Overview

We focus on how to effectively master REST Connect for secure banking integrations, emphasizing key principles and best practices that enhance security and operational efficiency.

In today’s digital landscape, what’s holding your team back from achieving robust and compliant financial systems?

We detail essential concepts such as:

- Statelessness

- Resource representation

- Secure configuration practices like HTTPS and OAuth 2.0

These elements are vital for maintaining the integrity of your financial operations. By adopting these practices, we can ensure a seamless integration experience that not only meets compliance standards but also drives operational excellence.

Let’s take the next step together towards a more secure banking future.

Introduction

In the rapidly evolving landscape of financial technology, we recognize that understanding the fundamentals of REST Connect is essential for banks striving to secure their integrations and enhance operational efficiency. As the industry shifts towards open banking, the principles of Representational State Transfer (REST) provide a robust framework for communication between clients and servers, enabling us to navigate the complexities of modern digital transformations. By mastering statelessness and leveraging resource representation, we empower financial institutions to optimize their systems while ensuring compliance with stringent security standards.

This article delves into the intricacies of REST Connect, offering valuable insights into:

- Configuration best practices

- Monitoring strategies

- The pivotal role of platforms like Avato in driving successful banking integrations

What’s holding your team back from embracing these advancements? Let us guide you through the process of enhancing your operational capabilities.

Understand REST Connect Fundamentals

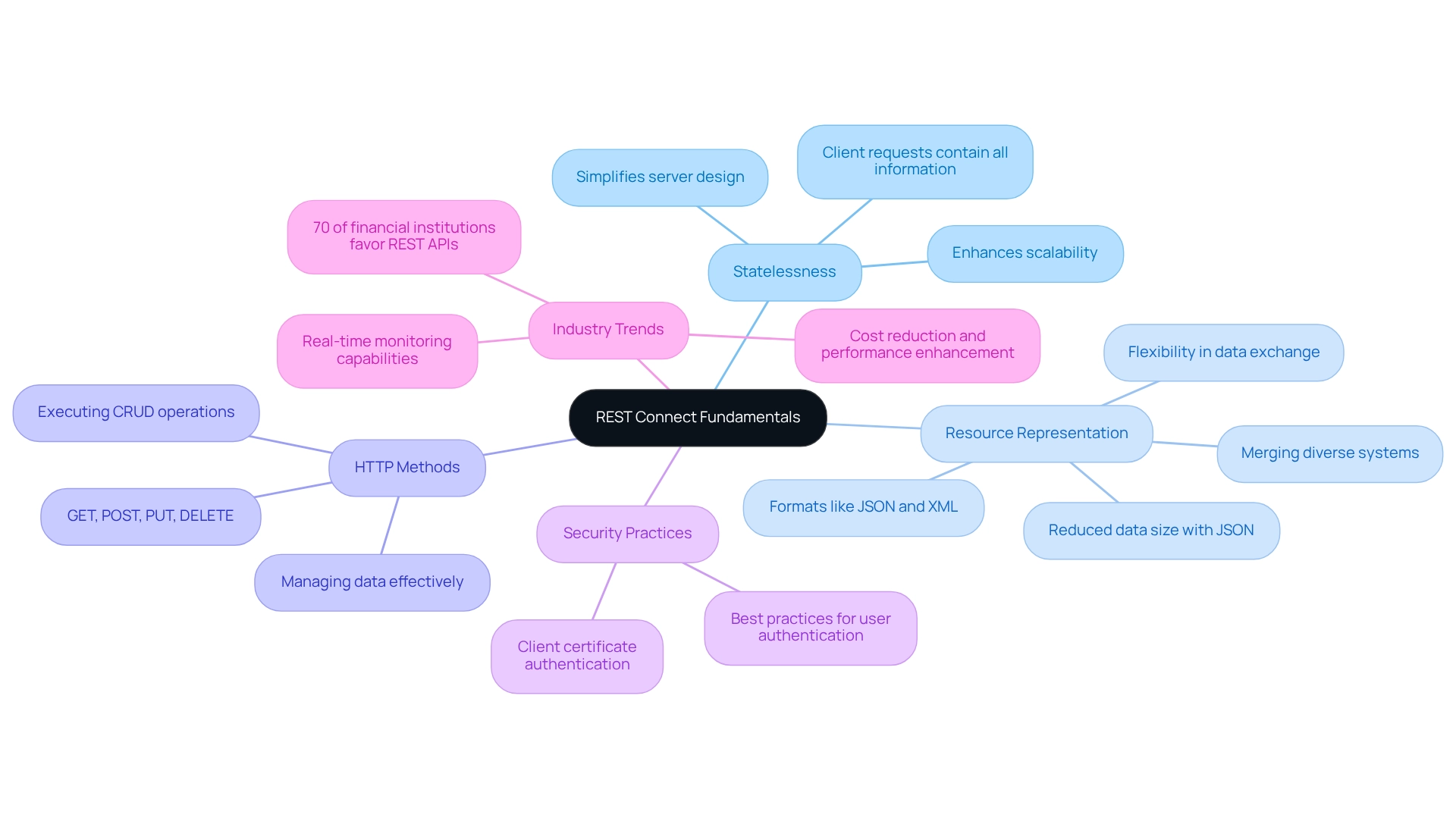

Representational State Transfer (REST) is not just an architectural approach; it is a vital strategy that utilizes standard HTTP methods for communication between clients and servers, making it particularly relevant for secure financial system connections in 2025. Understanding its core principles is essential for us to develop robust and compliant systems. Key concepts include:

-

Statelessness: Each client request must contain all necessary information for processing, simplifying server design and enhancing scalability. This principle is crucial for maintaining high performance in financial applications, where efficiency is paramount.

-

Resource Representation: Resources can be represented in various formats, such as JSON or XML, providing flexibility in data exchange. JSON, in particular, offers advantages such as reduced data size and ease of use, making it a preferred choice for many organizations. This adaptability is crucial for merging diverse systems within the financial industry, particularly when utilizing a hybrid platform to enhance the value of legacy systems.

-

HTTP Methods: Proficiency in methods like GET, POST, PUT, and DELETE is essential for executing CRUD operations on resources, ensuring that we can effectively manage data as finance professionals.

Mastering these fundamentals not only strengthens the security of our financial connections but also aligns with current trends in API adoption, which has seen a significant increase in the financial services sector. According to recent statistics, REST APIs have become the favored option for over 70% of financial institutions, reflecting their increasing significance in the sector.

Successful applications of REST connect architecture in financial services showcase its efficiency in simplifying complex connection tasks. For example, we have been crucial in assisting organizations in updating their legacy systems, enabling banks to innovate without the risks usually linked to digital transformation. A significant instance is a recent project where our platform allowed a major bank to lower connection expenses by 30% while enhancing system performance through real-time monitoring.

Furthermore, best practices in user authentication, such as client certificate authentication, are essential for ensuring secure banking connections. By applying the architectural principles of Representational State Transfer, we can improve our operational capabilities while ensuring adherence to industry standards. Moreover, we enable organizations to maintain a competitive advantage by offering a dependable and efficient platform that supports their digital transformation efforts, including features like real-time monitoring and cost reduction.

Configure REST Connect for Secure Banking Integrations

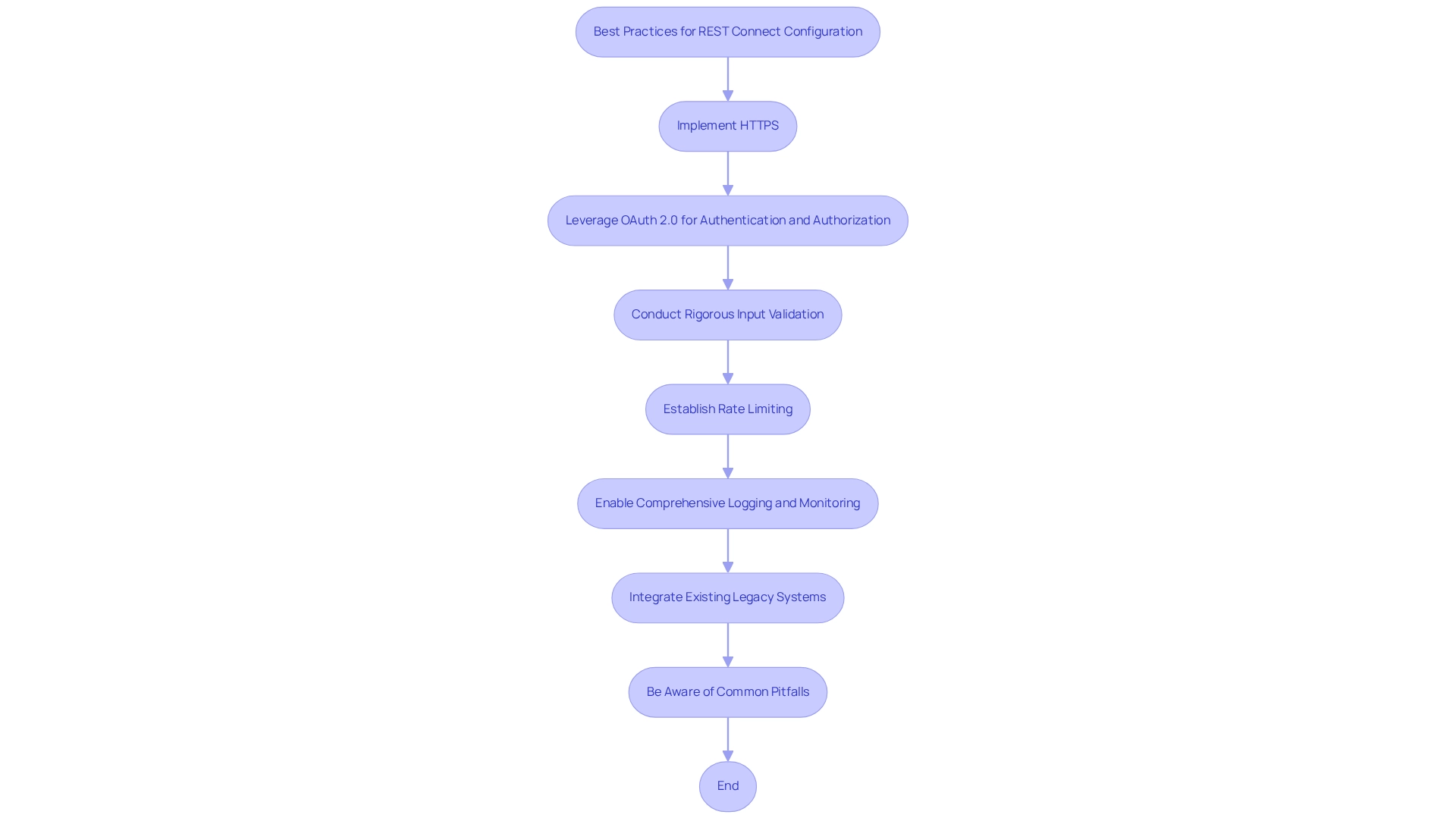

To configure REST Connect for secure financial integrations, we must adhere to best practices that ensure robust security and reliability:

- Implement HTTPS: By using HTTPS, we encrypt data in transit, safeguarding sensitive information from eavesdropping and tampering. This is crucial as open finance relies on secure data sharing.

- Leverage OAuth 2.0 for Authentication and Authorization: We ensure that only authorized users can access the API. Role-based access control (RBAC) should be implemented to restrict permissions based on user roles, further enhancing security. Given the heightened security requirements of open financial systems, this step is essential.

- Conduct Rigorous Input Validation: We must validate all incoming data to prevent injection attacks and ensure that only expected data formats are processed. This step is vital in maintaining the integrity of our systems and aligns with the need for robust security measures in open banking.

- Establish Rate Limiting: It is important to implement rate limiting to prevent abuse of the API and protect against denial-of-service attacks. This practice helps maintain service availability and performance, which is critical as we prepare for the increased demand associated with open banking.

- Enable Comprehensive Logging and Monitoring: We should log API requests and responses thoroughly to monitor for unusual activity and facilitate troubleshooting. Ongoing oversight is crucial for detecting possible security risks, particularly in open finance where data sharing is vital.

- Integrate Existing Legacy Systems: Rather than discarding legacy systems, we should consider how they can be integrated into our open banking strategy. This approach can save time and resources while improving the overall unification process.

- Be Aware of Common Pitfalls: Combining systems can be fraught with challenges, such as underestimating the complexity of legacy system unification or failing to account for scalability. Being aware of these pitfalls can aid in devising a more effective incorporation strategy.

By adhering to these configuration practices, we can significantly enhance the security of our connections, allowing us to rest connect while ensuring a strong defense against evolving cyber threats and preparing for the opportunities and challenges presented by open banking.

Monitor and Optimize REST Connect Integrations

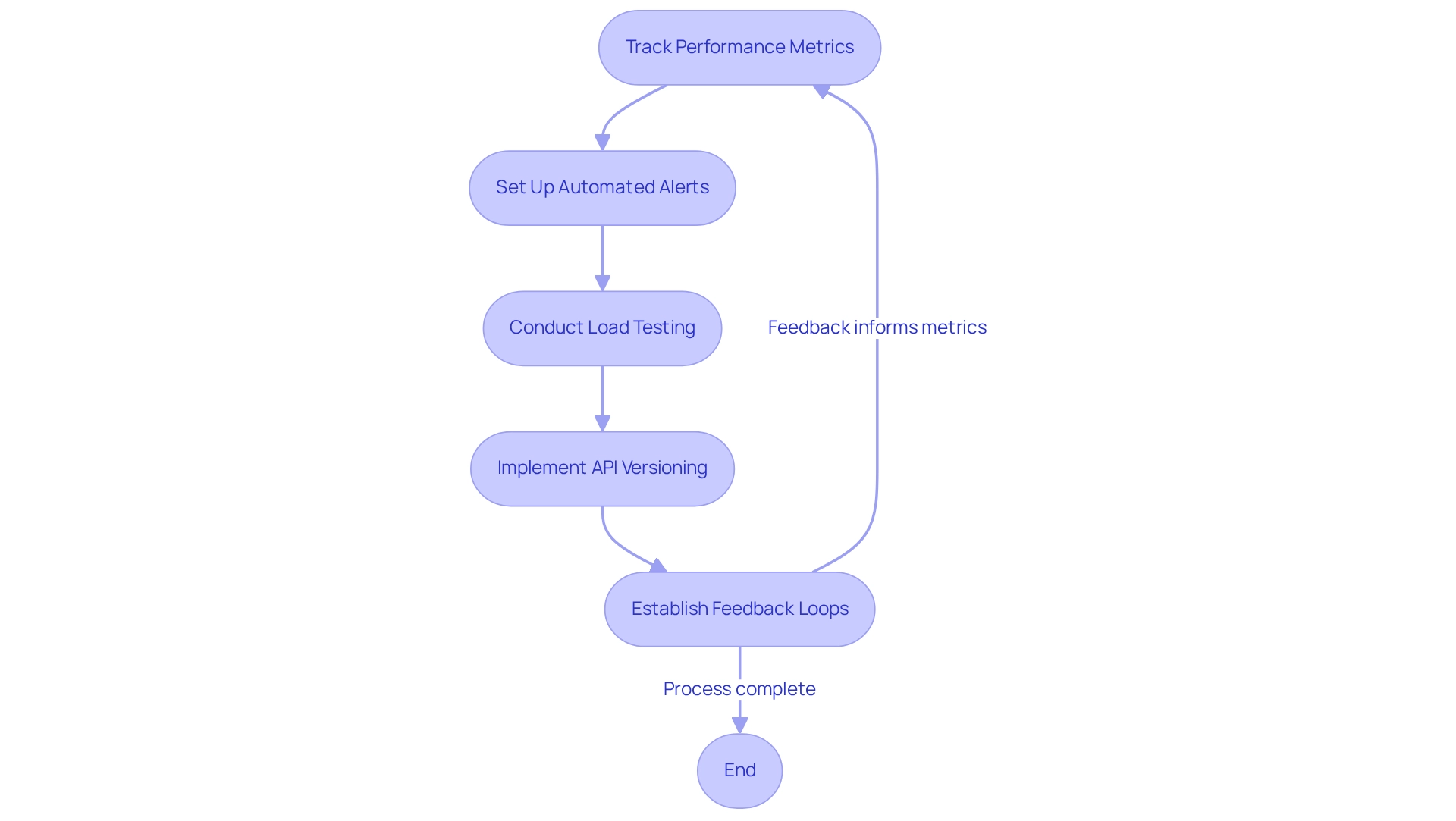

To ensure the ongoing success of REST Connect, we implement robust monitoring and optimization strategies, leveraging our dedicated hybrid platform.

Performance Metrics: We track key performance indicators (KPIs) such as response times, error rates, and throughput to identify potential bottlenecks. Our platform provides powerful analytics tools that assist in effectively monitoring these metrics.

Automated Alerts: We set up automated alerts for critical metrics, enabling us to respond swiftly to issues before they impact users. With our secure connection solutions, we ensure that alerts are both dependable and actionable.

Load Testing: We conduct regular load testing to evaluate system performance under various conditions, identifying areas for improvement.

Our architecture is meticulously crafted to manage high loads, ensuring that your connections remain robust.

API Versioning: We implement versioning for our APIs, allowing us to manage changes without disrupting existing connections, which facilitates smoother transitions and updates. Our platform supports API versioning, aiding in the preservation of seamless connectivity as your systems evolve.

Feedback Loops: We establish feedback mechanisms with users to gather insights on performance and usability, which inform our future optimizations. Our company promotes collaboration with users to enhance operational transparency and problem-solving.

By actively overseeing and refining REST Connect connections with the assistance of our hybrid platform, we enable banking institutions to ensure high availability and performance, ultimately boosting user satisfaction and trust. Our dedication to simplifying integration challenges is reflected in our successful partnerships with leading banks, as evidenced by testimonials from satisfied clients who have experienced significant improvements in their operational efficiency.

Conclusion

Understanding and implementing REST Connect fundamentals is crucial for banks aiming to thrive in the open banking era. By grasping the principles of statelessness, resource representation, and effective use of HTTP methods, we can build secure and efficient systems that meet the demands of modern digital transformations. The evidence shows that REST APIs are increasingly favored within the industry, with a significant majority of banks recognizing their potential to streamline integrations and enhance performance.

Configuring REST Connect with best practices ensures that security remains a top priority. Utilizing HTTPS, robust authentication methods like OAuth 2.0, and rigorous input validation are essential steps in safeguarding sensitive data. Additionally, maintaining legacy systems within our integration strategy not only preserves valuable resources but also enhances overall system functionality. Being mindful of common pitfalls allows us to navigate the complexities of integration more effectively, fostering a secure and compliant environment.

Monitoring and optimizing REST Connect integrations are vital for our sustained success. By leveraging performance metrics, automated alerts, and regular load testing, we can proactively address issues and optimize system performance. Implementing API versioning and establishing feedback loops with users further enhances our operational efficiency. The support of platforms like Avato empowers us to navigate these challenges seamlessly, ensuring high availability and user satisfaction.

In conclusion, embracing REST Connect principles and best practices positions us not only to meet current regulatory requirements but also to drive innovation in an increasingly competitive landscape. The journey towards digital transformation is complex, but with the right strategies in place, we can enhance our operational capabilities and secure our future in the evolving world of open banking.