Overview

We recognize that implementing integrated banking solutions effectively is paramount for operational success. Our focus is on best practices that can transform your banking operations. Conducting thorough evaluations is essential; it allows us to identify the unique challenges your organization faces. Adopting a phased approach ensures that integration occurs smoothly, minimizing disruptions. Furthermore, investing in employee training not only enhances skills but also fosters a culture of adaptability within your team.

Security is a non-negotiable priority in today’s landscape. We must engage stakeholders at every level to navigate complexities such as legacy systems and regulatory compliance. What’s holding your team back from achieving this integration? By addressing these challenges head-on, we can ensure successful integration that drives enhanced operational efficiency.

In conclusion, we invite you to embrace these best practices. Together, we can unlock the full potential of integrated banking solutions, paving the way for increased efficiency and effectiveness in your operations.

Introduction

In the dynamic world of finance, we recognize that integrated banking solutions are not just advantageous; they are essential for success. These solutions empower financial institutions to operate with unparalleled agility and efficiency, facilitating seamless connections across diverse banking systems. This enhancement not only elevates customer experiences but also drives innovation in an era defined by relentless technological advancements.

As we navigate the complexities posed by outdated legacy systems, data silos, and stringent regulatory compliance, the necessity for a strategic approach to integration becomes increasingly clear. By embracing best practices and committing to continuous evaluation, we can overcome these challenges and unlock substantial operational and financial benefits.

This article explores the critical importance of integrated banking solutions, the key challenges encountered during implementation, and the best practices that will guide us toward successful integration in a rapidly evolving landscape.

Define Integrated Banking Solutions and Their Importance

Integrated banking solutions represent the seamless connection of diverse banking systems and services, enabling them to function as a cohesive unit. This integration is essential for enhancing operational efficiency, improving customer experiences, and facilitating real-time data sharing across platforms. In today’s swiftly evolving financial landscape, where client expectations continue to rise, cohesive approaches empower us to swiftly adapt to market demands, eliminate operational silos, and drive innovation. By adopting unified strategies, we can streamline processes, enhance data accuracy, and ultimately achieve superior financial outcomes for both our organization and our clients.

The significance of integrated banking solutions is highlighted by the forecast that by 2026, 60% of core banking platforms will include native AI capabilities—a notable increase from less than 10% today. This trend highlights the urgency for us to modernize our infrastructure to remain competitive and respond to the shifting technological landscape. Furthermore, organizations investing in contemporary core systems, such as our hybrid connection platform, not only enhance operational performance but also boost customer satisfaction and business agility, gaining a critical competitive edge.

Our hybrid integration platform is designed to augment and extend the value of legacy technologies while simplifying complex integrations. With real-time monitoring and performance alerts, we can significantly reduce costs and access isolated assets, creating substantial business value. Expert insights indicate that banks with integrated compliance features in their core operations can lower regulatory reporting costs by up to 40%, effectively mitigating compliance-related risks. This statistic illustrates the tangible benefits of integration, reinforcing the notion that integrated banking solutions are essential for navigating the complexities of today’s regulatory environment.

Moreover, a recent case study titled “Conclusion on Core Banking Modernization” reveals that financial institutions transitioning to modern core platforms gain a competitive advantage through enhanced operational performance, customer satisfaction, and business agility. However, we must remain vigilant regarding potential challenges during implementation, such as integrating legacy technologies and ensuring compliance with regulatory standards. Addressing these challenges proactively will be crucial for effective execution and maximizing the benefits of integrated banking systems.

Identify Key Challenges in Implementing Integrated Solutions

The implementation of integrated banking solutions comes with several significant challenges.

- Legacy Frameworks pose a considerable obstacle, as many banks continue to rely on outdated technologies that lack seamless connectivity. This dependence complicates the integration of new technologies, stifling innovation and efficiency. For high-frequency trading platforms, as Sarah Lee points out, this can mean processing thousands more transactions per second—a critical competitive advantage in markets where milliseconds determine profit margins. Our company has demonstrated its capability to address these legacy challenges effectively, as evidenced by our collaboration with financial institutions such as Coast Capital, where we facilitated significant transitions with minimal downtime.

- Data Silos also hinder progress. The existence of disparate data sources can obstruct the flow of information, leading to inefficiencies and an increased potential for errors. This fragmentation severely impacts decision-making processes and customer service. Our hybrid connectivity platform assists organizations in overcoming these data silos by facilitating smooth communication between different networks, thereby enhancing operational efficiency.

- Regulatory Compliance is another critical challenge. The banking industry is heavily regulated, and navigating this intricate landscape can impede coordination efforts. Banks must ensure that all integrated networks comply with various laws and standards, complicating the implementation process. We prioritize compliance in our integration strategies, ensuring that all solutions meet regulatory requirements while supporting modernization.

- Change Management is essential to overcoming resistance from employees accustomed to legacy processes. Effective change management strategies are vital to facilitating a smooth transition and encouraging staff buy-in. Our experience in managing transitions underscores the importance of involving stakeholders early in the process to align expectations and foster acceptance. By engaging stakeholders and modeling business processes, we ensure that unification efforts are well-supported and understood throughout the organization.

- Security Risks inherently increase as we connect various platforms, raising the potential attack surface for cyber threats. As banks integrate multiple systems, they must implement robust cybersecurity measures to protect sensitive customer data and maintain trust. This is particularly crucial during digital transformation, where safeguarding customer information is paramount. Our platform is designed with security as a priority, assisting financial institutions in mitigating risks associated with integration.

These challenges remain vital as banks strive to modernize their operations. For instance, the adoption of cloud-based solutions has been shown to save time and costs, ultimately increasing profits. However, without addressing the underlying challenges posed by outdated frameworks, banks may struggle to fully realize these benefits. Customer testimonials from organizations such as OSME Pacific and BC Provincial Health Services Authority highlight how we have successfully navigated these coordination challenges. Our platform has empowered these organizations to tackle legacy issues, demonstrating the importance of a strategic approach to connectivity that emphasizes security and compliance while facilitating the modernization of outdated systems.

Outline Best Practices for Successful Implementation

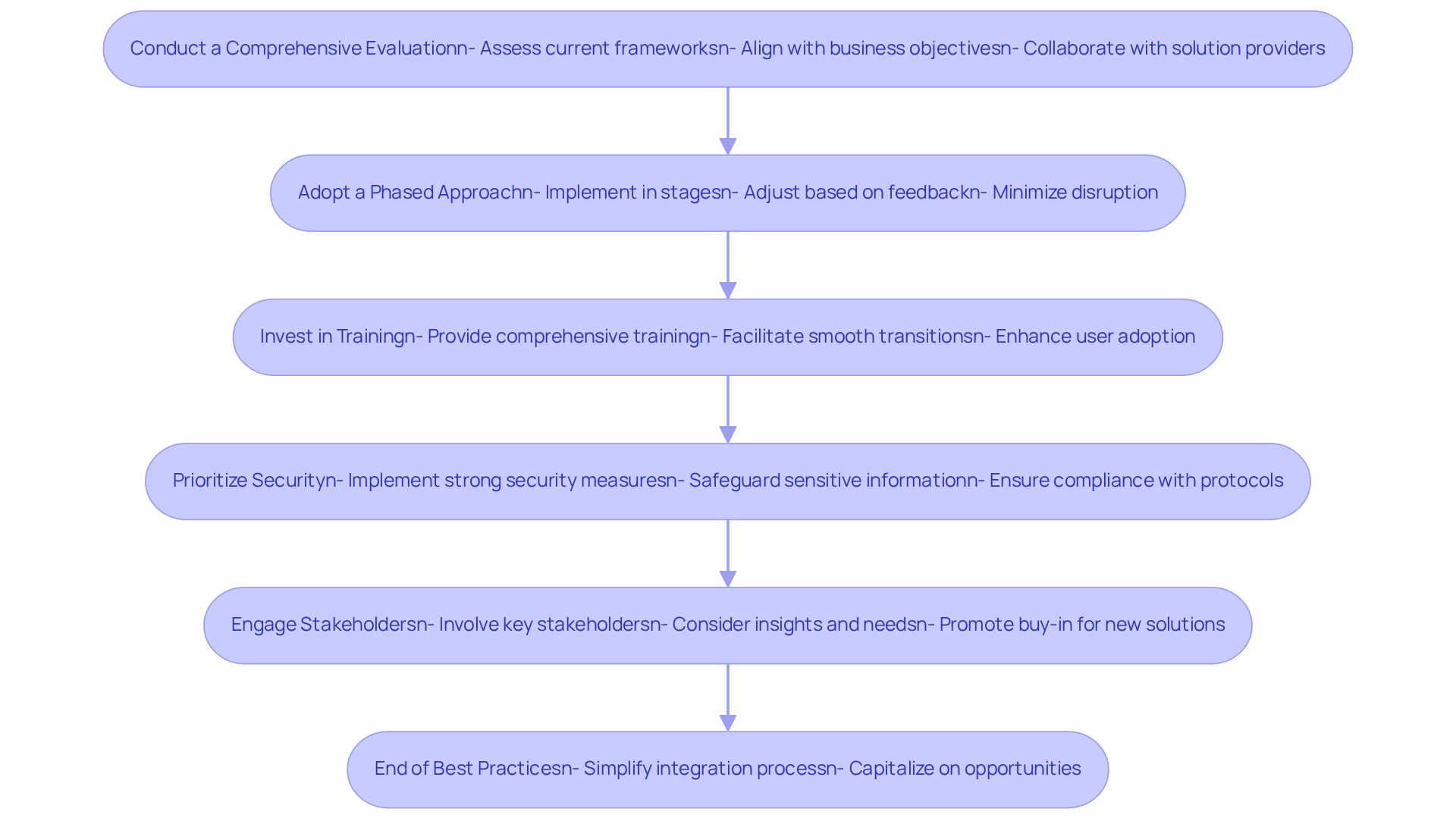

To successfully implement integrated banking solutions, we must consider the following best practices:

- Conduct a Comprehensive Evaluation: We begin by assessing our current frameworks and recognizing our objectives for unification. This ensures alignment with our business objectives and helps pinpoint areas for improvement. Collaborating with our solution provider, such as Avato, allows us to create a comprehensive plan that aligns with our institution’s objectives and the changing needs of our customers. We must be cautious about discarding legacy frameworks, as they may still possess valuable capabilities that can be utilized.

- Adopt a Phased Approach: We should implement the merging in stages rather than all at once. As Jim Marous, co-publisher of The Financial Brand, emphasizes, a phased approach allows for adjustments based on feedback and performance, minimizing disruption and enhancing adaptability. Notably, the return period for initial investments in visualization platforms is typically 14-18 months, highlighting the financial benefits of careful planning. The hybrid unification platform facilitates this approach by enabling gradual modernization of outdated technologies without the necessity for total renovations.

- Invest in Training: Comprehensive training for our staff is crucial. It facilitates smooth transitions and enhances user adoption, ensuring that our employees are well-equipped to navigate the new systems. We highlight the significance of training in enhancing the effectiveness of our solutions.

- Prioritize Security: Strong security measures are essential to safeguard sensitive information during and after the merging process. As the banking sector evolves towards digital transformation, maintaining high security standards is paramount. Avato’s solutions are architected for secure transactions, ensuring compliance with stringent security protocols necessary for open banking.

- Engage Stakeholders: We must involve key stakeholders throughout the unification process. Their insights and needs should be taken into account to encourage buy-in and ensure the new solutions effectively meet operational requirements. The case analysis of Finch’s method for financial integration demonstrates the significance of tackling fragmentation in financial networks, promoting open banking as a means to link these networks.

These best practices not only simplify the integration process but also enable us to capitalize on the opportunities offered by integrated banking solutions and enhanced security measures. Furthermore, with a discussion on trends in innovation management scheduled for April 17, 2025, it is crucial for banking institutions to stay informed and adapt these practices to remain competitive.

Emphasize Continuous Evaluation and Adaptation of Solutions

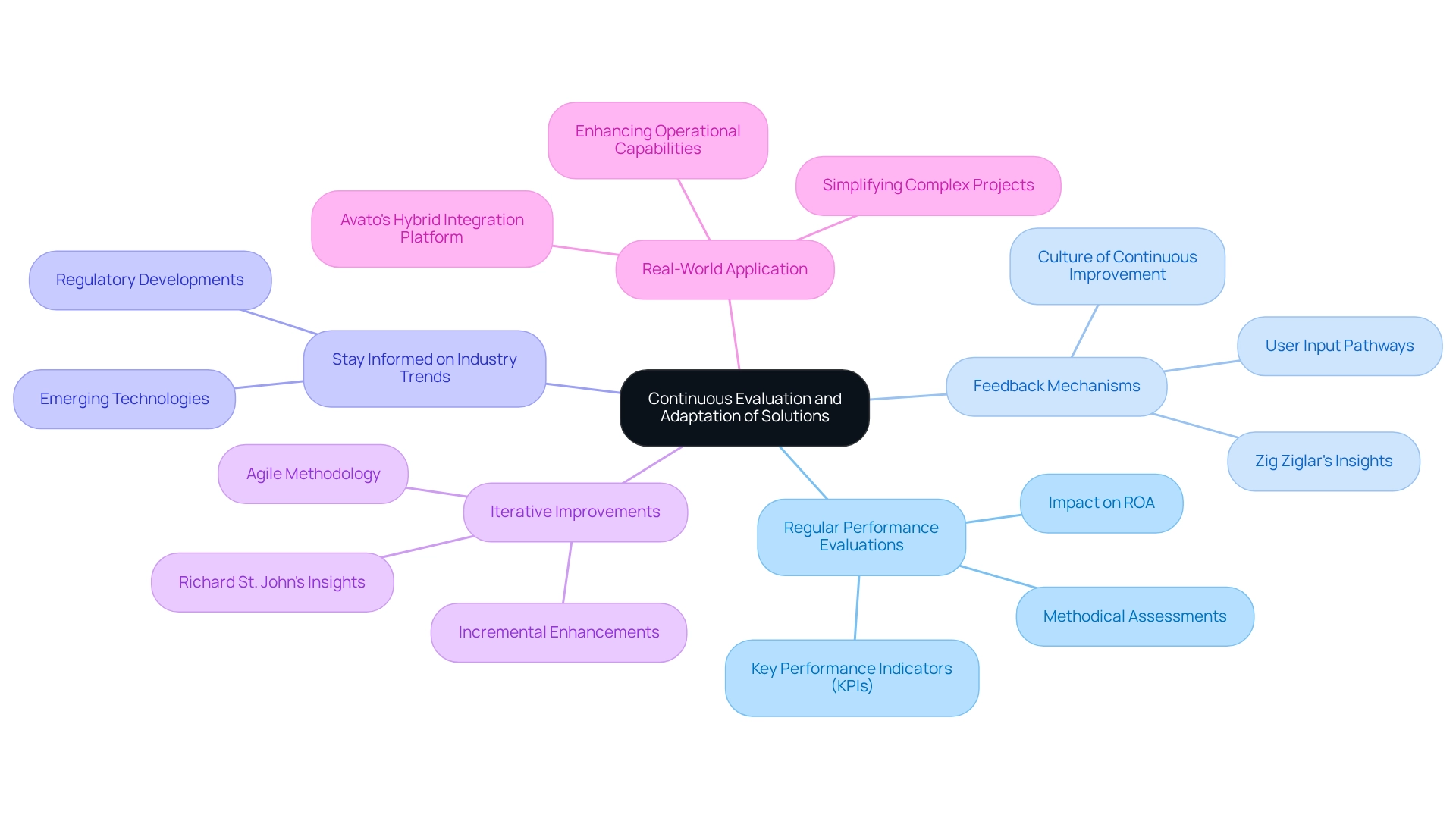

To ensure the ongoing effectiveness of integrated banking solutions, it is essential to establish a robust framework for continuous evaluation and adaptation. This framework encompasses several key practices:

- Regular Performance Evaluations: We carry out methodical assessments of combined frameworks against established Key Performance Indicators (KPIs). This process aids in pinpointing areas for enhancement and guarantees that our frameworks align with organizational objectives. Research indicates that effective performance reviews can significantly enhance a bank’s Return on Assets (ROA), measuring the efficiency of generating profits from total assets.

- Feedback Mechanisms: We establish organized pathways for user input to understand difficulties encountered by end-users and possibilities for improvements. As Zig Ziglar noted, “Research indicates that workers have three prime needs: interesting work, recognition for doing a good job, and being let in on things that are going on in the company.” Engaging users in this manner fosters a culture of continuous improvement.

- Stay Informed on Industry Trends: We actively monitor emerging technologies and regulatory developments that could affect our incorporation strategies. Staying updated allows us to adapt proactively to changes in the banking landscape.

- Iterative Improvements: We embrace an agile methodology to implement incremental enhancements based on evaluation findings. Richard St. John stated that best practice performance management is a continual growth process. This approach ensures that our integrated banking solutions evolve in tandem with the organization’s changing needs, maintaining relevance and efficiency.

- Real-World Application: Consider the case of a hybrid connectivity platform, which has been praised by customers for simplifying complex connection projects and delivering results within desired time frames and budget constraints. Avato, derived from the Hungarian word for “dedication,” embodies our commitment to architecting technology foundations that enable banks to unlock isolated assets and enhance business value creation. This demonstrates how ongoing assessment can result in successful outcomes in banking unification projects.

By prioritizing these practices, we can enhance our operational capabilities, reduce costs, and ensure that our integrated banking solutions remain effective in a dynamic environment. To learn more about how Avato can support your integration needs, contact us today!

Conclusion

Integrated banking solutions are essential for financial institutions striving to excel in today’s dynamic landscape. By fostering seamless connectivity among diverse banking systems, we enhance operational efficiency, elevate customer experiences, and enable real-time data sharing. As we confront challenges posed by legacy systems, data silos, and regulatory complexities, the imperative to adopt integrated solutions becomes increasingly clear. The potential benefits—significant cost savings and improved compliance—underscore the critical nature of this transition.

While implementing integrated banking solutions presents challenges, such as outdated technologies and the necessity for robust change management strategies, we can successfully navigate these obstacles. By adhering to best practices—conducting thorough assessments, adopting phased implementation approaches, and prioritizing security—we ensure that our solutions remain effective and aligned with the evolving needs of our organization and its customers.

Ultimately, the shift toward integrated banking solutions transcends mere strategy; it is vital for maintaining competitiveness in a rapidly changing technological environment marked by rising customer expectations. By embracing integration, we not only enhance our operational capabilities but also unlock new avenues for innovation and growth, positioning ourselves for future success. Let us take this crucial step together and lead the way in transforming our financial landscape.