Overview

This article provides a comprehensive comparison of core banking software vendors, focusing on their key features, strengths, weaknesses, and overall suitability for diverse banking institutions. It underscores the critical role of factors such as:

- Scalability

- Integration capabilities

- Security features

- User experience

- Cost structure

- Vendor support

By offering insights into how various vendors address the evolving needs of financial organizations within a competitive landscape, this analysis equips decision-makers with the knowledge necessary to navigate their options effectively.

Introduction

In the rapidly evolving financial landscape, core banking software stands as a critical foundation for modern banking operations. As institutions strive to enhance customer experiences and streamline processes, the transition from traditional legacy systems to innovative cloud-native solutions has become increasingly vital. This transformation not only promises heightened efficiency and security but also positions banks to respond swiftly to market demands.

With the U.S. Core Banking Software Market projected to grow significantly, understanding the key features, integration capabilities, and security measures of various vendors is essential for financial institutions aiming to thrive in this competitive environment.

This article delves into the importance of core banking software, the evolution towards cloud solutions, and provides a comparative analysis of leading vendors, equipping banks with the insights needed to make informed decisions in their digital transformation journey.

Understanding Core Banking Software: Definition and Importance

Core banking software vendors provide essential software that serves as the backbone of a bank’s operations, encompassing functions such as account management, transaction processing, and customer relationship management. These frameworks enhance the seamless provision of services across different branches and channels, allowing customers to access their accounts and conduct transactions instantly. As the U.S. financial landscape evolves, the significance of robust core banking solutions becomes increasingly critical.

The Central Financial Software Market is anticipated to undergo substantial expansion from 2025 to 2032, influenced partly by the rising practicality and acceptance of cloud services. The importance of central financial software in digital transformation becomes more apparent, prompting financial institutions to reassess their operational strategies.

Centralizing operations through essential financial networks not only lowers costs but also improves customer experiences, rendering it crucial for financial organizations aiming to retain a competitive advantage in today’s digital environment. Avato’s hybrid integration platform plays a pivotal role in this transformation by enhancing and extending the value of legacy technologies, simplifying complex integrations, and ensuring continuous uptime and reliability—key requirements for finance, healthcare, and government sectors.

The advantages of adopting a strong central financial infrastructure, particularly through collaboration with core banking software vendors, include enhanced operational efficiency, streamlined procedures, and the capacity to respond swiftly to evolving market needs. Avato’s platform is architected for secure transactions, trusted by institutions that require a rock-solid foundation for their digital transformation initiatives.

Real-world examples demonstrate how essential financial software can revolutionize customer interactions. For instance, institutions that have adopted centralized systems report higher customer satisfaction rates due to faster transaction processing and improved service delivery. As Gustavo Estrada, a client, remarked, “Avato has streamlined intricate projects and provided outcomes within preferred timelines and budget limitations,” underscoring the efficiency of sophisticated fundamental financial solutions.

Moreover, the recent introduction of SAP SE’s Fioneer, designed to offer innovative solutions for the financial sector, highlights the continuous development in fundamental technology. Expert opinions emphasize that investing in sophisticated central financial solutions, like those provided by Avato, is vital for financial institutions seeking to innovate and meet changing customer demands.

In summary, the strategic deployment of essential financial software, supported by Avato’s hybrid integration platform, not only enhances operational excellence but also positions financial institutions to thrive in an increasingly competitive environment.

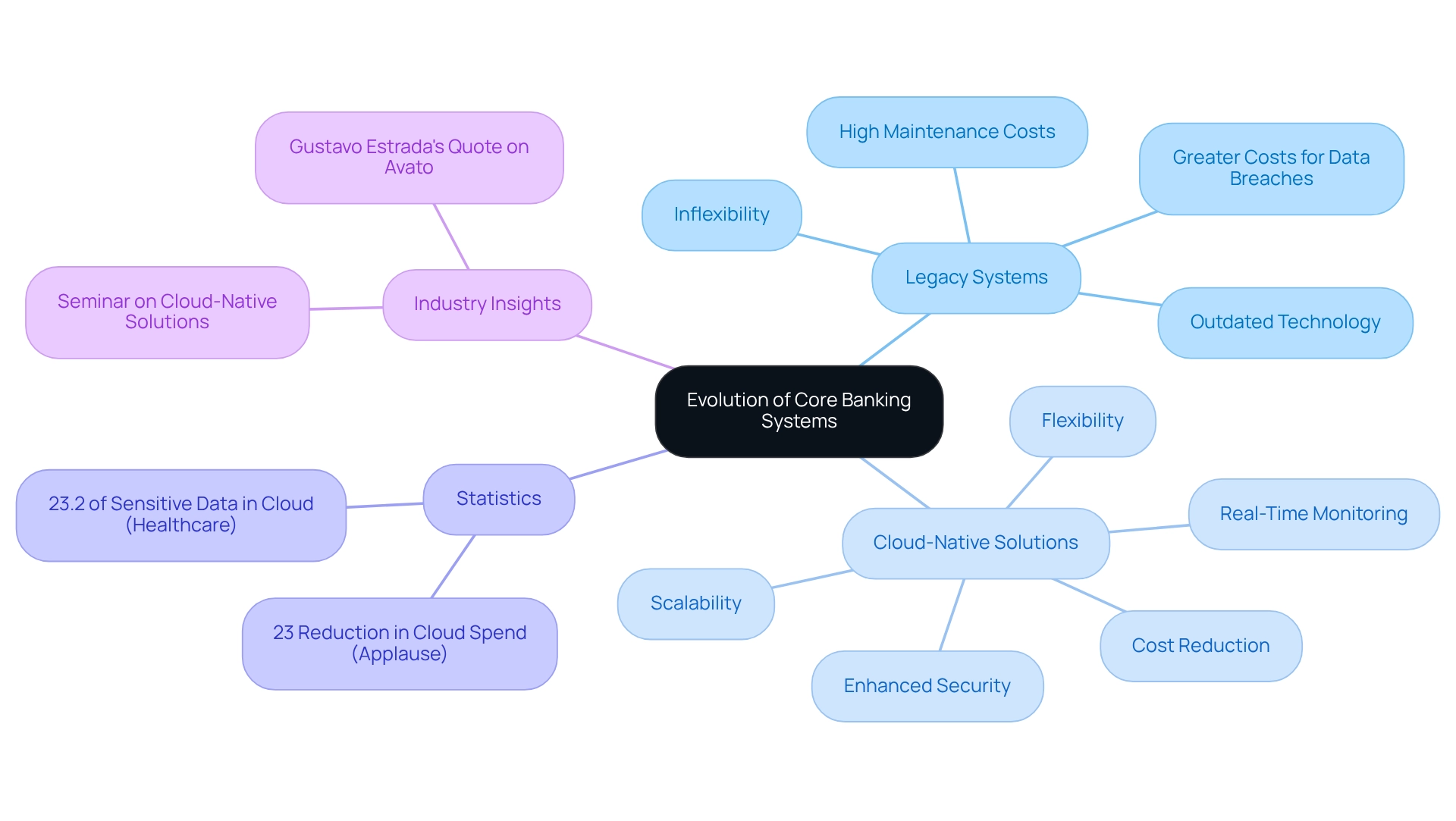

Evolution of Core Banking Systems: From Legacy to Cloud-Native Solutions

The evolution of core banking software vendors signifies a pivotal shift from traditional legacy frameworks—often characterized by outdated technology and inflexibility—to modern cloud-native solutions that prioritize scalability, flexibility, and enhanced security. Legacy systems typically required substantial upkeep and were susceptible to interruptions, hindering financial institutions’ ability to innovate and adapt to changing market conditions. In contrast, cloud-native solutions leverage distributed architectures, empowering financial organizations to dynamically scale operations and seamlessly integrate new technologies.

This transition is critical as financial institutions strive to improve customer experiences and respond swiftly to market demands. For instance, a recent seminar underscored how these institutions are harnessing cloud-native solutions provided by core banking software vendors to modernize their infrastructure and unlock new business models, illustrating the growing trend towards cloud adoption in the financial sector. Insights from this seminar highlighted the significance of cloud technology across various sectors, including healthcare, where the Sans Institute reports that health records constitute 23.2% of sensitive data stored in the cloud.

This statistic underscores the necessity of cloud adoption in enhancing operational capabilities across diverse sectors. Furthermore, organizations that have transitioned to cloud-native infrastructures report notable operational advancements, including reduced expenses and improved security protocols. Avato’s Hybrid Integration Platform exemplifies this by streamlining complex integrations and augmenting the value of legacy technologies, enabling financial institutions to decrease costs while ensuring continuous uptime and reliability.

The platform also features real-time monitoring and alerts on performance, which are vital for sustaining operational efficiency. As Gustavo Estrada observed, Avato simplifies complex projects and delivers results within desired timelines and budget constraints, showcasing the advantages of adopting cloud-native solutions. Statistics reveal that financial institutions utilizing cloud-native foundational services experience a substantial reduction in operational expenses and time commitments related to data breaches—costs that are significantly higher for those still reliant on outdated platforms.

As we approach 2025, the adoption rates of cloud-native fundamental financial systems from core banking software vendors continue to escalate, reflecting a broader industry shift towards more agile and resilient financial operations. This evolution not only enhances operational capabilities but also positions financial institutions to maintain a competitive edge in an increasingly digital landscape. Avato, founded by a dedicated team of enterprise architects, stands at the forefront of this transformation, committed to addressing complex integration challenges and empowering financial institutions to thrive in the digital age.

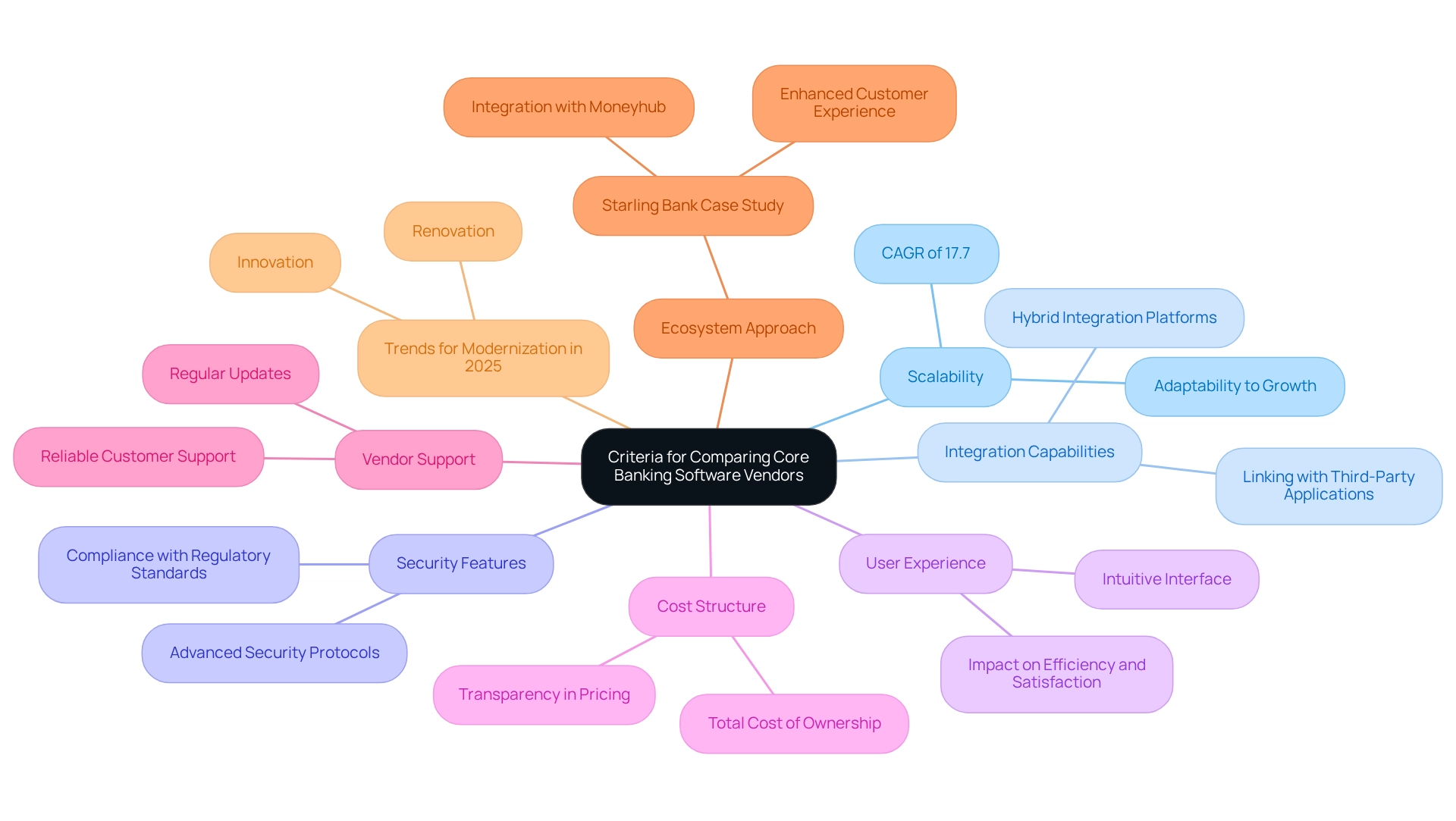

Criteria for Comparing Core Banking Software Vendors: Key Features and Considerations

When evaluating core banking software vendors, several critical features and considerations must be prioritized:

- Scalability: The software’s capacity to adapt and grow alongside the bank’s evolving needs is essential, particularly for institutions anticipating rapid expansion. With a projected compound annual growth rate (CAGR) of 17.7% in the core banking sector, scalability becomes a pivotal factor in ensuring long-term viability.

- Integration Capabilities: Successful integration with current frameworks and third-party applications is essential for improving functionality and optimizing operations. Avato’s hybrid integration platform illustrates how companies can utilize their existing resources instead of beginning anew, facilitating smooth links between diverse frameworks. As the need for effective financial oversight solutions grew during the COVID-19 pandemic, the capability to link these platforms has become progressively vital, particularly in relation to preparing for open financial services.

- Security Features: Given the sensitive nature of financial data, robust security measures are non-negotiable. Core banking software vendors must implement advanced security protocols to safeguard against potential breaches, ensuring compliance with regulatory standards. Avato emphasizes the importance of tightening security measures as open banking evolves, reinforcing the need for integration solutions that are compliant with stringent security protocols.

- User Experience: An intuitive interface significantly influences both employee efficiency and customer satisfaction. A user-friendly design can facilitate smoother operations and improve overall service delivery.

- Cost Structure: Understanding the total cost of ownership—including licensing, maintenance, and potential hidden costs—is crucial for effective budgeting. Transparency in pricing can help institutions avoid unexpected financial burdens.

- Vendor Support: Reliable customer support and regular updates are essential for maintaining system performance and security. A vendor’s commitment to ongoing support can greatly impact the success of the software implementation.

In addition to these features, banks are increasingly adopting an ecosystem approach to enhance customer relationships and operational efficiency. For example, Starling Bank has effectively incorporated third-party services, like Moneyhub, to offer additional value to its business clients, showcasing the significance of both scalability and integration in contemporary financial solutions.

As Mr. Ali Zali, Commercial Director, noted, “We have purchased recently a report from SkyQuest Technology, and we are happy to inform you that this report was so useful and practical for our team.” This emphasizes the importance of using extensive resources when assessing fundamental financial software.

Looking forward, two key trends for fundamental modernization in 2025 are innovation—delivering new capabilities that current platforms cannot offer—and renovation—enhancing existing functionalities that have been problematic. These trends highlight the necessity for financial institutions to adjust their software solutions to meet evolving market demands, with an emphasis on strategic integration methods that future-proof their operations.

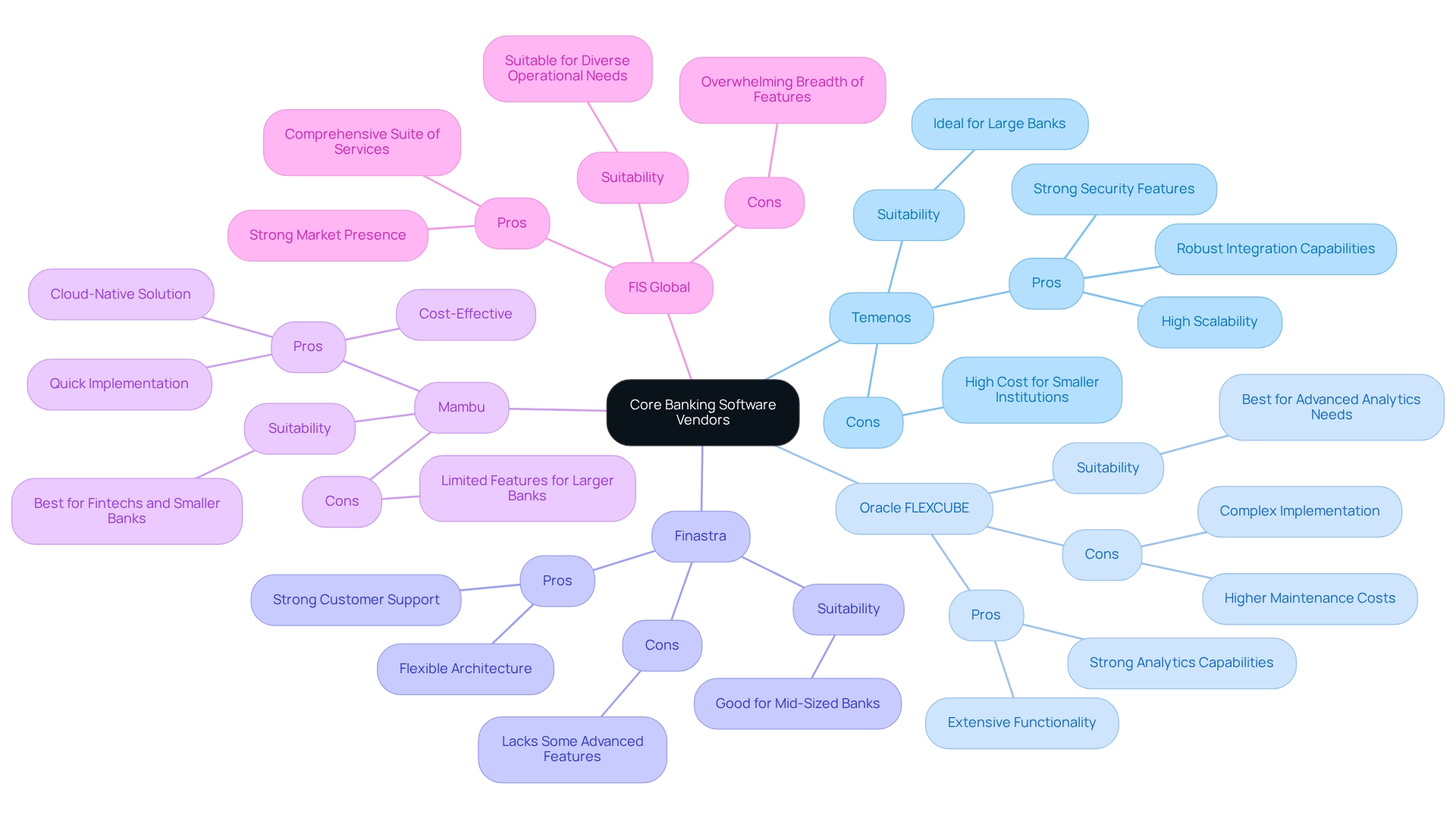

Comparative Analysis of Leading Core Banking Software Vendors: Pros, Cons, and Suitability

In this comparative analysis, we explore several leading core banking software vendors, highlighting their strengths, weaknesses, and suitability for various banking institutions.

1. Temenos:

- Pros: Renowned for its high scalability, Temenos offers robust integration capabilities and strong security features, making it a preferred choice for large banks.

- Cons: However, the cost can be prohibitive for smaller institutions, which may struggle to justify the investment.

- Suitability: It is ideal for large banks seeking comprehensive, enterprise-level solutions that can manage extensive operations.

2. Oracle FLEXCUBE:

- Pros: This platform boasts extensive functionality and strong analytics capabilities, enabling banks to leverage data effectively for decision-making.

- Cons: Nevertheless, its complexity in implementation and higher maintenance costs can pose challenges for some institutions.

- Suitability: Best suited for banks that require advanced analytics and reporting features to enhance their operational efficiency.

3. Finastra:

- Pros: Finastra is recognized for its flexible architecture and strong customer support, which can be crucial for banks navigating digital transformation.

- Cons: It may lack some advanced features compared to its competitors, potentially limiting its appeal for larger institutions.

- Suitability: A good fit for mid-sized banks seeking flexibility without incurring high costs.

4. Mambu:

- Pros: As a cloud-native solution, Mambu is quick to implement and cost-effective, making it attractive for institutions looking to innovate rapidly.

- Cons: Its limited features may not meet the needs of larger banks, which often require more comprehensive solutions.

- Suitability: Best for fintechs and smaller banks that prioritize agility and speed in their operations.

5. FIS Global:

- Pros: FIS Global offers a comprehensive suite of services and has a strong market presence, providing banks with a wide range of functionalities.

- Cons: The breadth of features can be overwhelming, potentially complicating the user experience.

- Suitability: Suitable for banks looking for an all-in-one solution that can address diverse operational needs.

In the evolving landscape of core banking solutions, understanding the pros and cons of each vendor is crucial for banks aiming to enhance their operational capabilities while managing costs effectively. For instance, banks are likely to face challenges in managing deposits as the cost of funding may not decrease proportionately with falling interest rates, leading to elevated deposit costs. Asset and liability management committees will need to find optimal balances between loan and deposit rates to maintain profitability in the evolving economic environment.

As Vikram (Vik) Bhat, Vice Chair and US Financial Services Industry Leader at Deloitte, emphasizes, selecting the right core banking software vendors is essential for fostering professional growth within banking institutions. As the market continues to shift, institutions must consider their specific needs and the unique offerings of each vendor to make informed decisions.

Conclusion

The significance of core banking software in the financial sector is paramount, serving as the backbone of modern banking operations. As institutions transition from traditional legacy systems to innovative cloud-native solutions, they not only enhance operational efficiency but also elevate customer experiences. This evolution is critical in a rapidly changing market where agility and responsiveness are essential. The insights into various vendors illustrate the diverse functionalities and integration capabilities that empower banks to thrive in this competitive landscape.

The comparative analysis of leading core banking software vendors underscores the necessity of selecting the right solution tailored to specific institutional needs. Factors such as scalability, security, user experience, and vendor support are crucial considerations that can significantly influence a bank’s operational success. With the core banking software market projected to grow, financial institutions must remain vigilant in evaluating their options to ensure they choose a vendor that aligns with their strategic objectives.

In conclusion, the journey towards digital transformation in banking hinges on the adoption of robust core banking systems. As financial institutions embrace cloud-native technologies and innovative integration platforms, they position themselves not only to meet current customer expectations but also to anticipate future demands. By making informed decisions and investing in advanced solutions, banks can secure their long-term viability and success in an increasingly digital world.