Overview

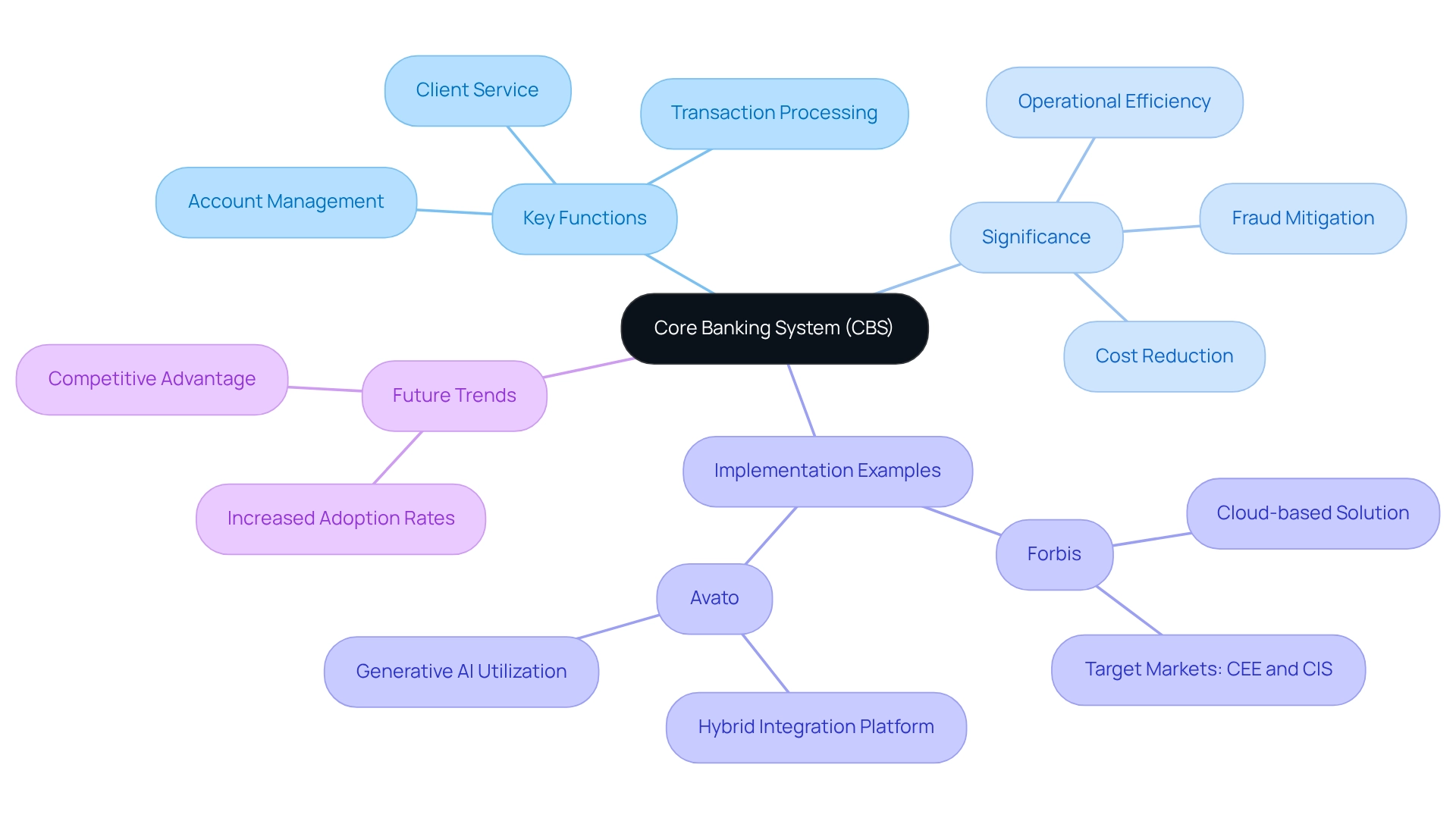

We recognize that the core banking system (CBS) serves as a pivotal infrastructure for financial institutions. It facilitates the efficient management of operations, including:

- Account management

- Transaction processing

- Client services across multiple branches

CBS not only enhances operational efficiency but also significantly reduces errors and elevates customer experiences through real-time processing and the integration of advanced technologies. This positions CBS as essential for modern banking, enabling us to meet the evolving needs of our clients effectively.

Introduction

In the dynamic landscape of financial services, we recognize that core banking systems (CBS) are the backbone of modern banking operations. These centralized software platforms not only facilitate seamless account management and transaction processing but also enhance customer service across multiple branches.

As the demand for real-time banking solutions intensifies, we see financial institutions increasingly acknowledging the pivotal role of CBS in driving operational efficiency and improving customer experiences. With approximately 70% of banks adopting these integrated solutions, the evolution from legacy systems to advanced platforms reflects a broader trend in our industry—one that emphasizes the importance of innovation and adaptability in meeting the needs of a tech-savvy clientele.

As we navigate this transformation, the integration of cutting-edge technologies like artificial intelligence and cloud computing is reshaping the delivery of financial services, ensuring that we remain competitive in a rapidly changing environment.

What’s holding your team back from embracing this evolution?

Define Core Banking System: Key Concepts and Functions

A core banking system definition indicates that it is not just a software platform; it is the backbone of financial institutions, enabling efficient management of essential operations such as account management, transaction processing, and client service. By connecting multiple branches, we enable users to access their accounts and conduct transactions seamlessly across various locations. Our CBS encompasses managing deposits, withdrawals, loans, and a range of financial services, ensuring that all transactions are processed in real-time and accurately reflected in client accounts. This infrastructure is vital to contemporary finance, enhancing operational effectiveness and significantly improving customer experiences.

The significance of CBS is underscored by the fact that approximately 70% of institutions utilize centralized software platforms for account management, reflecting a growing trend toward integrated solutions. Furthermore, Central Banks operate through 150 locations across Missouri, Kansas, Illinois, and Oklahoma communities, demonstrating the operational scale and necessity of CBS in managing multiple branches effectively. Experts emphasize that robust financial frameworks not only enhance operations but also mitigate fraud and reduce operational expenses through instantaneous financial functionalities.

For instance, the implementation of CBS has shown improvements in operational efficiency within financial organizations, as illustrated by case studies such as Forbis, which offers a cloud-based essential financial solution tailored for specific markets. Forbis exemplifies how the core banking system definition can enhance operational efficiency and client service by providing integrated solutions.

As we look toward 2025, the adoption rates of core financial systems are on the rise, with many institutions recognizing their crucial role in maintaining a competitive advantage in the financial landscape. Gustavo Estrada, a client, noted that Avato can streamline complex projects and deliver results within desired timelines and financial constraints, further emphasizing the significance of CBS in contemporary finance.

Avato’s hybrid integration platform is instrumental in enhancing the functionalities of CBS by facilitating seamless data connectivity and integration across various financial operations. This capability not only transforms financial institutions with speed and reliability but also leverages generative AI to enhance user experiences and operational efficiency. The core banking system definition is essential for financial institutions aiming to modernize their operations and elevate customer satisfaction, positioning it as a key element of modern financial architecture.

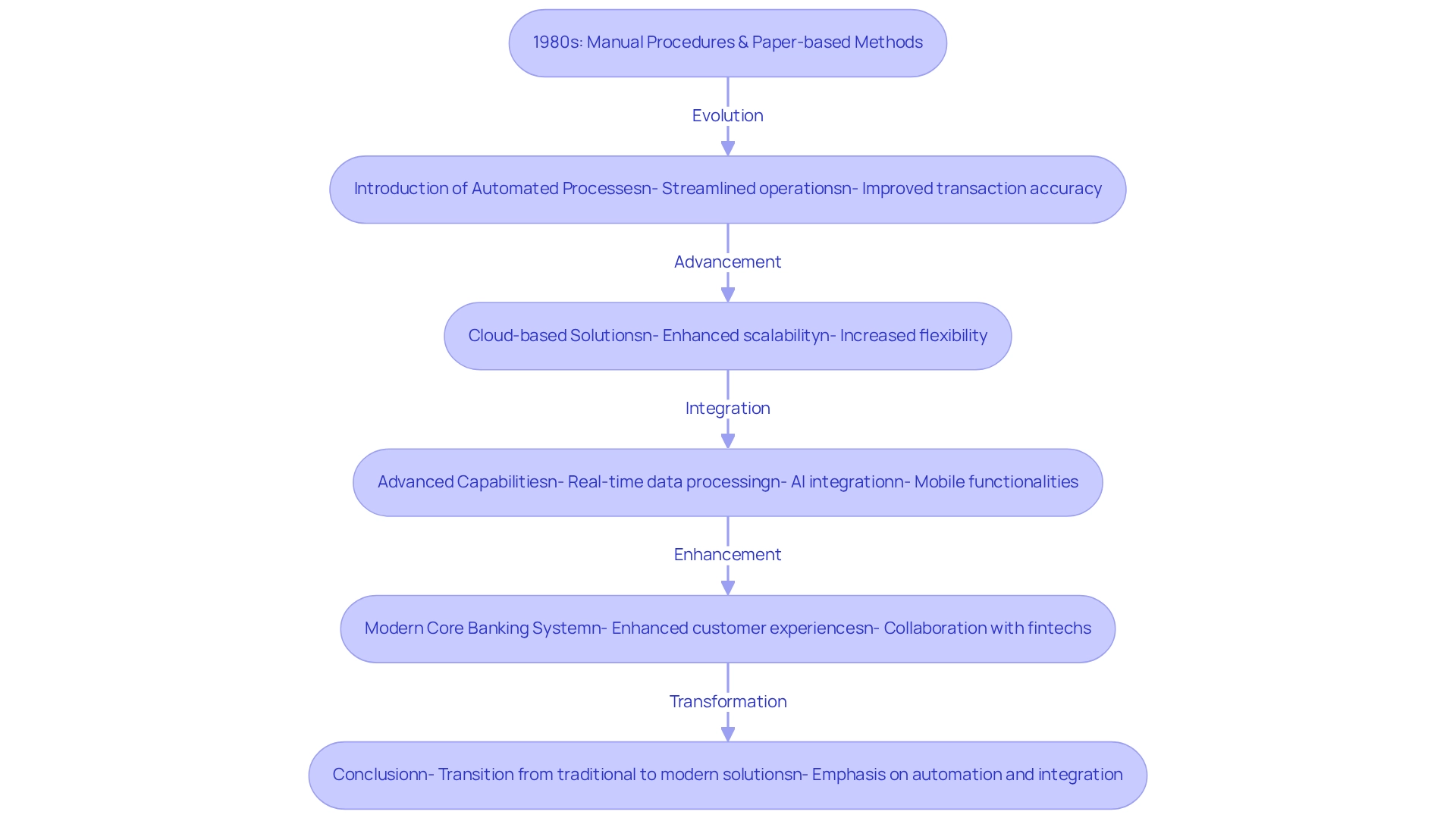

Explore the Evolution of Core Banking Systems: From Legacy to Modern Solutions

Since their inception in the 1980s, the core banking system definition has undergone a significant transformation. Initially, we relied on manual procedures and paper-based methods, which proved ineffective and prone to errors. The introduction of automated processes marked a pivotal shift, enabling us to streamline operations and improve transaction accuracy. As technology has progressed, cloud-based solutions have further revolutionized our landscape, providing enhanced scalability and flexibility.

The core banking system definition encompasses advanced capabilities such as real-time data processing, artificial intelligence integration, and mobile functionalities. These innovations are essential in meeting the growing customer demand for seamless and efficient financial experiences. For instance, the European open banking market saw a remarkable 385% increase in API call volume in 2022, underscoring the shift towards more integrated and responsive banking solutions.

To navigate this evolution, we are increasingly adopting Avato’s Hybrid Integration Platform. This platform enhances and expands the value of our legacy technologies, simplifies complex integrations, and significantly reduces costs. By providing real-time monitoring and alerts on performance, Avato empowers us to unlock isolated assets and enhance business value creation.

Industry specialists assert that the advancement of essential financial services, according to the core banking system definition, transcends technological enhancements; it signifies a fundamental transformation of the financial system itself. As Jim Marous, co-publisher of The Financial Brand, states, ‘The transition to modern core banking system definition is not solely about technology; it involves reimagining the entire banking experience to meet client expectations in a digital era.’ Regulatory initiatives like PSD2 in Europe have compelled us to open our APIs to third-party providers, fostering collaboration within the fintech ecosystem. This shift not only enhances our service offerings but also drives competitive differentiation.

As we transition from outdated frameworks to modern solutions, we increasingly leverage innovative technologies to automate previously manual processes. Avato’s secure hybrid integration platform plays a crucial role in this transition, allowing us to lead the AI revolution and enhance B2B customer experiences by bridging legacy frameworks with contemporary expectations. This transition is not merely about adopting new tools; it requires rethinking how we deliver financial services. The network effect of open finance ecosystems indicates that the value of these frameworks increases with the number of participants, further emphasizing the importance of collaboration in today’s financial landscape.

In conclusion, the evolution of core financial frameworks aligns with the core banking system definition, transitioning from traditional to modern solutions and reflecting a broader movement towards automation and integration, which enables us to assist our clients more effectively in an increasingly digital environment.

Understand the Importance of Core Banking Systems: Enhancing Efficiency and Customer Experience

The core banking system definition indicates that core financial platforms are essential for enhancing operational efficiency and user experience within financial institutions. By centralizing financial operations, we significantly reduce manual intervention, minimize errors, and optimize processes. This operational efficiency leads to faster transaction processing times and improved service delivery, which are crucial for meeting the evolving demands of our clients.

We also recognize that modern core financial platforms enable omnichannel access, allowing clients to effortlessly reach their accounts and perform transactions across various platforms, including mobile applications and online finance. This flexibility not only boosts client satisfaction but also fosters loyalty and retention in a fiercely competitive landscape.

Statistics reveal that approximately 85% of millennials and Gen Z prefer digital financial services over traditional methods. We understand that the core banking system definition is vital for meeting these preferences, as it provides the necessary infrastructure for digital services and ensures that we can satisfy the needs of a technology-savvy clientele. Furthermore, insights from financial experts suggest that adopting advanced core financial platforms can lead to significant improvements in customer satisfaction scores, often observed before and after platform upgrades.

Avato plays a pivotal role in integrating disparate systems, ensuring a cohesive foundation that businesses need to simplify, standardize, and modernize their operations. By effectively mobilizing stakeholders, we guarantee that requirements are accurately captured from the outset, which is critical for the success of integration projects. Our platform is designed for secure transactions, establishing it as a reliable choice for financial institutions, healthcare, and governmental sectors, where continuous uptime is paramount.

Case studies illustrate the transformative impact of core financial frameworks on operational efficiency. For instance, the technological evolution of core financial platforms is driven by the need for greater digital transformation and integration with fintech solutions. Emerging technologies such as AI and distributed ledger technology enhance core financial capabilities by automating tasks and improving data security, positioning institutions for sustained competitive advantage. In conclusion, the core banking system definition is crucial, as these frameworks are not merely technological upgrades; they are vital for fostering operational efficiency and enhancing client experience. By integrating advanced technologies and providing seamless access to financial services, we ultimately cultivate increased customer loyalty and drive business success. Avato’s hybrid integration platform is instrumental in this transformation, empowering financial institutions to navigate the complexities of contemporary finance with confidence.

Analyze Core Banking System Components: Features and Functionalities

The core banking system definition highlights its pivotal role in today’s financial landscape, comprising several essential components that work synergistically to streamline banking operations. These components include:

- Account Management: We recognize that this module is crucial for supervising client accounts, encompassing deposits, loans, and investments. It guarantees accurate monitoring and reporting, which is vital for preserving client trust and ensuring regulatory compliance.

- Transaction Processing: This feature facilitates real-time processing of transactions such as fund transfers, withdrawals, and deposits. Immediate updates to client accounts are essential for enhancing user experience and operational efficiency.

- Client Relationship Management (CRM): Our integrated CRM tools enable banks to manage client interactions effectively, track preferences, and enhance service delivery. This capability is increasingly important as we seek to improve customer engagement strategies.

- Compliance and Risk Management: Equipped with functionalities that ensure adherence to regulatory requirements, our core financial systems manage risks associated with financial transactions, sustaining operational resilience in the financial sector.

- Reporting and Analytics: Advanced reporting tools provide insights into financial operations, empowering institutions to make informed, data-driven decisions. This analytical capability is crucial for enhancing performance and adapting to market fluctuations, illustrating the core banking system definition.

Together, these elements significantly enhance the functionality and reliability of primary financial systems, enabling institutions to operate effectively and respond adeptly to client demands. As Jamie Dimon pointed out, mastering technology is crucial for future success in the banking industry, underscoring the importance of integrating advanced technological solutions to bolster fundamental banking functionalities.

Moreover, our hybrid integration platform exemplifies how technology can simplify the integration of these core components, allowing banks to modernize their operations effectively. By leveraging our platform, financial institutions can maximize the value of their legacy systems, streamline complex integrations, ensure compliance with stringent security protocols, and unlock data and systems in weeks rather than months. Key features such as real-time monitoring, cost reduction, and support for 12 levels of interface maturity further enhance our platform’s capabilities, making it an essential tool for banks preparing for the open banking landscape.

Conclusion

The evolution of core banking systems is not just pivotal; it is transformative, shaping the future of financial services. By transitioning from legacy systems to modern, integrated solutions, we enhance operational efficiency, streamline transaction processing, and elevate customer experiences. The adoption of centralized software platforms represents a fundamental shift in how we deliver banking services, effectively meeting the demands of an increasingly tech-savvy clientele.

The significance of core banking systems is underscored by our ability to facilitate real-time data processing and omnichannel banking, catering to the preferences of younger generations who favor digital interactions. As we embrace advanced technologies such as artificial intelligence and cloud computing, we position ourselves to thrive in a competitive landscape, fostering customer loyalty through improved service delivery.

Ultimately, the integration of innovative platforms like Avato’s hybrid integration system exemplifies the transformative potential of modern core banking solutions. By unlocking the capabilities of legacy systems and streamlining operations, we navigate the complexities of the modern financial environment with confidence. Embracing this evolution is not merely a strategic choice; it is essential for financial institutions like ours aiming to remain relevant and successful in the future. Are you ready to join us in this evolution?