Overview

We recognize that essential compliance fintech strategies are crucial for banking success, underscoring the imperative of regulatory adherence in the financial sector. By integrating advanced technologies, providing regular training, and collaborating closely with regulators, we enhance operational integrity and ensure compliance with evolving regulations.

What challenges are you facing in navigating this complex landscape? Together, we can develop tailored solutions that not only meet compliance requirements but also drive your business forward.

Introduction

In the rapidly evolving landscape of fintech, compliance has become an essential pillar for success. As regulatory demands intensify, we recognize that financial institutions must adopt innovative solutions that not only streamline compliance processes but also enhance operational efficiency.

Our hybrid integration platform stands at the forefront of this transformation, providing a robust framework for securely connecting disparate systems while adhering to stringent regulatory standards. With features designed to mitigate risks and ensure data integrity, we empower banks and fintech companies to navigate the complexities of compliance with confidence.

As the industry prepares for the challenges of 2025, understanding the intersection of technology and regulatory requirements is paramount for maintaining a competitive edge and fostering consumer trust.

What challenges are holding your team back from achieving compliance excellence? Let us guide you through these complexities and elevate your operational capabilities.

Avato: Secure Hybrid Integration Platform for Compliance in Banking

We have meticulously crafted our hybrid integration platform to meet the rigorous demands of compliance fintech in the banking sector. Founded by a dedicated group of enterprise architects, we embody a commitment to simplifying complex integrations. By securely connecting various systems, we enable financial institutions to enhance their operations while adhering to compliance fintech standards. Our platform’s advanced security features protect sensitive information, making it essential for banks navigating the complex terrain of regulations in today’s digital environment.

With features like real-time monitoring and alerts, our platform, which focuses on compliance fintech, allows organizations to uphold regulations effortlessly, significantly reducing the risk of regulatory violations. Notably, we support 12 levels of interface maturity, showcasing our adaptability and sophistication in tackling compliance fintech challenges.

Furthermore, a case study illustrates how we maximize the potential of legacy systems while enhancing operational capabilities, reinforcing our value proposition. For instance, Coast Capital experienced merely a 63-second disruption during a significant system change, demonstrating our reliability and effectiveness in preserving operational integrity during crucial transitions.

Additionally, our platform significantly reduces costs, making it a vital solution for financial institutions. As these institutions face growing regulatory challenges in 2025, incorporating compliance fintech solutions is not merely advantageous but crucial for maintaining operational integrity and a competitive edge. Our dedication to leading hybrid integration solutions guarantees that banks can manage regulatory requirements effectively, ensuring compliance fintech with assurance.

Consumer Financial Protection Bureau (CFPB): Key Regulatory Guidelines for Fintech Compliance

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in regulating the financial services sector, particularly concerning compliance fintech companies. As we navigate this landscape, it is imperative that we remain vigilant regarding the latest CFPB regulatory updates, as these changes directly impact our adherence strategies.

Regular reviews of CFPB regulations are essential for us to effectively mitigate risks and bolster consumer trust—an increasingly vital factor in a competitive financial environment. Notably, 53% of data protection experts now recognize managing data privacy as a critical part of their responsibilities, underscoring the growing importance of these regulations.

Furthermore, the primary skill required for an ideal regulatory officer is subject matter expertise, highlighting the necessity for knowledgeable personnel to navigate these intricate regulations. By aligning with CFPB guidelines, we can enhance our compliance fintech capabilities and position ourselves for long-term success.

Our Hybrid Integration Platform can streamline this process by transforming unstructured data into a structured requirements model, enabling us to automate regulatory processes and focus on essential business tasks. However, we must also confront challenges to compliance confidence, such as inadequate resources and a lack of supportive company culture, to improve our overall compliance posture.

Get your copy now to discover how we at Avato can assist you in navigating these challenges effectively.

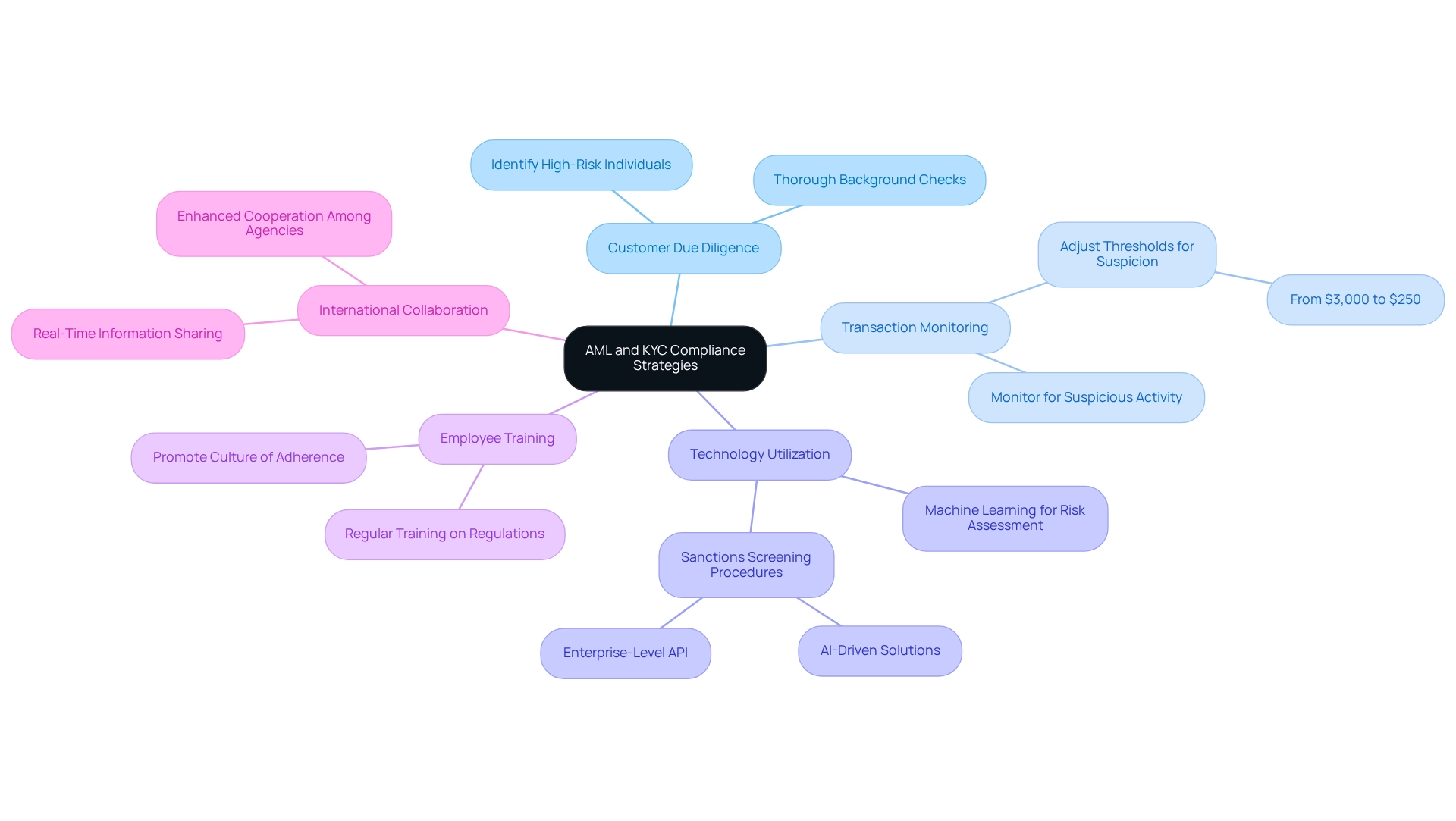

Anti-Money Laundering (AML) and Know Your Customer (KYC): Essential Compliance Strategies

To effectively combat financial crimes, we must adopt comprehensive Anti-Money Laundering (AML) and Know Your Customer (KYC) strategies. This involves conducting thorough customer due diligence, which is crucial for identifying high-risk individuals and entities. Monitoring transactions for suspicious activity is essential, especially as the threshold for suspicious transactions has been significantly lowered from $3,000 to $250, reflecting a more stringent regulatory environment.

Advanced technologies, particularly machine learning, play a pivotal role in enhancing these strategies. By automating risk assessments, we improve the accuracy of identifying potential threats, allowing our organizations to respond swiftly to emerging risks. Efficient sanctions screening procedures are essential for compliance fintech to adhere to AML regulations and safeguard ourselves from exploitation by money launderers, thus enhancing our overall regulatory stance. As Paul Dixon, a RegTech content creator and strategist, mentions, “AI-driven and featuring an enterprise-level API with 99.99% uptime are reasons why clients worldwide rely on us for their sanctions screening requirements,” emphasizing the significance of dependable technology in our regulatory efforts.

Regular training for employees on AML and KYC regulations is also critical. This promotes a culture of adherence within our organization, ensuring that staff are well-equipped to recognize and tackle regulatory challenges. As the landscape of financial crime changes, improved international collaboration among regulators, law enforcement, and financial institutions is anticipated to enable real-time information sharing, further strengthening our adherence efforts. The hybrid integration platform can facilitate this collaboration by effortlessly linking various systems and allowing effective data exchange, which is crucial for upholding legal standards and performing comprehensive audits.

In 2025, effective applications of AML and KYC technologies in compliance fintech will be defined by their capacity to adjust to these evolving demands, ensuring that we not only fulfill compliance obligations but also retain a competitive advantage in the financial services industry. Banking IT managers should consider how integrating Avato’s solutions can enhance our AML and KYC alignment efforts, ultimately leading to more effective risk management and regulatory adherence.

Data Privacy and Security: Strategies for Compliance in Fintech

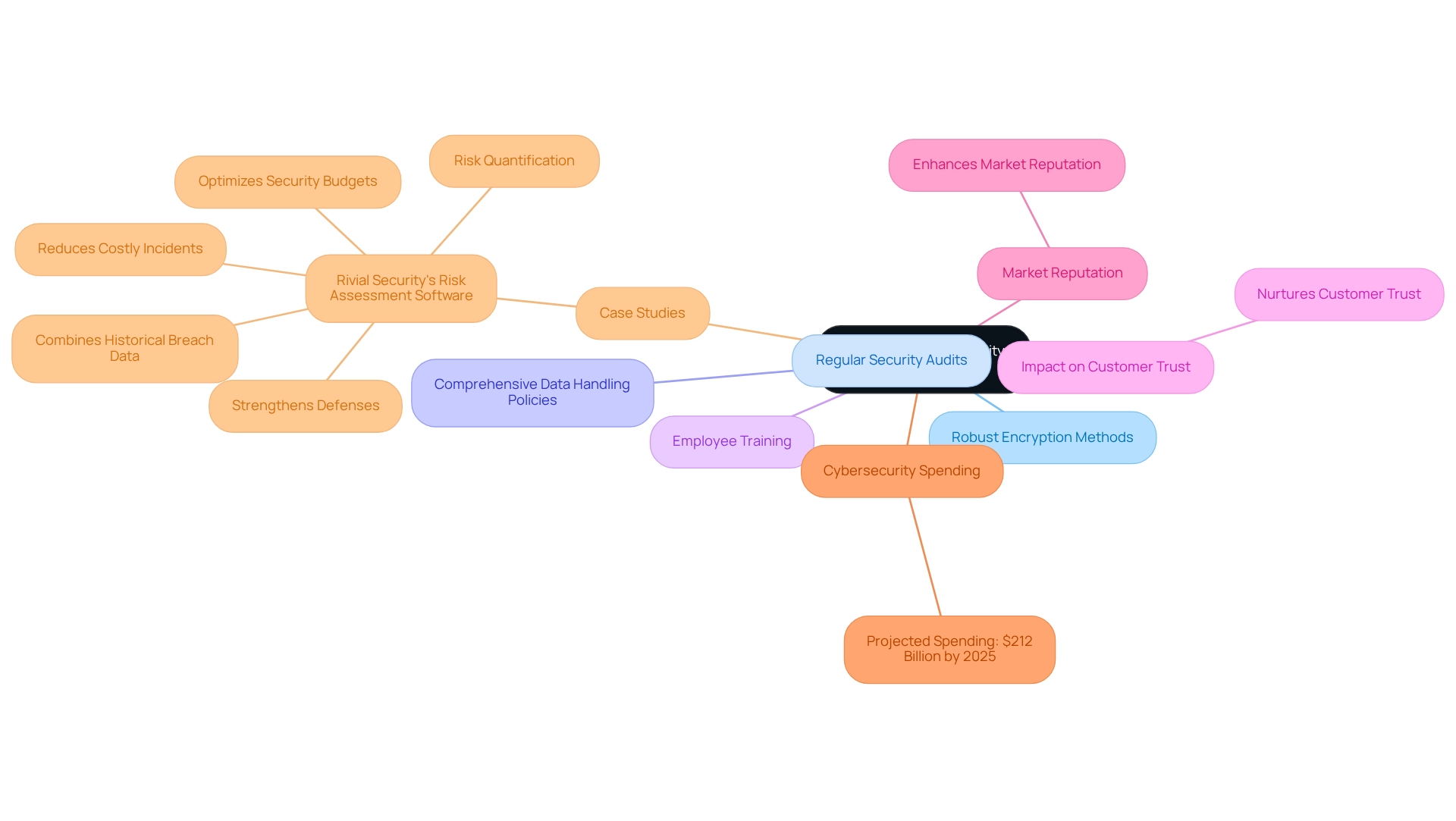

As compliance fintech companies, navigating the complexities of GDPR and CCPA regulations is imperative for us; we must prioritize data privacy and security. Key strategies we implement include:

- Robust encryption methods

- Regular security audits

- Comprehensive data handling policies

Additionally, training our employees on data protection practices is essential to minimize breach risks. A proactive strategy in compliance fintech not only guarantees adherence but also nurtures customer trust, ultimately enhancing our market reputation. Recent statistics reveal that data breaches in the fintech sector are on the rise, with projections indicating that global cybersecurity spending will reach $212 billion in 2025. This underscores the urgency for us to adopt effective data privacy security strategies, particularly in light of evolving cyber threats that require our readiness and adaptability.

Case studies, such as Rivial Security’s risk assessment software, illustrate the tangible benefits of prioritizing data security. By combining historical breach data with risk quantification, Rivial has assisted clients in strengthening defenses, reducing costly incidents, and optimizing security budgets. As the landscape of data privacy regulations continues to change, we must remain informed about the latest developments and adjust our adherence strategies accordingly. This includes understanding the implications of new regulations and leveraging expert insights to enhance our data privacy frameworks.

Regular Risk Assessments and Audits: Maintaining Compliance in Fintech

Frequent risk evaluations and audits are essential for compliance fintech firms as they navigate the complexities of ever-evolving regulations. These assessments play a crucial role in identifying vulnerabilities within our processes and systems, enabling us to proactively address potential issues before they escalate into significant problems.

By creating a regular audit timetable that incorporates both internal and external auditors, we ensure thorough coverage of regulatory requirements. This is particularly vital considering that 50% of organizations allocate 6-10% of their revenue to regulatory expenses. Such a substantial investment underscores the importance of effective adherence strategies for compliance fintech.

Cultivating a culture of ongoing enhancement is imperative for compliance fintechs like us that seek to improve our regulatory stance. Regular audits not only help us recognize gaps but also enhance our success rate in compliance fintech initiatives. In fact, the projected total cost of financial crime adherence across financial institutions globally is estimated at $213.9 billion, highlighting the financial burden that adherence poses and the necessity for effective strategies. This context strengthens our case for regular audits as a means to mitigate these expenses.

Furthermore, establishing a formal adherence charter can yield significant savings, with organizations saving an average of $520,000. This statistic further emphasizes the financial advantages of prioritizing regulatory initiatives. Consistently performing security evaluations and adherence checks is crucial to ensure that our updated systems meet all legal standards, particularly regarding Avato’s hybrid integration solutions.

To conduct efficient adherence audits, we must emphasize the integration of risk assessments into our audit procedures. This includes determining the frequency of assessments, which is critical for staying ahead of regulatory changes. Expert opinions indicate that the primary skill required for an ideal regulatory officer is subject matter expertise, underscoring the significance of knowledgeable personnel in implementing successful audit strategies. By prioritizing regular risk evaluations, we can significantly reduce risks and ensure ongoing adherence to regulations.

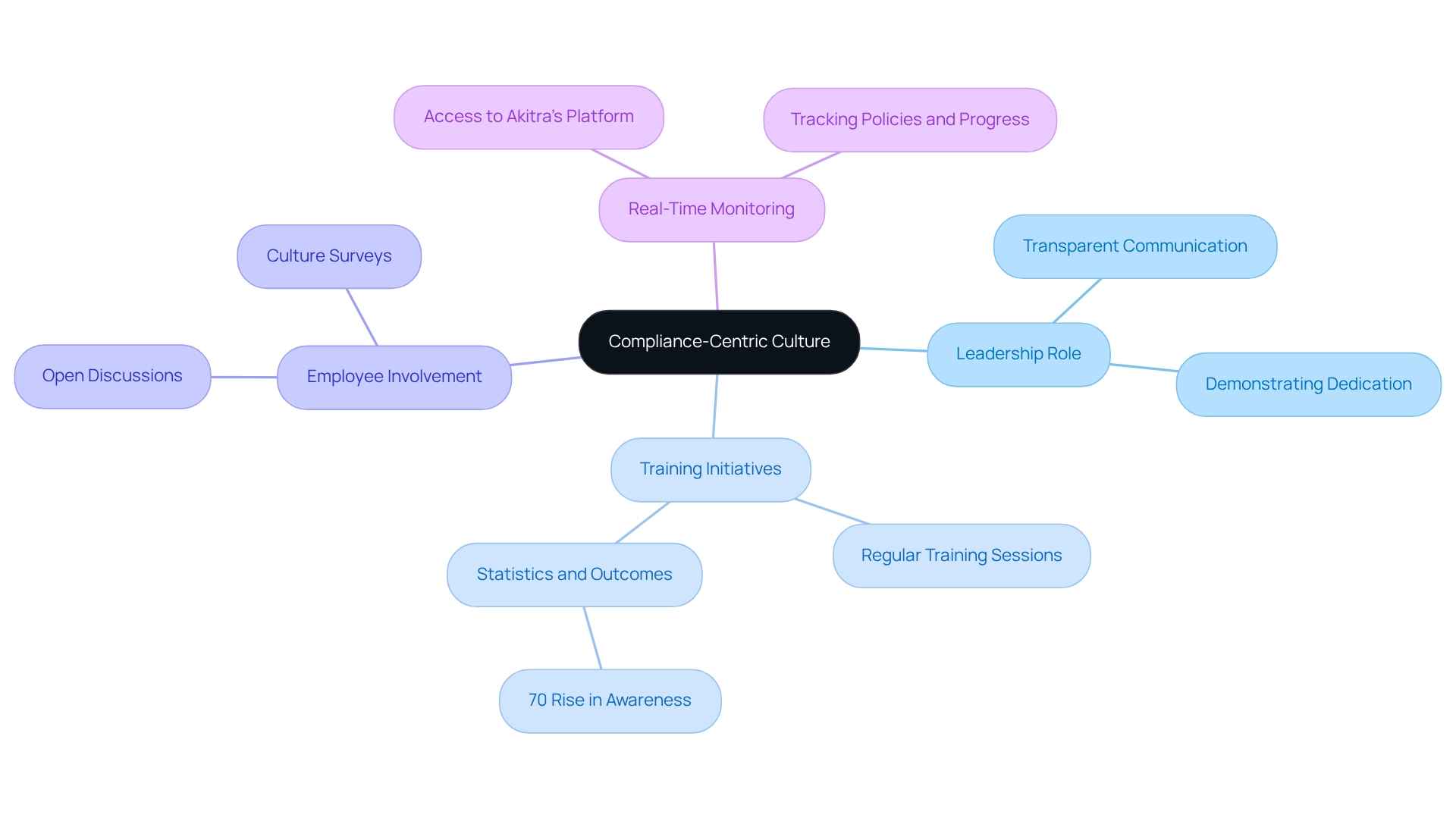

Compliance-Centric Culture: Building Awareness and Adherence in Fintech

Establishing a compliance fintech culture within our organization is crucial for ensuring that all employees are aware of and adhere to regulatory requirements. Leadership plays a pivotal role in this process by demonstrating a strong dedication to adherence through transparent communication and consistent training initiatives. Regular training sessions not only inform our employees about regulatory standards but also cultivate an atmosphere where open discussions about challenges and successes related to regulations are encouraged. This approach boosts employee involvement and strengthens the notion that adherence is a collective duty throughout our organization.

Incorporating compliance fintech into our organizational culture guarantees that each team member comprehends their role in upholding standards, which greatly reduces the risk of non-adherence. Statistics indicate that organizations with a robust adherence culture experience improved performance and reduced incidents of regulatory breaches. Significantly, well-organized training programs can result in a 70% rise in awareness among our staff. As Tracee Lee Beebe, Operations Manager, remarked, “I valued the capability to access Akitra’s platform and visually monitor policies, evidence, and progress in real-time,” emphasizing the significance of real-time tracking in our regulatory efforts.

Furthermore, successful employee training programs have been shown to enhance engagement, and integrating case studies like the Ozone API Tool for US Banks illustrates practical applications of building a compliance-centric culture. By prioritizing adherence as a core value and conducting regular culture surveys to gain insights into employee experiences, we can navigate the complexities of regulatory landscapes while fostering a culture of accountability and integrity.

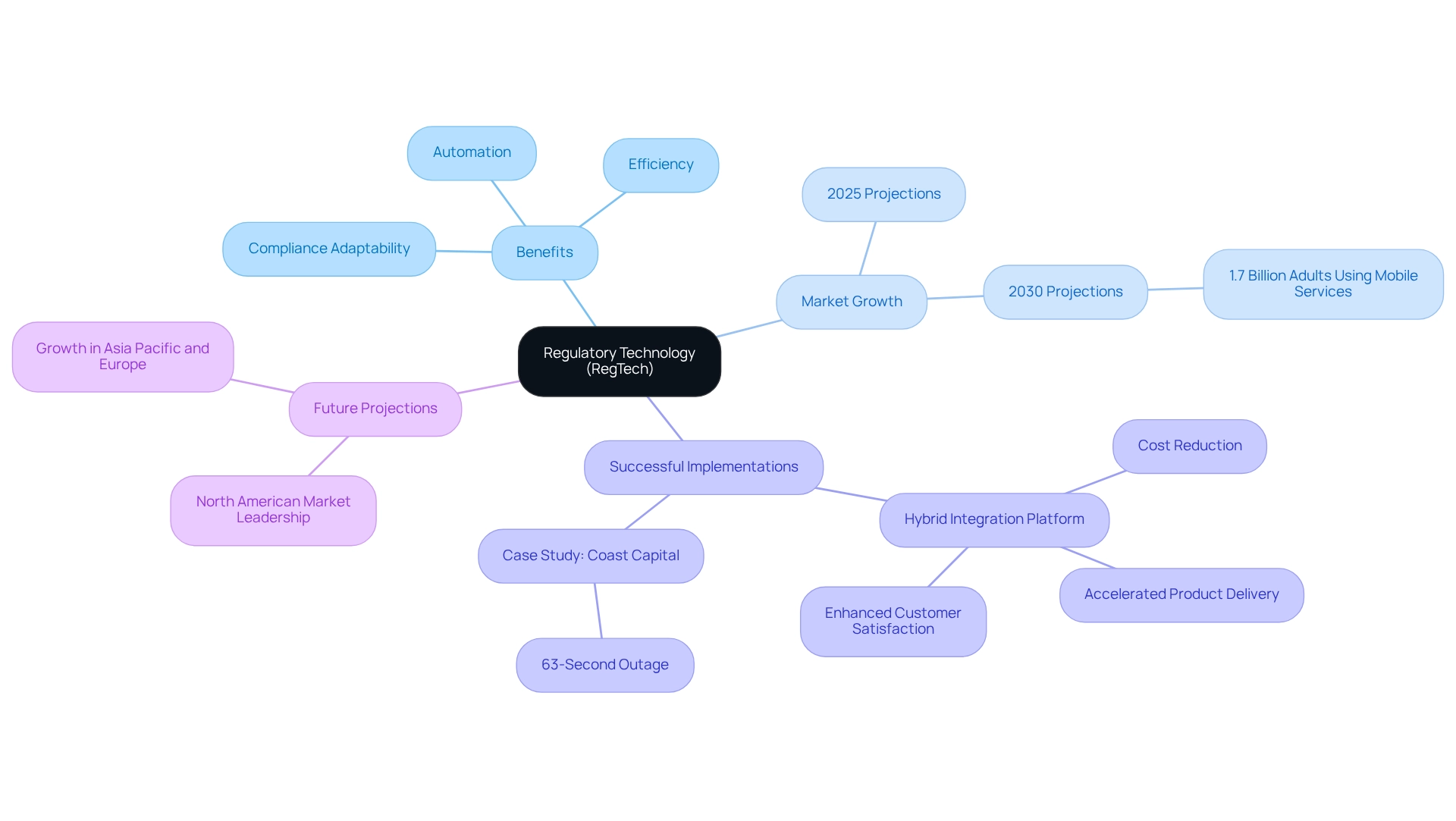

Regulatory Technology (RegTech): Streamlining Compliance Processes in Fintech

Regulatory Technology (RegTech) is revolutionizing the regulatory landscape for compliance fintech. By automating regulatory processes, we reduce the workload on oversight teams and significantly enhance accuracy. Our advanced technologies simplify essential tasks such as transaction monitoring, reporting, and risk evaluations, enabling compliance fintech firms to concentrate on innovation while ensuring strict compliance with legal obligations.

Looking ahead to 2025, we anticipate a surge in RegTech adoption, with the North American market poised to lead in revenue share due to rapid digital adoption and technological advancements. As highlighted in the Regional Analysis of the RegTech Market, it is projected that 1.7 billion adults will utilize financial services through mobile technology by 2030. This statistic underscores the urgent necessity for robust regulatory measures in an increasingly digital environment.

Moreover, automation in RegTech not only enhances efficiency but also enables compliance fintechs to swiftly adapt to compliance changes, thereby preserving a competitive edge. Our successful implementations of regulatory technology have demonstrated significant improvements in compliance fintech processes, showcasing that RegTech is not merely a tool but a strategic asset for financial services. For example, our hybrid integration platform has transformed operations, enabling financial institutions to reduce costs, accelerate product delivery, and enhance customer satisfaction through seamless integrations. A notable instance involved our collaboration with Coast Capital, where we executed a major system transition with only a 63-second outage, exemplifying the platform’s reliability and effectiveness.

As Daniel Bedford observes, “Our Trade Surveillance Systems research report offers a comprehensive examination of the condition of this evolving market,” emphasizing the importance of staying ahead in regulations. Additionally, we guarantee 24/7 uptime for essential integrations, highlighting the critical nature of reliability in regulatory processes. As industry leaders emphasize, investing in compliance fintech is crucial for managing the complexities of regulations in today’s rapidly changing financial landscape.

Collaboration with Regulators: Enhancing Compliance Strategies in Fintech

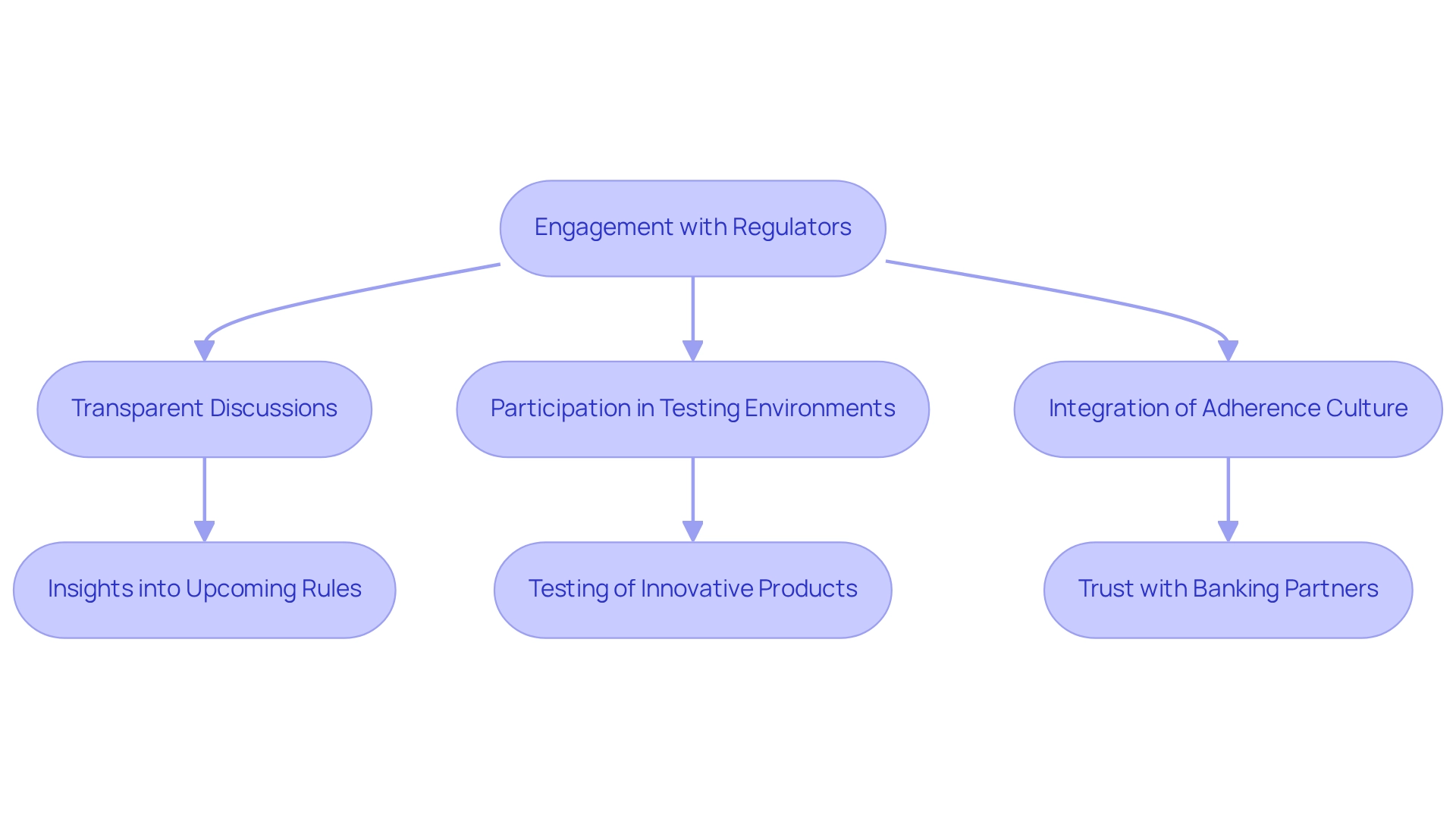

We must prioritize cooperation with regulators to enhance our adherence strategies. Engaging in transparent discussions with oversight organizations not only provides us with insights into upcoming rules but also emphasizes best practices crucial for maneuvering the intricate legal environment. Participation in innovation testing environments is especially advantageous, as it allows us to test innovative products in a controlled setting while receiving valuable guidance from authorities. This joint method promotes strong connections with oversight bodies, enabling us to tackle adherence challenges more efficiently and play an active role in shaping the governance framework.

Recent statistics indicate that the presence of regulatory sandboxes has led to the establishment of global best practices for fintech activities, underscoring their significance in our industry. This structure is essential for us as it offers a framework within which we can innovate while maintaining regulatory standards. Moreover, case studies demonstrate that integrating adherence into our everyday operations and culture is vital for conforming to the strict demands of banks and financial institutions. A robust adherence culture not only assists us in managing regulatory complexities but also builds trust with our banking partners, ultimately improving our operational capabilities and market positioning. As Gustavo Estrada mentioned, “The company has streamlined intricate projects and provided outcomes within expected timelines and financial limits,” emphasizing the efficiency of strong regulatory solutions. Furthermore, the incorporation of automated data gathering, analysis, and reporting tools is becoming increasingly essential, enabling us to concentrate on other important business activities while ensuring regulatory adherence.

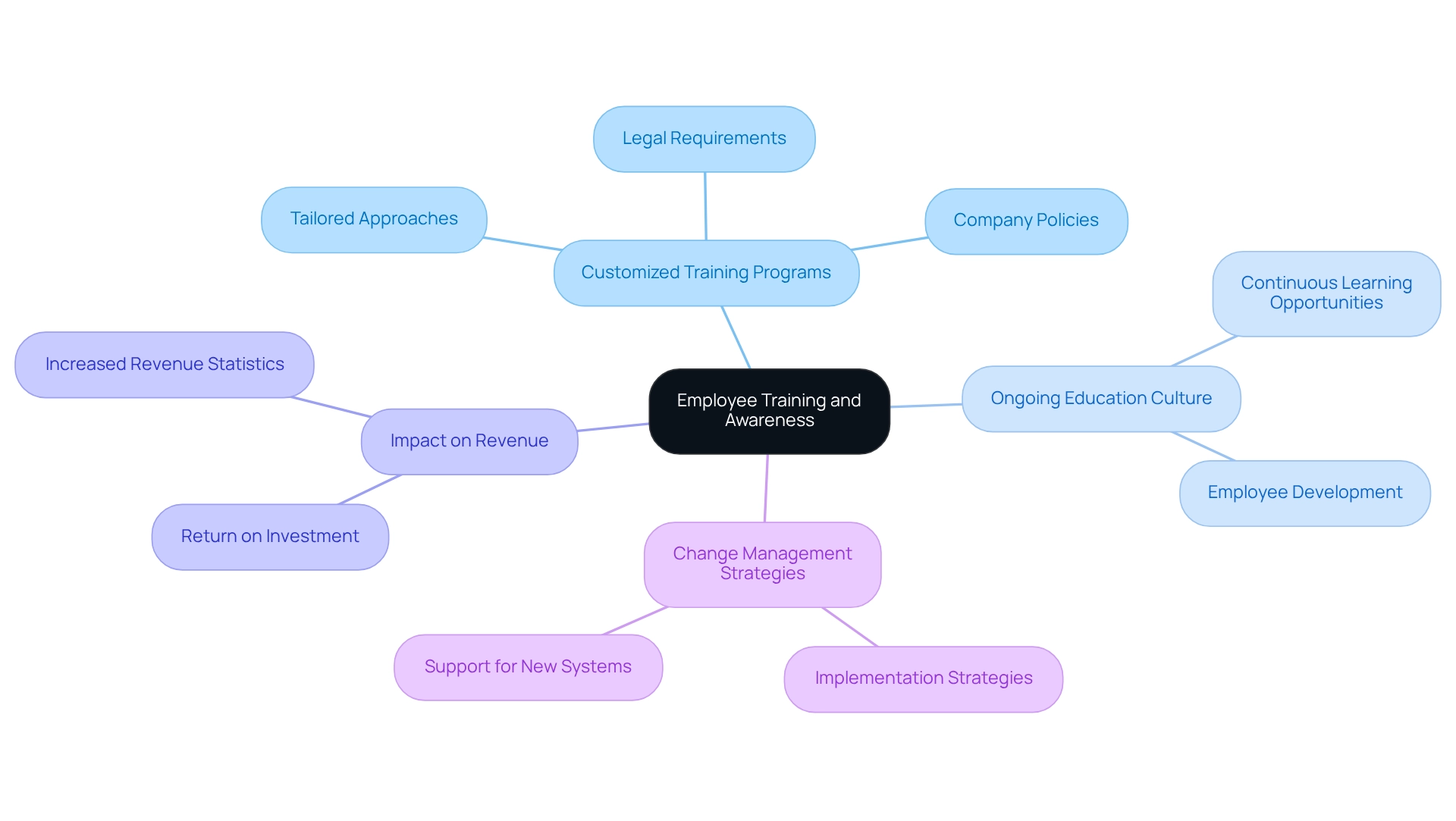

Employee Training and Awareness: Ensuring Compliance Understanding in Fintech

To ensure thorough adherence knowledge within fintech organizations, we must implement regular and customized training programs for our staff, as suggested in the user manual. These programs should encompass essential legal requirements, company policies, and best practices for adherence, specifically tailored to align with Avato’s hybrid integration platform. By investing in comprehensive training, we not only equip our employees with vital knowledge but also cultivate a culture of innovation and flexibility, which is crucial for navigating the complexities of compliance environments. Customizing training to specific roles significantly enhances its effectiveness, ensuring that our employees are well-versed in their responsibilities.

Moreover, fostering a culture of ongoing education is essential; it keeps our employees updated on evolving regulations and strengthens our organization’s overall adherence stance. While statistics reveal that firms investing in employee training experience a 43% rise in revenue, our focus should remain on customized training methods. Effective training programs in compliance fintech demonstrate that these tailored approaches lead to improved adherence to regulations, ultimately safeguarding our organization from potential risks. Additionally, implementing change management strategies alongside training initiatives, as outlined in Avato’s user manual, can facilitate the transition to new systems, ensuring that our staff feel comfortable and confident in utilizing Avato’s hybrid integration platform.

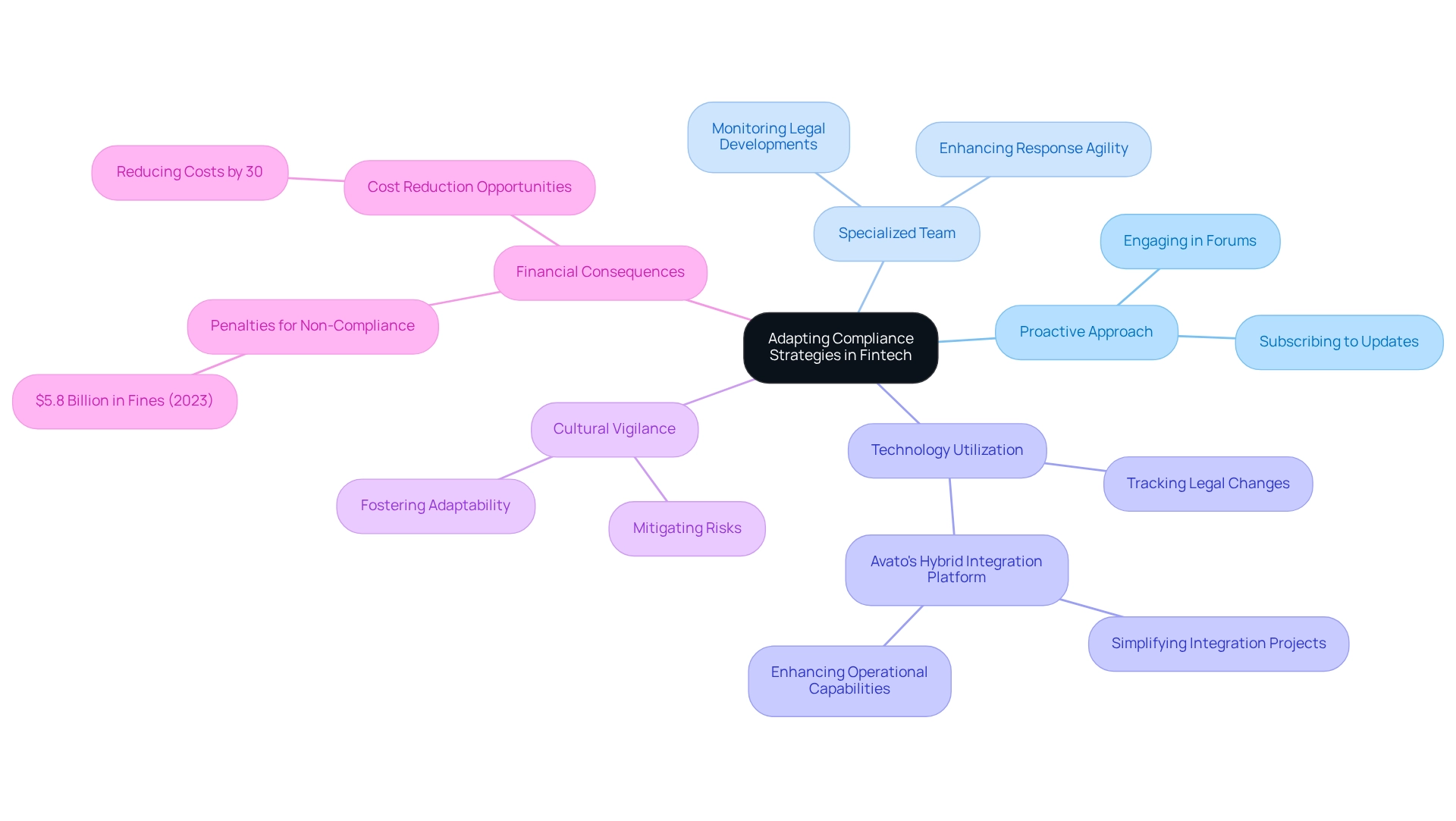

Staying Updated with New Regulations: Adapting Compliance Strategies in Fintech

We must adopt a proactive approach in keeping informed about new regulations to effectively adjust our adherence strategies. This involves not only subscribing to compliance updates and engaging in industry forums but also utilizing advanced technology to track changes in the legal landscape.

Forming a specialized team dedicated to monitoring legal developments significantly enhances our ability to respond to changes. By 2025, we anticipate that compliance fintech firms focusing on adherence will demonstrate enhanced agility. Research suggests that those who actively interact with rule updates can reduce adherence-related expenses by up to 30%.

The financial consequences of insufficient adherence are stark, as evidenced by the $5.8 billion in penalties paid by crypto and digital payments firms in 2023 for deficiencies in customer verifications and anti-money laundering measures. By fostering a culture of vigilance and adaptability, we can mitigate risks and ensure ongoing compliance with regulatory requirements, ultimately positioning ourselves for success in an increasingly complex environment.

As Jamie Dimon pointed out, mastering technology is vital for future success, underscoring the crucial intersection of regulation and innovation in the financial services sector. In this context, we must regard security and regulatory matters with the same seriousness as banks, particularly in international operations.

As William Blake aptly stated, ‘What is now proved was once only imagined,’ emphasizing the innovative mindset required for adherence in fintech. Additionally, leveraging solutions like Avato’s Hybrid Integration Platform can facilitate compliance fintech and integration in regulated environments, streamlining our digital transformation through structured requirements management and supporting us in navigating the complexities of regulatory compliance.

Conclusion

Navigating the intricate landscape of compliance in the fintech industry is not just a necessity; it is a strategic imperative. We understand that this multifaceted approach requires the integration of advanced technology, a robust culture of compliance, and proactive engagement with regulatory bodies. Our Avato hybrid integration platform stands out as a critical tool, enabling financial institutions to securely connect disparate systems while ensuring adherence to stringent regulations. With capabilities such as real-time monitoring and data integrity assurance, we empower organizations to effectively mitigate risks and enhance operational efficiency.

As the regulatory environment continues to evolve, we recognize that fintech companies must prioritize:

- Regular risk assessments

- Employee training

- Collaboration with regulators

to strengthen their compliance strategies. By fostering a compliance-centric culture, we cultivate awareness and accountability among staff—essential elements for meeting the growing demands of regulatory frameworks like those established by the Consumer Financial Protection Bureau (CFPB) and anti-money laundering (AML) requirements.

Moreover, adopting regulatory technology (RegTech) solutions transcends mere compliance; it is about enabling innovation and maintaining a competitive edge in a fast-paced financial landscape. By automating compliance processes and ensuring real-time data management, we allow fintechs to focus on strategic growth while minimizing the risk of regulatory breaches.

In conclusion, the intersection of technology and compliance is vital for the future of fintech. As we prepare for the challenges of 2025, investing in robust compliance solutions like our Avato platform becomes essential for sustaining operational integrity and fostering consumer trust. Our unwavering commitment to compliance will not only safeguard against potential risks but also pave the way for a more resilient and innovative financial services sector.