Overview

In today’s fast-paced financial landscape, integrating ERP systems with banking operations is not just beneficial—it’s essential for enhanced efficiency. We recognize that this integration streamlines processes, reduces errors, and significantly improves data accuracy. As a result, our clients experience notable cost savings and operational improvements. Supported by compelling case studies and expert insights, we emphasize the critical role this integration plays in modern financial institutions. By embracing these advancements, we position ourselves as strategic partners in navigating the complexities of the financial sector.

Are you ready to elevate your operational efficiency? Let us guide you through the transformative benefits of ERP bank integration.

Introduction

In the rapidly evolving landscape of the banking sector, we recognize that the integration of Enterprise Resource Planning (ERP) systems with banking operations is emerging as a game-changer. As financial institutions strive to enhance operational efficiency, data accuracy, and compliance, the seamless connectivity offered by advanced integration platforms like Avato’s becomes indispensable.

What if we could automate payment processes, optimize cash flow management, and enhance security measures for sensitive data? By embracing these innovative solutions, we position ourselves not only to streamline operations but also to achieve sustainable growth in an increasingly competitive environment.

Let us explore how ERP bank integration can transform our operations and set us on the path to success.

Avato: Enhance Operational Efficiency with Seamless Bank Integration

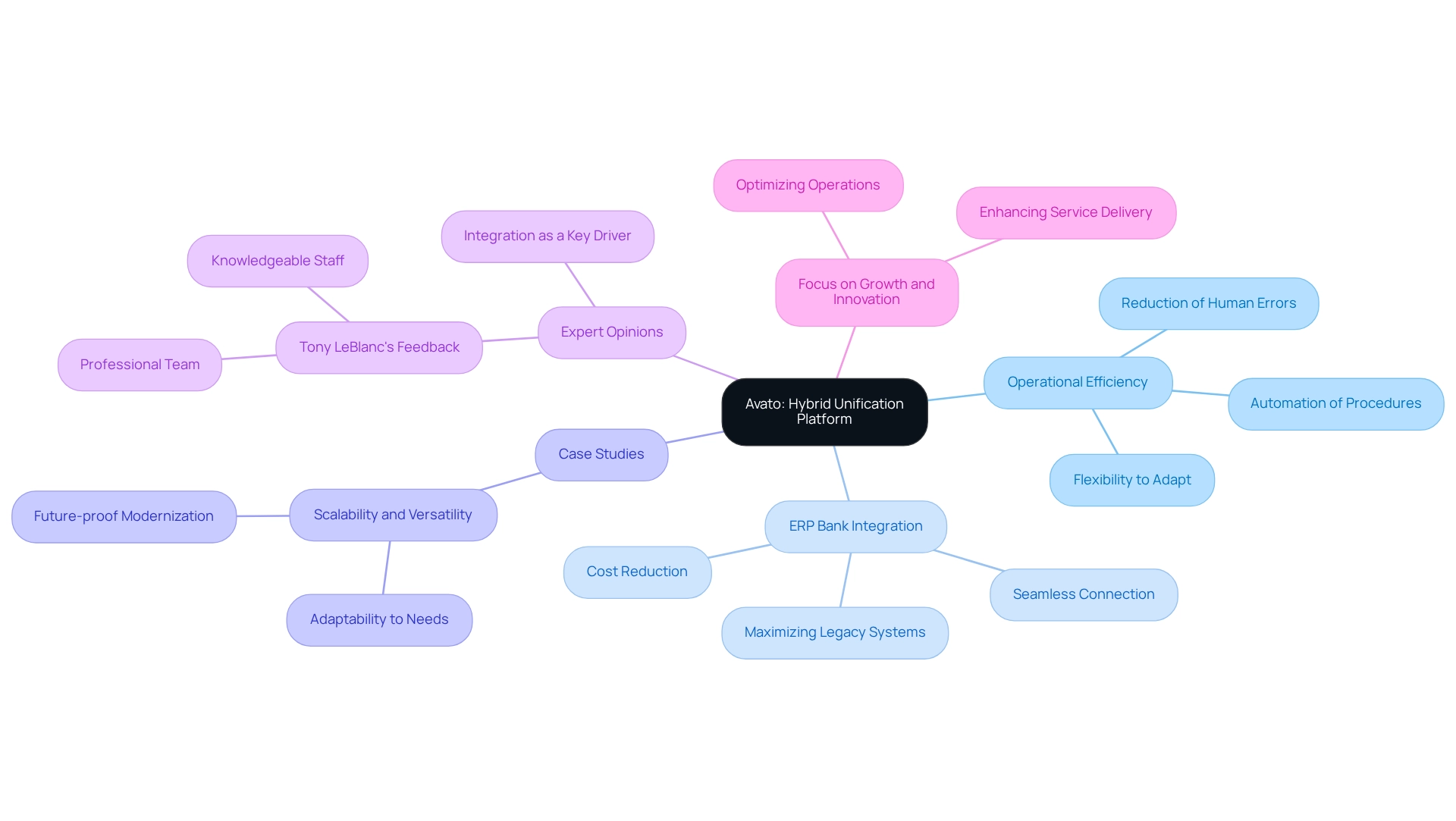

Our hybrid unification platform is meticulously crafted to enhance operational efficiency by seamlessly implementing ERP bank integration, connecting banking systems with enterprise resource planning (ERP) solutions. This unification empowers financial institutions to automate procedures, significantly reduce human errors, and elevate overall workflow efficiency. By harnessing our cutting-edge technology, we enable financial organizations to achieve not only operational efficiency but also the flexibility required to adapt to evolving market demands.

In 2025, the benefits of ERP unification in banking are more evident than ever, with institutions reporting remarkable improvements in operational performance. For instance, BMO has emerged as the first financial institution to offer a fully embedded banking solution in Canada, demonstrating how unified systems can lead to a substantial increase in productivity, allowing financial organizations to focus on growth and innovation.

Expert opinions underscore the importance of hybrid connection platforms in bolstering competitiveness within the financial sector. The implementation of ERP bank integration is increasingly recognized as a crucial element of operational excellence, enabling financial institutions to optimize workflows and enhance service delivery. Our hybrid connection platform not only simplifies complex integrations but also maximizes the value of legacy systems, significantly lowering costs and accelerating the unification of isolated systems.

Case studies illustrate the scalability and versatility of our platform, particularly highlighted in the case study titled ‘Scalability and Versatility,’ which showcases its capacity to adapt to the dynamic needs of financial institutions. This adaptability not only secures modernization initiatives for the future but also ensures that banks can maintain a competitive edge as they grow and evolve.

As emphasized by industry representatives, including Tony LeBlanc from the Provincial Health Services Authority, the cooperative nature of our unification solutions fosters a professional environment that enhances project outcomes. He noted, ‘Good team. Good people to work with. Extremely professional. Extremely knowledgeable.’ This positive feedback from banking IT managers reflects our platform’s effectiveness in simplifying complex integration projects while delivering results within desired timelines and budget constraints.

Improve Data Accuracy and Compliance through ERP Bank Integration

The integration of ERP bank integration with banking operations is not just beneficial; it is essential for enhancing information accuracy and compliance. By automating data entry and synchronization across platforms, we can significantly reduce human errors, ensuring that financial data remains consistent and current. This seamless ERP bank integration streamlines our operations while enhancing compliance with regulatory mandates, enabling precise reporting and creating robust audit trails. Such measures are crucial for fostering trust and transparency in our financial dealings, ultimately positioning us to meet evolving regulatory standards effectively.

As we approach an estimated $50 billion ERP market by 2025, driven by the demand for ERP bank integration solutions, the importance of these systems in preserving information integrity and compliance cannot be overstated. However, we must acknowledge that challenges persist; the top three challenges for ERP systems are:

- Data accuracy

- User experience

- Analytics

David Luther, a Digital Content Strategist, notes that “the two most commonly cited challenges during implementation are insufficient testing and not enough process reengineering.” Addressing these challenges, including the critical need for precisely capturing requirements and future-proofing our systems, is vital for successful ERP implementation.

Moreover, mobilizing stakeholders effectively is essential to ensure that requirements are accurately captured from the outset. By utilizing the right technology and tools, we can illustrate both the current state and the ideal state of our operations, facilitating better process modeling. Additionally, we cannot overlook the transformative impact of generative AI in financial services. With a significant increase in its use for enhancing customer experience through sophisticated chatbots and virtual assistants, we can leverage AI to streamline our operations and improve service delivery. This aligns with insights from the case study titled “Generative AI: The New Frontier in Financial Services,” which highlights our growing reliance on AI for operational efficiency.

Furthermore, the case study titled “The State of ERP Market Growth” emphasizes the rapid growth of the ERP market, underscoring our increasing reliance on integrated solutions. For banking IT managers, concentrating on these elements can lead to more efficient implementation strategies, ensuring that our ERP bank integration not only enhances information accuracy but also strengthens compliance in a constantly changing regulatory environment.

Achieve Real-Time Data Access for Informed Decision-Making

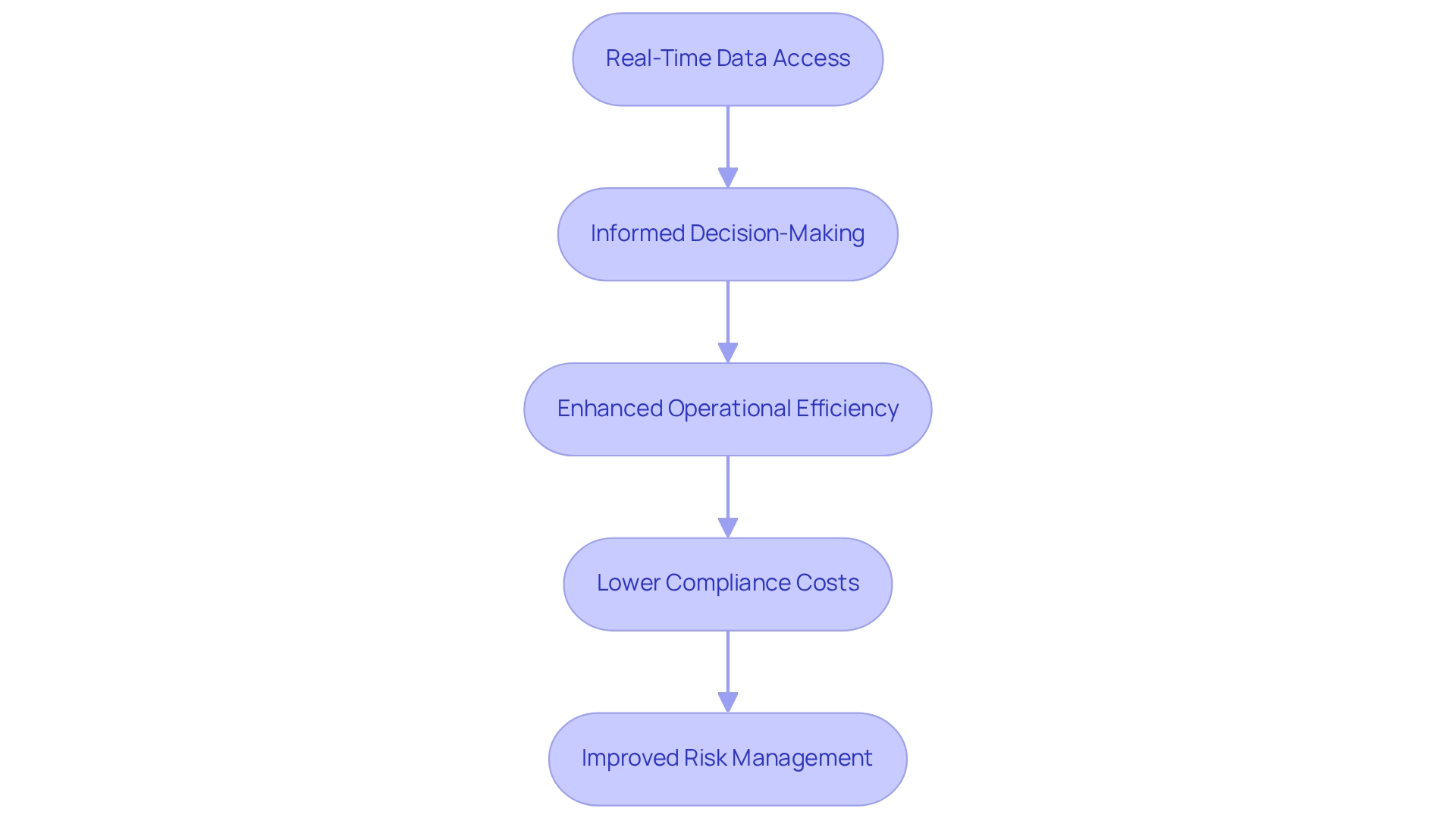

One of the most notable benefits of our ERP bank integration is the capability to obtain real-time information, enabling us to make knowledgeable choices based on the most up-to-date financial details. Integrated systems empower us to monitor cash flows, assess risks, and respond swiftly to market fluctuations, thereby enhancing our strategic planning and operational agility.

For instance, a prominent financial services company that integrated real-time information analytics into its risk management procedures reported an impressive 30% decrease in compliance-related expenses within just one year. This illustrates how ERP bank integration can optimize our operations and lower costs, and the significance of real-time information access cannot be overstated; it directly impacts decision-making in financial institutions by offering timely insights that foster innovation and growth.

As specialists highlight, the quality and use of gathered information are crucial for effective decision-making. Moreover, case studies emphasize how financial institutions utilizing ERP bank integration have enhanced their operational efficiency and responsiveness. The digital revolution underscores the move towards open information and collaboration, which boosts innovation and accessibility in both government and business sectors, ultimately benefiting our banking operations through ERP bank integration.

In the current landscape, we recognize that maintaining a competitive edge requires essential access to real-time information. As Andrew McAfee aptly states, ‘The world is one large information challenge,’ underscoring the need for financial institutions to utilize real-time insights efficiently. This viewpoint emphasizes the difficulties we encounter in handling extensive quantities of information, reinforcing the necessity for robust ERP systems that enable real-time access.

By streamlining and simplifying integration platforms, as advocated by Avato, we can enhance our decision-making processes and ensure we are well-equipped to navigate the complexities of the financial environment while adhering to stringent security protocols.

Automate Payment Processes to Reduce Errors and Save Time

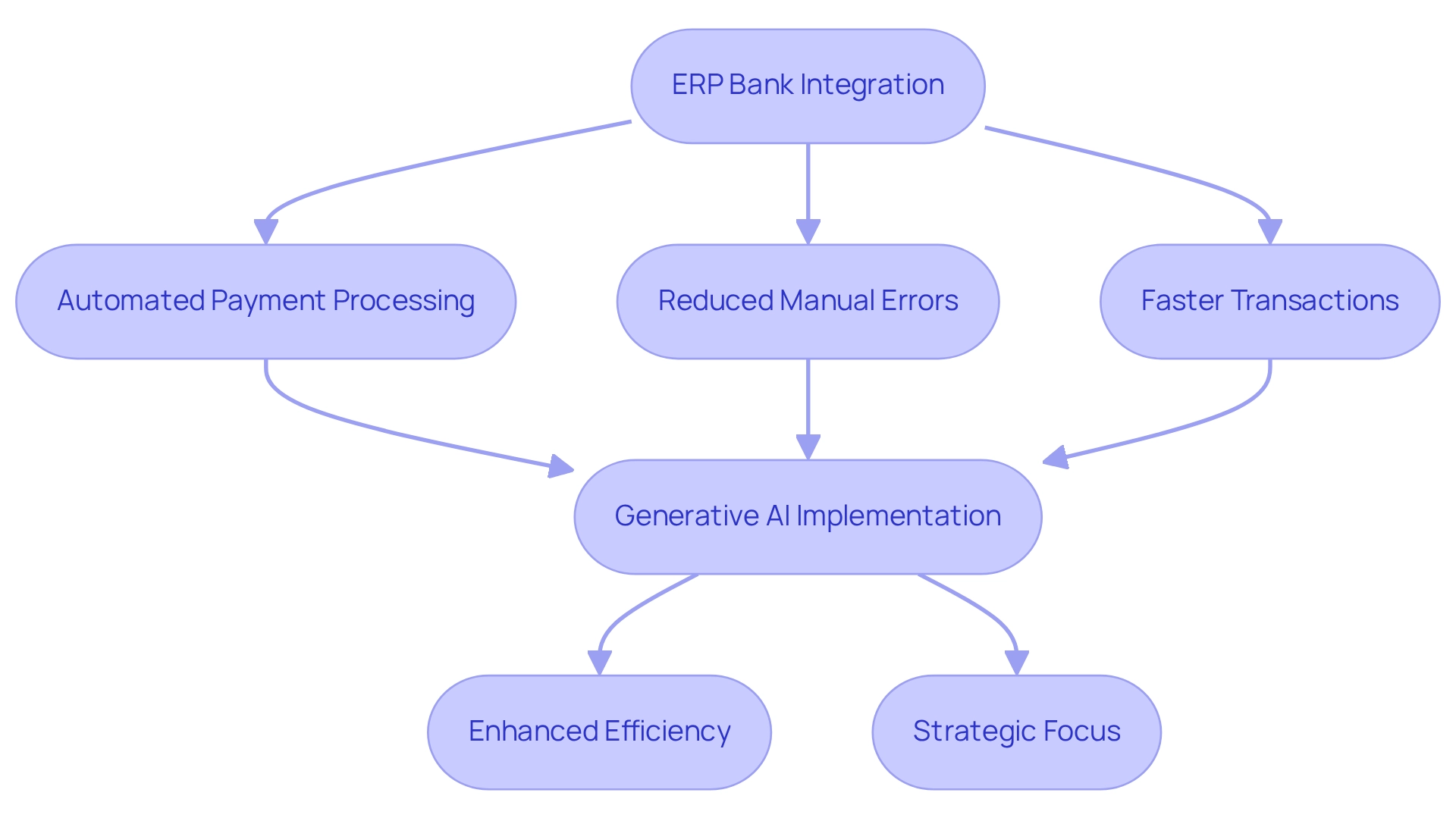

ERP bank integration is essential for financial institutions aiming to automate payment processes, thereby significantly reducing the risk of errors that often arise from manual data entry. Automated solutions execute transactions with remarkable speed and precision, ensuring that payments to vendors and clients are processed promptly. This shift conserves valuable time and boosts the overall efficiency of our financial operations. By relieving our personnel from routine processing tasks, we can redirect our focus toward more strategic initiatives that drive growth and innovation.

As Rituparna, a Tech Expert, observes, “ERP systems are no longer a luxury or an optional upgrade—they’re the backbone of modern business transformation.” This insight underscores the critical role of automation in minimizing errors in banking transactions. A case study titled “Generative AI: The New Frontier in Financial Services” reveals that generative AI is increasingly utilized in our industry, with over half of financial professionals now employing it for document processing and report generation. By adopting advanced automation solutions, including generative AI technologies, we can streamline our payment processes, resulting in substantial time savings and enhanced accuracy.

As we approach 2025, the trend toward automating payment processes continues to gain momentum, with many banks reporting a marked decrease in errors associated with payment processing. Statistics indicate that organizations utilizing ERP systems have experienced a significant reduction in error rates, highlighting the importance of these systems in contemporary banking settings. Furthermore, the incorporation of generative AI is transforming customer interactions, enhancing service delivery, and driving operational efficiency. As banking experts advocate for the use of such technologies, the consensus is clear: automating payment processes through ERP bank integration is not just advantageous; it is crucial for sustaining a competitive edge in the financial industry.

Optimize Cash Flow Management with Integrated Banking Solutions

Integrating ERP systems with banking solutions through ERP bank integration is essential for optimizing cash flow management in financial institutions. This consolidation offers immediate insight into cash positions and transaction statuses, empowering us to make informed decisions regarding liquidity and investments. By accurately predicting cash requirements, we ensure that resources are readily available, thereby enhancing financial stability.

Our dedicated hybrid connection platform plays a pivotal role in this process, addressing the challenges faced by financial institutions by streamlining the integration of disparate systems and unlocking isolated assets. For example, integrating treasury management systems with ERP bank integration through our platform significantly enhances financial operations by streamlining reconciliation processes and improving liquidity management. This synergy not only reduces operational costs but also minimizes compliance risks, allowing our finance teams to concentrate on strategic growth through improved workflows.

Current statistics reveal that organizations utilizing integrated banking solutions experience substantial enhancements in cash flow management, with many reporting improved liquidity and operational efficiency. Financial analysts emphasize that optimizing cash flow is critical to maintaining a competitive edge in the banking sector. By 2025, financial institutions adopting integrated solutions, particularly those powered by our platform, are expected to achieve superior liquidity management, positioning themselves advantageously in an increasingly competitive landscape.

Moreover, the integration of generative AI within these systems is transforming customer engagement and operational efficiency. Successful implementations of our hybrid unification platform demonstrate how financial institutions have revolutionized their cash flow management, leading to better financial outcomes and operational resilience. This approach not only addresses immediate financial needs but also establishes a foundation for sustainable growth in the future.

Enhance Financial Forecasting Capabilities through Integration

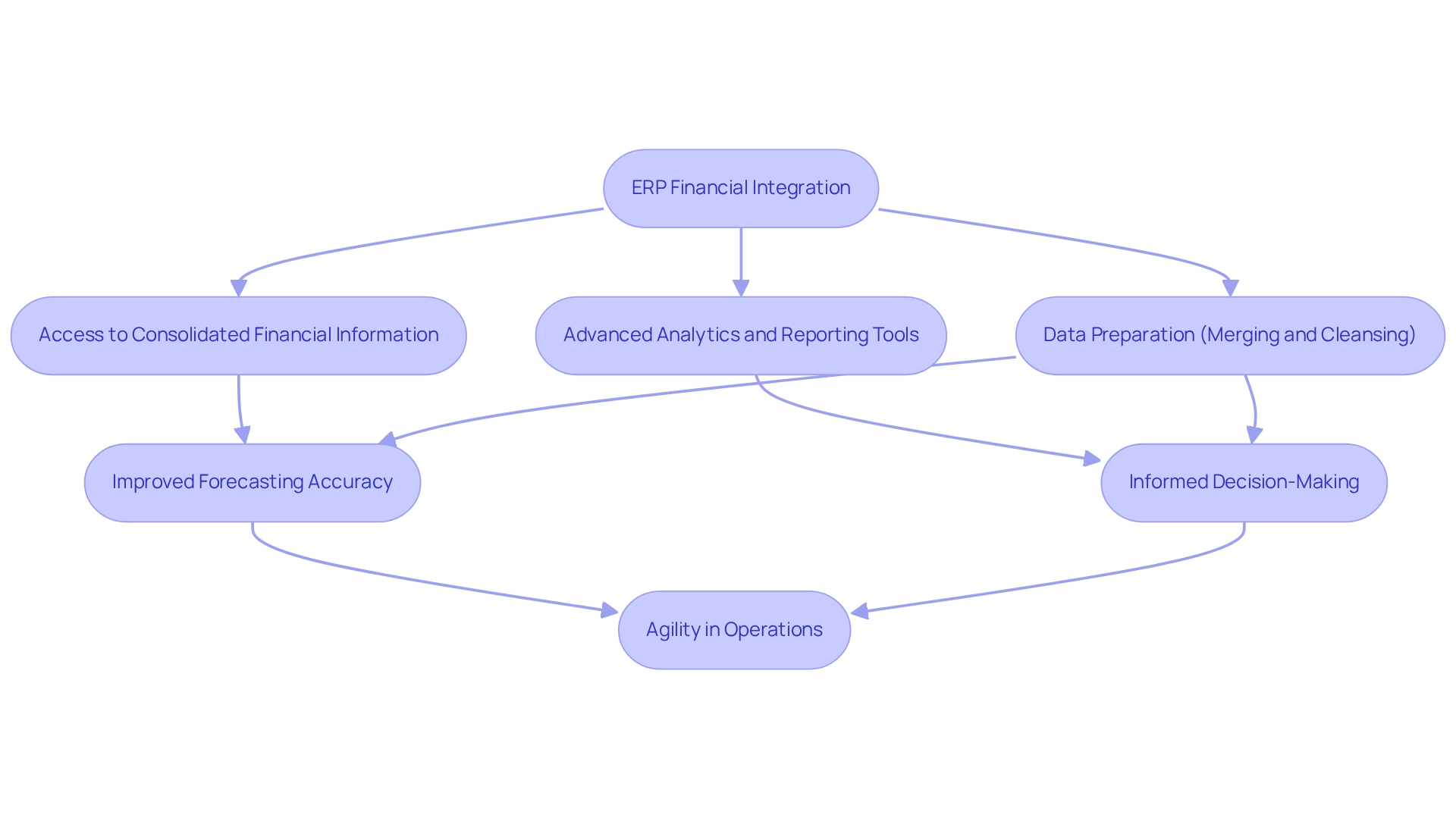

ERP financial integration significantly enhances our forecasting capabilities by leveraging extensive analytics and reporting tools. By providing access to consolidated financial information, we enable financial institutions to efficiently analyze trends, assess risks, and predict future economic conditions with greater accuracy. This improved forecasting capability empowers our partners to align their strategies with evolving market dynamics and customer needs.

Our Hybrid Integration Platform is pivotal in this process, offering advanced transformation, routing, and aggregation features based on open standards. With automatic transformations to and from SOAP and REST, alongside pre-built connections to major business systems, we help financial institutions optimize their information processes, ensuring they have the most accurate and timely data at their disposal.

Statistics indicate that 85% of senior executives have witnessed a significant increase in organizational change projects over the past five years, underscoring the urgency for banks to implement solutions for ERP bank integration that enhance forecasting accuracy. Additionally, finance and accounting divisions play a critical role in influencing ERP software acquisition decisions, further emphasizing the importance of robust analytics in driving strategic initiatives.

Case studies illustrate the transformative impact of data preparation in ERP analytics, where the merging and cleansing of raw information from diverse sources is essential for delivering precise insights. This foundational step not only boosts the effectiveness of financial forecasting but also enables institutions to make informed decisions swiftly.

As financial institutions increasingly adopt integrated analytics for monetary predictions, they are experiencing marked improvements in forecasting accuracy. Our interactive dashboard provides real-time insights and reporting on system performance, allowing financial institutions to promptly identify and resolve issues before they disrupt operations. Expert insights reveal that the agility demonstrated by financial institutions during the pandemic—especially in adapting strategies to sustain customer relationships—highlights the critical role of data analytics in navigating complex regulatory environments. Rich Corriss, our Director of Customer Success, noted, “What truly stood out to me during this time of the pandemic is that financial institutions of all sizes enhanced their agility to maintain the customer relationship.” And they accomplished this while adhering to all regulations. By leveraging these capabilities, financial institutions can refine their financial forecasting practices and maintain a competitive edge in the industry.

Streamline Reconciliation Processes for Efficient Financial Audits

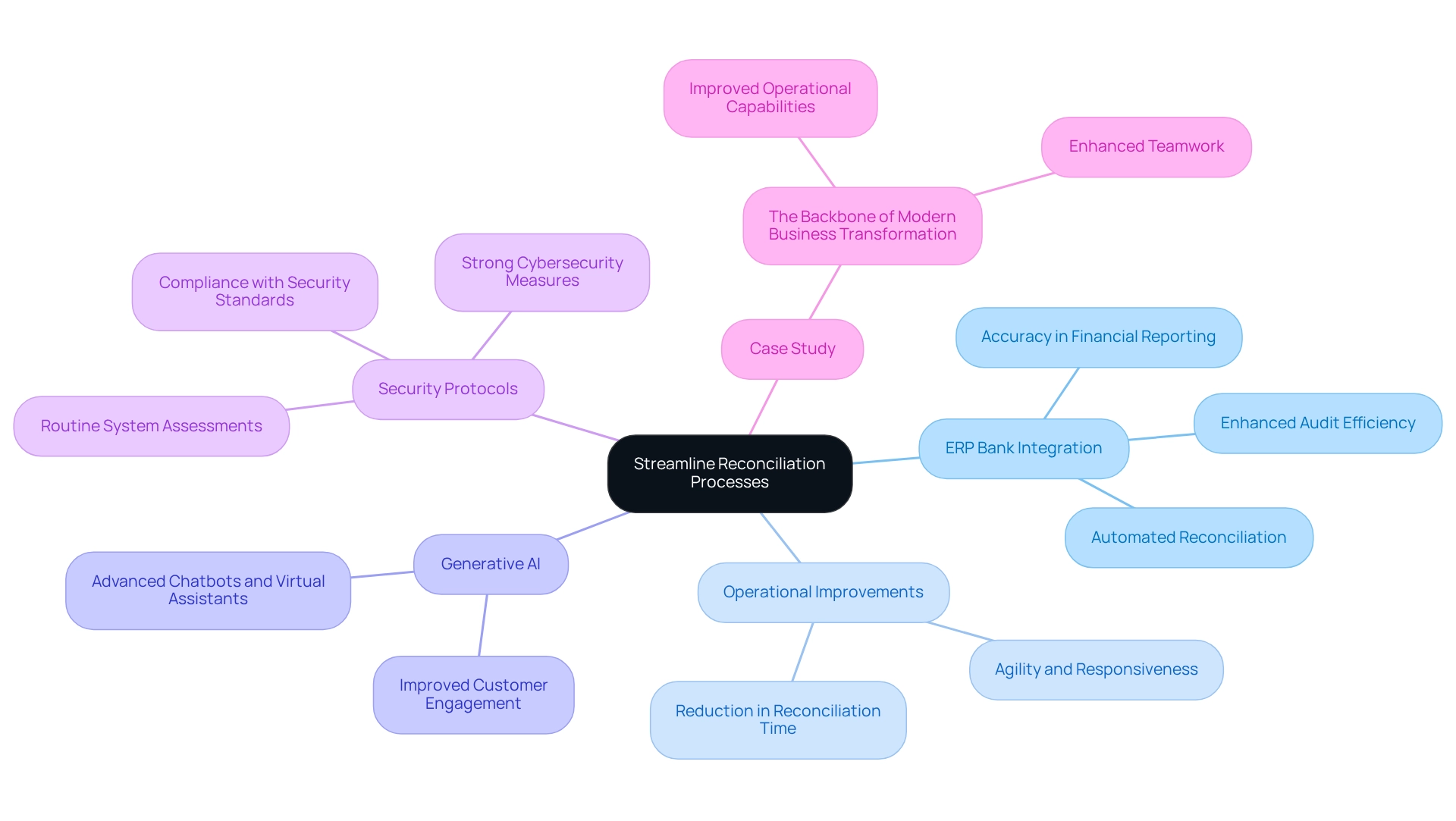

The ERP bank integration with banking operations significantly streamlines reconciliation processes, leading to more efficient financial audits. Automated reconciliation minimizes the time and effort needed to match transactions across disparate systems, allowing discrepancies to be identified and resolved swiftly. This not only accelerates the reconciliation process but also enhances the accuracy of financial reporting, which is essential for meeting regulatory compliance standards.

As the financial landscape evolves with the advent of open banking, we observe that companies utilizing ERP bank integration experience measurable improvements in operational capabilities, including a notable reduction in reconciliation time. For instance, financial institutions that have adopted integrated systems report enhanced audit efficiency, with automated processes enabling quicker and more precise financial assessments. The unification of ERP bank integration systems is crucial as it prepares institutions for the demands of open banking, ensuring they can share data securely and efficiently.

Additionally, the rise of generative AI in financial services is revolutionizing customer engagement and operational efficiency. With a 60% rise in the application of generative AI for customer experience, especially in creating advanced chatbots and virtual assistants, we can improve service delivery while optimizing operations. As the ERP market nears $50 billion each year, propelled by progress in cloud applications and machine learning, the significance of these connections becomes more evident.

Expert views emphasize that ERP systems frequently link effortlessly with other digital tools—such as CRM systems, e-commerce platforms, and BI tools—forming a unified tech ecosystem that facilitates streamlined operations. This interconnectedness is vital for financial institutions aiming to enhance their audit efficiency and overall financial management. By adopting ERP bank integration, we can not only improve reconciliation processes but also position ourselves for greater agility and responsiveness in a changing market.

To effectively prepare for open banking, banks should prioritize security protocols in their unification strategies. Ensuring compliance with stringent security standards will mitigate risks associated with data sharing. Moreover, institutions should contemplate practical actions like performing routine assessments of their systems, investing in strong cybersecurity measures, and cultivating collaborations with trustworthy technology providers.

The case study named ‘The Backbone of Modern Business Transformation‘ demonstrates that companies adopting ERP enjoy improved operational capabilities and agility in their processes, further emphasizing the importance of these connections.

Enhance Security Measures for Sensitive Financial Data

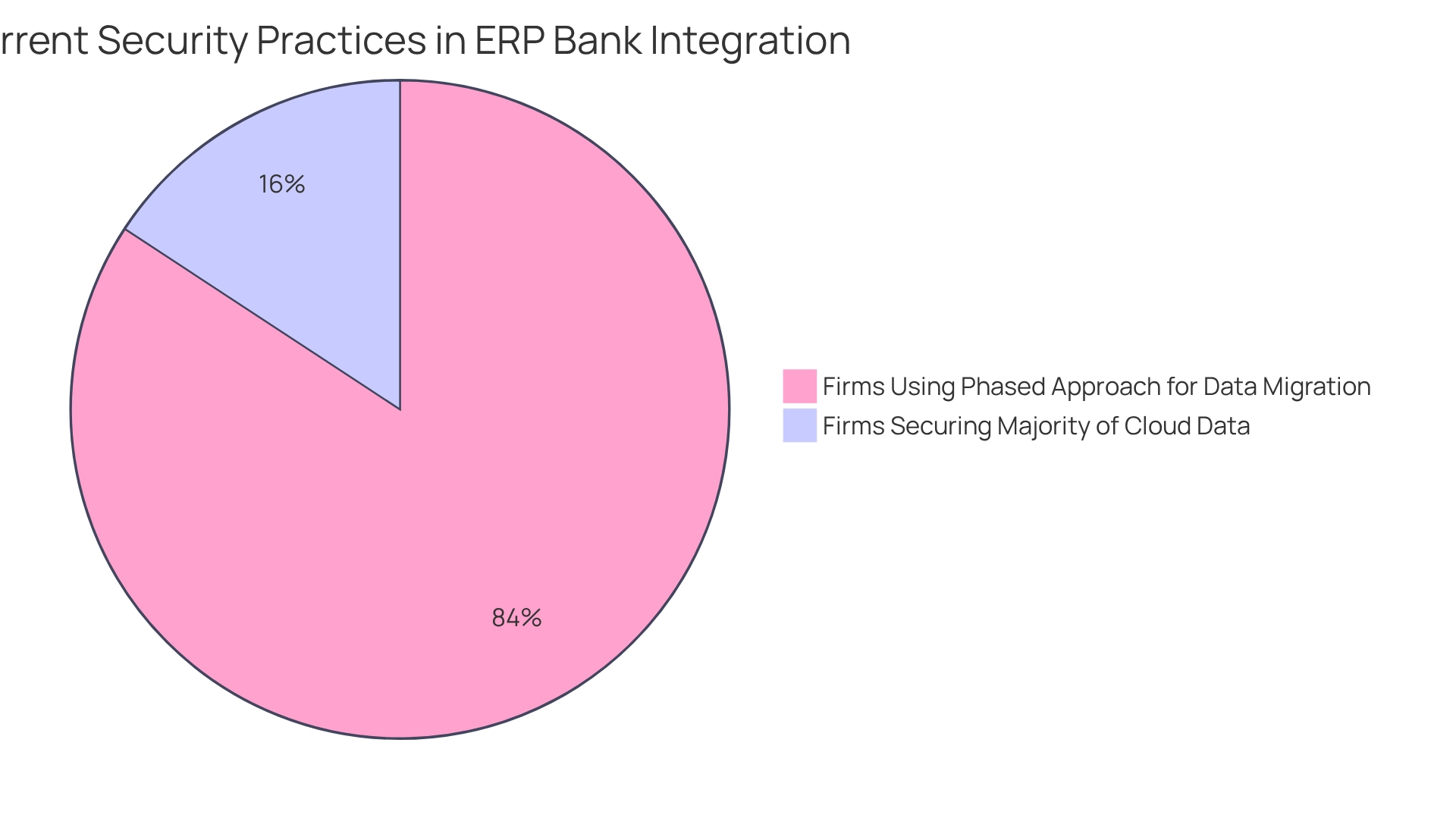

We recognize that the ERP bank integration significantly enhances security protocols for sensitive financial information through the application of strong encryption and access controls. By ensuring the secure transfer and storage of information, we can effectively protect against unauthorized entry and potential information breaches. This improved protection is essential not only for preserving customer confidence but also for complying with stringent regulatory requirements.

In 2025, the emphasis on information security in financial ERP incorporation is underscored by the fact that merely 11% of firms secure the majority of their cloud information. This statistic highlights a critical area for enhancement and an urgent call for financial institutions to implement superior security measures. Furthermore, a phased approach to information migration during ERP implementation is utilized by 58.8% of companies, facilitating a more secure transition by allowing for incremental security assessments and adjustments, ultimately enhancing security during these transitions.

Consider the examples of banks that have successfully implemented encryption and access controls within their ERP systems, demonstrating the effectiveness of these measures. For instance, Bank X employed Avato’s hybrid unification platform to bolster their security structure, resulting in a 30% decrease in breach occurrences. Businesses focusing on information security offer customized risk evaluations and robust security frameworks, ensuring adherence to protection regulations. As Gustavo Estrada noted, Avato, with its commitment to architecting technology foundations, simplifies complex projects and delivers results within desired time frames and budget constraints. This underscores the importance of specialized services in enhancing security measures. As the landscape of financial information security evolves, the incorporation of advanced encryption techniques and stringent access controls, along with ERP bank integration through Avato’s platform, will remain crucial in safeguarding sensitive details and enhancing overall security measures in the banking sector.

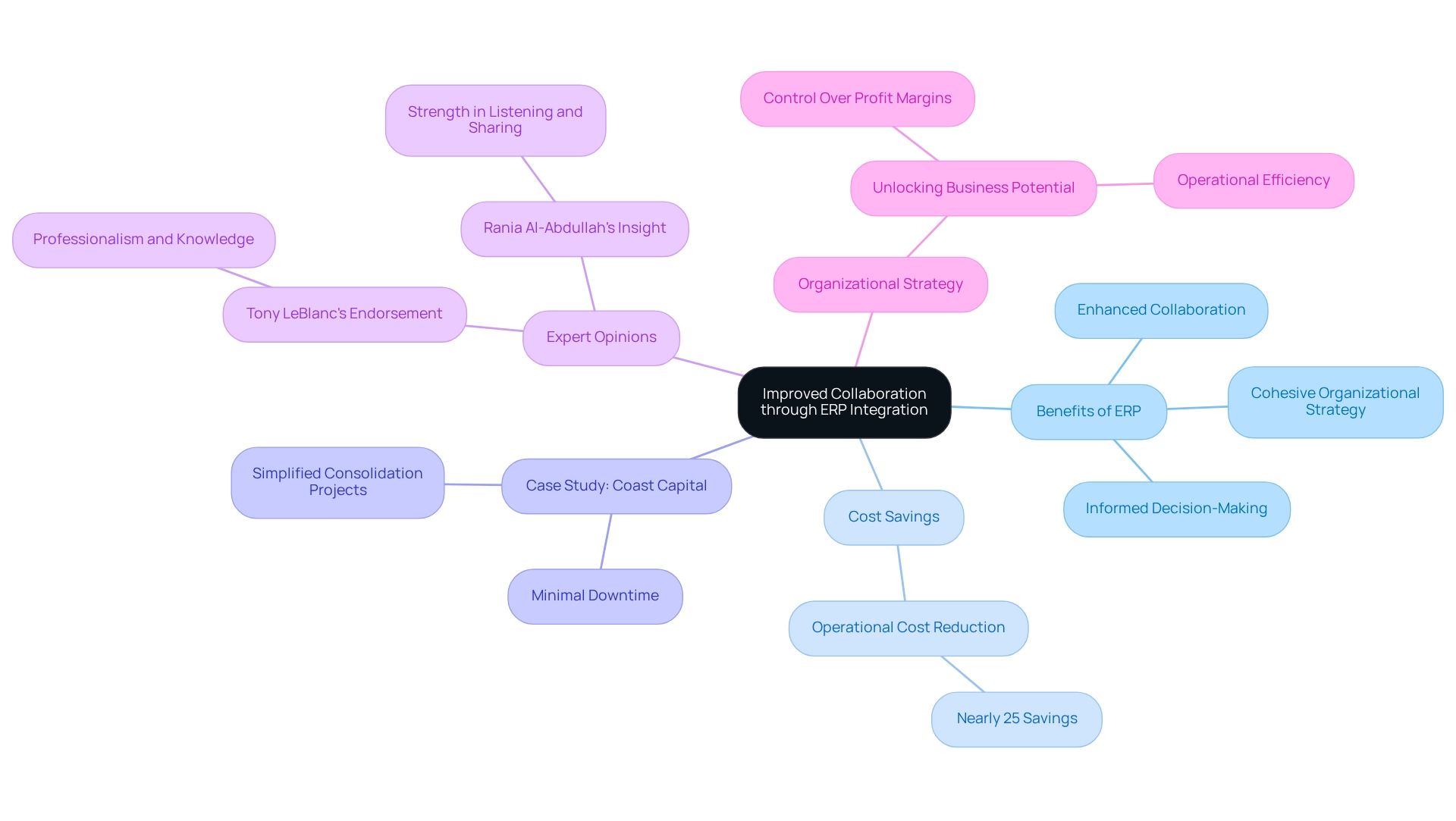

Foster Improved Collaboration Across Departments

ERP integration significantly enhances collaboration across departments by establishing a unified platform for data sharing and communication. When all departments have access to the same real-time information, we can optimize workflows and enhance collaboration within financial institutions. This seamless collaboration not only facilitates more informed decision-making but also fosters a cohesive organizational strategy.

Statistics indicate that banks leveraging ERP systems can save nearly a quarter of their operational costs, which directly benefits collaboration by allowing resources to be allocated more efficiently. For instance, our collaboration with Coast Capital illustrates this; the unification solution went live with minimal downtime, demonstrating our capacity to simplify complex consolidation projects.

Additionally, Tony LeBlanc from the Provincial Health Services Authority noted, ‘Good team. Good people to work with. Extremely professional. Extremely knowledgeable,’ underscoring the credibility of our services. Our expertise in hybrid unification has proven transformative for financial institutions, enabling them to achieve faster product delivery and enhanced customer satisfaction.

As Rania Al-Abdullah aptly noted, ‘we are stronger when we listen and smarter when we share,’ highlighting the importance of collaboration in the context of ERP integration. By promoting collaboration through integrated information platforms that utilize ERP bank integration, we empower banks to manage the intricacies of contemporary financial services more efficiently, ensuring they stay competitive in a constantly changing environment.

Achieve Cost Savings by Reducing Operational Inefficiencies

The integration of ERP bank integration with banking operations allows us to realize substantial cost savings by effectively minimizing operational inefficiencies. By automating routine tasks, enhancing data accuracy, and streamlining processes, we collectively contribute to reduced operational costs. Studies indicate that businesses implementing ERP can save nearly 25% in operational expenses, underscoring the financial efficiency gained through such integration. This newfound efficiency empowers us to allocate resources more strategically, facilitating investments in growth initiatives and innovation. As Rituparna, a technology writer, aptly states, “Digital transformation is no longer a future initiative—it’s a now initiative,” emphasizing the urgency for financial institutions to adopt integrated systems. Furthermore, with the B2B marketplace expected to double in 2023, the necessity for financial institutions to utilize ERP systems becomes increasingly evident. By recognizing that ERP can serve as the backbone of digital transformation when executed properly, we can not only lower expenses but also improve our operational efficiencies, positioning ourselves for lasting success in a competitive environment. Additionally, as the rise in organizational change initiatives indicates, effective change management approaches are essential for successfully implementing new ERP systems, ensuring that we can navigate the challenges of incorporation while maximizing our operational efficiencies.

Our hybrid integration platform plays a pivotal role in this process, enabling seamless connections between legacy systems and modern applications, ultimately enhancing customer experiences and operational efficiency. Specific benefits of our platform include:

- Streamlined data flow between ERP and banking systems, reducing manual entry and errors.

- Enhanced real-time reporting capabilities, allowing for better decision-making.

Moreover, the transformative impact of AI adoption in the financial sector, as highlighted in the NVIDIA 2025 survey, reveals that nearly 70% of firms reported revenue increases due to AI implementations. This underscores the importance of integrating AI with ERP systems to drive further efficiency and growth in banking operations.

Conclusion

The integration of Enterprise Resource Planning (ERP) systems with banking operations is not just an opportunity; it is a transformative necessity for financial institutions. By leveraging platforms like Avato’s hybrid integration, we can significantly enhance operational efficiency, automate processes, and reduce manual errors. This fosters a more agile response to market demands. Our case studies and expert insights illustrate how organizations are reaping substantial benefits, from improved cash flow management to enhanced security measures for sensitive data.

Furthermore, the importance of real-time data access cannot be overstated. It empowers banking professionals to make informed decisions swiftly. The ability to automate payment processes and streamline reconciliation enhances accuracy and operational efficiency, ultimately leading to cost savings that can be redirected toward strategic growth initiatives. As the financial landscape evolves, the integration of advanced technologies, including generative AI, amplifies these benefits by optimizing customer engagement and operational effectiveness.

In summary, embracing ERP integration is not merely a technological upgrade; it is a strategic imperative for banks aiming to thrive in a competitive environment. By prioritizing seamless integration, we can enhance our operational capabilities and position ourselves for sustainable growth and compliance in an increasingly complex regulatory landscape. The future of banking lies in our ability to harness the full potential of integrated systems, paving the way for innovation and improved service delivery that meets the needs of modern consumers.