Overview

We recognize that effective integration of modern core banking systems is not just a trend; it is essential for enhancing operational efficiency and customer service within financial institutions. As we navigate the transition from legacy systems to modern architectures, we understand the critical role of technologies such as cloud infrastructure and microservices.

It is vital to adopt a phased modernization approach to tackle challenges like data migration and compliance effectively. What obstacles are holding your institution back from achieving these advancements?

By embracing these modern solutions, we can significantly improve our operational capabilities and customer satisfaction. Let us partner together to ensure a seamless transition that positions us for future success.

Introduction

In the rapidly evolving landscape of finance, core banking systems (CBS) are the essential framework that supports financial institutions in their quest for efficiency and innovation. As customer preferences shift towards digital banking, the demand for modernized systems capable of handling real-time transactions and providing seamless integration with various services has never been greater.

We delve into the critical importance of CBS, exploring the transition from outdated legacy systems to agile, modern architectures that prioritize customer-centric services. By examining architectural advancements, integration strategies, and the challenges faced during modernization, we reveal that embracing these changes is vital for banks aiming to thrive in a competitive environment.

With insights from industry leaders and emerging technologies, the discussion highlights the pivotal role of advanced core banking systems in shaping the future of financial services.

What’s holding your team back from making this transition? We invite you to explore how we can support your journey towards modernization and success.

Define Core Banking Systems and Their Importance

Core financial platforms (CFP) serve as the technological backbone of financial institutions, enabling us to oversee customer accounts, handle transactions, and maintain financial records effectively. These structures are vital for executing essential financial operations such as deposits, withdrawals, loans, and payments. The significance of central financial frameworks is underscored by their ability to deliver a cohesive platform that enhances operational efficiency, elevates customer service, and ensures compliance with regulatory standards.

In an era where approximately 85% of millennials and Gen Z prefer digital finance, institutions striving to maintain a competitive edge find modern core banking systems indispensable. They facilitate real-time data processing and seamless integration with various financial services, empowering us to respond swiftly to market demands and customer expectations.

Avato’s hybrid integration platform plays a crucial role in this landscape by simplifying complex integrations and augmenting the value of legacy systems, enabling banks to access data and resources in weeks rather than months. Key features of Avato’s platform include real-time monitoring and alerts on performance, essential for sustaining operational efficiency.

As Brian Moynihan, CEO of Bank of America, stated, “The firm’s ambitious strategy to invest USD 3.8 billion in technology initiatives showcases its dedication to innovation and digital transformation in the financial sector.” This investment highlights the critical role of modern core banking systems in driving innovation.

Moreover, as the community financial institutions segment is expected to experience the highest growth rate in the coming years, implementing modern core banking systems, supported by Avato’s secure hybrid integration solutions, will be pivotal in enhancing operational efficiency and innovation across the sector.

Regional analysis reveals that the relevance of CBS varies across North America, Europe, Asia Pacific, the Middle East & Africa, and South America, emphasizing the necessity for tailored solutions in diverse markets.

Explore the Evolution from Legacy to Modern Core Banking Systems

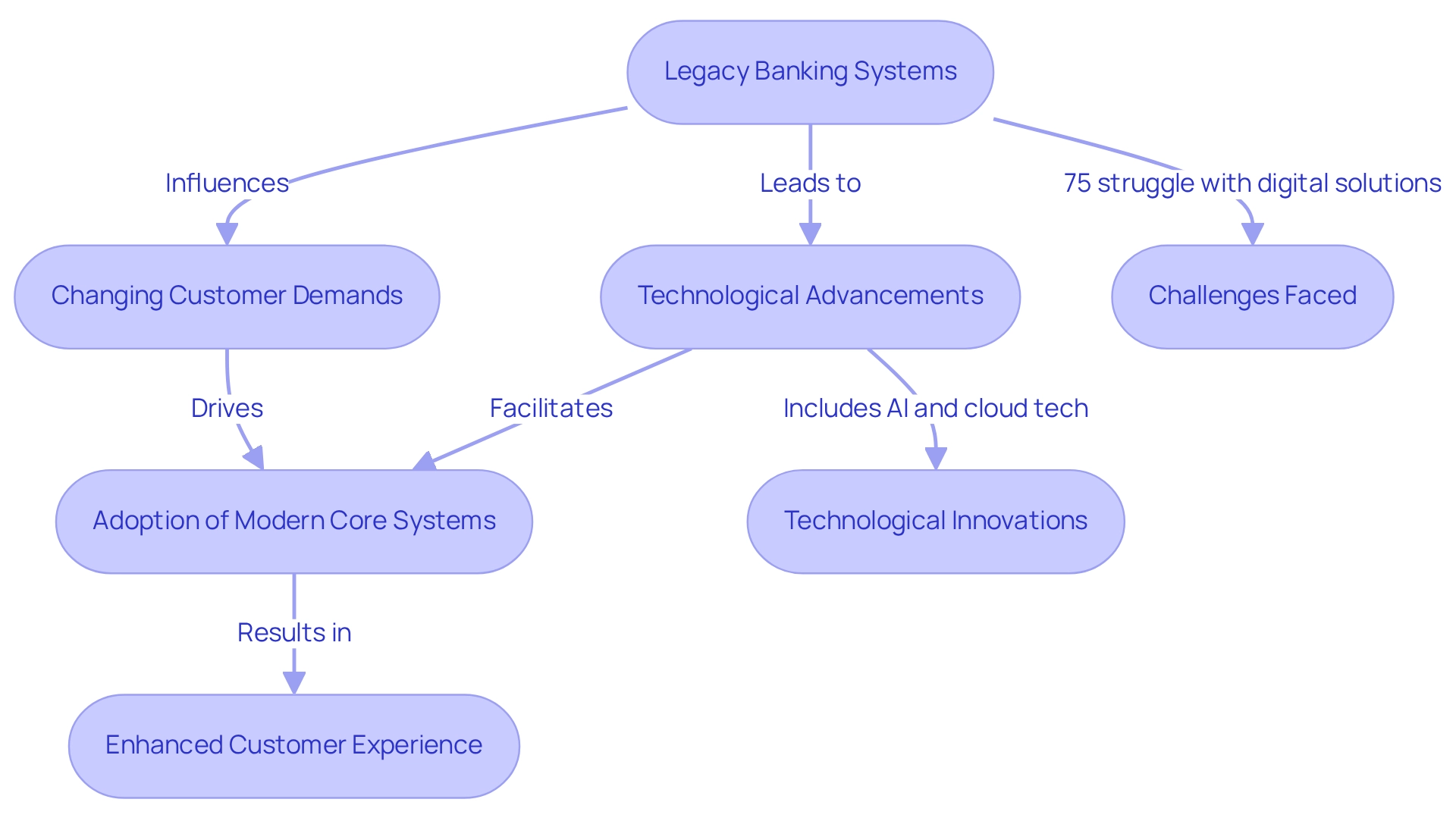

The transition from traditional financial infrastructures to modern core banking systems is fundamentally altering the financial landscape. This shift is propelled by swift technological progress and changing customer demands. Legacy frameworks, often reliant on outdated technology, exhibit inflexibility and a limited capacity to adapt to new requirements. In contrast, contemporary core financial platforms harness the benefits of cloud technology, open APIs, and microservices architecture, collectively enhancing flexibility, scalability, and integration capabilities.

This transition signifies more than a mere technological upgrade; it embodies a strategic shift towards customer-centric services and real-time data access. As we adopt contemporary frameworks, we unlock the potential to provide improved services, including mobile transactions, tailored customer experiences, and accelerated transaction processing. Notably, statistics reveal that 75% of financial institutions face challenges in adopting new digital solutions due to their outdated infrastructure, underscoring the necessity for modernization.

Instances of financial institutions successfully transitioning from outdated infrastructures to modern core banking systems illustrate this trend. These institutions utilize continuous compliance monitoring tools to uphold regulatory standards and minimize compliance findings, ensuring they meet the evolving demands of the financial landscape. As Tony LeBlanc from the Provincial Health Services Authority stated, “Avato speeds up the unification of isolated platforms and fragmented information, providing the connected foundation enterprises require to simplify, standardize, and modernize.” This emphasizes the effectiveness of contemporary solutions in overcoming connection challenges.

Moreover, generative AI is emerging as a pivotal tool in this transformation, with a 60% increase in its application for enhancing customer experience through sophisticated chatbots and virtual assistants. Over half of financial professionals now leverage generative AI for document processing and report generation, streamlining operations and boosting productivity across various departments.

Furthermore, advancements in technology are not only facilitating this evolution but are also reshaping the operational frameworks of banks, enabling them to remain competitive in an increasingly digital world. Our hybrid integration platform accelerates secure integration for finance, healthcare, and government, providing a robust foundation for digital transformation efforts. As we approach 2025, the advancement of central financial frameworks will continue to accelerate, driven by innovations that enhance security and operational efficiency. The introduction of tools like IBM’s m-Ray, an open-source vulnerability scanner for mainframe platforms, demonstrates our commitment to improving cybersecurity practices within the financial sector, illustrating how technological progress is directly influencing the shift to modern core financial architectures. This ongoing transformation is essential for financial institutions aiming to thrive in a dynamic environment, where modern core banking systems facilitate agility and responsiveness to customer needs.

Analyze the Architecture and Integration of Modern Core Banking Systems

Modern core banking systems are increasingly developed using a microservices architecture, which promotes modular design and deployment. This approach allows us to integrate various services and applications seamlessly, enabling a more agile response to shifting market demands. A pivotal element of this architecture is the integration of cloud infrastructure, which provides the scalability and reliability essential for managing fluctuating workloads. Furthermore, open APIs facilitate effortless connections with external services, a crucial feature for banks aspiring to expand their service offerings. This integration empowers us to connect with fintech solutions, payment processors, and other key financial services, aligning with the strategic methods necessary for preparing for open finance.

The advantages of adopting a modern architecture are substantial. We can significantly enhance operational efficiency, reduce costs, and improve customer experiences. Notably, organizations that have embraced microservices report a marked increase in the speed of release cycles, allowing for quicker iterations and adjustments to meet customer needs. However, we must recognize that microservices are not a one-size-fits-all solution; careful consideration is essential to determine their applicability to specific technology challenges. As Sam Newman aptly states, “Which is right, AP or CP? Well, the reality is it depends,” underscoring the nuanced decision-making involved in adopting microservices.

Moreover, fewer than 3% of organizations plan to decrease resource allocation for microservices, highlighting the growing trend and significance of this architecture in the financial sector. Insights from the case study titled “Lessons Learned from Microservices Implementation” reveal that while microservices offer significant advantages, we must also be mindful of their limitations. As the financial sector continues to evolve, leveraging modern core banking systems along with cloud infrastructure and microservices will be crucial for maintaining a competitive edge and achieving greater customer satisfaction, with cloud-leading institutions scoring 23 points higher on satisfaction indices. Recognizing when and how to apply microservices, along with enhancing connection strategies with Avato’s hybrid platform, is vital for successful adoption, ensuring that we can adeptly navigate the complexities of contemporary technology.

Address Challenges and Strategies for Core Banking Modernization

Updating modern core banking systems presents significant challenges, including data migration, integration with legacy systems, and compliance with regulatory requirements. We believe that a phased approach to modernization is crucial; it allows us to implement incremental upgrades instead of a complete overhaul. This strategy minimizes disruption and ensures continuous service delivery.

Throughout the modernization process, we must prioritize data governance and security to protect sensitive customer information. Collaborating with experienced suppliers like Avato, which offers specialized unification services through its dedicated hybrid connection platform, can facilitate smoother transitions. Avato’s platform specifically addresses data migration challenges by providing tools that simplify the transfer of data from outdated frameworks to modern architectures. Moreover, their international team of integration experts ensures that we have access to the necessary resources, especially as approximately 50% of organizations in Europe have adopted a cloud-first strategy to enhance business efficiency. This trend is exemplified by the success of 10x Banking’s Meta Core Solution, which accelerates transformation while mitigating the risks associated with legacy systems.

As we look ahead to 2025, the core banking software market faces obstacles stemming from privacy concerns, software complexity, and security vulnerabilities that could impede growth. To navigate these challenges, financial institutions should establish clear objectives and develop a roadmap for their modernization initiatives. David Grinberg, Director of FinTech at TechMagic, aptly stated, “It always starts with defining clear goals and creating a roadmap for the modernization project.” By implementing these strategies and leveraging Avato’s innovative hybrid integration solutions, which include compliance management features, we can successfully modernize our core systems, reduce risks, and enhance operational capabilities. This ongoing pursuit for modern core banking systems among banks underscores the urgency for modernization.

Conclusion

Modernizing core banking systems is not just beneficial; it is essential for the operational efficiency of financial institutions. As we transition from legacy systems to modern architectures, we enable effective transaction processing and customer account management, delivering services that are truly customer-centric and responsive to evolving market demands. The urgency for modernization has never been clearer, especially as many banks grapple with the challenges posed by outdated systems.

Our modern core banking systems leverage microservices architecture and cloud integration, providing the flexibility and scalability necessary to remain competitive. These advancements not only enhance operational efficiency but also significantly improve customer experiences through personalized services and streamlined processes. Furthermore, technologies like generative AI facilitate this transformation, allowing for better customer interactions and engagement.

However, the journey toward modernization is fraught with challenges, including data migration and compliance with regulations. We advocate for a phased approach, supported by experienced vendors like Avato, to mitigate risks and ensure a smooth transition while safeguarding sensitive information.

In conclusion, modernizing core banking systems is vital for financial institutions seeking innovation and improved customer satisfaction. By adopting advanced technologies and strategic integration, we can unlock new growth opportunities in an increasingly digital landscape. Adaptability and innovation will be the cornerstones of our success in a competitive environment. What steps will you take to ensure your institution thrives in this new era?