Overview

In today’s rapidly evolving financial landscape, migrating to the ISO 20022 standard is not just a choice; it is a necessity for organizations aiming to stay competitive. We understand that this transition can seem daunting, but with the right approach, it can be a smooth and successful journey.

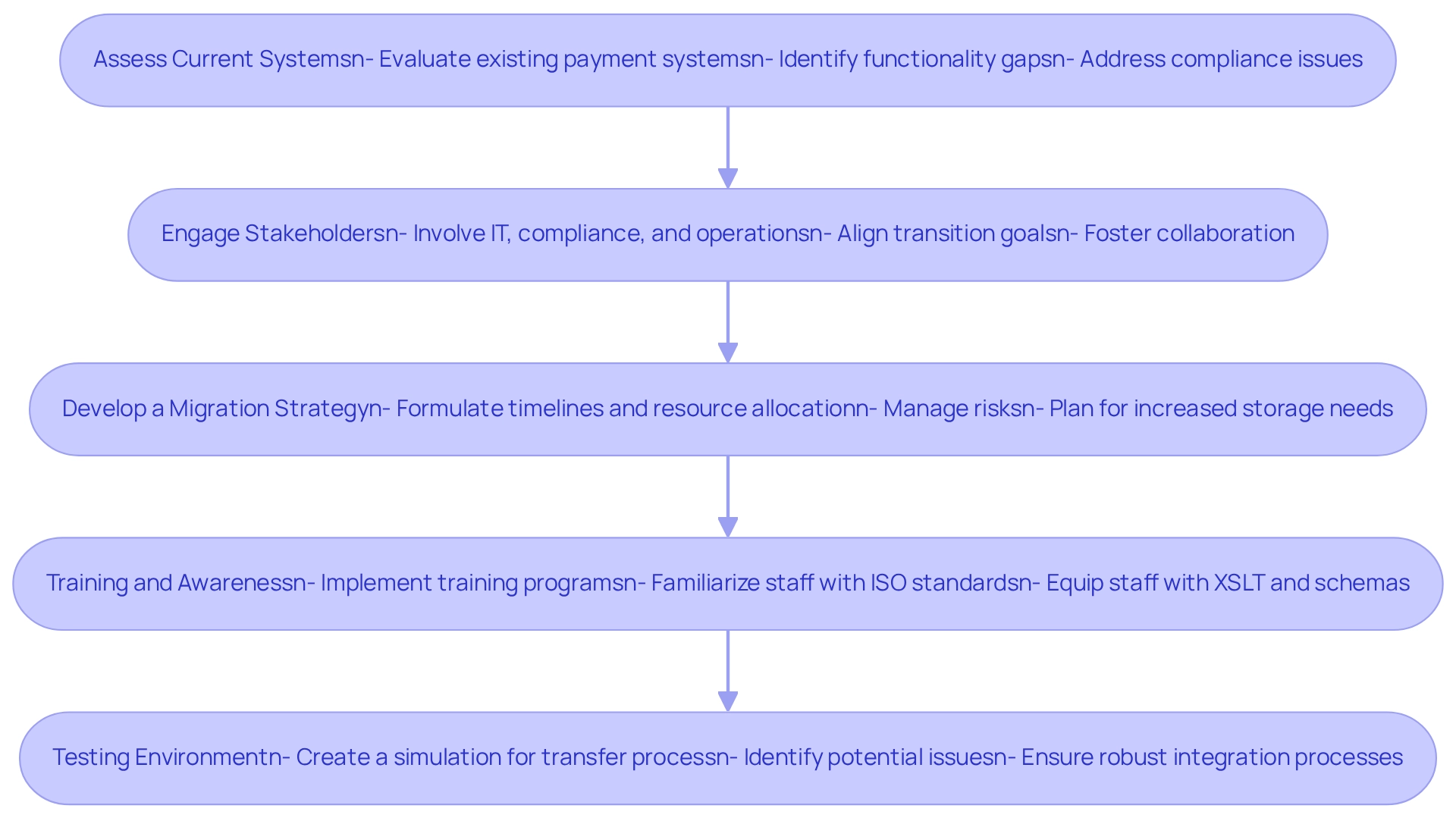

Our article, “ISO Migration: Essential Steps for a Smooth Transition,” outlines a structured methodology that we believe will empower your organization. We emphasize the importance of:

- Assessing current systems

- Engaging stakeholders

- Developing a comprehensive migration strategy

- Providing necessary training

- Executing the migration process with precision

Thorough preparation and strategic planning are paramount to overcoming challenges and ensuring compliance throughout the transition. By following these essential steps, we can help you navigate this complex process with confidence and clarity.

Introduction

In the ever-evolving landscape of financial services, we recognize that the shift towards ISO 20022 represents a pivotal transformation in the way institutions communicate and process transactions. This international messaging standard not only promises to enhance data quality and promote interoperability but also aims to future-proof our banking operations.

However, as we approach the 2025 compliance deadline, many organizations grapple with the complexities of migration. Understanding the key concepts and preparing adequately for this transition is not just advisable; it is imperative.

In this article, we will delve into the essentials of ISO 20022, outlining the critical steps for successful migration, the common challenges encountered during the process, and the transformative potential this standard holds for the future of financial communication.

Understand ISO 20022: Key Concepts and Benefits

ISO represents a transformative global messaging standard that revolutionizes communication among financial institutions by allowing for more detailed information in payment messages. This enhancement not only significantly improves processing efficiency but also minimizes errors. We recognize the key benefits of adopting ISO 20022, which include:

- Enhanced Data Quality: By supporting structured data, ISO 20022 facilitates better compliance and reporting, crucial for regulatory adherence. As Tagai highlights, “Crucially, he aims to illuminate the beacon under the banner of information quality!”

- Interoperability: The standard promotes seamless communication between diverse systems and institutions, fostering collaboration and efficiency across the financial ecosystem. This interoperability is essential for us to integrate with various platforms and technologies, ensuring a smoother transition and enhanced operational capabilities.

- Future-Proofing: As our sector embraces digital transformation, adopting the ISO standard equips us to effectively leverage emerging technologies, ensuring we remain competitive. Avato’s hybrid integration platform, with its 12 levels of interface maturity, supports this transition by unlocking data and systems in weeks, not months. This allows us to balance speed with the sophistication required to future-proof our technology stack.

A 2023 study revealed that only 63% of institutions are likely to meet the 2025 deadline for ISO compliance, emphasizing the urgency for us to take action. ISO migration is not merely a compliance effort; it creates opportunities for innovation and the adoption of advanced technology solutions. For instance, banks that have migrated report operational efficiencies, faster time to market, and reduced costs as a direct result of improved infrastructure.

Expert insights underscore the significance of data quality in this transition, with industry leaders promoting a focus on interoperability to enhance the advantages of ISO. As we prepare for this transition, understanding these concepts is essential, as they highlight the strategic benefits of embracing this standard in the evolving landscape of banking and finance. Our commitment to architecting the technology foundation necessary for rich, connected customer experiences further enhances the potential for successful digital transformation and system integration.

Prepare for Migration: Essential Prerequisites

To ensure a successful migration to ISO 20022, we must undertake essential preparatory steps that lay a strong foundation for this transition:

- Assess Current Systems: We begin by conducting a thorough evaluation of our existing payment systems to identify functionality gaps and compliance issues with ISO standards. This evaluation is crucial, as many financial organizations have not fully modernized their core systems, limiting their ability to utilize information effectively. A case study titled “Challenges in ISO 20022 Adoption” reveals that this disparity hinders our industry from fully unlocking the benefits of ISO 20022, highlighting the need for continued investment in internal systems by payment service providers and corporates. By leveraging XSLT, we can streamline the transformation of XML data structures, significantly reducing labor in this assessment phase while minimizing programming errors through its robust data manipulation capabilities.

- Engage Stakeholders: Next, we actively involve key stakeholders from IT, compliance, and operations early in the process. Effective stakeholder engagement is vital for aligning our transition goals and fostering collaboration across departments. Statistics indicate that projects with strong stakeholder involvement are significantly more likely to succeed, with a reported success rate increase of up to 70%. Employing process modeling methods can assist us in visualizing current and desired conditions, ensuring all stakeholders are aligned and contributing to our overall transition strategy.

- Develop a Migration Strategy: We must formulate a comprehensive migration strategy that details timelines, resource allocation, and risk management approaches. This strategic plan should also account for the increased storage needs for messages related to ISO migration, requiring new archiving concepts. As Cleland observed, we should not view ISO migration merely as a regulatory necessity but as a transformative opportunity for the payments ecosystem. Incorporating schemas into this strategy can help us catch programming errors early, leading to significant cost savings and enhancing data integrity.

- Training and Awareness: Implementing training programs for our staff is essential to familiarize them with ISO standards and the migration process. Ensuring that all team members are informed and prepared will facilitate a smoother transition. Joanna Forman, Senior Manager at Ernst & Young LLP, emphasizes that banks must understand the impact ISO 20022 will have on their individual and corporate clients, making training indispensable. Our training should also include the use of XSLT and schemas to improve information management practices, ensuring that staff are equipped to utilize these tools effectively.

- Testing Environment: Finally, we create a testing environment to simulate the transfer process. This allows us to identify potential issues and address them before the live implementation, minimizing disruptions. Testing should include scenarios that utilize XSLT for data transformation to ensure that our integration processes are robust and error-free.

By adhering to these procedures, we can establish a strong basis for our ISO migration, ensuring compliance and operational effectiveness while unleashing the transformative potential of this new standard.

Execute the Migration: Step-by-Step Process

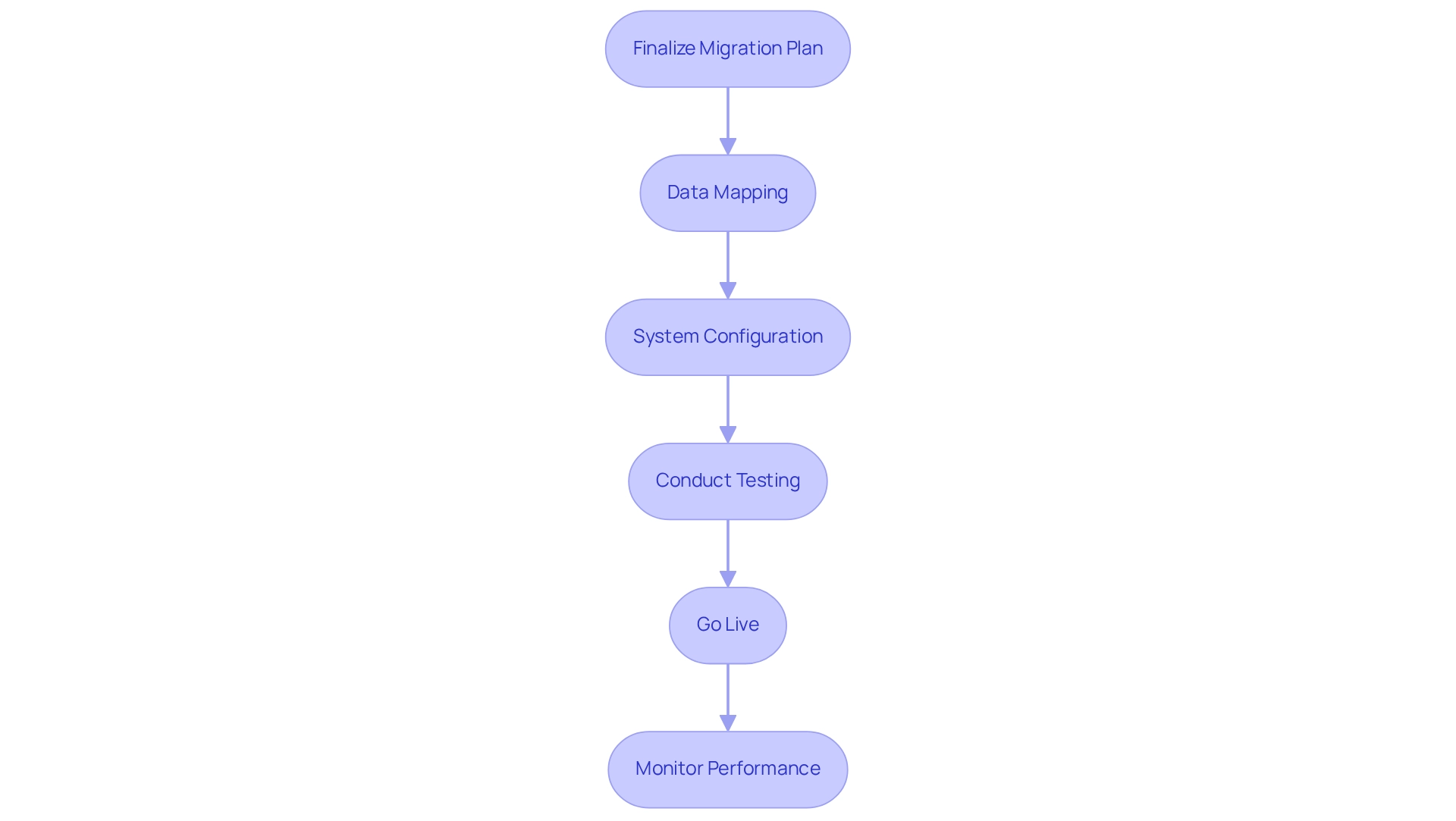

To successfully execute the migration to ISO 20022, we must adhere to the following steps:

- Finalize Migration Plan: We begin by reviewing and solidifying our migration strategy established during the preparation phase, ensuring all stakeholders are aligned.

- Data Mapping: Next, we carefully map existing data fields to the new ISO format, addressing compatibility issues to facilitate a smooth transition.

- System Configuration: We update and configure our systems to support ISO 20022 messaging, which may involve necessary software upgrades and adjustments. Our hybrid integration platform simplifies this process, enabling seamless integration of disparate systems and ensuring our technology stack is future-proofed.

- Conduct Testing: We engage in comprehensive testing of the new system using sample transactions to identify and rectify any potential issues before full implementation. With our robust architecture, we ensure secure transactions and maintain operational continuity throughout this phase.

- Go Live: We execute the transfer in a phased approach, starting with less critical systems to reduce risks linked to the transition. Our platform supports 24/7 uptime, making it ideal for integration projects where reliability is paramount.

- Monitor Performance: After the transition, we closely observe system performance and transaction processing to swiftly address any emerging issues, ensuring operational continuity. Our solution enhances operational visibility, allowing for effective issue resolution and ongoing optimization of our systems.

By adhering to these steps, we can effectively manage the complexities of ISO migration, positioning ourselves to take advantage of the improved analytics and customer offerings that the new standard delivers. As Ruslan Valis, VP of Engineering at DashDevs, notes, “The optimal time to start implementing this standard is NOW,” highlighting the urgency of this transition. This process not only streamlines operations but also enriches analytics capabilities, making it a crucial step for banks aiming to enhance their customer offerings. Successful case studies have demonstrated that organizations adopting this transition can achieve significant enhancements in efficiency and project outcomes.

Troubleshoot Common Issues During Migration

As organizations transition to ISO format, they often encounter common obstacles that can impede progress. Information incompatibility is a significant challenge; legacy formats must be meticulously mapped to ISO 20022 standards. We can streamline this process by utilizing XSLT, which transforms XML data structures efficiently, reducing the potential for errors and saving costs associated with manual data handling. Conducting thorough testing is essential to identify and rectify discrepancies early in the process.

System downtime is another critical concern. To minimize operational disruption, we recommend scheduling transfers during off-peak hours. Additionally, having a rollback plan is crucial to address any critical failures that may arise.

Stakeholder resistance can also pose a challenge. Gaining buy-in from all stakeholders is vital. We engage stakeholders efficiently and articulate the advantages of ISO to reduce opposition and promote a cooperative atmosphere. Engaging stakeholders early in the process ensures that their requirements are accurately captured, leading to a smoother transition.

Training gaps must be addressed as well. Ongoing training and support are necessary to bridge knowledge gaps among staff, ensuring that team members are well-equipped to navigate the new system effectively. Implementing structured training programs facilitates change management and enhances staff confidence in using the new integration platform.

Lastly, regulatory compliance is imperative. Regular consultations with compliance teams ensure that all transition aspects adhere to regulatory requirements, thereby avoiding potential pitfalls. This is particularly important in the context of our hybrid integration solutions, which prioritize regulatory compliance and security audits. By proactively addressing these challenges, we can significantly improve our chances of a successful ISO migration, ensuring operational integrity and compliance throughout the transition. For instance, our successful integration project with BC Provincial Health Services Authority exemplifies how effective planning and execution can lead to swift achievement of integration goals, even in highly regulated environments.

Conclusion

The transition to ISO 20022 represents a pivotal moment for financial institutions, offering not only enhanced data quality and interoperability but also the ability to future-proof our banking operations. The key benefits of adopting this international messaging standard extend far beyond mere compliance; they pave the way for innovation and operational efficiencies that can fundamentally transform the financial landscape. We cannot overstate the urgency of meeting the 2025 compliance deadline, as only a fraction of institutions are currently on track to achieve this milestone.

Successful migration necessitates a structured approach, which begins with a thorough assessment of our existing systems and the engagement of relevant stakeholders. Developing a comprehensive migration strategy, combined with robust training and a testing environment, lays the groundwork for a seamless transition. The execution phase, characterized by careful data mapping, system configuration, and rigorous testing, is where we can truly capitalize on the advantages of ISO 20022.

Despite the challenges that may arise during migration—such as data incompatibility and stakeholder resistance—we can mitigate these issues through proactive planning and effective communication. By addressing these common hurdles and fostering a culture of collaboration and continuous learning, we can ensure compliance while unlocking the full potential of ISO 20022. As the financial services industry continues to evolve, embracing this standard is not merely a necessity; it is a strategic imperative that will shape the future of our financial communication and operations.