Overview

An integrated banking system represents a cohesive financial framework that consolidates various operations and services into a single platform. This integration enhances efficiency, customer experience, and compliance with regulations.

How does this system facilitate improved communication and adaptability to customer needs? Furthermore, it ensures compliance with evolving regulatory standards, positioning financial institutions for a competitive advantage in a rapidly changing market.

By embracing such systems, institutions can not only meet current demands but also anticipate future challenges, ultimately driving success.

Introduction

In the dynamic world of finance, integrated banking systems are emerging as the backbone of modern financial institutions. They offer a unified platform that significantly enhances operational efficiency and customer satisfaction. As banks grapple with evolving consumer expectations and stringent regulatory requirements, the shift towards integration is not merely beneficial; it is essential. Furthermore, advancements in technology, including artificial intelligence and open banking, position these systems to revolutionize the way banks operate, making them more agile and responsive.

This article delves into the significance of integrated banking systems, exploring their benefits, technological foundations, challenges, and the best practices that can help financial institutions thrive in an increasingly competitive landscape. Are you ready to discover how embracing integration can transform your banking operations and meet the demands of today’s market?

Defining Integrated Banking Systems: A Comprehensive Overview

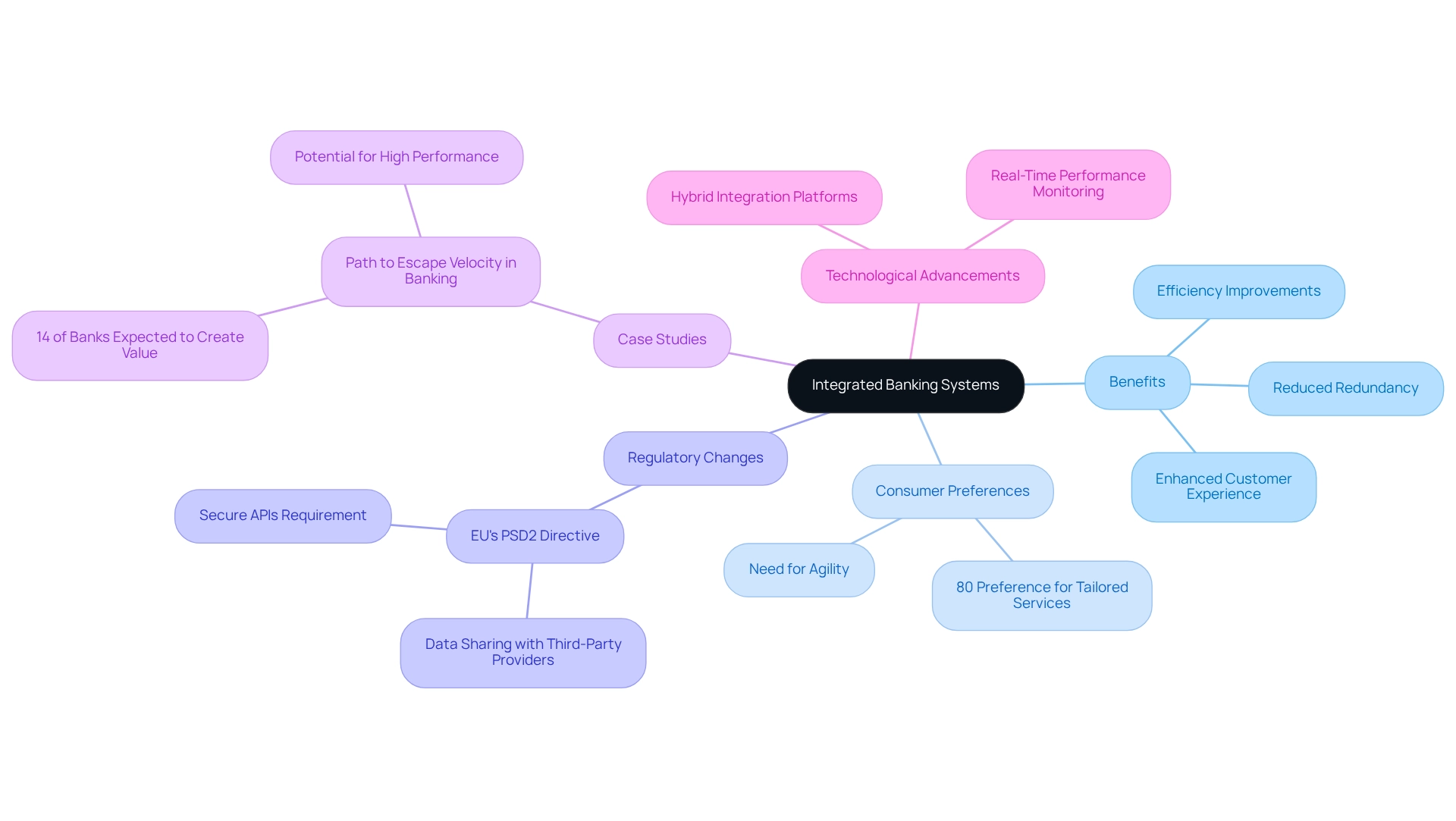

Integrated financial networks represent a cohesive structure that consolidates various financial operations, applications, and services into a single platform. This integration promotes smooth communication among platforms, enabling banks to handle customer accounts, transactions, and services with improved efficiency. By merging previously isolated networks, integrated financial platforms significantly enhance operational efficiency, reduce redundancy, and elevate the overall customer experience.

In today’s fast-paced financial environment, where agility and responsiveness to customer needs are critical, the significance of an integrated banking system cannot be overstated. Recent statistics reveal that 80% of consumers prefer tailored financial services, based on a survey conducted among a national sample of 2,211 adults with a margin of error of plus or minus 2 percentage points. This underscores the necessity for financial institutions to adapt swiftly to changing customer expectations.

As of 2025, a considerable proportion of financial institutions is anticipated to have embraced unified platforms, indicating a rising trend towards modernization in the sector.

Furthermore, the European Union’s updated Payment Services Directive (PSD2) highlights this transition by requiring financial institutions to share customer data with third-party providers through secure APIs. This regulatory change not only encourages innovation but also enhances competition within the financial sector, driving the need for robust integrated solutions that can efficiently address these new requirements. Avato’s hybrid integration platform is specifically crafted to tackle these challenges, allowing financial institutions to comply with PSD2 while maximizing and enhancing the value of their legacy infrastructures.

Avato, derived from the Hungarian word for ‘of dedication,’ plays a crucial role in this transformation. Founded by a group of enterprise architects committed to solving complex problems simply, Avato offers real-time observation and notifications on performance, guaranteeing that financial institutions can uphold 24/7 availability and dependability—vital for intricate frameworks in finance, healthcare, and government.

Successful instances of integrated banking systems can be observed in various institutions that have effectively streamlined their operations. A notable case study titled ‘Path to Escape Velocity in Banking’ indicates that 14% of financial institutions are expected to create value based on their current financial metrics, suggesting a viable path for achieving high performance. This discovery demonstrates how an integrated banking system, supported by Avato’s platform, can assist financial institutions in leveraging their capabilities for a competitive edge, in contrast to the superior performance rates seen in other sectors.

Recent advancements in unified financial networks have centered on improving security and user experience, ensuring that financial institutions can satisfy the demands of contemporary finance. As Vik Sohoni, a senior partner in the Chicago office, aptly states, ‘Improvise, adapt, and overcome,’ encapsulating the essence of what integrated financial networks enable. By promoting an integrated banking system, these networks not only enhance operations but also empower institutions to thrive in a progressively intricate economic landscape.

The Importance of Integrated Banking Systems in Modern Finance

In the rapidly evolving financial landscape of 2025, the integrated banking system has emerged as a cornerstone for success, particularly as artificial intelligence (AI) continues to reshape the industry. These frameworks not only enhance operations but also significantly reduce expenses, with research indicating that digital adoption rates soar from 35-45% with traditional setups to an impressive 70-85% when utilizing contemporary core platforms. This shift is crucial as financial institutions strive to improve customer service by offering a cohesive view of customer interactions across various channels, thus fostering a more personalized banking experience.

Furthermore, integrated frameworks are vital in ensuring compliance with stringent regulatory standards. By accurately capturing and reporting information, financial institutions can mitigate risks associated with non-compliance, which is increasingly critical in today’s regulatory landscape. As competition intensifies from FinTech firms, the adaptability provided by an integrated banking system empowers financial institutions to swiftly respond to market changes and evolving customer needs, positioning them favorably for future growth.

The transformative impact of AI is evident, with nearly 70% of firms reporting revenue increases due to AI implementations, as highlighted in the NVIDIA 2025 survey. This underscores the necessity for financial institutions to adopt cohesive platforms capable of leveraging generative AI for enhanced customer experience and operational efficiency. The significance of these frameworks is further reinforced by expert insights, such as the projection that the global embedded finance market will reach $112.6 billion in 2024, with a compound annual growth rate of 16.1% through 2029.

This growth signals a broader trend where an integrated banking system is not merely a technological enhancement but a strategic imperative for institutions aiming to thrive in a competitive marketplace. Additionally, ESG considerations are increasingly being woven into embedded finance offerings, highlighting the demand for financial products that prioritize sustainability and social impact.

Key trends continue to influence the future evolution of essential financial frameworks, emphasizing the need for institutions to modernize their operations. Case studies, notably titled ‘Conclusion on Core Modernization,’ illustrate the transformative effects of core modernization, demonstrating how financial institutions that invest in an integrated banking system achieve superior operational performance, heightened customer satisfaction, and enhanced business agility. As banks navigate the complexities of modern finance, the implementation of an integrated banking system will remain a crucial element in delivering exceptional customer service and maintaining a competitive edge.

Avato’s hybrid integration platform is designed to expedite secure integration for financial services, healthcare, and government, ensuring that organizations can effectively harness the power of AI and an integrated banking system to drive their success.

Tony Leblanc from the Provincial Health Services Authority states, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This testimonial reflects the trust and reliability that Avato brings to its clients, further solidifying its position as a leader in integrated solutions.

Key Benefits of Adopting Integrated Banking Systems

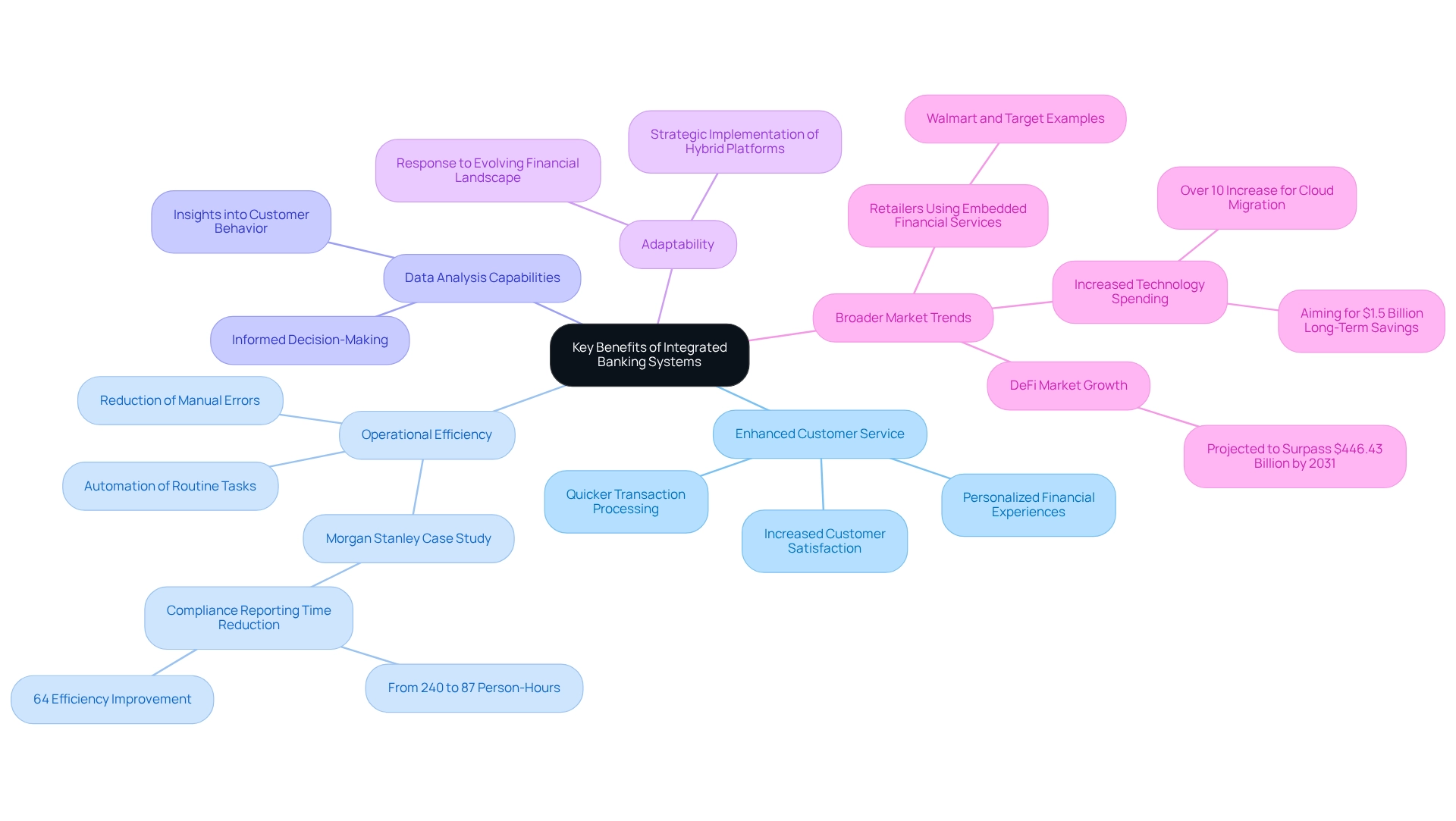

Embracing an integrated banking system presents myriad advantages for institutions, particularly as they prepare for the evolving landscape of open finance. These frameworks significantly enhance customer service by facilitating quicker transaction processing and delivering personalized financial experiences tailored to individual client needs. Such responsiveness not only boosts customer satisfaction rates but also cultivates deeper loyalty among clients.

Furthermore, cohesive frameworks improve operational efficiency by automating routine tasks and minimizing manual errors, leading to substantial cost savings. A notable case study involving Morgan Stanley exemplifies this: the introduction of a regulatory compliance visualization dashboard cut their quarterly compliance reporting preparation time from 240 person-hours to merely 87 person-hours, achieving an impressive 64% efficiency improvement.

In addition, the integrated banking system augments data analysis capabilities, empowering institutions to glean valuable insights into customer behavior and preferences. This data-driven methodology fosters more informed decision-making, ultimately enhancing service offerings. Statistics reveal that banks employing unified frameworks witness significant increases in customer satisfaction rates, with many reporting improvements in service delivery and operational performance.

As the financial landscape evolves, particularly with the rise of an integrated banking system, the ability to adapt and innovate through cohesive frameworks becomes essential for maintaining a competitive edge. The decentralized finance (DeFi) market is projected to surpass $446.43 billion by 2031, underscoring the growing importance of interconnected frameworks within the financial sector. Moreover, as Gustavo Estrada remarked, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” further validating the effectiveness of integrated systems in boosting operational efficiency.

Additionally, retailers such as Walmart and Target are leveraging embedded financial services to enhance customer experiences, illustrating the broader benefits of unification beyond finance. This trend is further emphasized by a major bank’s recent decision to increase technology spending by over 10 percent to transition applications to the cloud, aiming for improved efficiency and long-term cost savings. As financial organizations prepare for open finance, the strategic implementation of hybrid connection platforms, such as those offered by Avato, will be crucial in transforming business operations and refining connection strategies.

Technological Foundations: How APIs and Data Integration Drive Banking Systems

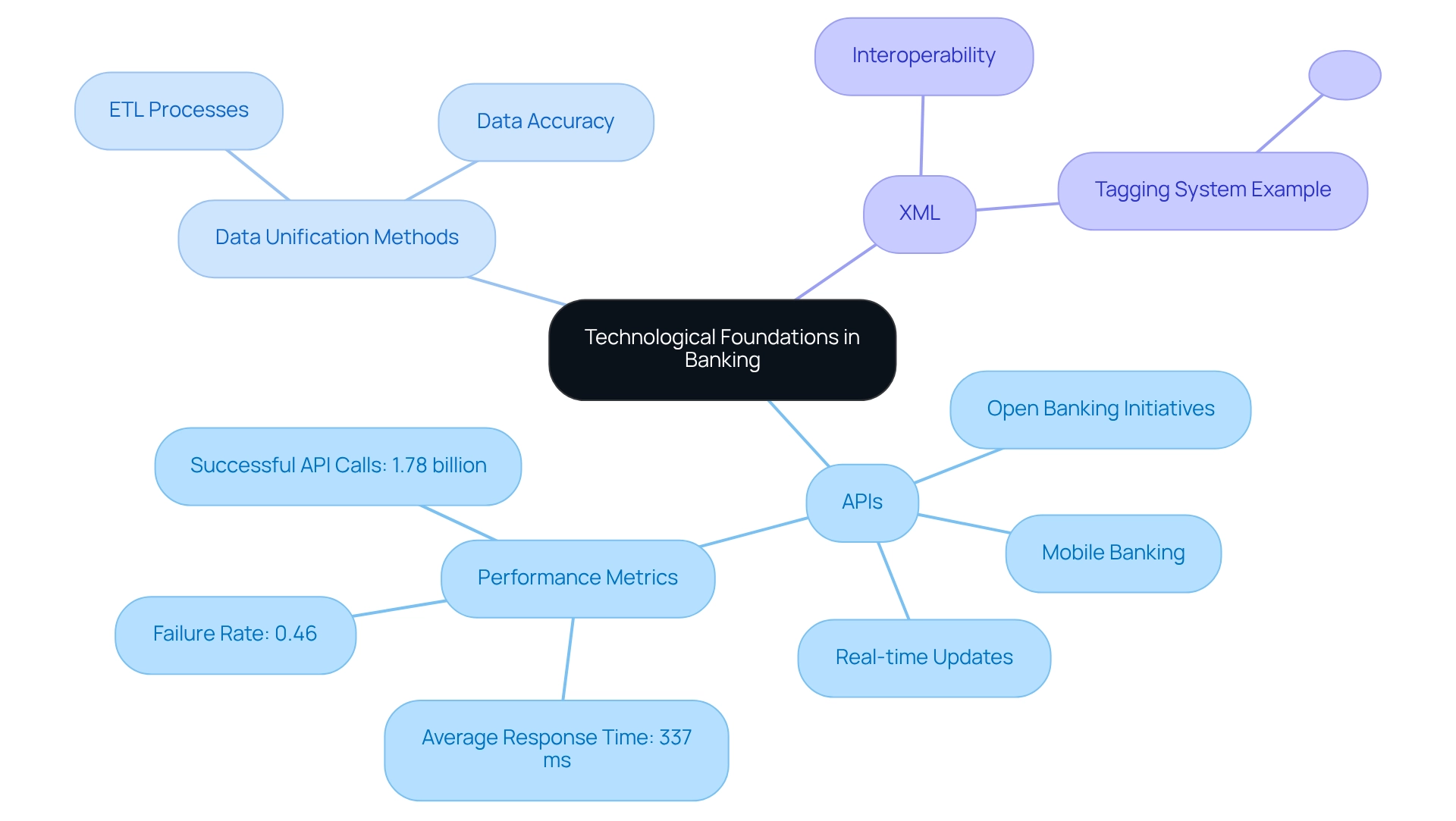

At the core of combined financial systems lie advanced technologies such as Application Programming Interfaces (APIs) and sophisticated data unification techniques. APIs act as vital conduits for data exchange between disparate banking applications, enabling real-time updates and interactions essential for services like mobile banking. Clients today demand immediate access to their accounts, and APIs facilitate this by ensuring seamless communication across platforms.

Data unification methods, particularly ETL (Extract, Transform, Load) processes, are crucial in consolidating data from various sources, making it readily accessible throughout the organization. This integration not only enhances data accuracy but also supports informed decision-making and operational efficiency.

A key component that bolsters these integration efforts is XML (eXtensible Markup Language), which provides a robust framework for data interoperability. XML decouples data access from the software that creates and utilizes it, ensuring that data remains usable despite technological changes. Its simplicity and comprehensive open specification make it an ideal option for representing diverse data structures, thereby enhancing the longevity and flexibility of financial frameworks. XML employs a tagging system where data is enclosed within tags, allowing for clear identification and organization of information. For instance, an address can be depicted as <address>1234 Whosville</address>, with the tag expressing the meaning of the data.

Recent statistics underscore the importance of APIs in the financial sector. In a comprehensive analysis conducted in February 2025, the performance of various account providers’ Open Banking APIs was evaluated, revealing an impressive average API response time of 337 milliseconds. This study also noted a staggering total of over 1.78 billion successful API calls, with a remarkably low failure rate of just 0.46%.

Such metrics emphasize the reliability and effectiveness of APIs in enabling integrated financial services. This examination aligns with current open finance initiatives and digital transformation efforts that are driving growth in the API finance market.

As banks continue to embrace digital transformation, the unification of these technologies becomes crucial. By leveraging APIs, robust data unification techniques, and XML, financial institutions can create a seamless and efficient financial experience, ultimately driving customer satisfaction and loyalty. Unlike proprietary data formats that can render data unusable when the associated software becomes obsolete, XML ensures long-term usability and adaptability.

As Gustavo Estrada pointed out, Avato streamlines intricate projects and delivers outcomes within expected time frames and budget limitations, demonstrating the efficiency of combined solutions in the financial sector.

Challenges in Implementing Integrated Banking Systems: Navigating the Complexities

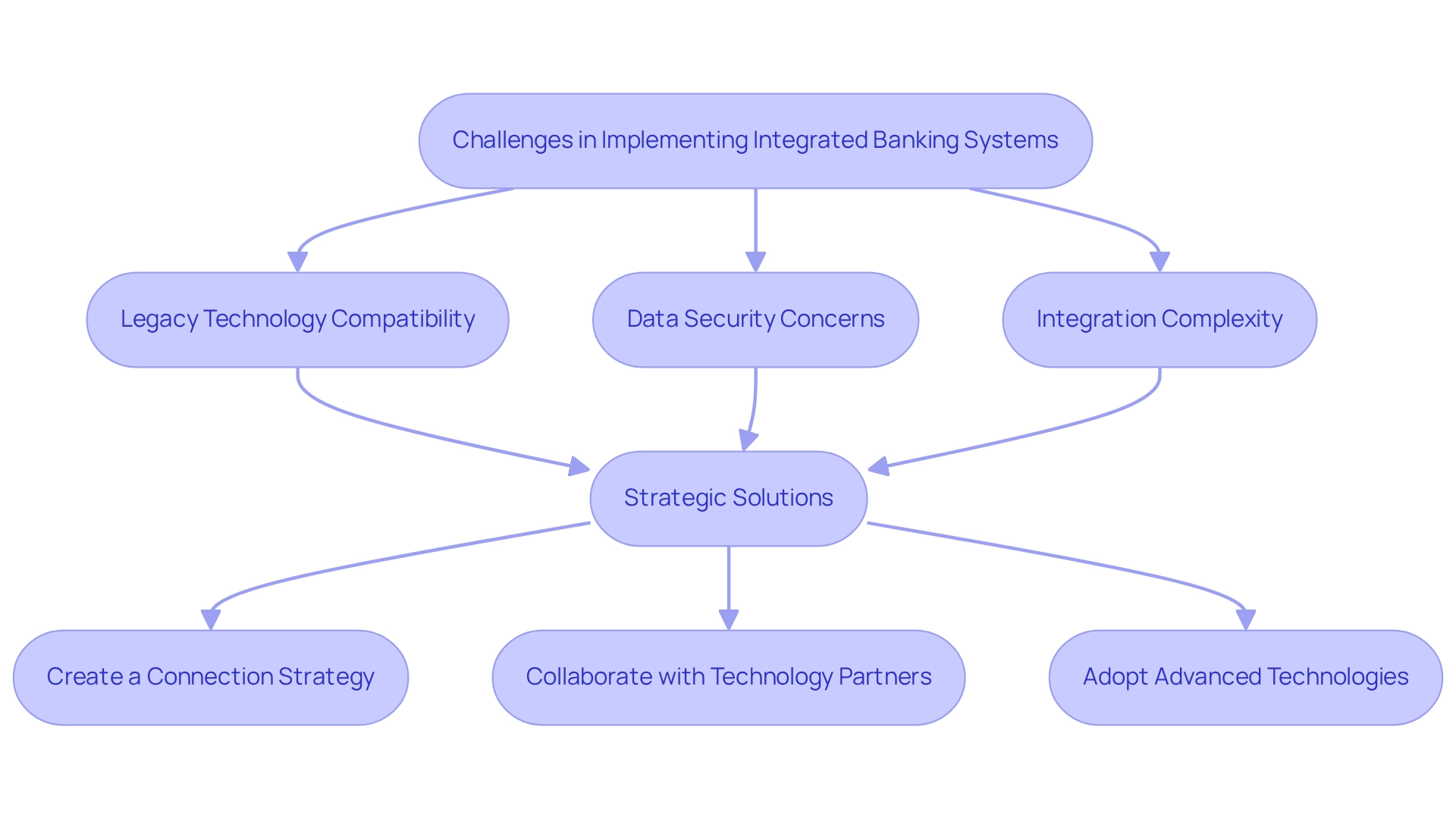

Implementing an integrated banking system presents a myriad of challenges that financial institutions must navigate. One of the most urgent concerns is legacy technology compatibility, which often obstructs the smooth integration of new innovations. Numerous financial institutions continue to depend on obsolete technologies that are not intended to function with contemporary applications, resulting in considerable operational inefficiencies.

In fact, only a quarter of financial institution respondents in a recent survey indicated that their data management platforms are well-prepared to adopt advanced technologies like generative AI, highlighting a critical gap in readiness for integration. Moreover, these institutions face data security concerns that arise from integrating multiple systems, as each connection can potentially expose sensitive information to vulnerabilities. The complexity of these connections can also lead to project delays and increased expenses, making it essential for financial institutions to conduct thorough evaluations of their current infrastructure before starting on connection projects.

To tackle these challenges, it is vital for financial institutions to create a clear connection strategy that outlines their objectives and the steps required to accomplish them. Collaborating with skilled technology partners, like Avatar, can offer the knowledge required to manage the complexities of combining systems. Avato, which derives its name from the Hungarian word for ‘dedication,’ embodies a commitment to architecting the technology foundation required to power rich, connected customer experiences.

Its specialized hybrid integration platform is crafted to streamline the connection of distinct frameworks, allowing financial institutions to access segregated assets and improve business value generation. The platform showcases strong data governance methods that assist in reducing risks linked to data security and compliance.

Case studies demonstrate how certain banks have effectively addressed legacy technology challenges. For example, significant financial organizations implementing edge computing solutions have reported an impressive 69% reduction in transaction processing times, illustrating the potential advantages of updating their infrastructure. Moreover, testimonials from clients emphasize how Avato’s platform has simplified their incorporation processes, resulting in enhanced operational efficiency and better customer satisfaction.

This trend suggests that as the boundary between banking and technology keeps becoming less distinct, financial organizations must also vie for talent with tech firms, further highlighting the necessity for a strategic method to integration.

In 2025, the challenges of creating an integrated banking system will likely evolve, necessitating ongoing adaptation to regulatory changes and cybersecurity protocols. As financial institutions strive to enhance their operational capabilities, addressing legacy technology compatibility and embracing innovative solutions like Avato’s hybrid platform will be paramount for maintaining a competitive edge in the rapidly changing financial landscape. Moreover, financial institutions may encounter difficulties in sustaining an ideal equilibrium between loan and deposit rates because of macroeconomic changes, further complicating their consolidation efforts.

Best Practices for Successful Integration of Banking Systems

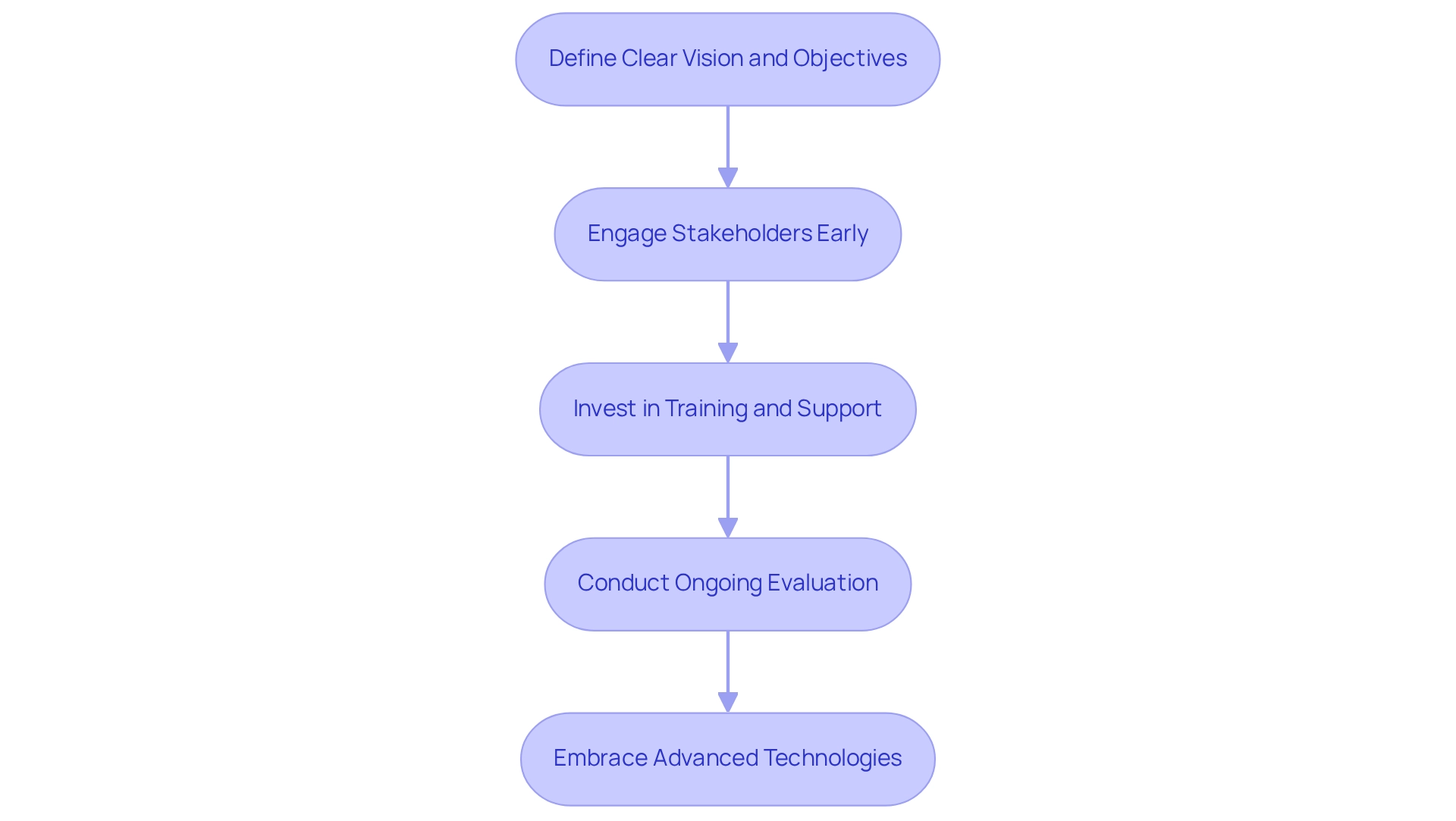

To achieve effective unification of banking networks, implementing an integrated banking system is essential, guided by several best practices.

-

Banks must articulate a clear vision and establish specific objectives for the integration project, ensuring alignment with broader business goals. This foundational step not only directs the project but also facilitates the measurement of success against defined benchmarks.

-

The early involvement of stakeholders from various departments is critical. Engaging these key players fosters collaboration and enables the identification of potential challenges before they escalate. Research indicates that projects with strong stakeholder engagement experience significantly higher success rates, as diverse perspectives lead to more comprehensive solutions.

-

Investing in training and support for staff is vital to promote user acceptance of new technologies. As organizations transition to integrated platforms, ensuring that employees are well-equipped to navigate these changes can dramatically enhance operational efficiency and user satisfaction.

-

Ongoing observation and assessment of the integrated networks are essential. This continuous evaluation helps identify areas for improvement and ensures that the systems adapt to evolving business needs. For instance, a recent case study highlighted how an Austrian financial institution leveraged data analytics to enhance its payment processing capabilities, ultimately serving 2.5 million customers with high reliability.

Such proactive measures not only boost performance but also enable financial institutions to respond swiftly to market changes.

In 2025, as the financial sector increasingly embraces advanced analytics-enabled solutions—evidenced by a McKinsey survey indicating that all surveyed institutions have accelerated this adoption—the emphasis on stakeholder involvement and best practices will be paramount. Moreover, with nearly 30% of digital banking product acquisitions in France conducted through digital signatures, the significance of embracing digital solutions in banking systems cannot be overstated. By focusing on these strategies, banks can simplify their connection processes through an integrated banking system while improving their overall service delivery, ensuring exceptional customer experiences and fostering long-term growth.

As Gustavo Estrada observed, ‘Avato has the capability to simplify intricate projects and provide outcomes within specified timelines and budget limitations,’ underscoring the importance of efficient integration solutions like Avato’s Hybrid Integration Platform in transforming business integration and modernizing outdated infrastructures. Get your copy now.

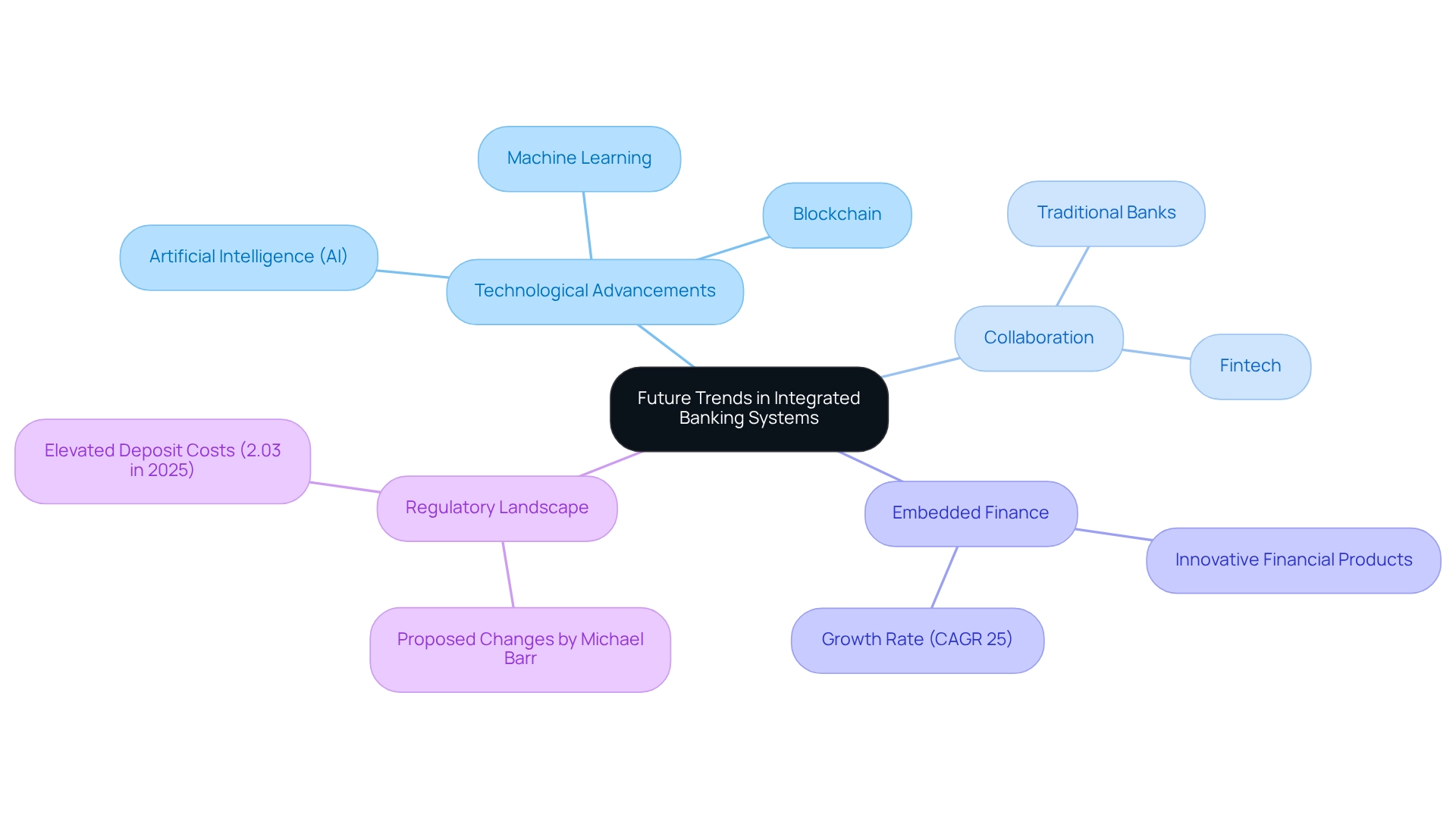

Future Trends in Integrated Banking Systems: What Lies Ahead

The future of the integrated banking system is on the brink of a significant transformation, driven primarily by advancements in technologies such as artificial intelligence (AI), machine learning, and blockchain. These innovations are enhancing data analytics capabilities and enabling financial institutions to deliver highly personalized services while improving risk management strategies. For instance, the combination of AI and machine learning facilitates real-time data processing, which can substantially lower compliance costs—DBS Bank achieved a 26% reduction in compliance expenses through automated regulatory reporting.

Furthermore, the emergence of open finance is fostering greater collaboration between traditional financial institutions and fintech companies, creating opportunities for innovative financial products and services. This collaborative environment is essential as customer expectations evolve, demanding more customized and efficient financial solutions. Key trends shaping this future include the mainstreaming of embedded finance, projected to expand at a compound annual growth rate (CAGR) of approximately 25% over the next five years. This indicates a significant shift in how financial services are distributed and consumed.

As Michael Barr, Federal Reserve Vice Chair, noted, there will be substantial modifications to the initial proposal he will present to the Federal Reserve Board, highlighting the evolving regulatory landscape.

As we approach 2025, the integrated banking system must adapt to these changes to remain competitive in a rapidly changing economic environment. Avato’s dedicated hybrid unification platform plays a pivotal role in this transformation, empowering financial institutions to lead the AI revolution and future-proof their operations through seamless data and system integration. Avato’s platform emphasizes hyper-personalization, sustainability-linked products, and the modularization of banking infrastructure, which will be crucial in addressing the diverse needs of customers.

Significantly, deposit expenses are expected to remain high at 2.03% in 2025, influencing financial institutions’ collaboration strategies. Expert insights indicate that banks utilizing Avato’s hybrid integration solutions will not only enhance operational efficiency but also foster a more engaging customer experience, ultimately driving growth and innovation in the sector. Avato’s commitment to solving complex problems and enhancing business value lies at the core of its mission, ensuring that financial institutions are well-equipped to navigate the future of banking.

Conclusion

The exploration of integrated banking systems reveals their critical role in shaping the future of financial institutions. By unifying various banking operations, these systems enhance efficiency, improve customer experiences, and ensure compliance with increasingly stringent regulations. The transition to integrated systems is not merely a technological upgrade; it is a strategic necessity for banks to remain competitive in a rapidly evolving landscape.

Key benefits of adopting integrated banking systems include:

- Streamlined operations

- Reduced costs

- Enhanced data analytics capabilities

As banks face challenges such as legacy system compatibility and data security concerns, the implementation of robust integration strategies becomes essential. Engaging experienced technology partners, like Avato, can significantly aid in overcoming these hurdles and maximizing the value derived from existing systems.

Looking ahead, the future of integrated banking systems is poised for transformation through advancements in artificial intelligence, machine learning, and open banking. These technologies will enable banks to offer personalized services and foster collaborations with fintech companies, meeting the rising expectations of consumers. As the financial landscape continues to evolve, the adoption of integrated systems will remain a pivotal factor in driving innovation and ensuring long-term success for financial institutions. Embracing this shift is not just an option; it is a vital step towards thriving in tomorrow’s banking environment.