Overview

We recognize that the modernization of banking systems is not just an option; it is an imperative. Our article delineates four pivotal strategies essential for this transformation:

- Legacy system replacement

- Digital transformation

- Customer-centric approaches

- Alignment of technology with business strategy

These strategies are not merely theoretical; they address the pressing need for banks to enhance operational efficiency and customer service amidst fierce competition. Moreover, they ensure compliance with evolving regulations, positioning institutions for sustained growth and innovation.

What’s holding your team back from embracing these essential changes? By adopting these strategies, we can collectively advance towards a more efficient and customer-focused banking landscape. Let us guide you in this journey toward modernization and success.

Introduction

In the dynamic world of banking, we recognize that modernization has emerged as a crucial strategy for survival and growth. As we grapple with the complexities of outdated systems and the relentless pace of technological advancement, the need for a comprehensive overhaul of processes and infrastructure has never been more pressing.

Key concepts such as:

- Legacy system replacement

- Digital transformation

- Customer-centric approaches

are at the forefront of this evolution, enabling us to enhance operational efficiency and deliver superior customer experiences. With the ongoing rise of fintech competitors and evolving regulatory landscapes, understanding the importance of modernization is essential for banks like us looking to thrive in an increasingly competitive environment.

This article delves into the critical aspects of banking modernization, offering insights on effective methodologies, technology alignment, and the role of integration platforms in achieving seamless connectivity.

Define Modernization in Banking: Key Concepts and Importance

The modernization of the banking system is not merely a trend; it is a strategic imperative for banks striving to excel in a fast-paced environment. As we navigate this evolving landscape, we recognize that the enhancement of frameworks, infrastructure, and processes is essential to meet current demands. Key concepts include:

- Legacy System Replacement: Transitioning from outdated systems to modern platforms that support current technologies and meet customer expectations is essential. By 2025, the urgency for legacy replacement is underscored by the increasing vulnerability of outdated technologies to security threats, which can lead to significant financial and reputational risks. The hybrid platform plays a vital role in enhancing and prolonging the value of these legacy systems, streamlining intricate connections, and significantly reducing costs through effective resource management.

- Digital Transformation: This encompasses the comprehensive integration of digital technologies across all financial operations, fundamentally altering how institutions function and deliver value to their customers. The biometric ATM market, valued at USD 35.2 billion in 2022 and projected to grow to USD 46.7 billion by 2032, exemplifies the shift towards more secure and efficient banking solutions. This trend highlights the necessity for financial institutions to adopt contemporary technologies to remain competitive and secure—an objective achievable through real-time monitoring and alert functionalities.

- Customer-Centric Approaches: Modernization emphasizes enhancing customer experiences through personalized services and streamlined processes, which are crucial in a competitive environment increasingly influenced by fintech innovations. Our commitment to designing robust technology foundations enables financial institutions to access isolated assets, thereby improving customer experiences and fostering business value creation.

The significance of the modernization of the banking system is evident in its ability to reduce operational costs, enhance service delivery, and ensure compliance with evolving regulations such as AML and GDPR. As we confront challenges from fintech competition and changing consumer preferences, the modernization of the banking system is not just advantageous; it is essential for survival and growth. Expert insights suggest that digital transformation transcends technical challenges; it is a cultural journey that necessitates a holistic approach to the modernization of the banking system.

To implement effective modernization strategies, we recommend the following steps:

- Assess Current Frameworks: Evaluate existing legacy infrastructures to identify vulnerabilities and areas for enhancement.

- Invest in Modern Technologies: Explore solutions like biometric ATMs and other digital innovations that enhance security and customer experience.

- Focus on Compliance: Ensure that modernization efforts align with regulatory requirements, such as AML and GDPR, to mitigate risks.

- Foster a Cultural Shift: Encourage a culture that embraces digital transformation across all levels of the organization. As Daumantas Dvilinskas, CEO & Co-Founder of TransferGo, aptly stated, “Digital transformation is not just a technical challenge but a cultural journey.”

- Leverage Expert Services: Consider collaborating with IT managed service providers that offer comprehensive support for the design, development, and implementation of new solutions effectively. This collaboration enables organizations to gain a competitive advantage through efficient digital infrastructure management.

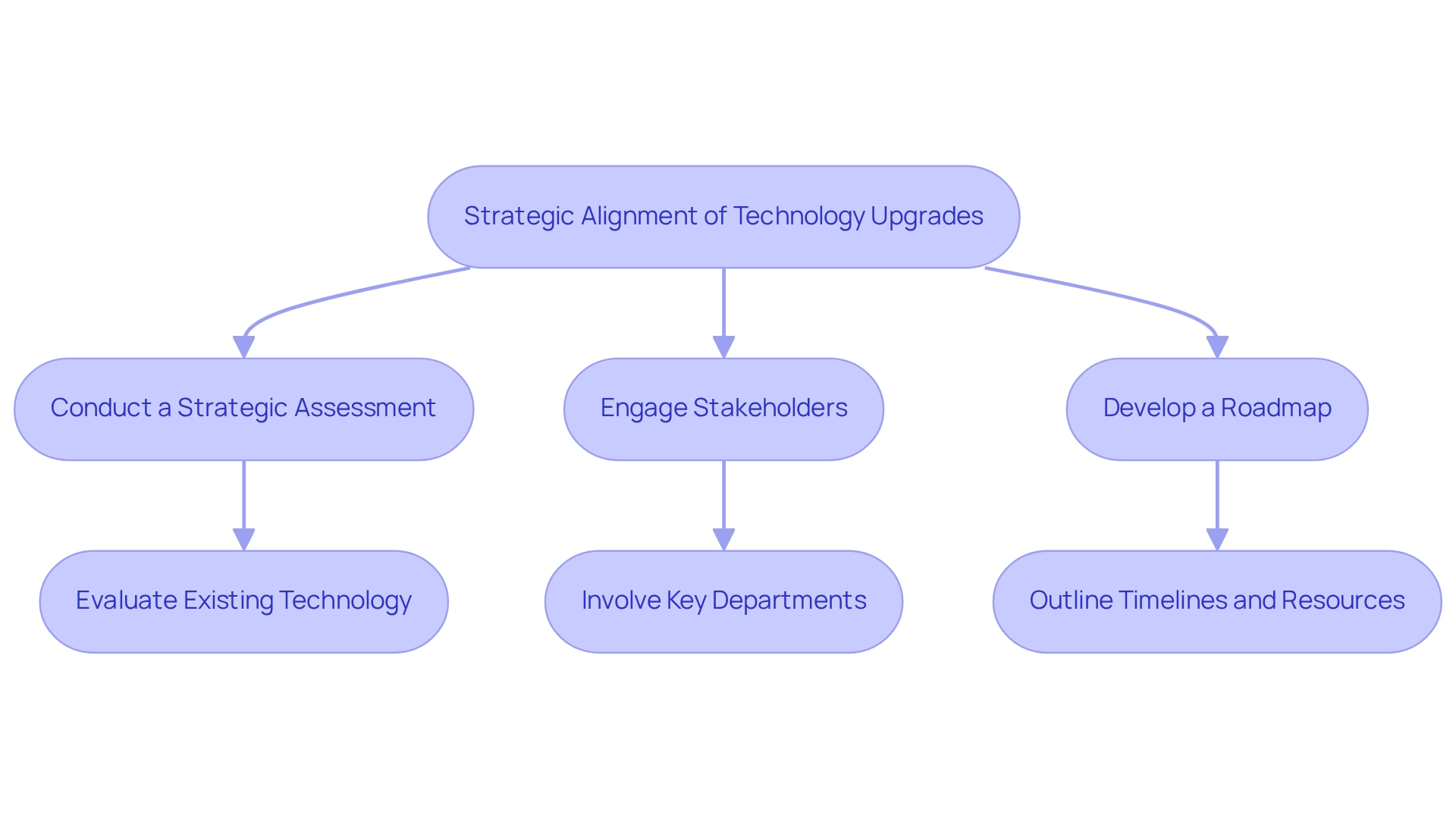

Align Technology Upgrades with Business Strategy and Compliance

To achieve the modernization of the banking system successfully, we must strategically align technology upgrades with our overarching business objectives and compliance requirements. This alignment can be achieved through several key steps:

- Conduct a Strategic Assessment: We evaluate existing technology against business goals to pinpoint gaps and opportunities for enhancement. This assessment is crucial, as 67% of global executives express concerns about the complexity of ESG regulations, highlighting the need for clarity in aligning technology with compliance mandates. Our specialized unification services can aid in this assessment, ensuring that technology solutions are customized to satisfy both business and regulatory requirements.

- Engage Stakeholders: We involve key stakeholders from various departments to ensure that technology upgrades address diverse needs and adhere to compliance standards. Engaging stakeholders fosters a collaborative environment that can lead to innovative solutions. Our global partnership services enhance internal teams, offering the required expertise to enable this engagement efficiently.

- Develop a Roadmap: We create a comprehensive modernization roadmap that outlines timelines, resources, and compliance checkpoints to guide implementation. This roadmap reflects insights from industry leaders, such as Jamie Dimon, who emphasizes that mastering technology is essential for future success in banking. Utilizing Avato’s hybrid integration platform simplifies this process, facilitating structured requirements management that aligns with legacy modernization efforts.

By ensuring that our technology upgrades align with business strategies, we can significantly enhance operational efficiency while contributing to the modernization of the banking system and maintaining compliance with regulatory requirements. This approach not only leads to improved customer trust and satisfaction but also positions us to navigate current compliance challenges effectively. For instance, a case study on enhancing borrower satisfaction illustrates how customer-centric communication strategies can elevate borrower experiences, demonstrating the tangible benefits of aligning technology with customer needs. Furthermore, as 61% of compliance officers anticipate increased spending on compliance processes in the coming years, prioritizing compliance in technology upgrades becomes imperative for the modernization of the banking system and adaptability in the banking sector. As William Blake once said, “What is now proved was once only imagined,” reminding us that innovation in technology upgrades begins with visionary thinking.

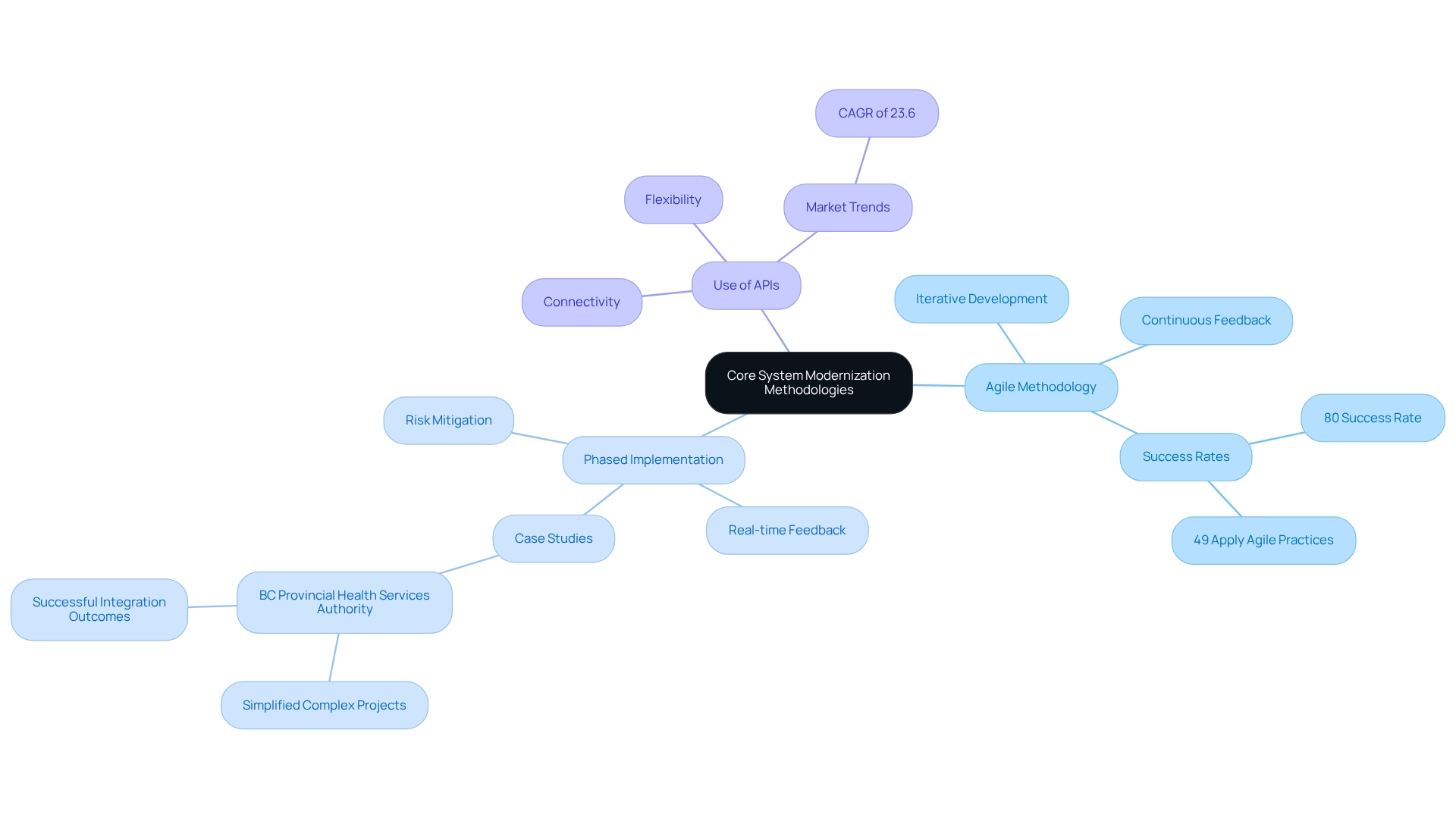

Implement Effective Methodologies for Core System Modernization

Effective methodologies for the modernization of the banking system encompass several key strategies.

- Agile Methodology: We embrace an agile approach, fostering iterative development and continuous feedback. This allows us to swiftly adapt to evolving requirements. Notably, organizations that implement agile governance see success rates soar to 80%, underscoring its effectiveness in driving the modernization of the banking system. Furthermore, 49% of respondents apply Agile practices to the entire application delivery lifecycle, highlighting its prevalence in the banking sector.

- Phased Implementation: By adopting a phased approach to modernization, we mitigate risks and enable adjustments based on real-time feedback and performance metrics. This strategy has proven effective in various banking situations, especially during the modernization of the banking system, as demonstrated by case studies where organizations achieved notable unification results efficiently. For instance, Gustavo Estrada from BC Provincial Health Services Authority commended the platform for streamlining intricate projects and enabling successful incorporation, particularly emphasizing its impact on lowering expenses. He noted, ‘The Hybrid Connection Platform is tailored to facilitate this staged implementation approach, enabling a more seamless transition and improved adaptability.’

- Use of APIs: Our employment of Application Programming Interfaces (APIs) enhances connectivity with current frameworks and external services, promoting flexibility and scalability. This capability is essential as the worldwide digital transformation market is projected to expand at a CAGR of 23.6% from 2022 to 2030, highlighting the necessity for financial institutions to remain agile and responsive. The platform not only enhances but also expands the value of traditional infrastructures, simplifying the management of intricate connections while significantly reducing expenses. These approaches not only facilitate the modernization of the banking system but also empower financial institutions to efficiently react to market shifts and client needs, ensuring a competitive advantage in an increasingly digital environment. Furthermore, the ongoing observation and analytics features of the Hybrid Platform deliver strong insights that assist in optimizing operations and recognizing new opportunities for innovation, thereby further improving performance.

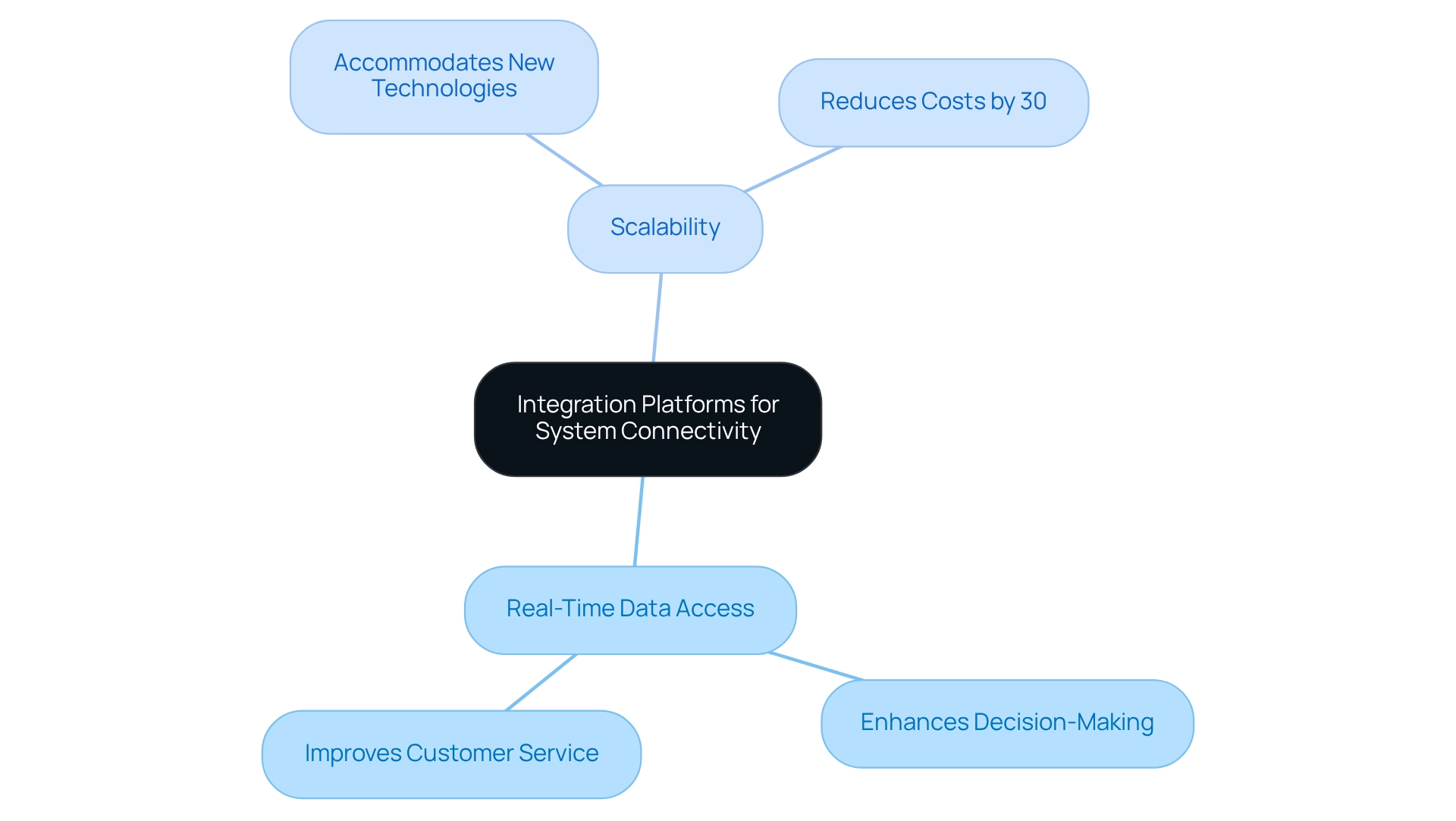

Leverage Integration Platforms for Seamless System Connectivity

To achieve seamless system connectivity, we must leverage integration platforms like Avato, which offer numerous advantages.

Our hybrid integration platform facilitates swift connections between legacy systems and new applications, significantly reducing downtime and expediting the modernization of the banking system. This capability is crucial as we face increasing pressure to innovate quickly in a competitive landscape. We have successfully executed solutions in diverse financial institutions, showcasing our capacity to manage intricate integrations with minimal interruption—such as a brief 63-second outage during a significant transition at Coast Capital.

- Real-Time Data Access: Our platform enables real-time data sharing across multiple frameworks, enhancing decision-making processes and improving customer service. Access to current information allows financial institutions to react swiftly to market fluctuations and client requirements. As emphasized by pleased clients, ‘The platform speeds up the unification of isolated systems and fragmented data, providing the connected foundation enterprises require to simplify, standardize, and achieve the modernization of banking system.’

- Scalability: Our integration solutions are crafted to scale seamlessly as financial institutions grow, accommodating new technologies and rising transaction volumes without requiring significant supplementary investments. This flexibility is essential for institutions seeking to stay nimble in a swiftly changing economic landscape. The transformational impact of our platform is evident in successful projects, which have resulted in cost reductions of up to 30% and quicker product delivery for our clients.

By adopting Avato’s integration platform, we can ensure that our modernization of banking system efforts lead to a more connected, efficient, and customer-centric operation, ultimately driving growth and enhancing our competitive advantage.

Conclusion

Modernization in banking is not merely an option; it is a necessity for our survival and growth in an increasingly competitive environment. By concentrating on essential aspects such as legacy system replacement, digital transformation, and customer-centric approaches, we can significantly enhance our operational efficiency and service delivery. The urgency to update outdated systems has become paramount, especially given the rising security threats and the demand for improved customer experiences.

Aligning our technology upgrades with business strategies and compliance requirements is essential for successful modernization. Engaging stakeholders, conducting strategic assessments, and developing a comprehensive roadmap are critical steps that ensure our technology solutions meet both regulatory and operational needs. This alignment not only builds customer trust but also positions us to respond effectively to evolving market demands and compliance challenges.

Implementing effective methodologies, such as agile practices and phased approaches, further empowers us to navigate the complexities of modernization. Utilizing integration platforms like Avato provides seamless connectivity and real-time data access, enabling us to respond swiftly to changing customer needs and market conditions.

Ultimately, embracing modernization in banking transcends the mere adoption of new technologies; it represents a strategic imperative that fosters innovation, enhances customer satisfaction, and ensures long-term sustainability. As the financial landscape continues to evolve, prioritizing modernization will be crucial for us as we aim to thrive in this dynamic environment.