Overview

In 2025, the landscape of banking is set to transform dramatically, and we must recognize the urgency of modernization. Financial institutions face the pressing need to adapt to evolving technologies and customer expectations. By leveraging:

- Hybrid integration platforms

- Collaborating with fintech firms

- Adopting cloud-based solutions

- Utilizing data analytics

we can enhance operational efficiency, security, and customer satisfaction. These strategies are not just beneficial; they are essential for maintaining competitiveness in a rapidly changing financial environment. What’s holding your team back from embracing these advancements? Let us work together to ensure your institution thrives amid these challenges.

Introduction

In the rapidly evolving financial landscape of 2025, we recognize that banks face an urgent need to modernize their operations while effectively integrating legacy systems with cutting-edge technologies. The adoption of hybrid integration platforms, such as Avato, is revolutionizing how we connect diverse systems, facilitating a seamless flow of data and significantly enhancing overall performance.

As the urgency for modernization intensifies—driven by rising operational costs and security risks—we must also explore strategic partnerships with fintech solutions to ignite innovation and deliver customer-centric services.

This article delves into the multifaceted strategies essential for us to navigate our modernization journeys, focusing on:

- Leveraging data analytics

- Embracing cloud solutions

- Fostering a culture of continuous improvement

To ensure we remain competitive and responsive to customer demands.

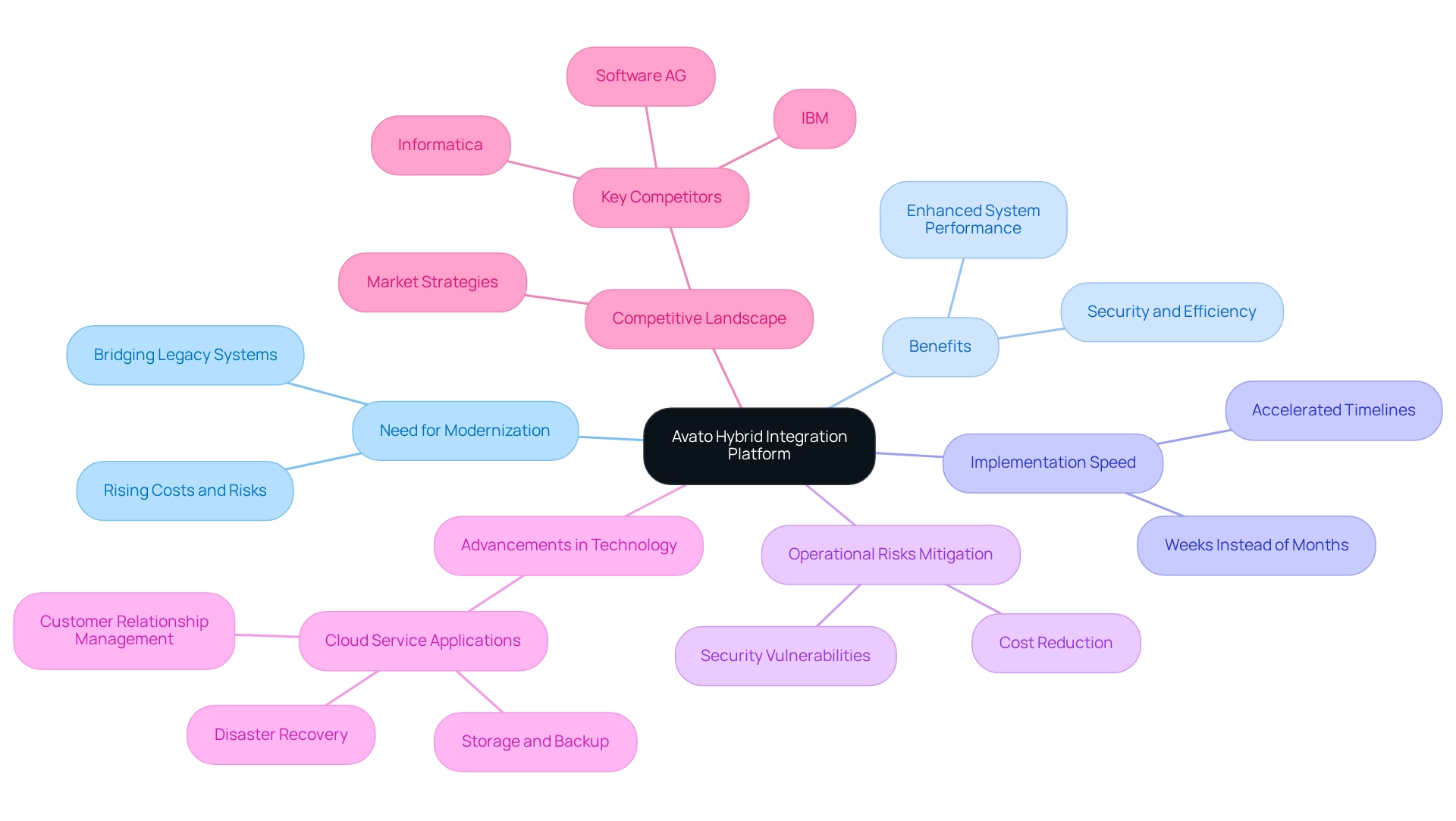

Avato: Leverage a Secure Hybrid Integration Platform for Seamless System Connections

At Avato, we recognize the pressing need for banking modernization to bridge the gap between legacy systems and contemporary applications. Our hybrid connection platform facilitates seamless data flow across diverse platforms, a crucial capability for those aiming to modernize operations while preserving the value of existing infrastructures.

By leveraging our technology, financial institutions can dramatically accelerate implementation timelines—unlocking data and systems in weeks rather than months—while mitigating operational risks such as elevated costs and security vulnerabilities associated with outdated systems. This enhancement of overall system performance is vital in the rapidly evolving financial landscape of 2025.

As banking modernization urgency escalates, driven by rising expenses and threats linked to obsolescence, adopting hybrid connection platforms becomes indispensable. Recent advancements in hybrid amalgamation technology, including improved cloud service applications for storage, disaster recovery, and customer relationship management, empower banks to fully exploit their legacy systems, ensuring competitiveness and responsiveness to market demands.

With a steadfast focus on security and efficiency, we position Avato as a leader in banking modernization initiatives, empowering institutions to navigate the complexities of integration with confidence.

As Gustavo Estrada aptly stated, ‘Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints.’ This assertion underscores our effectiveness in the competitive landscape, where platforms like Software AG, Informatica, and IBM also contend for market share. However, our unique approach ensures that we remain the preferred choice for banking IT managers seeking reliable, innovative solutions.

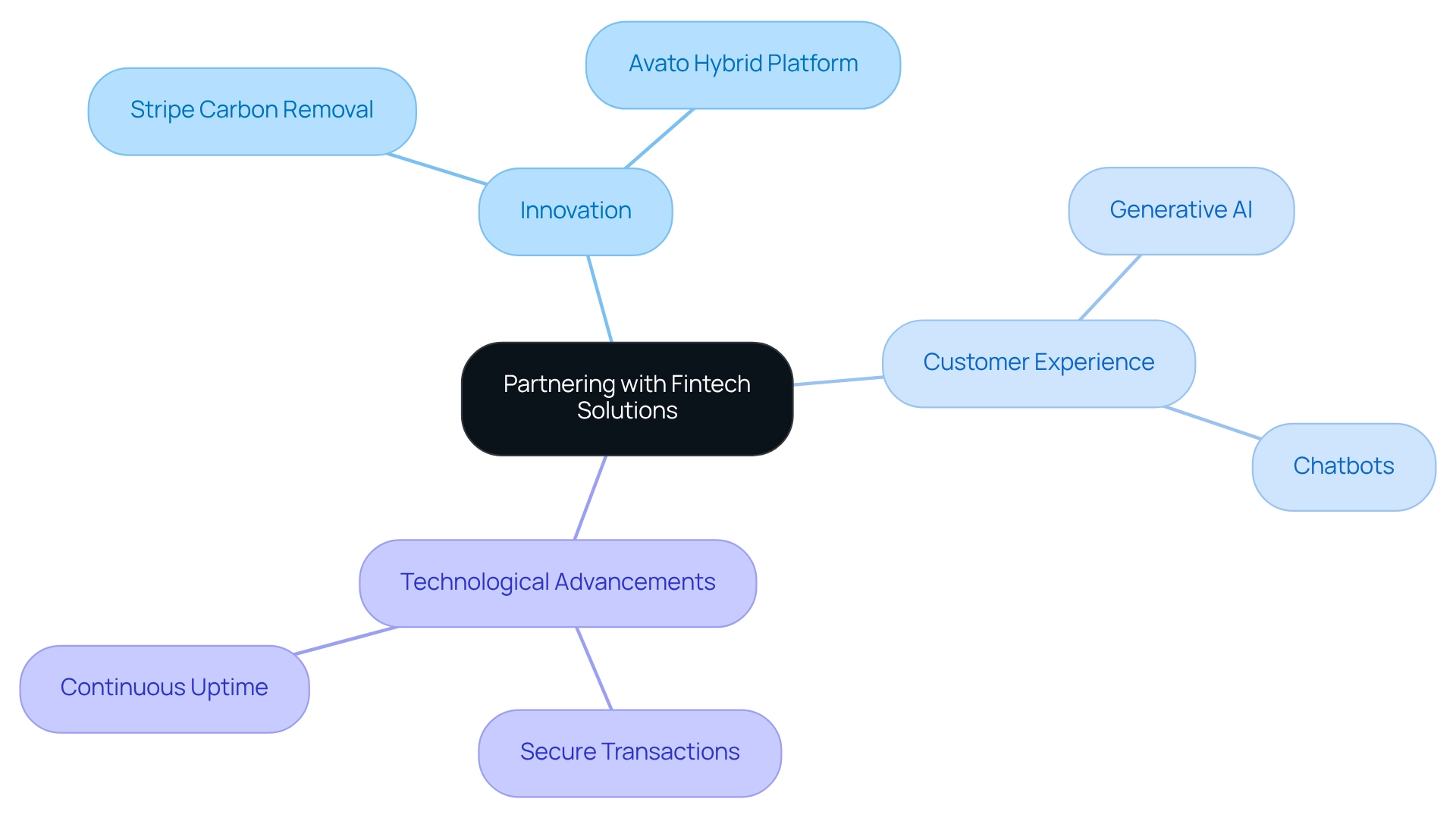

Partner with Fintech Solutions to Drive Innovation and Customer-Centric Modernization

Collaborating with fintech firms is essential for financial institutions seeking to leverage advanced technologies and flexible approaches that significantly enhance customer experiences. By incorporating fintech solutions, we can offer tailored services, optimize our operations, and swiftly adapt to evolving market demands. This collaborative strategy not only drives innovation but also positions us as leaders in customer-focused service delivery, a critical factor for maintaining a competitive edge in 2025.

With over 26,000 fintech startups worldwide, the landscape is increasingly competitive, making differentiation through strategic partnerships vital. Effective partnerships, such as Stripe’s integration of carbon removal services, illustrate how fintech can help us meet rising consumer demands for sustainable financial offerings.

Furthermore, the application of generative AI has surged by 60%, particularly in enhancing client experiences through advanced chatbots and virtual assistants, which can further elevate our service delivery. As the financial services industry evolves, embracing fintech collaborations and utilizing advanced unification solutions like Avato’s hybrid platform will be crucial for us to achieve banking modernization efficiently and enhance customer satisfaction.

Avato’s hybrid platform, designed for secure transactions and continuous uptime, supports 12 levels of interface maturity, allowing us to balance speed and sophistication in our development projects. To initiate or enhance these partnerships, we encourage banking IT managers to actively seek out fintech firms that align with their strategic objectives and explore collaborative projects centered on innovation and customer-centric solutions.

As Tony LeBlanc from the Provincial Health Services Authority noted, ‘Avato accelerates the integration of isolated systems and fragmented data, delivering the connected foundation enterprises need to simplify, standardize, and pursue banking modernization.

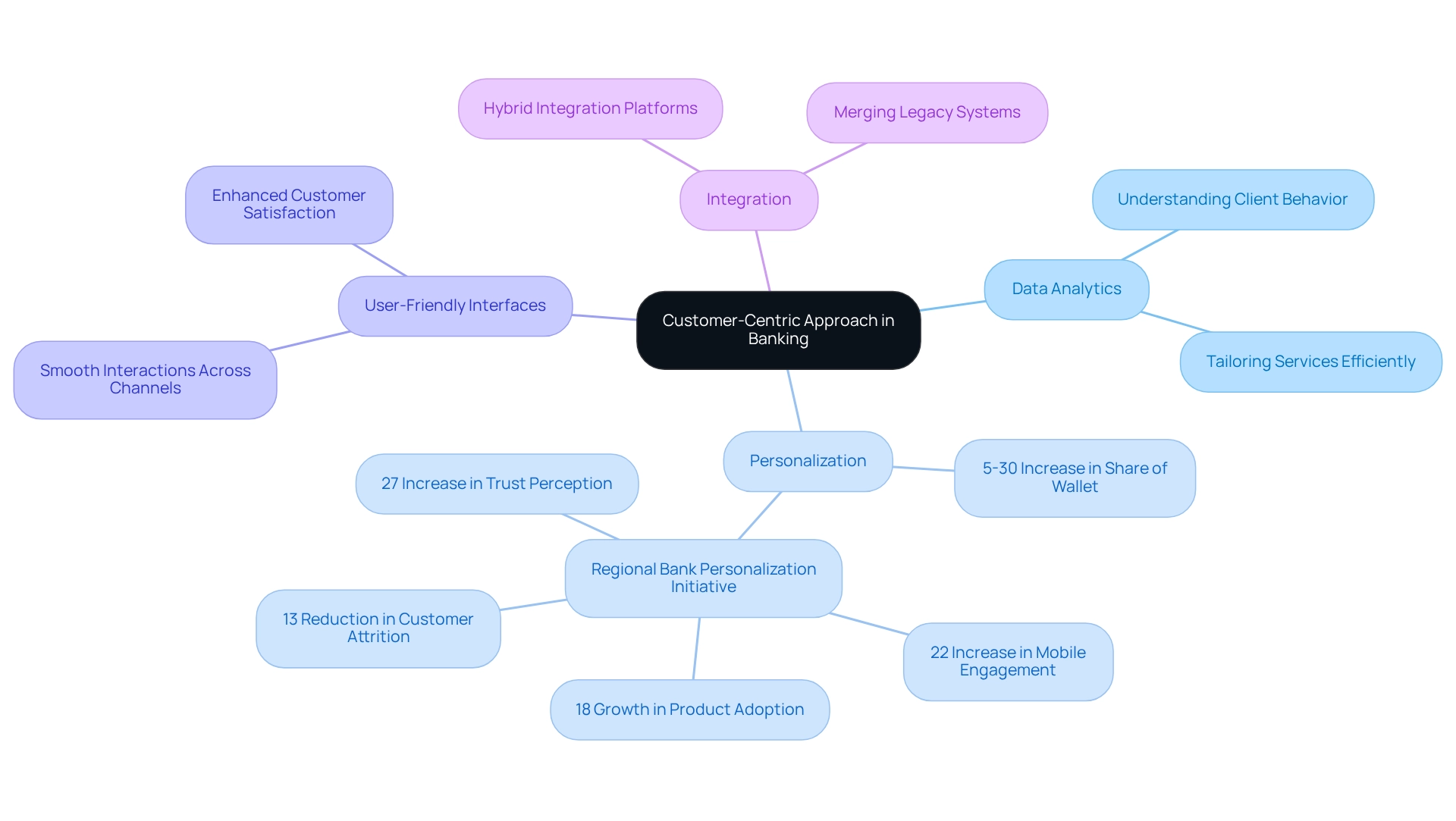

Adopt a Customer-Centric Approach to Enhance User Experience in Banking

To enhance user experience, we must adopt a customer-focused strategy that prioritizes client needs and preferences. In today’s competitive landscape, utilizing data analytics is crucial for comprehending client behavior, enabling us to tailor our services efficiently. By creating user-friendly interfaces and facilitating smooth interactions across multiple channels, we can significantly enhance customer satisfaction and loyalty—essential factors for sustained success.

What if we told you that in 2025, financial institutions prioritizing personalization are projected to see a 5-30% increase in share of wallet across products? This statistic highlights the financial benefits of a customer-focused strategy. A notable case study from a mid-sized regional financial institution illustrates this: their comprehensive personalization initiative, which included AI-driven spending insights, personalized recommendations for financial advisors, customized email communications, and targeted educational content based on life events, led to a remarkable 22% increase in mobile app engagement and an 18% growth in product adoption within just one year.

Moreover, adopting personalization now allows us to establish a sustainable growth foundation in an increasingly competitive digital environment. As industry experts highlight, measuring personalization metrics should extend beyond traditional engagement metrics to capture the true effectiveness of these strategies. Furthermore, as we prepare for open banking modernization, merging existing legacy systems with a hybrid integration platform can improve user experience and optimize operations. Forrester notes that CX leaders plan to invest 24% of their CX program budgets in third-party service providers, underscoring our industry’s focus on enhancing customer experience.

This urgency for us to adopt these strategies is critical for maintaining a competitive edge. Are we ready to lead the charge in transforming user experience through personalization?

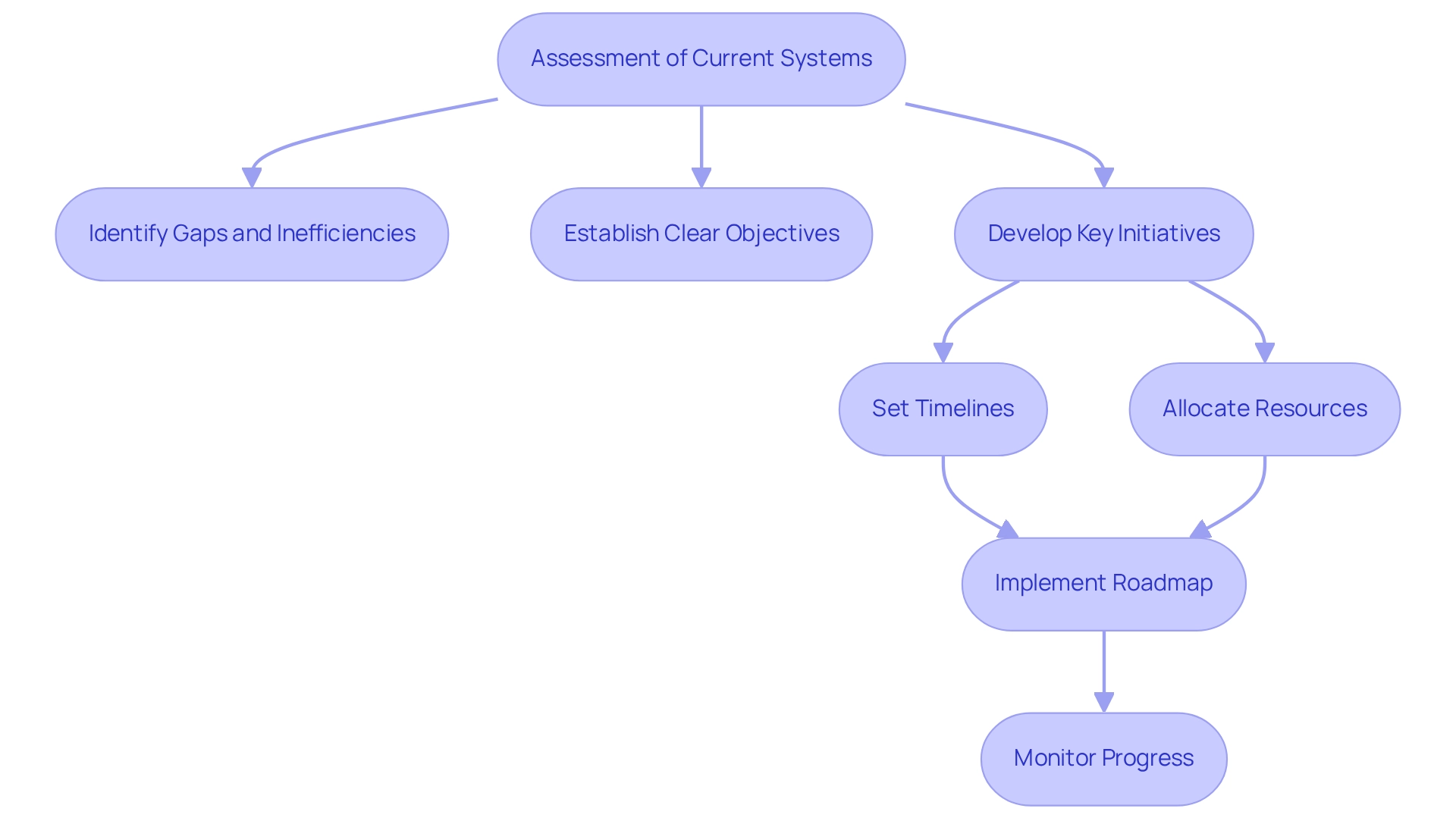

Create a Comprehensive Roadmap for Strategic Banking Modernization

Developing a comprehensive roadmap for banking modernization is essential for aligning our technology enhancements with strategic goals. This process begins with a thorough assessment of our current systems to identify gaps and inefficiencies. Establishing clear objectives is crucial, as it guides the development of key initiatives, timelines, and resource allocations necessary for successful implementation.

A well-structured roadmap not only minimizes disruptions but also maximizes our return on investment. By 2025, effective modernization roadmaps will be defined by an emphasis on improving client experiences, with 65% of consumers now anticipating AI to accelerate financial transactions—a substantial rise from 46% in 2023. This shift underscores the necessity for financial institutions to incorporate advanced technologies into their modernization strategies, as digital transformation is crucial for meeting evolving client expectations.

At Avato, emerging from our commitment to simplifying intricate integration challenges, we play a pivotal role in this transformation with our hybrid integration platform. By bridging legacy systems with modern expectations, we empower financial institutions to unlock isolated assets, enhance business value, and streamline their digital transformation efforts. Best practices for developing a banking modernization roadmap include:

- Engaging stakeholders early in the process to ensure alignment and buy-in

- Prioritizing initiatives based on impact and feasibility

- Incorporating real-time monitoring systems to track progress in banking modernization

Furthermore, successful financial institutions have implemented multi-layered security strategies to tackle growing cybersecurity threats, as illustrated in case studies showing how these practices can reduce risks and uphold customer trust.

Expert insights indicate that strategic planning is essential for the success of modernization initiatives. By following these steps and utilizing our dedicated hybrid integration solutions, we can help financial institutions develop a strong roadmap that not only addresses current needs but also prepares them for future expansion in a progressively competitive market. To learn more about how we can assist in your financial modernization journey, download our comprehensive guide now.

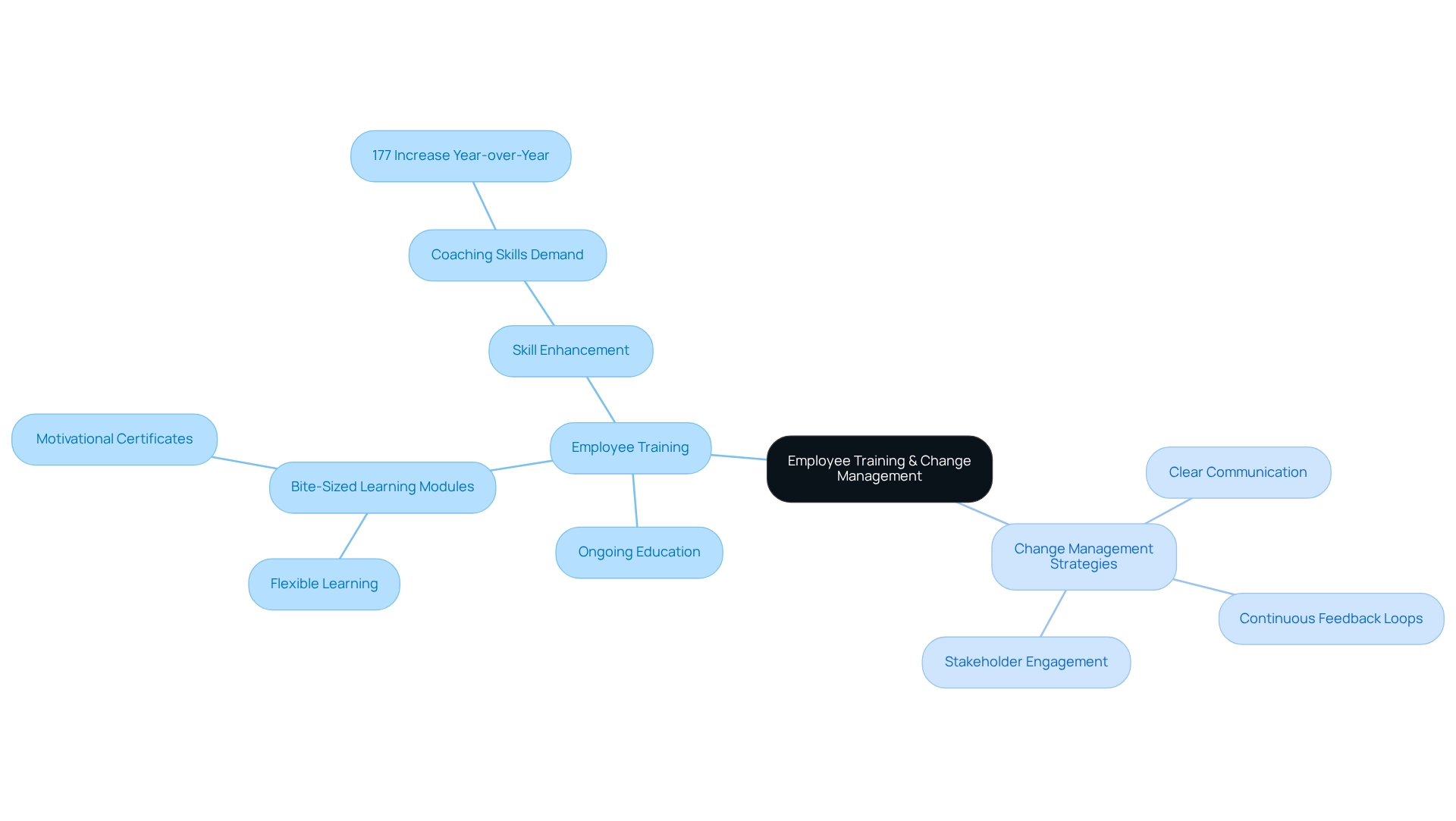

Focus on Employee Training and Change Management for Smooth Transitions

To ensure successful transitions during modernization, we must prioritize comprehensive employee training and robust change management strategies, particularly as we prepare for open banking. This involves not only ongoing education about emerging technologies and processes but also cultivating a culture that embraces change. By equipping our staff with crucial skills and knowledge, we can significantly boost productivity and foster enthusiasm for modernization efforts.

In 2025, the effectiveness of our employee training will be paramount, with studies indicating that organizations investing in training experience a notable enhancement in operational efficiency. For instance, a recent report highlighted a 177% increase in the demand for acquiring coaching skills, underscoring the necessity for us to adjust our training programs in alignment with evolving industry standards. This is especially relevant as the financial sector strives to achieve efficiencies for digital assets comparable to traditional markets, as noted by DTCC.

Insights from change management experts suggest that successful transitions in finance require a structured approach. Strategies such as clear communication, stakeholder engagement, and continuous feedback loops are essential for minimizing resistance and maximizing buy-in from employees. As we prepare for open access, integrating secure and reliable connections between applications will be crucial. Greg Sullins from Newgen Software anticipates a transformative year for the financial sector in 2025, emphasizing the need for agility, innovation, and seamless customer experiences, which further highlights the importance of effective training and change management.

Case studies, such as those from SC Training, demonstrate that bite-sized learning modules can effectively motivate employees, leading to a more skilled and committed workforce. These courses align well with the needs of finance employees, allowing them to engage in learning at their own pace while acquiring essential skills necessary for navigating the complexities of open finance integration. Ultimately, the impact of effective change management on our success in banking modernization cannot be overstated. By implementing strategic training initiatives and fostering an adaptable culture, we can navigate the complexities of modernization while ensuring that our workforce is prepared to meet new challenges head-on. The expanding collection of studies, including findings from the Papers in Monetary Economics: Financial System & Institutions eJournal, which has released over 12,233 articles, emphasizes the essential role of training in enhancing operational capabilities within the financial sector.

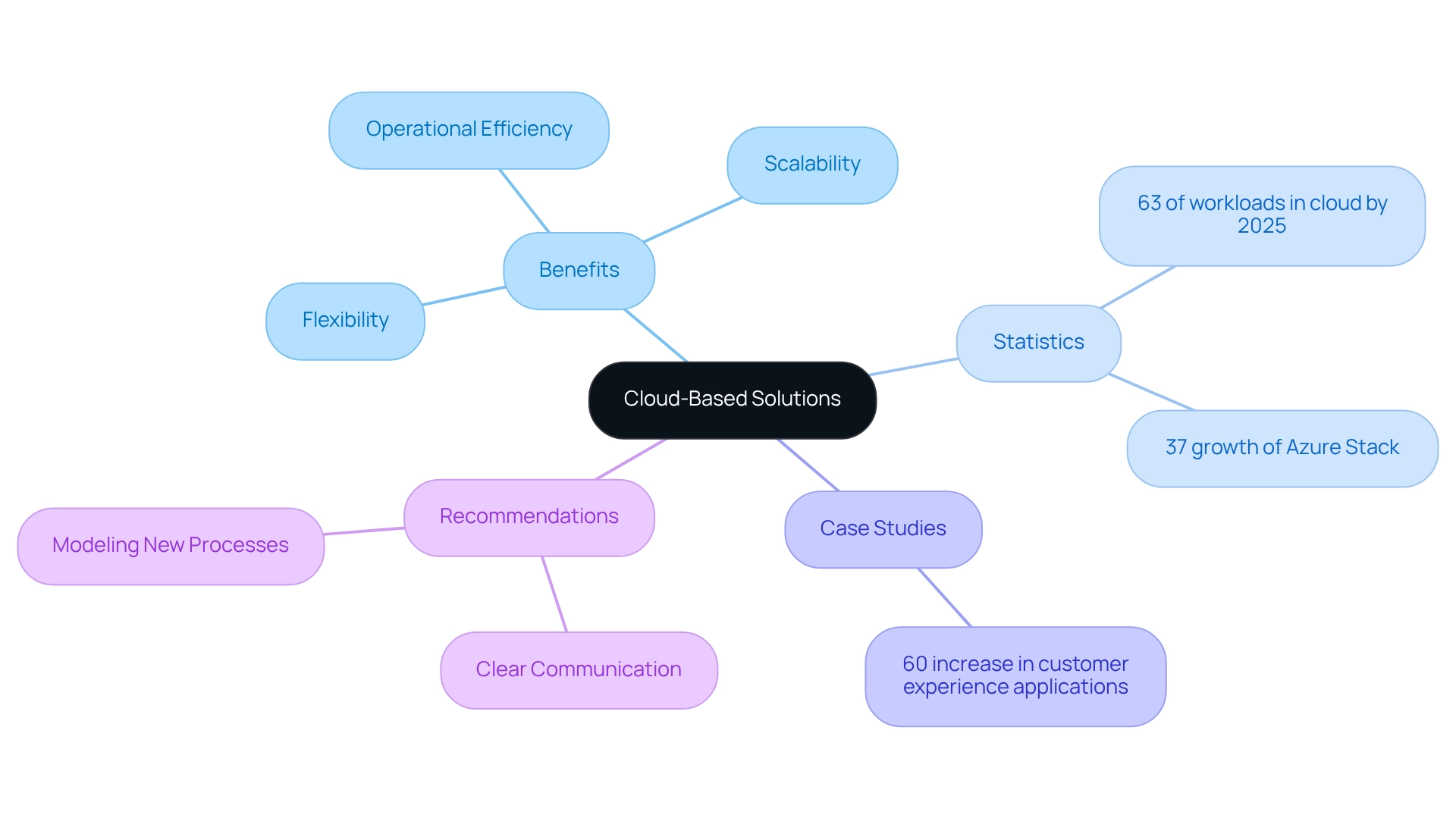

Embrace Cloud-Based Solutions for Enhanced Flexibility and Scalability

Embrace Cloud-Based Solutions for Enhanced Flexibility and Scalability

We believe that adopting cloud-based solutions empowers financial institutions to significantly enhance their operational flexibility and scalability. These technologies facilitate rapid adaptation to evolving market conditions, allowing us to scale resources dynamically and optimize infrastructure costs. By utilizing cloud services, we can foster improved collaboration among teams and enhance data accessibility, ultimately leading to more efficient operations and superior client service.

Statistics indicate that as of 2025, a substantial 63% of small and medium-sized business workloads are hosted in the cloud, reflecting a broader trend in the financial sector towards cloud adoption. This change not only simplifies processes but also enables us to react quickly to client needs and regulatory modifications. Furthermore, Microsoft Azure Stack usage grew to 37% in 2022, surpassing VMware vSphere in the private cloud market, indicating a strong preference for cloud solutions among financial institutions.

Moreover, successful case studies highlight how banks that have integrated cloud solutions alongside generative AI report enhanced operational efficiency. The use of generative AI has seen a 60% increase in customer experience applications, particularly in developing sophisticated chatbots and virtual assistants, which can be seamlessly integrated into cloud environments. Organizations facing cloud cost management challenges have recognized the necessity for robust strategies to control expenses while maximizing the benefits of cloud investments. As highlighted by Gartner for High Tech, utilizing best practices in cloud unification and generative AI is crucial for addressing these challenges effectively.

To mobilize stakeholders effectively, we encourage IT managers in the financial sector to engage in clear communication about the benefits of cloud adoption and generative AI integration. By modeling new business processes and activity flows, we can plot a course to success that aligns with organizational goals. As cloud technology continues to evolve, its role in driving banking modernization becomes increasingly critical, ensuring that we remain competitive and responsive in a fast-paced financial landscape.

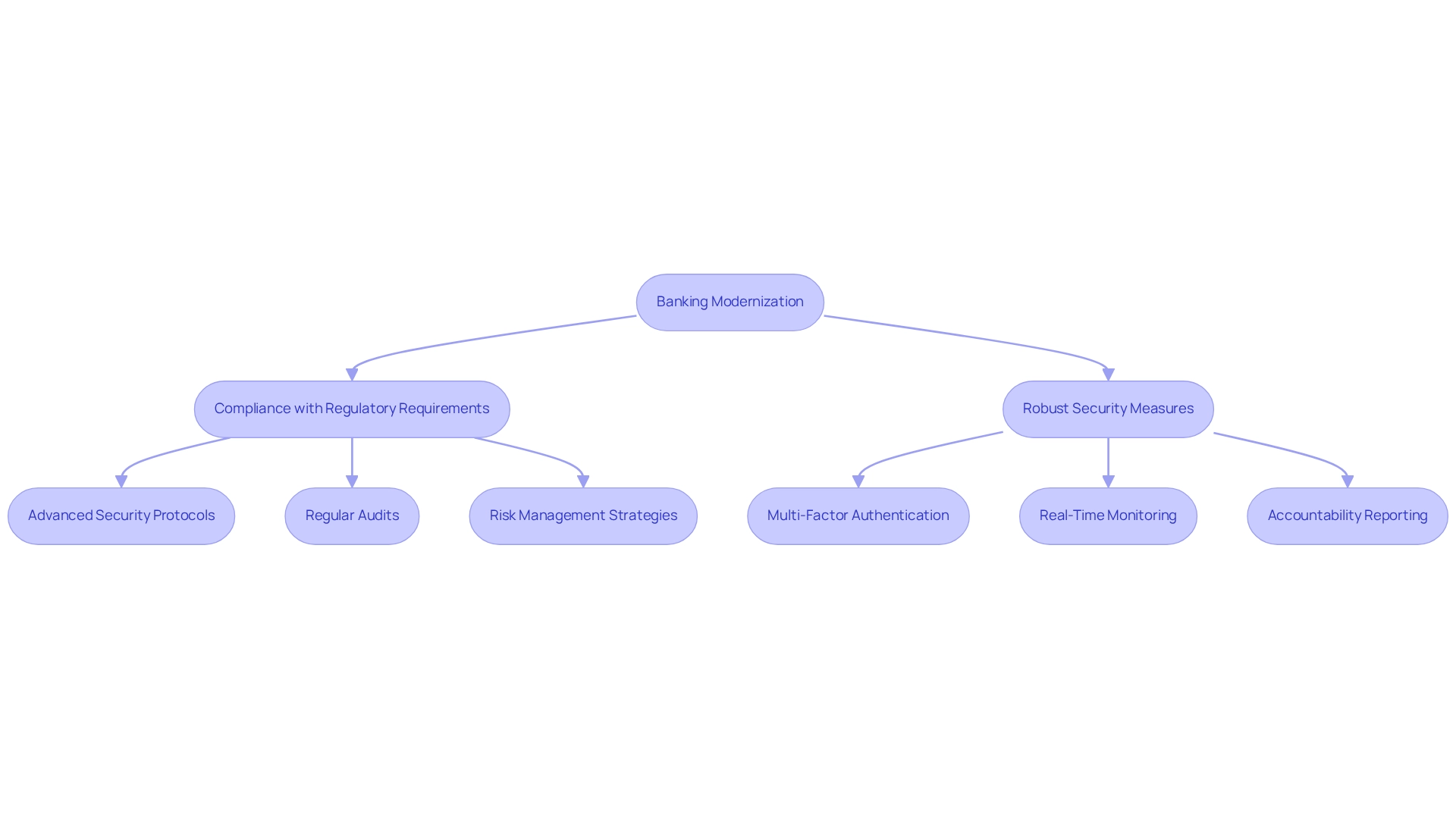

Ensure Compliance and Security as Core Components of Modernization

In the process of banking modernization, we must prioritize compliance with regulatory requirements alongside robust security measures. This entails the implementation of advanced security protocols, regular audits, and a proactive approach to evolving regulations. A staggering 52% of compliance experts indicate that insufficient data about partners exposes businesses to significant risks, underscoring the need for comprehensive risk management strategies.

By integrating compliance and security into our banking modernization framework, we can protect sensitive client information and build trust with our patrons, which is essential for ongoing success. Furthermore, almost one-third of companies have indicated being targets of fraud or financial crime in the last five years. This emphasizes the necessity for us to implement strict security protocols. Effective execution of these protocols not only safeguards our assets but also boosts customer trust in our financial services.

Insights from regulatory experts suggest that regular board-level and CEO reporting on compliance issues can lead to substantial savings, averaging $1.08 million per organization. This practice highlights the significance of accountability and transparency in our compliance initiatives, especially as we navigate the intricacies of banking modernization.

Furthermore, we must utilize tools like Avato’s dedicated hybrid integration platform, which offers features such as real-time data integration and automated compliance reporting, to streamline our compliance processes and enhance risk management within the context of banking modernization. This ensures that we are well-equipped to handle the challenges of modern banking.

As we navigate the complexities of banking modernization, ensuring security during system upgrades is paramount. The latest security measures, including multi-factor authentication and real-time monitoring, are essential for mitigating risks and maintaining operational integrity. By prioritizing compliance and security, we can effectively modernize our systems while reinforcing client trust and loyalty in 2025.

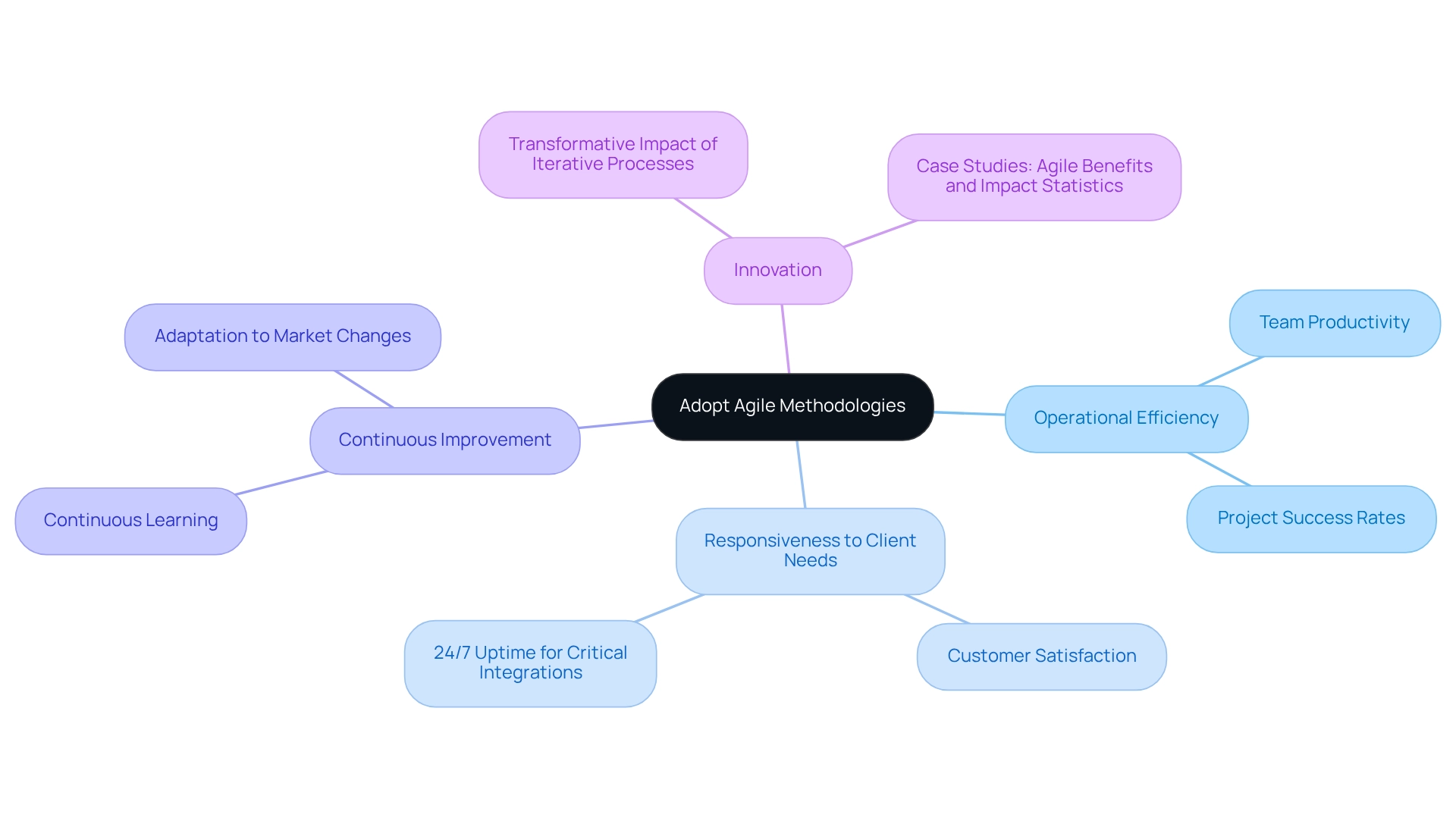

Adopt Agile Methodologies for Continuous Improvement in Banking Services

Adopting agile methodologies enables us to greatly enhance operational efficiency and responsiveness to client needs. By embracing iterative processes and promoting cross-functional collaboration, we can swiftly adapt to market changes and continuously refine our services. This agile approach not only elevates customer satisfaction but also fosters innovation, positioning us to remain competitive in an ever-evolving landscape.

As we look ahead to 2025, the adoption of agile practices among our financial development teams has reached unprecedented levels, reflecting a broader trend towards flexibility and responsiveness in the financial sector. Statistics indicate that organizations implementing agile methodologies have experienced notable improvements in team productivity and project success rates, reinforcing the effectiveness of this approach. Significantly, we guarantee round-the-clock availability for essential connections, providing a robust basis for digital transformation efforts and emphasizing the dependability that agile methodologies contribute to our financial operations.

Expert insights reveal that continuous learning and adaptation are crucial for financial institutions aiming to thrive in the competitive market. Leaders in the industry, such as Viraj Mahajan, have acknowledged the transformative impact of iterative processes, emphasizing that agile practices not only streamline operations but also enhance service delivery. Our hybrid unification platform supports this transformation by simplifying complex connections and delivering cost-effective solutions tailored for regulated sectors like banking, healthcare, and government. Case studies, including ‘Agile Benefits and Impact Statistics,’ illustrate successful implementations of agile methodologies, showcasing how we have leveraged these strategies to enhance efficiency and collaboration, ultimately leading to higher project success rates. As we navigate the complexities of banking modernization, the integration of agile methodologies, supported by our innovative solutions, stands out as a vital strategy for achieving sustainable growth and delivering exceptional client experiences.

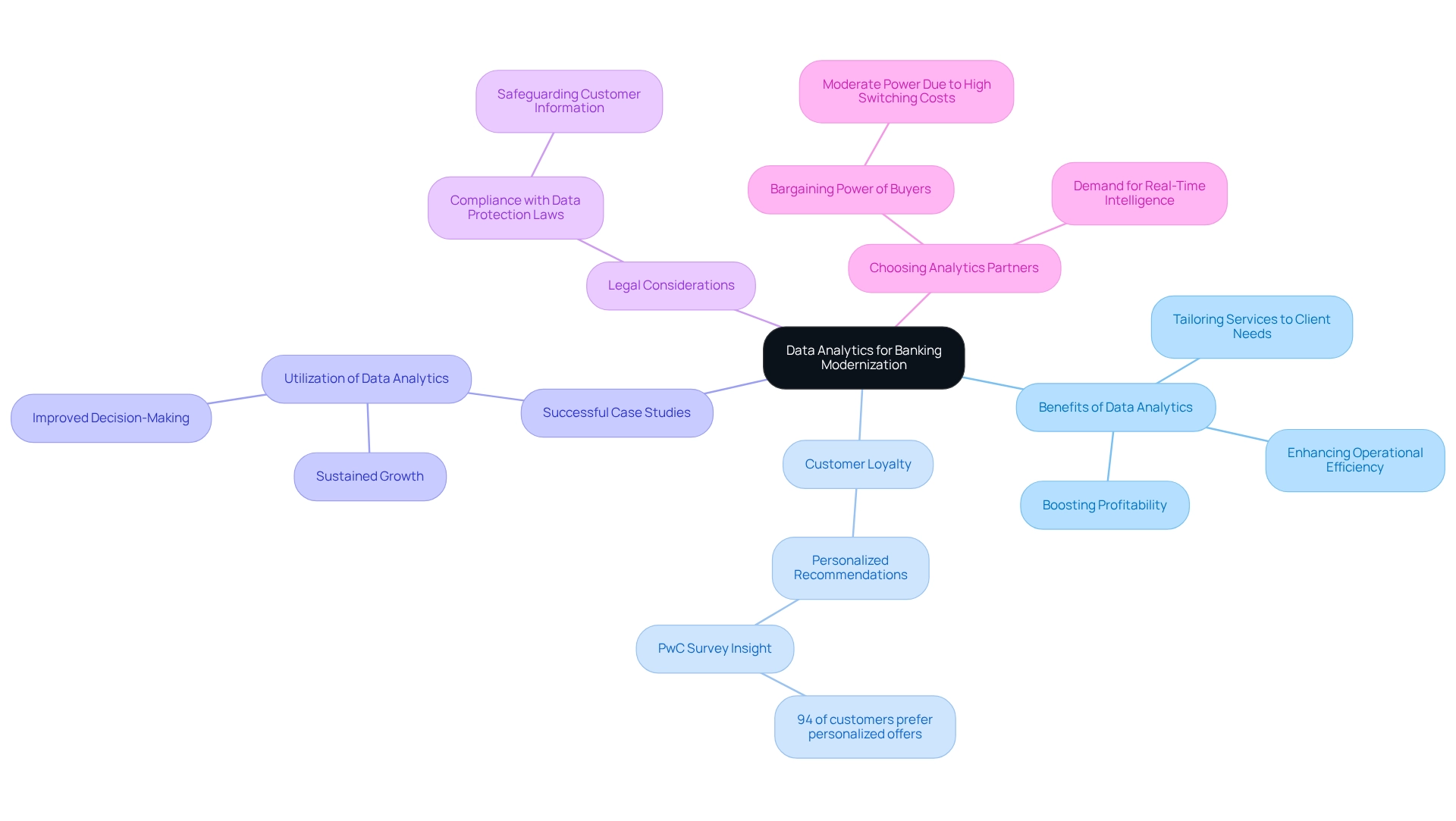

Leverage Data Analytics to Inform Modernization Strategies

Leveraging data analytics is not just beneficial; it is essential for shaping effective strategies for banking modernization. By meticulously examining client data, transaction patterns, and current market trends, we can uncover valuable insights that guide our strategic decision-making. This data-focused approach not only helps us identify areas for enhancement but also enables us to tailor our services to better meet client needs, ultimately boosting operational efficiency and profitability.

As we look to 2025, the emphasis on data analytics becomes even more pronounced. Financial institutions like ours are increasingly relying on real-time intelligence to tackle cash flow challenges and enhance working capital. A recent PwC survey indicates that 94% of banking customers are more likely to remain loyal to institutions that provide personalized recommendations based on their financial situations. This underscores the critical role of data in fostering customer loyalty.

Moreover, successful case studies demonstrate how we have effectively utilized data analytics to drive decision-making, resulting in improved outcomes and sustained growth. Our dedicated hybrid connectivity platform plays a pivotal role in this process, simplifying the connection of disparate systems and allowing us to harness data more effectively.

As the landscape evolves, banking modernization through the integration of data analytics into our strategies will be crucial for maintaining a competitive edge. Furthermore, we must navigate legal factors that require adherence to data protection regulations to safeguard customer information, ensuring that our modernization efforts do not compromise security.

In this competitive market, selecting the right analytics partners is vital, as the bargaining power of buyers in the Big Data Analytics market highlights the necessity for us to choose providers capable of delivering robust, compliant solutions. As businesses increasingly seek banking partners that offer real-time intelligence, the demand for data-driven solutions will continue to shape the future of banking modernization, empowering us to lead the AI revolution.

Conclusion

In the dynamic financial landscape of 2025, modernization is not merely a goal for us; it is an absolute necessity. By adopting hybrid integration platforms like Avato, we can seamlessly connect legacy systems with modern technologies, significantly enhancing our operational efficiency and data flow. This approach accelerates integration timelines while mitigating security risks, ensuring we can respond swiftly to evolving market demands.

Strategic partnerships with fintech companies further amplify our innovation, enabling us to deliver personalized services that resonate with customer expectations. The integration of advanced technologies, including generative AI, plays a critical role in enhancing user experiences and operational capabilities, positioning us as leaders in customer-centric service delivery.

Moreover, embracing cloud-based solutions offers us the flexibility and scalability needed to thrive in a competitive environment. By ensuring compliance and robust security measures are integral to our modernization efforts, we safeguard customer trust while navigating the complexities of the digital landscape.

Ultimately, our journey toward modernization requires a comprehensive roadmap that emphasizes continuous improvement, employee training, and agile methodologies. By leveraging data analytics to inform our strategic decisions, we can create tailored solutions that meet customer needs while driving long-term growth. In this rapidly evolving sector, our commitment to modernization, innovation, and customer-centricity will define the leaders of tomorrow.