them to consistently challenge established norms, embrace experimentation, and recognize the inherent risks of failure.

As banks navigate an increasingly competitive landscape, particularly from FinTech innovators, and adapt to evolving client expectations, grasping the intricacies of bank digital transformation becomes crucial for both survival and growth. This transformation encompasses a wide array of initiatives, from enhancing user interactions through intuitive mobile banking applications to automating back-office processes, thereby boosting efficiency and ensuring compliance.

Avato’s dedicated hybrid integration platform plays a pivotal role in this transformation by streamlining the integration of diverse systems and accessing previously isolated assets. The name ‘Avato’ derives from the Hungarian term for ‘of dedication,’ symbolizing the company’s commitment to building the technological foundation necessary for rich, interconnected customer experiences. By leveraging Avato’s expertise, financial institutions can achieve bank digital transformation, enhancing their operational efficiency and generating substantial business value, ensuring they remain competitive in a rapidly evolving market.

Key features of Avato’s hybrid integration platform include real-time data synchronization, seamless API management, and robust security protocols, all crafted to empower financial institutions in their transformation endeavors. Recent trends indicate that the global online banking market is projected to reach an impressive $22.3 trillion by 2026, with a compound annual growth rate (CAGR) of 8.5%. This growth underscores the urgency for financial institutions to innovate and adapt.

Successful instances of bank digital transformation abound, illustrating how institutions can scale effective solutions organization-wide following initial pilot programs. For instance, financial institutions are expected to enhance profitability by refining their business models in response to challenging macroeconomic conditions anticipated in 2025, characterized by lower interest rates and moderate economic growth. This adjustment is essential as financial institutions strive to manage expenses efficiently while discovering innovative ways to boost noninterest revenue.

Expert opinions emphasize that bank digital transformation is not merely beneficial but essential through the adoption of technology. As Michael Barr, Federal Reserve Vice Chair, observes, substantial changes in operational strategies are imperative to meet the demands of a swiftly changing financial landscape. Furthermore, the focus on fee transparency in wealth management highlights the necessity for financial institutions to leverage technological solutions, such as those provided by Avato, to enhance client satisfaction and maintain competitiveness in an environment where client dissatisfaction with fees is on the rise.

In conclusion, the impact of technological advancement on banking operations is profound, driving bank digital transformation, fostering efficiency, enhancing client experiences, and stimulating innovation. Avato’s hybrid integration platform accelerates this change through secure and efficient system integration, enabling financial institutions to prioritize their online strategies and capitalize on emerging opportunities. A recent endorsement from a leading financial institution states, ‘Avato’s integration platform has revolutionized our operations, allowing us to respond to client needs more swiftly and effectively than ever before.

Key Drivers of Digital Transformation in the Banking Sector

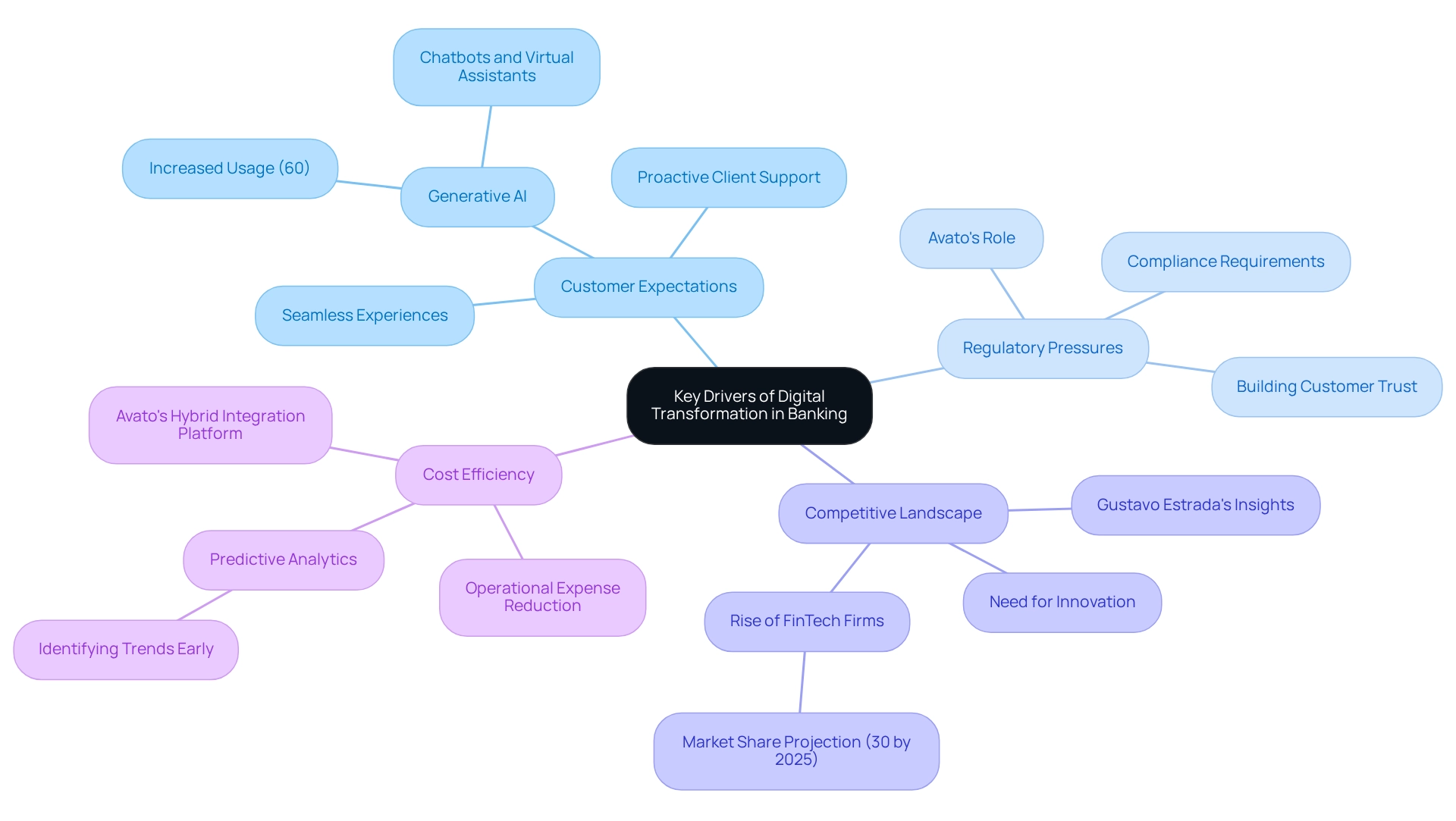

Several key factors are propelling digital transformation in the banking sector.

Customer Expectations: Modern consumers demand seamless and personalized experiences across all channels. A recent survey reveals that 75% of clients expect their banking services to be as user-friendly as their preferred applications, underscoring the necessity for banks to adapt.

Proactive client support fosters strong relationships by keeping clients informed and safe, which is essential in meeting these expectations. The integration of generative AI, particularly through advanced chatbots and virtual assistants, is becoming crucial in enhancing user interactions and satisfaction. Notably, there has been a 60% increase in the use of generative AI for client experience, highlighting its significance.

Technological advancements, such as artificial intelligence, blockchain, and cloud computing, are key drivers of digital transformation in how financial institutions operate. These technologies not only enhance service provision but also drive digital transformation by improving operational efficiency, enabling financial institutions to respond promptly to client needs. Avato’s hybrid integration platform plays a pivotal role in simplifying the integration of isolated legacy systems, allowing financial institutions to modernize their operations effectively and securely.

This platform supports 12 levels of interface maturity, balancing speed with the sophistication required for future-proofing technology stacks.

Regulatory Pressures: The banking industry faces increasing scrutiny from regulators, necessitating the implementation of more robust and transparent systems. Compliance with evolving regulations is not merely a legal obligation; it also serves as a competitive advantage in building customer trust.

Avato’s expertise in hybrid integration ensures that financial institutions can meet these regulatory demands efficiently.

Competitive Landscape: The rise of FinTech firms has intensified rivalry, compelling traditional financial institutions to innovate swiftly to maintain market share. By 2025, it is anticipated that FinTech companies will capture over 30% of the financial services market, emphasizing the need for traditional institutions to enhance their digital services.

As noted by Gustavo Estrada, Avato has been recognized for its professionalism and expertise in the context of digital transformation, streamlining complex projects and delivering results within preferred timelines and budget constraints, which is vital for financial institutions facing these challenges.

Cost Efficiency: Digital solutions present a significant opportunity for financial institutions to reduce operational expenses. By automating processes and leveraging data analytics, financial institutions can streamline operations, ultimately boosting their bottom line.

Moreover, investing in predictive analytics enables banks to identify trends early, allowing proactive measures to retain clients and recommend suitable products. Avato’s hybrid integration platform not only accelerates secure system integration but also contributes to cost savings and faster product delivery, enhancing overall customer satisfaction.

These elements collectively influence the landscape of digital transformation in banking, prompting institutions to reevaluate their strategies and embrace innovation to meet the evolving needs of their clients.

Challenges in Implementing Digital Transformation

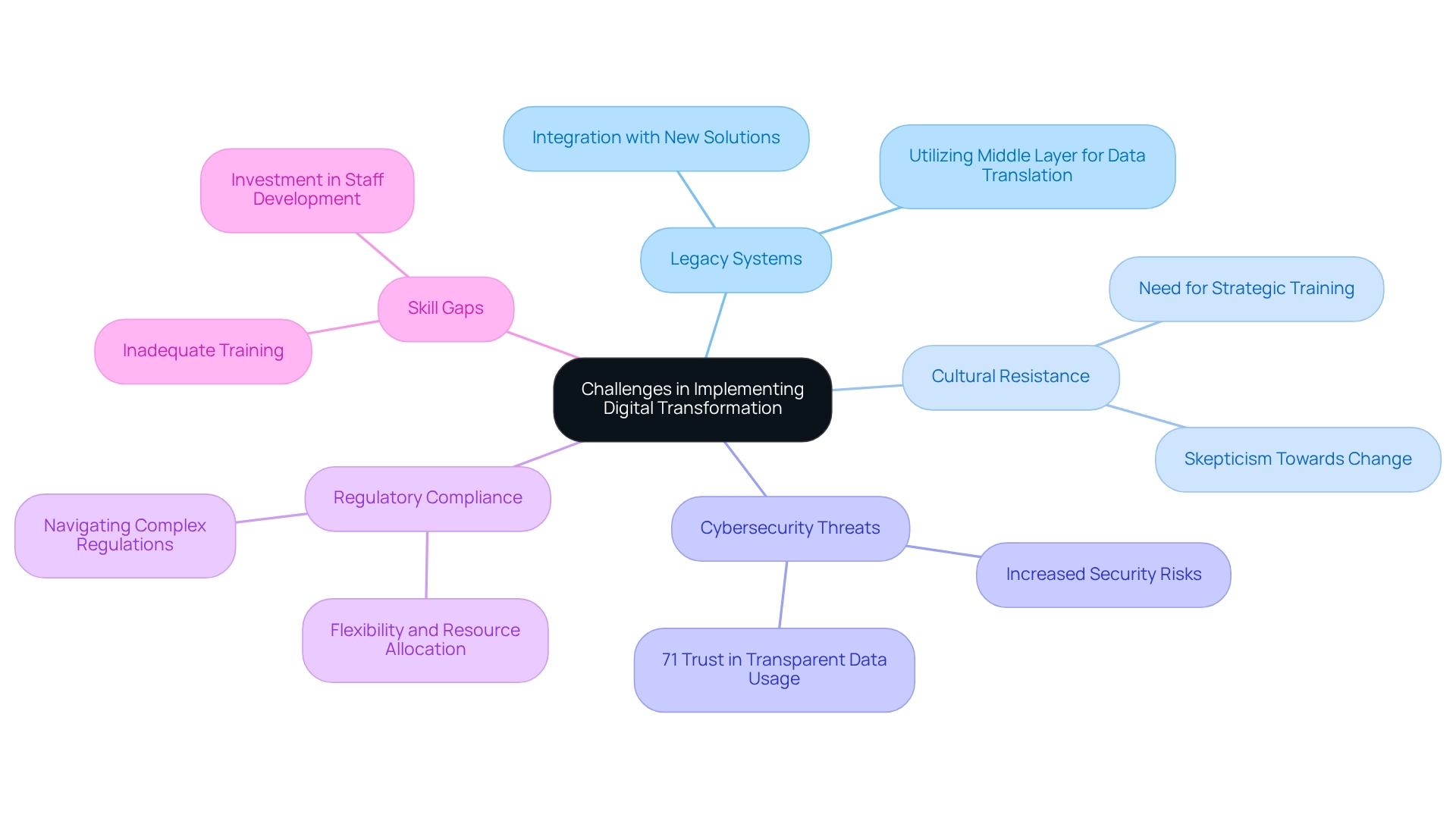

Implementing digital transformation in banking presents a myriad of challenges that organizations must navigate to achieve success.

- Legacy Systems: A significant number of financial institutions continue to rely on outdated technology, complicating the integration of new digital solutions. However, as highlighted in recent discussions on open banking, it is crucial not to discard legacy systems entirely. Instead, financial institutions should leverage existing assets by utilizing a middle layer that translates data into open formats, allowing seamless connections with modern applications. This approach can mitigate increased costs and prolonged project timelines associated with complete system overhauls.

- Cultural Resistance: Change is often met with skepticism, particularly in established institutions. Employees may resist alterations to familiar processes and workflows, which can stall progress. This cultural inertia is a prevalent obstacle to bank digital transformation, as highlighted by several case studies where financial institutions faced challenges in promoting a digital-first mindset among employees, ultimately impacting their transformation initiatives. To combat this, strategic training and change management are essential to prepare staff for the integration of new technologies, particularly as open banking takes root.

- Cybersecurity Threats: As financial institutions digitize their operations, they inadvertently expose themselves to heightened cybersecurity risks. The growing dependence on digital platforms requires strong security measures to safeguard sensitive client information. Open banking, while offering opportunities for innovation, also increases the potential for security breaches. Therefore, banks must ensure their integration solutions adhere to stringent security protocols to build client trust. In fact, 71% of customers are more likely to trust a financial institution that transparently explains how their personal data is used, underscoring the importance of security in building customer confidence.

- Regulatory Compliance: The banking sector is heavily regulated, and navigating this complex landscape can significantly slow down transformation efforts. Adherence to changing regulations demands financial institutions to be flexible and forward-thinking, frequently requiring extra resources and time to ensure compliance without hindering innovation. As open banking regulations arise, financial institutions must prepare to fulfill these requirements while enhancing their integration strategies.

- Skill Gaps: A common obstacle in the shift to a technological environment is the absence of relevant skills among the workforce. Numerous financial institutions struggle to apply new technologies efficiently because of inadequate training and expertise among staff. This skills gap can obstruct the adoption of innovative solutions and restrict the potential advantages of technological transformation. Investing in staff training and development is essential to equip teams with the necessary skills to navigate the complexities of integration and open banking.

Tackling these challenges is vital for financial institutions striving for bank digital transformation and enhancing client experiences. For instance, the case study titled “Financial Inclusion through Digital Banking” illustrates how companies like Chime and N26 are focusing on providing accessible banking services through mobile apps, helping to empower individuals without traditional banking access. By utilizing advanced integration platforms such as Avato, which offer a dependable, future-ready technology stack, financial institutions can surmount these challenges and prepare themselves for achievement in the technological era.

As noted by Gustavo Estrada, a customer, “Avatar has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” reinforcing the platform’s effectiveness in navigating these challenges.

Proven Strategies for Successful Digital Transformation

To effectively manage technological change, banks must contemplate the following strategies:

- Establish a Clear Vision: Defining what digital change means for your organization and setting measurable goals is crucial. A clear vision not only directs the bank’s digital transformation process but also aligns stakeholders and resources towards common objectives. Leaders can emphasize ‘lighthouse’ projects to motivate employees and generate momentum, ensuring that the change mirrors business, cultural, and technical developments.

- Invest in Technology: Leveraging modern technologies such as AI, machine learning, and cloud computing is essential for enhancing services and operational efficiency. With spending on security measures for IoT forecasted to reach $6 billion in 2023, banks must prioritize secure technology investments to protect sensitive data while innovating. This emphasis on security is crucial as it supports the trust essential for successful bank digital transformation in the online realm. Avato’s Hybrid Integration Platform plays a key role in this process, facilitating secure and efficient system integration that speeds up technological transformation efforts. Key features of Avato’s platform encompass seamless connectivity, real-time data processing, and robust security protocols, which collectively improve operational efficiency and client trust.

- Foster a Digital Culture: Encouraging innovation and agility within the organization is vital. A culture that embraces change empowers employees to contribute ideas and solutions, facilitating a smoother transition to digital practices.

- Enhance Client Experience: Utilizing data analytics to understand client needs allows banks to tailor services accordingly. The rise of generative AI has significantly transformed client engagement, with a 60% increase in its use for enhancing client experience through sophisticated chatbots and virtual assistants. For example, mobile transfers have greatly enhanced access for clients in remote regions, as emphasized by Maria Djata, a trader who remarked on the ease of ordering products and transferring funds without the need to travel. This demonstrates how technology, especially generative AI, can improve user experience and accessibility. A case study from a leading financial institution demonstrates how implementing generative AI solutions led to a 40% increase in client satisfaction scores, showcasing the tangible benefits of these technologies.

- Collaborate with Fintechs: Partnering with FinTech companies can accelerate innovation and provide access to new technologies and customer segments. A case study of a major European financial institution illustrates this point; by redesigning its operating model and overhauling its core banking architecture, the institution achieved a 30% cost savings and enhanced its capacity to deliver future value. This comprehensive method to technological change illustrates the significance of strategic partnership and the concrete advantages it can produce.

By applying these tested strategies, financial institutions can effectively align themselves for achievement in the changing technological environment of 2025 and beyond, emphasizing bank digital transformation and utilizing Avato’s solutions to navigate the intricacies of technological change.

Aligning IT and Business Goals for Effective Transformation

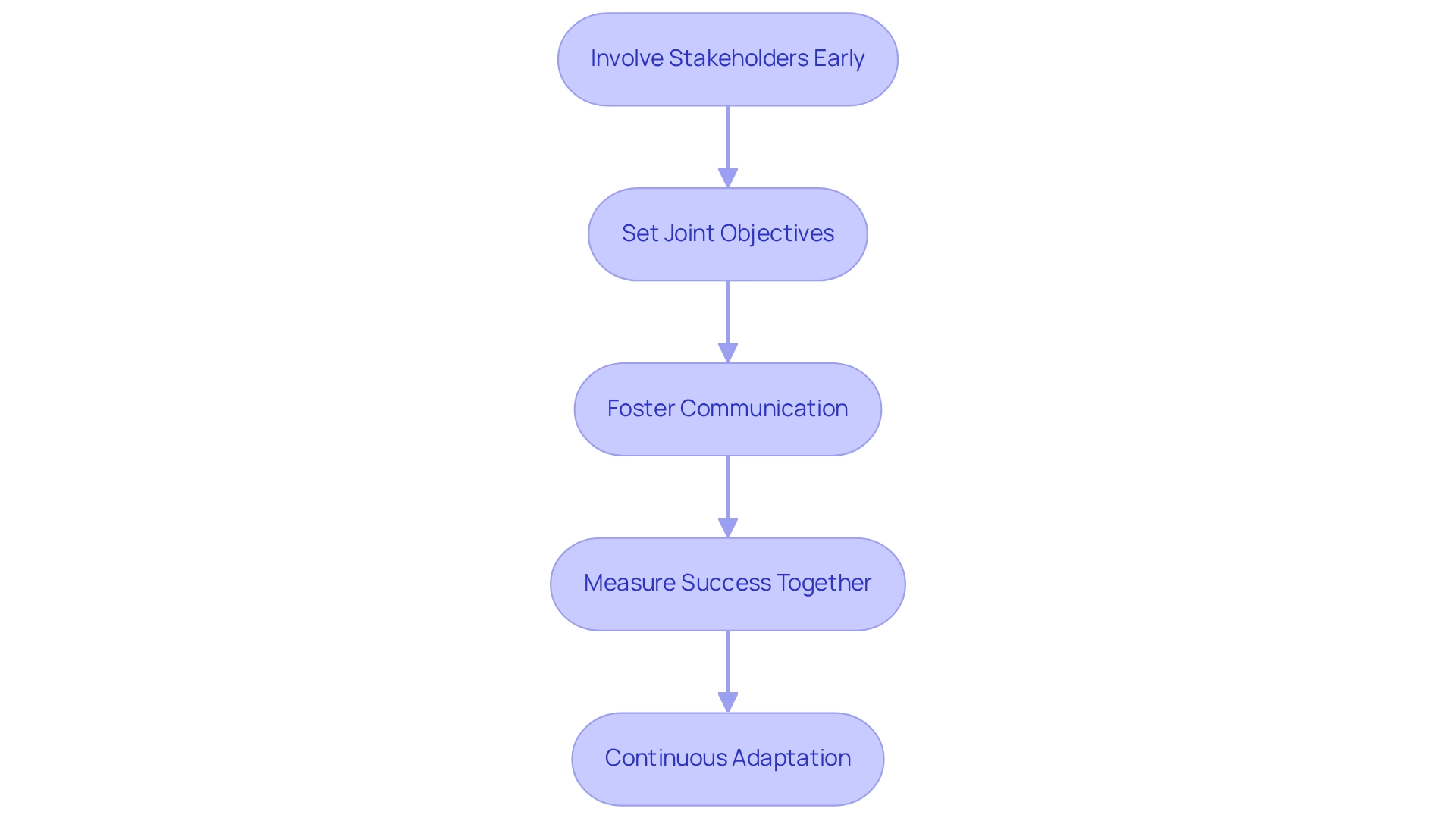

Aligning IT and business objectives is vital for successful bank digital transformation. To achieve this, banks should adopt the following strategies:

- Involve Stakeholders Early: Engaging both IT and business leaders from the outset ensures that diverse perspectives are integrated into the planning process. This collaborative approach fosters a sense of ownership and commitment to the transformation initiatives.

- Set Joint Objectives: Establishing shared goals that reflect both IT capabilities and business needs is essential. This alignment not only clarifies priorities but also enhances the likelihood of achieving desired outcomes.

- Foster Communication: Creating robust channels for ongoing dialogue between IT and business units facilitates collaboration and helps address challenges as they arise. Regular updates and feedback loops can significantly improve the responsiveness of both teams.

- Measure Success Together: Utilizing shared metrics to evaluate the success of digital initiatives ensures accountability across departments. By establishing success criteria together, financial institutions can more effectively monitor progress and make informed modifications to their strategies.

Recent statistics indicate a shift in focus within the financial sector, with the ratio of ‘run the institution’ versus ‘change the institution’ evolving from 60:40 to approximately 50:50. This change emphasizes the increasing acknowledgment of the necessity for change alongside operational stability, highlighting the significance of stakeholder involvement and shared goals.

A case study titled ‘Roadmap for Bank Digital Transformation’ emphasizes the importance of a continuous process of adaptation and innovation, focusing on a customer-centric approach. By outlining clear objectives, defining success criteria, and establishing key performance indicators (KPIs), financial institutions can effectively navigate their digital change journey. These solutions enable organizations to identify, assess, create, execute, and manage improved business processes, which is crucial for achieving change objectives.

Furthermore, a prominent US bank recently raised its technology expenditure by more than 10 percent to expedite its change and migrate applications to the cloud. This action demonstrates the urgency and dedication necessary for successful bank digital transformation in the banking industry.

Expert insights indicate that successful bank digital transformation relies on the active participation of stakeholders throughout the process. As Nazar Kvartalnyi, COO at Inoxoft, notes, collaboration is key to bringing bold ideas to life. Engaging stakeholders not only enhances the quality of decision-making but also fosters a culture of innovation within the organization.

Moreover, Avato’s Hybrid Integration Platform plays a pivotal role in the bank digital transformation by accelerating secure system integration for banking, healthcare, and government sectors. With its robust architecture designed for secure transactions and support for 12 levels of interface maturity, Avato enables organizations to balance speed and sophistication in their integration projects. This capability is further enhanced by the transformative impact of generative AI, which is revolutionizing client interaction and operational efficiency in financial services.

As highlighted in recent case studies, the adoption of generative AI has led to a 60% increase in its use for customer experience, particularly in developing sophisticated chatbots and virtual assistants, streamlining operations and enhancing productivity across various departments. Avato’s commitment to 24/7 uptime ensures that these integrations are error-free, providing a solid foundation for bank digital transformation initiatives.

Leveraging Technology for Seamless Integration

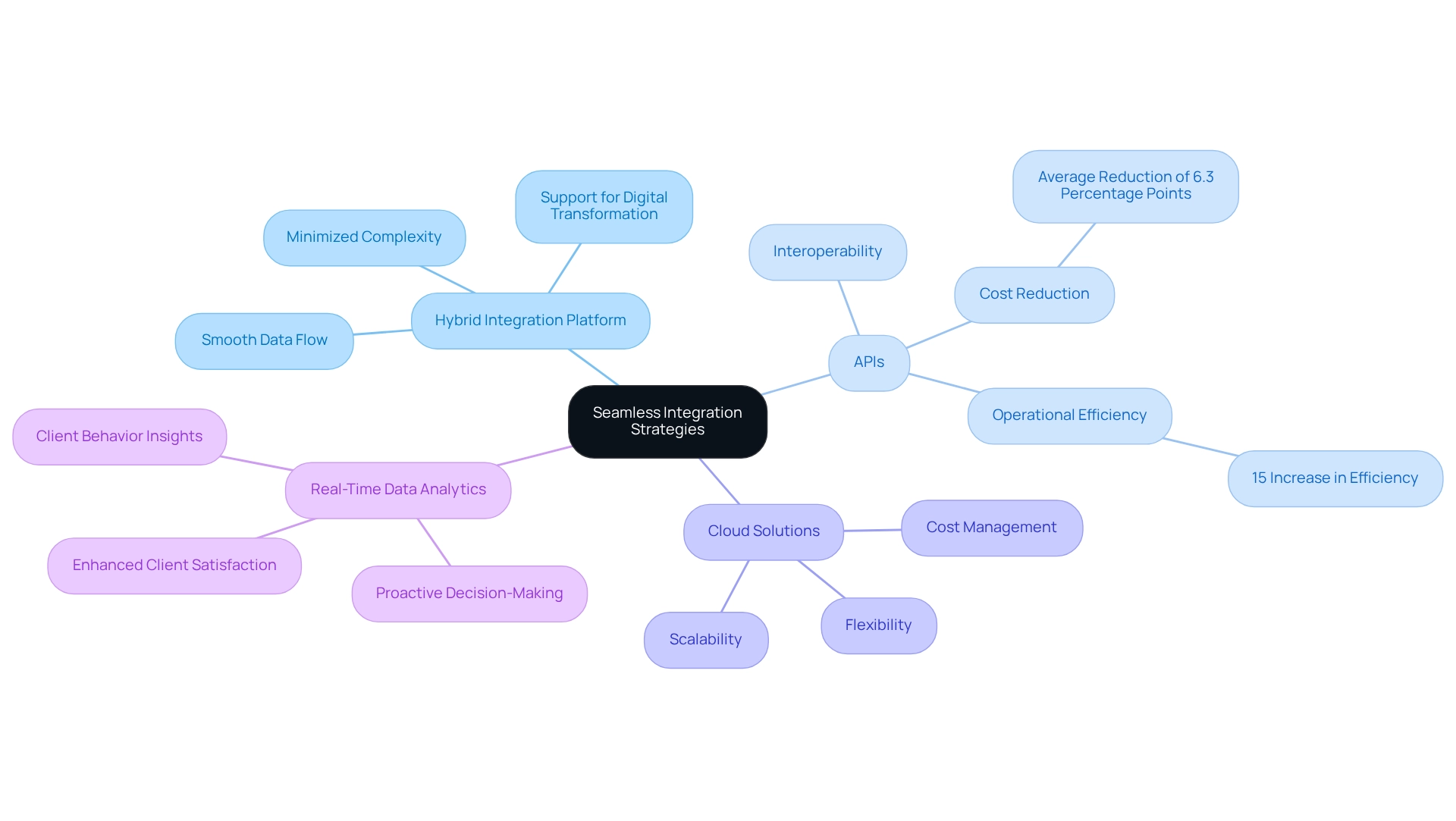

To achieve seamless integration, financial institutions should focus on the following strategies:

- Adopting a Hybrid Integration Platform: Implementing Avato’s hybrid integration platform is crucial for connecting legacy systems with modern applications. This approach enables a smooth data flow across the organization, facilitating better communication and operational efficiency. By utilizing Avato’s platform, financial institutions can greatly minimize the complexity of their integration efforts, enabling faster adaptation to market changes while supporting bank digital transformation and maximizing the value of their legacy systems. Arvato, born from a dedication to simplifying complex integrations, stands as a testament to this mission.

- Implementing APIs: Developing and deploying standardized APIs is essential for enhancing interoperability among various systems. APIs serve as the backbone of modern banking integration, enabling disparate systems to communicate effectively. Standardized APIs and industry-wide collaboration are essential for financial institutions to facilitate bank digital transformation from legacy systems to agile architectures. Banks that embrace bank digital transformation by adopting collaborative data strategies through APIs have reported an average reduction of 6.3 percentage points in their cost-to-income ratios over three years, showcasing the financial benefits of this approach. For instance, a prominent financial institution that integrated Avato’s API solutions saw a 15% increase in operational efficiency within the first year.

- Utilizing Cloud Solutions: Leveraging cloud technologies enhances scalability and flexibility in banking operations. Cloud solutions enable financial institutions to swiftly modify their resources in reaction to shifting demands, guaranteeing that they can uphold high standards of service without incurring excessive expenses. This adaptability is vital in today’s fast-paced financial environment.

- Real-Time Data Analytics: Utilizing sophisticated analytics tools that deliver real-time insights into client behavior and operational performance is essential for the bank digital transformation and proactive decision-making. By utilizing real-time information, financial institutions can enhance their comprehension of clients’ needs and refine their services accordingly, fostering innovation and boosting client satisfaction.

Adopting these strategies not only simplifies integration processes but also enables financial organizations to succeed in a progressively competitive environment. Avato’s secure hybrid integration platform is essential for bank digital transformation, ensuring 24/7 uptime and reliability, making it an ideal choice for complex systems in banking, healthcare, and government. The integration of the Banking Industry Architecture Network (BIAN) standards with Avato’s platform features further supports these efforts by providing a framework that simplifies modernization and enhances system interoperability, ultimately driving innovation through industry-wide collaboration.

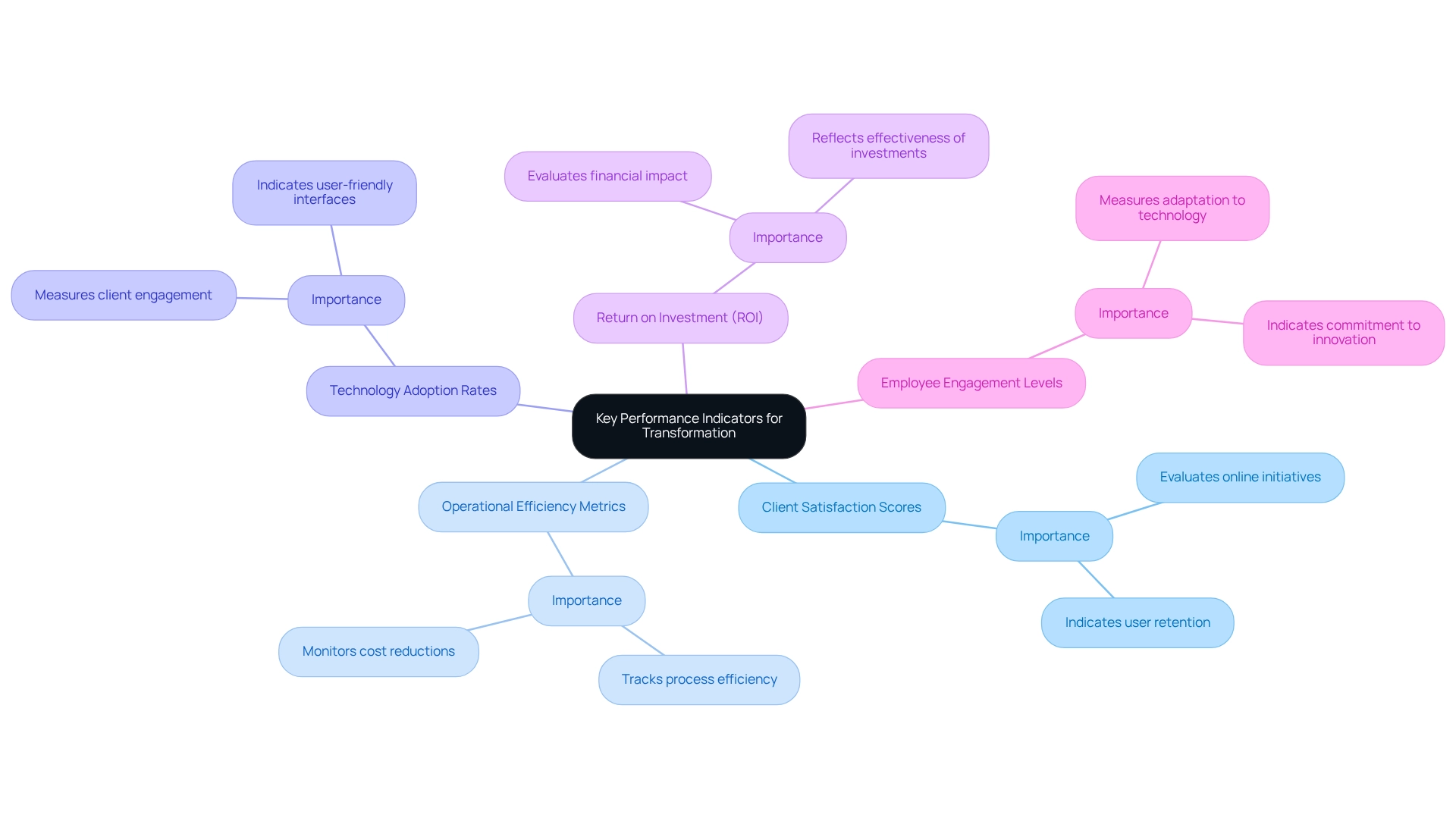

Measuring Success: Key Performance Indicators for Transformation

To effectively gauge the success of digital transformation initiatives, banks must focus on several critical key performance indicators (KPIs):

- Client Satisfaction Scores: These scores are essential for evaluating how effectively online initiatives correspond with client needs and expectations. High satisfaction levels indicate that online services are meeting or exceeding user demands, which is crucial for retention and loyalty. As one user noted, Avato is a ‘fantastic tool to accelerate customer service,’ underscoring the significance of online initiatives in enhancing service delivery.

- Operational Efficiency Metrics: Monitoring improvements in process efficiency and cost reductions is vital. This includes tracking the number of workflow processes implemented to enhance operational performance, leading to significant savings and streamlined operations. Financial institutions should strive to increase the quantity of workflow procedures established as part of their digital transformation initiatives. Avato’s Hybrid Integration Platform simplifies complex integration projects, allowing banks to build on existing systems rather than starting from scratch, thus optimizing operational capabilities.

- Technology Adoption Rates: Assessing the proportion of clients using online platforms for transactions and services provides insight into the success of technological offerings. A higher adoption rate signifies effective engagement strategies and user-friendly interfaces, essential for preparing for open banking.

- Return on Investment (ROI): Evaluating the financial impact of electronic advancement initiatives ensures that these efforts deliver concrete value. A positive ROI reflects the effectiveness of investments in technology and processes, particularly in the context of strategic integration approaches that enhance customer experience through digital transformation.

- Employee Engagement Levels: Evaluating how effectively employees adapt to new technologies and processes is vital, as their commitment is key to the success of technological change. Engaged employees are more likely to embrace changes and contribute to a culture of innovation, which is crucial when implementing Avato’s hybrid integration platform.

As the banking sector continues to evolve, the importance of these KPIs will only grow. Institutions must enhance their online strategies and manage investments effectively to improve the account holder experience, ensuring they remain competitive in a rapidly changing environment. By addressing the challenges of vendor-supplied integration solutions and emphasizing future-proofing systems, arvato assists financial institutions in navigating the intricacies of technological evolution.

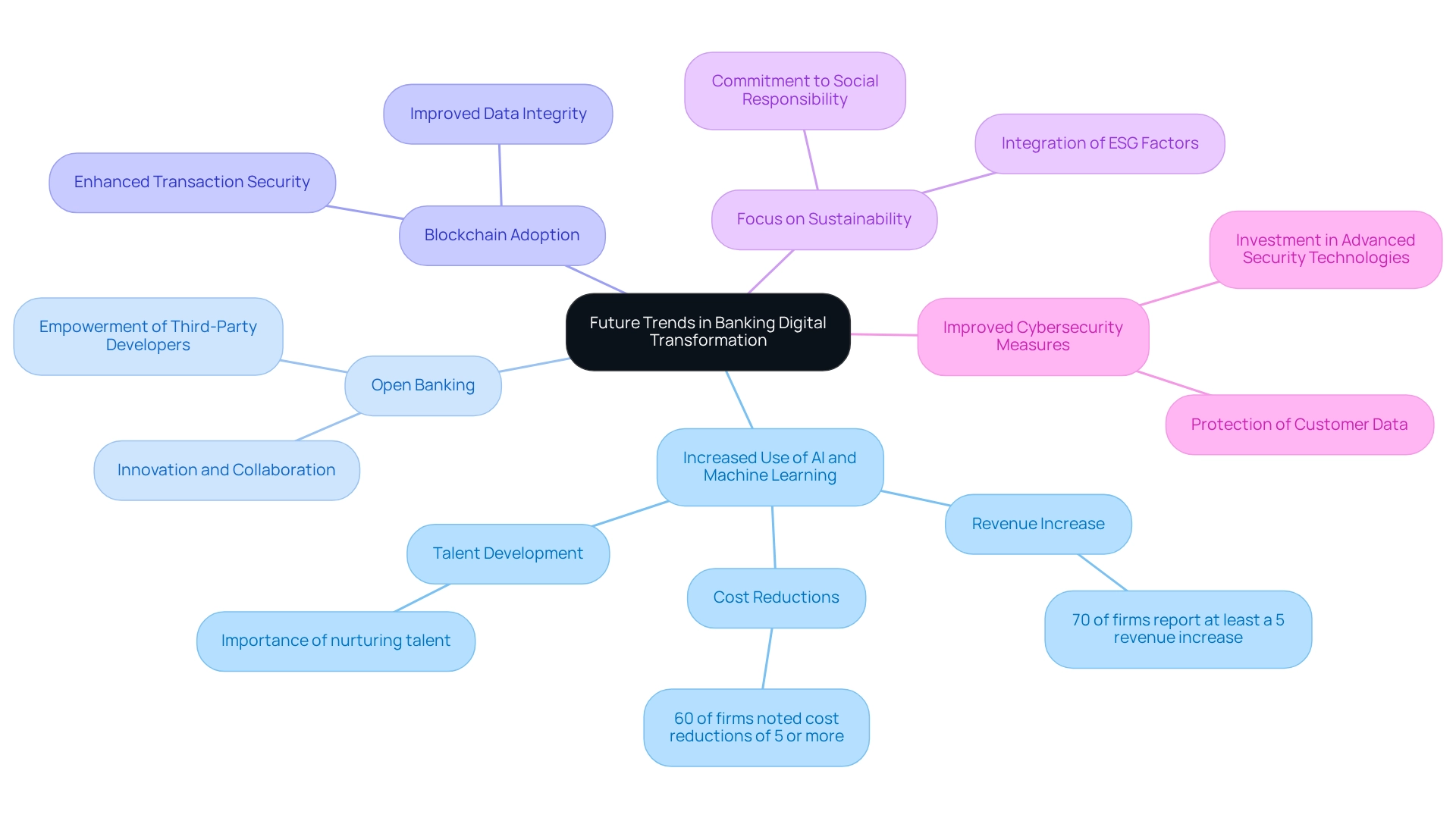

Future Trends in Banking Digital Transformation

As we look to the future, several pivotal trends are poised to redefine digital transformation in the banking sector:

- Increased Use of AI and Machine Learning: By 2025, the integration of AI and machine learning will significantly enhance personalization and operational efficiency within banking institutions. The NVIDIA 2025 State of AI in Financial Services survey reveals that nearly 70% of firms reported at least a 5% revenue increase attributable to AI implementations, while over 60% noted cost reductions of 5% or more.These technologies will allow financial institutions to analyze vast amounts of data, leading to more personalized client experiences and streamlined operations. Vikram (Vik) Bhat, Vice Chair and US Financial Services Industry Leader at Deloitte, emphasizes the importance of nurturing talent and fostering professional growth within teams to leverage these technologies effectively. To fully capitalize on these advancements, strategic AI integration must be prioritized, alongside addressing the talent challenge in the industry.

- Open Banking: The transition towards open banking is set to revolutionize the financial landscape. This shift will empower third-party developers to create innovative applications and services that integrate seamlessly with financial institutions, fostering a culture of collaboration and innovation that benefits consumers.

- Blockchain Adoption: As financial institutions increasingly explore blockchain technology, its potential to enhance transaction security and data integrity will become more pronounced. The adoption of blockchain is expected to transform operational processes, making them more transparent and efficient.

- Focus on Sustainability: Environmental, social, and governance (ESG) factors are becoming central to banking strategies. As client expectations change, financial institutions will need to adjust their operations with sustainable practices, demonstrating a commitment to social responsibility that connects with their patrons.

- Improved Cybersecurity Measures: With the increase of online threats, the significance of strong cybersecurity measures cannot be overstated. Financial institutions will be required to invest in advanced security technologies to protect customer data and uphold trust, ensuring that their modernization efforts do not compromise security.Additionally, the Basel III Endgame re-proposal suggests lower capital requirements for financial entities, which may lead to decreased excess capital and increased mergers and acquisitions activity among smaller institutions. As financial institutions prepare for these regulatory changes, they are redeeming preferred shares and engaging in credit risk transfers to lower capital retention. This is expected to result in a 9% increase in common equity tier 1 for global systemically important banks (G Sibs), illustrating the significant impact of regulatory changes on banking performance. These trends not only highlight the direction of bank digital transformation but also underscore the critical role of AI and machine learning in shaping a more efficient, secure, and customer-centric banking environment.

Avato’s hybrid integration platform will be essential for businesses to adapt to these changing demands, empowering financial institutions to lead the AI revolution and future-proof their operations through seamless data and system integration. Don’t wait! Connect with Avato today to explore your evolving AI needs.

Our AI assessment is designed to provide you with tailored insights and strategies to elevate your business. Let’s discover how we can help you thrive in the AI landscape!

Conclusion

Digital transformation in banking signifies a profound shift that redefines not only how financial institutions operate but also how they engage with their customers. The integration of advanced technologies, such as AI and blockchain, alongside platforms like Avato, empowers banks to enhance operational efficiency, meet evolving customer expectations, and navigate the challenges posed by a competitive landscape.

What drives this transformation? Heightened customer expectations for seamless experiences, the pressures of regulatory compliance, and the need for cost efficiency are key factors. However, banks face significant challenges, including outdated legacy systems, cultural resistance to change, and cybersecurity threats. Addressing these issues is essential for banks aiming to modernize and improve customer experiences.

Successful digital transformation demands a clear vision, strategic investments in technology, and the fostering of a digital culture within organizations. By aligning IT and business goals, banks can create a collaborative environment that supports innovation and agile responses to market demands. Furthermore, leveraging key performance indicators will enable institutions to measure success, ensuring that digital initiatives deliver tangible value.

Looking ahead, trends such as open banking, increased AI adoption, and a focus on sustainability will further shape the future of banking. As these trends unfold, the role of hybrid integration platforms like Avato will be crucial in helping banks adapt and thrive in an increasingly digital world. Embracing these changes not only positions banks for success but also enhances their ability to provide exceptional service to their customers, ultimately leading to a more resilient and customer-centric financial landscape.