Overview

We recognize that in today’s fast-paced banking environment, operational efficiency is not just a goal—it’s a necessity. To navigate the complexities of modern banking infrastructures, we must prioritize essential system integration technologies. Hybrid integration platforms, middleware, APIs, and EDI are not merely options; they are critical tools that streamline processes, enhance data accuracy, and facilitate seamless communication.

What’s holding your team back from achieving optimal performance? By embracing these technologies, we can transform our operations, ensuring compliance while driving innovation. For instance, hybrid integration platforms enable us to connect disparate systems effortlessly, leading to significant improvements in workflow and data management.

As a result, we stand to gain not only efficiency but also a competitive edge in the market. The integration of these technologies can lead to measurable outcomes, such as reduced operational costs and improved customer satisfaction. It’s time to take action—let’s prioritize these solutions and position ourselves for success in the ever-evolving banking landscape.

Introduction

In the rapidly evolving landscape of banking technology, we recognize that the integration of disparate systems presents a critical challenge for financial institutions. As we strive to enhance operational efficiency and ensure regulatory compliance, hybrid integration platforms like Avato emerge as essential allies.

These platforms not only facilitate seamless connectivity between legacy systems and modern applications but also empower us to adapt swiftly to market dynamics. With features designed to maximize data accessibility and minimize downtime, Avato positions itself as an indispensable resource for IT managers navigating the complexities of today’s financial environment.

As the demand for secure and efficient integration solutions grows, understanding the transformative potential of such platforms is vital for banking institutions like ours that aim to maintain a competitive edge.

What’s holding your team back from embracing this change?

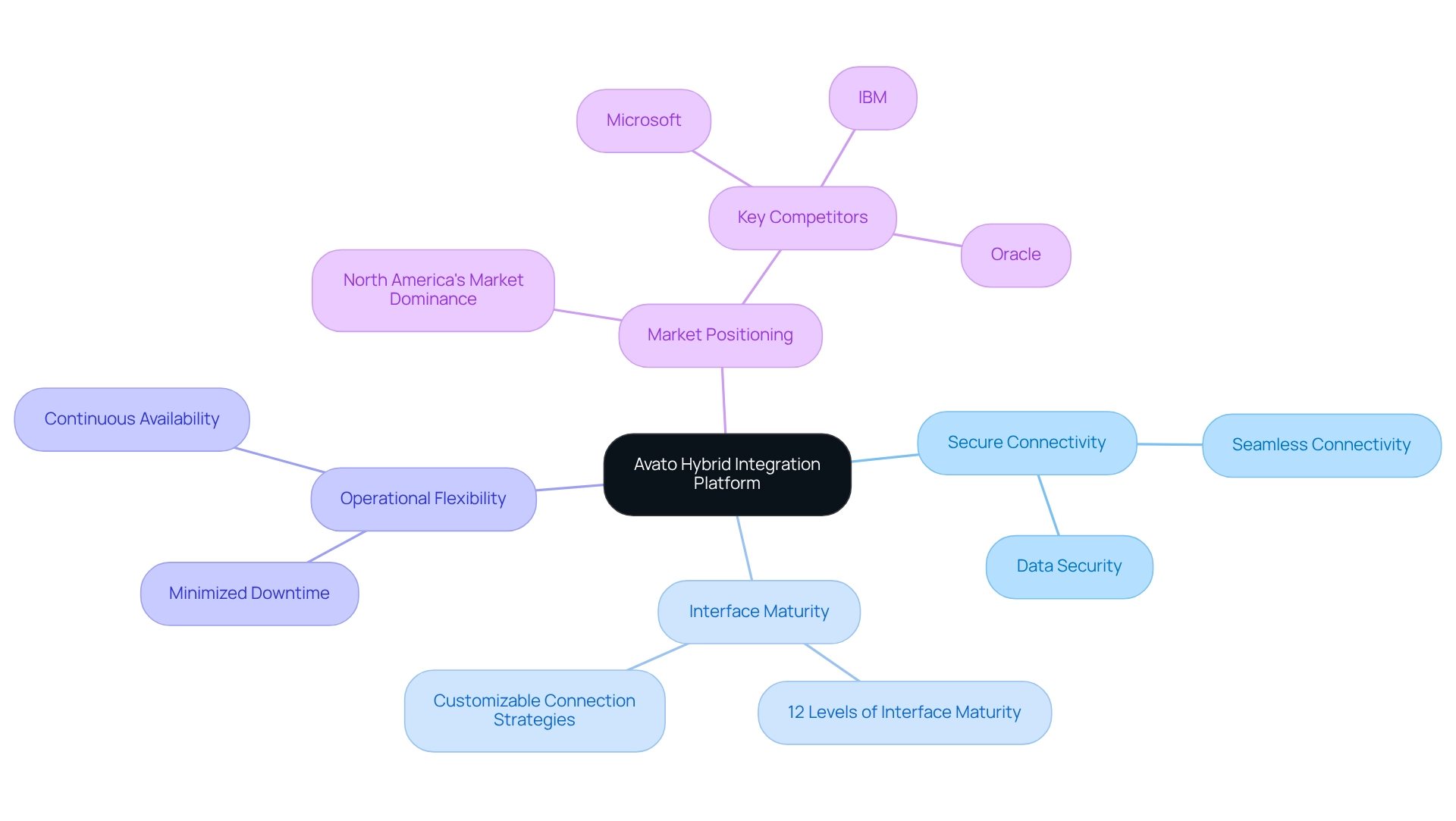

Avato: Secure Hybrid Integration Platform for Complex Systems

We present our platform as a leading secure hybrid solution, expertly designed to address the complex challenges faced by modern banking infrastructures. By facilitating seamless connectivity among disparate systems using system integration technologies, we ensure that data flows efficiently and securely—an essential requirement in a sector where compliance and security reign supreme. Our robust framework supports 12 levels of interface maturity, allowing organizations to customize their connection strategies to align with specific operational needs. This flexibility is critical for financial institutions navigating stringent regulatory environments while striving for enhanced operational efficiency.

Our unwavering commitment to minimizing downtime and guaranteeing continuous availability for critical connections positions us as an indispensable asset for IT managers in the banking sector. Our hybrid platform leverages system integration technologies to not only streamline intricate connections but also enhance the value of legacy systems, enabling organizations to access data and systems in weeks rather than months. As the demand for secure and efficient connection solutions escalates, we distinguish ourselves by providing a reliable foundation that utilizes system integration technologies to not only meet current demands but also anticipate future challenges. With the hybrid connectivity market poised for significant growth—particularly in North America due to extensive cloud service adoption—our capabilities ensure that financial institutions can maintain a competitive edge while adeptly managing their complex connectivity requirements.

As Amarildo, Manager of Global Strategic Alignment at MasterCard, noted, “We believe the work done by Data Bridge Team for our requirements in the North America Loyalty Management Market was fantastic and would love to continue working with your team moving forward.” This statement underscores the importance of seamless connectivity in financial IT. Moreover, with key players in the hybrid integration platform market such as Microsoft, IBM, and Oracle, our innovative approach positions us favorably against competitors, solidifying our status as a leader in the industry.

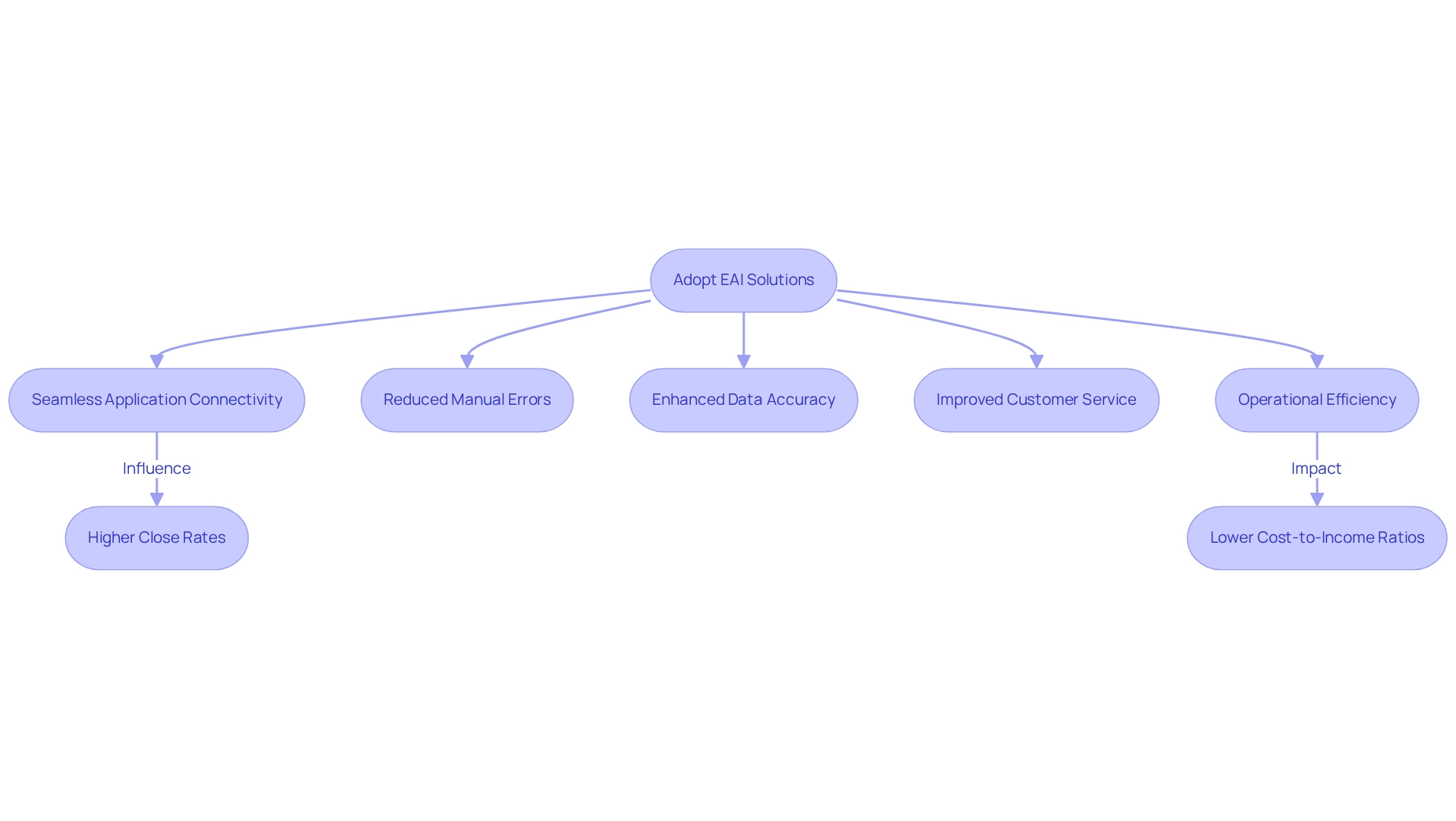

Enterprise Application Integration (EAI): Streamlining Application Connectivity

As banking IT managers, we find that system integration technologies, including Enterprise Application Integration (EAI), are vital for connecting disparate applications and enabling seamless collaboration. Our EAI solutions leverage system integration technologies to automate the exchange of information between systems, significantly reducing manual errors and enhancing data accuracy. In fact, 59% of organizations indicate that effective connections enhance their close rates, highlighting the influence of EAI on operational efficiency.

By adopting EAI and implementing system integration technologies, we can streamline operations, elevate customer service, and respond swiftly to market dynamics. This unification approach, leveraging system integration technologies, not only enhances productivity but also guarantees adherence to regulatory standards, establishing it as a cornerstone of our banking IT strategy. Furthermore, banks that implement collaborative data strategies have seen their cost-to-income ratios decrease by an average of 6.3 percentage points over three years, illustrating the financial benefits of EAI.

The hybrid unification platform is crucial in this transformation, especially in the financial services industry. By harnessing generative AI, we enhance customer experience through sophisticated chatbots and virtual assistants, while also improving operational efficiency with automated document processing and report generation. This dual focus on customer engagement and backend efficiency positions us to thrive in a competitive landscape.

As emphasized in a recent partnership announcement, “New Google Workspace interfaces with SAP’s flagship cloud ERP, SAP S/4HANA Cloud, enabling smooth connection between core business systems and collaborative tools,” the significance of smooth connectivity cannot be overstated for IT managers in finance.

Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, are recognizing the importance of system integration technologies, which are driven by digital transformation and cloud adoption. The case study titled “Emerging Markets for Enterprise Application Integration” indicates that sectors such as healthcare, manufacturing, and financial services are witnessing significant growth opportunities as businesses prioritize integration to enhance operational capabilities.

As we look to improve data accuracy, EAI solutions offer a reliable pathway. Successful implementations in financial services demonstrate that system integration technologies effectively integrate legacy systems with modern applications, enhancing data integrity and positioning us to adapt to evolving demands in a competitive landscape. Our knowledge in hybrid connectivity guarantees that financial institutions can reach these objectives with efficiency and dependability.

Tony LeBlanc from the Provincial Health Services Authority states, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This testimonial underscores our commitment to delivering effective integration solutions.

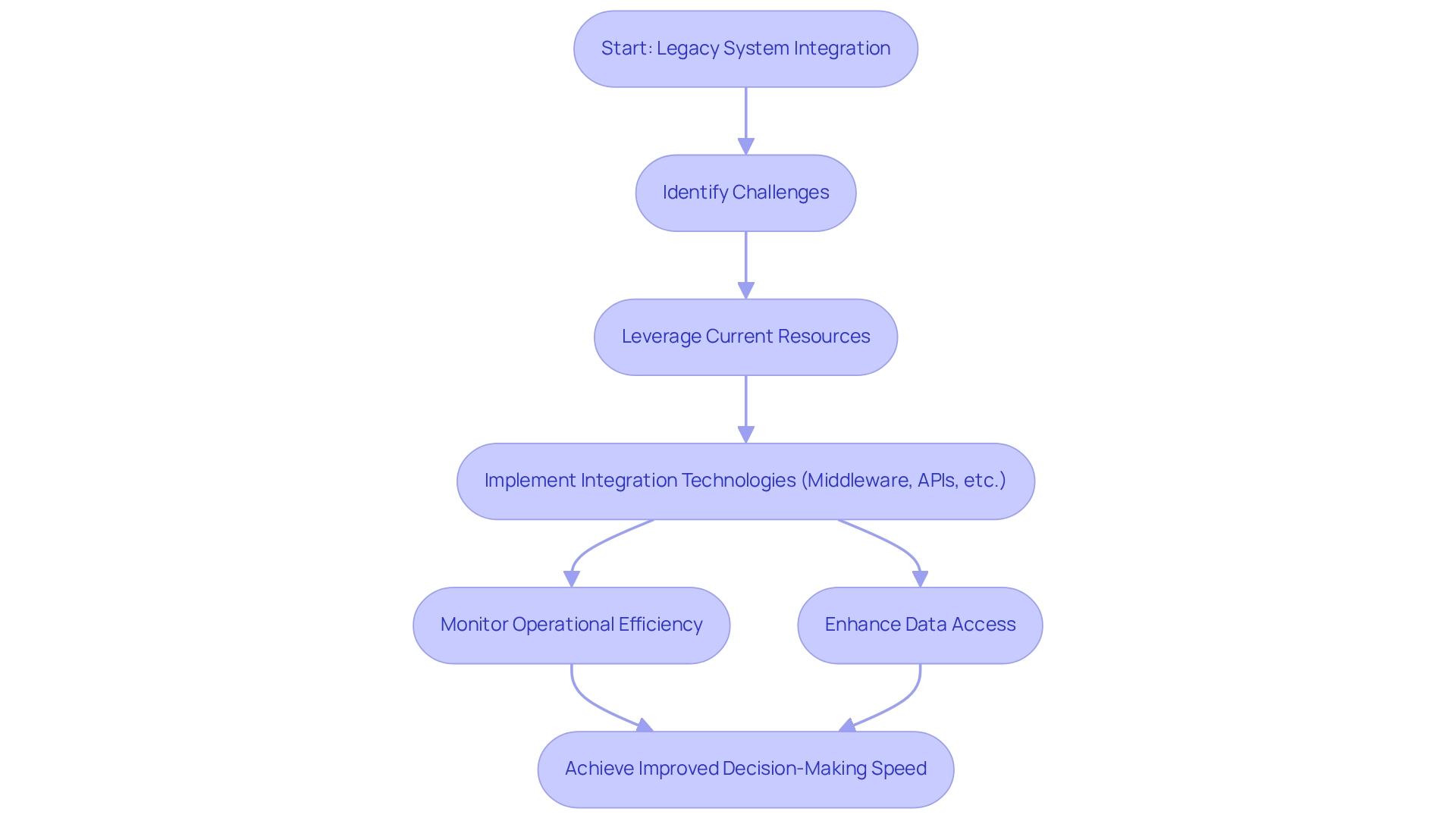

Legacy System Integration: Bridging the Gap Between Old and New Technologies

Combining legacy platforms with modern technologies presents a formidable challenge for banking IT managers. These frameworks often rely on outdated architectures, significantly hindering innovation and operational efficiency. To effectively integrate legacy platforms, we must leverage current resources and implement system integration technologies such as middleware, APIs, and advanced connection tools that facilitate communication between older systems and newer applications. This strategy not only safeguards existing investments but also modernizes our technology stack, ultimately enhancing service delivery and operational agility.

In 2025, a considerable number of banks continue to grapple with legacy technology unification issues, underscoring the urgency to address these challenges. The unification process is critical, as outdated frameworks can obstruct decision-making, impacting our organization’s responsiveness to market changes. A case study titled ‘Decision-Making Speed Affected by Legacy Software’ highlights how these antiquated technologies impede timely responses, emphasizing the necessity for improved data access and investment in modern analytics tools. By enhancing data access and investing in these analytics tools, we can boost decision-making speed and accuracy, thus securing a competitive advantage.

Successful legacy system unification projects in financial institutions illustrate the effectiveness of strategic approaches. For instance, banks that have adopted hybrid connection platforms, such as those provided by a certain vendor, report significant improvements in operational capabilities and reduced costs. Avato ensures round-the-clock availability for essential connections, highlighting the importance of reliability in these processes. IT leaders stress the necessity of bridging old and new technologies, acknowledging that the journey to modernize legacy systems with system integration technologies is not only challenging but also vital for long-term success in the rapidly evolving financial landscape. As we move towards AI adoption, overcoming these integration hurdles will be crucial for harnessing the full potential of emerging technologies.

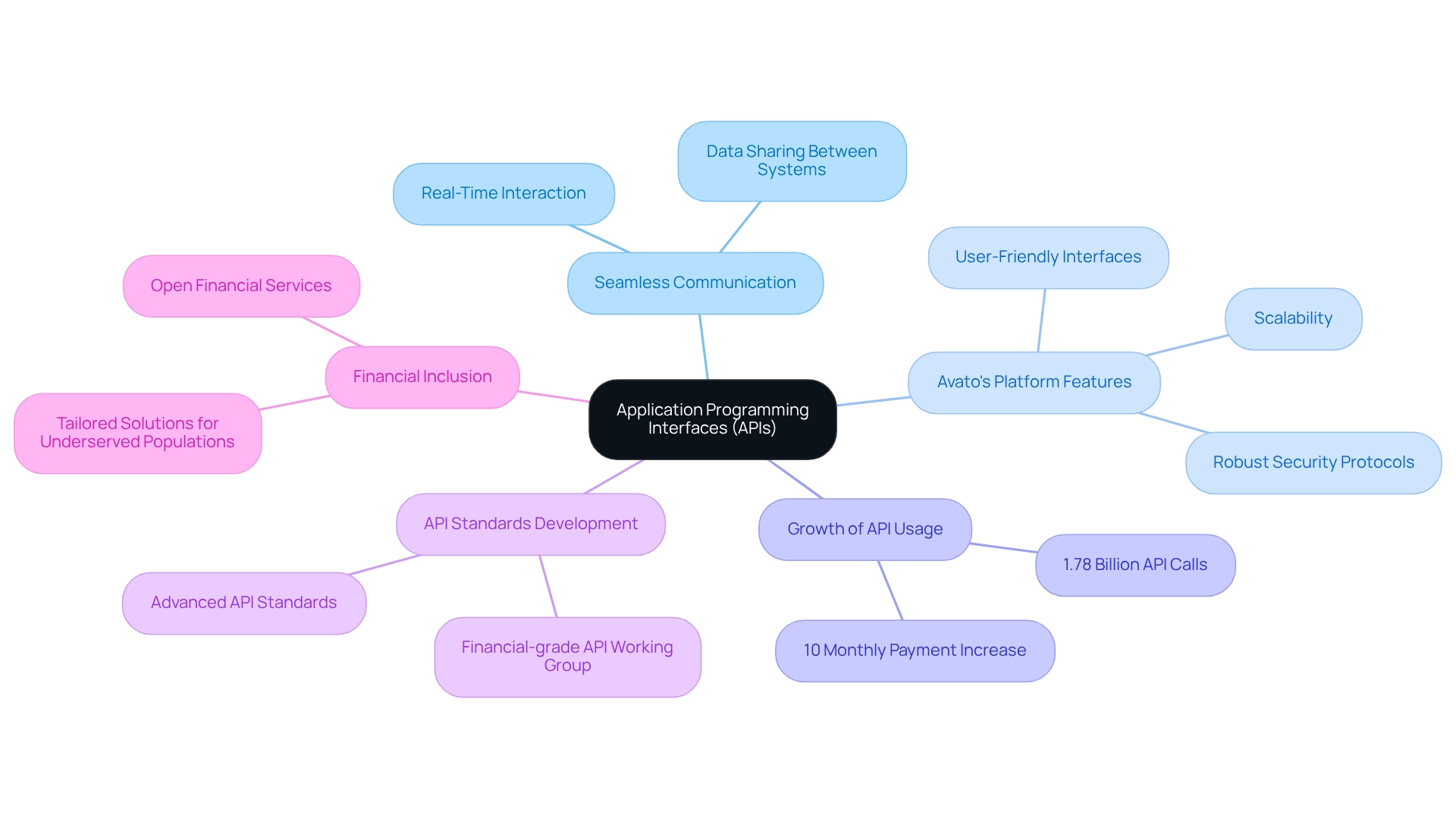

Application Programming Interfaces (APIs): Enabling Seamless Communication

Application Programming Interfaces (APIs) are not just tools; they are the backbone of seamless communication among diverse banking applications. We enable real-time interaction and data sharing between systems through system integration technologies, which is crucial for delivering a unified customer experience. Our hybrid platform enhances this process by streamlining the connection of third-party services—such as payment gateways and customer relationship management tools—significantly boosting our service offerings. Key features of Avato’s platform include robust security protocols, scalability, and user-friendly interfaces that empower financial institutions to innovate swiftly, adapt to customer demands, and sustain a competitive advantage in the marketplace.

The importance of APIs is underscored by the rapid growth in their usage; for instance, the number of successful API calls made by third-party providers (TPPs) in the UK reached an impressive 1.78 billion. This surge reflects our increasing reliance on APIs to streamline operations and improve customer interactions. Furthermore, industry leaders emphasize that APIs are pivotal in enhancing customer experience in finance, as they allow for personalized services and faster transaction processing.

Recent developments, such as the Financial-grade API Working Group’s efforts to establish advanced API standards for open financial services, highlight the ongoing evolution of API integration in the financial sector. These standards are essential for ensuring security and interoperability, allowing financial institutions to leverage APIs effectively. Additionally, open financial services are playing a crucial role in promoting financial inclusion, as illustrated by the case study titled ‘Financial Inclusion through Open Financial Services.’ This initiative enables fintech companies to leverage APIs to create tailored solutions for underserved populations, broadening access to financial services and fostering innovation within the industry.

As we progress into 2025, the role of APIs in financial application unification will keep growing, providing various advantages such as increased operational efficiency, better customer experiences, and the capacity to react to market shifts quickly. Avato’s hybrid connection platform, driven by our deep dedication to system integration technologies, is at the forefront of this evolution, ensuring that banks can effectively harness the power of APIs. The ongoing expansion of open finance, with payments rising by 10% month-on-month, further demonstrates the essential role of APIs in contemporary financial strategies.

Middleware: The Backbone of System Integration

Middleware is essential for efficient network connectivity, serving as a vital link between various applications and databases. It facilitates seamless data exchange and communication across platforms, ensuring that information flows smoothly throughout our organization. In the financial sector, middleware solutions are particularly valuable for connecting legacy platforms with contemporary applications, providing the adaptability and scalability required in today’s dynamic economic environment. By leveraging middleware, we can significantly enhance operational efficiency, reduce connection costs, and improve overall performance.

Our hybrid connectivity platform exemplifies how middleware can accelerate secure system integration, especially in sectors such as banking, healthcare, and government. With a focus on delivering a connected foundation, we enable banks to simplify, standardize, and modernize their operations. As Tony LeBlanc from the Provincial Health Services Authority remarked, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This testimonial highlights our unwavering commitment to excellence in integration solutions.

Successful middleware implementations have demonstrated substantial benefits in financial institutions. For instance, banks that effectively integrate regulatory compliance through middleware experience 27% fewer regulatory findings, underscoring its importance in maintaining compliance and operational integrity. Middleware not only streamlines processes but also enhances system reliability, as evidenced by case studies showcasing its transformative role in financial transaction systems. The case study titled “The Role of Middleware in Financial Transaction Systems” illustrates how middleware technologies, such as IBM MQ, have revolutionized transaction processing, improved security, and fostered financial inclusion by integrating AI and machine learning for enhanced operational efficiency.

As financial futurist Brett King observes, the institutions that will thrive in the next decade will perform core financial functions with unparalleled efficiency—an objective that middleware can help us achieve. This is further supported by Pavel Abdur-Rahman’s assertion that while true AI requires quantum computing, ‘Augmented Intelligence’—which middleware can facilitate—transforms industries today. Our hybrid connectivity platform, designed for projects requiring continuous operation with no tolerance for flaws, mistakes, or disruptions, ensures that institutions can adapt to changing requirements. IT experts consistently emphasize the significance of middleware in achieving operational efficiency, establishing it as a fundamental component of system integration technologies in modern banking. We encourage banking IT managers to consider specific middleware solutions and strategies, such as our hybrid system, that leverage system integration technologies to enhance operational capabilities and maintain a competitive edge.

Integration Platform as a Service (iPaaS): Cloud Solutions for Modern Integration

Integration Platform as a Service (iPaaS) provides a powerful cloud-based solution that leverages system integration technologies for organizations like ours, seeking to optimize the integration of systems. As pioneers in hybrid connectivity solutions, we equip organizations with essential tools and services to seamlessly connect applications, data, and workflows across diverse environments. For banking IT managers, adopting the iPaaS solution can significantly simplify connection projects, reducing both complexity and costs.

With features such as pre-built connectors and automated workflows, our iPaaS empowers banks to accelerate their digital transformation initiatives while upholding rigorous compliance and security standards. In 2023, organizations allocated approximately USD 2.3 trillion to digital transformation efforts, underscoring the increasing demand for efficient unification solutions. This trend is particularly evident in North America, which currently leads the iPaaS industry due to substantial investments and the presence of key players, fostering heightened competition and innovation in system integration technologies.

Successful implementations of iPaaS in financial services have demonstrated its capacity to enhance operational efficiency and agility through effective system integration technologies. For instance, our client Gustavo Estrada remarked, ‘the company has streamlined complicated projects and provided outcomes within expected timelines and financial limits.’ As banking IT managers navigate the complexities of modern connectivity, leveraging iPaaS not only streamlines workflows but also enables organizations to swiftly adapt to evolving market demands. The strategic utilization of our iPaaS solutions is vital for maintaining a competitive edge in the rapidly changing financial landscape.

Business-to-Business (B2B) Integration: Enhancing External Collaboration

Business-to-Business (B2B) connection is not just important; it is essential for banks that aim to foster collaboration with external partners, including vendors and financial institutions. By streamlining data exchange and communication, effective B2B collaboration significantly enhances operational efficiency and reduces transaction costs. For instance, banks that adopt B2B unification solutions can automate processes such as invoicing and order management, resulting in quicker transaction times and increased customer satisfaction. This capability is becoming increasingly crucial, as 67% of companies allocate resources to enhancements that improve close rates, underscoring the strategic importance of these connections in driving business success.

As we look to 2025, the landscape of B2B connectivity in banking is set to evolve further, with a focus on advanced technologies that enhance security and efficiency. The rise of digital transactions necessitates robust fraud prevention measures; in 2022, 56% of U.S. companies reported being affected by B2B payment fraud. This highlights the urgent need for banks to adopt advanced unification solutions that not only enhance collaboration but also protect against financial losses, which can exceed $1 million for 23% of B2B companies due to payment fraud.

The transformative influence of AI is particularly relevant here. According to the NVIDIA 2025 survey, nearly 70% of firms reported at least a 5% revenue increase linked to AI implementations. Successful B2B collaboration projects in financial institutions illustrate the effectiveness of these solutions. For example, one vendor adeptly managed a 6-year-old invoice via Upflow, demonstrating how integrating systems can enhance payment procedures and operational effectiveness. Furthermore, the share of overdue invoices decreases from 19% in the initial 30 days to 14% in subsequent phases, suggesting that proactive payment pursuit through coordination can yield improved financial results for banks. By enhancing cooperation with external partners, we can leverage synergy to create more agile and responsive operations. Industry leaders emphasize that the future of finance hinges on our ability to leverage system integration technologies to integrate seamlessly with external systems, ensuring that institutions remain competitive in a rapidly evolving financial landscape. As the global fraud detection market is projected to exceed $30 billion by 2025, the integration of system integration technologies such as AI and machine learning into B2B processes will be critical for maintaining security and operational integrity. In conclusion, B2B integration is not merely a technical necessity but a strategic imperative for banks looking to thrive in an increasingly interconnected world.

Electronic Data Interchange (EDI): Standardizing Business Transactions

Electronic Data Interchange (EDI) serves as a standardized framework for the seamless transfer of business documents between organizations, playing a crucial role in the financial sector. By automating the exchange of essential documents such as invoices, purchase orders, and payment confirmations, we significantly reduce manual processing errors and accelerate transaction times. This automation not only enhances operational efficiency but also bolsters compliance with stringent regulatory requirements, a critical factor in our industry.

As we strive to improve our transaction processing capabilities, the adoption of system integration technologies like EDI becomes increasingly vital. Effective EDI mapping tools, which define how data fields in one document correspond to those in another, are essential for maintaining data accuracy and identifying discrepancies early in the transaction process. This capability reduces the risk of errors, especially as EDI adoption grows within the financial sector. We anticipate that the demand for advanced EDI mapping solutions will increase alongside EDI adoption, emphasizing its strategic significance for financial IT managers.

Incorporating technologies like XSLT can further enhance our EDI processes by streamlining XML data transformation and reducing programming errors. XSLT’s declarative nature allows us to manipulate XML data structures efficiently, leading to significant cost savings and improved accuracy in data handling. As we prepare for open finance initiatives, utilizing XSLT alongside EDI offers a robust framework for integrating new tools with our current infrastructures, ensuring compliance and security in transactions.

Statistics indicate that cloud-based EDI providers achieve near-100% uptime, underscoring the reliability of these systems in supporting continuous operations. As the demand for sophisticated EDI solutions grows, particularly in response to evolving compliance standards, we recognize the strategic advantages of using system integration technologies to integrate EDI into our operations. The report on Electronic Data Interchange in the financial sector outlines key trends, growth drivers, and challenges, further emphasizing the evolving landscape of EDI in finance.

Industry leaders emphasize that EDI not only streamlines processes but also enhances relationships with partners by ensuring timely and accurate communication. As Gustavo Estrada noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” highlighting the importance of effective EDI solutions in achieving our operational goals.

Looking ahead to 2025, the role of EDI in financial transactions will continue to evolve, driven by market trends and the increasing need for standardized processes. By leveraging EDI and utilizing system integration technologies like XSLT, we can enhance our transaction processing efficiency, improve compliance, and maintain a competitive edge in the rapidly changing financial landscape.

Real-time Monitoring and Alerts: Ensuring System Performance

Real-time monitoring and alerts are essential for sustaining the performance and reliability of banking infrastructures. We utilize advanced monitoring tools that enable us to effectively track performance metrics, swiftly identify potential issues, and receive immediate alerts for any anomalies. This proactive approach empowers us to address issues before they disrupt operations, ensuring continuous service availability, particularly through the use of system integration technologies. Our Hybrid Connection Platform plays a pivotal role in this context, accelerating the unification of isolated systems and fragmented data, thus providing the connected foundation enterprises require. Architected for secure transactions, we have earned the trust of banks, healthcare, and government sectors, making our platform an ideal solution for banking IT managers. It accommodates 12 tiers of interface maturity, allowing institutions to balance implementation speed with the complexity necessary to future-proof their technology stack. As Tony LeBlanc from the Provincial Health Services Authority noted, ‘Good team. Good people to work with. Extremely professional. Extremely knowledgeable.’

The significance of real-time monitoring extends beyond operational efficiency; it is also crucial for regulatory compliance. By offering thorough insights into infrastructure performance and security, our tools assist institutions in meeting stringent regulatory standards. For instance, Japan’s recent tightening of anti-money laundering laws underscores the growing demand for transaction monitoring tools, projected to reach a market value of US$ 1.19 billion by 2024, with a compound annual growth rate of 10.7% through 2034. This growth highlights the increasing necessity for real-time monitoring to ensure compliance and mitigate risks associated with regulatory scrutiny.

Moreover, banks leveraging remote management tools have reported a 20% reduction in onsite service visits, illustrating the tangible benefits of real-time monitoring in enhancing operational efficiency. As IT leaders emphasize the importance of proactive performance management, the incorporation of alerts significantly improves the reliability of banking IT infrastructures. By fostering a culture of vigilance among staff, as noted by Team Sanction Scanner, we can better prevent fraud and ensure operational integrity, ultimately leading to increased customer trust and satisfaction. Our company provides a robust foundation for your digital transformation efforts, ensuring that banks can navigate the complexities of contemporary regulatory landscapes with confidence.

Hybrid Integration Platforms: Balancing On-Premises and Cloud Solutions

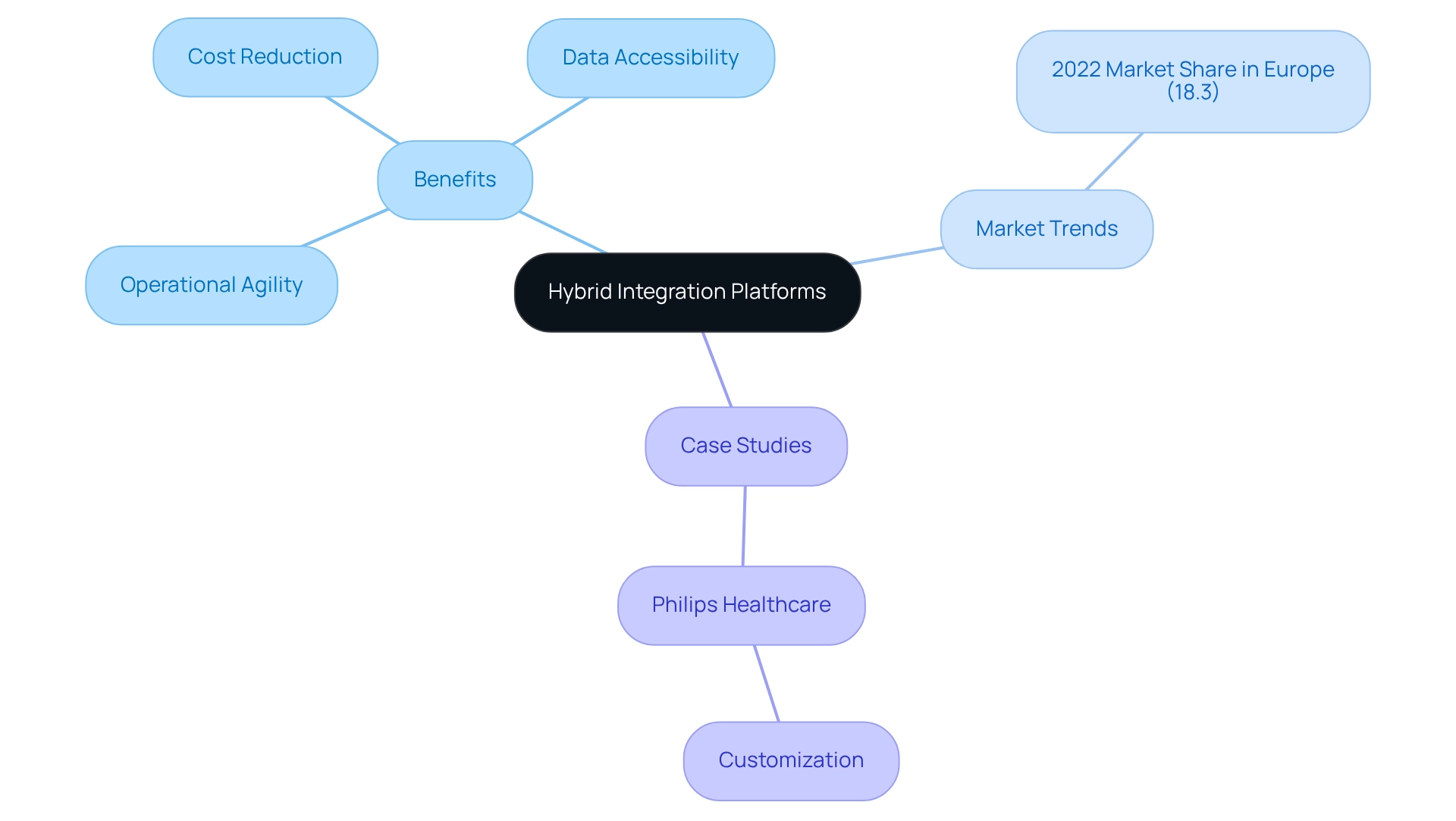

Hybrid connection platforms represent a powerful solution for organizations aiming to seamlessly utilize system integration technologies to connect on-premises and cloud-based systems. We enable financial IT managers to optimize their existing infrastructure while embracing cutting-edge cloud technologies through our committed hybrid unification platform. By implementing system integration technologies through hybrid integration solutions, banks can significantly enhance operational agility, reduce costs, and improve data accessibility. This adaptability is vital in the banking sector, where regulatory compliance and data security take precedence. We facilitate rapid innovation while ensuring that banks retain stringent control over their data and systems.

In 2022, Europe accounted for an 18.3% market share in the hybrid unification platform sector, signaling a rising dependency on system integration technologies within the financial services industry. This trend reveals that banking IT managers are increasingly turning to hybrid solutions and adopting system integration technologies to fulfill the demands of contemporary financial environments. Successful case studies, such as the customized market study we conducted for Philips Healthcare, demonstrate how tailored unification strategies can drive effective decision-making and operational improvements. The Marketing Director at Philips Healthcare noted, “The study was tailored to our objectives and requirements with clearly outlined milestones,” highlighting the importance of customization in addressing specific challenges. Our platform played a pivotal role in this success by providing robust features that ensure seamless data flow and connectivity across diverse systems.

Industry leaders underscore the importance of balancing on-premises and cloud solutions, recognizing that hybrid connection, facilitated by system integration technologies, not only streamlines processes but also enhances overall efficiency in financial operations. Looking ahead to 2025, we anticipate that the trend towards hybrid integration platforms, particularly those utilizing system integration technologies like ours, will persist, equipping banking IT managers with the necessary tools to navigate the complexities of modern financial landscapes while ensuring compliance with financial regulations and secure data management.

Conclusion

We recognize that embracing hybrid integration platforms like Avato is not just beneficial but essential for banking institutions aiming to thrive in today’s complex financial landscape. By effectively bridging the gap between legacy systems and modern applications, Avato enhances operational efficiency, ensures regulatory compliance, and minimizes downtime—key factors for IT managers navigating the industry’s challenges. The platform’s robust features facilitate seamless connectivity, allowing us to adapt swiftly to market dynamics and leverage our existing investments.

As the demand for secure and efficient integration solutions continues to rise, we cannot overstate the transformative potential of Avato. Its capabilities not only support real-time monitoring and alerts, ensuring system performance, but also streamline business-to-business collaborations and enhance customer experiences through advanced technologies like APIs and middleware. This adaptability positions us to respond proactively to evolving market needs and regulatory demands.

In conclusion, the integration of hybrid solutions is not merely a technical necessity but a strategic imperative for financial institutions. By prioritizing platforms like Avato, we can unlock significant operational benefits, maintain a competitive edge, and ultimately foster a more agile and innovative environment. Now is the time for banking IT managers to embrace these advancements and lead their organizations toward a more connected and efficient future.