Overview

Enhancing data integration capability in banking systems is not just beneficial; it is essential for consolidating information from various sources, improving decision-making, and delivering personalized customer services. We recognize that adopting advanced integration technologies, such as AI and cloud solutions, alongside best practices—like establishing clear objectives and ensuring information quality—can significantly enhance operational efficiency and customer engagement in our sector.

What’s holding your team back from embracing these transformative technologies? By implementing these strategies, we can unlock new levels of performance and customer satisfaction. Let us take decisive action together to elevate our banking systems and meet the evolving needs of our clients.

Introduction

In today’s rapidly evolving banking landscape, we recognize that the ability to integrate diverse data sources effectively is paramount for institutions seeking to enhance operational efficiency and deliver personalized customer experiences.

As we navigate the complexities of modern finance, mastering the fundamentals of data integration is essential for developing a cohesive strategy that not only improves decision-making but also prepares us for future challenges.

What’s holding your team back from overcoming data silos and ensuring regulatory compliance?

The journey toward seamless data integration may be fraught with obstacles, yet it offers immense potential for transformation.

By leveraging advanced technologies and best practices, we can unlock valuable insights and gain a competitive edge in a market that demands agility and innovation.

Let’s embrace this opportunity together.

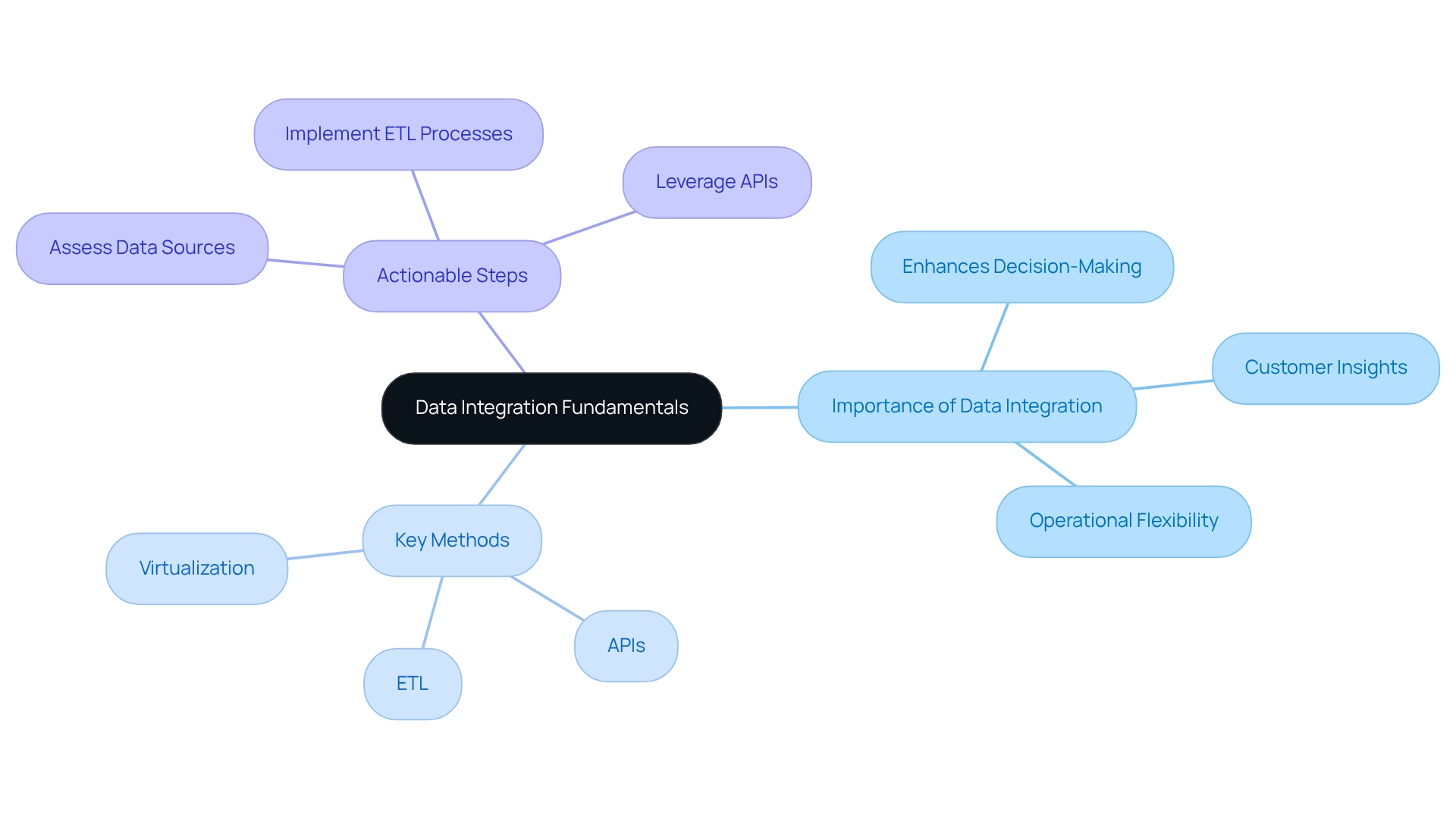

Understand Data Integration Fundamentals

The merging of information is not just a technical necessity; it is a strategic imperative that utilizes our data integration capability to consolidate details from various origins into a cohesive view, thereby enhancing our decision-making and operational effectiveness. In the banking sector, this means utilizing the data integration capability to integrate data from core banking systems, customer relationship management (CRM) systems, and a variety of digital channels. Key methods of information integration include Extract, Transform, Load (ETL), Application Programming Interfaces (APIs), and virtualization. Mastering these fundamentals is crucial for us to create a unified information strategy that significantly enhances our data integration capability and improves customer insights and operational flexibility.

For instance, banks that effectively combine information across various platforms can achieve a comprehensive 360-degree perspective of their customers. This capability empowers us to deliver personalized services, which in turn boosts customer satisfaction. In fact, DBS Bank reported a remarkable 64% increase in customer engagement through personalized financial insights provided via mobile services, illustrating the transformative power of effective information unification.

Moreover, as the banking industry evolves in 2025, the importance of data integration capability will become even more pronounced. Organizations that embrace innovative unification strategies, such as those offered by Avato’s Hybrid Platform, can improve their data integration capability to maximize the value of their legacy systems while simplifying complex connections and reducing costs. This platform guarantees 24/7 uptime and reliability—essential for navigating regulatory complexities and enhancing customer experiences. The cost reduction aspect is particularly vital, as it enables us to allocate resources more efficiently while maintaining high service standards.

To effectively apply data integration strategies, we encourage banking professionals to consider the following actionable steps:

- Assess existing data sources and identify integration points.

- Implement ETL processes to streamline information consolidation.

- Utilize APIs to facilitate real-time information exchange between systems.

- Leverage information virtualization to provide a unified perspective without the need for physical information movement.

Incorporating expert perspectives on information merging principles is essential for banking professionals aiming to utilize these strategies effectively. As David Sides aptly stated, “Data is like a faint light when you’re lost in a dark room. Follow it, try to make sense of it, and you might actually know where you are and what’s around you.” This viewpoint underscores the necessity of a robust information unification framework in guiding financial institutions toward informed decision-making and operational excellence, highlighting the significance of choosing the appropriate technology and engaging stakeholders throughout the unification process.

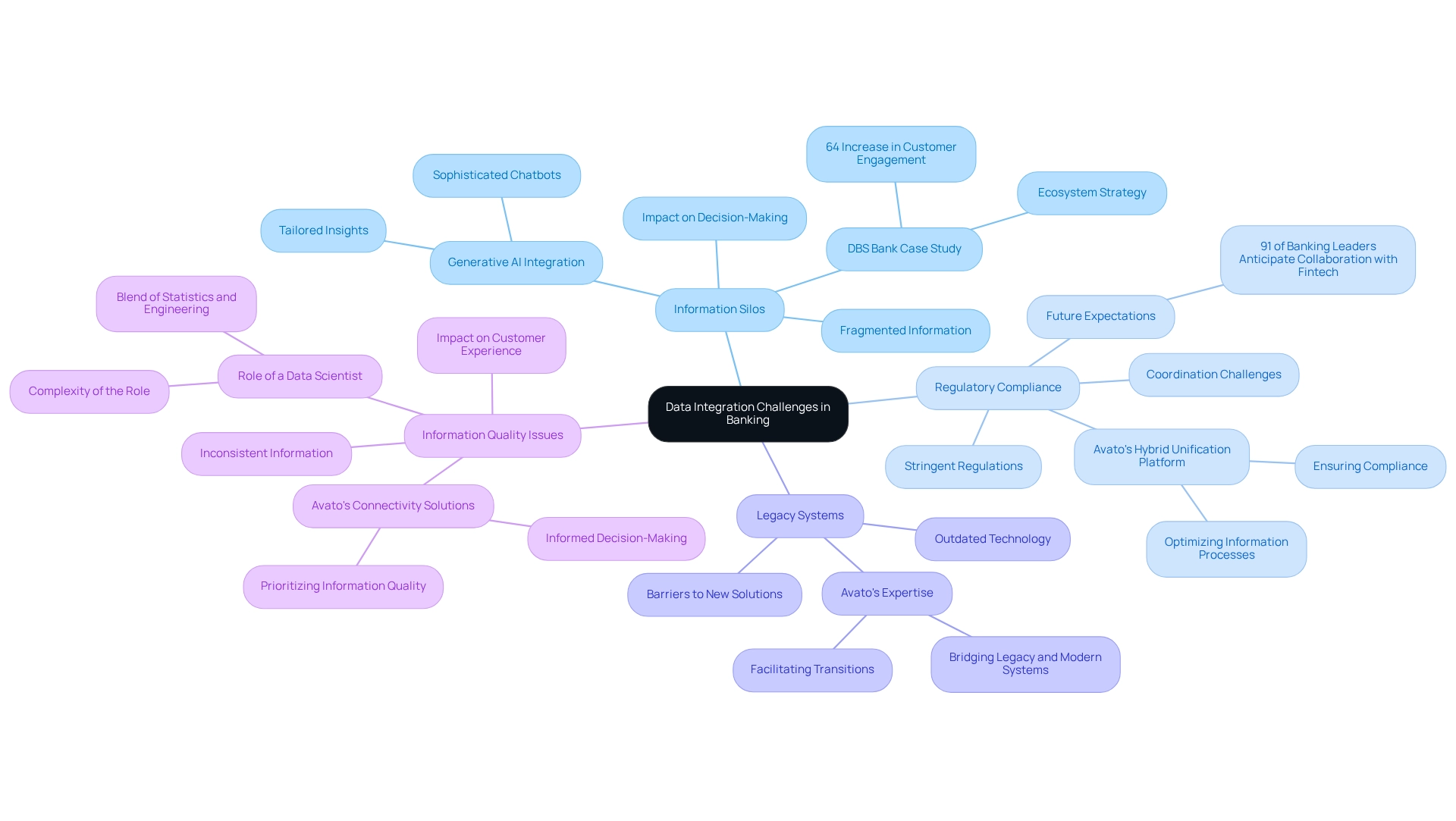

Identify Common Data Integration Challenges in Banking

Banks frequently encounter significant challenges in information unification, highlighting the importance of their data integration capability, which can hinder both operational efficiency and compliance. These challenges include:

-

Information Silos: Isolated systems within our banks often struggle to communicate effectively, resulting in fragmented information. This disconnection not only obstructs decision-making but also restricts our ability to deliver personalized services. For example, DBS Bank reported a 64% increase in customer engagement through personalized insights, underscoring the necessity of dismantling these silos. As noted in the DBS Digital Transformation Case Study, ‘DBS’s ecosystem strategy illustrates how external information collaboration enhances internal unification.’ The integration of generative AI can further elevate customer experiences by enabling sophisticated chatbots and virtual assistants to provide tailored insights.

-

Regulatory Compliance: Our sector is governed by stringent regulations that demand strict adherence to information governance and privacy laws. These requirements complicate our coordination efforts, as we must ensure that all information handling processes comply with legal standards. By 2028, 91% of banking leaders anticipate that information collaboration will extend beyond our organizations to include fintech partners, highlighting the need for compliant merging strategies. Avato’s hybrid unification platform is designed to meet these compliance requirements by optimizing information processes while ensuring adherence to regulations.

-

Legacy Systems: Many banks, including ours, still rely on outdated technology that is ill-equipped for modern connectivity methods. This reliance on legacy systems poses a significant barrier to adopting new solutions, as these systems often lack the flexibility and functionalities necessary for efficient information merging. Avato’s expertise in hybrid unification can help us bridge the gap between legacy systems and contemporary expectations, facilitating smoother transitions and enhanced operational efficiency.

-

Information Quality Issues: Inconsistent or erroneous information can severely undermine our integration initiatives. Poor information quality leads to flawed insights and decision-making, adversely affecting customer experiences and operational efficiency. Managing quality information is akin to the role of a scientist, combining statistical and engineering concepts, as emphasized in the case study ‘Defining the Role of a Scientist.’ Avato’s commitment to providing top-notch connectivity solutions ensures that information quality is prioritized, enabling us to make informed decisions.

To effectively tackle these challenges, we must adopt a strategic approach that involves investing in modern connectivity technologies and establishing robust information governance frameworks. By doing so, we can enhance our data integration capability and navigate the complexities of the banking landscape more effectively. Furthermore, as information collaboration reshapes the definition of a financial institution, embracing these changes will be crucial for our future success.

Implement Best Practices for Effective Data Integration

To achieve effective data integration, we must consider the following best practices:

- Establish Clear Objectives: We need to clearly define the goals of our information unification efforts, such as enhancing customer insights or streamlining operational processes. This clarity is essential for directing our strategy on data integration capability and assessing success. Investments in collaborative information technologies are critical for keeping pace with industry innovation, emphasizing the need for clear objectives.

- Choose the Right Tools: We should invest in connection platforms like Avato’s Hybrid Connection Platform, which can seamlessly link various data sources and provide real-time data processing capabilities. The right tools are essential for sustaining agility in a rapidly evolving banking landscape by enhancing data integration capability. As Jon Gitlin noted, “integrations are key for sales,” highlighting the importance of selecting effective integration tools that can handle complex integrations simply and maximize the value of legacy systems.

- Ensure Information Quality: We must implement robust cleansing and validation processes to uphold high standards of information quality. High-quality data integration capability is foundational for accurate decision-making and operational efficiency, especially as we prepare for the increased data sharing that open banking entails.

- Foster Collaboration: We should promote teamwork between IT and business departments to guarantee alignment on unification objectives and strategies. This partnership can enhance our data integration capability and lead to more efficient incorporation results, along with a mutual comprehension of goals, which is essential for the successful execution of hybrid incorporation solutions.

- Monitor and Optimize: We need to continuously observe connection processes and enhance them based on performance metrics and user feedback. Avato’s platform provides real-time monitoring and alerts on system performance, which enhances our data integration capability by enabling us to identify areas for improvement and ensure that our integration efforts remain aligned with business objectives.

- Prioritize Security: As open banking enhances information sharing, it is imperative to implement stringent security protocols to protect sensitive details. Ensuring compliance with the highest security standards will enhance consumer trust and safeguard against potential breaches by leveraging our data integration capability.

For instance, DBS Bank’s implementation of a cooperative information ecosystem enabled real-time credit decisions and reduced ATM network downtime by 37%. This example demonstrates how embracing a cloud-based unification platform with data integration capability can significantly speed up the incorporation of new information sources, leading to faster insights and improved service delivery. Furthermore, utilizing generative AI in information consolidation workflows can improve data integration capability by automating essential tasks such as information cleansing and anomaly detection, which are vital for upholding quality. The effective execution of generative AI in our information strategies will rely on strong unification solutions like Avato’s, which have a robust data integration capability to guarantee high-quality, accessible knowledge. As Tony LeBlanc from the Provincial Health Services Authority mentioned, “Avato speeds up the unification of isolated systems and fragmented information, providing the connected foundation we require to simplify, standardize, and modernize.” This comprehensive method highlights the significance of data integration capability and information unification tools in fields such as banking, improving decision-making and operational efficiency.

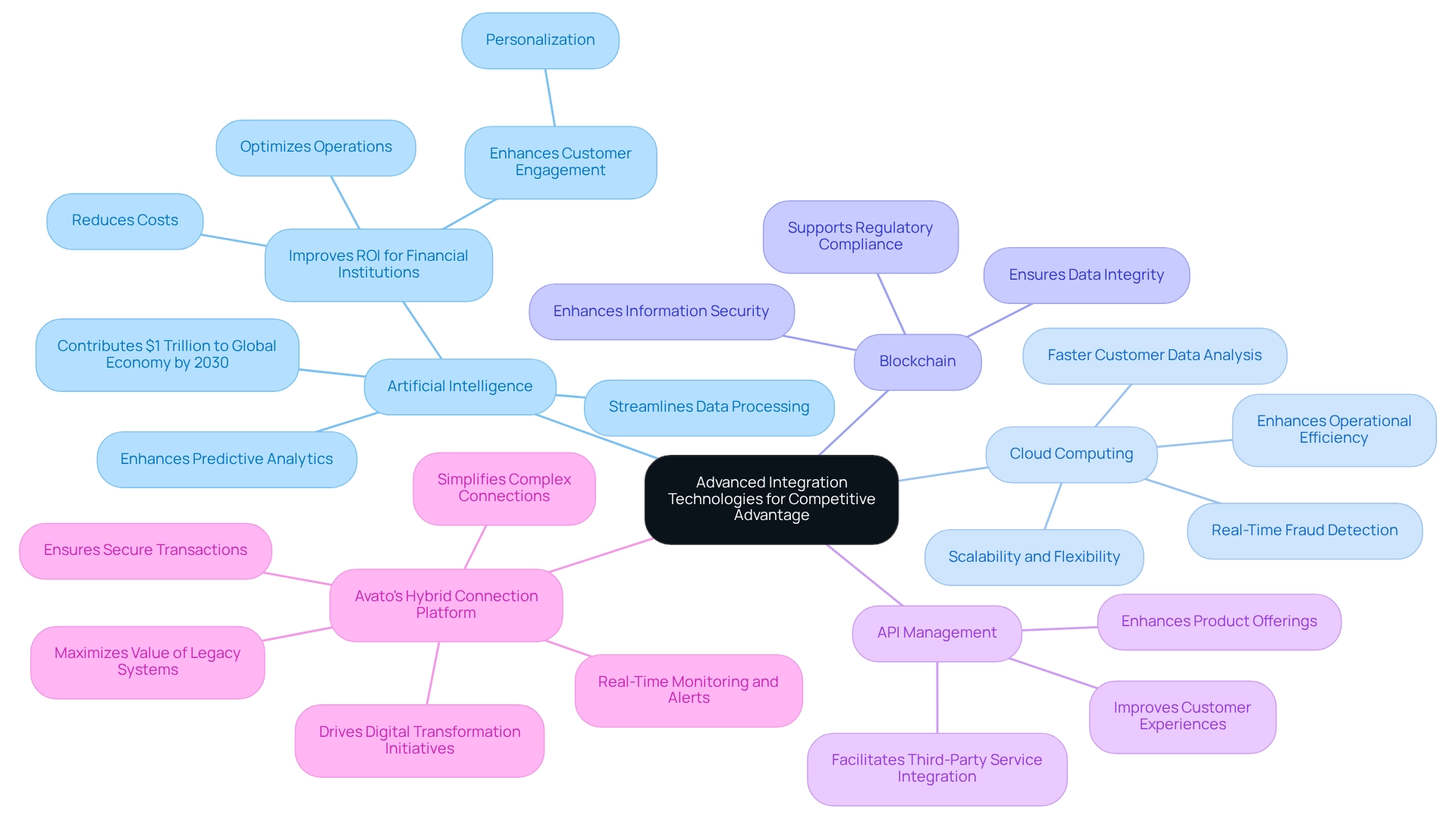

Leverage Advanced Integration Technologies for Competitive Advantage

To gain a competitive advantage, we must leverage our data integration capability with advanced integration technologies. Consider the following:

- Artificial Intelligence (AI): AI streamlines data processing and enhances predictive analytics, allowing us to foresee customer requirements and elevate service provision. By 2030, AI is projected to contribute approximately $1 trillion to the global economy, underscoring its transformative potential in banking. As noted by Dave Andre, a Senior Writer, “AI significantly enhances ROI for financial institutions by optimizing operations, reducing costs, and improving customer engagement through personalization.”

- Cloud Computing: Our cloud-based integration solutions, like those provided by Avato, offer scalability and flexibility, enabling us to examine customer information swiftly and identify fraud instantly. This capability is crucial for adapting to evolving market demands and enhancing operational efficiency. Through cloud computing, we can achieve quicker information analysis and bolster fraud detection abilities, vital for upholding security and trust.

- Blockchain: This technology enhances information security and transparency, particularly in transactions and compliance reporting. Its decentralized nature ensures that data integrity is maintained, which is essential for regulatory compliance in the banking sector.

- API Management: Effective API management facilitates the seamless incorporation of third-party services, enhancing our product offerings and improving customer experiences. This is increasingly significant as we aim to innovate and deliver personalized services to our clients.

- Avato’s Hybrid Connection Platform: By utilizing Avato’s secure hybrid connection platform, we can maximize the value of our legacy systems while simplifying complex connections. This platform is designed for secure transactions and guarantees 24/7 uptime, making it a reliable choice for us. Additionally, it features real-time monitoring and alerts on system performance, empowering us to unlock isolated assets, reduce costs, and drive digital transformation initiatives effectively.

By adopting these technologies, including Avato’s solutions, we can significantly enhance our data integration capability, drive innovation, and improve customer engagement, positioning ourselves as leaders in the financial services industry.

Conclusion

The journey towards effective data integration in banking represents not just a technological upgrade; it signifies a fundamental shift that can redefine operational efficiency and customer engagement. By mastering the essentials of data integration, we can break down silos, enhance data quality, and ensure compliance with regulatory standards. The importance of a cohesive data strategy is underscored by the significant improvements seen in institutions like DBS Bank, which achieved a 64% increase in customer engagement through personalized services.

However, challenges such as legacy systems, data quality issues, and regulatory compliance must be addressed strategically. By investing in advanced integration technologies such as AI, cloud computing, and robust API management, we can not only overcome these obstacles but also gain a competitive edge in a rapidly changing landscape. The adoption of platforms like Avato’s Hybrid Integration Platform demonstrates how legacy systems can be effectively integrated with modern solutions, ensuring reliability and fostering innovation.

Ultimately, the future of banking hinges on our ability to leverage data integration effectively. By prioritizing collaboration, establishing clear objectives, and continuously optimizing integration processes, we can unlock the full potential of our data, leading to improved decision-making and enhanced customer experiences. Embracing these best practices and technologies will position us for success in a digital-first era, paving the way for transformative growth and sustainability.