Overview

In the fast-evolving landscape of banking IT, understanding the distinct roles of APIs (Application Programming Interfaces) and ESBs (Enterprise Service Buses) is crucial for operational efficiency. APIs empower rapid development and facilitate direct application interactions, making them ideal for businesses seeking agility. On the other hand, ESBs excel in managing complex integrations among multiple legacy systems, ensuring seamless communication and data flow. This differentiation not only enhances our operational capabilities but also supports our strategic initiatives in financial institutions.

What’s holding your team back from leveraging these powerful tools? By recognizing when to deploy APIs versus ESBs, we can optimize our technology stack and drive significant improvements in our processes.

Let’s explore how we can harness these technologies to transform our operations and achieve greater success together.

Introduction

In the rapidly evolving landscape of banking technology, we recognize that the integration of diverse systems has become a paramount concern for financial institutions. At the heart of this transformation are two critical components:

- Application Programming Interfaces (APIs)

- Enterprise Service Buses (ESBs)

While APIs enable seamless interactions and rapid development, ESBs provide a robust framework for managing intricate workflows across legacy systems. Understanding the distinct functionalities and strategic applications of these technologies is essential for us as banking IT managers aiming to enhance operational efficiency and drive innovation. As we navigate the complexities of digital transformation, the choice between leveraging APIs or ESBs can significantly impact our ability to meet consumer expectations and maintain a competitive edge in an increasingly digital world.

Define API and ESB: Core Concepts and Functions

An API (Application Programming Interface) represents a pivotal element in modern software development, particularly when discussing API vs ESB, as it acts as a collection of protocols and tools that enables diverse applications to interact seamlessly. We recognize that application programming interfaces empower developers to harness specific functionalities or data from a service without delving into its internal mechanics. Their lightweight nature makes them particularly well-suited for web and mobile applications, facilitating rapid development and connectivity. Moreover, application interfaces can be categorized by architectural style, including:

- REST

- SOAP

- GraphQL

- Webhooks

- gRPC

Each serving distinct functions within financial systems.

Conversely, when discussing API vs ESB, it’s important to note that an ESB (Enterprise Service Bus) functions as a middleware architecture that streamlines communication among various applications within an organization. Acting as a centralized hub, the ESB manages the flow of data and services, enabling complex connections and workflows. It supports multiple communication protocols and data formats, making it an ideal solution for bridging legacy systems with contemporary applications.

Current trends reveal a significant surge in API adoption within the financial services sector, illustrating the importance of understanding API vs ESB, with API availability for Universal Banking Networks (UBN) reaching an impressive 97.32% in March 2025. This trend underscores our increasing reliance on APIs in the context of API vs ESB to enhance operational efficiency and customer engagement in the financial sector. Additionally, the flexibility and adaptability of architectures like Avato’s hybrid integration platform ensure that integrations remain effective as business processes and technologies evolve. We enable organizations to unlock data and systems in weeks, not months, significantly reducing costs while maximizing the value of legacy systems. As Gustavo Estrada, a customer of Avato, aptly noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints.” This adaptability proves crucial for financial IT managers, allowing them to respond swiftly to evolving demands and maintain competitive advantages. Furthermore, HSBC’s innovative approach to incorporating abandoned consent requests in rejected API call reporting highlights the current challenges in the industry, illustrating the complexities that banking IT managers must navigate within the evolving API landscape.

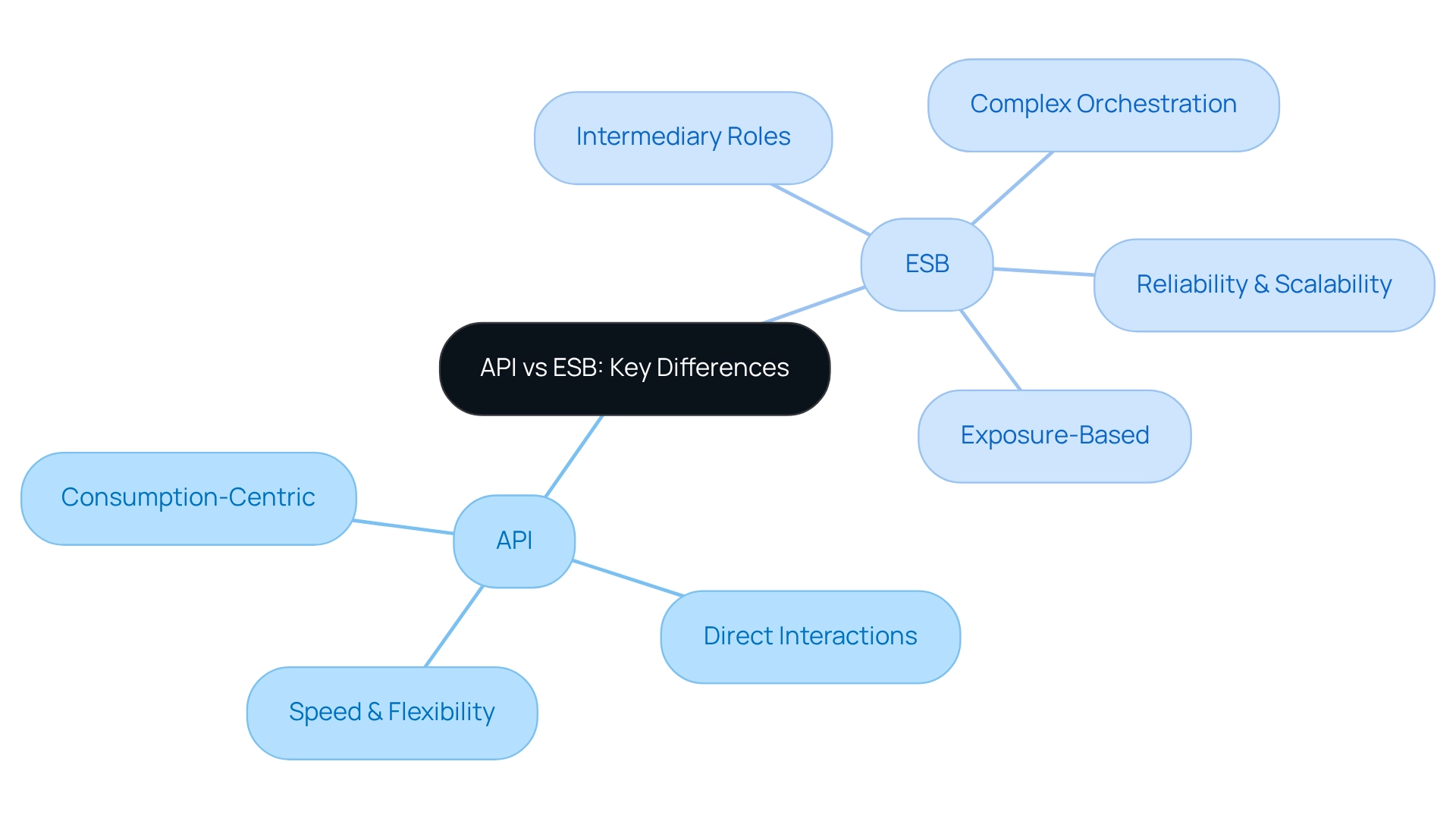

Contrast API and ESB: Key Differences in Functionality

The essential difference between application interfaces and enterprise service buses (ESBs) can be understood through the comparison of API vs ESB, particularly in their connection methods. APIs are consumption-centric, designed to expose specific functionalities for client consumption, enabling direct interactions between applications. This model facilitates swift and flexible connections, particularly advantageous in dynamic environments such as banking.

Conversely, we see that enterprise service buses operate on an exposure-based model, acting as intermediaries that manage and route messages between services. This architecture supports complex orchestration and coordination scenarios, especially in environments with numerous legacy systems. While application interfaces are generally simpler to deploy and oversee, the discussion of API vs ESB reveals that enterprise service buses provide a more comprehensive approach for managing intricate connections across diverse systems.

In banking, the choice between API vs ESB can significantly influence operational efficiency. Organizations utilizing enterprise service buses can automate processes and respond quickly to evolving business needs, as evidenced by case studies highlighting event-driven structures within connection platforms. This capability enables efficient automation of actions and workflows. Moreover, banks leveraging APIs vs ESB experience a notable increase in connection speed, while those employing ESBs benefit from enhanced reliability and scalability in their connection strategies.

Our hybrid unification platform exemplifies this approach, allowing businesses to maximize and extend the value of their legacy systems while simplifying complex connections and significantly reducing costs. It also provides real-time monitoring and notifications regarding system performance, ensuring that organizations can proactively manage their connections. As Gustavo Estrada noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints.” This nuanced understanding of API vs ESB functionalities, along with our commitment to architecting technology solutions, is crucial for IT managers seeking to optimize their integration strategies.

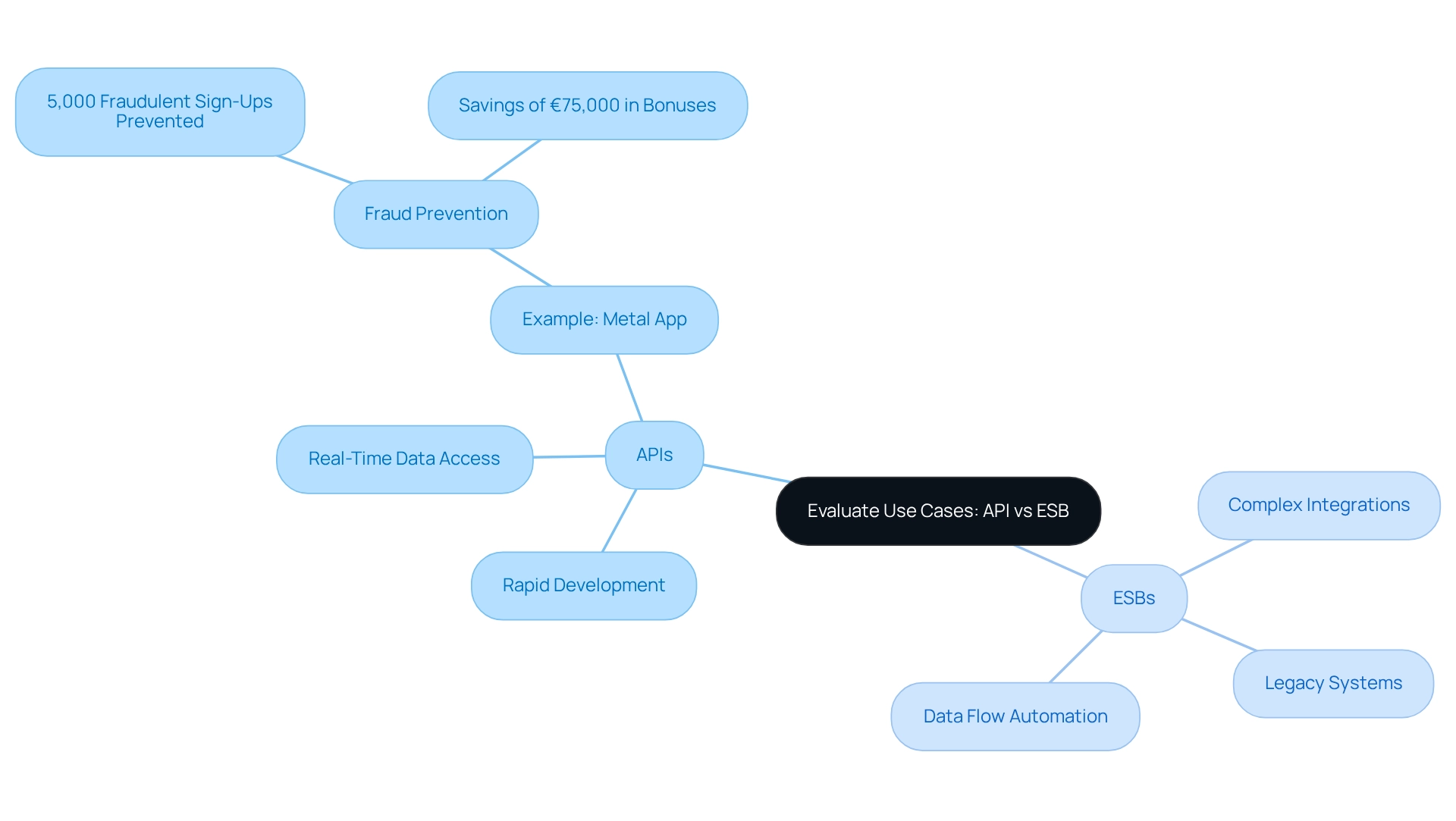

Evaluate Use Cases: When to Choose API or ESB

Application programming interfaces (APIs) are indispensable in scenarios that demand rapid development and deployment. In the realm of open finance, for instance, APIs empower external developers to access financial services, fostering innovation and enhancing customer experiences. They excel in applications requiring real-time data access and user interactions, such as mobile finance apps, where speed and responsiveness are paramount. A notable example is the cryptocurrency trading app Metal, which utilized an identity API to verify KYC data, successfully preventing 5,000 fraudulent sign-ups and saving over €75,000 in bonuses. This case illustrates how APIs can bolster security and user confidence through effective real-time data management.

Conversely, enterprise service buses (ESBs) are more suited for complex connection scenarios involving numerous legacy systems. We might implement an ESB to connect our core financial system with various customer relationship management (CRM) tools and payment gateways. This integration facilitates seamless data flow and process automation across our organization, ensuring effective communication among all systems.

Furthermore, integrating generative AI into these frameworks can significantly enhance customer experience and operational efficiency. We are increasingly leveraging generative AI to develop sophisticated chatbots and virtual assistants that streamline customer interactions and improve service delivery. Recent surveys indicate a 60% rise in the use of generative AI for customer experience, with over half of financial professionals employing it for document processing and report generation, further enhancing our operations.

The financial sector stands to gain immensely from these technologies, with a €100 billion opportunity in Europe alone. This potential underscores the importance of utilizing integration platforms and application interfaces, along with generative AI, to improve operational efficiency and enhance service delivery. As we navigate the complexities of digital transformation, recognizing when to use APIs vs ESBs becomes vital for meeting consumer expectations and ensuring dependable connections in banking applications.

Assess Pros and Cons: API vs. ESB for Integration Strategies

When we consider APIs, the advantages are clear:

- Flexibility: APIs can be easily modified or extended to accommodate new functionalities, making them adaptable to evolving business needs.

- Speed: They enable rapid development cycles, allowing us to innovate quickly and respond to market demands.

- Simplicity: In the discussion of API vs ESB, application programming interfaces are generally easier to implement and require less overhead compared to ESBs, facilitating faster deployment.

However, we must also acknowledge the downsides:

- Limited orchestration capabilities: APIs may struggle with complex integrations that require extensive data transformation or routing, potentially leading to inefficiencies.

- Security concerns: Exposing APIs can create vulnerabilities if not effectively managed, necessitating strong security measures, particularly as open financial services heighten the demand for strict security protocols.

Turning our attention to ESBs, the benefits include:

- Robust integration: ESBs excel in managing complex integrations and orchestrating workflows across multiple systems, making them ideal for intricate banking environments.

- Protocol mediation: They can handle various communication protocols, ensuring compatibility in heterogeneous environments.

- Centralized management: Enterprise Service Buses offer a single point of control for monitoring and managing connections, enhancing oversight and operational efficiency.

On the downside, we recognize that ESBs can be:

- Complex to implement: They often require significant configuration and governance, which can extend project timelines.

- Costly: The overhead associated with ESB implementations can be higher than that of API-based solutions, impacting budget considerations for financial institutions.

In the context of contemporary large-scale businesses, which utilize approximately 470 SaaS applications, the intricacy of connections becomes apparent. This statistic underscores the importance of managing numerous applications effectively by understanding the differences between API vs ESB.

Furthermore, incorporating AI and machine learning technologies into iPaaS platforms can boost automation and decision-making processes, demonstrating how advanced technologies can enhance the efficiency of both APIs and ESBs in financial settings.

As noted by Gustavo Estrada, a customer, “Avato has the capability to streamline intricate projects and provide outcomes within preferred schedules and financial limitations,” emphasizing the practical advantages of utilizing a strong unification platform like Avato in managing the challenges of financial system connections. Moreover, Avato’s hybrid connectivity platform is designed to expedite secure system unification for finance, healthcare, and government, ensuring that connections expand with business requirements. This adaptability is vital for financial IT managers to contemplate in their unification strategies.

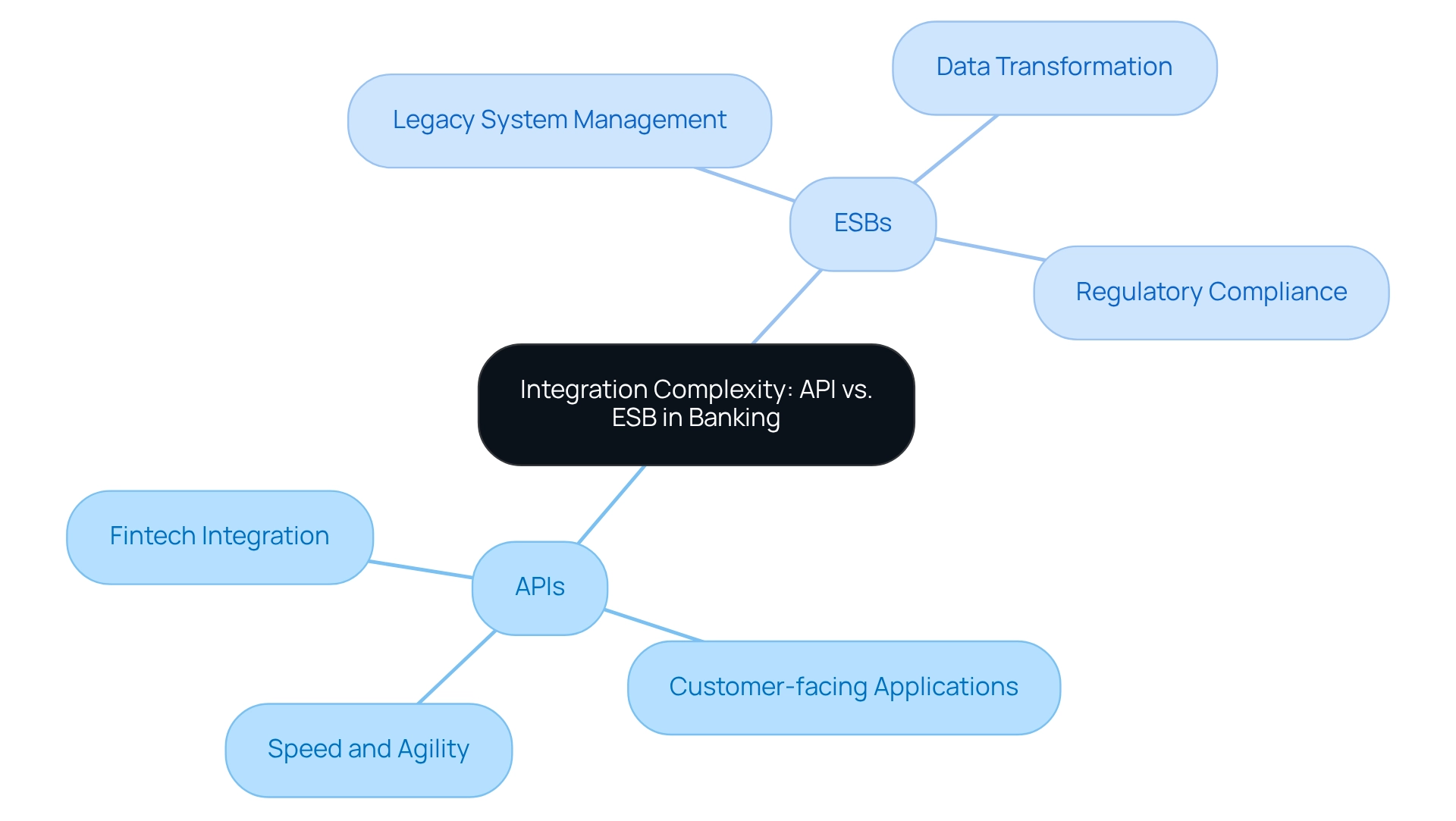

Integration Complexity: API vs. ESB in Banking Environments

In banking environments, integration complexity often arises from the need to connect various legacy systems, navigate stringent regulatory requirements, and provide real-time data access. APIs are frequently the preferred choice in scenarios where speed and agility are essential, particularly when developing new customer-facing applications or integrating with fintech solutions. They enable us to respond swiftly to market dynamics and evolving customer demands, facilitating rapid development cycles.

Conversely, when managing multiple legacy systems that require extensive data transformation and orchestration, ESBs become indispensable. They provide the robust infrastructure necessary to oversee complex workflows, ensuring seamless data flow between systems while maintaining compliance with security standards. This capability is especially beneficial for large financial organizations with intricate IT environments, where the unification of diverse systems is vital for operational efficiency and regulatory compliance.

As global expenditure on digital transformation is projected to reach $3.9 trillion by 2027, driven by the imperative to modernize outdated technologies, we must prioritize effective unification strategies to address these challenges. This urgency is underscored by the need for robust security measures when integrating legacy systems, as industry experts highlight that “many businesses, in their eagerness to modernize, enact strategies for digital transformation that are unsuitable and undeliverable.”

The unification challenges faced by banking IT specialists emphasize the necessity for a balanced strategy that considers API vs ESB for agility and comprehensive data management. We support this balance through our expert unification services, including enterprise architecture, project management, and technical analysis, complemented by our hybrid unification platform, ensuring 24/7 uptime for critical connections. This enables us to cultivate an innovation mindset while effectively addressing incorporation challenges. By utilizing application interfaces and enterprise service buses, we can enhance operational capabilities and foster innovation in our services. Furthermore, engaging stakeholders effectively and modeling new business processes are crucial steps in navigating these integration challenges.

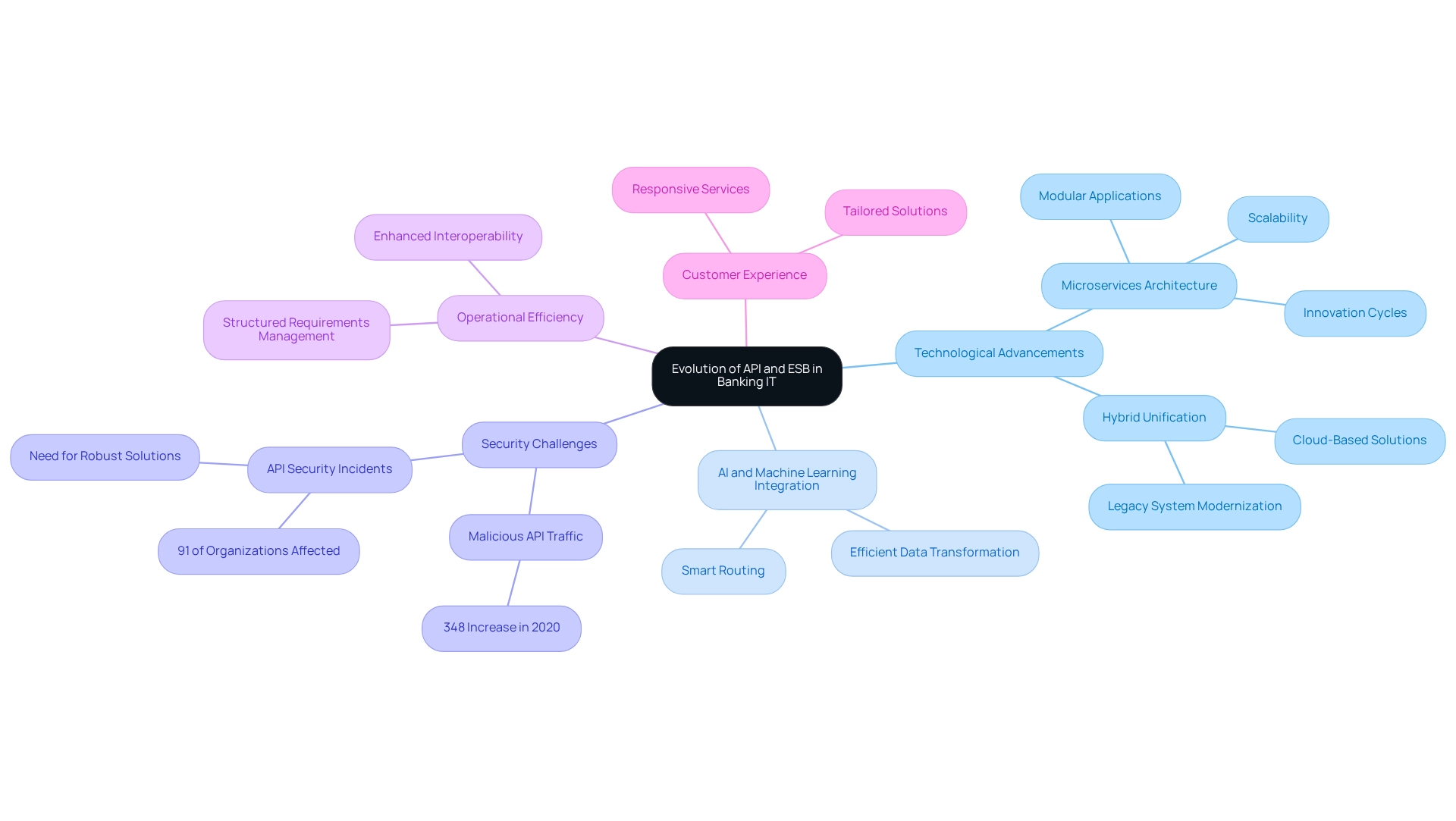

Future Trends: The Evolution of API and ESB in Banking IT

As the banking sector evolves, we recognize that both application interfaces and enterprise service buses are crucial in the discussion of API vs ESB as they adapt to new technological advancements. The increasing adoption of microservices architecture is set to significantly enhance the role of APIs, empowering us to create more modular and scalable applications. This transformation not only fosters quicker innovation cycles but also enriches customer experiences by enabling more responsive and tailored services.

Conversely, in the API vs ESB context, enterprise service buses will continue to play their crucial role in managing complex connections, particularly as we embrace cloud-based solutions and hybrid environments. Our hybrid unification platform exemplifies this evolution, streamlining digital transformation through structured requirements management and modernizing legacy systems. This platform aids financial IT managers in converting unstructured data into a structured format, ensuring that requirements are clearly defined and easily testable.

The integration of artificial intelligence and machine learning into ESB frameworks is anticipated to further enhance their capabilities, facilitating smarter routing and more efficient data transformation processes. Looking ahead, the future of connectivity in the finance sector will likely adopt a synergistic approach, where API vs ESB will coexist and support one another to meet diverse connectivity needs. This collaboration will be essential for banks aiming to improve operational efficiency and remain competitive in a rapidly changing landscape.

However, the rise in malicious API traffic highlights the pressing need for robust API management solutions. Organizations seeking to harness the full potential of their APIs must invest in secure and scalable management solutions. Furthermore, with a significant percentage of organizations experiencing API security incidents, it is imperative for banking IT managers to prioritize security in their integration strategies.

Ultimately, effective API management not only fosters innovation but also enhances interoperability across varied technological landscapes—a goal we are dedicated to achieving. Get your copy now.

Conclusion

The integration of APIs and ESBs is not just beneficial; it is essential for banking institutions like ours that aim to enhance operational efficiency and drive innovation. APIs empower rapid development and facilitate direct interactions between applications, making them ideal for scenarios that demand speed and agility, such as open banking and mobile applications. Their lightweight architecture enables us to innovate quickly, effectively responding to market changes and consumer demands.

Conversely, ESBs offer a robust framework for managing complex integrations, particularly in environments where multiple legacy systems must communicate. They excel in orchestrating workflows and ensuring seamless data flow across our organization, which is crucial for maintaining compliance and operational efficiency. As the banking landscape evolves with advancements like generative AI and cloud-based solutions, the role of ESBs remains vital in managing intricate integration challenges.

Looking ahead, a synergistic approach that leverages both APIs and ESBs will be imperative for financial institutions like ours. This collaboration will not only optimize our integration strategies but also enhance customer experiences and drive operational efficiency. As digital transformation accelerates, we must prioritize security and effective management of these technologies to protect against potential vulnerabilities.

In summary, understanding the distinct functionalities and strategic applications of APIs and ESBs is crucial for navigating the complexities of digital transformation in banking. By adopting a balanced integration strategy, we can better meet consumer expectations, maintain competitive advantages, and ultimately foster innovation in our services.