Overview

Legacy systems continue to dominate banking operations, largely due to substantial historical investments, regulatory compliance requirements, and the intricate nature of financial processes that complicate replacement efforts. We recognize that these systems provide reliability and stability, having been meticulously refined over decades. However, we must also acknowledge the inherent risks and operational inefficiencies tied to their prolonged use. This illustrates the challenging equilibrium that banks must navigate between modernization and the necessity of maintaining essential functions.

What’s holding your team back from embracing a more efficient future?

Introduction

In the banking sector, the persistence of legacy systems presents both significant challenges and unique opportunities. As we navigate the complexities of modernization, we must address a landscape shaped by historical investments, regulatory demands, and the intricate mechanics of financial operations. While these aging systems provide stability and encapsulate valuable institutional knowledge, they also introduce substantial risks, particularly in cybersecurity and compliance. As we strive to enhance operational efficiency and meet the evolving expectations of our customers, innovative solutions like Avato’s hybrid integration platform emerge as essential tools for bridging the gap between legacy and modern technologies.

We invite you to explore the factors driving our reliance on legacy systems, the advantages they offer, the challenges they present, and the strategic considerations necessary for successful modernization.

Understanding the Persistence of Legacy Systems in Banking

Understanding the Persistence of Legacy Systems in Banking

Legacy systems in banking endure due to a confluence of historical investments, regulatory compliance, and the intricate nature of financial operations. Many financial institutions made substantial investments in these platforms, originally designed to handle essential banking operations like transaction processing and customer account oversight. As these structures became deeply integrated into the operational framework of financial institutions, replacing them without causing considerable disruption has become increasingly challenging.

At Avato, we recognize the complexities surrounding these challenges. Our hybrid integration platform offers a dedicated approach, enabling banks to unlock isolated assets and enhance operational efficiency. Regulatory adherence plays a crucial role in the endurance of outdated infrastructures. These systems have been meticulously customized over decades to meet specific compliance standards, rendering them indispensable for many institutions. The fear of operational risk, combined with the potential for service interruptions, further solidifies the reliance on these outdated technologies. In fact, as of 2025, approximately 75% of financial institutions will struggle with adopting new digital solutions due to their outdated infrastructure.

Expert opinions emphasize that historical investments in these frameworks create a cycle of reliance that is difficult to escape. For instance, many financial institutions continue to maintain outdated systems, raising the question: why are legacy systems still in use? This reliance is not only for operational continuity but also to comply with regulatory requirements. Case studies illustrate that banks have faced negative impacts on employee experience due to outdated software, with over 50% of employees expressing dissatisfaction linked to their tools. Such dissatisfaction can lead to increased turnover costs, as frustrated employees may seek opportunities elsewhere. A notable case study reveals that legacy software adversely affects employee performance and productivity, hindering companies’ competitiveness.

Moreover, the elevated ownership expenses associated with on-premise software hosting, including administrative costs and maintenance, complicate the transition to more flexible solutions. Despite these challenges, it is noteworthy that 32% of financial institutions have successfully integrated artificial intelligence into their core infrastructures, demonstrating that modernization is achievable, albeit complex. Our hybrid integration platform exemplifies a dedicated approach to simplifying these transitions, enabling banks to unlock isolated assets and enhance operational efficiency.

Ultimately, while traditional platforms pose significant obstacles, the banking sector must navigate these challenges to enhance operational efficiency and meet evolving customer expectations. As one specialist aptly noted, ‘business results should always be prioritized, not frameworks – contemporary or outdated.’ This perspective underscores the necessity for financial institutions to focus on achieving business objectives while managing their legacy infrastructure. At Avato, we are prepared to assist in this journey with innovative integration solutions.

Advantages of Legacy Systems for Banking Operations

The enduring relevance of legacy infrastructures prompts us to consider: why do financial institutions continue to rely on these systems? Primarily, they offer exceptional stability and reliability, having been rigorously tested over many years in real-world scenarios. Numerous financial organizations depend on these frameworks for essential functions, consistently demonstrating their ability to handle high transaction volumes with minimal downtime. Financial institutions utilizing outdated frameworks report reliability metrics often exceeding 99.9%, underscoring their robustness in vital financial operations.

Furthermore, outdated frameworks encapsulate a wealth of organizational knowledge, preserving business rules and processes that have evolved over time. This institutional memory is invaluable for informed decision-making and ensuring operational continuity. While the prospect of adopting new technologies may seem daunting due to the associated costs of training, process integration, and potential service disruptions, we must ask: why are legacy systems still in use despite the immediate benefits of modernization? Therefore, conducting a thorough risk evaluation is essential to navigate the complexities of such transitions effectively.

Avato, committed to streamlining intricate amalgamations, plays a pivotal role in this context, enabling banks to enhance and extend the value of their legacy frameworks. By simplifying complex integrations, we empower financial institutions to seamlessly connect new technologies with existing assets. The Avato Hybrid Integration Platform offers functionalities such as real-time monitoring and performance alerts, significantly reducing costs and enhancing operational efficiency. Industry experts emphasize that the advantages of traditional frameworks extend beyond mere operational efficiency. Bharat Kulkarni highlights that modernization must align with the evolving expectations of customers and regulatory bodies, marking it as a critical step for the future of banking.

Case studies illustrate how financial institutions have effectively integrated new modules with older architectures, exemplified by the facade pattern that links a new loan management module with an antiquated core banking framework. This approach facilitates smooth interactions without altering the existing infrastructure, reinforcing the benefits of preserving these frameworks. Ultimately, while the challenges of modernization are substantial, the stability and dependability of older frameworks raise the question: why are legacy systems still in use within the banking sector? They continue to provide a robust foundation for financial operations. With our expertise, we guide financial institutions through these complexities, enhancing their operational capabilities while safeguarding the value of their existing frameworks.

Challenges and Risks of Continuing Legacy System Use

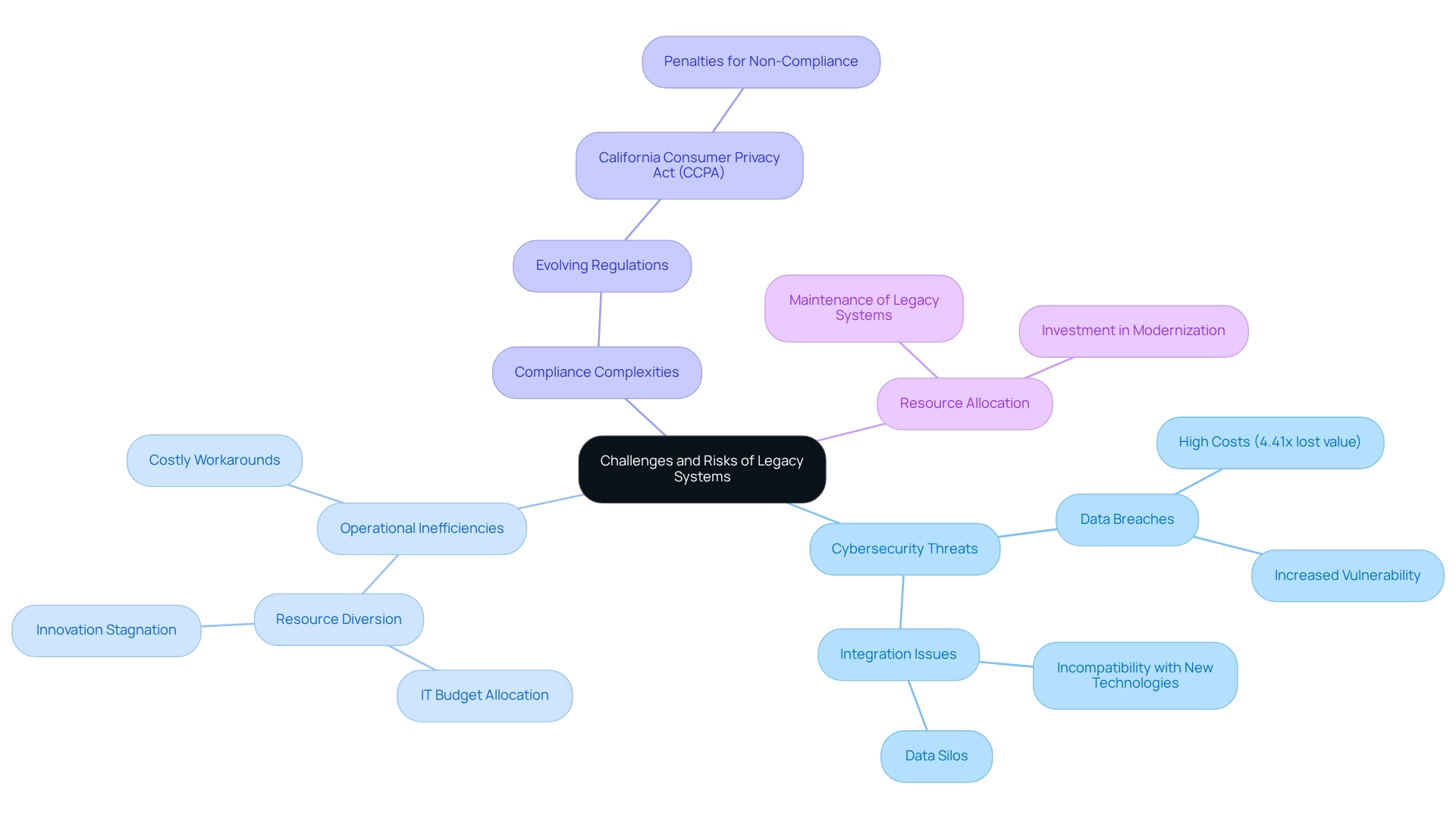

Relying on outdated technologies presents significant challenges and risks for banks, prompting us to question why legacy systems remain in use—especially in the realm of cybersecurity. The susceptibility of many legacy frameworks to breaches and attacks raises alarms about their continued presence, as these systems were not designed to withstand contemporary security threats. As technology evolves, older infrastructures often struggle to integrate with newer applications, leading us to ponder why legacy systems persist, resulting in data silos and operational inefficiencies. This challenge of unification compels us to consider why legacy systems are still in use, particularly as financial institutions allocate a substantial portion of their IT budgets to maintain these platforms, diverting resources from innovation and modernization efforts.

Moreover, compliance with regulations becomes increasingly complex, leading us to ask why legacy systems are still utilized as laws and standards evolve. Banks may find themselves resorting to costly patches or workarounds to satisfy new requirements, further taxing their resources. For instance, the California Consumer Privacy Act (CCPA) imposes significant penalties for non-compliance, reinforcing the question of why legacy systems are still in operation, given the financial risks associated with outdated technology.

The alarming statistics surrounding cybersecurity threats linked to legacy infrastructures underscore the inquiry about why legacy systems continue to be employed. Data breaches in these environments can lead to costs as high as 4.41 times the lost transaction value, factoring in fines, fees, and investigative expenses. As central financial authorities acknowledge cybersecurity as a paramount concern—78.9% of surveyed entities identify it as a major challenge—it becomes imperative to question why legacy systems are still in place within financial institutions, highlighting the urgent need to modernize their frameworks.

At Avato, founded by a dedicated team of enterprise architects, we offer a hybrid connectivity platform that supports 12 levels of interface maturity, enabling financial organizations to navigate these connectivity challenges effectively. By ensuring round-the-clock availability for critical connections, we emphasize the importance of reliability in modern banking systems. A prime example of our impact is our collaboration with Coast Capital, where the integration of various interfaces facilitated significant transitions with minimal downtime, illustrating how contemporary solutions can enhance operations and boost customer satisfaction.

In conclusion, financial institutions worldwide must take decisive action to strengthen their cyber defenses, achieve cyber resilience, and understand why legacy systems are still in use amid a rapidly evolving cybersecurity landscape. The pressing need for banks to modernize their infrastructure leads to the inquiry of why legacy systems persist, while solutions like Avato can streamline complex projects and deliver results within desired timelines and budgetary constraints.

Strategic Considerations for Legacy System Modernization

Updating outdated frameworks necessitates a strategic method that aligns risk management with the imperative for innovation. We begin this process by conducting a thorough evaluation of our current infrastructures to pinpoint essential functionalities and identify areas primed for improvement. Collaborating with solution providers like Avato enables us to formulate a comprehensive modernization plan that aligns with our institutional goals and addresses customer needs.

A phased modernization approach is particularly effective in mitigating risks, allowing us to transition gradually to new technologies while ensuring operational continuity. Avato’s hybrid connection platform exemplifies this strategy, facilitating the integration of cloud-based solutions and APIs with traditional frameworks, thereby enhancing our capabilities without necessitating a complete overhaul.

Moreover, investing in training and change management is vital to equip our personnel with the skills required to navigate new technologies and processes effectively. Mobilizing stakeholders early in the process and modeling new business processes are critical steps that ensure alignment with our overarching business goals and customer needs. Notably, 59% of banking leaders have recognized outdated infrastructure as a primary challenge, raising the question: why are legacy systems still in use? This underscores the urgency of addressing them. Avato’s solutions are designed to tackle this challenge directly, guaranteeing 24/7 uptime for essential integrations and allowing us to modernize with confidence.

Successful case studies, such as Avato’s collaboration with Coast Capital, illustrate how strategic modernization can lead to enhanced fraud mitigation and improved consumer experiences. As John Johnstone observed, Avato simplifies complex projects and delivers results within desired time frames and budget constraints. By adopting a phased approach, we can achieve higher success rates in our modernization initiatives, ensuring we remain competitive in an evolving landscape.

Conclusion

The banking sector’s reliance on legacy systems presents a complex landscape of both advantages and challenges. While these systems offer unparalleled stability and encapsulate invaluable institutional knowledge, they also pose significant risks, particularly in terms of cybersecurity and regulatory compliance. What’s holding your team back? The persistent use of outdated technologies can hinder innovation and operational efficiency, making it imperative for us to address these concerns proactively.

At Avato, we recognize that our hybrid integration platform emerges as a vital solution, facilitating a seamless transition between legacy and modern systems. By enabling banks to integrate new technologies without sacrificing the reliability of existing infrastructures, we empower financial institutions to enhance their operational capabilities while mitigating risks. This approach allows for a more strategic modernization process, underscoring the importance of aligning technological advancements with evolving customer expectations.

Ultimately, the journey toward modernization is essential for banks to remain competitive in a rapidly changing financial landscape. By embracing innovative solutions and adopting a phased approach to modernization, we can not only preserve the value of legacy systems but also pave the way for a more efficient and secure future. The time for action is now; the benefits of modernization extend beyond mere operational improvements to encompass enhanced customer experiences and long-term sustainability.