Overview

We recognize the critical importance of mastering JSONPath for secure banking integrations. Efficiently retrieving data while adhering to stringent security measures is not just a necessity; it is a fundamental requirement in today’s financial landscape. By implementing best practices such as:

- Access control

- Encryption

- Secure development techniques

we can collectively enhance the safety and accuracy of information retrieval in financial systems. What challenges are you facing in ensuring data security? Let us guide you through these complexities, ensuring that your integrations are not only effective but also secure. Together, we can navigate the intricacies of secure banking integrations with confidence.

Introduction

In the rapidly evolving landscape of banking technology, we recognize that the ability to efficiently retrieve and manage data is paramount. As financial institutions increasingly rely on APIs for seamless integration, understanding JSONPath becomes essential. This powerful query language empowers us to navigate complex JSON structures with ease, ensuring that critical data points are accessed swiftly and accurately.

However, successful implementation goes beyond mere syntax; it requires adherence to best practices that safeguard sensitive information. By exploring real-world applications and expert insights, we delve into the transformative potential of JSONPath in banking integrations.

We highlight its advantages and the common pitfalls that organizations must avoid to maintain security and efficiency. What’s holding your team back from leveraging this powerful tool? Let’s explore how we can enhance your data management strategies together.

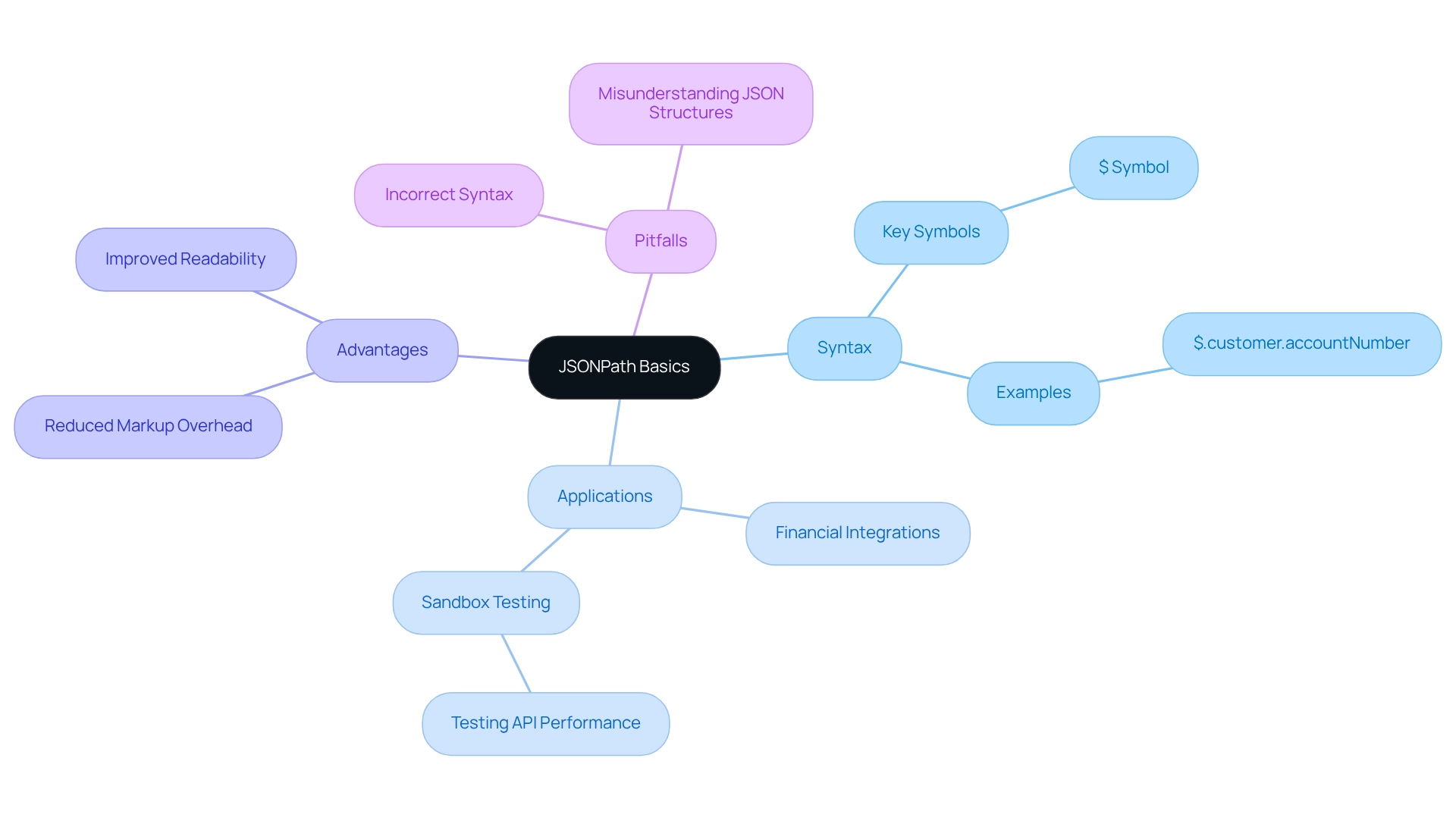

Understand JSONPath Basics for Effective Key Retrieval

JSONPath stands as a powerful query language for JSON, akin to the role XPath plays for XML. We enable users to traverse JSON structures effectively, retrieving specific data points essential for financial integrations where accuracy is paramount.

As industry expert Fiodar Hmyza notes, “APIs are an integral part of any banking system, but due to the specifics of the industry, their development and configuration calls for extra attention due to rigid security requirements.”

Understanding the syntax and operators of this query language is crucial for efficiently using jsonpath get keys for retrieval. The basic syntax employs the ‘$’ symbol to denote the root element, followed by either dot notation or bracket notation to jsonpath get keys for accessing nested elements. For example, to retrieve the ‘accountNumber’ key from a ‘customer’ object, the expression would be $.customer.accountNumber.

Furthermore, sandbox testing allows us to evaluate API performance without jeopardizing actual information, showcasing how JSONPath can be securely utilized in financial integrations. Mastery of these fundamentals is vital for implementing secure and efficient information retrieval processes in the banking sector.

Moreover, when considering formats for integration, JSON provides notable advantages over XML, including reduced markup overhead and improved readability, establishing it as a preferred choice in hybrid integration platforms. However, we must remain vigilant about common pitfalls, such as incorrect syntax or misunderstandings of JSON structures, which can lead to errors in information retrieval.

Ultimately, mastering how to jsonpath get keys not only enhances accuracy but also streamlines integration processes, offering significant benefits in the fast-paced financial sector.

What steps will you take to ensure your team is equipped with this essential knowledge?

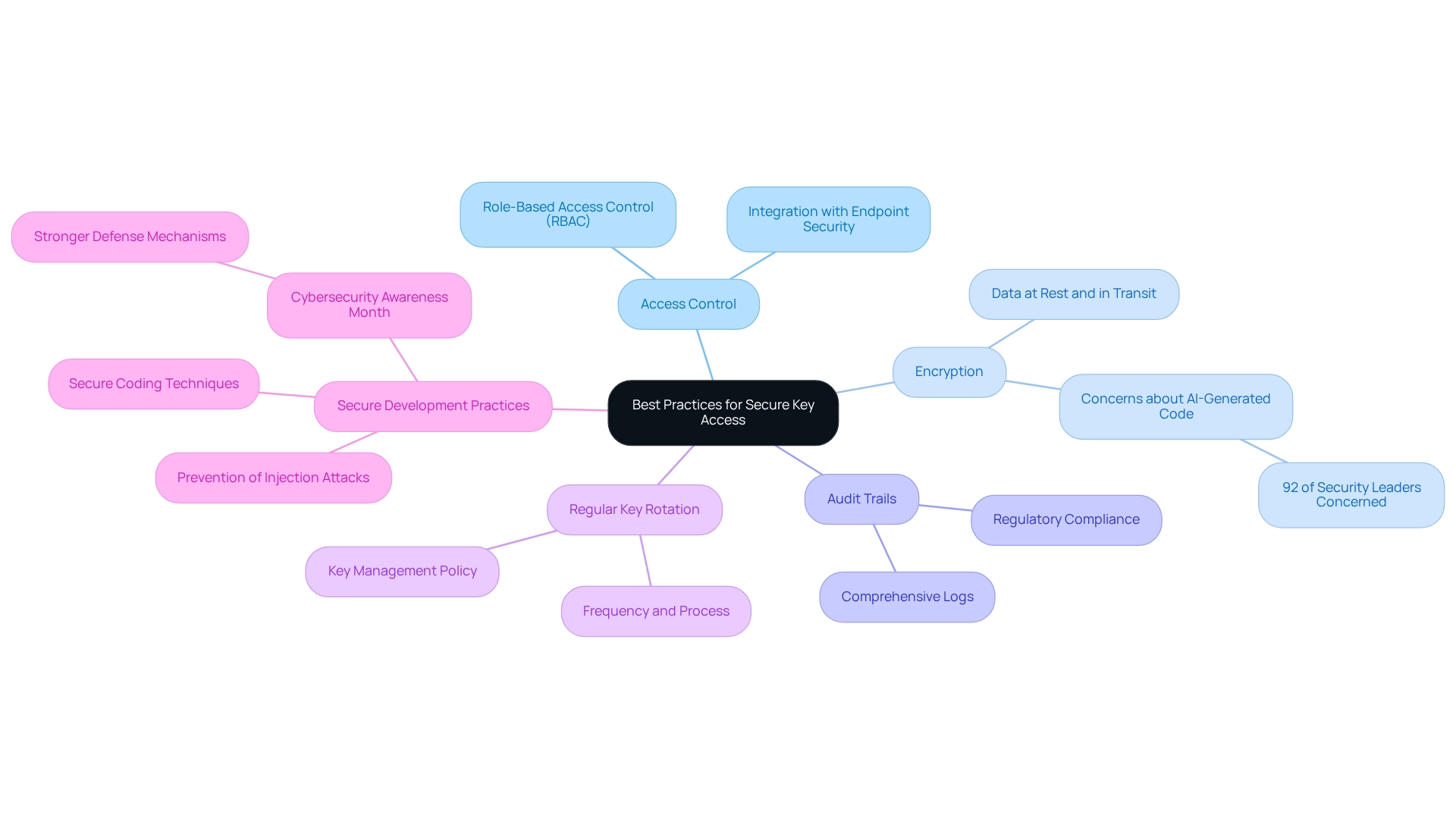

Implement Best Practices for Secure Key Access in Banking Systems

To secure key access in banking systems, we must adopt several best practices that are essential for safeguarding sensitive information.

-

Access Control: We implement stringent access controls to restrict key retrieval to authorized personnel only. Role-based access control (RBAC) is crucial, as it guarantees that only individuals with appropriate permissions can access sensitive information, thereby minimizing the risk of unauthorized access. Furthermore, integrating RBAC with endpoint security solutions enhances our control over user access to devices and applications, preventing unauthorized changes.

-

Encryption: We always secure sensitive information both at rest and in transit. This practice adds a critical layer of security, making it significantly more challenging for unauthorized users to access the data, thus safeguarding against potential breaches. Given that 92 percent of security leaders express concern about risks posed by AI-generated code, the importance of robust encryption practices cannot be overstated.

-

Audit Trails: We maintain comprehensive logs of all key access and retrieval activities. This not only facilitates effective monitoring but also supports compliance with regulatory requirements, ensuring that we can demonstrate accountability in our key management practices.

-

Regular Key Rotation: We regularly rotate encryption keys to minimize the risk of key compromise. Establishing a key management policy that outlines the frequency and process for key rotation is vital for maintaining security over time.

-

Secure Development Practices: We ensure that our developers follow secure coding techniques when implementing query expressions. This helps prevent vulnerabilities such as injection attacks, which can compromise the integrity of the key retrieval process. Cybersecurity Awareness Month highlights the importance of implementing stronger defense mechanisms that protect organizations and citizens from increasing cyber-crime, emphasizing the need for secure development practices.

By following these best practices, we can significantly enhance the security of our key retrieval processes, aligning with the growing emphasis on robust cybersecurity measures in the financial sector. Additionally, engaging younger audiences in cybersecurity awareness, as highlighted in the case study “The Importance of Cybersecurity Training for Future Generations,” can help shape future leaders in the field and foster a culture of security within our organizations.

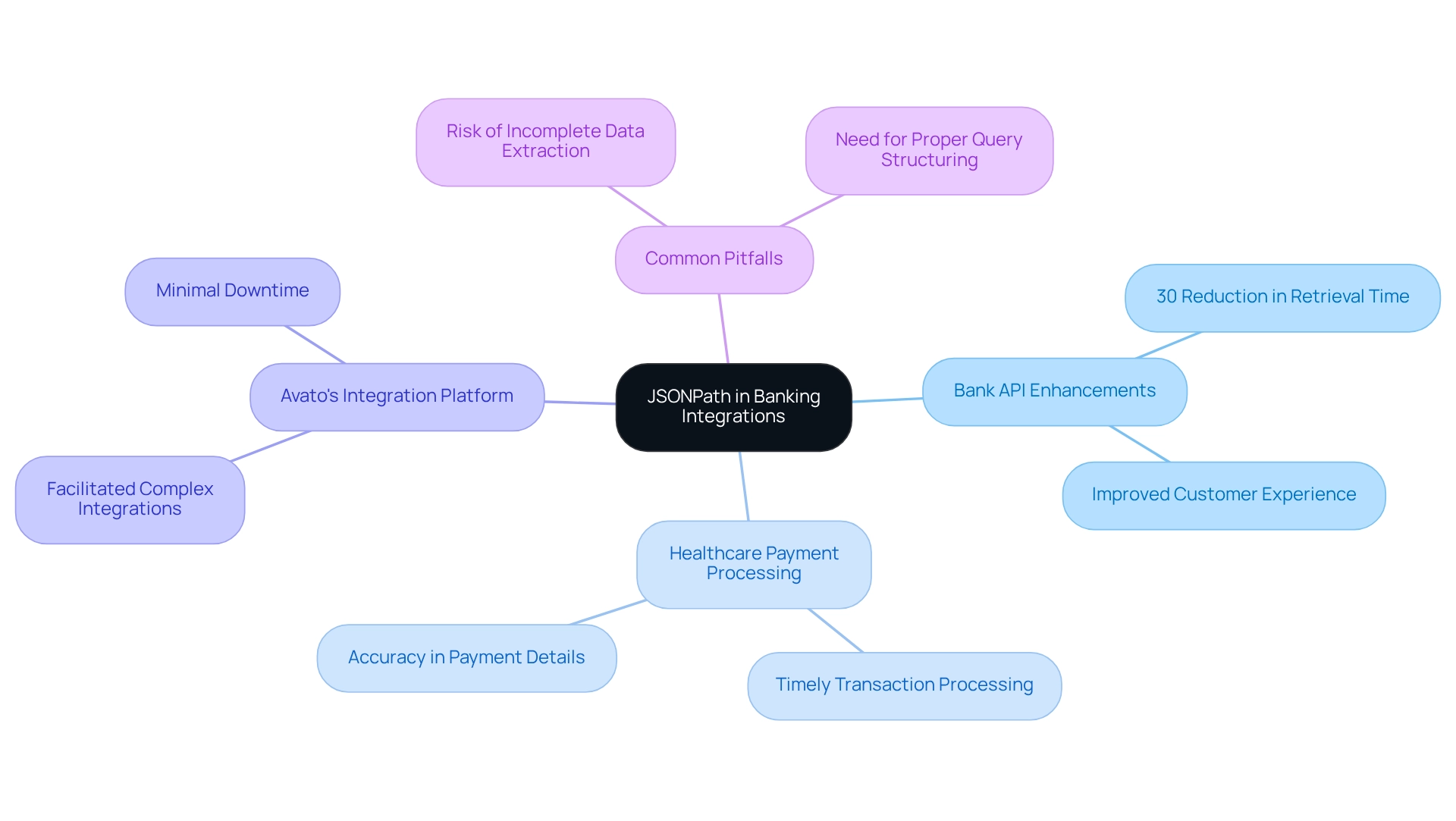

Explore Real-World Examples of JSONPath in Banking Integrations

In the banking sector, we recognize that this tool has emerged as a transformative asset in various integration projects. For instance, a prominent bank utilized a query language to enhance its API responses for customer account details. By leveraging path expressions in JSON format, the bank efficiently extracted essential data fields such as account balances and transaction histories, achieving a remarkable 30% reduction in data retrieval time. This improvement not only bolstered operational efficiency but also fostered a more responsive customer experience.

Another significant example involves a healthcare payment processing system that integrated seamlessly with financial APIs. By employing a query language, the system adeptly parsed and retrieved payment details from intricate JSON responses, ensuring timely transaction processing. This capability is crucial in a sector where speed and accuracy are paramount.

These practical applications underscore the adaptability of the query language in enhancing information integration processes within the financial sector. By streamlining API responses, we can significantly elevate customer experiences and operational efficiency, positioning ourselves competitively in a rapidly evolving market. Moreover, statistics reveal that APIs offer immediate access to user information without necessitating in-person branch visits, emphasizing the importance of effective data retrieval techniques such as JSON in contemporary finance.

Avato’s hybrid integration platform exemplifies this transformation, as evidenced by its successful implementation at Coast Capital, where it facilitated complex integrations with minimal downtime. The platform’s capacity to support multiple interfaces and enable major system transitions has proven invaluable in enhancing operational capabilities. Additionally, a case study titled “API Banking for Internal Efficiency” illustrates how banks can utilize APIs internally to enhance efficiencies across various business areas, interfacing with automation tools to reduce human error. This internal use of APIs supports rapid innovation and helps us remain competitive in a fast-paced market.

Incorporating expert opinions lends further credibility to our discussion. As Gustavo Estrada remarked, “Avato can streamline intricate projects and provide outcomes within preferred timelines and budget limits,” underscoring the efficiency of our integration solutions.

However, we must remain vigilant regarding common pitfalls associated with the implementation of this query language in banking integrations. Misuse of the query language can lead to inefficiencies or retrieval errors. For instance, failing to properly structure queries to jsonpath get keys can result in incomplete data extraction. Therefore, careful planning and execution are paramount for success.

Conclusion

The integration of JSONPath into banking systems marks a pivotal advancement in our data management strategies. By mastering the fundamentals of JSONPath, we can adeptly navigate intricate JSON structures to extract critical data points with unmatched precision. This capability is indispensable in the banking sector, where accuracy and speed are not just preferred but essential. Moreover, the benefits of adopting JSON over XML for data integration underscore our growing preference for more streamlined and readable formats.

Implementing best practices for secure key access is equally crucial. By prioritizing:

- Access control

- Encryption

- Audit trails

- Regular key rotation

- Secure development practices

we can significantly bolster the security of our data retrieval processes. These measures not only safeguard sensitive information but also enable us to comply with regulatory standards and foster trust with our customers.

Real-world examples vividly illustrate the transformative impact of JSONPath in our banking integrations. Successful implementations have resulted in enhanced operational efficiency and improved customer experiences, showcasing the tangible benefits of embracing this powerful tool. However, we must remain vigilant about common pitfalls to avoid potential errors and inefficiencies during implementation.

In conclusion, leveraging JSONPath effectively can revolutionize data management in our banking industry. By prioritizing security and adhering to best practices, we can unlock the full potential of this technology, ultimately driving innovation and maintaining a competitive edge in a rapidly evolving market. Embracing these strategies will pave the way for a more efficient and secure future in banking technology.