Overview

Choosing the right enterprise integration tool is crucial for operational success. We must ensure compatibility with existing systems, prioritize scalability, emphasize ease of use, and assess vendor support. These four key practices are not just recommendations; they are essential for enhancing operational efficiency and ensuring successful integration.

In sectors like banking, where compliance and security are paramount, aligning our integration strategies with business objectives becomes even more critical. What challenges are we facing in our current systems? By addressing these practices, we can streamline our operations and achieve our goals more effectively. Let us take the necessary steps to enhance our integration strategies today.

Introduction

In today’s landscape, where digital transformation is not just beneficial but essential, we recognize that enterprise integration tools are pivotal solutions for organizations striving to connect disparate systems and streamline operations. These tools do more than facilitate data sharing and automate processes; they are instrumental in enhancing compliance, especially in regulated sectors like banking.

As the demand for effective integration solutions intensifies, it becomes crucial for us to understand the fundamental capabilities and best practices for selecting and implementing these tools. This article delves into the intricacies of enterprise integration, emphasizing the importance of security, scalability, and stakeholder engagement in achieving successful outcomes.

By exploring these themes, we empower organizations to navigate the complexities of integration and drive operational efficiency in an increasingly competitive landscape.

What’s holding your team back from leveraging these essential tools? Let’s explore how we can transform your operations together.

Understand the Fundamentals of Enterprise Integration Tools

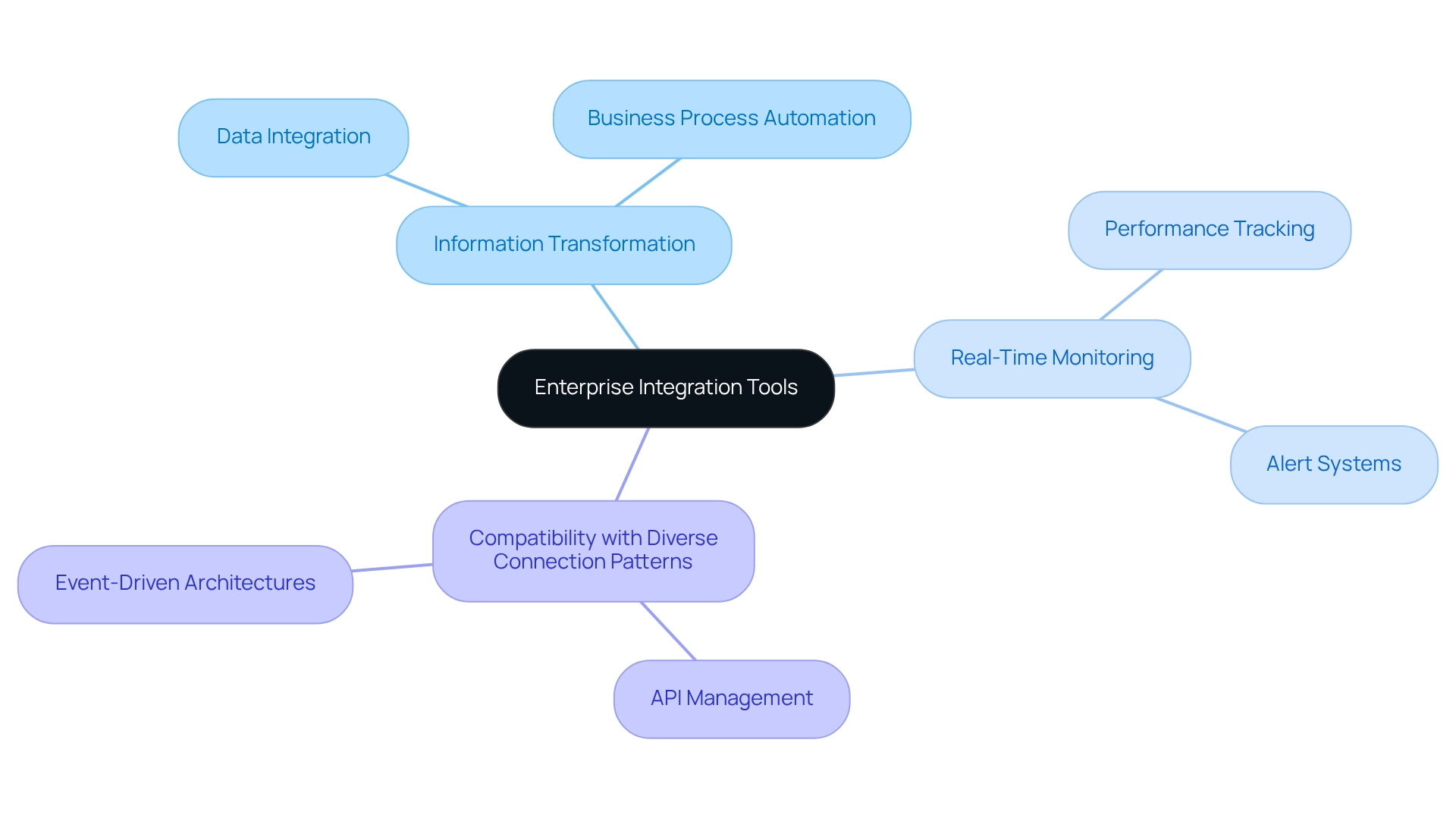

Enterprise integration tools are not merely software applications; they are essential solutions that ensure seamless connectivity among various systems, applications, and information sources within our organization. By facilitating information exchange and process automation, we significantly enhance operational efficiency and empower informed decision-making. Our key functionalities include:

- Information transformation

- Real-time monitoring

- Compatibility with diverse connection patterns such as API management and event-driven architectures

A solid understanding of these fundamentals enables us to pinpoint our specific needs for system integration and select the most suitable resources.

In the banking sector, for example, our connection resources must ensure secure information exchange between legacy systems and modern applications, all while adhering to stringent regulatory standards. This capability not only bolsters compliance but also elevates customer service by streamlining operations. With 83% of organizations prioritizing product connections to boost close rates and sales, grasping the core functionalities of these resources is critical for aligning our connection strategies with overarching business objectives. We anticipate significant growth in the enterprise application unification market, driven by the increasing demand for enterprise integration tools that facilitate efficient information management solutions across various sectors.

Address Compliance and Security Challenges in Banking Integration

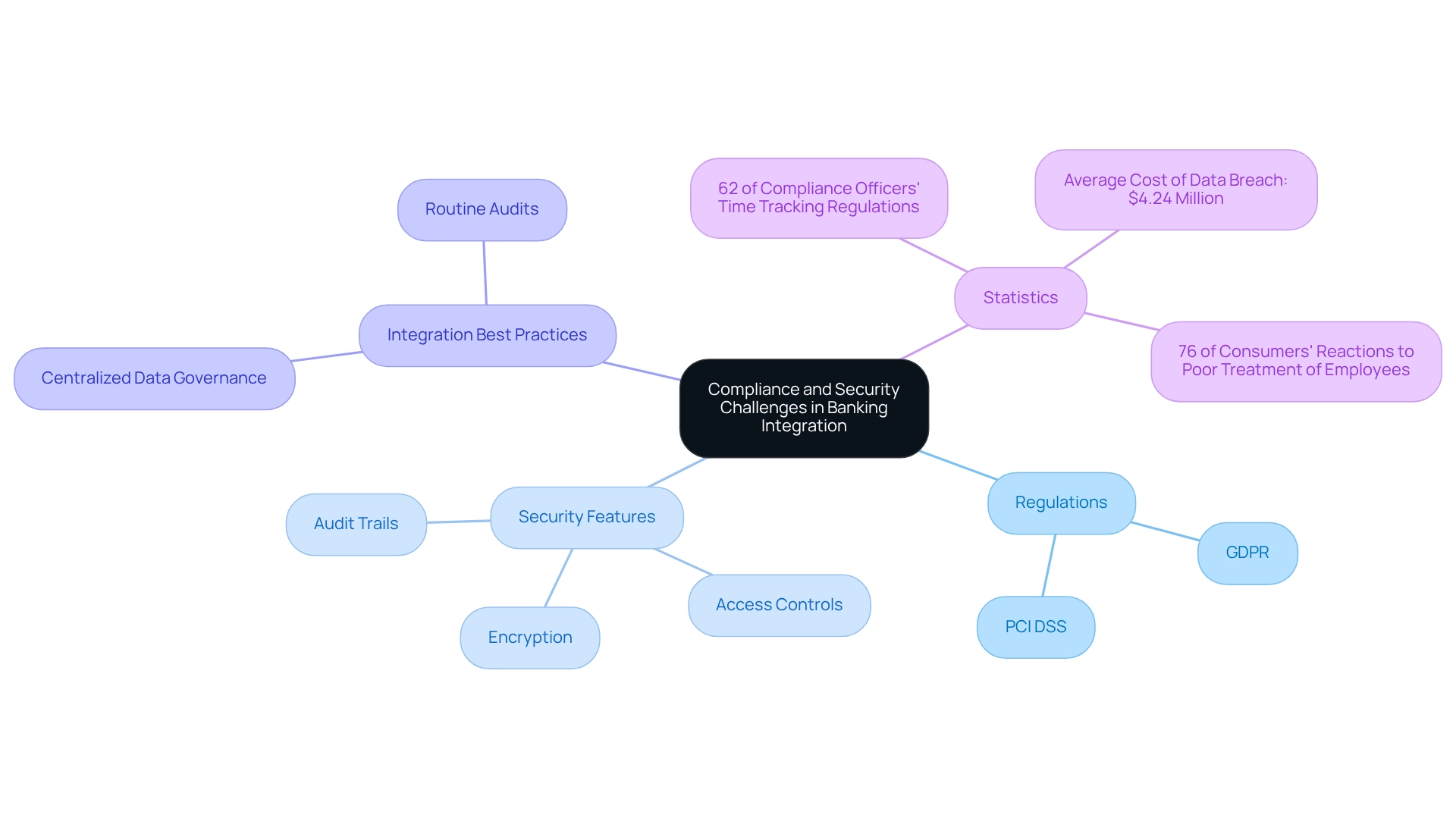

In the banking industry, we recognize that unification tools must comply with strict regulations such as GDPR and PCI DSS, essential for ensuring information protection and privacy. We prioritize solutions that incorporate robust security features, including encryption, access controls, and comprehensive audit trails. Furthermore, efficient integration solutions should provide inherent reporting functionalities, allowing us to showcase adherence to regulatory standards effortlessly.

When we connect our customer relationship management (CRM) system with our main banking platform, it is crucial to ensure that client information is encrypted during transmission and that access is strictly restricted to authorized personnel. By proactively tackling these compliance and security challenges, we can significantly reduce the risks linked to breaches and avoid expensive regulatory penalties.

Statistics reveal that 62% of compliance officers dedicate between 1 to 7 hours weekly to track regulatory developments, highlighting the ongoing challenges in maintaining compliance. Moreover, adopting best practices in compliance can lead to significant cost reductions, with entities possibly saving millions through centralized data governance and routine audits. By focusing on these aspects, we can enhance our operational efficiency while safeguarding sensitive information.

Select the Right Enterprise Integration Tool for Banking Needs

When we consider an enterprise integration tool tailored for banking requirements, it is crucial to prioritize several essential factors:

-

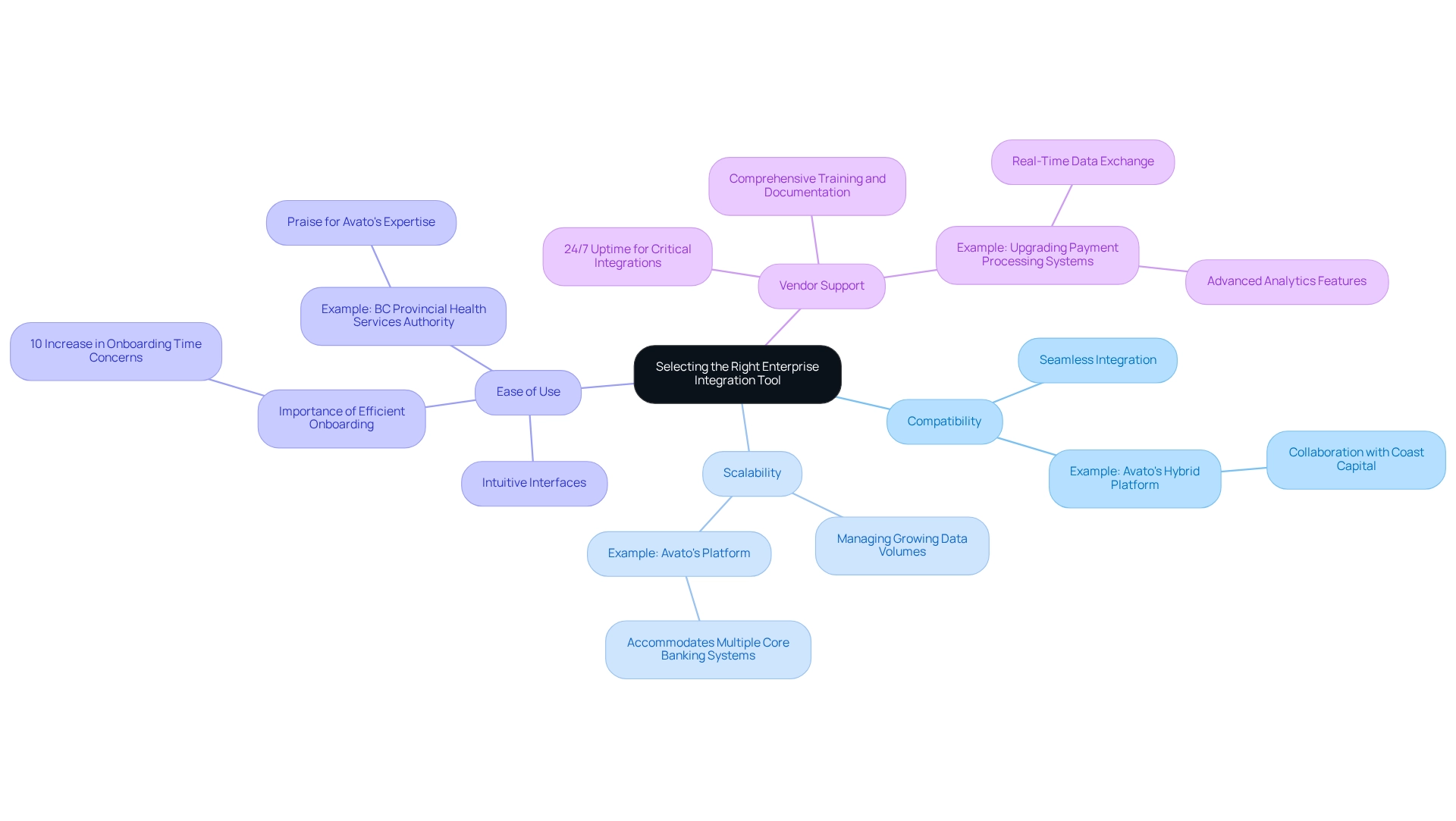

Compatibility: We must ensure that the enterprise integration tool seamlessly integrates with existing systems and technologies to prevent operational disruptions. Studies indicate that organizations increasingly prefer products that align well with their current applications. For instance, Avato’s hybrid integration platform has successfully connected various financial institutions with minimal downtime, as evidenced by its collaboration with Coast Capital.

-

Scalability: It is vital to select a solution that can evolve alongside our organization, effectively managing growing data volumes and user demands. The need for scalability is becoming increasingly apparent in the banking sector, necessitating resources that can adapt to changing business environments. Avato’s platform accommodates multiple core banking systems without requiring modifications, ensuring it can scale according to our institution’s needs.

-

Ease of Use: We should opt for tools with intuitive interfaces that facilitate quick onboarding and require minimal training. A user-friendly design significantly enhances productivity and reduces the time needed to implement new systems. Notably, the percentage of companies that feel onboarding new supply chain partners takes too long has risen by roughly 10%, highlighting the importance of efficient onboarding processes. Avato’s commitment to streamlining merging procedures has proven advantageous for entities such as the BC Provincial Health Services Authority, which praised Avato’s expertise and professionalism.

-

Vendor Support: We must assess the level of support provided by the vendor, including comprehensive training, detailed documentation, and ongoing maintenance. Robust vendor assistance is essential for ensuring effective integration and lasting satisfaction. Avato’s dedication to guaranteeing round-the-clock uptime for critical connections reinforces the reliability that banking IT managers seek in connectivity solutions. A strategic approach to addressing enterprise connectivity challenges using an enterprise integration tool can enhance efficiency and foster innovation, making strong vendor support indispensable in the banking industry. For example, when a bank aims to upgrade its payment processing system, it should select an enterprise integration tool that enables real-time data exchange and offers advanced analytics features. This capability allows for effective monitoring of transaction performance and compliance, ultimately driving efficiency and innovation in banking operations. The expertise of the BC Provincial Health Services Authority, which successfully managed complex unification projects with Avato, underscores the significance of selecting tools that deliver timely and cost-effective results.

Implement Best Practices for Successful Integration

To achieve successful integration, we must adopt best practices that drive results:

-

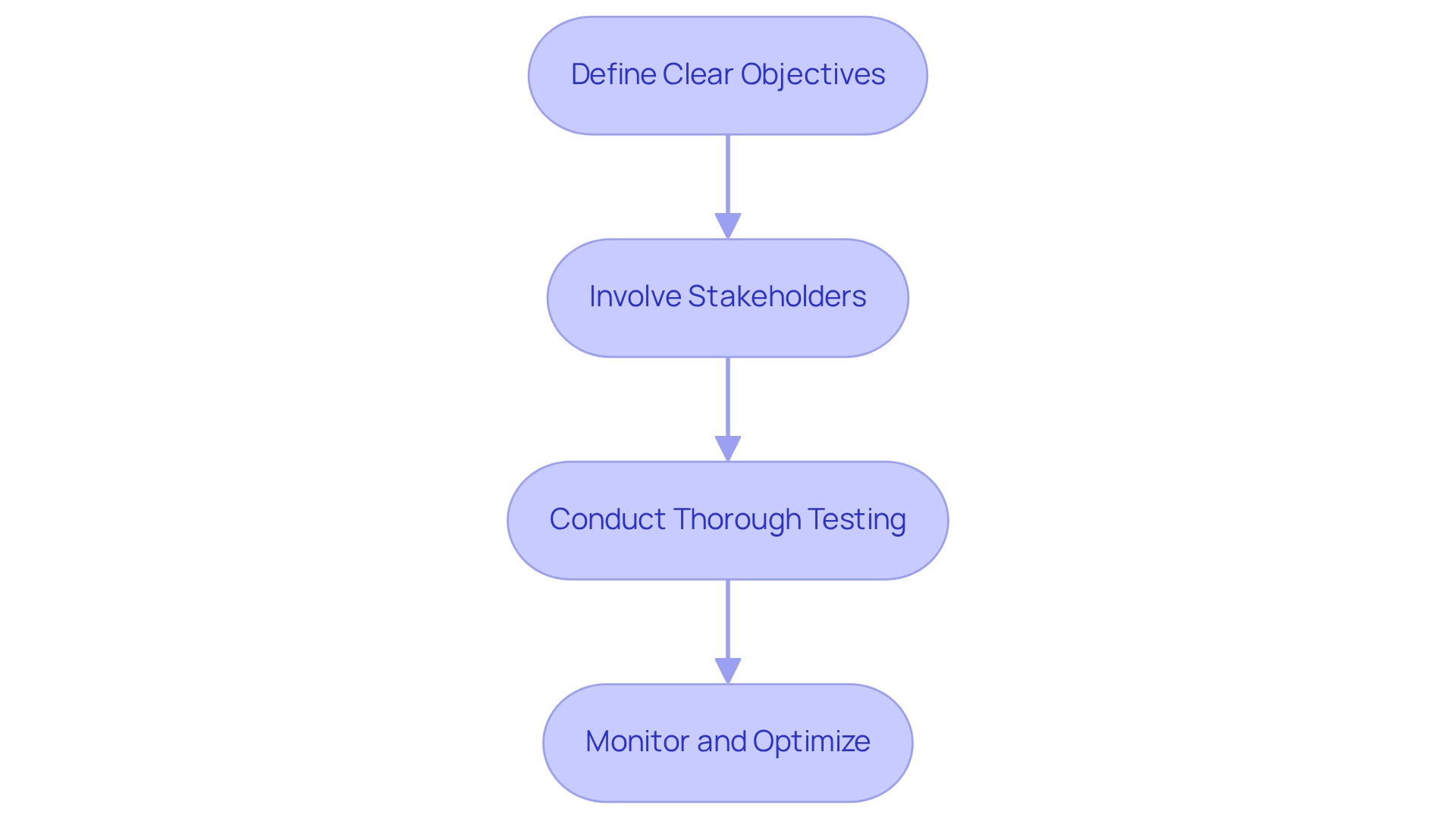

Define Clear Objectives: We establish specific goals for our projects, such as reducing processing times or improving data accuracy. Clear objectives direct our incorporation process and help gauge success.

-

Involve Stakeholders: Engaging key stakeholders from various departments ensures that our incorporation meets the needs of all users. We effectively engage stakeholders by employing the appropriate technology and tools to depict the current and desired conditions of the incorporation accurately. Stakeholder involvement is crucial; it fosters collaboration and enhances the likelihood of project success. As Gustavo Estrada noted, “Avato simplifies complex projects and delivers results within desired time frames and budget constraints,” underscoring the importance of effective project management. Furthermore, utilizing XSLT simplifies the merging process, minimizing the effort needed in transforming XML data structures, ultimately resulting in cost savings and error reduction through the use of schemas.

-

Conduct Thorough Testing: We implement rigorous testing protocols to identify and resolve issues before going live. This step is essential to ensure that our system operates as intended and minimizes disruptions.

-

Monitor and Optimize: We continuously observe the performance of our system and make adjustments as necessary to enhance efficiency. Frequent evaluations can lead to enhancements, ensuring that our coordination remains aligned with business goals. Notably, 39% of social media users desire prompt replies, highlighting the necessity for timely response implementation. Utilizing continuous monitoring and analytics further improves performance, ensuring that our systems remain adaptable and future-proof.

For instance, when integrating a patient management system with billing software, we involve IT, finance, and clinical staff in the planning process. This collaborative approach ensures that our unification addresses the needs of all departments, ultimately enhancing operational efficiency. By following these best practices, we can significantly improve the effectiveness of our integration efforts and achieve our digital transformation goals.

Conclusion

Enterprise integration tools are critical enablers for organizations like ours seeking to streamline operations and enhance connectivity among disparate systems. Understanding their fundamental capabilities—such as data transformation, real-time monitoring, and compliance with integration patterns—is essential for selecting the right tools that align with our business objectives. In regulated sectors like banking, where compliance and security are paramount, these tools not only facilitate data sharing but also ensure adherence to stringent regulations, thereby mitigating risks associated with data breaches.

Selecting the appropriate integration tool involves careful consideration of:

- Compatibility

- Scalability

- Ease of use

- Vendor support

By prioritizing these factors, we ensure that our organization can adapt to changing business landscapes and operational demands. Implementing best practices—such as defining clear objectives, involving stakeholders, conducting thorough testing, and continuously monitoring performance—further enhances the likelihood of successful integration.

In an era where digital transformation is vital for competitive advantage, we must leverage effective enterprise integration solutions to drive operational efficiency and innovation. Embracing these tools not only fosters compliance and security but also positions us to navigate the complexities of modern business landscapes successfully. The time to act is now; optimizing our integration efforts can pave the way for enhanced performance and sustained growth in the future.