Overview

In the banking sector, the distinction between ESB and API is critical, fundamentally rooted in their architecture and specific use cases. We recognize that ESBs are tailored for managing complex internal integrations, seamlessly connecting legacy systems. On the other hand, APIs empower organizations by facilitating external access and interactions, offering the agility and speed essential for modern applications and enhanced customer engagement. This dynamic interplay underscores the complementary roles these technologies play in driving digital transformation within the financial landscape.

What challenges are you facing in this evolving environment? Let us guide you in harnessing the full potential of both ESBs and APIs to optimize your operations and elevate your customer experience.

Introduction

In the rapidly evolving landscape of banking technology, we recognize that understanding the distinction between Enterprise Service Buses (ESB) and Application Programming Interfaces (API) is crucial for IT managers.

These two architectural paradigms play pivotal roles in facilitating communication and integration among diverse systems, each tailored to meet specific operational needs.

As we grapple with the complexities of legacy systems and the demands for innovative customer solutions, the choice between ESB and API can significantly impact our efficiency and service delivery.

This article delves into the core concepts, functional differences, and strategic applications of ESB and API, shedding light on how these technologies can empower financial institutions like ours to thrive in a competitive market.

Define ESB and API: Core Concepts for Banking IT Managers

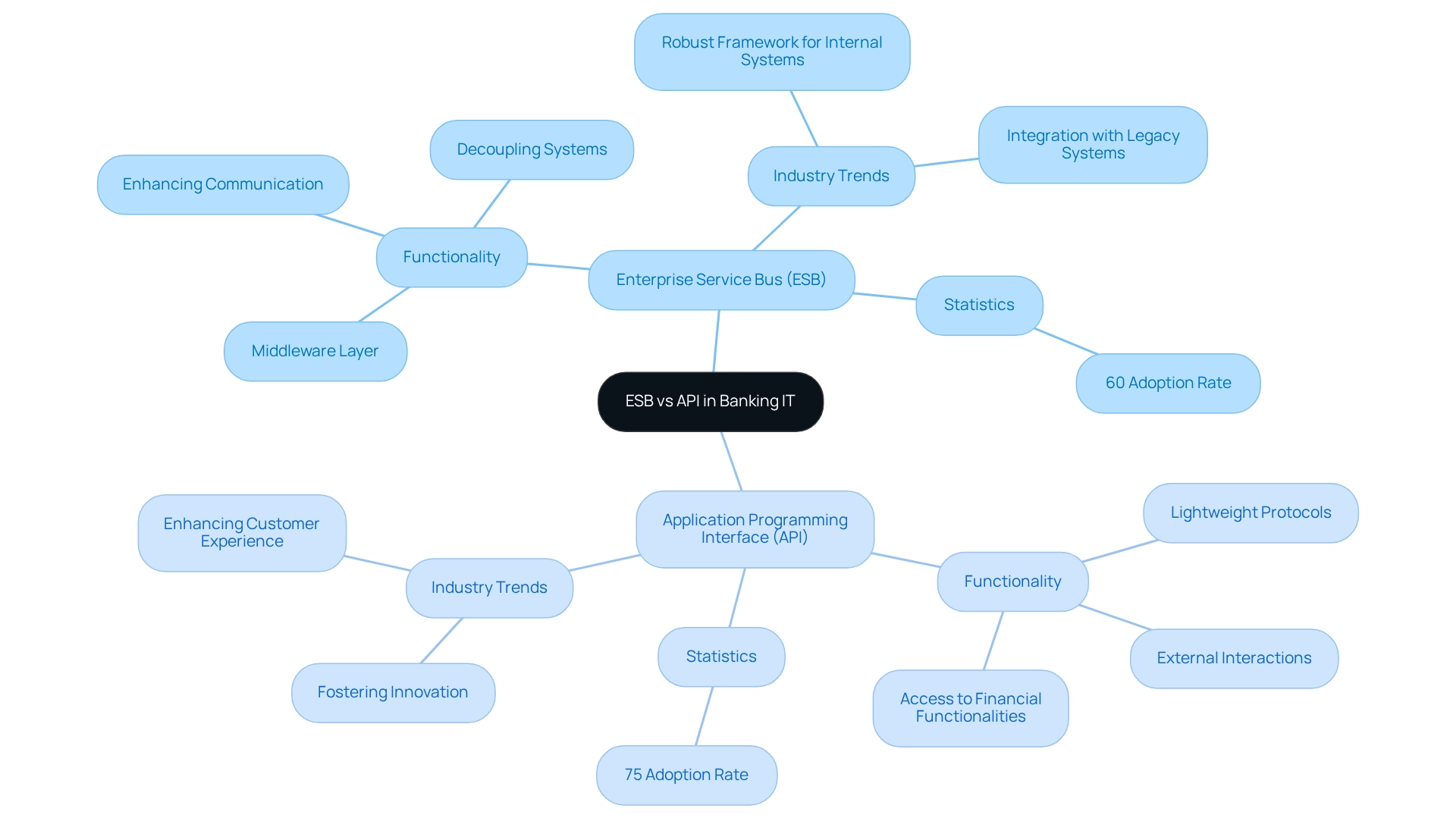

In the context of ESB vs API, the Enterprise Service Bus (ESB) serves as a critical architectural pattern that enhances communication among diverse systems within a banking organization. As a middleware layer, it facilitates seamless data and service exchange between various systems, particularly in complex environments where multiple legacy systems must interact without direct connections. This approach encourages decoupling and improves flexibility, empowering us to adapt to evolving technological needs.

Conversely, an Application Programming Interface (API) comprises a set of protocols and tools that enable different software systems to interact efficiently. APIs are designed to be lightweight, often exposing specific functionalities of an application to external developers or systems. In the financial sector, APIs allow third-party services to access financial functionalities, fostering innovation and significantly enhancing customer experiences. As we approach 2025, understanding the differences between ESB vs API remains crucial for IT managers in the finance industry.

While examining ESB vs API, it becomes clear that ESBs provide a robust framework for connecting internal systems, whereas APIs focus on facilitating external interactions and linkages. Recent statistics indicate that approximately 60% of financial institutions are utilizing ESB for connectivity, while around 75% are adopting APIs, highlighting the growing trend of ESB vs API utilization in the sector. This dual strategy is essential for contemporary financial operations, ensuring that we can leverage both internal efficiencies and external innovations, particularly in the context of ESB vs API.

Avato’s hybrid connection platform exemplifies how we can enhance the value of legacy systems while simplifying intricate connections and reducing costs. As Chetan Patil notes, the earnings for the software unification sector are projected to rise, highlighting the increasing significance of these technologies in finance. Furthermore, IBM’s participation in software unification demonstrates practical applications of ESB vs API, showcasing how these technologies can enhance operational efficiencies.

With leading companies such as IBM, Microsoft, and Oracle dominating the market, it is crucial for us to stay informed about agile connectivity trends to remain competitive. The global application unification market is poised to unlock new growth opportunities, further emphasizing the significance of ESB vs API in the current landscape.

Contrast ESB and API: Key Functional Differences and Use Cases

The fundamental distinction in the discussion of ESB vs API lies in their architecture and specific use cases within the banking sector.

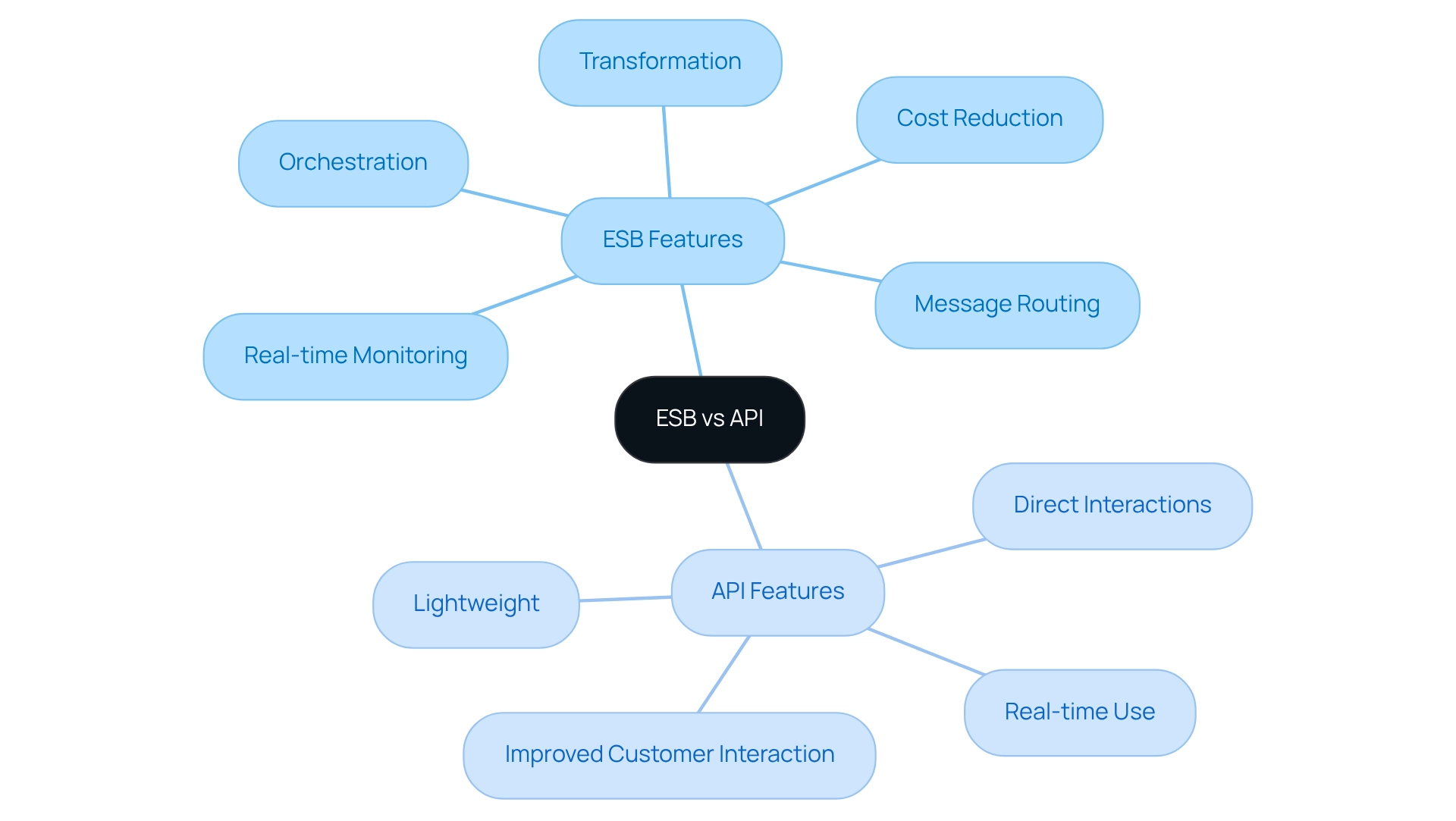

We recognize that ESBs are designed to handle complex connections across various systems, providing features such as message routing, transformation, and orchestration. This capability makes them especially efficient in environments where data must transfer smoothly between different systems in a controlled manner. Our Hybrid Integration Platform enhances this functionality by maximizing and extending the value of legacy systems, simplifying complex integrations, providing real-time monitoring and alerts on system performance, and significantly reducing costs. Conversely, APIs enable easier, direct interactions, allowing software to request and exchange data without the added complexity of a middleware layer.

In the financial sector, ESBs are frequently utilized to integrate legacy systems with modern applications. For example, they can link a core financial system to a customer relationship management (CRM) tool, ensuring that data is synchronized and accessible across platforms. Our secure hybrid integration platform is especially appropriate for financial services, healthcare, and government sectors, accelerating the integration of isolated legacy systems. APIs, conversely, are often used to enable external services to access financial offerings, such as payment processing or obtaining account details, thus improving customer interaction and service provision.

While ESBs provide robust processing capabilities, they can introduce latency, making them less ideal for high-frequency transactions. In contrast, APIs are lightweight and intended for real-time uses, such as mobile finance apps, which demand quick responses to user actions. Organizations embracing agile collaboration methods, such as those enabled by us, report a 40% rise in user satisfaction compared to conventional approaches, emphasizing the significance of speed and efficiency in contemporary financial applications. As Val Srinivas, a senior research leader in banking and capital markets, remarked, ‘In most scenarios, inflation should not be a pressing concern entering 2025,’ suggesting that banks may focus on technological advancements, particularly the ESB vs API, to enhance operational efficiency.

In summary, while ESBs are skilled at handling complex connections, the discussion of ESB vs API highlights that APIs provide the agility and speed required for external interactions. Together, they serve as complementary technologies that empower banks to navigate the complexities of digital transformation effectively. Furthermore, insights from multiple Deloitte proprietary surveys indicate that leveraging these technologies can significantly improve operational efficiency, similar to trends observed in companies like Softbank, which adopted Kissflow to streamline operations. As we explore non-traditional avenues for expansion, as emphasized in the Capital Markets Revenue Recovery case study, the combination of ESB and API technologies will be vital in addressing obstacles and ensuring success.

Evaluate Suitability: When to Choose ESB vs API in Banking Environments

When considering the esb vs api, it is important to evaluate critical factors such as connection complexity, the existing technology landscape, and specific business objectives.

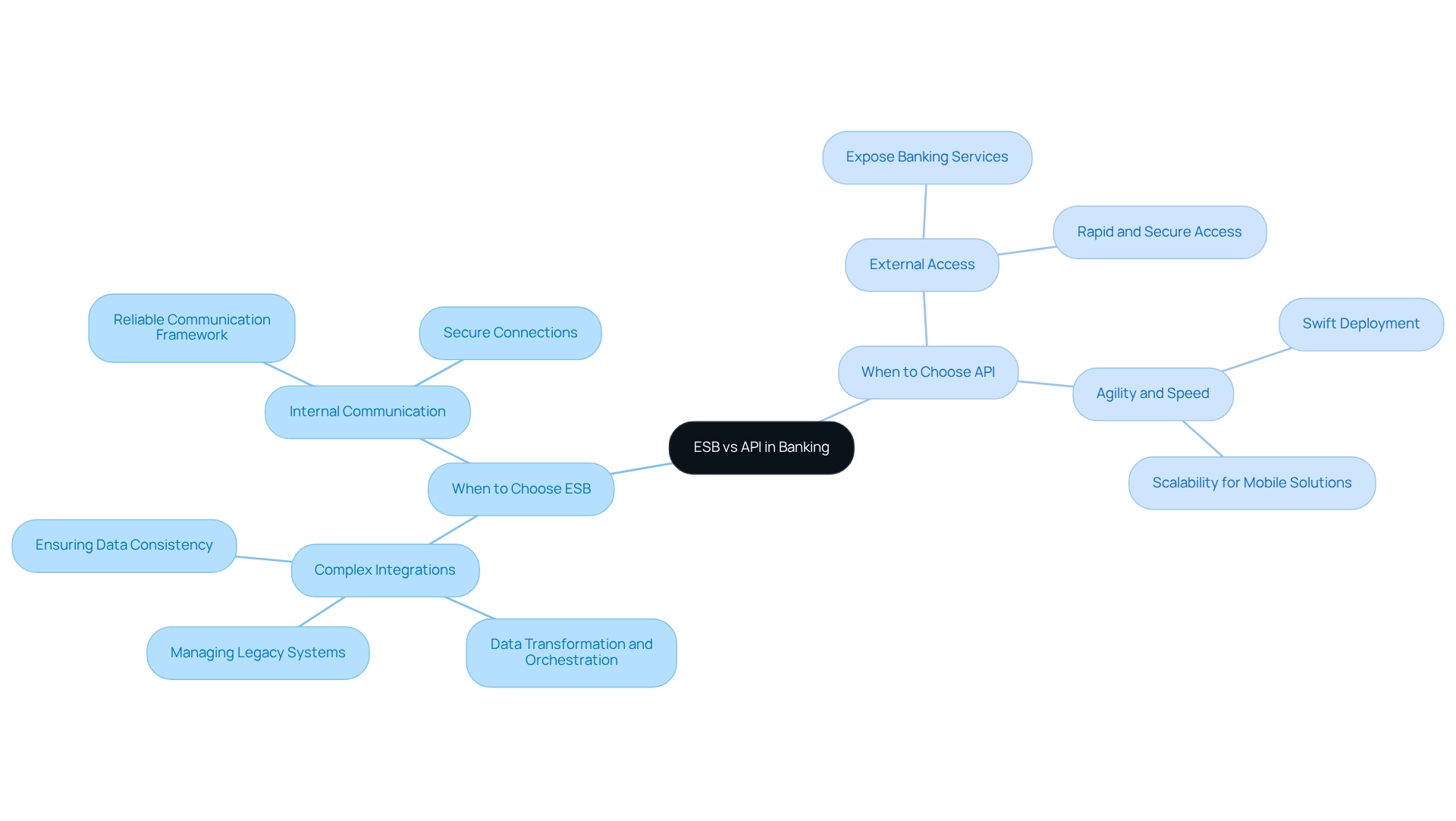

When to Choose ESB:

- Complex Integrations: For organizations grappling with multiple legacy systems that demand extensive data transformation and orchestration, an ESB is the optimal choice. This technology excels in managing the intricacies of system integration while ensuring data consistency and reliability. Our hybrid integration platform enhances this process by unlocking isolated assets and facilitating seamless data flow—an essential capability as financial institutions prepare for open access. We must remember that discarding legacy systems in favor of newer solutions is not always necessary; many existing systems can be effectively leveraged.

- Internal Communication: In scenarios that require consistent and reliable communication between internal applications, an ESB provides a robust framework for efficient interactions. This underscores the need for secure and trustworthy connections, particularly in the context of open finance.

When to Choose API:

- External Access: If the goal is to expose banking services to third-party developers or partners, APIs emerge as the preferred solution. They enable rapid and secure access to specific functionalities without the complexity of intricate middleware, aligning seamlessly with the strategic objectives of open finance.

- Agility and Speed: For applications that demand swift deployment and scalability—such as mobile banking solutions—APIs offer the flexibility and performance essential to meet evolving customer needs. Our solutions are designed to support this agility, ensuring financial institutions can adapt to changing market conditions.

Ultimately, the decision regarding esb vs api should be informed by the specific connectivity challenges faced by your organization, with a clear understanding of each technology’s strengths and limitations. Recent statistics indicate that banks employing ESB for complex connections report higher success rates compared to those relying solely on APIs. As Kai Waehner, Global Field CTO, notes, “this differs from middleware like MQ, ETL, and ESBs,” highlighting the unique advantages of ESB technology. Moreover, case studies such as Rolls-Royce’s transition to a service-oriented model illustrate the importance of adjusting collaboration strategies to meet business needs. Additionally, our experience at Yenlo across various industries, including banking, demonstrates the versatility of integration solutions available today.

Conclusion

The exploration of Enterprise Service Buses (ESB) and Application Programming Interfaces (API) reveals their distinct yet complementary roles within the banking sector. ESBs serve as robust integration frameworks, expertly managing complex interactions between legacy systems and modern applications, ensuring data consistency and operational reliability. In contrast, APIs provide the agility and speed necessary for external access, allowing third-party developers to innovate and enhance customer experiences.

Understanding when to implement ESB versus API is crucial for us as banking IT managers. Choosing ESB is ideal for organizations grappling with intricate integrations and internal communications, while APIs excel in scenarios demanding rapid deployment and external access to banking services. This strategic selection can significantly impact our operational efficiency and adaptability in an ever-evolving technological landscape.

Ultimately, leveraging both ESB and API technologies empowers us to navigate the complexities of digital transformation effectively. As the banking industry continues to embrace open banking and customer-centric innovations, integrating these solutions will be essential for achieving competitive advantages and fostering growth. The future of banking technology lies in harnessing the strengths of both paradigms, ensuring that we remain agile, responsive, and well-equipped to meet the demands of our customers.