Overview

We delve into nine distinct types of system integration that are crucial for banking IT managers. These integrations not only enhance operational efficiency but also significantly improve customer satisfaction. From API integration to Enterprise Service Bus (ESB) and orchestration, we explore the benefits, challenges, and real-world applications of each integration type. The complexities of modern banking environments necessitate the adoption of advanced integration strategies.

What’s holding your team back from realizing these efficiencies? By embracing these integration solutions, we can navigate the evolving landscape of banking together, ensuring that we stay ahead in delivering exceptional service to our customers.

Introduction

In the rapidly evolving landscape of banking technology, we recognize that the integration of diverse systems has become a critical focus for IT managers. With the rise of digital transformation, understanding the various system integration types empowers us to enhance operational efficiency, improve customer experiences, and mitigate security risks.

However, as financial institutions navigate this complex terrain, we often face challenges that raise questions about the best strategies to adopt. What integration methods can effectively bridge the gap between legacy systems and modern solutions, while ensuring seamless collaboration across platforms?

This article delves into the nine essential system integration types that we must explore to thrive in a competitive environment.

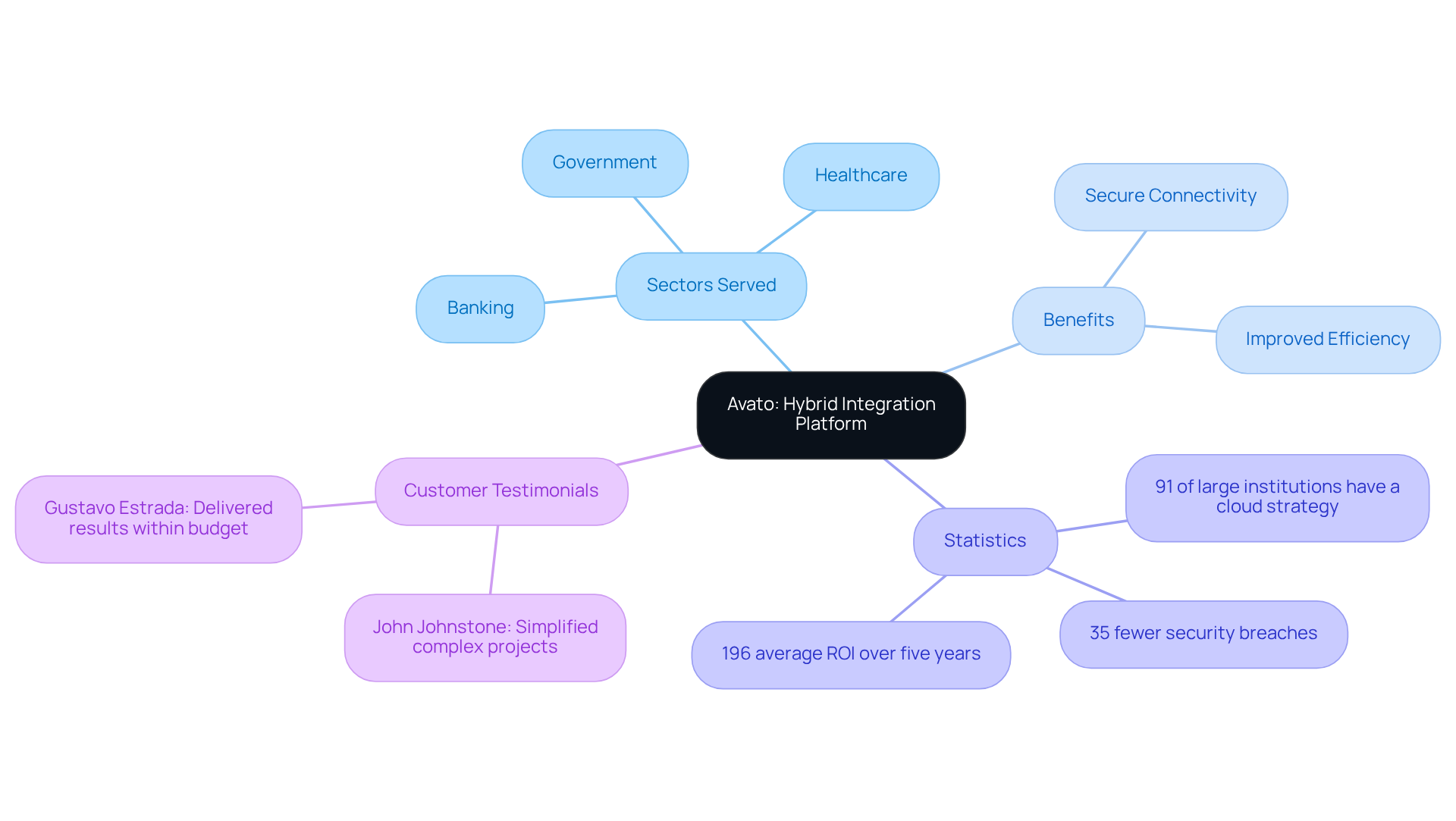

Avato: Secure Hybrid Integration Platform for Complex Systems

We recognize that conventional unification approaches often falter in complex environments. This is where Avato shines as a cutting-edge hybrid unification platform, expertly designed to securely connect intricate systems and data through various system integration types. We thrive in sectors like banking, healthcare, and government, where traditional methods frequently struggle. Our robust technology foundation effectively mitigates the risks associated with digital transformation, empowering enterprises to innovate without compromising security or efficiency.

Significantly, our platform accommodates 12 tiers of interface maturity as system integration types, enabling organizations to balance the pace of incorporation with the complexity needed to future-proof their technology stack. This flexibility makes Avato an invaluable resource for IT managers in the financial services industry. Consider this: 91% of large institutions now have a formal cloud strategy, indicating a notable shift towards integrated solutions that enhance security and operational efficiency.

Successful implementations of Avato’s hybrid connectivity solutions have led to significant improvements in customer satisfaction and operational cost reductions. This underscores the essential role of secure connectivity in modern banking technology. Furthermore, financial institutions that adopt hybrid cloud models have encountered 35% fewer security breaches compared to those relying solely on traditional infrastructures. Additionally, organizations utilizing cloud technologies have seen an average ROI of 196% over five years, with a median payback duration of just 2.3 years.

Customer testimonials, such as that from John Johnstone, highlight our effectiveness in simplifying complex projects and delivering results within desired time frames and budget constraints. What’s holding your team back? Let us partner with you to unlock the full potential of your digital transformation journey.

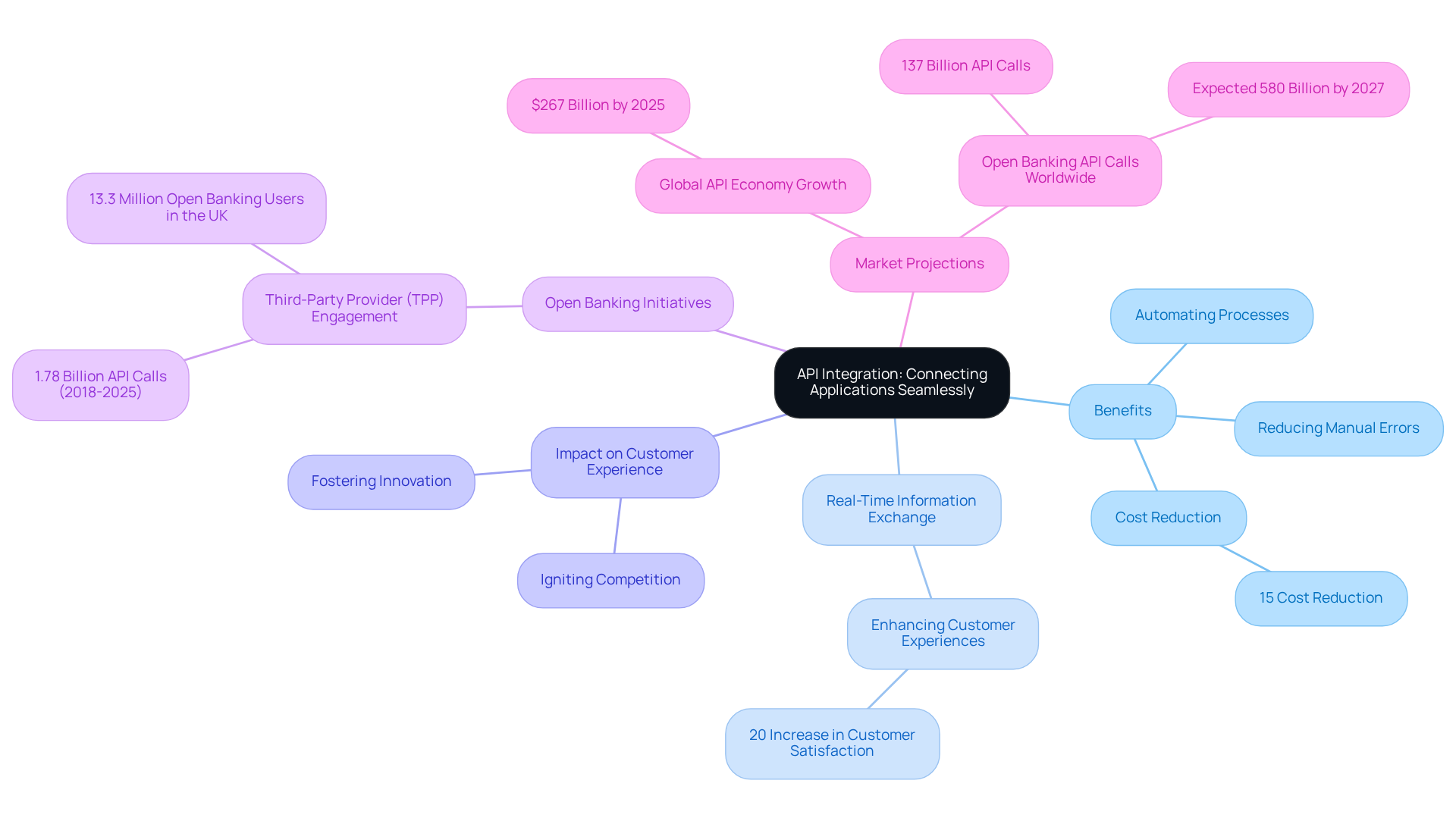

API Integration: Connecting Applications Seamlessly

API connectivity empowers us as banking organizations to seamlessly integrate various applications, facilitating real-time information exchange that significantly enhances customer experiences. By leveraging APIs, we can automate processes, reduce manual errors, and elevate our service delivery. This unification strategy is crucial for advancing our open banking initiatives, allowing third-party services to securely access banking information. Such access not only fosters innovation but also ignites competition within the financial sector.

For example, in the UK, third-party providers (TPPs) successfully made 1.78 billion API calls from 2018 to 2025, illustrating the swift adoption of open banking practices. Moreover, we have observed that financial institutions utilizing APIs report a 20% increase in customer satisfaction, underscoring the transformative impact of real-time data exchange on customer interactions.

As the global API economy is projected to reach $267 billion by 2025, the strategic implementation of API connectivity is becoming increasingly vital for us as financial institutions aiming to maintain a competitive edge and enhance our operational capabilities.

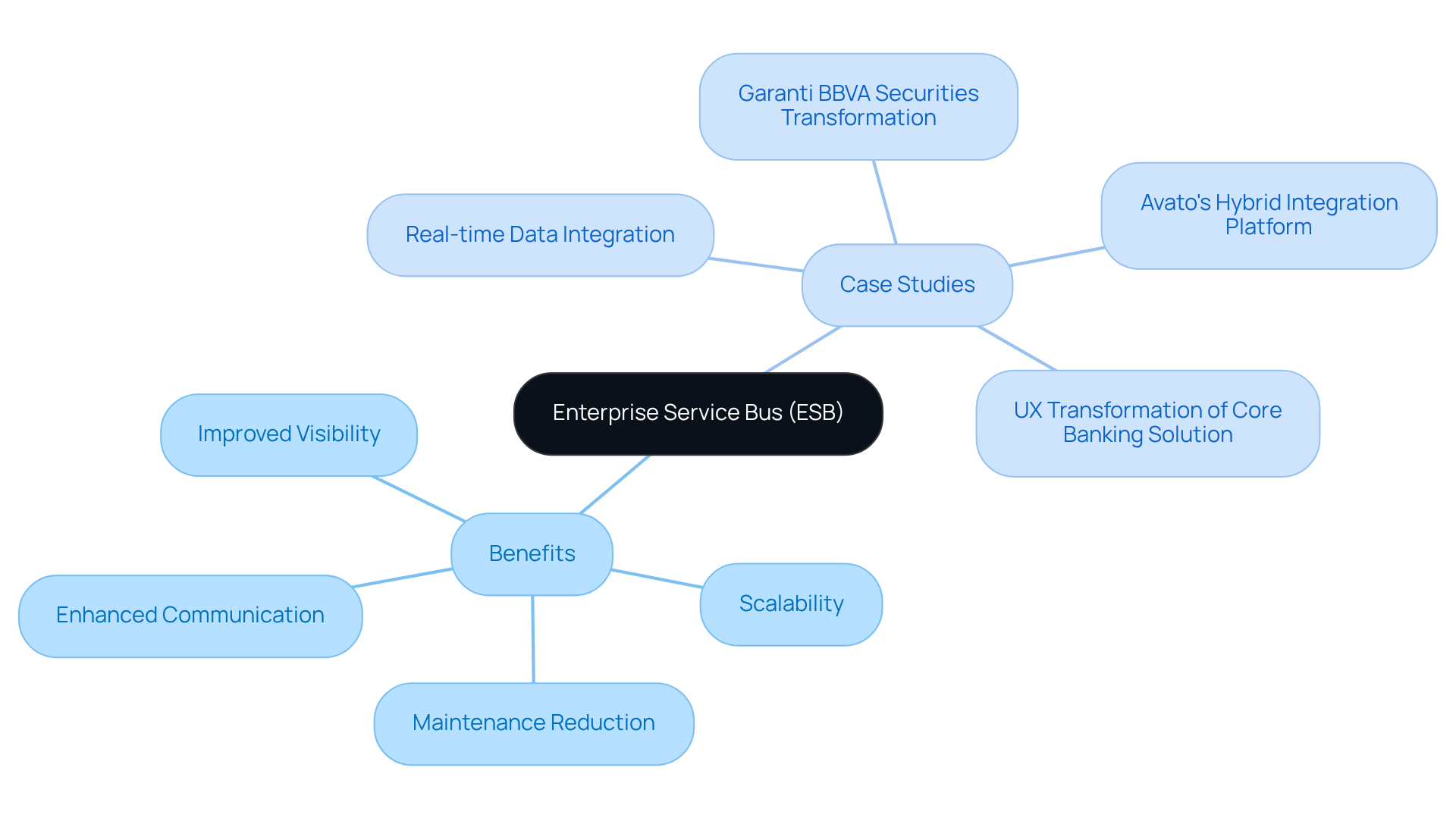

Enterprise Service Bus (ESB): Centralized Integration Architecture

We recognize that communication among various applications within a banking institution can often be fragmented and inefficient. An Enterprise Service Bus (ESB) serves as a centralized architecture that streamlines communication, representing one of the various system integration types, and effectively decouples systems. This not only enhances the management and scalability of connections but also allows us to adapt swiftly to evolving demands. By simplifying the integration process, the ESB significantly reduces maintenance overhead related to system integration types, minimizing the need for extensive manual intervention.

Furthermore, it provides improved visibility and control over data flows, which is crucial for compliance and operational efficiency. As financial institutions increasingly prioritize modernization, we see the ESB emerging as a preferred solution. It enables us to leverage existing legacy systems while enhancing overall performance.

Case studies demonstrate that financial institutions adopting ESB solutions have experienced significant enhancements in operational capabilities, ultimately leading to improved customer experiences and reduced costs.

Are you ready to transform your banking operations with the ESB? Let us guide you through this essential modernization journey.

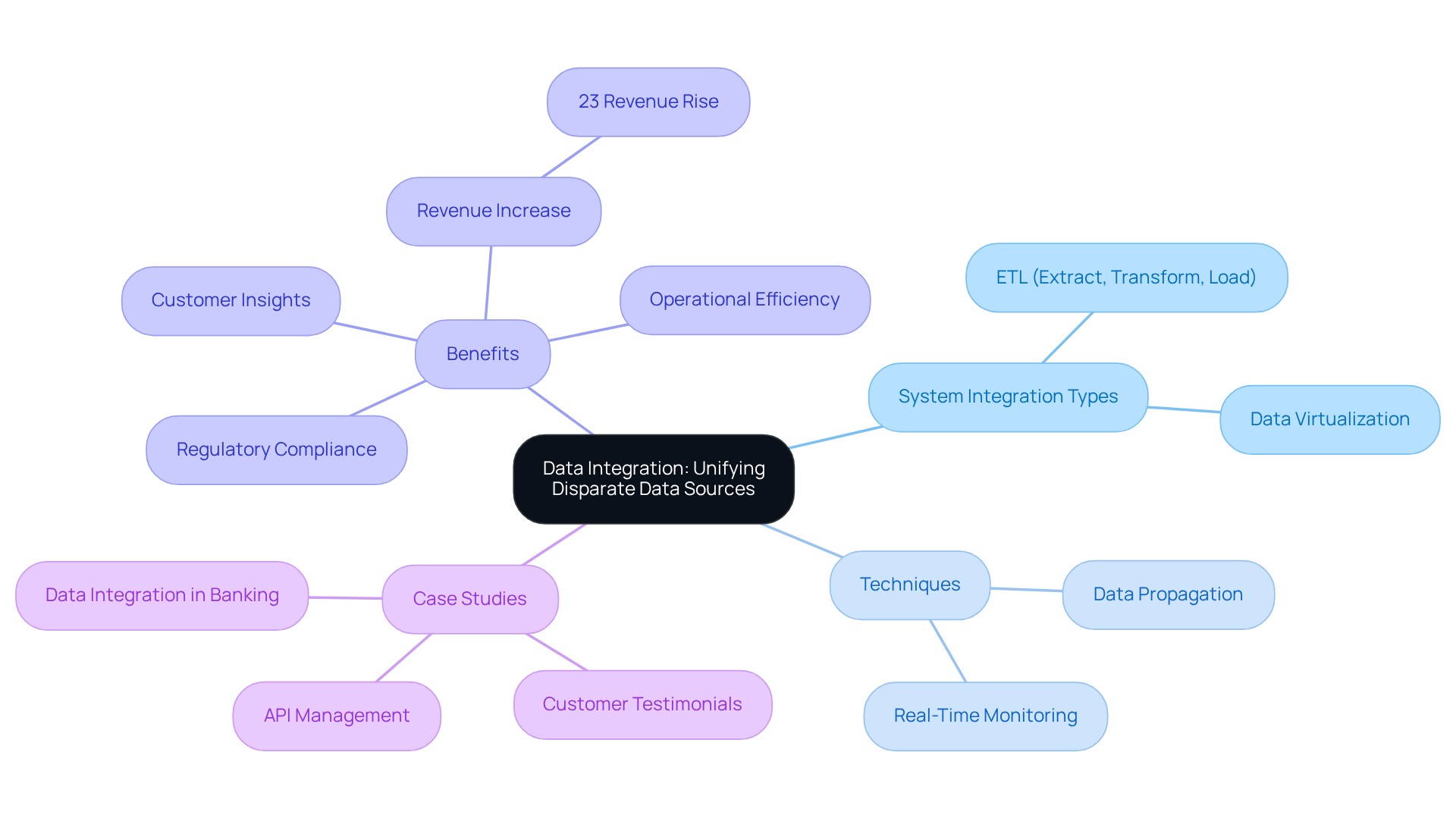

Data Integration: Unifying Disparate Data Sources

System integration types are essential for financial institutions, as they enable us to merge details from various sources into a unified perspective that enhances our decision-making capabilities. By combining diverse information sources, we gain deeper customer insights, optimize our operations, and ensure compliance with regulatory standards.

Techniques such as ETL (Extract, Transform, Load) and data virtualization are essential system integration types in this process, allowing us to respond swiftly to market changes and operational demands. Our Hybrid Integration Platform plays a crucial role in maximizing and extending the value of legacy technologies, enabling us to build on existing assets rather than discarding them.

Furthermore, the platform is designed for secure transactions, ensuring that our connection projects maintain 24/7 uptime with no room for defects or outages—an essential requirement given the sensitive nature of banking operations. We also provide real-time monitoring and alerts regarding system performance, allowing us to proactively manage our connections and sustain operational efficiency.

Statistics reveal that organizations employing effective information unification strategies experience a 23% rise in revenue, underscoring the financial advantages of these practices. Additionally, 80% of enterprise Business Operations leaders assert that system integration types are critical for continuous operations, highlighting their significance in the banking sector.

Case studies illustrate the successful implementation of information integration in banking. For instance, a financial organization utilized ETL processes to synchronize customer information across its systems, ensuring current details that support informed decision-making. This approach not only improved operational efficiency but also enhanced customer service by providing a comprehensive view of client interactions.

The various system integration types within integrated information perspectives empower us to make informed choices, significantly influencing our strategic direction. As Geoffrey Moore emphasizes, effective analytics enables organizations to learn from past performance and forecast future trends, providing a competitive edge in the financial landscape.

By 2025, we must prioritize sophisticated information integration strategies to remain adaptable and responsive to evolving market conditions, ensuring we harness the full potential of our information assets.

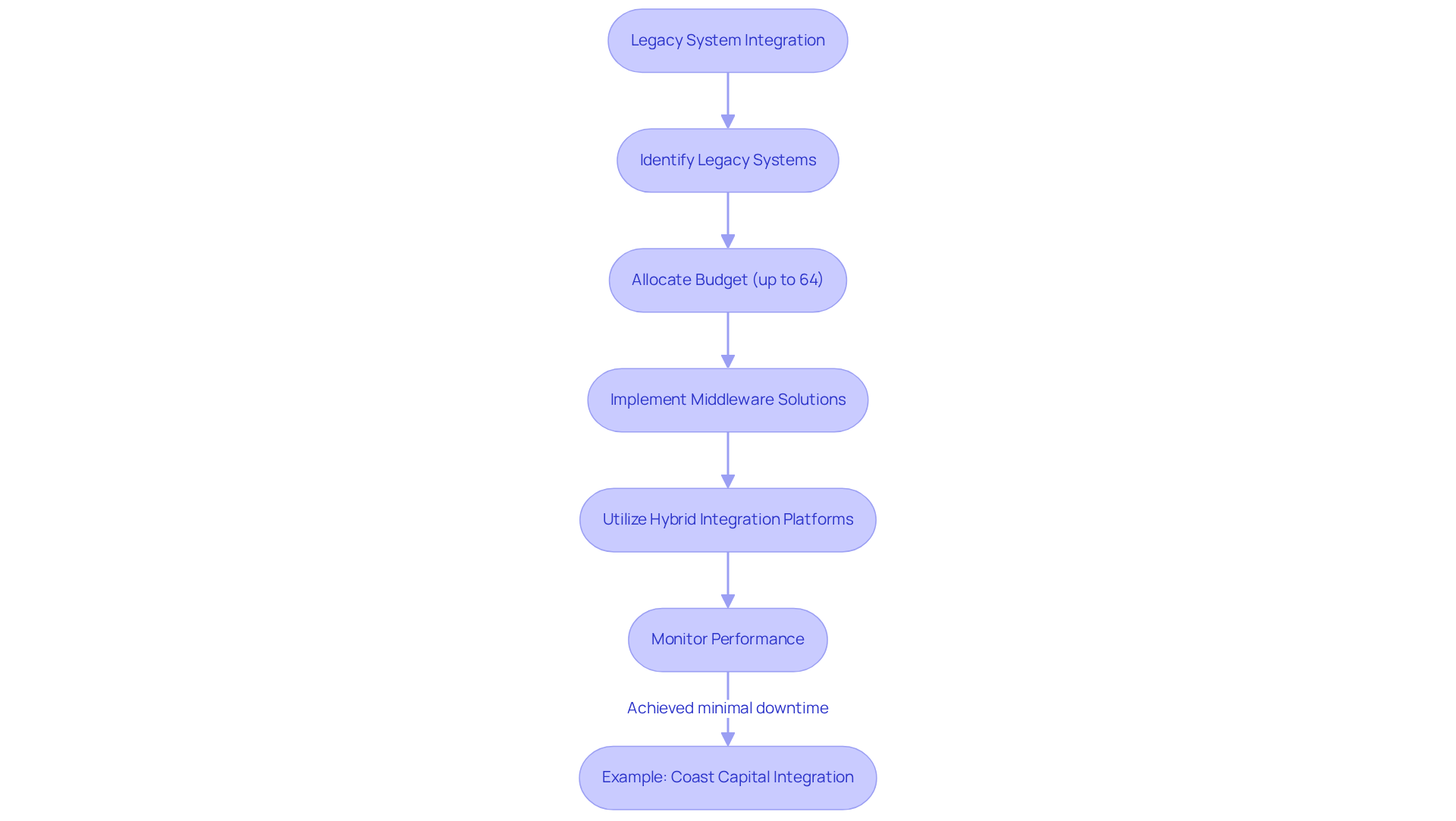

Legacy System Integration: Bridging Old and New Technologies

Integrating outdated infrastructures with contemporary technologies presents a formidable challenge for many banks. These older frameworks often house critical information and functions vital for daily operations. We allocate a substantial portion of our technology expenditure—up to 64% of IT budgets—to sustaining these outdated infrastructures, which can stifle innovation and expose us to security vulnerabilities. Effective system integration types leverage middleware solutions and hybrid integration platforms, such as Avato, to facilitate seamless data flow between legacy and modern infrastructures. This approach not only minimizes disruption but also allows us to optimize our existing technology investments.

Middleware serves as a crucial link between diverse platforms, enabling interoperability and enhancing operational efficiency. By implementing a phased strategy for modernization, we can gradually integrate new technologies while preserving essential legacy functions. For instance, our collaboration with Coast Capital exemplifies this method; the solution became operational in February 2013, supporting various interfaces and facilitating significant transitions with minimal downtime. Notably, in June 2016, Avato enabled the transition of Coast Capital’s complete telephone banking and contact center telephony setup with merely a 63-second interruption, showcasing the platform’s efficiency in real-world scenarios.

Moreover, Avato’s Hybrid Integration Platform provides real-time monitoring and alerts on performance, further bolstering our operational capabilities. Expert insights highlight the urgency of addressing legacy system challenges. Nearly 75% of banking leaders recognize outdated infrastructure as a significant barrier to achieving digital transformation goals. Industry specialists warn that financial institutions resisting modernization risk falling behind in a rapidly evolving market. Therefore, utilizing hybrid integration platforms as a form of system integration types not only simplifies the connection process but also empowers us to respond swiftly to changing customer expectations and regulatory demands.

In conclusion, merging outdated frameworks with contemporary technologies is not merely a technical hurdle; it is a strategic imperative for financial institutions aiming to enhance operational capabilities and maintain a competitive edge. By employing middleware and hybrid integration solutions, like Avato’s platform, we can navigate the complexities of legacy system unification, utilizing different system integration types to ensure a smoother transition into the digital era.

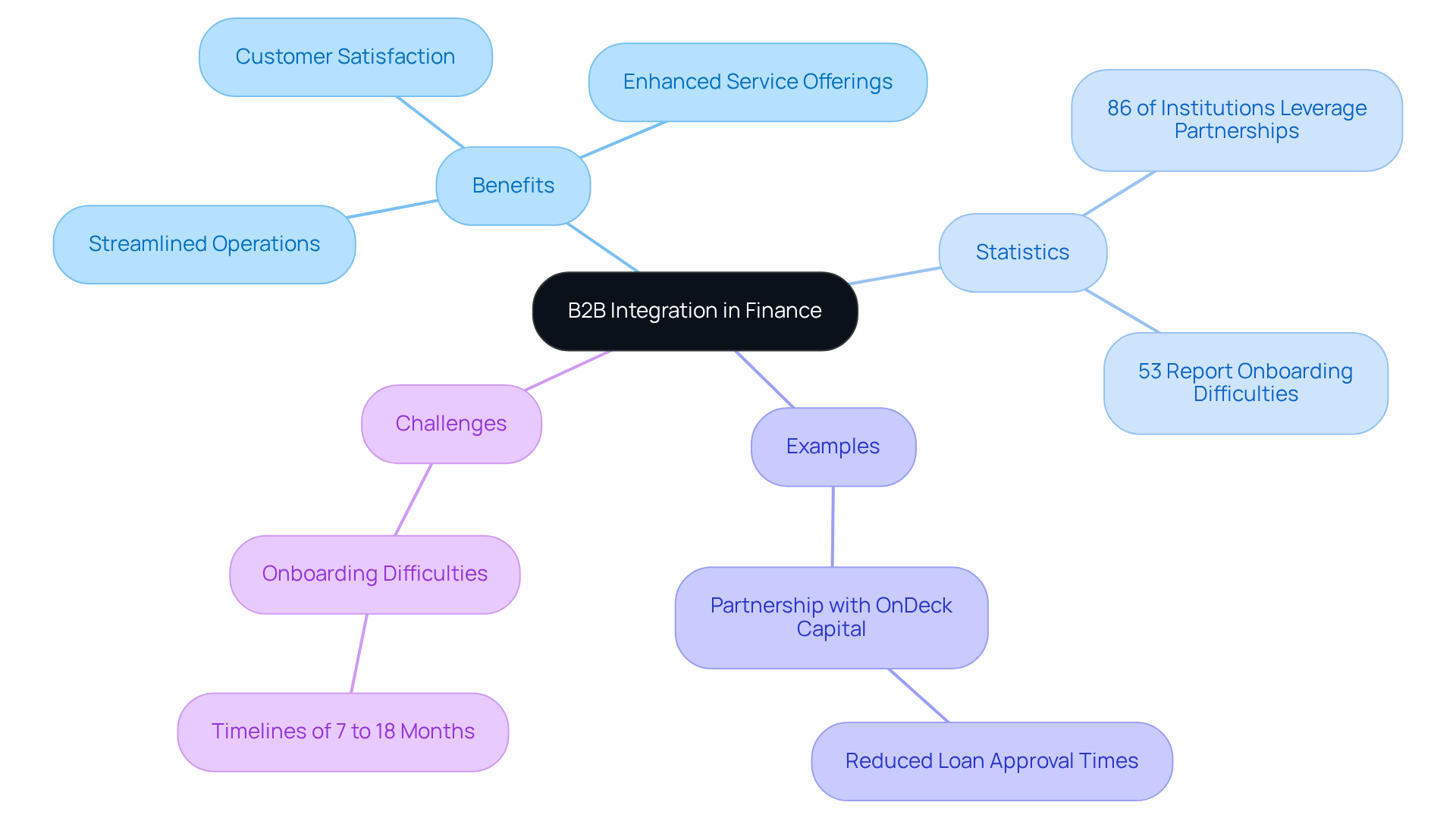

Business-to-Business (B2B) Integration: Collaborating with External Partners

B2B collaboration is essential for us as financial institutions striving to work efficiently with external partners, including payment processors and fintech firms. By leveraging secure connections through APIs and Avato’s Hybrid Integration Platform, we can streamline operations, enhance our service offerings, and significantly improve customer satisfaction.

Our platform is designed to enhance and prolong the value of legacy systems, simplifying intricate connections while ensuring 24/7 availability and dependability—critical elements in the banking industry. This form of connection is particularly vital in the context of open banking, where collaborations with third-party providers foster innovative financial solutions.

Recent research shows that 86% of financial institutions leverage partnerships to reduce expenses and accelerate implementation periods, underscoring the strategic significance of B2B collaboration. A prime example of successful B2B cooperation is our partnership with OnDeck Capital, which illustrates how digital onboarding can reduce loan approval times from days to minutes, thereby enhancing the overall customer experience.

However, we also encounter challenges in B2B collaboration; for example, 53% of us report difficulties in onboarding new partners. As we increasingly recognize the necessity of integrating fintech innovations, our focus on B2B partnerships is expected to grow, driving both operational efficiency and customer engagement in the financial services landscape.

With Avato’s secure connection solutions, we can overcome these challenges and accelerate our digital transformation initiatives.

Point-to-Point Integration: Direct Connections Between Systems

Point-to-point linkage creates direct connections between two systems, enabling information exchange and communication. However, while this approach can be effective for specific scenarios, such as limited application landscapes or temporary projects, it poses significant challenges as the number of connections grows. In the banking sector, where security and compliance are paramount, managing these direct connections can lead to increased complexity and potential data inconsistencies. A survey indicates that 70% of tech professionals experience burnout due to the pressures of constant change, highlighting the need for scalable solutions.

We recognize that relying exclusively on point-to-point connections can impede a financial institution’s capacity to grow efficiently. As noted by industry analysts, this method lacks flexibility and can complicate supply chains, making it less viable for organizations aiming for sustainable growth. For instance, a case study showed that banks utilizing point-to-point connections encountered substantial difficulties in sustaining operational efficiency and compliance, ultimately resulting in higher expenses and resource allocation.

Statistics indicate that 59% of organizations employ various tools to oversee their cloud environments, complicating precise cost monitoring and management. This trend underscores the significance of thoughtfully assessing merging requirements. While point-to-point solutions may suffice for smaller institutions, larger banks are increasingly opting for platforms that provide a more robust and scalable approach.

In contrast, Avato’s Hybrid Connection Platform offers a comprehensive solution by enhancing and extending the value of legacy frameworks while simplifying intricate connections. With support for 12 levels of interface maturity, we enable accelerated connection of isolated legacy systems, unlocking data and systems in weeks rather than months. The platform also features real-time monitoring and alerts, ensuring 24/7 uptime and reliability—critical for banking operations. By utilizing Avato’s platform, banks can steer clear of the pitfalls of point-to-point connections and instead concentrate on a more scalable and efficient connectivity strategy.

In summary, while point-to-point connections are one of the system integration types that can meet specific needs, banking IT managers must weigh their limitations against the demands of modern financial operations. Transitioning to more advanced unification solutions, such as Avato’s platform, can enhance agility, reduce costs, and improve overall operational capabilities.

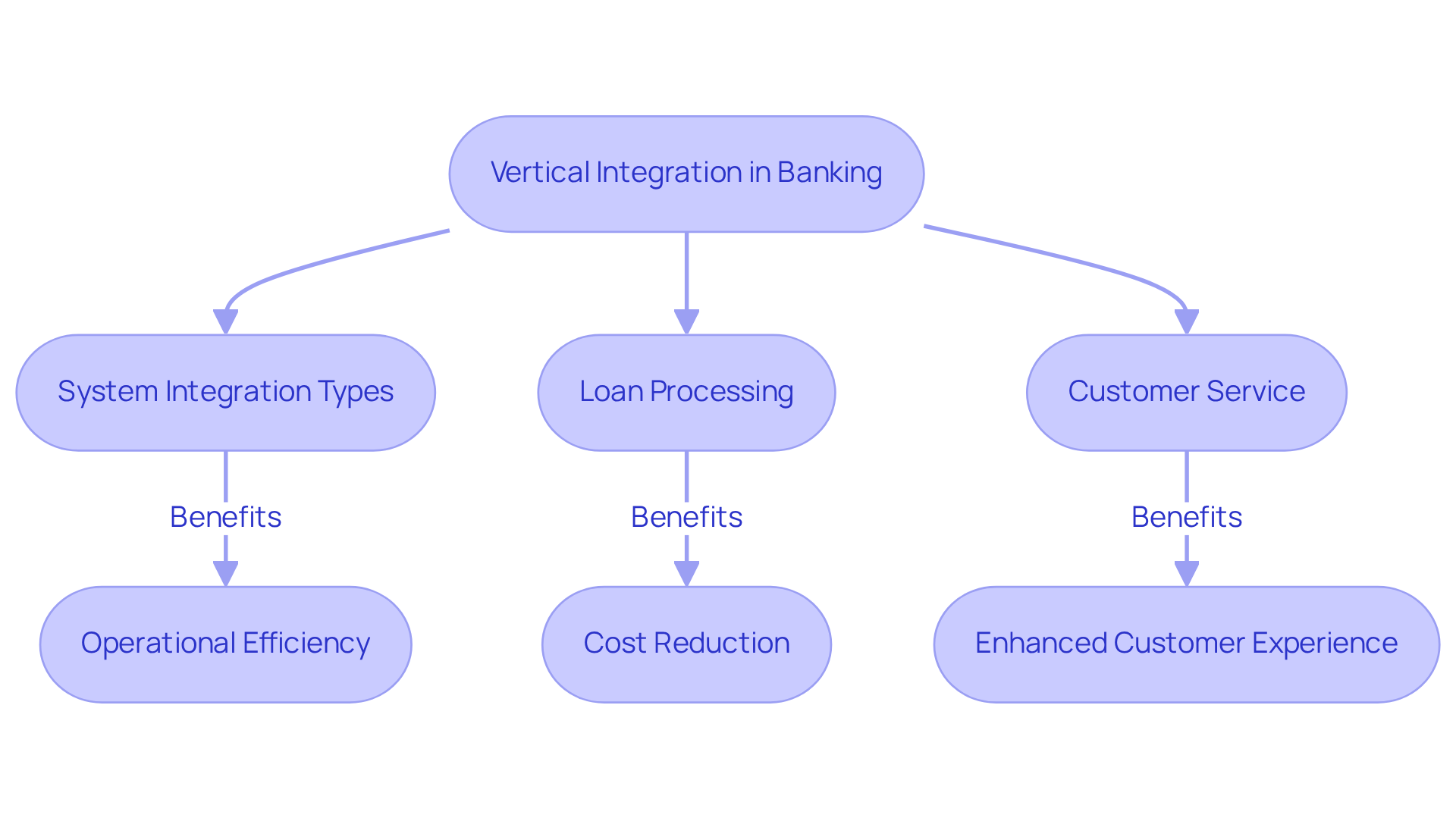

Vertical Integration: Streamlining Industry-Specific Processes

Vertical integration in banking is essential for streamlining processes tailored to the financial services industry. By implementing different system integration types such as loan processing and customer service, we can significantly enhance operational efficiency and reduce costs. This cohesive approach not only improves the customer experience but also ensures adherence to stringent industry regulations.

The ability to connect isolated systems using different system integration types facilitates real-time data access and decision-making, which is crucial in a fast-paced financial environment. As we adopt this unification through various system integration types, we can anticipate a notable enhancement in service delivery and operational flexibility, ultimately resulting in a competitive edge in the marketplace.

What’s holding your organization back from embracing this transformative strategy? We invite you to explore how vertical integration can revolutionize your banking operations and drive success.

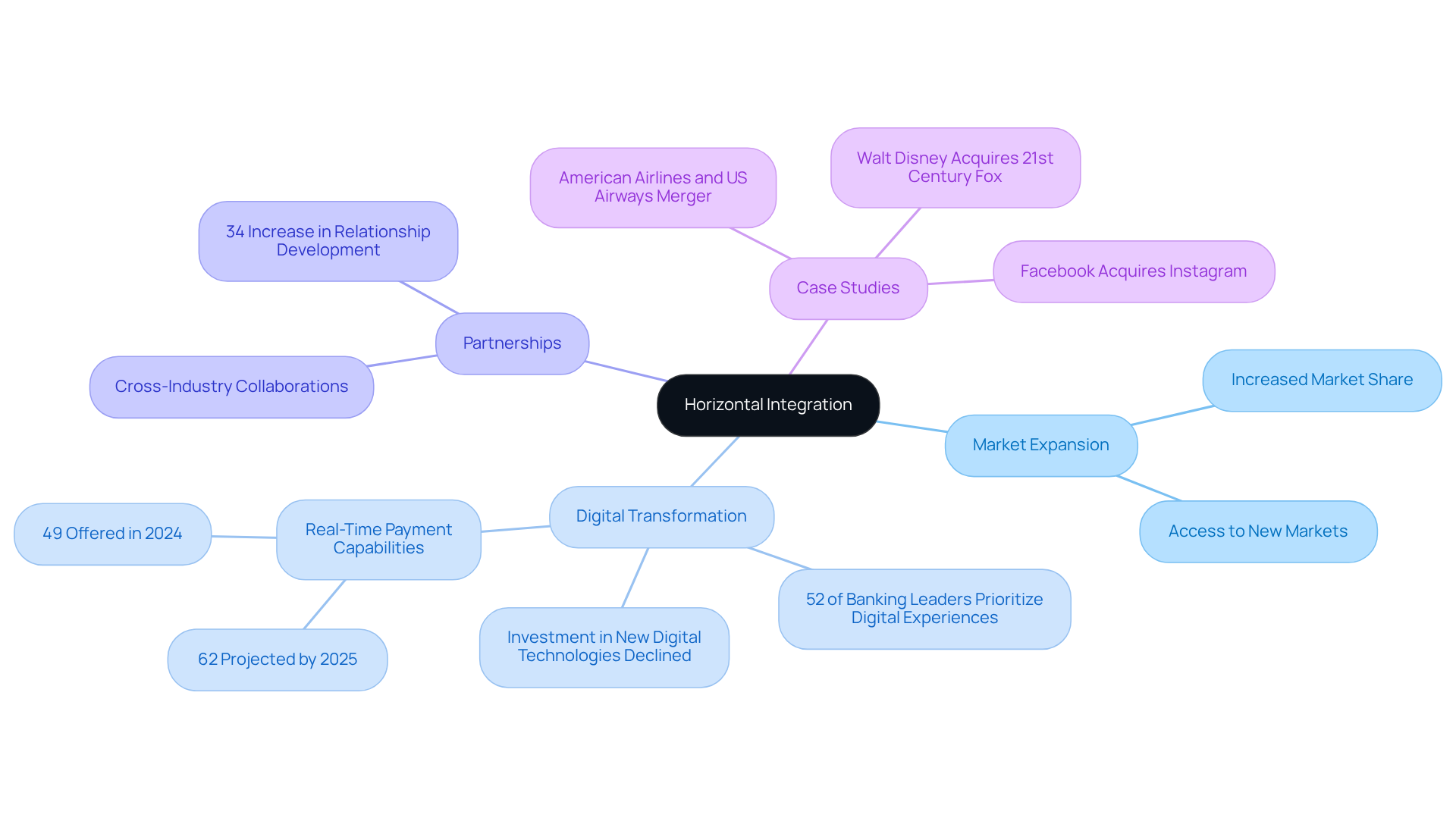

Horizontal Integration: Expanding Across Industries

Horizontal consolidation empowers us to expand our service offerings across diverse sectors, effectively accessing new markets and customer segments. By forging partnerships with companies in various industries, we can introduce innovative financial products tailored to meet a wide array of customer needs. This strategy not only boosts our competitiveness but also enhances our resilience in a rapidly evolving financial landscape.

Consider this: 52% of banking leaders emphasize enhancing digital customer experiences, underscoring our commitment to adjusting services to satisfy changing needs through horizontal collaboration strategies. Our hybrid connection platform, Avato, plays a crucial role in this transformation, ensuring 24/7 uptime and reliable connectivity that supports our digital transformation initiatives. With support for 12 levels of interface maturity, Avato enables us to balance implementation speed with the sophistication required to future-proof our technology stack.

Additionally, successful case studies, such as the merger between American Airlines and US Airways, exemplify how horizontal integration can enhance market presence and operational efficiency in banking contexts. As we increasingly acknowledge the significance of cross-industry partnerships—particularly with 43% of leaders expecting considerable market upheaval from unconventional competitors—we position ourselves to capitalize on new opportunities and foster growth in an interconnected economy.

Furthermore, the statistic that 34% of institutions report an increase in relationship development as a secondary focus highlights the positive impacts of such strategies. By harnessing generative AI, we can further elevate customer experience and operational efficiency, empowering us to lead the AI revolution in financial services.

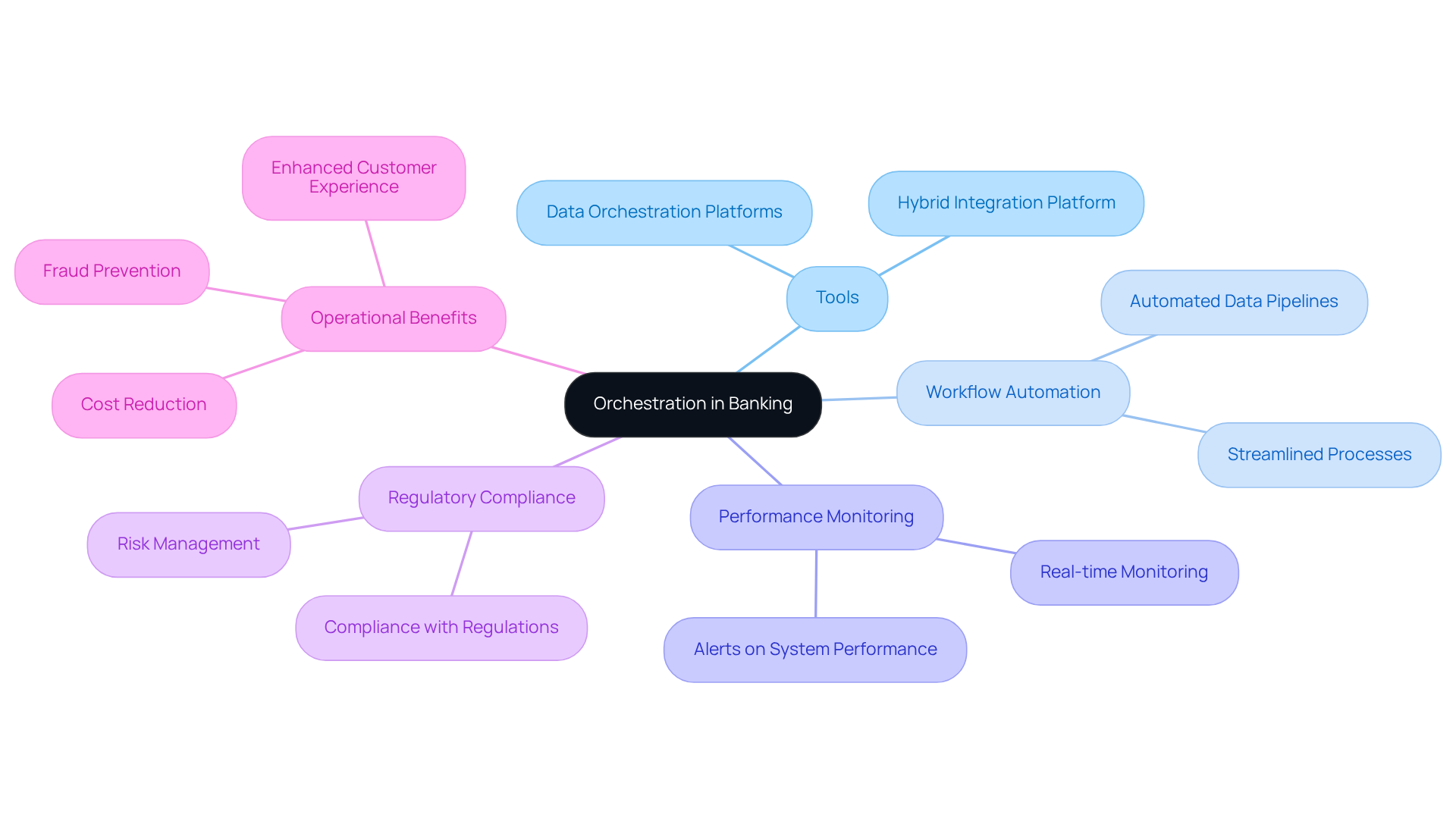

Orchestration: Managing Complex Integrations Efficiently

Orchestration is essential for coordinating various unification processes, ensuring they function seamlessly together. In the banking sector, orchestration tools are pivotal in managing complex connections by automating workflows, monitoring performance, and ensuring compliance with regulatory requirements. Our Hybrid Integration Platform enhances this process by providing real-time monitoring and alerts on performance, which are crucial for effectively managing these intricate integrations. By adopting orchestration strategies, we can significantly boost operational efficiency, minimize errors, and elevate overall service delivery while maximizing and extending the value of our legacy systems.

Consider how information orchestration enhances workflows in critical areas such as account onboarding and fraud prevention, supporting regulatory compliance and improving operational effectiveness. Furthermore, this strategic approach aids in fraud prevention and risk management by creating dynamic customer profiles through data aggregation, ultimately reducing costs. This empowers us to respond swiftly to evolving customer expectations and market demands, fostering a more agile and competitive environment. So, what’s holding your team back? Let us partner with you to unlock the full potential of orchestration and drive your organization forward.

Conclusion

In the ever-evolving landscape of banking technology, we recognize that the integration of diverse systems stands as a crucial strategy for IT managers striving to enhance operational efficiency and customer satisfaction. By exploring various system integration types, we can effectively bridge the gap between legacy systems and modern solutions, ensuring secure and seamless collaboration across platforms.

Throughout this article, we have highlighted key integration types such as:

- API integration

- Enterprise Service Bus (ESB)

- Hybrid integration platforms like Avato

for their transformative roles in banking operations. The insights we’ve shared demonstrate how these solutions not only mitigate security risks but also drive significant improvements in customer experiences and operational capabilities. Moreover, the statistics and case studies presented illustrate the tangible benefits of embracing these integration strategies, emphasizing their critical importance in the evolving financial landscape.

As the banking sector continues to adapt to rapid technological advancements, the urgency for strategic integration becomes increasingly evident. We must prioritize the adoption of sophisticated integration solutions to remain competitive and responsive to market demands. Embracing these practices will not only enhance our operational agility but also empower us to leverage our data and systems more effectively, ultimately leading to a more innovative and customer-centric banking experience. What’s holding your team back from taking this vital step forward?