Overview

We recognize that enhancing the connected customer experience in banking is not just an option; it is imperative. The integration of secure practices, customer journey mapping, and personalized engagement through data analytics is crucial. By implementing these strategies, we can significantly improve operational efficiency, foster client loyalty, and create seamless interactions across various channels. As a result, we pave the way for a more cohesive and satisfying customer experience.

What challenges are you facing in achieving this level of integration? Let us partner with you to transform these challenges into opportunities for growth and success.

Introduction

In today’s landscape, where customer expectations have reached unprecedented heights, we in the banking sector confront a critical challenge: delivering seamless and personalized experiences. We recognize that this is not just a matter of service; it is an imperative for survival. This article delves into ten innovative strategies that we can adopt to cultivate a connected customer experience, underscoring the vital roles of integration, data analytics, and customer feedback. As we strive to navigate an increasingly competitive terrain, we must ask ourselves: what specific steps can we take to truly understand and meet the evolving needs of our clients?

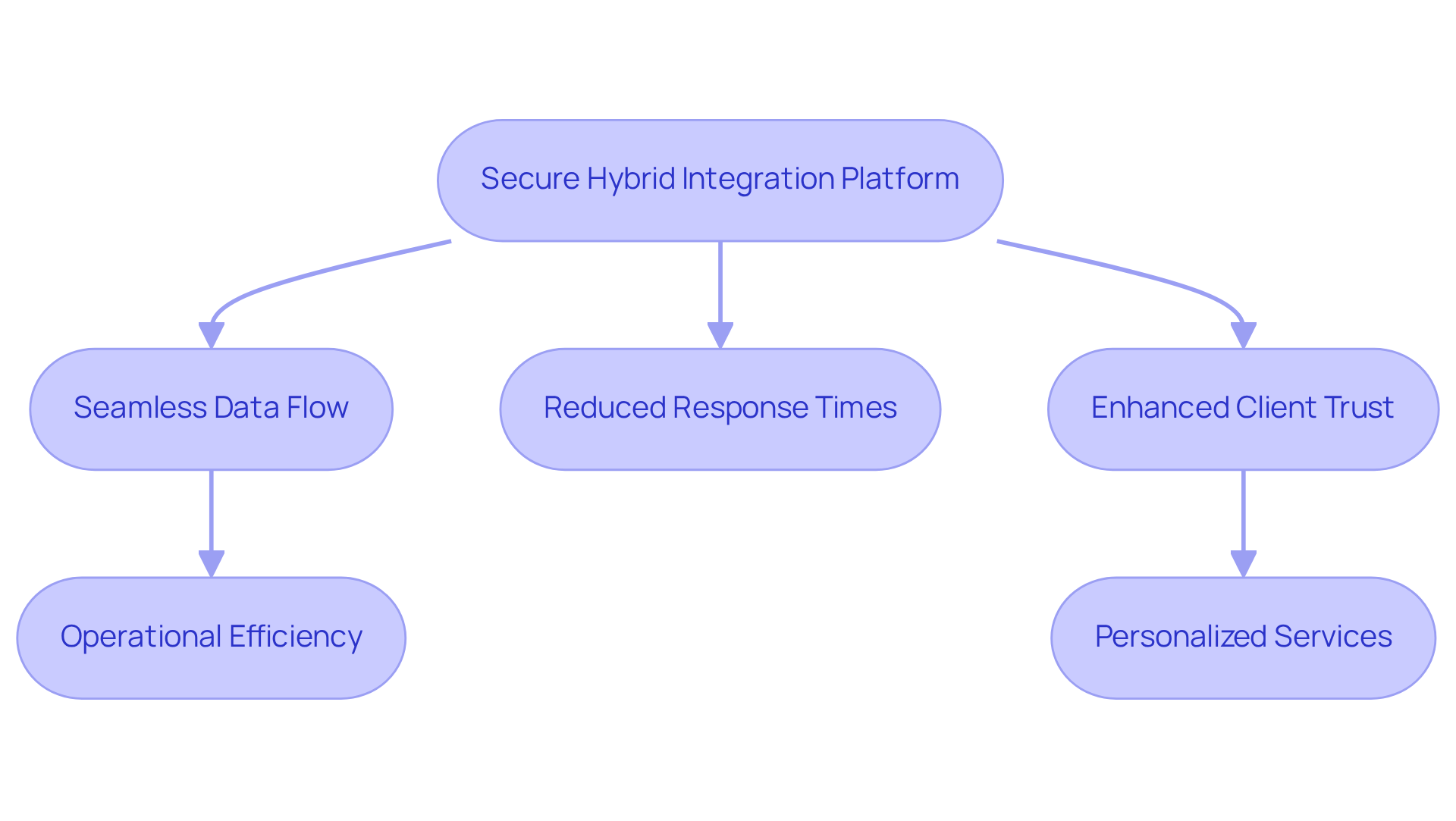

Avato: Secure Hybrid Integration Platform for Reliable Customer Connections

At Avato, we recognize that secure integration is not just an option; it’s a necessity for modern banking. Our hybrid integration platform is meticulously crafted to link diverse systems, ensuring seamless data flow across multiple channels. By effectively addressing the complexities posed by legacy systems, we empower banks to deliver reliable and consistent interactions with their clients. This integration enhances operational efficiency and fosters client trust, as customers experience fewer disruptions and receive more personalized services.

Furthermore, our solutions have demonstrated a significant reduction in response times to potential security threats, bolstering client confidence in the banking sector. As financial institutions navigate an increasingly intricate landscape, the ability to integrate securely and efficiently is paramount for maintaining a competitive edge and ensuring a connected customer experience.

We invite you to explore how our platform can transform your operations and elevate your client interactions.

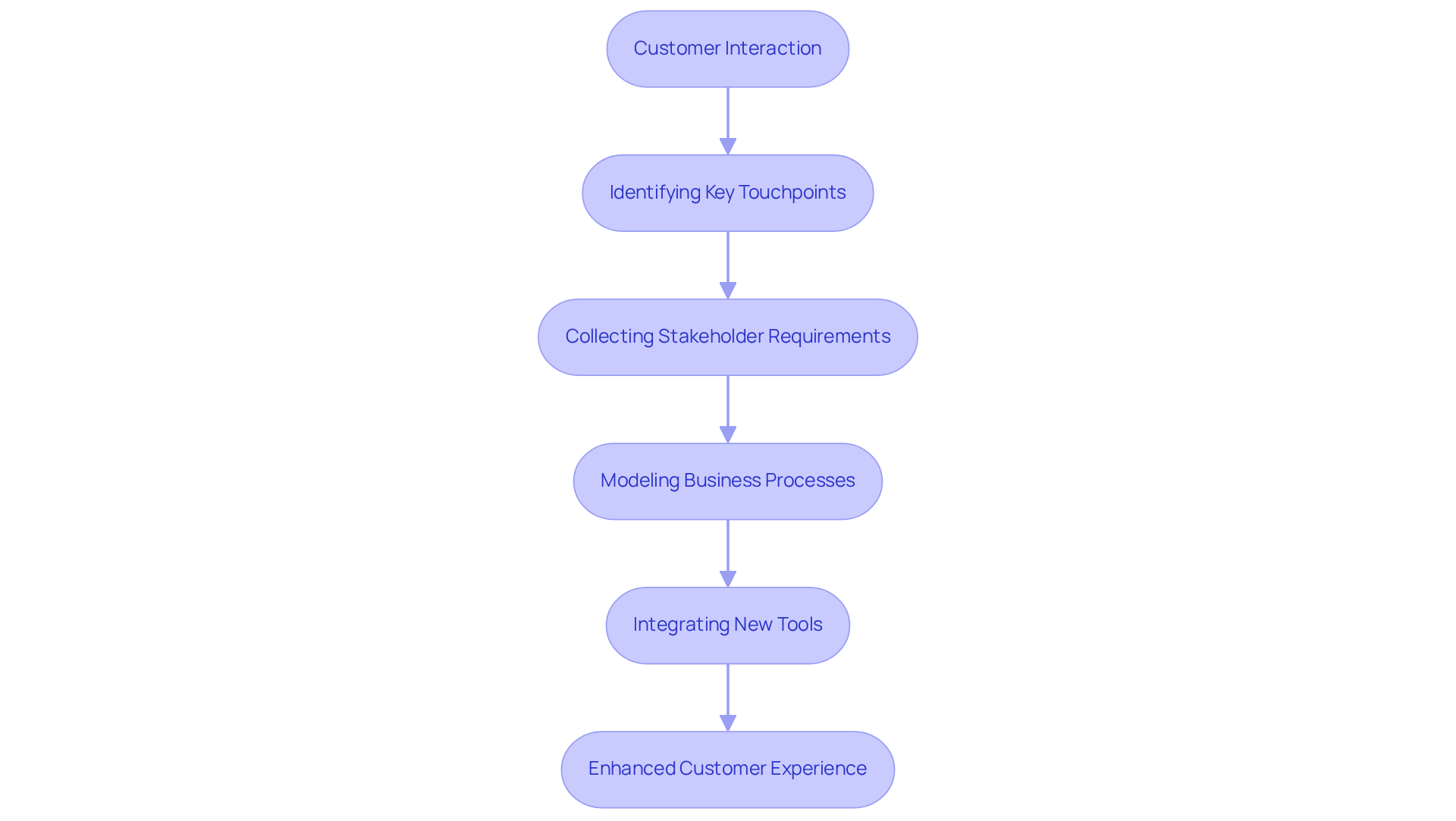

Implement Customer Journey Mapping to Enhance Experience Insights

Mapping the client journey is crucial for ensuring a connected customer experience; it involves visualizing the steps individuals take when interacting with banking services. This process not only aids in recognizing key instances that impact the connected customer experience but also highlights areas for improvement.

By leveraging our hybrid integration platform, we empower financial institutions to engage stakeholders effectively, collecting precise requirements and modeling their business processes. This guarantees that every touchpoint is optimized for client needs, resulting in a connected customer experience that enhances loyalty and retention.

As Tony LeBlanc from the Provincial Health Services Authority aptly noted, ‘Avato accelerates the integration of isolated systems, delivering the connected foundation we need.’

Furthermore, our emphasis on future-proofing systems enables financial institutions to incorporate new tools effortlessly, ensuring that user journey mapping evolves in tandem with technological progress.

What’s holding your team back from achieving this level of integration? Let us guide you in transforming your client interactions to foster a connected customer experience and drive lasting loyalty.

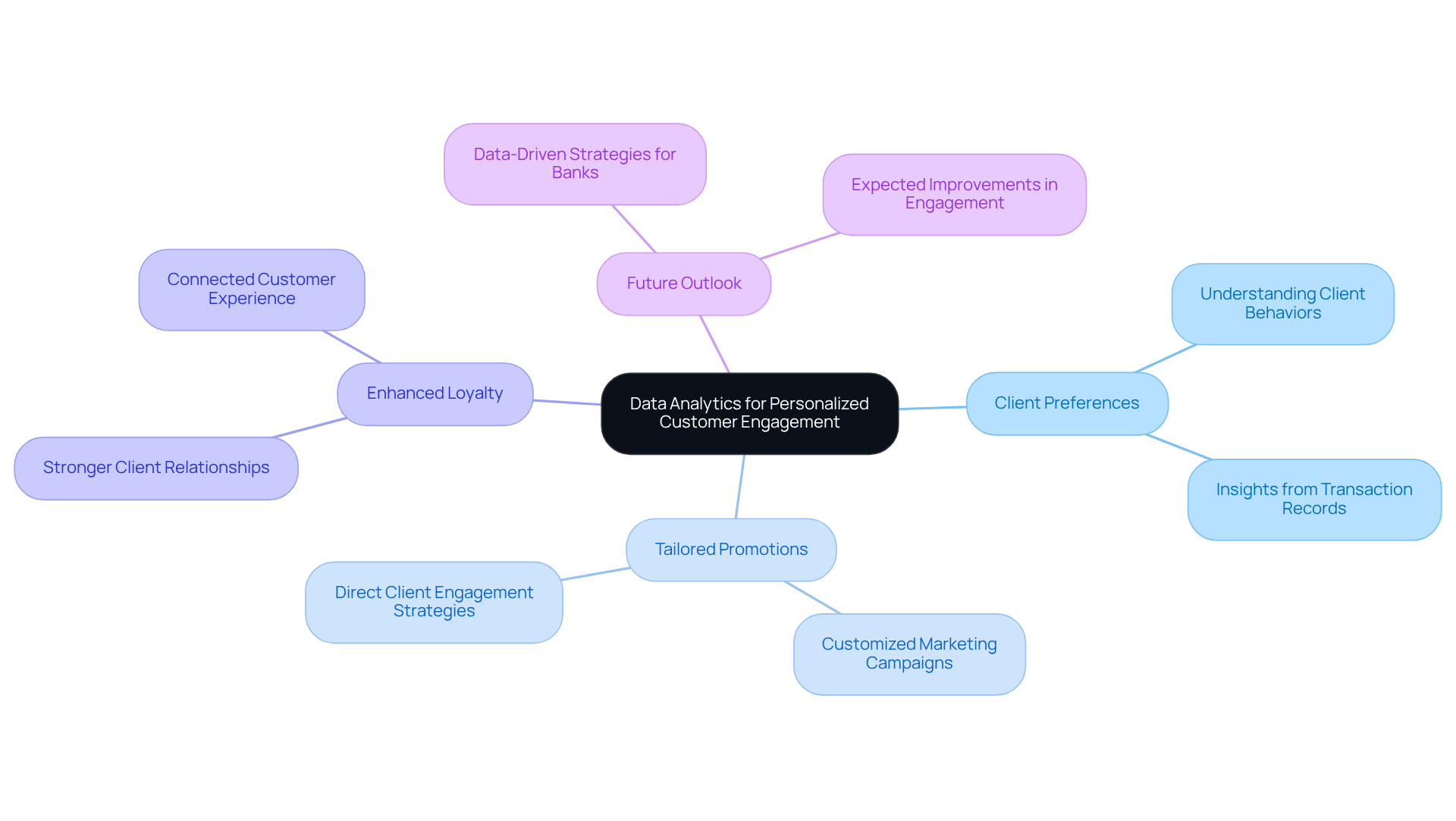

Utilize Data Analytics for Personalized Customer Engagement

Data analytics is a powerful tool that enables us to uncover vital insights into client preferences and behaviors. This capability aids us in crafting customized marketing campaigns and product offerings that resonate with our audience.

For example, by analyzing transaction records, we can implement tailored promotions that directly connect with specific clients, significantly boosting engagement and driving sales. This personalized approach not only fosters stronger client relationships but also creates a connected customer experience that enhances loyalty and retention.

As banking analysts emphasize, leveraging data analytics effectively can transform our interactions, enhancing the connected customer experience and making them more relevant and impactful.

Looking ahead to 2025, we believe that banks prioritizing data-driven strategies will likely witness substantial improvements in client insights and engagement outcomes, ultimately positioning themselves for greater success in an increasingly competitive landscape.

Adopt Omnichannel Communication for Seamless Customer Interactions

Implementing a comprehensive communication approach enables our clients to create a connected customer experience by transitioning seamlessly between channels—such as mobile apps, websites, and in-branch services—while retaining context. This cohesive experience significantly enhances client satisfaction and loyalty, creating a connected customer experience where individuals feel recognized and valued, regardless of their chosen method of engagement.

In 2025, we are increasingly acknowledging that effective omnichannel strategies not only simplify interactions but also contribute to a connected customer experience that fosters deeper emotional connections with our clients. By prioritizing seamless communication and ensuring robust security measures, we can address client needs more effectively, ultimately leading to improved retention and satisfaction rates.

Successful executions of these strategies demonstrate that when clients perceive their interactions as part of a connected customer experience, they are more inclined to remain loyal and advocate for our brand.

Avato’s hybrid integration platform is instrumental in this transformation, accelerating secure system integration across banking, healthcare, and government sectors. For instance, our clients have reported substantial enhancements in operational efficiency and client engagement after adopting Avato’s solutions.

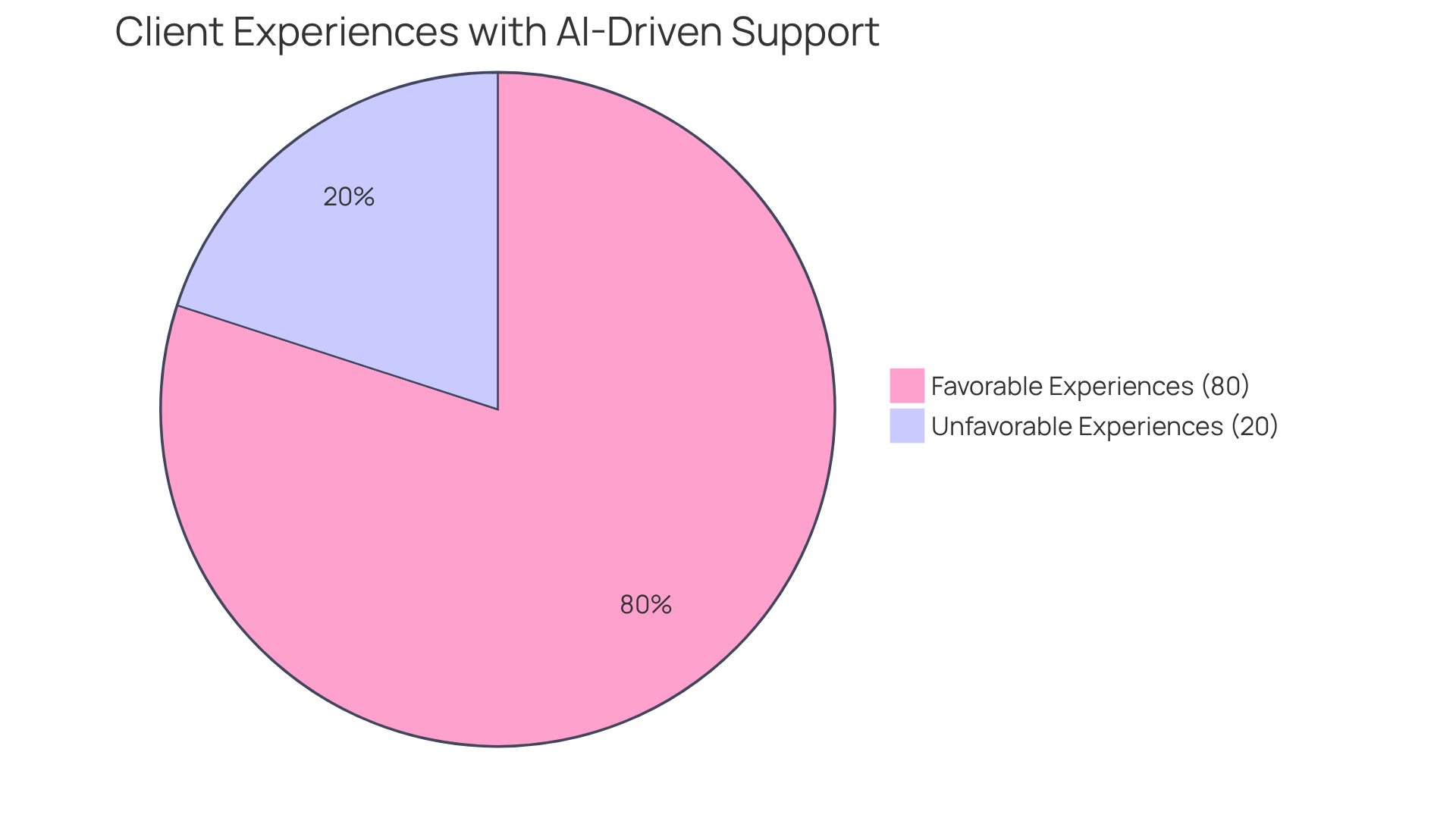

Leverage AI Solutions to Improve Customer Service Efficiency

Artificial Intelligence is revolutionizing service in banking, automating routine inquiries and empowering our human agents to tackle more complex issues. With chatbots and virtual assistants now providing 24/7 support, we ensure our users receive prompt assistance. This capability not only enhances operational efficiency but also significantly improves the connected customer experience by reducing wait times.

For instance, banks that have adopted AI-driven chatbots report a remarkable 37% decrease in first response times, facilitating faster interactions with clients. Furthermore, a study indicates that 80% of clients who engaged with AI-driven support reported favorable experiences, underscoring the effectiveness of these solutions.

As we approach 2025, we anticipate that the integration of AI in banking support will intensify, with projections suggesting that 95% of interactions will be managed by AI. This trend highlights AI’s essential role in enhancing service efficiency and delivering a connected customer experience.

Successful implementations, such as Bank of America’s virtual assistant Erica, which has handled over 50 million interactions, exemplify the potential of AI to streamline operations and enhance the connected customer experience in the financial sector.

What could AI do for your banking experience?

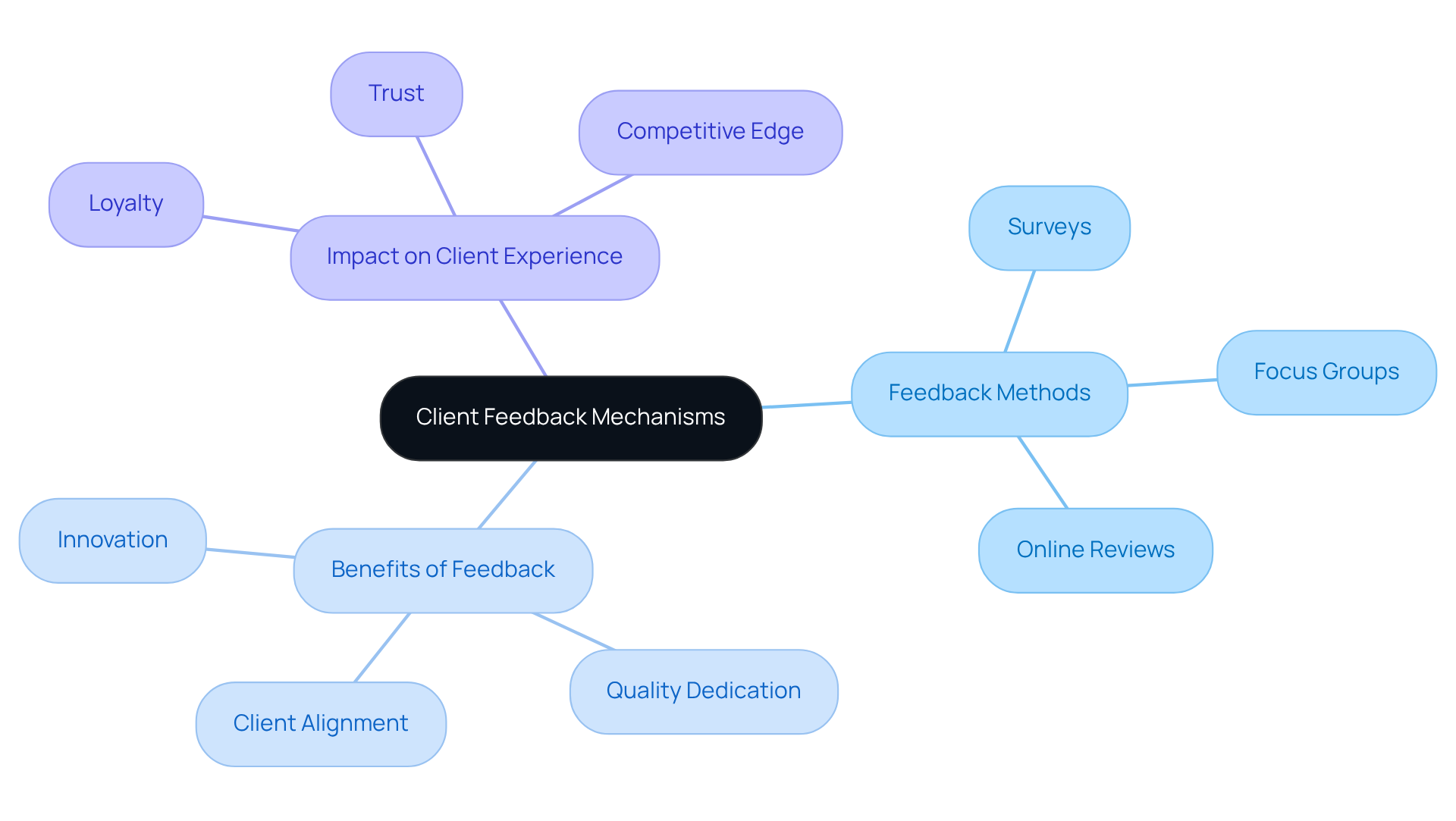

Establish Feedback Loops for Continuous Improvement

Establishing robust mechanisms for gathering client feedback—such as surveys, focus groups, and online reviews—enables us to capture essential insights into client perceptions. In 2025, we cannot overstate the importance of client feedback in our banking offerings, as it directly impacts improvement and client satisfaction.

For instance, organizations that actively engage with client feedback can innovate in a client-focused manner, demonstrating their dedication to quality and responsiveness. This approach not only assists us in aligning our services with client expectations but also contributes to a connected customer experience that cultivates loyalty and trust.

As Randi Zuckerberg points out, client feedback offers a competitive edge, which is essential in our industry where distinction is vital. Moreover, Oprah Winfrey highlights that interacting with feedback enhances the connected customer experience—an essential element for financial institutions striving to foster long-term loyalty.

By analyzing feedback effectively, we can make informed decisions that lead to continuous improvement, ensuring we remain relevant and competitive in a rapidly evolving financial landscape. Ultimately, client feedback is the cornerstone of enhancement, and with Google searches for ‘client experience’ tripling in the last decade, it is clear that comprehending and responding to client needs is more important than ever.

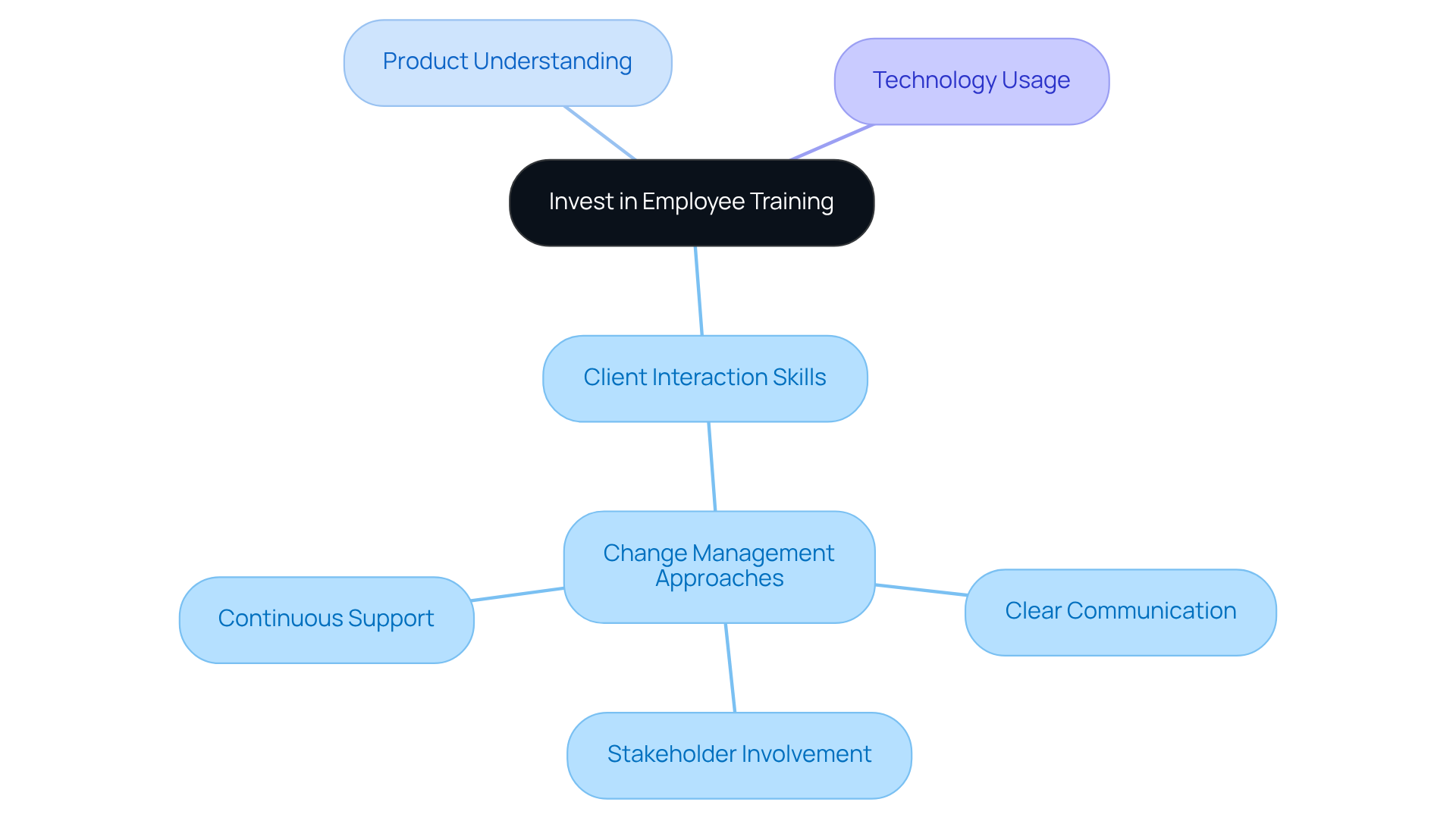

Invest in Employee Training for Superior Customer Experience

Investing in employee training programs that emphasize client interaction skills, product understanding, and technology usage is crucial for providing a connected customer experience. We recognize that comprehensive training ensures our staff are comfortable with Avato’s new hybrid integration platform, enabling them to leverage its capabilities effectively.

Furthermore, by executing specific change management approaches—such as:

- Clear communication

- Stakeholder involvement

- Continuous support

we can ease the transition to new technologies and foster a culture of innovation within our organization. Frequent training sessions will keep our staff informed about new technologies and approaches to client interaction, which will enhance the connected customer experience by allowing them to effectively address changing client requirements.

What’s holding your team back from achieving this level of excellence? Let’s prioritize training to empower our employees and enhance the connected customer experience.

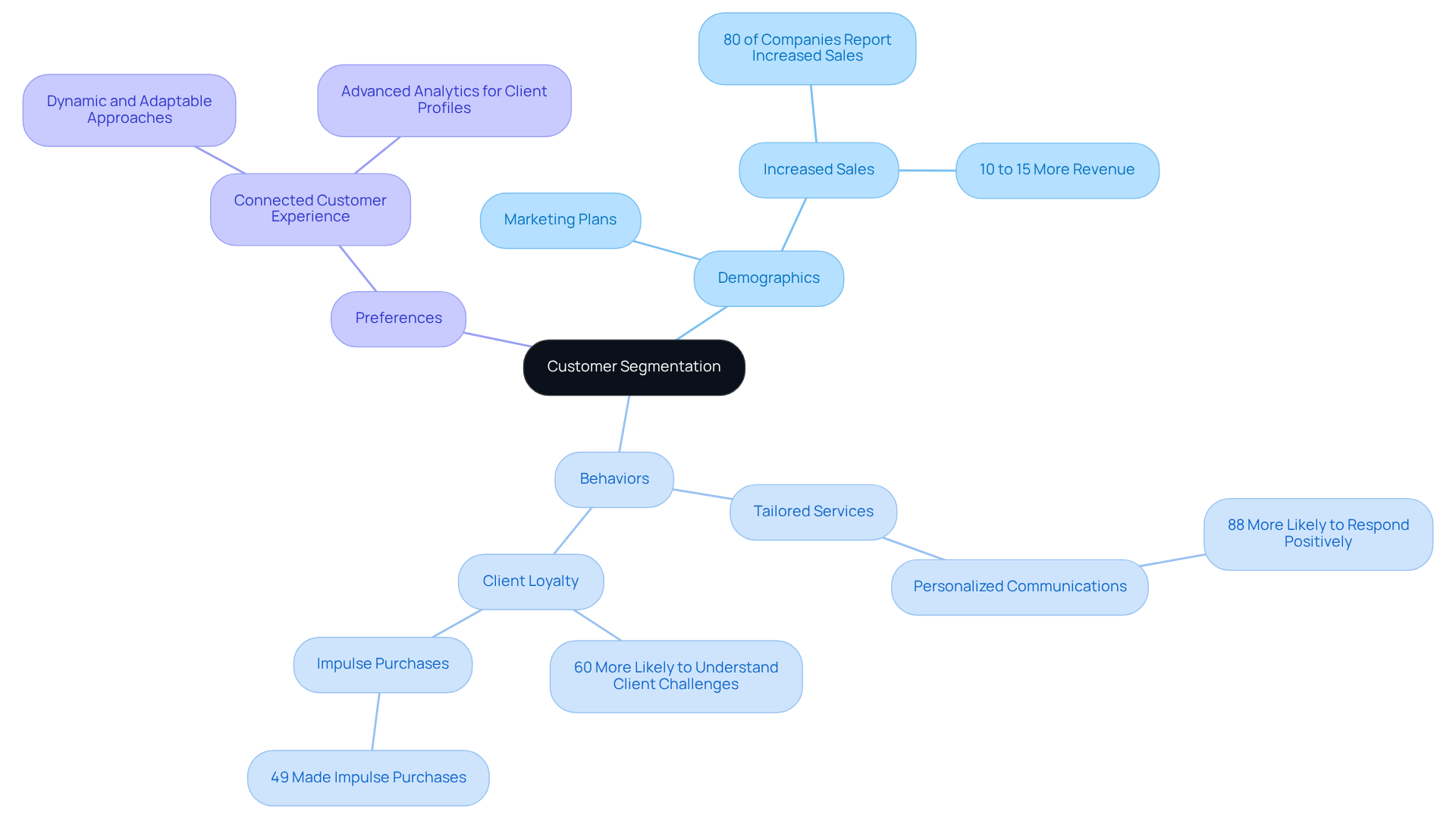

Implement Customer Segmentation for Tailored Experiences

Segmenting our clients by demographics, behaviors, and preferences empowers us to craft focused marketing plans and tailored service offerings. This customized approach not only ensures that our clients receive pertinent information but also significantly enhances their connected customer experience. In fact, 80% of companies leveraging market segmentation report increased sales, underscoring the effectiveness of this strategy in driving revenue growth.

Furthermore, customized experiences are essential for creating a connected customer experience, fostering loyalty among our clients, with research indicating that 88% of users are more likely to respond positively to personalized communications. By employing segmentation strategies, we can achieve a remarkable 760% increase in revenue from segmented campaigns, highlighting the financial benefits of understanding client needs.

As we move into 2025, the latest trends in client segmentation strategies emphasize the importance of dynamic and adaptable approaches. Successful financial institutions are utilizing advanced analytics to develop detailed client profiles, which allows us to provide a connected customer experience through customized offerings that align with individual preferences. This not only boosts client satisfaction but also allows us to better respond to the evolving needs of our patrons.

Numerous examples exist of financial institutions effectively using segmentation to enhance their services. Organizations that segment their audience are 60% more likely to understand client challenges and concerns, leading to improved value propositions. By focusing on tailored experiences, we can significantly enhance the connected customer experience, which in turn boosts client engagement and loyalty, ultimately driving long-term success in a competitive landscape.

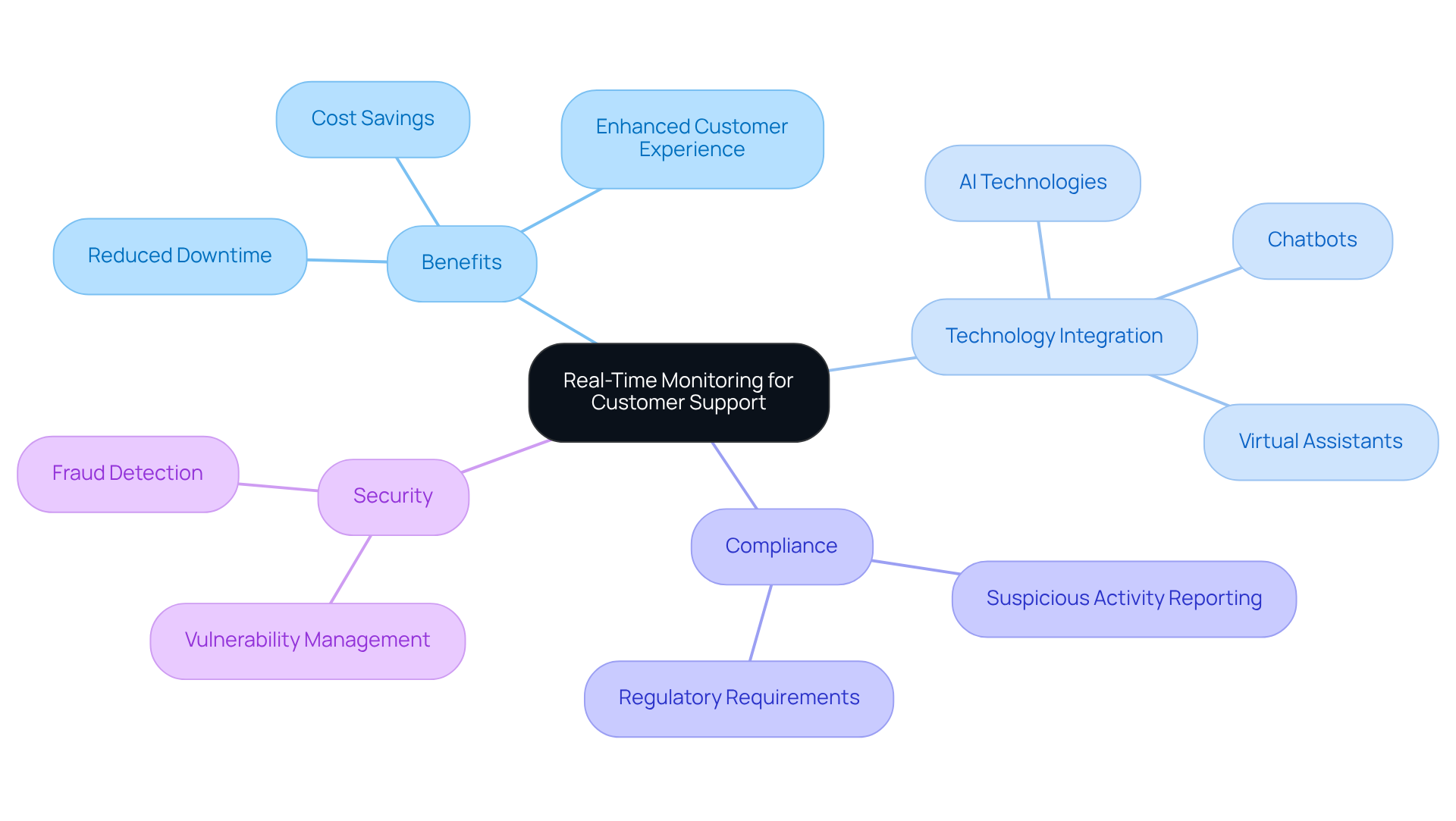

Incorporate Real-Time Monitoring for Proactive Customer Support

Real-time monitoring tools empower us to continuously track system performance and client interactions, enabling the identification of potential issues before they escalate. This proactive approach not only enhances the connected customer experience but also minimizes disruptions. For instance, we have observed that financial institutions employing these tools report a 30% decrease in downtime, leading to considerable cost savings and improved service delivery. Furthermore, the detailed analytics provided by these monitoring systems offer valuable insights into client behavior and transaction trends, enabling us to enhance the connected customer experience through effective service customization.

As the global transaction monitoring market is projected to reach US$ 17.59 billion in 2024, the emphasis on real-time monitoring is becoming increasingly vital for ensuring compliance with stringent regulations, particularly as open banking initiatives gain traction. Financial institutions are legally required to implement robust mechanisms to identify and report suspicious activities, making integration a critical component of our strategy.

By leveraging these technologies, including generative AI for enhanced operational efficiency and engagement through chatbots and virtual assistants, we can foster a connected customer experience that improves client satisfaction through timely and efficient support while addressing the growing demand for specialists in AI and machine learning to manage these advanced systems. Additionally, it is crucial for us to prioritize security in our integration processes to safeguard against potential vulnerabilities.

What steps are you taking to ensure your systems are equipped for the future?

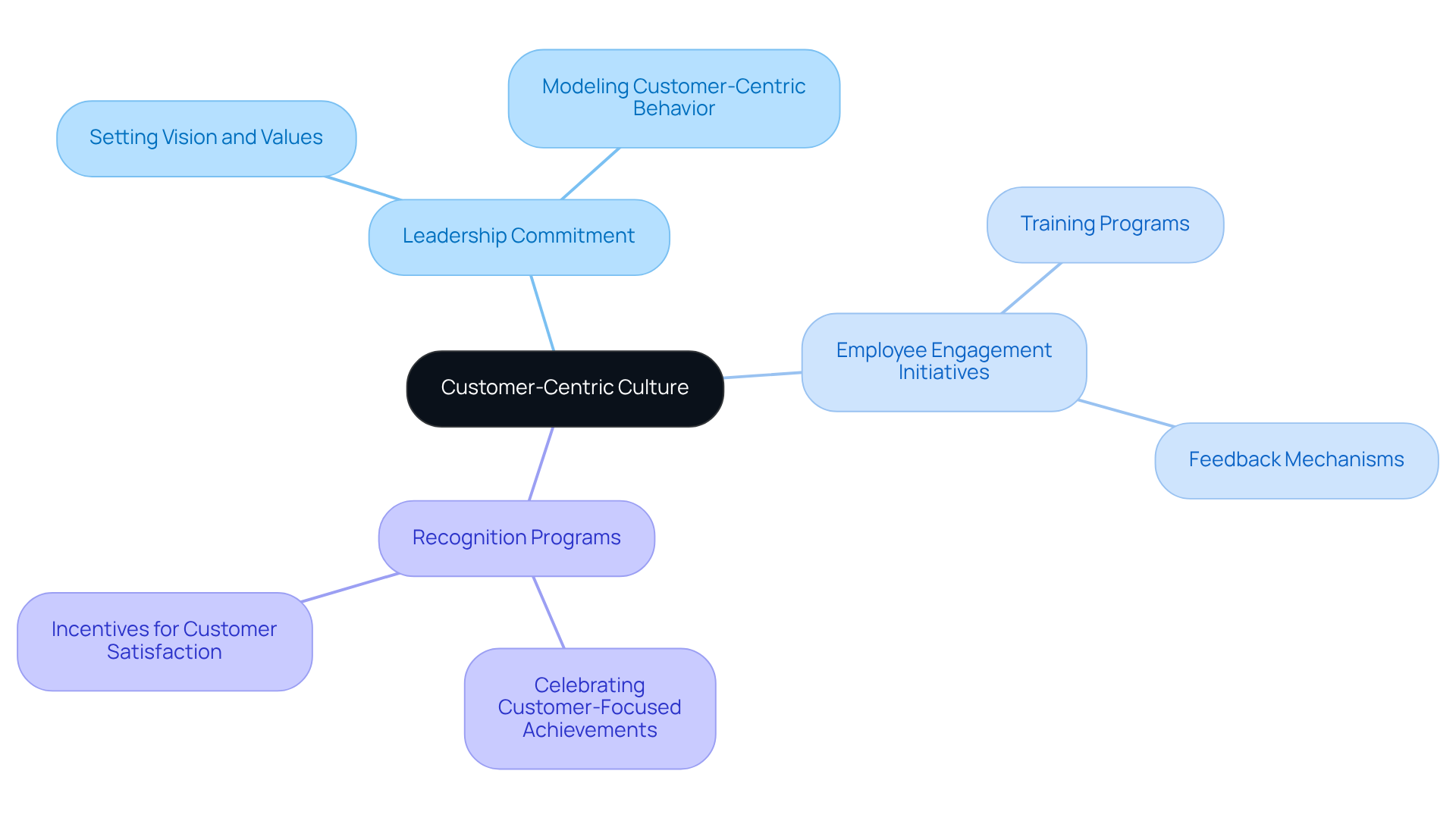

Cultivate a Customer-Centric Culture for Lasting Impact

Fostering a customer-centric culture is essential for ensuring a connected customer experience that prioritizes customer satisfaction at every level of our organization. We recognize that this can be achieved through our:

- Leadership commitment

- Employee engagement initiatives

- Recognition programs that celebrate customer-focused achievements

A strong customer-centric culture not only leads to lasting relationships but also enhances our connected customer experience and brand reputation. What’s holding your team back from embracing this vital approach? By instilling these values, we can transform our interactions and drive success together.

Conclusion

In the pursuit of a connected customer experience within the banking sector, we recognize that delivering personalized and seamless interactions is not merely optional; it is a fundamental requirement. Our strategies emphasize the importance of integrating advanced technologies, leveraging data analytics, and fostering a customer-centric culture to meet and exceed client expectations.

What insights have emerged from our discussion? Implementing customer journey mapping, adopting omnichannel communication, and utilizing AI solutions can significantly enhance client engagement and satisfaction. Furthermore, establishing feedback loops and investing in employee training are crucial for continuous improvement, ensuring our staff are equipped to provide exceptional service. Each of these strategies contributes to a holistic approach that not only addresses current challenges but also prepares financial institutions for future demands.

Ultimately, the future of banking hinges on our ability to cultivate a connected customer experience. By prioritizing integration, personalization, and proactive support, we can foster deeper relationships with our clients, driving loyalty and long-term success. Embracing these strategies is not just about keeping pace with industry trends; it is about positioning ourselves as leaders in a rapidly evolving landscape where customer satisfaction is paramount.