Overview

In today’s rapidly evolving banking landscape, understanding the integration frameworks of ESB (Enterprise Service Bus) and SOA (Service-Oriented Architecture) is crucial for IT managers. We recognize that ESB excels in managing complex connections and facilitating real-time data exchange, while SOA emphasizes the importance of reusable services that provide flexibility and scalability. These characteristics are essential for modernizing banking operations and enhancing overall efficiency.

Furthermore, our analysis demonstrates how ESB functions as a centralized communication backbone that streamlines the integration of legacy systems. In contrast, SOA promotes modular service development, enabling banks to respond swiftly to market changes and operational demands. By leveraging these frameworks, we can help your organization navigate the complexities of integration and drive meaningful transformation.

What challenges are you facing in your integration strategy? Let us partner with you to harness the power of ESB and SOA, ensuring that your banking operations are not only efficient but also poised for future growth.

Introduction

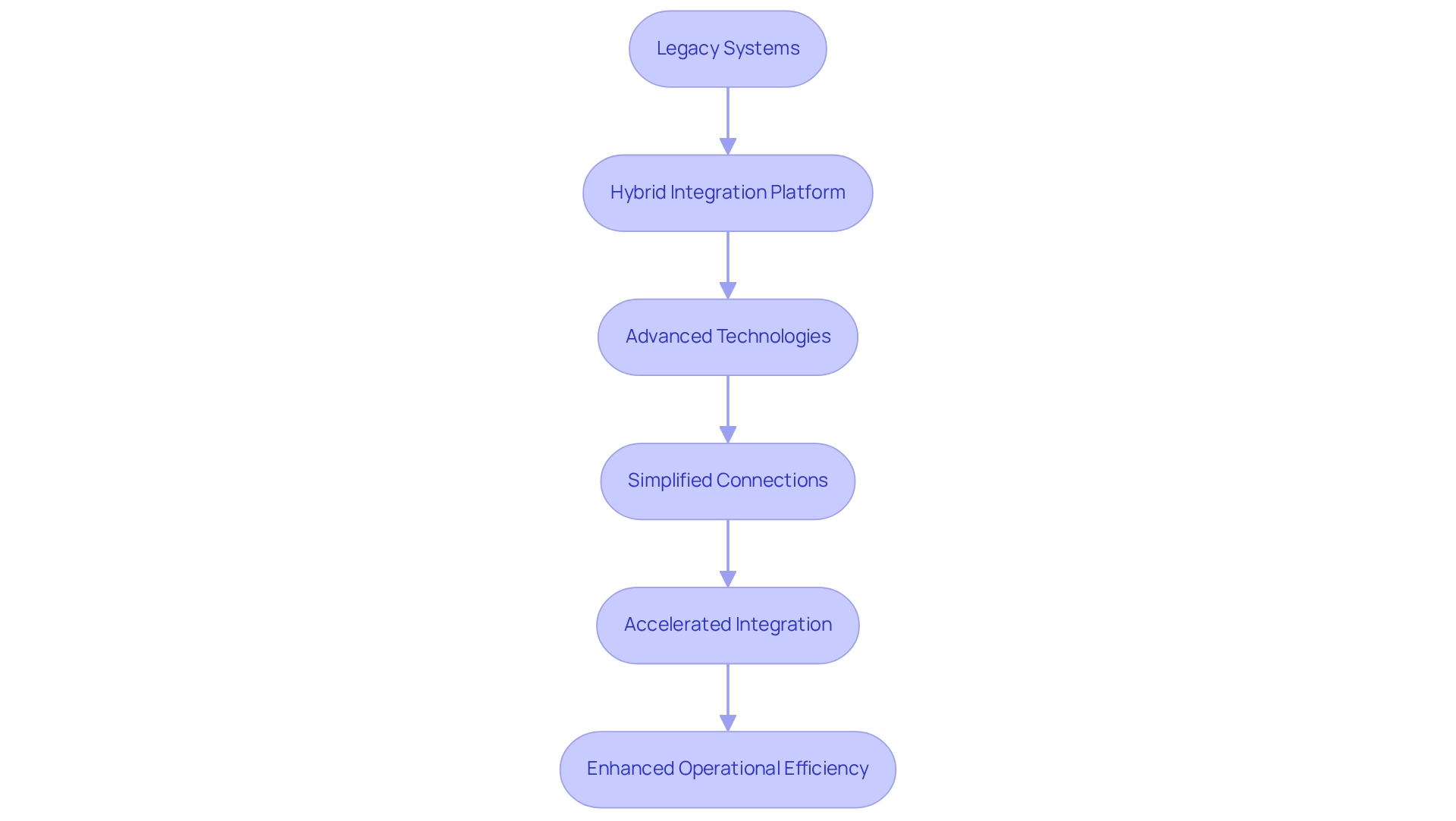

In the rapidly evolving world of banking, we recognize that the integration of legacy systems with modern applications presents a critical challenge for financial institutions. As we strive to enhance operational efficiency and remain competitive, solutions like our hybrid integration platform emerge as game-changers. By facilitating seamless connections between disparate systems, we empower banks to unlock the full potential of their existing infrastructure while adhering to strict regulatory standards.

What’s holding your team back from achieving this integration? This article delves into the transformative capabilities of hybrid integration, exploring the architectural frameworks of Enterprise Service Bus (ESB) and Service-Oriented Architecture (SOA), and how they work in tandem to streamline operations, enhance security, and drive cost efficiency in a sector increasingly defined by digital innovation.

Avato: Transforming Legacy Systems with Hybrid Integration

At Avato, we recognize the pressing need for financial institutions to bridge the gap between legacy infrastructures and modern applications. Our hybrid integration platform is meticulously designed to empower banks, enhancing operational efficiency while significantly reducing integration time. By leveraging advanced technologies, we enable organizations to unlock the full potential of their existing frameworks, all while ensuring compliance with industry regulations. This transformation is not just beneficial; it is essential for banks striving to maintain a competitive edge in today’s rapidly evolving digital landscape.

With support for 12 levels of interface maturity, our platform simplifies complex connections and accelerates the integration of isolated legacy systems. As a result, banks can achieve tangible business value in weeks rather than months. What’s holding your team back from realizing these efficiencies? Let us partner with you to navigate these complexities and drive your organization forward.

Architectural Framework: ESB vs. SOA Explained

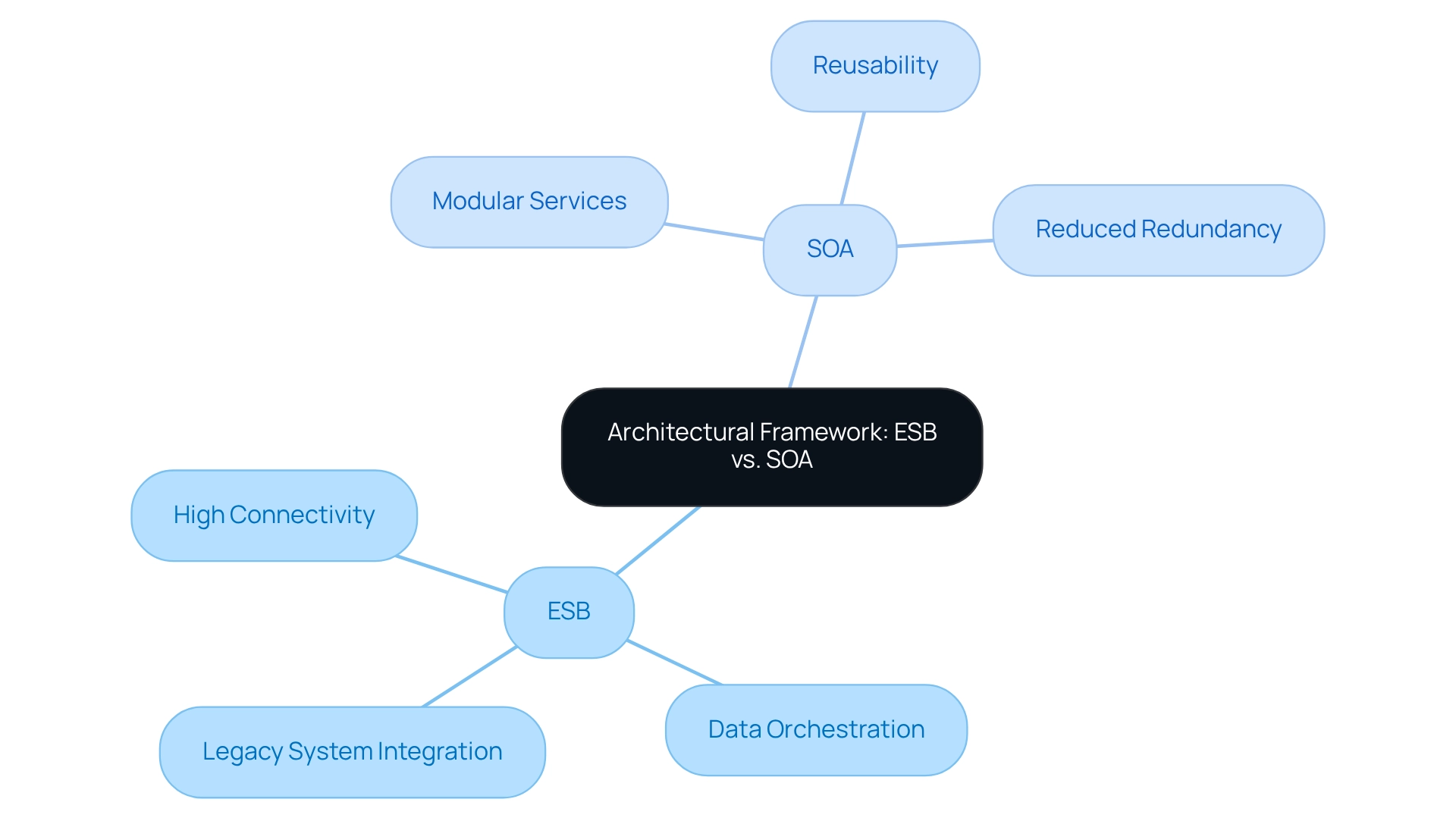

ESB and SOA are not just frameworks; they are essential pillars of contemporary financial IT environments. We recognize that ESB serves as a centralized communication backbone, enabling seamless connections among various applications and facilitating real-time data exchange. Conversely, the concepts of ESB and SOA focus on creating reusable services accessible across multiple platforms, thereby promoting flexibility and scalability in application development.

For us, as banking IT managers, grasping the nuances between these frameworks is critical. ESB is particularly advantageous in environments that demand high connectivity and data orchestration, streamlining the integration of legacy systems with new applications. In contrast, SOA empowers the development of modular services that can be reused, effectively reducing redundancy and accelerating deployment times.

Current trends reveal a significant uptick in the adoption of ESB and SOA solutions among financial institutions, driven by the pressing need for enhanced operational efficiency and agility. Our observations indicate that the ESB market is characterized by ongoing innovation, with many organizations transitioning from traditional connection methods to advanced ESB platforms like Avato. This shift is substantiated by case studies, such as the implementation of Avato’s solutions in finance, which have notably streamlined service delivery through a centralized platform designed for secure transactions.

Expert opinions underscore that while ESB and SOA are both essential, ESB excels in managing complex connections, while SOA provides the necessary framework for service reusability. This synergy allows us to leverage both architectures effectively, ensuring robust coordination strategies that can adapt to evolving business requirements.

As we look toward 2025, the distinctions between ESB and SOA remain pronounced, with ESB focusing on unification and SOA on service management, both of which are indispensable for crafting a cohesive IT ecosystem. This highlights that ESB and SOA not only support one another but also empower us, IT managers in the financial sector, to navigate the complexities of interconnectivity. This ultimately enhances our operational capabilities and responsiveness to market changes.

We view Avato as a dedicated hybrid unification platform that simplifies disparate systems while boosting business value, making it an essential partner for finance IT managers striving to future-proof their operations.

Service Orchestration: How ESB Enhances Integration

We significantly enhance integration through effective service orchestration in ESB and SOA, allowing multiple services to collaborate seamlessly. This orchestration is especially crucial in the financial industry, particularly as institutions prepare for the shift to open finance, where secure and dependable connections between applications are essential. By efficiently managing the flow of data and services, we minimize latency and boost overall operational efficiency.

For instance, financial institutions that have adopted our solutions for ESB and SOA have noted an impressive 28% increase in finalized applications due to shorter processing durations. Furthermore, our use of ESB in finance has been associated with improved transaction efficiency, with numerous organizations attaining operational efficiency ratios under 50%, signifying robust performance.

A recent case study highlighted the evolution of financial IT, showcasing how the integration of microservices architecture alongside our ESB and SOA has led to a synergistic approach, ensuring that both APIs and ESB and SOA coexist to meet diverse connectivity needs. This dual approach underscores the necessity for effective API management solutions to ensure security and interoperability, especially as open finance introduces new challenges and opportunities.

In summary, we not only streamline complex financial operations but also enhance service orchestration, leading to quicker response times and improved customer service. As the financial services landscape continues to evolve, the strategic implementation of our solutions through ESB and SOA will be crucial for banks aiming to maintain a competitive edge.

Scalability: ESB’s Advantage Over SOA

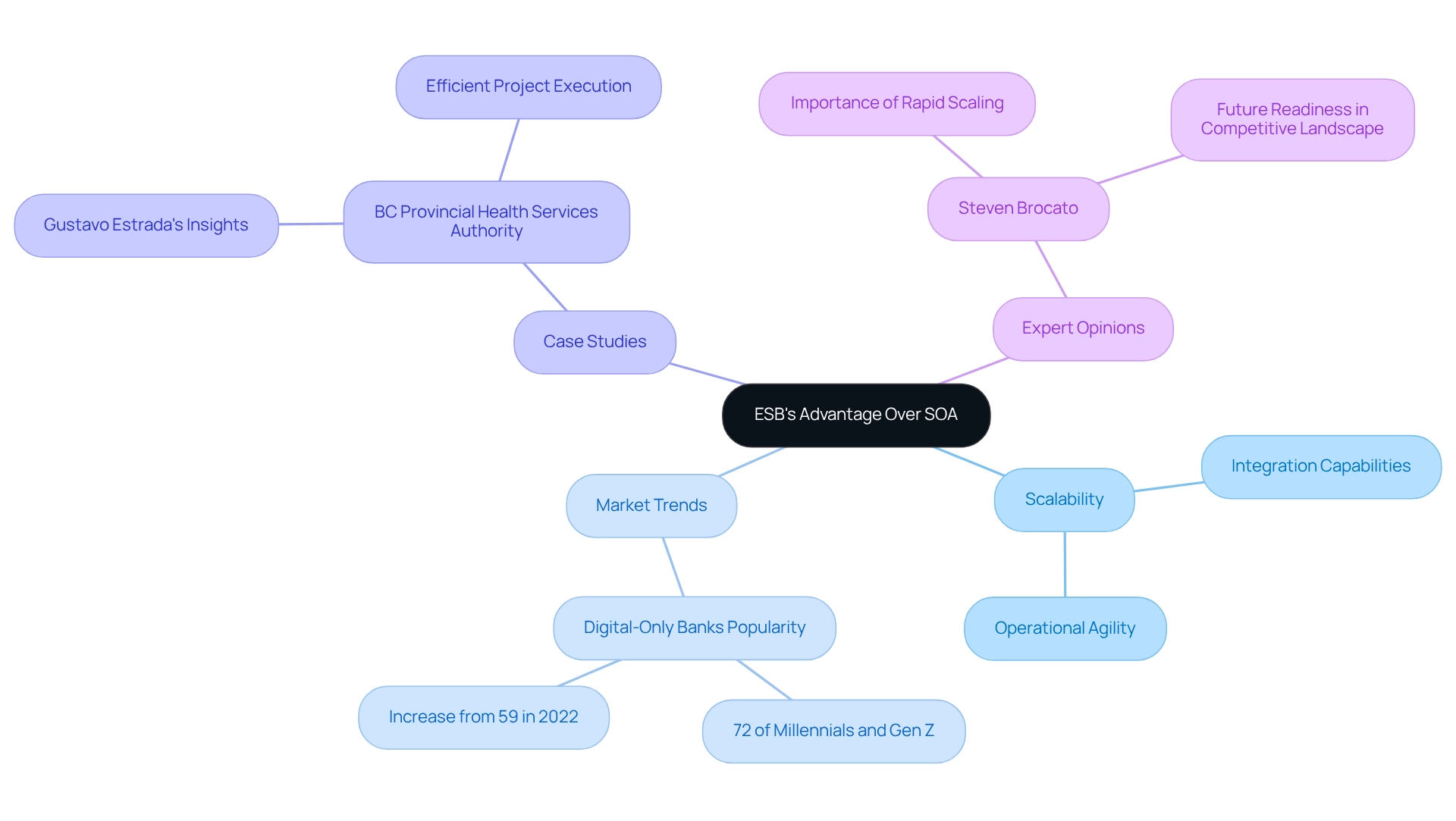

A significant advantage of using ESB and SOA is the scalability that ESB provides. We understand that ESB allows organizations to effortlessly integrate new services and applications without significant reconfiguration, which is essential for adapting to the rapidly changing demands of the financial sector. By utilizing ESB, we can guarantee that our unification solutions develop alongside business growth, thus preserving a competitive advantage.

In 2023, 72% of millennials and Gen Z consumers identified digital-only banks as their primary financial institutions, reflecting a shift that necessitates agile operational capabilities, which can be achieved through the effective use of ESB and SOA to enhance banking operations and enable institutions to respond swiftly to market changes and customer needs.

For instance, Avato’s hybrid unification solutions have been crucial in enabling complex assimilation projects within financial institutions, like Coast Capital, where our platform supported multiple interfaces and allowed significant system transitions with minimal downtime. Gustavo Estrada from BC Provincial Health Services Authority observed how Avato’s ESB capabilities facilitated the effective implementation of complex projects, enhancing our platform’s reputation for providing timely and cost-effective results. This flexibility is crucial as financial institutions progressively aim to handle complexity across different channels and departments.

Expert views highlight the significance of adaptable connection solutions in banking. As Steven Brocato, Principal Solutions Architect for Financial Services Industry at AWS, emphasizes, the ability to scale operations rapidly is vital for future readiness in a competitive landscape. Banks that effectively utilize both ESB and SOA can not only enhance their operational capabilities but also significantly reduce costs, positioning themselves for sustained success in an increasingly digital world.

What’s holding your team back from leveraging this powerful integration platform?

Protocol Support: ESB’s Flexibility Compared to SOA

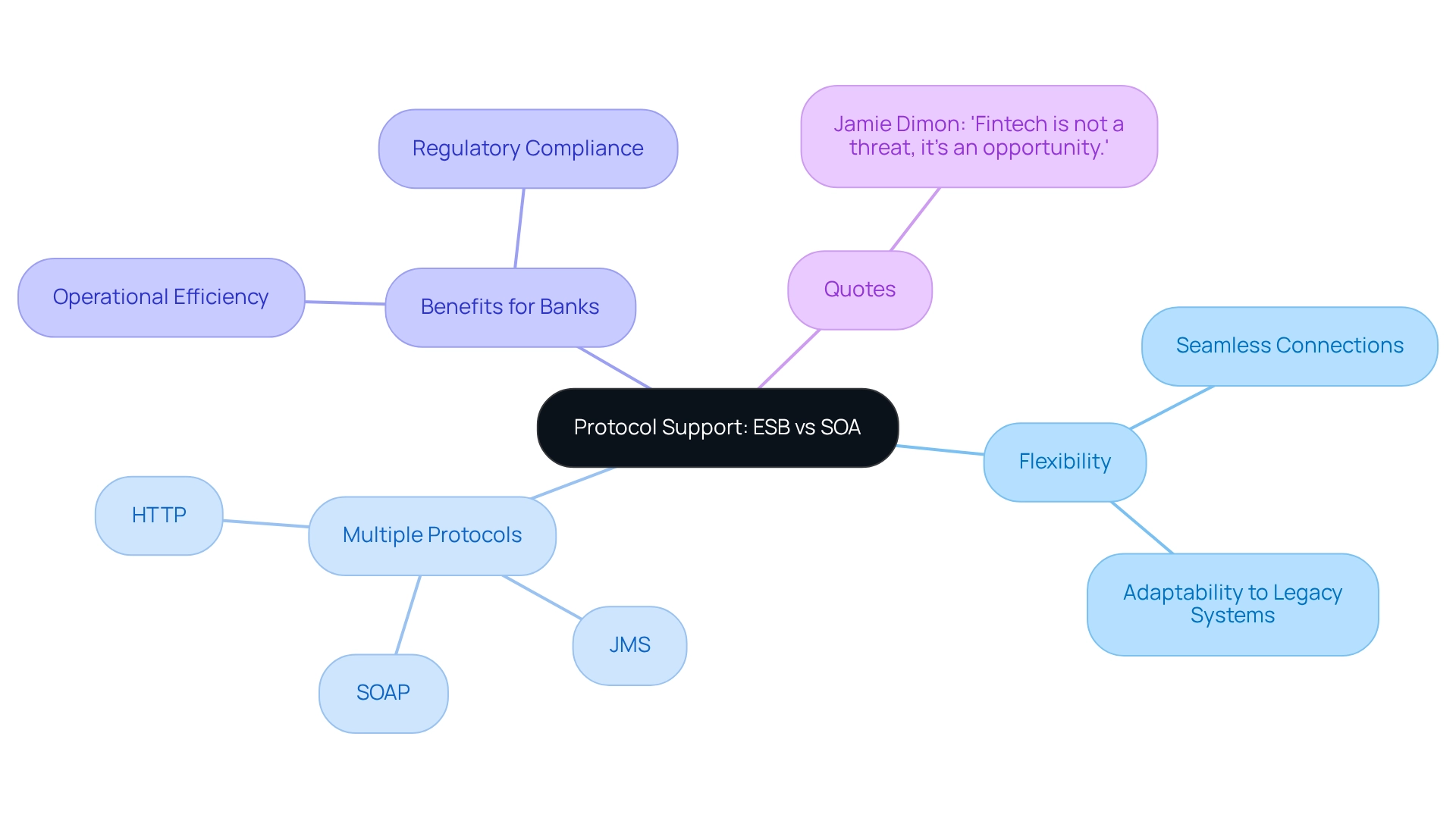

We provide robust protocol support through our ESB and SOA, facilitating seamless connections among a diverse array of applications and services. Unlike SOA, which often requires strict adherence to specific protocols, our approach using ESB and SOA accommodates multiple communication standards, including HTTP, JMS, and SOAP. This adaptability is essential for banks that frequently navigate a blend of legacy and modern technologies. By enabling all components to communicate effectively without extensive modifications, we enhance operational efficiency and simplify integration complexity.

As the banking sector increasingly embraces digital transformation, the ability to integrate various platforms swiftly and securely becomes paramount, particularly in highly regulated environments. For instance, banks leveraging our ESB and SOA have successfully merged diverse networks, illustrating the adaptability of our protocols. This capability not only streamlines operations but also positions financial institutions to respond nimbly to shifting market demands and compliance obligations.

Our hybrid connection platform exemplifies this transformative potential, empowering banks to bridge legacy systems with contemporary expectations and harness generative AI for improved customer experiences and operational efficiency. As Jamie Dimon, CEO of JPMorgan Chase, aptly noted, ‘Fintech is not a threat, it’s an opportunity.’ We emphasize the importance of utilizing connection solutions like ESB and SOA to capitalize on these opportunities.

Security Features: ESB vs. SOA in Regulated Environments

In the highly regulated financial sector, security is not just important; it is paramount. We recognize that the architecture of ESB and SOA provides a suite of robust security features—authentication, authorization, and encryption—that collectively ensure data remains secure during transmission. Unlike Service-Oriented Architecture (SOA), which also incorporates security measures, the ESB and SOA’s centralized framework enables us to enforce security policies consistently across all integrated services. This consistency is crucial for banks like ours, which must adhere to stringent regulatory requirements.

Statistics reveal that 43% of data breach costs were mitigated in 2023, underscoring the importance of effective security measures in protecting sensitive information. Furthermore, as 58% of organizations are expected to transition their application portfolios to public cloud settings within the next two years, the demand for secure integration solutions becomes increasingly urgent.

Case studies demonstrate the impact of ESB’s security features in financial services. For instance, increased investments in cybersecurity technologies not only safeguard our bank’s reputation and customer trust but also enable us to develop innovative financial products that prioritize security, thus providing a competitive edge. Experts highlight that in today’s environment, where data breaches have increased in frequency since the 1980s, adopting security measures for ESB and SOA is crucial for ensuring compliance and protecting sensitive information. As we approach 2025, we anticipate that the security attributes of ESB and SOA in regulated financial settings will continue to evolve, ensuring that we can adeptly manage risks associated with data breaches while enhancing our operational capabilities.

Cost Efficiency: Comparing ESB and SOA

Cost efficiency is paramount when we compare ESB and SOA, particularly in the financial industry. We find that ESB typically offers reduced implementation and maintenance costs due to its centralized structure, which minimizes the need for numerous direct connections. This streamlined approach not only simplifies operations but also boosts efficiency. In contrast, ESB and SOA can incur higher expenses, as they often require additional resources to effectively manage and maintain individual services.

For banking institutions aiming to optimize their budgets, we recognize ESB as a more cost-effective unification solution. By leveraging ESB, banks can significantly reduce connection costs while maintaining robust performance. Our hybrid unification platform at Avato exemplifies this, having successfully implemented solutions across various financial institutions, including Coast Capital, where we facilitated major transitions with minimal downtime and expense. For instance, our efforts enabled Coast Capital to overhaul its entire telephone banking system with just a 63-second outage, showcasing our platform’s efficiency and reliability.

Moreover, statistics reveal that nearly 80% of companies struggle to find qualified candidates for technology positions, underscoring the importance of implementing solutions that streamline merging processes. Here, ESB excels, as its emphasis on simplicity can alleviate staffing challenges. Our commitment at Avato to designing technological foundations empowers banks to secure their operations for the future through seamless data and system connections, ultimately enhancing financial efficiency.

As Alex Kreger, Founder & CEO, aptly states, “Focus and simplicity as a mantra”—a principle that aligns perfectly with the operational advantages of ESB. In summary, our cost analysis clearly favors ESB and SOA for financial institutions, presenting them as appealing choices for those looking to enhance their unification strategies while managing expenses. Furthermore, our solutions enable organizations to maintain a competitive edge in their respective industries, further solidifying the case for ESB in banking integration.

Interoperability: ESB’s Strength in Diverse Environments

We recognize that the combination of ESB and SOA stands out in its capability to foster interoperability, enabling seamless communication between different entities and applications, regardless of their underlying technologies. This is particularly beneficial for banks, which frequently operate a mix of legacy technologies and modern applications. By facilitating collaboration among diverse environments, we significantly enhance operational efficiency and promote effective data sharing across the organization.

Consider the case of small and independent hospitals, which struggle with interoperability compared to their larger counterparts. This highlights the critical need for robust integration solutions such as ESB and SOA. In the financial industry, where prompt access to information is essential, our ability to combine varied networks can lead to improved decision-making and customer support.

Current trends indicate that financial services are increasingly prioritizing interoperability to meet regulatory demands and enhance customer experiences. For instance, statistics show that 45 partners can monitor for and prevent unusual and potentially fraudulent activity, emphasizing the role of ESB in ensuring secure and efficient data exchanges. Moreover, banks that have successfully implemented solutions based on ESB and SOA report significant improvements in their operational capabilities, demonstrating the technology’s effectiveness in achieving seamless communication. Expert insights consistently highlight that a shared, unified approach is crucial for unlocking the full potential of interoperability in financial frameworks. This makes ESB an essential component of the contemporary financial landscape, and we invite you to explore how we can support your integration needs.

Implementation Challenges: Navigating ESB and SOA

Implementing ESB and SOA presents significant challenges, including complexity in configuration, the necessity for specialized skills, and potential resistance to change within our organization. We must proactively address these issues to ensure a seamless merging process.

To mitigate resistance, it is essential that we involve our employees early in the process and conduct thorough training sessions that foster a culture of adaptability. As we prepare for open banking, leveraging our existing legacy systems rather than discarding them can provide us with a strategic advantage.

By employing a middle layer to convert data into an open format, we can enhance our connectivity capabilities without reinventing the wheel. Furthermore, ensuring that our unification solutions adhere to stringent security protocols is vital to reducing risks related to data sharing.

Engaging our stakeholders effectively and modeling new business processes will further support our phased implementation strategy. By adopting these proactive methods, we can navigate challenges and achieve our unification objectives while preparing our frameworks for new tools and technologies.

Future Trends: The Evolution of ESB and SOA

The enterprise integration landscape is undergoing a significant transformation, driven by our increasing adoption of microservices architecture and cloud-native solutions. As financial institutions embrace these modern methodologies, the roles of ESB and SOA are evolving to meet new demands. We anticipate that upcoming advancements will witness ESB frameworks merging more fluidly with API management and microservices, thereby improving flexibility and scalability for financial institutions.

Statistics indicate a strong trend towards cloud-native solutions in financial services. A notable shift towards virtualized infrastructure is expected to further accelerate microservices adoption. This evolution is crucial for IT managers in banking, as staying ahead of these trends will be essential for maintaining a competitive edge.

Moreover, case studies highlight how banks are successfully implementing microservices and cloud-native solutions in conjunction with ESB and SOA, showcasing improved operational efficiency and responsiveness to market changes. For instance, Avato has demonstrated its skill in hybrid unification by enabling smooth transitions for financial institutions, including Coast Capital, which experienced minimal downtime during major upgrades. As Tony LeBlanc from the Provincial Health Services Authority remarked, “Avato speeds up the unification of disconnected networks and fragmented data, providing the connected foundation businesses require to simplify, standardize, and modernize.”

A study carried out by Microsoft revealed that 86% of participants in the U.S. intend to boost their investment in hybrid cloud and multi-cloud, emphasizing the significance of these trends in enterprise collaboration. This aligns with Avato’s capabilities, as its platform not only accelerates secure system unification but also enhances operational visibility, enabling organizations to address issues promptly and effectively. As the integration landscape continues to evolve, understanding these dynamics will empower banking IT managers to effectively leverage ESB and SOA, ensuring our organizations can adapt to the fast-paced digital environment.

Conclusion

At Avato, we recognize that banking institutions face significant challenges in integrating legacy systems with modern applications. Our hybrid integration platform stands out as a powerful solution, enabling banks to enhance operational efficiency, streamline service delivery, and swiftly adapt to changing market demands. The insights shared throughout this article underscore the critical role of architectural frameworks like Enterprise Service Bus (ESB) and Service-Oriented Architecture (SOA), illustrating how they can work together to facilitate seamless data exchange, improve security, and drive cost efficiency.

The advantages of ESB, particularly its scalability and protocol flexibility, position it as a superior choice for financial institutions aiming to future-proof their operations. Its capability to support diverse communication standards, coupled with robust security features, ensures that banks can maintain compliance while enhancing their integration capabilities. As the industry transitions towards open banking and digital transformation, the orchestration of services through ESB becomes increasingly vital, empowering banks to respond promptly to customer needs and regulatory requirements.

In conclusion, by embracing hybrid integration strategies, we enable banks to unlock the full potential of their existing infrastructure and empower them to thrive in an increasingly competitive landscape. As financial institutions continue to evolve, leveraging solutions like our platform will be essential for navigating the complexities of integration, enhancing operational agility, and delivering exceptional customer experiences in the digital age. What’s holding your team back from achieving these goals? Let us partner with you to transform your integration challenges into opportunities for growth.