Overview

We recognize the critical role that open-source Enterprise Service Bus (ESB) solutions play in banking integration. Our exploration identifies ten essential solutions, including:

- Avato

- Apache Kafka

- MuleSoft

These platforms enhance operational efficiency and streamline connectivity. They empower financial institutions to adapt to the evolving landscape of open finance through innovative integration strategies.

What challenges are holding your team back from leveraging these transformative tools? By embracing these solutions, we can collectively navigate the complexities of modern finance, ensuring your organization remains competitive and responsive to change.

Introduction

In the rapidly evolving landscape of banking integration, we recognize that numerous platforms vie for attention, each offering unique solutions to meet the complex demands of financial institutions. From hybrid integration platforms like Avato, which we leverage to bridge legacy systems with modern applications, to robust frameworks such as Apache Camel that streamline operations, our options are vast and varied.

As banks increasingly prioritize agility and efficiency in their operations, technologies like Apache Kafka and MuleSoft emerge as crucial players in enabling real-time data processing and effective API management.

This article delves into the leading integration solutions available today, exploring how we empower banks to enhance customer experiences, optimize operations, and remain competitive in an ever-changing market.

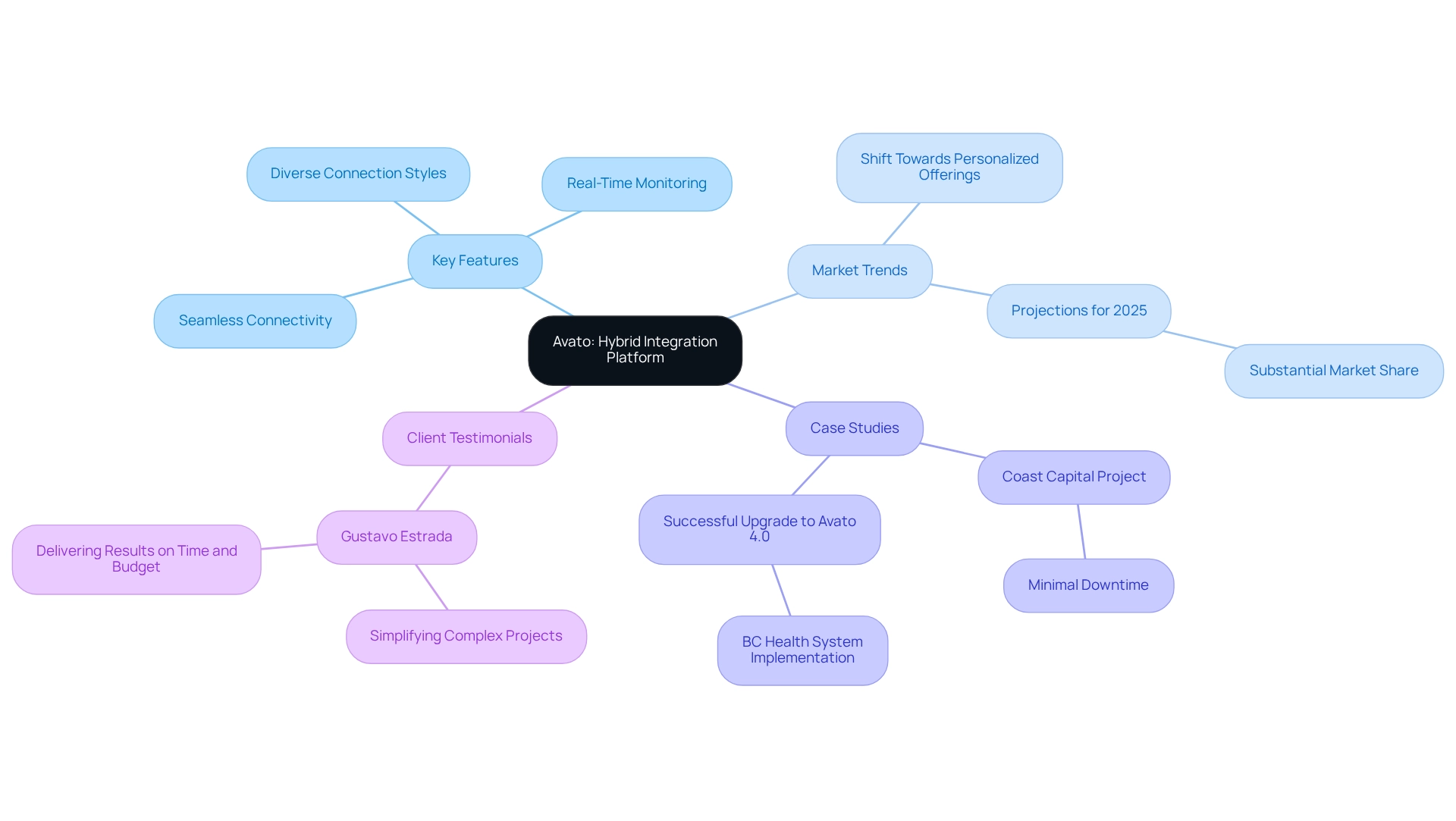

Avato: Leading Hybrid Integration Platform for Open Source ESB Solutions

At Avato, we emerge as a leading hybrid unification platform, meticulously crafted to meet the intricate unification demands of financial institutions. Our advanced architecture ensures seamless connectivity between legacy systems and modern applications, empowering organizations to innovate while upholding robust security and operational efficiency. With key features like real-time monitoring and support for diverse connection styles, we enable financial institutions to optimize operations and significantly enhance customer experiences.

Current statistics reveal a noteworthy shift towards personalized and scalable offerings among financial software companies, underscoring the rising significance of hybrid solutions. By 2025, hybrid unification platforms are projected to capture a substantial market share within the financial sector, driven by the demand for agile and secure merging strategies. Notably, we secured an RFP for a prominent schedule-one Canadian bank in April 2019, which highlights our credibility and strong market position.

Expert insights accentuate the critical role of hybrid unification in banking systems, with our firm leading the charge in providing solutions that simplify complex unification projects. A successful case study from February 2013 exemplifies this, as we implemented a hybrid unification solution for Coast Capital, facilitating major system transitions with minimal downtime. Our ability to ensure smooth transitions underscores our expertise in transforming financial institutions with speed and reliability.

Furthermore, testimonials from clients, such as Gustavo Estrada of BC Provincial Health Services Authority, reflect our commitment to delivering results within specified time frames and budget constraints. Named after the Hungarian term for ‘dedication,’ we are committed to building the technological foundation necessary for creating rich, connected user experiences through innovative combination solutions. This unwavering dedication to efficiency and effectiveness positions Avato as an essential ally for financial institutions seeking to modernize their integration processes and enhance their competitive advantage in a dynamic market.

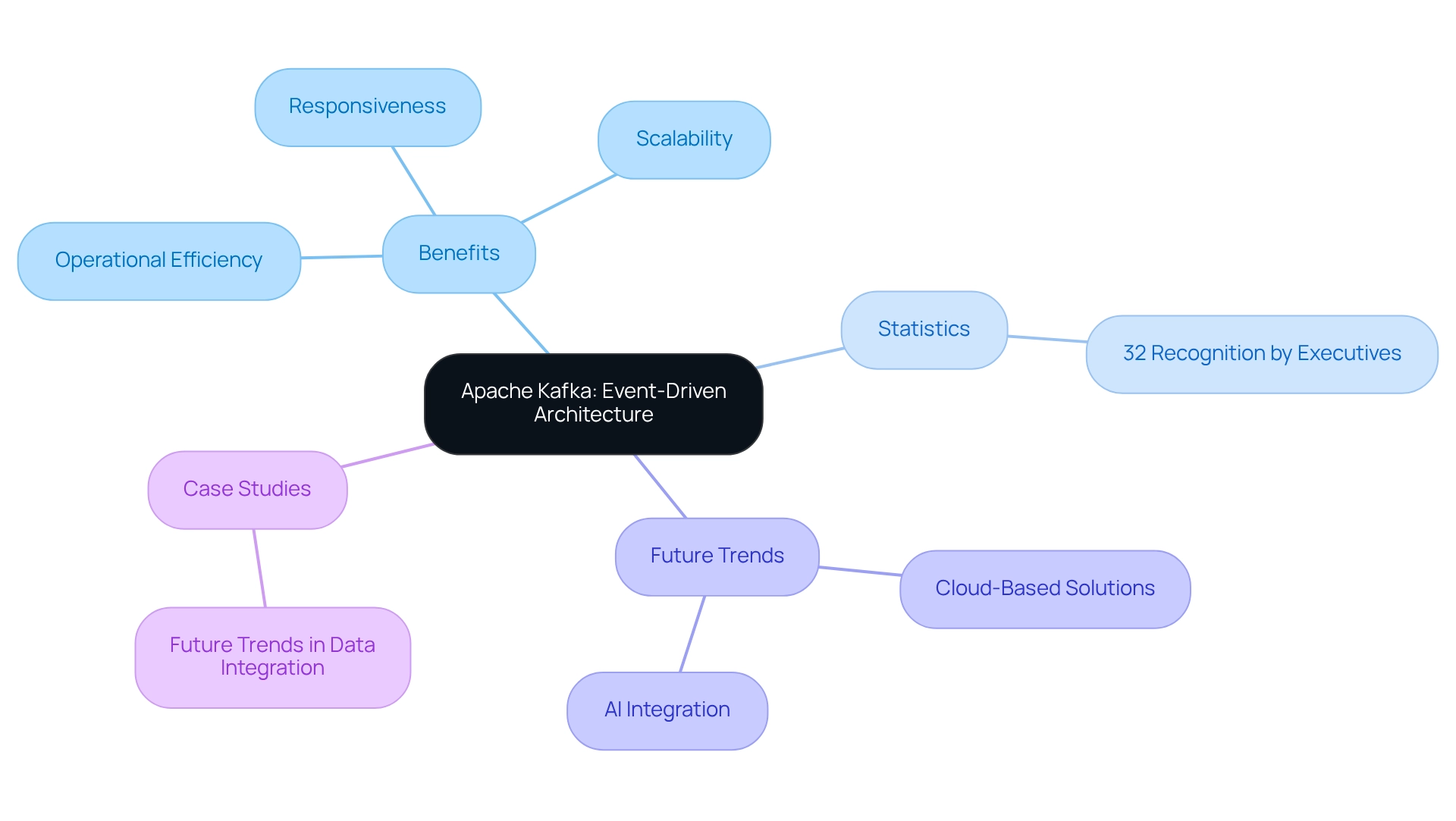

Apache Kafka: Event-Driven Architecture for Real-Time Integration

Apache Kafka stands as a powerful open-source stream processing platform, expertly designed for real-time data feeds. This makes it an ideal choice for financial institutions striving for excellence. Its event-driven architecture facilitates instantaneous processing of transactions and customer interactions, significantly enhancing our responsiveness and operational efficiency. By decoupling data producers from consumers, Kafka empowers banks to scale operations effortlessly while ensuring high throughput and low latency.

Recent statistics reveal that 32% of line-of-business executives recognize the potential of event-driven architecture to positively impact their business outcomes. This growing awareness underscores the significance of adopting technologies such as Kafka in the financial sector. Furthermore, the integration of business intelligence platforms and robotic process automation with Kafka enhances data visualization and operational efficiency, fostering innovation in financial services.

As we look towards 2025, the environment of financial merging continues to progress, with Apache Kafka leading the way. Notably, Avato’s Secure Hybrid Integration Platform complements Kafka by maximizing and extending the value of legacy systems, simplifying complex integrations, providing real-time monitoring and alerts on system performance, and significantly reducing costs.

This synergy enables banking institutions to harness real-time monitoring and alerts on system performance, ensuring 24/7 uptime and reliability for complex systems in banking, healthcare, and government.

The benefits of utilizing Apache Kafka for financial integration are numerous. It not only improves operational efficiency but also supports the increasing demand for real-time data access and processing. As financial institutions adopt event-driven architectures, they position themselves to adapt to the dynamic financial landscape, ensuring they remain competitive and responsive to customer expectations. Case studies highlight the successful implementation of Kafka in various financial scenarios, showcasing its effectiveness in streamlining processes and enhancing service delivery.

As Alex, a passionate visionary in the financial industry, states, “Event-driven architecture is a game changer for banks, enabling them to solve challenges and improve their operations significantly.” This viewpoint emphasizes the essential role of technologies such as Kafka and Avato’s Hybrid Connection Platform in shaping the future of financial system connectivity. Moreover, insights from the case study titled ‘Future Trends in Data Integration’ suggest that trends like greater adoption of cloud-based solutions and the emergence of AI and machine learning will further enhance the functionalities of data platforms, making them indispensable to our business strategies and innovation.

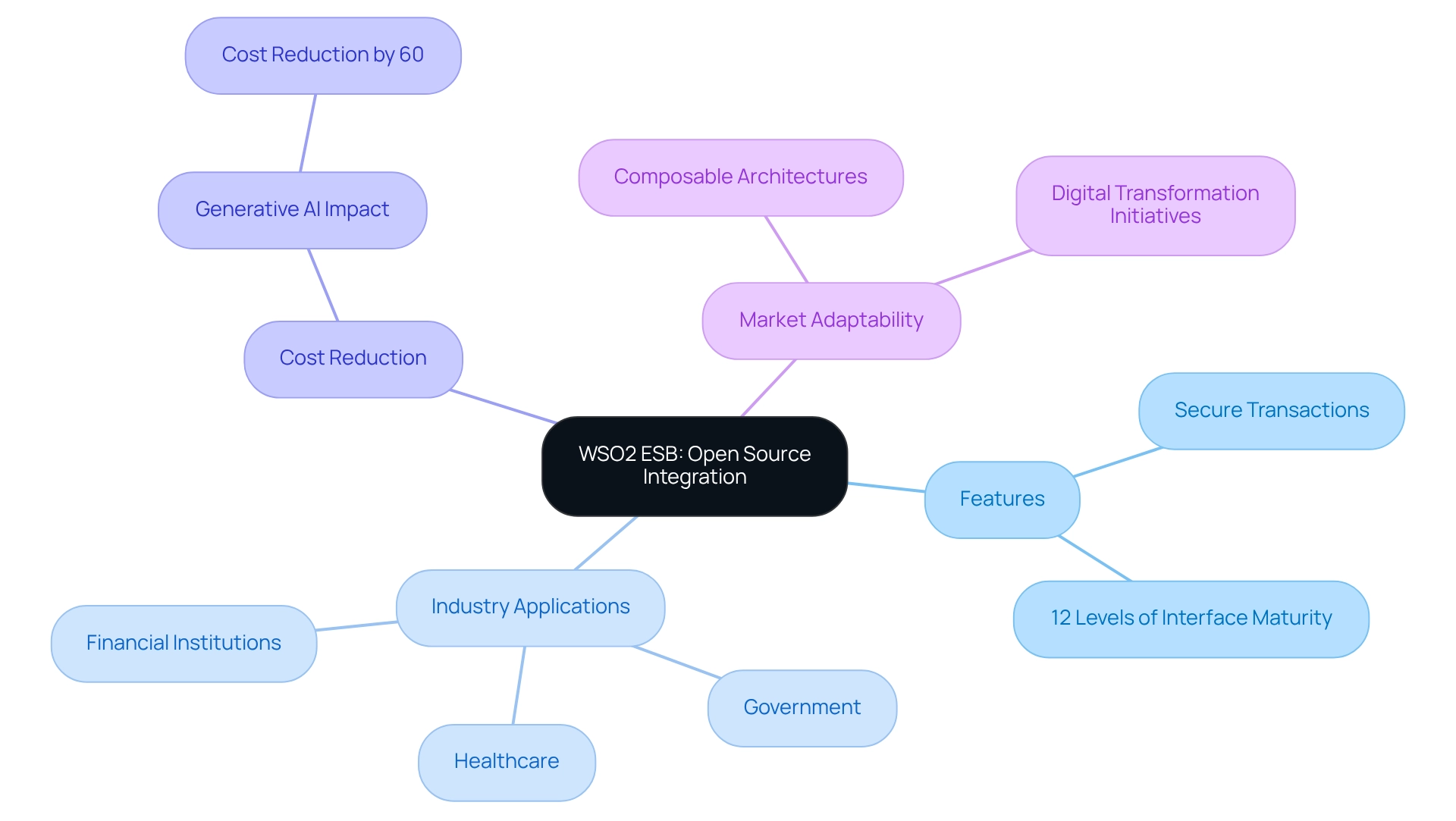

WSO2 ESB: Comprehensive Open Source Integration for Enterprises

We stand out as a committed hybrid solution designed to enhance communication across various banking systems. Our strong dedication to building technological frameworks empowers financial institutions to improve their adaptability, enabling them to swiftly respond to market changes and evolving customer demands. With robust features such as secure transactions and support for 12 levels of interface maturity, our platform significantly reduces implementation costs while future-proofing technology stacks. This aligns with projections indicating that generative AI could lower expenses by up to 60% within the next two to three years, underscoring our effectiveness in enhancing operational efficiency.

As Tony LeBlanc from the Provincial Health Services Authority noted, “This team is excellent and highly professional, providing outcomes that ease the assimilation process and speed up time-to-market for new services.” Our platform, designed for secure transactions, is trusted by financial institutions, healthcare, and government sectors, providing a solid foundation for digital transformation initiatives. As the banking sector progressively shifts toward composable architectures and marketplaces, we position ourselves as an essential resource for institutions seeking to enhance their connectivity capabilities while ensuring cost-effectiveness.

With our established history in facilitating seamless connections, we are a vital resource for financial institutions striving to thrive in a competitive landscape, especially as generative AI is anticipated to become a widespread tool for improving operational effectiveness and boosting revenue by 2030.

Talend Open Studio for ESB: User-Friendly Integration for Developers

We recognize that Talend Open Studio for ESB is not just another tool; it is an ESB open source platform designed with a user-friendly drag-and-drop interface, making it accessible to developers at all skill levels. This capability empowers financial institutions to swiftly create and execute workflow connections, significantly reducing the time to market for new services—a critical need as these organizations brace for the transformative impacts of open finance. Recent trends indicate that user adoption rates of ESB open source tools, such as Talend Open Studio, within the finance sector are on the rise, reflecting a growing acknowledgment of its robust capabilities. Financial entities report advancements in their time-to-market for new offerings, with many achieving operational workflows that are not only faster but also more efficient. Notably, Deloitte reveals that 79% of financial organizations have enhanced cross-departmental data sharing initiatives over the past three years, boasting a compound annual growth rate of 24%. This underscores the essential role of tools like Talend in advancing data sharing within financial institutions.

Furthermore, expert insights highlight the efficiency of Talend’s drag-and-drop tools, which streamline the unification process and enhance the user experience. Successful financial projects utilizing Talend for ESB open source have demonstrated the platform’s capability to standardize data ingestion frameworks, leading to enhanced reusability and operational efficiency. As we aim to leverage generative AI for improved customer experience, the connectivity features of Talend become increasingly vital, facilitating the development of advanced chatbots and virtual assistants that enrich customer interactions.

Moreover, we believe it is crucial for financial institutions to integrate their existing legacy systems rather than abandon them. These systems can be seamlessly connected with Talend to foster a robust open financial environment. Adhering to stringent security protocols is equally essential, as open financial systems heighten the risk of security breaches. Talend provides 24/7 live assistance for critical issues alongside various training resources, reinforcing our commitment to customer success and ensuring that developers of all skill levels can effectively harness the platform. As the skill set of banking professionals evolves, the demand for user-friendly connection tools like Talend Open Studio continues to grow, solidifying its position as an indispensable resource for modern banking connectivity strategies.

MuleSoft Anypoint Platform: Robust API Management and Integration

At MuleSoft, we recognize that the Anypoint Platform stands out as a leading solution that seamlessly integrates API management with robust connectivity features. This platform empowers financial institutions to create, manage, and secure APIs, ensuring smooth connectivity between diverse applications and services. By leveraging MuleSoft, we can significantly enhance digital offerings, resulting in improved customer engagement and operational efficiencies.

Furthermore, the MuleSoft Anypoint Platform not only facilitates this transition but also addresses the critical need for solid governance and monitoring in API management, especially in light of existing security challenges. Case studies reveal that financial institutions utilizing MuleSoft have successfully navigated the complexities of API management. For instance, multiple financial institutions have reported enhanced connectivity features and quicker time-to-market for new offerings, demonstrating the platform’s efficiency.

In addition, we observe that generative AI is progressively being employed in financial services, with a notable 60% rise in its use for customer experience, particularly in creating advanced chatbots and virtual assistants. This combination allows financial institutions to optimize operations and improve productivity across various departments.

As the number of active online banking participants continues to rise, MuleSoft’s strong API management features, coupled with the revolutionary effects of generative AI, will be crucial for fostering innovation and efficiency in financial systems. What’s holding your team back from embracing this transformative potential?

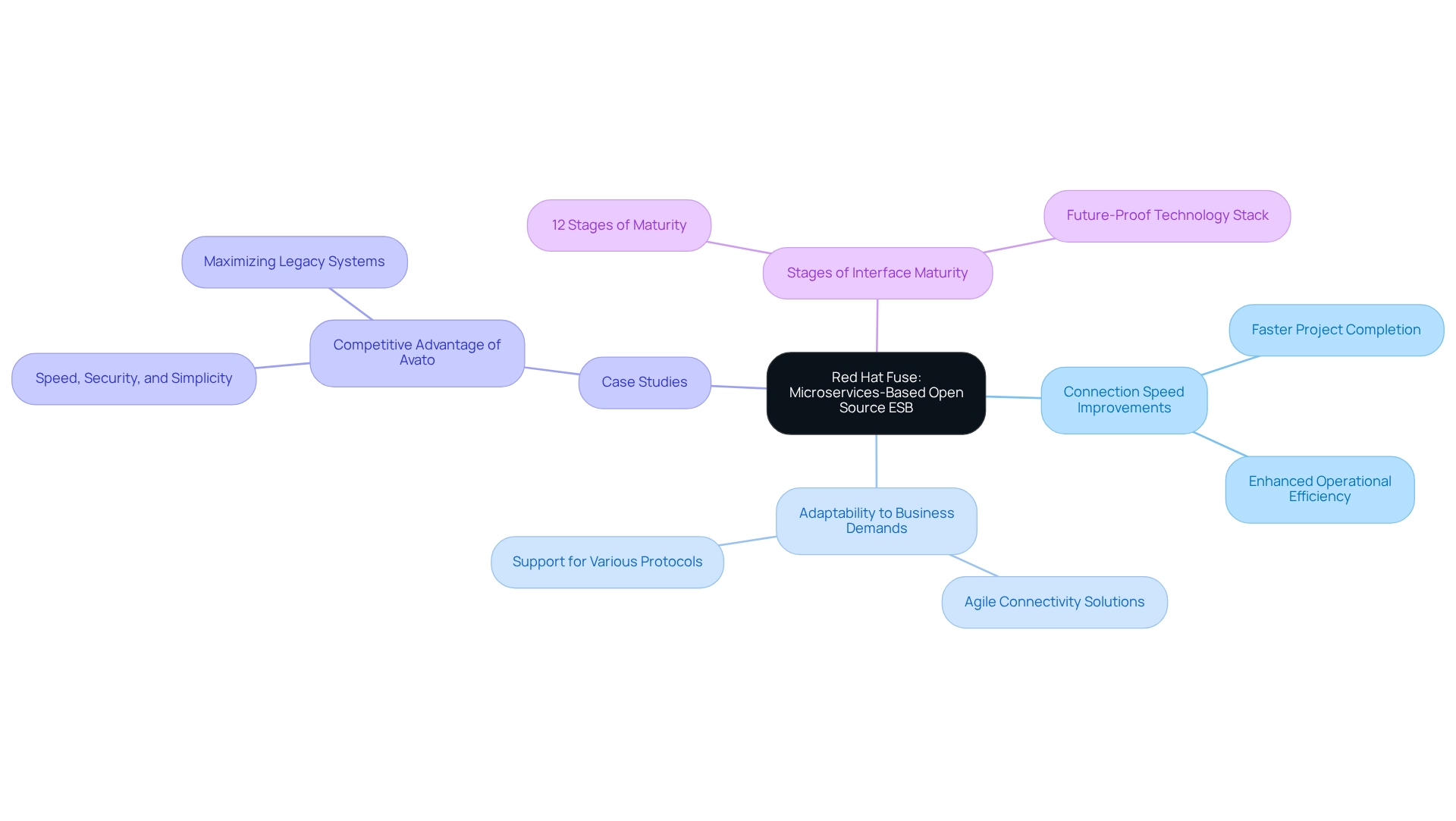

Red Hat Fuse: Microservices-Based Open Source ESB

Red Hat Fuse serves as a pivotal ESB open source that utilizes a microservices architecture to streamline connections across a diverse array of applications. We empower banks to swiftly develop and implement these connections, enabling them to adapt promptly to evolving business demands. By supporting various connection patterns and protocols, Red Hat Fuse allows financial institutions to craft agile and responsive linkage solutions. Recent statistics reveal that organizations utilizing Red Hat Fuse have experienced significant improvements in connection speed, with certain projects reaching completion in a fraction of the time compared to traditional methods. Furthermore, a partnership dedicated to assisting financial institutions in advancing their Open Banking journey underscores the platform’s critical role in today’s financial landscape.

Our hybrid integration platform, built on Red Hat’s JBoss Middleware and complemented by Red Hat premium licenses and support, fortifies these capabilities by providing a robust foundation for secure transactions, particularly within banking, healthcare, and government sectors. Case studies within the financial services sector illustrate how banks have successfully adopted microservices architecture using ESB open source options like Red Hat Fuse, leading to enhanced operational efficiency and cost reductions. For instance, our competitive edge lies in our ability to streamline complex projects, as highlighted by client Gustavo Estrada, who stated, “The firm has simplified complex projects and achieved results within expected time frames and budget limitations.”

Additionally, the platform supports 12 stages of interface maturity, enabling organizations to manage the pace of implementation while ensuring their technology stack remains adaptable for the future. Experts also emphasize our platform’s role in delivering agile connectivity solutions, making it an indispensable tool for financial institutions striving to maintain competitiveness in a rapidly changing market. Additionally, Avato’s commitment to shaping the future of financial mobility through innovation accentuates the importance of robust unification solutions in the evolving banking environment.

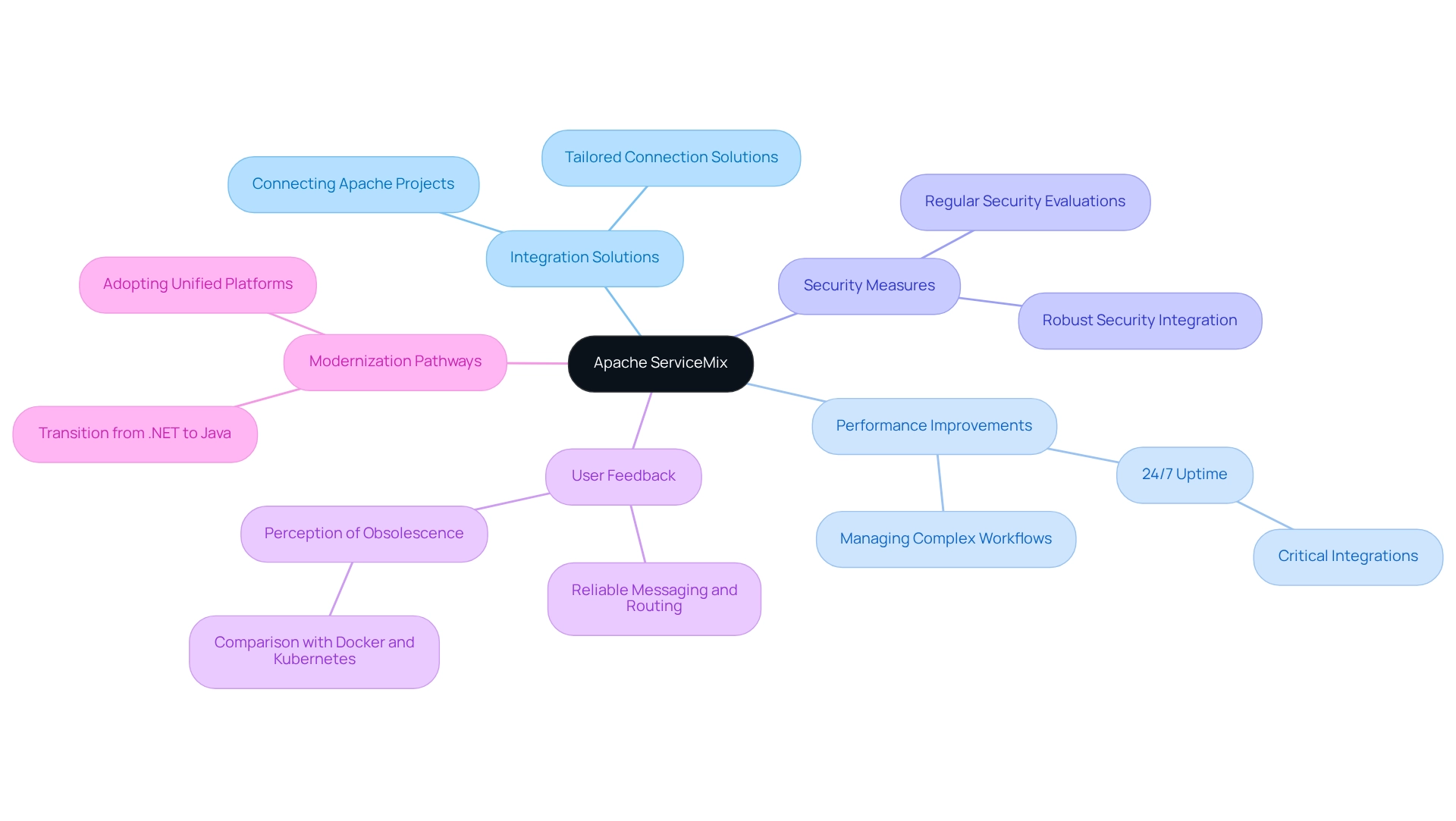

Apache ServiceMix: Flexible Integration for Diverse Enterprise Needs

Apache ServiceMix is a powerful assembly container that is considered an ESB open source solution, connecting various Apache projects, including ActiveMQ and Camel. This versatility allows us to tailor our connection solutions to meet specific operational needs, enabling banks to simplify their connection processes as they prepare for the evolving open financial environment. By leveraging ServiceMix, we can enhance system performance, ensuring that vital connections maintain 24/7 uptime—an essential requirement in the fast-paced financial sector.

Our successful implementation projects in the finance sector have demonstrated ServiceMix’s effectiveness in managing complex workflows and improving data flow between disparate systems. While users report that ServiceMix excels in reliable messaging and routing, it may appear outdated compared to modern technologies like Docker and Kubernetes, which offer enhanced control and flexibility. As one verified user noted, ServiceMix is the “best obsolete legacy stack” until organizations fully transition to contemporary solutions. This highlights the importance of moving from outdated systems to modern unification strategies, especially as open financial services demand stricter security and more effective data sharing.

To comply with stringent security protocols, we must prioritize integrating robust security measures into our ServiceMix implementations. Furthermore, we recommend that financial IT managers conduct regular security evaluations and stay informed about best practices for secure integration.

Apache ServiceMix is frequently recommended for those transitioning from .NET to Java environments, providing a pathway for banks to modernize their connection strategies. This recommendation underscores the platform’s relevance in the financial industry, allowing us to adapt our integration strategies as business requirements evolve.

In summary, Apache ServiceMix provides us with an ESB open source solution that is both flexible and effective for enterprise connectivity, ensuring we can meet the demands of 2025 and beyond while maintaining a competitive edge. By adopting such unified platforms, we can harness the capabilities of generative AI to enhance customer experience and operational effectiveness, ultimately transforming our service delivery.

Jitterbit: Fast and Easy Open Source ESB Integration

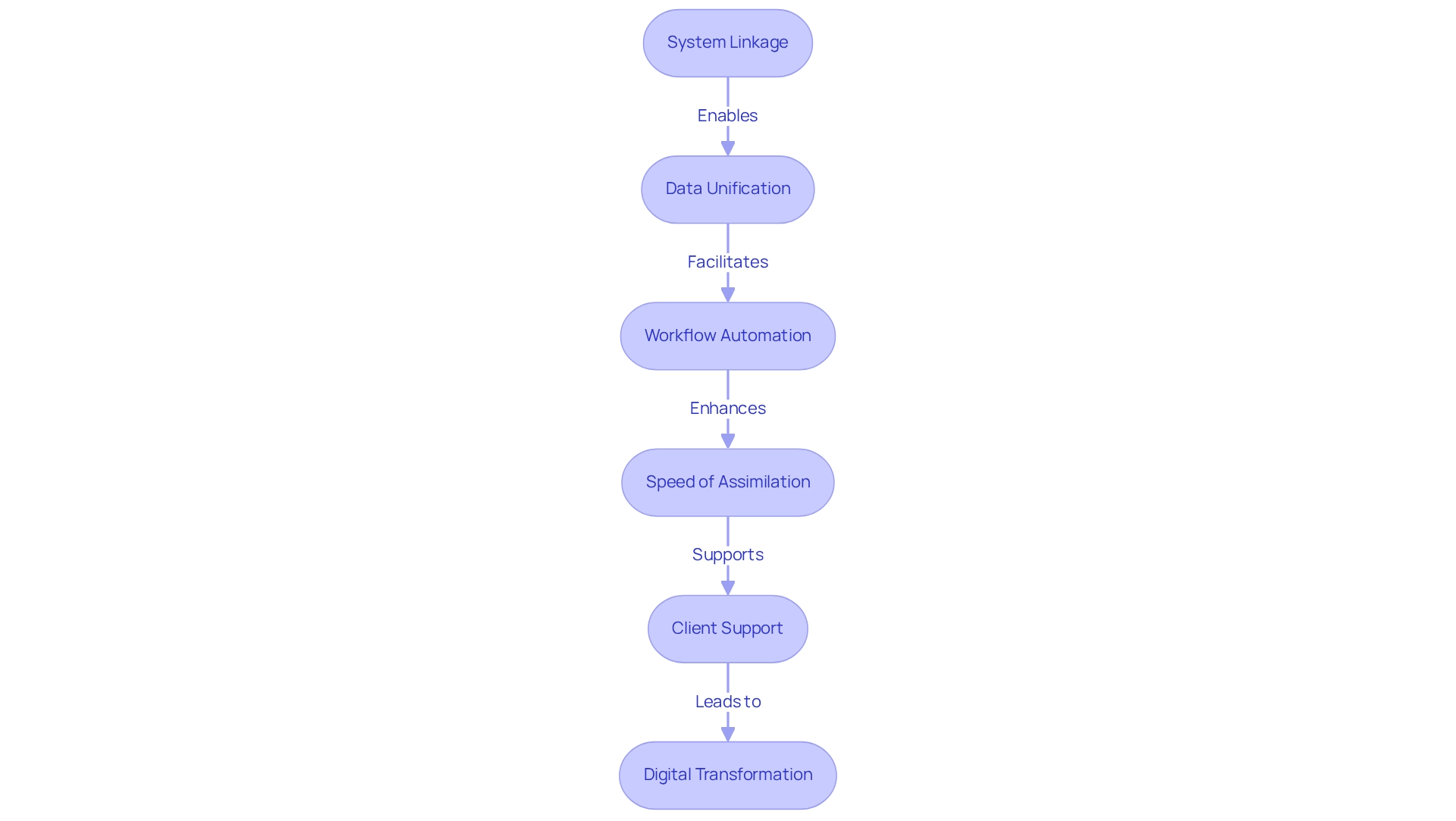

At Avato, we distinguish ourselves as a robust hybrid connection platform, emphasizing secure system linkage that makes us the ideal choice for banking institutions. Our architecture is meticulously designed to expedite the unification of isolated systems and fragmented data, enabling banks to swiftly connect applications and automate workflows. This efficiency significantly reduces the time required for unification projects, resulting in enhanced operational capabilities that allow financial institutions to serve customers faster than ever before.

Recent data reveals that our solution greatly enhances assimilation speed, with numerous financial clients reporting project completion durations decreased by as much as 50%. This acceleration is critical in a sector where timely access to data can directly influence customer satisfaction and operational success.

As we move into 2025, we continue to make headlines with our innovative solutions tailored for the financial sector. Our platform’s support for 12 levels of interface maturity empowers financial institutions to balance the speed of incorporation with the complexity necessary to future-proof their technology framework, further solidifying our position as leaders in financial system connections.

Expert opinions underscore the vital role of speed in banking integration. As Tony LeBlanc from the Provincial Health Services Authority notes, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This reflects the support we offer our clients during their digital transformation journeys. By simplifying application connectivity, we enable financial institutions to infuse intelligence into their processes, ultimately enhancing user satisfaction rates across financial services.

With our unwavering commitment to delivering swift unification solutions, we continue to assist banks in navigating the complexities of digital transformation, ensuring they remain competitive in a rapidly evolving environment.

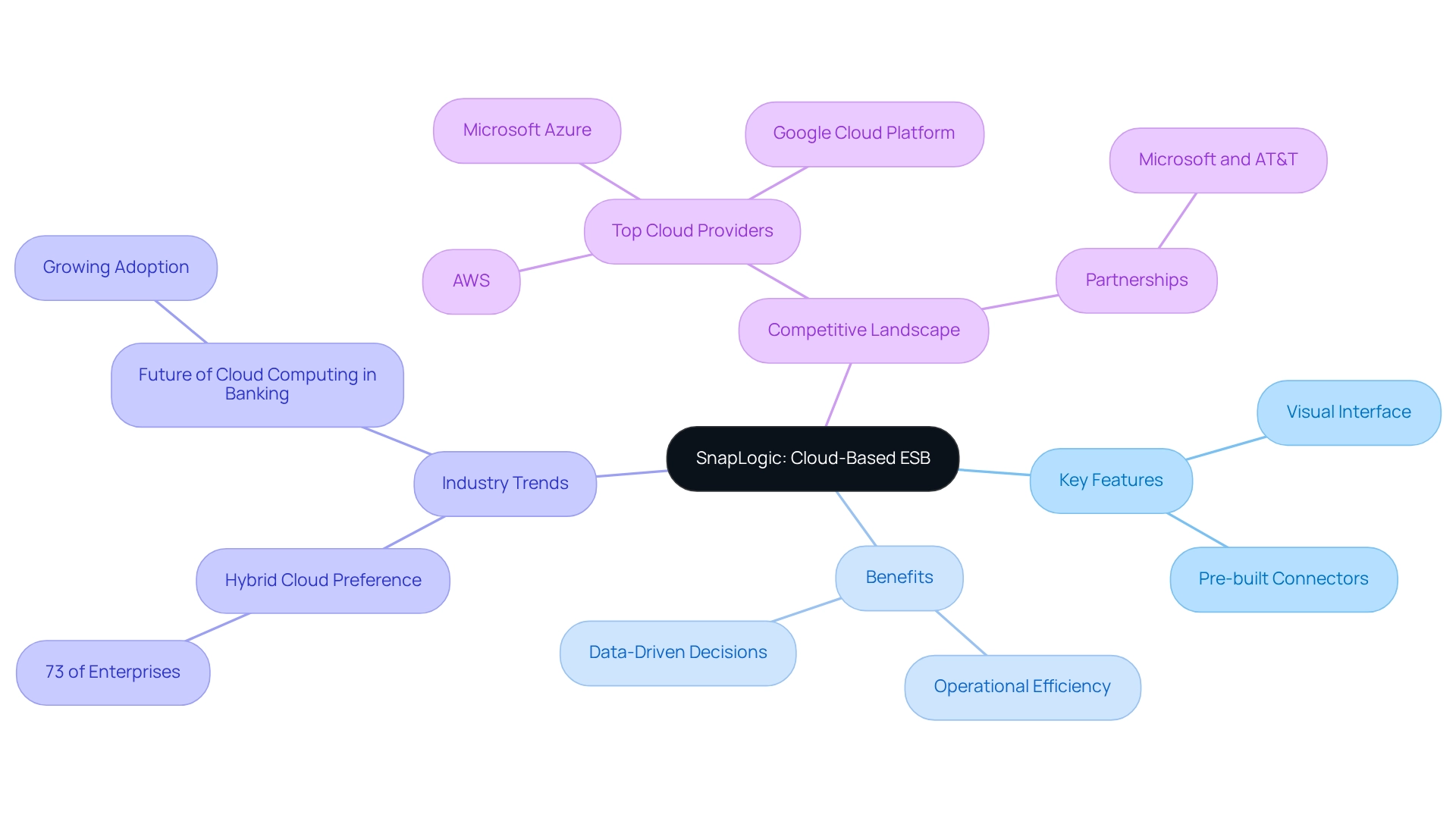

SnapLogic: Cloud-Based Open Source ESB for Simplified Data Integration

We are proud to distinguish ourselves as a cloud-based platform that delivers a comprehensive solution for data unification and application connectivity tailored specifically for the financial sector. Our intuitive visual interface, paired with a robust library of pre-built connectors, empowers financial institutions to streamline their integration processes effectively. This capability is crucial, as 73% of enterprises now prefer hybrid cloud models for their scalability and security advantages, especially when preparing for open financial services.

By leveraging SnapLogic, our partners in the financial sector can significantly enhance their data-driven decision-making, leading to improved operational efficiency. Our platform facilitates seamless connections between disparate systems and data sources, enabling institutions to respond swiftly to market changes and customer needs. As financial institutions increasingly adopt cloud-based connectivity platforms, they are witnessing substantial improvements in efficiency and customer service—elements vital for navigating the complexities of open banking through esb open source.

Case studies reveal that banks utilizing SnapLogic have achieved remarkable outcomes, including reduced connection times and enhanced operational resilience. The ongoing shift to cloud solutions is not merely a trend; it is a strategic imperative for financial institutions striving to maintain a competitive edge in a rapidly evolving landscape. As Gustavo Estrada aptly noted, “Avato has the capability to streamline intricate projects and produce outcomes within preferred timelines and financial limitations,” underscoring the importance of efficient unification solutions in modernizing and enhancing customer experience.

Furthermore, the future of cloud computing in the financial sector looks promising, with an increasing number of institutions recognizing the necessity of adopting cloud solutions to stay competitive. Our commitment to streamlining data connections is evident, positioning SnapLogic as an indispensable resource for banks aiming to modernize their operations and drive innovation. In a competitive landscape featuring leading cloud service providers such as AWS, Microsoft Azure, and Google Cloud Platform, our unique offerings establish us as the preferred choice for banking IT managers seeking robust connectivity solutions that align with the transformative impact of AI on financial services.

Apache Camel: Versatile Open Source Integration Framework for ESB

Apache Camel stands out as a robust framework for connecting systems, recognized as an ESB open source solution that offers a rich array of tools tailored for crafting effective solutions. Its extensive support for diverse enterprise connection patterns enables financial institutions to navigate complex merging scenarios effortlessly. In 2025, we believe that financial organizations utilizing Apache Camel can greatly improve their connection capabilities, streamline operations, and elevate service delivery.

Recent trends suggest that financial institutions are progressively embracing adaptable connection frameworks to satisfy the needs of a swiftly changing economic environment. With eight Canadian banks dedicated to the Net-Zero Banking Alliance, the need for effective and sustainable incorporation solutions has never been more essential. We recognize that Apache Camel’s flexibility enables these institutions to adopt innovative connection strategies that align with their sustainability objectives, such as optimizing resource use and reducing operational expenses.

Our company, established by a team of committed enterprise architects, demonstrates how organizations can streamline diverse systems and improve business value. By unlocking isolated assets, we enable banks to future-proof their operations through seamless data and system unification, ensuring they stay competitive in an AI-driven world. Our commitment to architecting technology foundations is rooted in our foundational values of dedication and innovation.

Expert views emphasize the significance of adopting agile connectivity frameworks. As Jodi Neiding, Vice President of the Americas Banking Portfolio, notes, “Those that hesitate risk falling behind in an increasingly AI-driven world.” This sentiment resonates strongly within the financial industry, where timely and effective incorporation is essential for maintaining a competitive advantage. By utilizing the ESB open source framework Apache Camel, we can ensure that financial institutions remain at the forefront of technological advancements and operational efficiency.

Particular case studies emphasize Apache Camel’s use in financial sector connections, demonstrating its efficiency in improving customer experience through generative AI applications, such as advanced chatbots and document processing, within the ESB open source environment. The positive feedback from industry leaders reinforces Apache Camel’s role as an ESB open source solution in delivering timely and budget-friendly options, making it an invaluable asset for banks aiming to modernize their operations.

As the financial services landscape continues to evolve, we assert that the versatility of Apache Camel in banking integration will play a pivotal role in shaping the future of enterprise integration patterns, ensuring that institutions can adapt to changing demands while enhancing operational efficiency.

Conclusion

The landscape of integration solutions for banking institutions is undergoing a transformative shift where agility, efficiency, and security are paramount. We recognize that platforms like Avato and Apache Kafka have emerged as leaders in hybrid and event-driven architectures, enabling banks to bridge legacy systems with modern applications while enhancing real-time data processing capabilities. As financial institutions strive for seamless connectivity and improved customer experiences, we cannot overstate the importance of robust integration solutions.

Furthermore, tools such as MuleSoft, Talend, and Red Hat Fuse offer unique features that cater to the diverse needs of banks, from API management to user-friendly interfaces for developers. These platforms not only facilitate rapid deployment but also support the shift towards open banking, ensuring compliance and security in an increasingly complex financial environment. The future of banking integration is undoubtedly tied to the effective utilization of these technologies, which empower institutions to adapt to market changes and enhance operational efficiency.

In conclusion, we see that the integration landscape for banking is being reshaped by innovative solutions that prioritize speed, security, and scalability. As banks continue to embrace these integration platforms, they position themselves not only to meet current demands but also to thrive in a competitive and evolving market. Our commitment to leveraging advanced integration strategies will ultimately define the success of financial institutions in enhancing customer engagement and operational excellence, paving the way for a more connected and responsive banking experience.