Overview

We recognize that the modernization of legacy systems is not merely an option but a necessity for enhancing banking efficiency. The advantages are clear:

- Operational flexibility is significantly improved.

- Maintenance costs are reduced.

- Customer experiences are elevated.

- Security measures are strengthened.

By modernizing outdated infrastructures, we enable financial institutions to streamline their operations, adapt swiftly to market changes, and integrate advanced technologies. This transformation not only fosters innovation but also ensures that we maintain a competitive edge in the financial sector.

What’s holding your team back from embracing this vital change? We invite you to explore how we can support your journey towards modernization and unlock the full potential of your operations.

Introduction

In the rapidly evolving landscape of financial services, we recognize the pressing need for banks to modernize their legacy systems. Outdated technologies not only hinder operational efficiency but also introduce significant security risks and restrict innovation.

This is where our hybrid integration platform comes into play—a transformative solution designed to streamline this complex process. By enabling seamless connections between disparate systems, we empower financial institutions to enhance productivity, improve customer experiences, and unlock new revenue streams.

As organizations navigate the challenges of digital transformation, the strategic modernization of IT infrastructure becomes not just a necessity, but a pathway to resilience and growth in an ever-competitive market.

What’s holding your team back from seizing these opportunities? Let us guide you through the journey of modernization.

Avato: Streamline Legacy System Integration with a Secure Hybrid Platform

We have skillfully designed our hybrid platform to facilitate legacy system modernisation, allowing financial institutions to securely and efficiently link diverse technologies. In projects where 24/7 uptime is crucial, we ensure that vital connections meet the demands of the highly regulated banking sector. With support for 12 levels of interface maturity, our platform not only accelerates the consolidation process but also effectively mitigates the risks associated with digital transformation. This empowers financial institutions to innovate without compromising security or compliance.

As Gustavo Estrada, an IT manager in finance, aptly states, ‘Avato can streamline intricate projects and provide outcomes within expected timelines and budget limitations.’ This capability is essential for financial institutions grappling with the challenges of legacy system modernisation and technology integration.

As banks progressively digitize their operations, we distinguish ourselves as an essential ally in managing the complexities of legacy system modernisation. What’s holding your team back from embracing this transformation? Let us guide you through the intricacies of modernization with confidence and clarity.

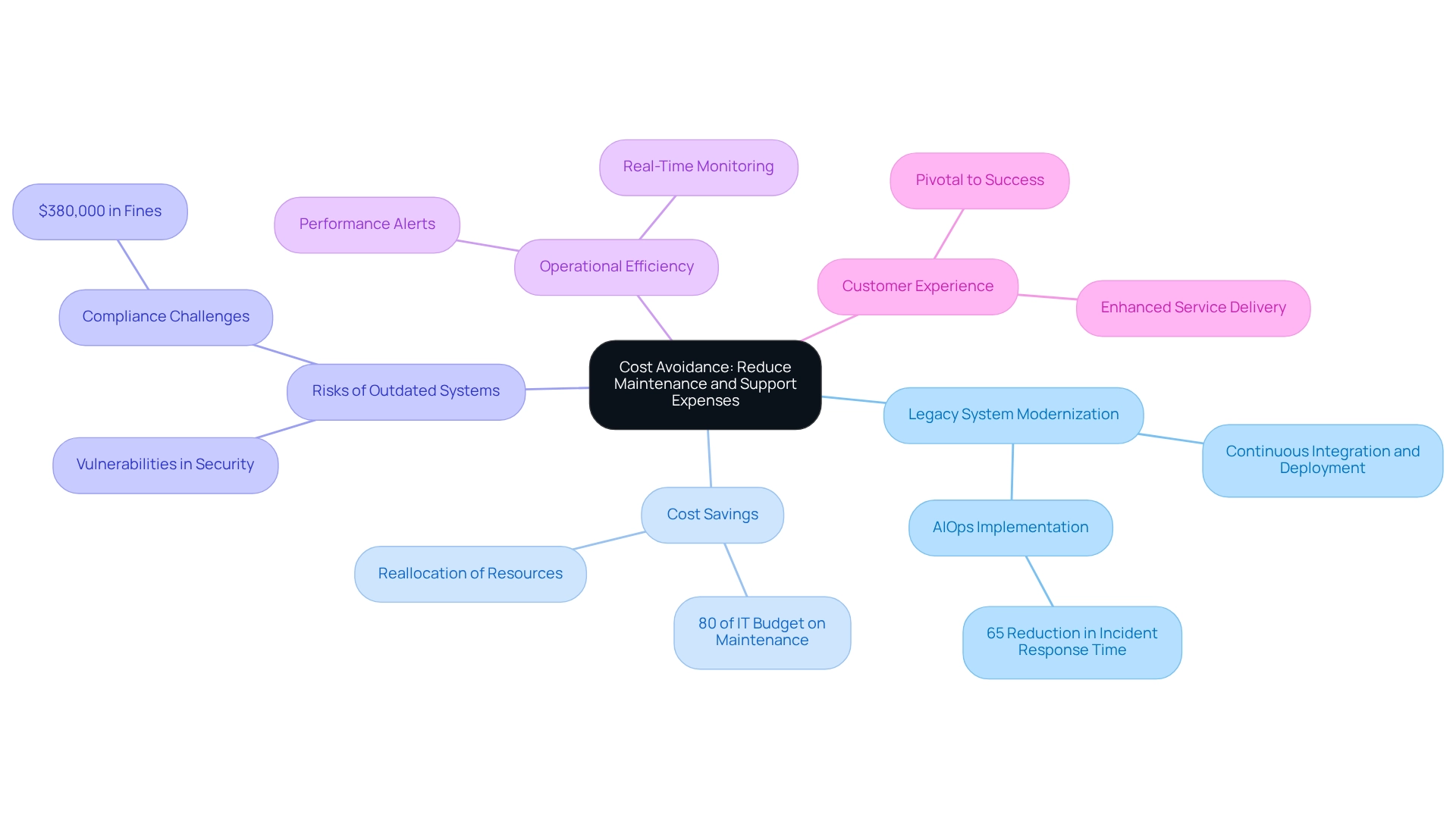

Cost Avoidance: Reduce Maintenance and Support Expenses

Updating legacy infrastructures through legacy system modernisation presents a significant opportunity for cost savings by curbing the ongoing maintenance and support expenses tied to outdated technologies. We recognize that financial institutions often grapple with high upkeep costs; some estimates indicate that obsolete technologies can consume as much as 80% of an IT budget. These systems typically require specialized skills that are increasingly difficult to find, leading to heightened support costs. By leveraging a dedicated hybrid platform, we can help financial institutions optimize their operations, substantially reduce reliance on costly technical assistance, and reallocate resources towards innovation and growth initiatives.

Consider the case of a healthcare provider that faced critical vulnerabilities in their outdated patient database, which could not be repaired due to compatibility issues. This predicament resulted in compliance challenges and ultimately incurred $380,000 in fines for failing to implement essential security measures. Such instances highlight the financial risks associated with maintaining obsolete infrastructures, underscoring the urgent need for legacy system modernisation in finance to avoid similar pitfalls. Moreover, adopting continuous integration and deployment pipelines can accelerate modernization efforts, enabling financial institutions to respond swiftly to market demands. The implementation of AIOps has been shown to reduce incident response times by 65% through predictive maintenance, directly translating to cost savings by minimizing both the frequency and duration of outages.

As banks transition to modern platforms like Avato’s alternatives, they not only reduce maintenance costs but also enhance customer experience—a critical factor for success in today’s competitive landscape. The Avato Hybrid Integration Platform offers features such as real-time monitoring and performance alerts, further boosting operational efficiency. In our current environment, customer experience is paramount to a company’s success. By investing in legacy system modernisation, financial institutions can enhance service delivery, avoid the pitfalls of outdated systems, and establish a more efficient, secure, and cost-effective operational framework.

Business Agility: Enhance Flexibility and Responsiveness to Market Changes

Legacy technologies hinder our capacity to swiftly adapt to market changes and evolving customer demands. Updating these systems through legacy system modernisation is essential for enhancing our operational flexibility, enabling us to launch new services and comply with regulatory changes more efficiently. As Piyush Gupta, CEO of DBS Bank, noted, core modernization significantly improves data utilization, laying the groundwork for a data-centric organization that enhances product development and customer engagement strategies.

Our hybrid platform is pivotal in this transformation, facilitating seamless integration of new technologies and processes. This capability empowers us to pivot rapidly in response to shifting market conditions, ultimately fostering greater business agility. We have successfully implemented hybrid connection solutions across multiple financial organizations, including a notable project with Coast Capital, where our platform enabled major transitions with minimal downtime. For instance, we transitioned Coast Capital’s entire telephone banking infrastructure in February 2013 with just a 63-second interruption, showcasing our reliability and commitment to operational continuity. Furthermore, our platform extends the value of legacy systems while significantly reducing costs. It provides real-time tracking and notifications on performance, ensuring 24/7 uptime for critical integrations.

Statistics reveal that organizations embracing modernization can achieve substantial improvements in responsiveness, with many banks reporting enhanced operational capabilities and reduced time-to-market for new offerings. As the financial ecosystem evolves, those who implement legacy system modernisation will be better positioned to thrive in a competitive landscape. Success will favor those who decisively and strategically embrace change. To embark on your modernization journey, we encourage you to assess your existing structures and identify key areas for unification.

Staff Productivity: Empower Employees with Efficient Tools

Updating outdated infrastructures through legacy system modernisation is imperative for providing our staff with effective resources that enhance workflows and reduce manual tasks. Our hybrid platform empowers our team by offering access to real-time data and insights, facilitating swift, informed decision-making. This capability not only significantly boosts productivity but also enhances employee satisfaction, allowing our workers to concentrate on higher-value tasks rather than being hindered by outdated processes.

In fact, organizations that have adopted contemporary banking methods report substantial productivity gains, with 90% of employees who have embraced AI at work experiencing a major boost in efficiency. As Austin Connolly, Lead Editor at Hubstaff, states, “When used right, productivity data can help you trigger immediate jumps in productivity and achieve sustained long-term success.”

As the financial sector progresses, utilizing sophisticated connection tools such as Avato’s becomes crucial for cultivating a more adaptable and responsive workforce, ultimately leading to improved results for both our staff and our organization.

To start utilizing contemporary connection tools, we encourage banking IT managers to engage in legacy system modernisation by evaluating their existing systems and pinpointing areas where automation and real-time data access can improve operational efficiency. Additionally, they should consider a phased implementation strategy for the platform to minimize risks and enhance adaptability.

Avato’s platform not only simplifies complex integrations but also guarantees secure transactions, making it a reliable option for financial institutions, healthcare, and government sectors.

Customer Experience: Deliver Enhanced Services and Support

We recognize that legacy system modernisation is essential for institutions aiming to deliver enhanced services and assistance to their clients. By seamlessly integrating customer-facing applications with backend systems, we can create a cohesive experience across all channels. This integration is crucial; over 50% of customers in the US and Canada prefer using e-wallets or credit cards for their e-commerce transactions, indicating a significant shift towards digital solutions.

Our platform, Avato, plays a pivotal role in this transformation, enabling faster response times and personalized services that align with the evolving expectations of customers in the digital age. Furthermore, the rise of generative AI, now the second-most-used AI workload in financial services, enhances this landscape. With a 60% increase in its application for customer experience—especially through advanced chatbots and virtual assistants—financial institutions can significantly boost engagement and operational efficiency.

As we focus on legacy system modernisation, we not only improve customer satisfaction but also promote retention and revenue expansion, thereby strengthening the essential connection between technology and customer experience. For instance, Latinia’s adaptable communication platform aids financial institutions in navigating various regulatory environments, facilitating accurate and prompt communication that keeps customers informed and engaged.

This illustrates how legacy system modernisation can support regulatory adherence while enhancing customer interaction, ultimately underscoring the strategic importance of investing in customer experience for brand loyalty. To further enhance stakeholder engagement and process modeling, we advocate for the integration of comprehensive strategies that align with our modernization efforts.

New Revenue Streams: Unlock Opportunities through Innovation

At Avato, we recognize the urgent need for enhanced integration of diverse structures and data within financial institutions. Legacy system modernisation is crucial because legacy frameworks often hinder these organizations from fully capitalizing on innovative opportunities and exploring new revenue channels. By implementing legacy system modernisation, we empower financial institutions to leverage advanced technologies like AI and data analytics, setting the stage for the creation of cutting-edge products and services.

For instance, institutions that have embraced AI-driven analytics have successfully rolled out tailored financial products, significantly boosting customer engagement and satisfaction. As of 2022, the telecommunications AI market is valued at approximately $2.5 billion, highlighting the escalating importance and financial potential of AI technologies in banking. Bharath Sattanathan, a partner in our Singapore office, asserts that “financial institutions will no longer be able to depend solely on the account ownership paradigm,” underscoring the critical need for innovation.

Moreover, the widespread adoption of voice assistants, with over 4 billion in use globally, illustrates how AI integration enhances user convenience and interaction. Our hybrid platform is pivotal in this transformation, enabling banks to swiftly adapt to evolving market trends and client demands. By streamlining integration processes, we help organizations unlock new avenues for growth and improve profitability, ensuring they remain competitive in an increasingly dynamic landscape.

As the banking sector continues to evolve, harnessing updated technologies will be essential for driving innovation and maximizing revenue potential, including the application of generative AI to craft customized financial products tailored to individual customer profiles. Avato’s dedication to architecting robust technology foundations ensures that financial institutions can spearhead the AI revolution, enhancing operational efficiency and enriching customer experiences.

Security Enhancement: Mitigate Risks with Modern Solutions

Legacy system modernisation is not just advisable; it is essential for enhancing security measures and reducing vulnerabilities linked to obsolete technologies. We, as financial institutions, are increasingly acknowledging the significance of cybersecurity. With 80% of organizations planning to enhance their information security investment in 2024, we are demonstrating our dedication to protecting assets and preserving trust in the financial sector. Furthermore, with 3.5 million unfilled cybersecurity positions worldwide in 2023, the necessity for us to update our infrastructures becomes even more evident.

Our Hybrid Integration Platform is equipped with advanced security features, including robust encryption and real-time monitoring, which are essential for protecting sensitive data from cyber threats. This platform not only streamlines intricate integrations but also significantly reduces expenses, enabling us to optimize the value of our legacy system modernisation. By effectively mitigating these risks, we enhance our security posture and ensure compliance with regulatory requirements, thereby fostering greater customer trust. As Megan Garza observes, “organizations can discover strategies to bolster their security stance through contemporary solutions,” emphasizing that legacy system modernisation is a crucial step for us as financial institutions seeking to improve our cybersecurity measures in 2025.

The banking industry’s cybersecurity journey is ongoing, highlighting our need for continuous evolution in security measures. Modernization is not merely a choice; it is a timely and necessary step for our future.

Feature Expansion: Integrate New Capabilities Seamlessly

Legacy system modernisation is essential for financial institutions seeking to seamlessly integrate new capabilities into their existing systems, which is a pivotal factor in maintaining competitive advantage. We recognize that Avato’s hybrid integration platform is crafted to support the addition of new features without disrupting ongoing operations. This flexibility not only enhances our service offerings but also empowers financial institutions to swiftly respond to evolving customer needs, particularly as open banking emerges in Canada.

With approximately 85% of millennials and Gen Z favoring digital banking, the necessity to adapt and innovate is critical. Furthermore, as global investment in fintech has fallen to a five-year low of $113.7 billion in 2023, the urgency for financial institutions to engage in legacy system modernisation and innovate is unmistakable. By leveraging Avato’s technology, we enable financial institutions to continually advance their technology stack, ensuring they remain at the forefront of the industry.

Additionally, our banking software improves risk management by providing real-time analytics and predictive insights, which are vital for informed decision-making. The European Union’s updated Payment Services Directive (PSD2) highlights the necessity for financial institutions to securely share customer data with third-party providers through secure APIs, making seamless collaboration increasingly essential.

To effectively prepare for open banking, financial institutions must prioritize security by implementing robust encryption and authentication measures within their integration processes. With Avato, we facilitate the efficient expansion of features and capabilities, ensuring operational continuity while enhancing customer engagement and satisfaction.

Digital banks are already harnessing data analytics and AI to develop customized products, further elevating customer engagement and satisfaction, as illustrated in the case study ‘Emerging Opportunities in Digital Banking.’ Moreover, the integration of generative AI is revolutionizing customer experience, enabling sophisticated chatbots and virtual assistants that streamline operations and boost productivity across various departments.

Innovation Enablement: Foster a Culture of Continuous Improvement

Legacy system modernisation is crucial for fostering a culture of continuous improvement within banking institutions. By leveraging our hybrid connection platform, which ensures secure transactions and consistent uptime for essential links, we empower our staff to innovate and explore new concepts and technologies. This proactive strategy not only boosts operational efficiencies but also equips financial institutions to swiftly adapt to changing market conditions and customer expectations.

For instance, during the pandemic, our agility in maintaining customer relationships was evident, as highlighted by Rich Corriss, underscoring the importance of a robust coordination strategy. Additionally, we accelerate the integration of disconnected networks and fragmented information through legacy system modernisation, allowing traditional financial institutions to embrace modern functionalities such as instant payments and digital wallets, thereby enhancing their competitive edge.

As one banking leader aptly noted, ‘If most of your budget goes to maintenance, you’re missing out on innovation.’ By nurturing an environment that encourages ongoing enhancement through technology, supported by our secure hybrid integration platform, we can significantly boost employee innovation and engagement.

To maximize the benefits of modernization, we recommend implementing real-time monitoring and alerts on performance, while utilizing support for 12 levels of interface maturity to future-proof your technology stack.

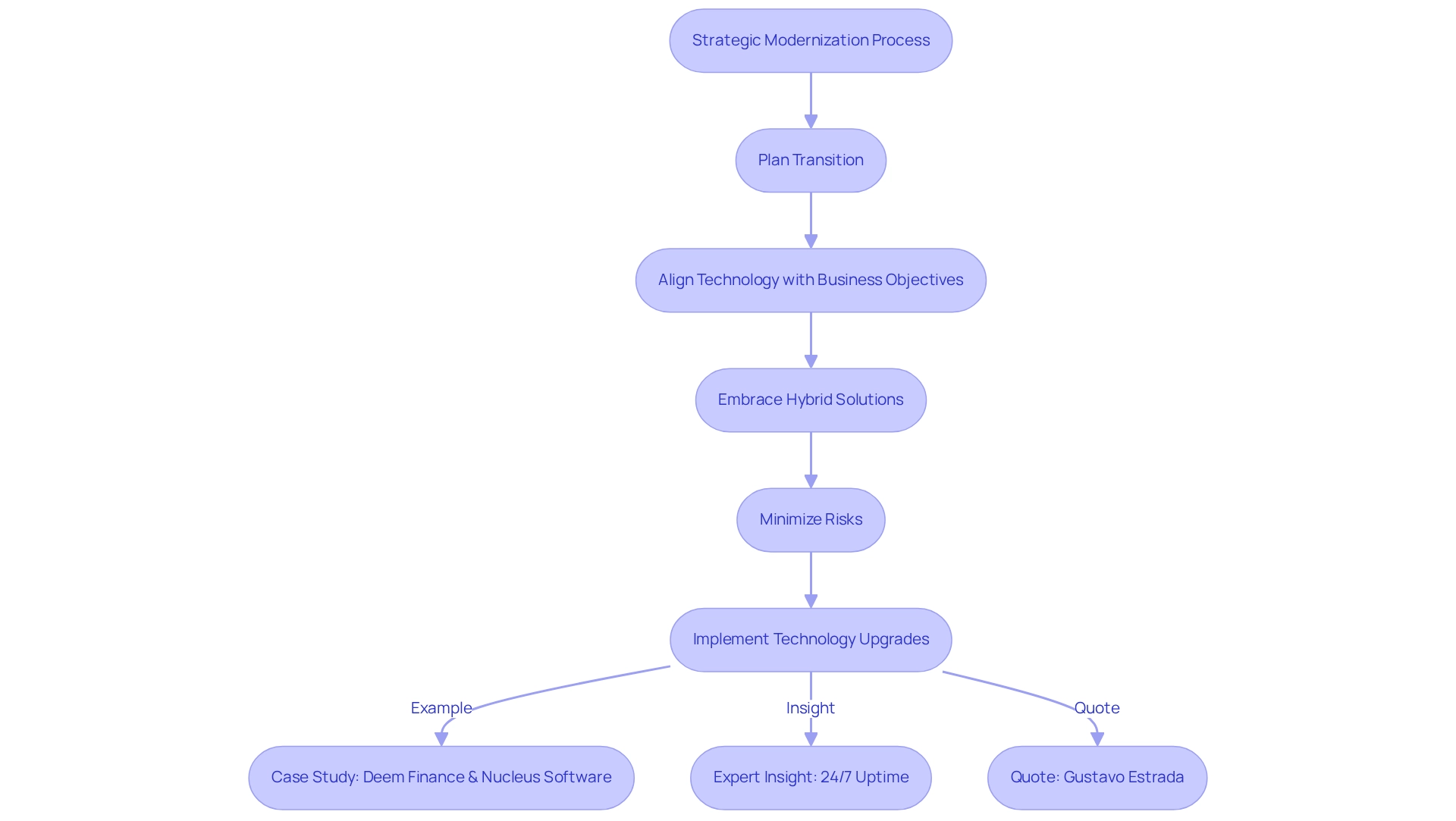

Strategic Modernization: Minimize Risks and Maximize Value

Strategic legacy system modernisation is essential for financial institutions seeking to minimize risks and maximize value. By meticulously planning our transition to contemporary platforms, we can enhance our technology while ensuring alignment with overarching business objectives. This strategic approach not only enables us to capitalize on existing investments but also positions us for future growth and innovation.

We encourage organizations to embark on their modernization journey to secure their future. This highlights the essential requirement for financial institutions to embrace contemporary solutions, such as a hybrid platform, which has proven to improve operational efficiency and service delivery.

Moreover, minimizing risks during technology transitions is paramount. Expert insights indicate that a well-organized modernization approach can substantially reduce the potential challenges linked to legacy upgrades. Our commitment to guaranteeing round-the-clock availability for essential connections further mitigates these risks, enabling banks to sustain smooth operations during the transition. Notably, the successful implementation of hybrid integration solutions in various financial institutions, such as Coast Capital, demonstrates our capability to manage complex integrations with minimal downtime, evidenced by a mere 63-second outage during a major system transition.

As Gustavo Estrada, a customer, noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” underscoring our effectiveness in supporting modernization efforts.

Case studies, such as Deem Finance’s expanded partnership with Nucleus Software, illustrate the tangible benefits of strategic modernization. This collaboration aims to enhance financial services in Brazil by leveraging advanced technology to improve operational efficiency. Such examples emphasize how we can maximize value through careful technology transitions, ultimately leading to improved service delivery and customer satisfaction.

In summary, the strategic modernization of banking systems in 2025 is not just about technology upgrades; it is about creating a resilient foundation for future success. By concentrating on reducing risks and enhancing value, we can navigate the complexities of legacy system modernisation with confidence, utilizing our expertise to effectively transform operations. Our founding vision at Avato of simplifying complex integrations through innovative enterprise architecture remains central to our mission.

Conclusion

The modernization of legacy systems is not merely an option; it is a critical undertaking for us in the banking sector, enabling us to navigate the complexities of today’s financial landscape. By utilizing Avato’s hybrid integration platform, we can achieve seamless integration of disparate technologies, ensuring operational efficiency and security. Reducing maintenance costs associated with outdated systems not only frees up resources for innovation but also enhances our overall productivity, allowing our employees to focus on higher-value tasks.

Moreover, modernized systems empower us to respond swiftly to market changes and evolving customer expectations. This agility is essential for maintaining a competitive edge, particularly as digital solutions become increasingly preferred by consumers. By enhancing customer experience through integrated services and real-time data access, we can foster greater engagement and satisfaction—vital components for our long-term success.

Our strategic approach to modernization minimizes risks while maximizing value, positioning us for future growth. With a commitment to continuous improvement and innovation, we can leverage advanced technologies such as AI and data analytics to unlock new revenue streams and enhance our operational capabilities. As the financial ecosystem continues to evolve, embracing modernization becomes not just a necessity but a pathway to resilience and sustained success.

In conclusion, our journey towards modernizing banking systems is imperative for organizations aiming to thrive in an increasingly competitive market. By prioritizing strategic modernization with platforms like Avato, we can effectively address the challenges posed by legacy systems, ensuring we are well-equipped to meet the demands of the future.