Overview

We recognize that enhancing efficiency is paramount for modern banking systems. Our focus is on strategies that can be implemented to achieve this goal. By integrating advanced technologies—such as hybrid connectivity platforms and AI—we can streamline operations, improve customer service, and ensure compliance. This integration not only enables financial institutions to remain competitive in a rapidly evolving market but also addresses the pressing challenges they face.

What’s holding your team back from embracing these transformative solutions? By adopting these technologies, we empower our partners to navigate complexities with confidence and clarity. Let’s take action together to redefine efficiency in banking.

Introduction

In today’s rapidly evolving banking landscape, we face a pressing challenge: modernizing our operations while ensuring robust security and compliance. The emergence of hybrid integration platforms, such as Avato, presents a powerful solution, enabling us to seamlessly connect disparate systems and enhance our operational efficiency.

With advanced capabilities that support real-time data access, artificial intelligence integration, and open banking readiness, Avato positions us as leaders in addressing the complexities of the modern financial environment.

As we strive to meet rising customer expectations and navigate stringent regulatory requirements, the importance of a reliable integration solution becomes increasingly evident. This paves the way for innovation and sustained growth in our sector.

What’s holding your team back from embracing this transformation?

Avato: Secure Hybrid Integration Platform for Modern Banking

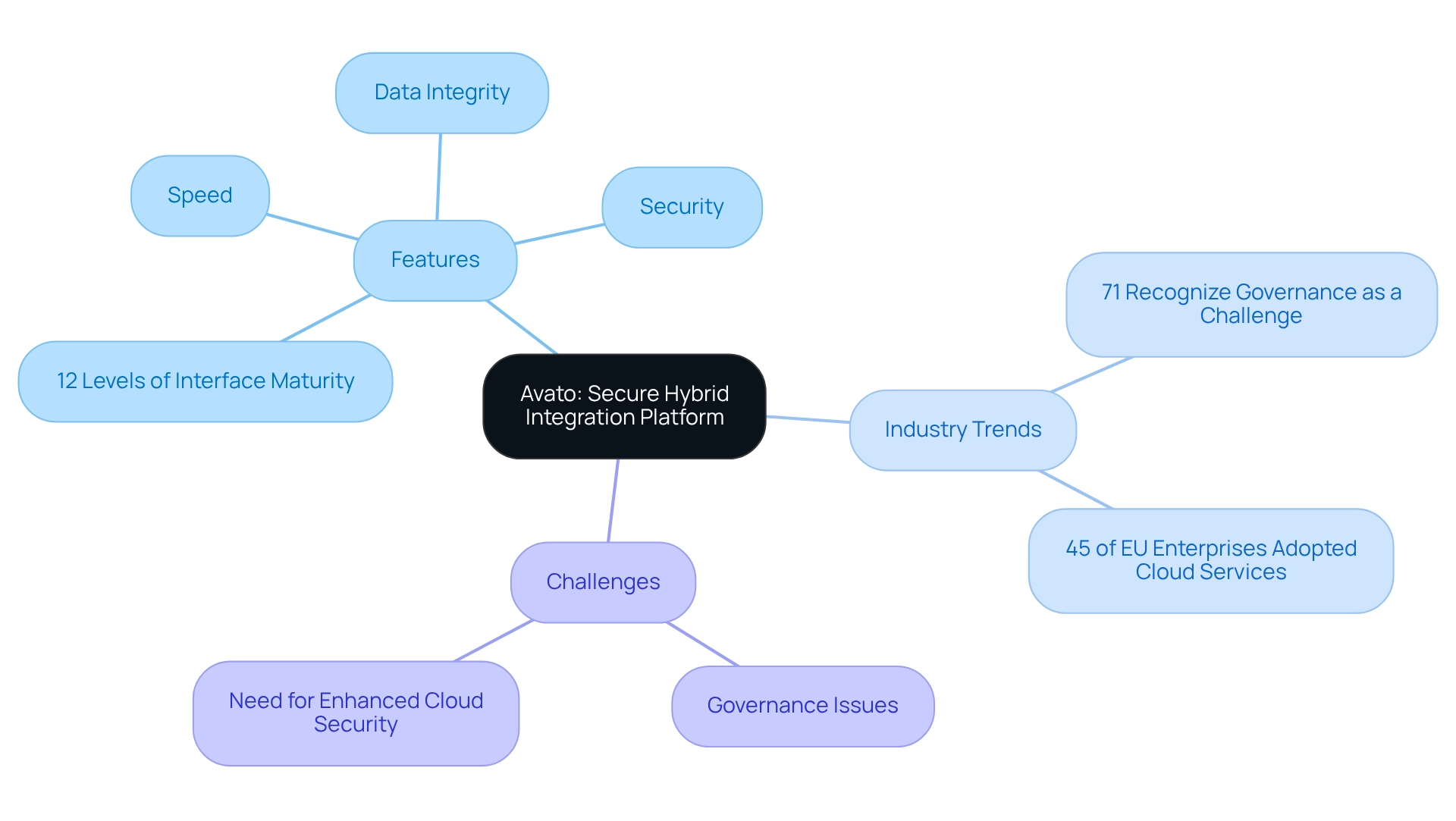

We have expertly designed our hybrid connection platform to link various modern banking systems, enabling institutions to modernize operations while maintaining strict security standards. With support for 12 levels of interface maturity, we empower banks to execute connections that are both swift and sophisticated, allowing them to respond effectively to changing market demands without sacrificing data integrity. This adaptability is crucial in the highly regulated banking sector, where compliance and security are non-negotiable.

Current trends indicate that a recent study revealed 71% of cloud decision-makers recognize governance as a major challenge, underscoring the significance of secure connection solutions. Cem Dilmegani, Principal Analyst at AIMultiple, emphasizes that “the incorporation of secure solutions is vital for organizations looking to leverage cloud technologies effectively.” This insight highlights the essential requirement for platforms that address these governance challenges.

In 2023, approximately 45% of enterprises in the European Union adopted cloud computing services, marking a 4 percentage point increase since 2021. This trend illustrates the growing dependence on hybrid connection platforms to enhance operational capabilities within modern banking systems. We distinguish ourselves by offering a robust technological foundation that not only streamlines intricate connections but also guarantees round-the-clock availability for essential banking functions.

As organizations increasingly recognize the necessity for enhanced cloud security, our platform provides a dependable solution that integrates speed, security, and simplicity. This positions us as a leader in the hybrid connectivity field, enabling financial institutions to optimize the capabilities of their legacy systems while effectively managing the challenges of modern banking systems and contemporary digital transformation.

Real-Time Data Access: Enhancing Decision-Making in Banking

Access to real-time information empowers us to swiftly adapt to market fluctuations and changing client demands. By utilizing Avato’s advanced integration capabilities, we can seamlessly synchronize data across diverse platforms, ensuring our decision-makers have immediate access to the most current information. This immediacy not only boosts operational efficiency but also significantly enhances client satisfaction by facilitating personalized services and prompt responses to inquiries.

The importance of real-time data access is underscored by a projected 218% increase in edge computing investments among financial institutions by 2026, reflecting our strategic commitment to enhancing data capabilities that directly support decision-making processes. Furthermore, organizations that adopt edge computing have reported a 52% reduction in security incidents, showcasing the dual benefits of improved efficiency and enhanced security.

Real-time data access also plays a pivotal role in client satisfaction. For example, we see financial institutions using analytics to handle transactions, developing customized offerings akin to how Starbucks’ loyalty program effectively employs analytics to boost revenue by over 25%. As Sarah Lee notes, “Starbucks’ loyalty program uses analytics to process over 90 million transactions per week, creating personalized offers that have increased revenue by more than 25% since implementation.” As we continue to refine our analytics approaches through regular audits and A/B testing, the impact of real-time data on decision-making and operational efficiency will only grow stronger in 2025 and beyond.

To leverage real-time data access effectively, we encourage banking IT managers to implement a robust analytics framework in modern banking systems that includes regular performance audits and the use of A/B testing to validate insights. This proactive strategy will guarantee that our organizations stay agile and responsive to both market changes and client needs. Additionally, embracing generative AI technologies can further enhance customer experience and operational efficiency, positioning us to thrive in the digital age. Involving stakeholders early in the process and designing new business processes can assist in ensuring that the incorporation of these technologies aligns with our organizational objectives.

Open Banking Readiness: Fostering Innovation and Collaboration

Open Banking Readiness: Fostering Innovation and Collaboration

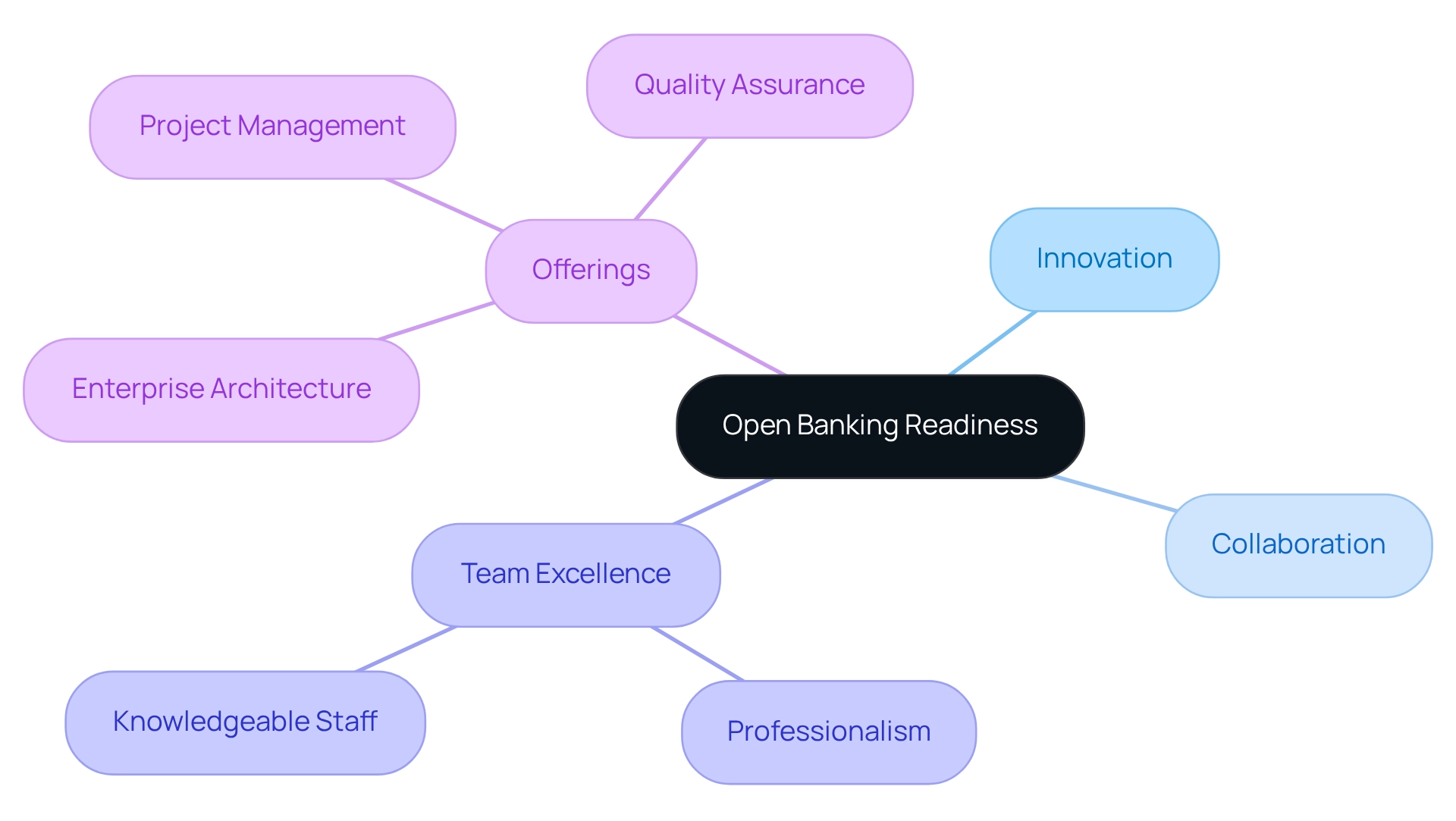

As we advance into the era of open banking, it is imperative that financial institutions prepare to share data securely with third-party providers. Our hybrid connectivity platform facilitates this transition by ensuring that connections are not only secure but also compliant with regulatory standards. By modernizing legacy systems, we streamline complex connections in modern banking systems, delivering cost-effective solutions that enhance operational efficiency.

Tony LeBlanc from the Provincial Health Services Authority notes, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This testimonial underscores our commitment to excellence in service delivery.

By embracing open banking, we empower financial institutions to drive innovation within modern banking systems, create new revenue streams, and enhance customer experiences through collaborative services that meet evolving consumer demands. Our offerings include:

- Enterprise architecture

- Project management

- Quality assurance

Supported by a team of experienced collaboration partners, this ensures seamless data and systems integration, allowing financial institutions to navigate the digital landscape with confidence.

Cybersecurity Measures: Safeguarding Financial Institutions

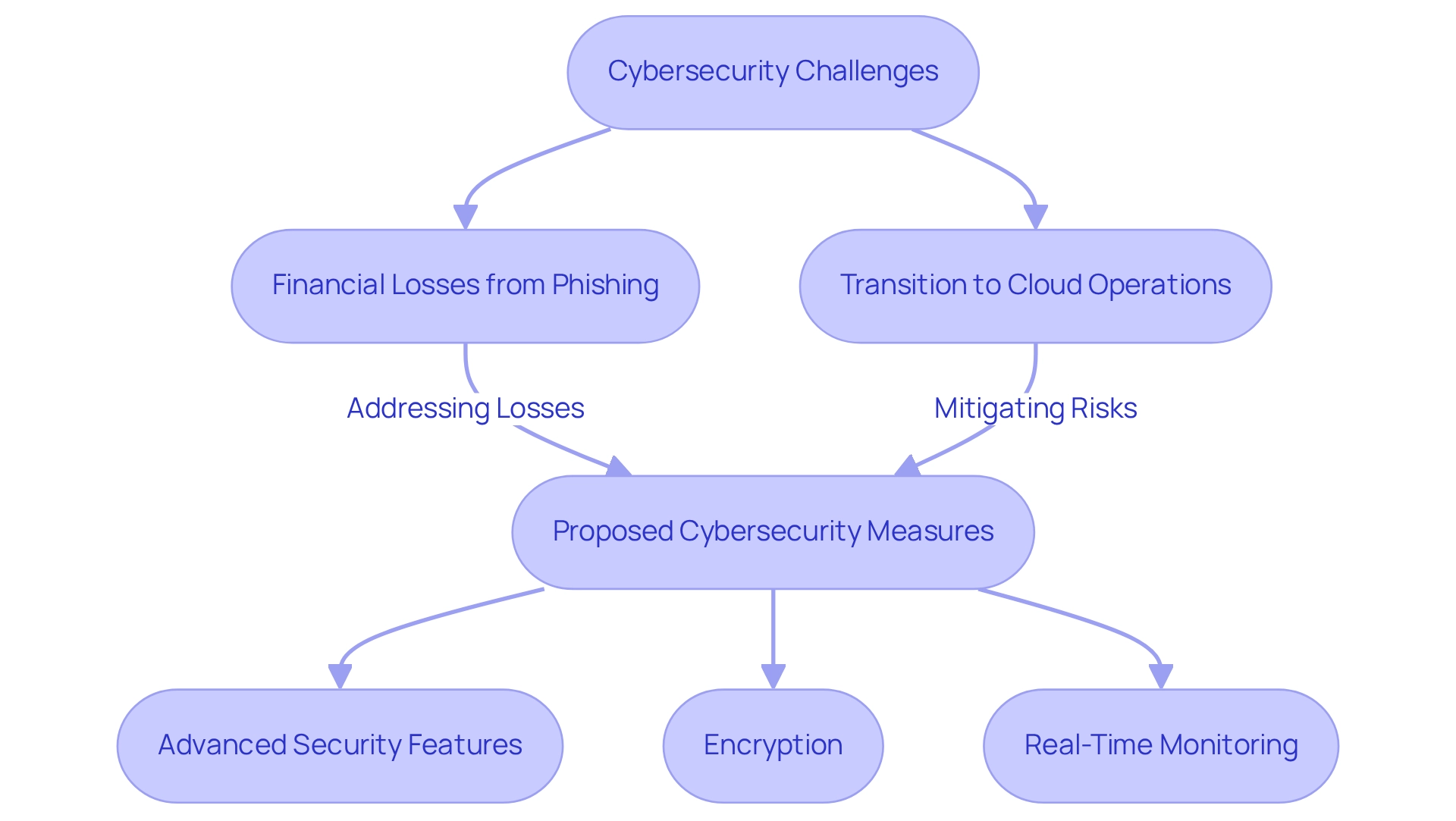

As cyber threats evolve in sophistication, we must prioritize robust cybersecurity measures to protect our assets and client information. Alarmingly, financial institutions are losing $17,700 every minute due to phishing attacks, with U.K. companies particularly at risk.

Our hybrid integration platform addresses these challenges by incorporating advanced security features such as encryption and real-time monitoring, effectively safeguarding against potential breaches. This commitment to secure data connectivity not only helps us meet regulatory requirements but also enhances client trust, ensuring that sensitive information remains protected.

As we approach 2025, with 70% of financial institutions expected to operate in the cloud, we are progressively investing in sophisticated cybersecurity strategies to mitigate risks and secure our operations within modern banking systems, ultimately fostering a safe environment for our clients.

As Kevin Skapinetz, Vice President of Strategy & Product Management at IBM Security, aptly states, “Using AI to quickly defend against cyberattacks is crucial, as speed is important in cybersecurity.”

What steps are you taking to ensure your organization is prepared?

Artificial Intelligence Integration: Transforming Banking Operations

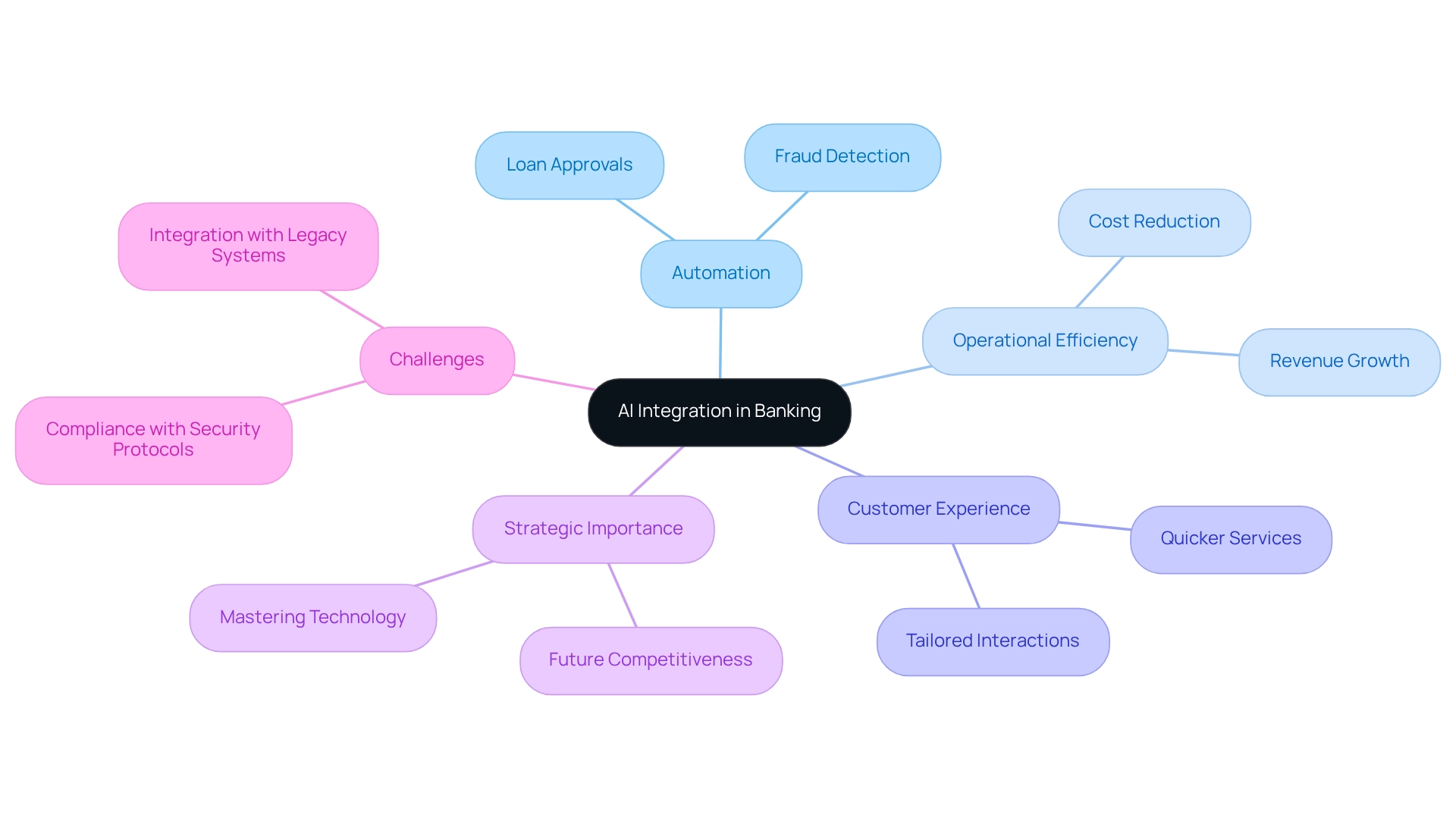

Artificial intelligence is fundamentally transforming modern banking systems by automating routine tasks and providing actionable insights through advanced data analytics. When we combine this technology with Avato’s hybrid platform, financial institutions can greatly simplify essential processes such as loan approvals and fraud detection, while also improving service interactions. This combination not only results in a decrease in operational expenses but also enhances the customer experience by facilitating quicker and more tailored services.

In 2025, statistics suggest that around 95% of new products do not succeed, emphasizing the essential need for financial institutions to utilize technology efficiently to stay competitive. As Jamie Dimon states, mastering technology is crucial for future success in banking, and the strategic incorporation of AI is a vital aspect of this mastery. By embracing AI, we are observing significant enhancements in efficiency and cost control. For instance, several institutions have successfully implemented AI-driven solutions for fraud detection, resulting in quicker response times and reduced losses.

Furthermore, Avato’s platform enables this AI incorporation, allowing us to unlock the full potential of our legacy systems while minimizing downtime. This capability is crucial in a landscape where operational agility is paramount, especially as modern banking systems and open banking become a reality. As banks prepare for this shift, they must ensure their unification solutions are compliant with stringent security protocols to protect consumer data.

As William Blake once said, “What is now proved was once only imagined,” underscoring the innovative nature of AI in banking. The transformative impact of AI adoption in modern banking systems is evident, as it drives revenue growth and enhances operational efficiency. As modern banking systems continue to evolve, the strategic integration of AI will be a key driver of innovation and efficiency. We encourage banking IT managers to consider how they can utilize AI and our platform to improve their operations and remain competitive in this challenging environment.

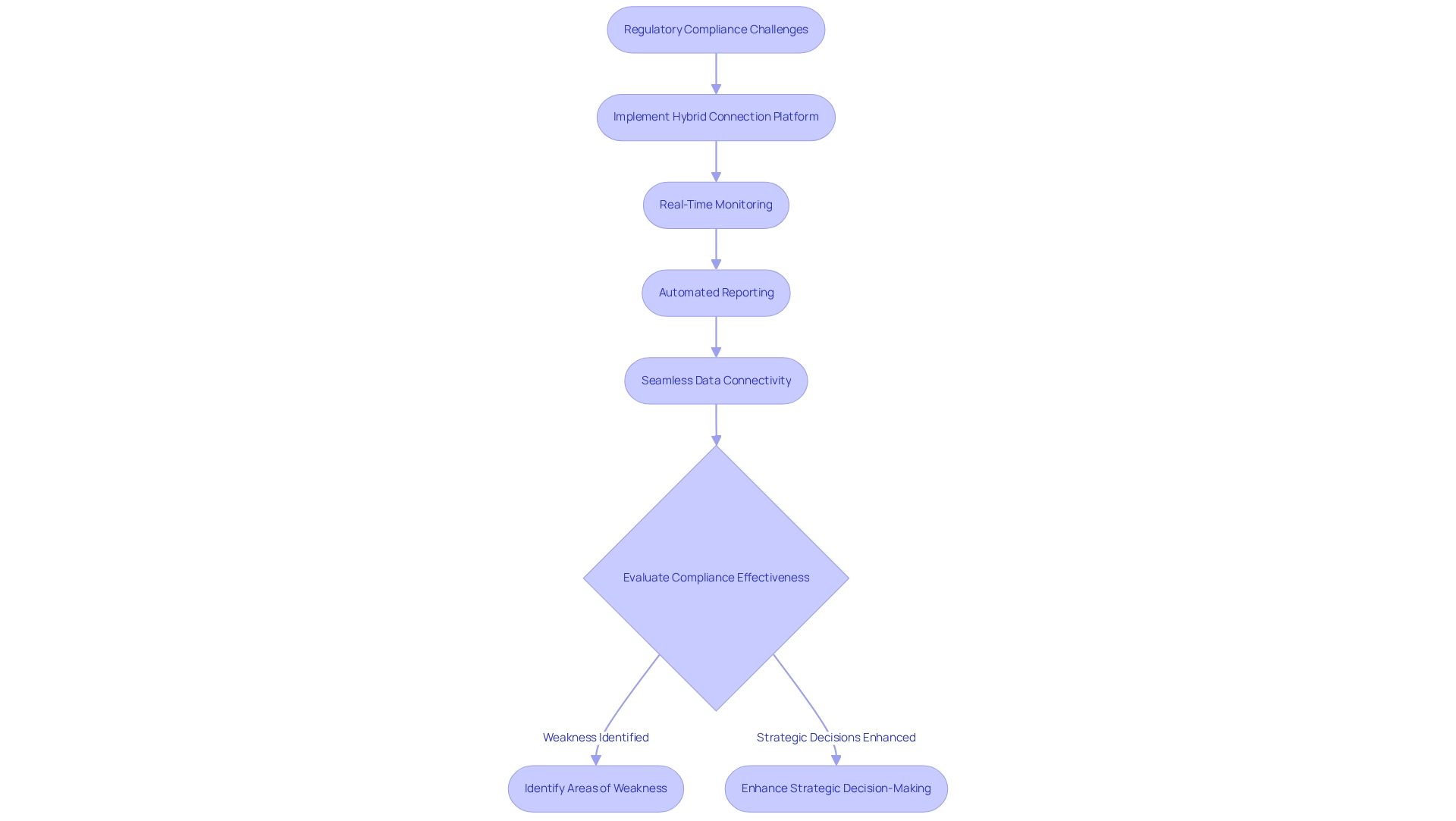

Regulatory Compliance: Meeting Legal Standards in Banking

Navigating the intricate landscape of regulatory compliance presents a formidable challenge for banks, particularly in 2025, where the stakes are higher than ever. We understand that the complexities of compliance can be overwhelming. That’s why Avato’s dedicated hybrid connection platform is specifically engineered to streamline compliance processes by offering robust tools for real-time monitoring, automated reporting, and seamless data connectivity. These features ensure that all integrations meet stringent legal standards, significantly reducing the risks associated with non-compliance. Consequently, financial institutions can protect their reputations and evade the significant penalties that frequently accompany regulatory failures.

Statistics reveal that each percentage point reduction in false positives can lead to annual savings of approximately $150,000 to $200,000 for mid-sized financial institutions, underscoring the financial impact of effective compliance strategies. Furthermore, leading financial institutions are increasingly recognizing transaction monitoring as a strategic investment rather than merely a compliance cost. This shift enables us to utilize monitoring data for informed strategic decisions, enhancing both risk management and operational efficiency. As James Wade, First Vice President & CISO, noted, “Through Diligent, we’ve been able to identify areas of weakness, where we need to shore up our cyber risk management, and we’ve also been able to elevate information up to our boards. Our mission is to be good stewards of our clients’ information, and with the Diligent platform, we’ve been able to do that.”

Expert insights emphasize that the incorporation of advanced monitoring technologies not only assists in compliance but also promotes innovation, stability, and operational efficiency within financial services. By utilizing a hybrid integration platform grounded in a strong commitment to designing technology solutions, we can ensure that our compliance efforts are not only effective but also aligned with our broader strategic goals, ultimately positioning ourselves for success in a rapidly evolving regulatory landscape. Furthermore, relocating financial services to the cloud enhances innovation, stability, security, and operational efficiency, further increasing the value of the solutions we offer.

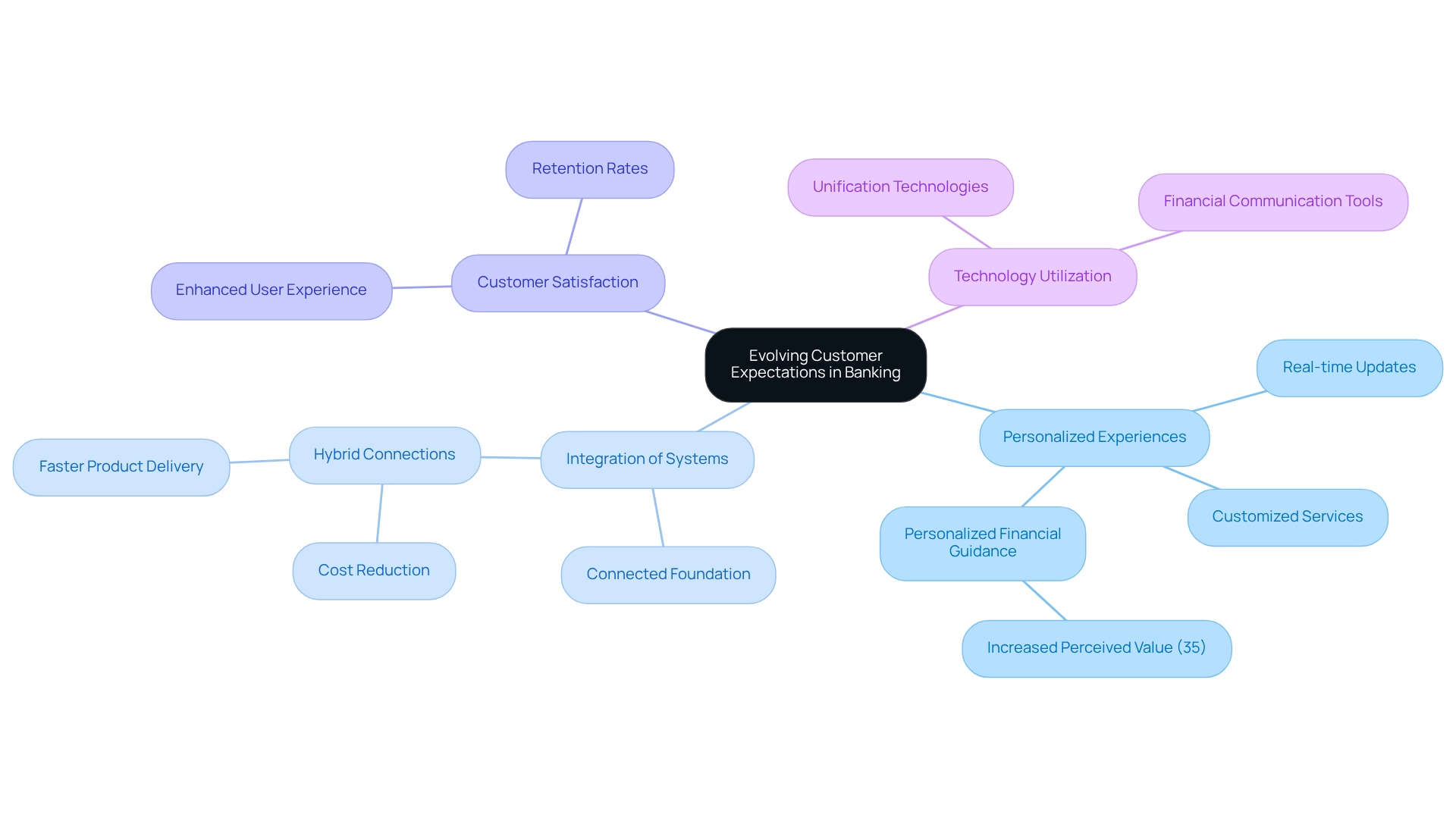

Evolving Customer Expectations: Adapting Banking Services

In today’s digital environment, we recognize that clients demand seamless and personalized banking experiences that are tailored to their unique needs through modern banking systems. By leveraging advanced integration capabilities, we can create customized services that significantly enhance client satisfaction. This encompasses delivering real-time updates, personalized financial advice, and streamlined access to services across various channels. As Jane Barratt, our chief advocacy officer, aptly states, “Consumers expect their financial providers to know them, but they, in turn, want to know who has access to their data and how it’s being used.” Furthermore, recent findings reveal that customers receiving personalized financial guidance are 35% more likely to perceive their banking relationship as ‘extremely valuable.’ This underscores the critical role we play in providing such personalized guidance.

We expedite the integration of isolated systems and fragmented data into modern banking systems, establishing the connected foundation enterprises require to simplify, standardize, and modernize. Designed for secure transactions, our platform is trusted by financial institutions, healthcare, and government, positioning us as a reliable ally in the digital transformation journey. To effectively adapt to evolving expectations, financial institutions should initiate targeted use cases in modern banking systems that demonstrate rapid successes, paving the way for broader personalization initiatives. Our platform, accommodating 12 tiers of interface maturity, enhances innovative financial communication tools by enabling banks to seamlessly link their systems and data, thereby improving the overall user experience.

As we look toward 2025, the focus on personalization within modern banking systems will only intensify. Consequently, it is imperative for financial organizations to harness unification technologies in modern banking systems to stay ahead of client expectations and boost retention rates. Banking IT managers ought to consider launching specific unification projects aligned with their strategic objectives, utilizing our platform to streamline processes and deliver customized services efficiently. With our expertise in hybrid connections, financial institutions can achieve cost reduction, faster product delivery, and enhanced customer satisfaction. As Tony LeBlanc from the Provincial Health Services Authority remarks, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.

Competitive Landscape: The Need for Banking Modernization

We are witnessing a profound transformation in modern banking systems, driven by rapid technological advancements and evolving consumer expectations. To maintain a competitive edge, we must prioritize the modernization of our systems and processes, especially by adopting modern banking systems. The hybrid connection platform is pivotal in this transition, enabling us to enhance legacy systems with remarkable efficiency. This capability empowers us to swiftly adapt to market dynamics and improve operational responsiveness, bolstered by Avato’s expert integration services, including enterprise architecture, project management, and global partnerships with managed service providers.

Modern banking systems transcend mere technological upgrades; they necessitate a fundamental rethinking of banking operations to deliver enhanced value to our clients. As industry leaders, such as Roman Myzuka, Managing Partner at Binariks, emphasize, improving client experience is the foremost priority for many mid-market banking executives. The effective execution of modernization efforts hinges on setting clear goals, thorough planning, and leveraging the expertise of seasoned professionals, like those at Avato.

A significant trend we anticipate in 2025 is the growing adoption of innovative payment options within modern banking systems, such as Pay-by-Bank, which facilitates direct transactions from financial accounts without the need for debit or credit cards. This approach not only enhances security and transaction speed but also allows businesses to bypass card processing fees, particularly in regions like Europe and East Asia. Our platform can seamlessly incorporate such payment methods, ensuring that we can offer these contemporary solutions to our clients, thereby bridging traditional systems with modern banking systems.

Statistics reveal an increasing urgency for modernization, with a considerable number of financial institutions recognizing the necessity of enhancing legacy systems to remain competitive in modern banking systems. For instance, Erica by Bank of America has engaged with 37 million customers since its launch, underscoring the importance of integrating advanced technologies to improve customer interactions. This statistic illustrates the potential advantages of modernization, which we can help other financial institutions achieve through our robust unification skills in modern banking systems.

As the competitive landscape evolves, institutions that embrace modern banking systems will not only enhance their operational capabilities but also position themselves advantageously in an increasingly digital marketplace. The integration of advanced technology, facilitated by a specialized hybrid connectivity platform, is essential for financial institutions striving for success in this dynamic environment, ensuring we can meet the needs of today’s consumers while preparing for future challenges.

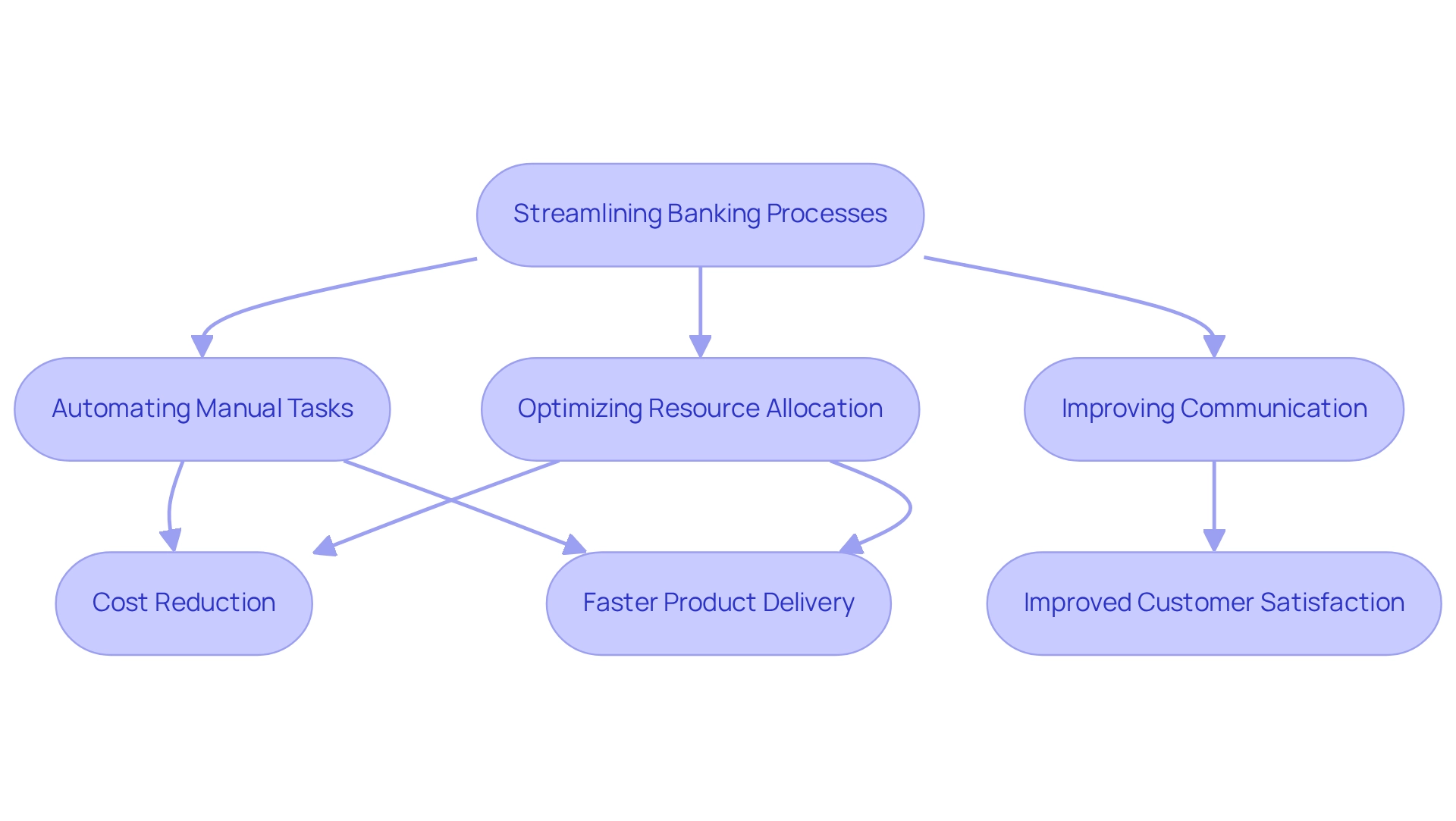

Operational Efficiency: Streamlining Banking Processes

Operational efficiency is not just a goal; it is a crucial driver of profitability in banking. We understand that by employing a hybrid connection platform, financial institutions can streamline their processes, reducing redundancies and enhancing workflow. This encompasses:

- Automating manual tasks

- Optimizing resource allocation

- Improving communication between departments

As we prepare for open banking, our platform facilitates a phased implementation strategy that minimizes risks while enhancing adaptability. Moreover, the integration of generative AI is pivotal, enabling us to create advanced chatbots and virtual assistants that elevate user experience and operational efficiency.

The outcome? A more agile organization that responds effectively to customer needs while minimizing operational costs. This ultimately leads to:

- Cost reduction

- Faster product delivery

- Improved customer satisfaction

What’s holding your team back from achieving these benefits? Let us partner with you to transform your operations and drive success.

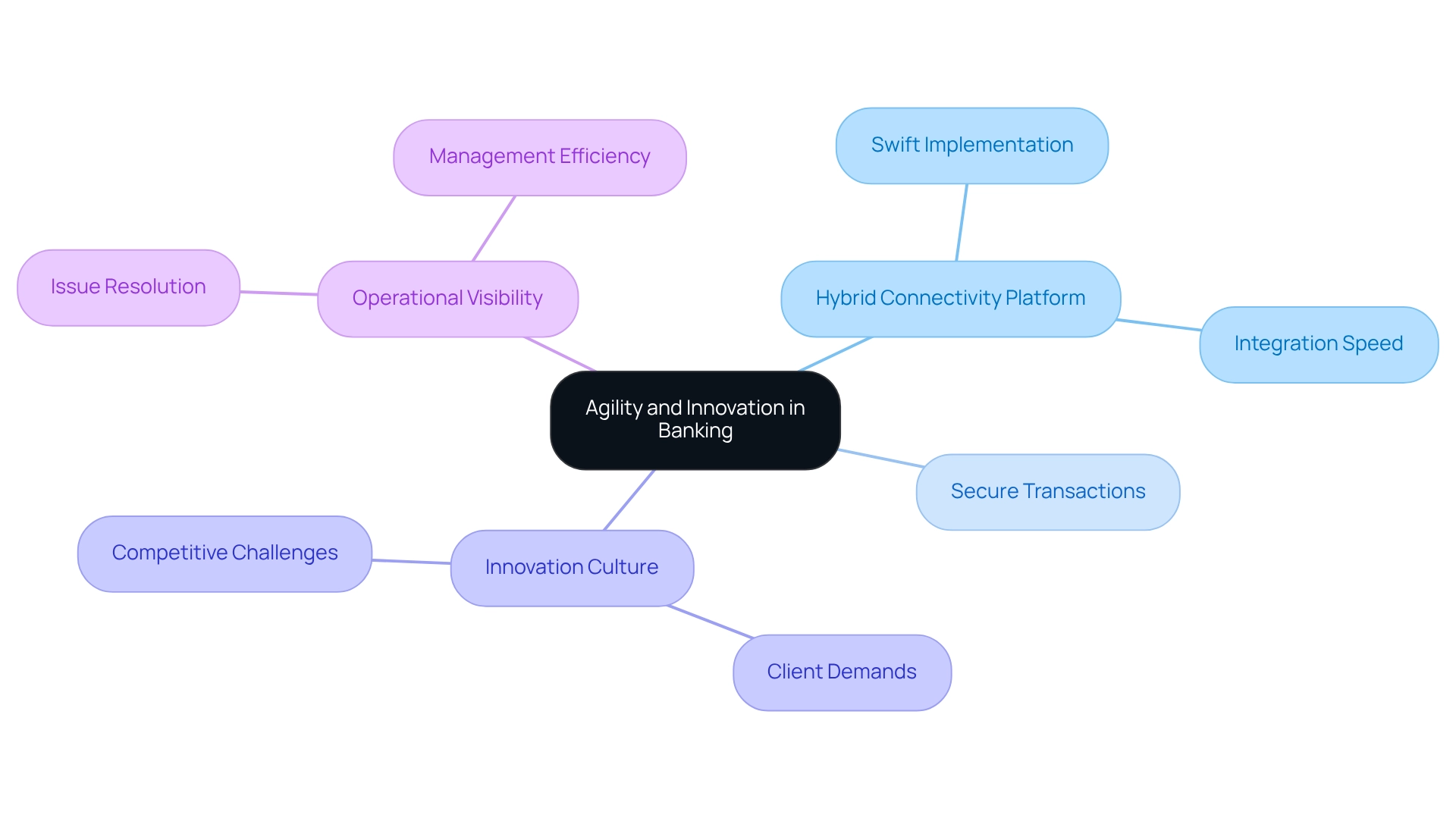

Agility and Innovation: Future-Proofing Banking Systems

To thrive in the future, we must foster a culture of agility and innovation within modern banking systems. Our hybrid connectivity platform enables swift implementation of new services and features, allowing us to test and adjust rapidly. Designed for secure transactions and relied upon by sectors such as banking, healthcare, and government, this solution accelerates the unification of isolated systems and fragmented data.

As Tony LeBlanc from the Provincial Health Services Authority notes, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.”

By cultivating an atmosphere that promotes innovation, we can remain at the forefront, adeptly addressing the evolving demands of our clients and responding efficiently to competitive challenges. With support for 12 levels of interface maturity, our platform ensures that financial institutions can balance the speed of integration with the sophistication needed to future-proof their technology stack.

Furthermore, we enhance operational visibility and issue resolution, empowering banks to manage their modern banking systems more effectively.

Get your copy now.

Conclusion

We stand at a pivotal juncture in the banking sector, where modernization, security, and compliance must coexist to meet the demands of today’s consumers and regulatory environments. Our hybrid integration platform emerges as a critical solution, enabling financial institutions to seamlessly connect disparate systems while ensuring robust security measures. By addressing the complexities of integration, we empower banks to enhance operational efficiency and respond effectively to market fluctuations, thereby reinforcing their competitive edge.

Real-time data access, artificial intelligence integration, and open banking readiness are not just buzzwords; they represent the foundation for fostering innovation and collaboration in banking. As institutions increasingly recognize the importance of personalized services and secure data sharing, the strategic implementation of our platform will enable them to meet evolving customer expectations while navigating stringent regulatory landscapes.

Moreover, as cybersecurity threats escalate, the need for advanced security measures becomes paramount. Our commitment to safeguarding sensitive information through cutting-edge technology ensures that banks can maintain customer trust while complying with regulatory standards. This dedication to security, coupled with operational agility, positions banks to thrive in an increasingly digital marketplace.

In conclusion, embracing our hybrid integration platform is not merely about keeping pace with change; it is about leading the charge towards a more innovative, secure, and customer-centric banking experience. As the industry evolves, those who prioritize integration and modernization will not only enhance their operational capabilities but also ensure long-term success in this dynamic environment. The time for transformation is now—what barriers will we dismantle to embrace this opportunity?