Overview

We recognize that modernizing financial operations is crucial for banking systems today. The integration of enterprise integration patterns (EIPs) plays a pivotal role in this transformation. By implementing patterns such as:

- Message Channel

- Message Router

- Service Activator

we empower financial institutions to streamline processes, enhance data handling, and significantly improve customer satisfaction. These patterns not only address the complexities of integrating legacy systems with contemporary technologies but also pave the way for greater operational efficiency.

What challenges are you facing in your integration efforts? We are here to provide the solutions that will drive your success.

Introduction

In today’s banking sector, we face unprecedented challenges stemming from legacy systems and evolving customer demands. It is essential for us to integrate advanced technologies to achieve success.

Our exploration of the transformative capabilities of various integration patterns, including the innovative Avato hybrid integration platform, reveals how we can effectively connect disparate systems securely. By examining key methodologies such as:

- Message Router

- Event Sourcing

- CQRS

we highlight not only how these patterns streamline operations but also how they enhance compliance and customer satisfaction.

As financial institutions strive to modernize their processes and maintain a competitive edge, understanding and implementing these integration strategies is crucial for navigating the complexities of today’s digital landscape.

What’s holding your team back from embracing these advancements? Let us guide you through this transformative journey.

Avato: Secure Hybrid Integration Platform for Complex Systems

We distinguish ourselves as a groundbreaking hybrid integration platform, skillfully crafted to securely link intricate networks and information within the financial industry. We tackle the challenges presented by outdated infrastructure, providing a robust solution that effectively reduces risks associated with digital transformation.

With advanced features such as real-time monitoring and support for 12 levels of interface maturity, we empower financial institutions to innovate swiftly while maintaining compliance and security. Our platform is indispensable for organizations aiming to modernize their operations, ensuring high performance and security without compromise.

As the demand for seamless integration increases, our dependable, future-ready technology stack establishes us as leaders in enabling secure system integration in the financial sector. Our dedication to solving complex problems is reflected in the positive feedback from clients. Gustavo Estrada, one of our customers, noted, “We have the ability to simplify complex projects and deliver results within desired time frames and budget constraints.”

Furthermore, we are built for integration projects where 24/7 uptime is required, ensuring that there is no room for defects, errors, or outages. This commitment to reliability is vital for financial institutions that rely on secure transactions.

Enterprise Integration Pattern: Definition and Importance

Enterprise integration patterns examples are essential solutions crafted to address the integration challenges we face in the financial sector. These patterns provide a structured framework for developing and executing integrations across diverse environments, ensuring seamless data flow between various platforms. As we increasingly encounter the complexities of merging outdated frameworks with modern applications, understanding EIPs becomes crucial for enhancing operational efficiency and enriching customer experiences.

The importance of EIPs in our financial networks cannot be overstated. They facilitate the unification of disparate legacy systems, a vital step for financial institutions like ours striving to modernize operations while minimizing disruption. Recent statistics indicate that over 70% of financial institutions grapple with integration challenges, underscoring the pressing need for effective solutions. By leveraging enterprise integration patterns examples, we can streamline our processes, reduce operational costs, and enhance service delivery, as case studies reveal the successful application of these enterprise integration patterns examples in various financial institutions. For example, proactive performance monitoring and the exploration of cloud-based solutions have effectively optimized system architecture, addressing capability and performance limitations during integration. Such strategies not only mitigate disruptions but also ensure that we can adapt to evolving market demands.

Recent advancements in generative AI further highlight the role of EIPs in boosting our operational efficiency. The application of generative AI has surged, particularly in enhancing customer experience through sophisticated chatbots and virtual assistants. This technology not only elevates customer engagement but also utilizes enterprise integration patterns examples, improving document processing and report generation, thus streamlining operations across our departments. Best practices now advocate for the use of observable event logs in decision-making and managing tool utilization through standardized APIs, aligning perfectly with EIP principles. Expert insights affirm that these patterns are pivotal in refining our integration strategies, ultimately leading to better outcomes for our banking operations.

In summary, the significance of EIPs in the banking sector is clear. They provide a blueprint for integrating outdated infrastructures and empower us to navigate the complexities of modern technology environments effectively. By harnessing EIPs alongside generative AI, we can enhance our operational capabilities and maintain a competitive advantage in an increasingly digital landscape.

Message Channel Pattern: Facilitating Communication Between Systems

The Message Channel Pattern is not just a technical detail; it is a vital conduit for transmitting messages between systems, utilizing various implementations such as point-to-point and publish-subscribe channels. In the financial industry, the efficiency of these message channels is paramount, ensuring the dependable and secure exchange of crucial information, including payment details. This reliability facilitates timely decision-making and significantly enhances customer service.

As we approach 2025, the importance of robust communication channels for banking operations cannot be overstated. Statistics reveal that financial institutions employing effective message channels experience significant enhancements in processing times, leading to increased customer satisfaction and operational efficiency. For instance, organizations that have embraced advanced message channel patterns report up to a 30% decrease in delays, underscoring the impact of these systems on overall performance.

Real-world implementations of message channels in financial services demonstrate their effectiveness. A notable case study illustrates a major financial institution that transitioned to a publish-subscribe model, resulting in improved data flow and reduced latency in transaction processing. This strategic shift not only streamlined operations but also positioned the institution to better respond to customer needs in a rapidly evolving market.

Industry leaders emphasize the necessity of secure communication channels for financial data. As Doug Larson wisely remarked, “Wisdom is the reward you gain from a lifetime of listening when you’d have preferred to speak,” highlighting the importance of understanding and applying effective communication strategies in financial institutions. By prioritizing reliable message channels and utilizing enterprise integration patterns examples, we can navigate integration challenges while maintaining a competitive edge in the financial landscape.

Message Router Pattern: Directing Messages Based on Criteria

The Message Router Pattern is indispensable in directing messages to their designated destinations based on specific criteria. This is particularly crucial in financial institutions, where distinct transaction types necessitate tailored processing paths. By embracing this pattern, we can significantly enhance message handling efficiency, resulting in reduced processing times and improved responsiveness.

As we look ahead to 2025, the efficiency of message routing in banking systems has never been more vital. The industry is adapting to evolving customer demands and regulatory requirements, and statistics indicate that efficient message routing can improve processing times by up to 30%. This capability enables us to respond swiftly to operations and customer inquiries.

The COVID-19 pandemic underscored the importance of effective message routing, as the surge in prepaid card activities reached a peak of 30.9% in 2020. This increase necessitated robust frameworks to manage the heightened volume. As the economy stabilized, the growth rate returned to a more typical 8.6% in 2021, further emphasizing the need for flexible and efficient processing methods.

Industry professionals highlight that a well-structured Message Router Pattern not only streamlines operations but also enhances customer satisfaction by ensuring timely transaction processing. Our Hybrid Integration Platform supports this by providing real-time monitoring and alerts on performance, guaranteeing 24/7 uptime and reliability. As Gustavo Estrada noted, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” showcasing the effectiveness of integrating advanced routing solutions in banking systems.

In conclusion, the impact of enterprise integration patterns examples like message router patterns on transaction processing in financial institutions is critical for maintaining a competitive edge in an increasingly complex financial landscape. As banks strive to optimize profitability and reassess their business strategies, implementing the Message Router Pattern is not just beneficial; it is a strategic imperative.

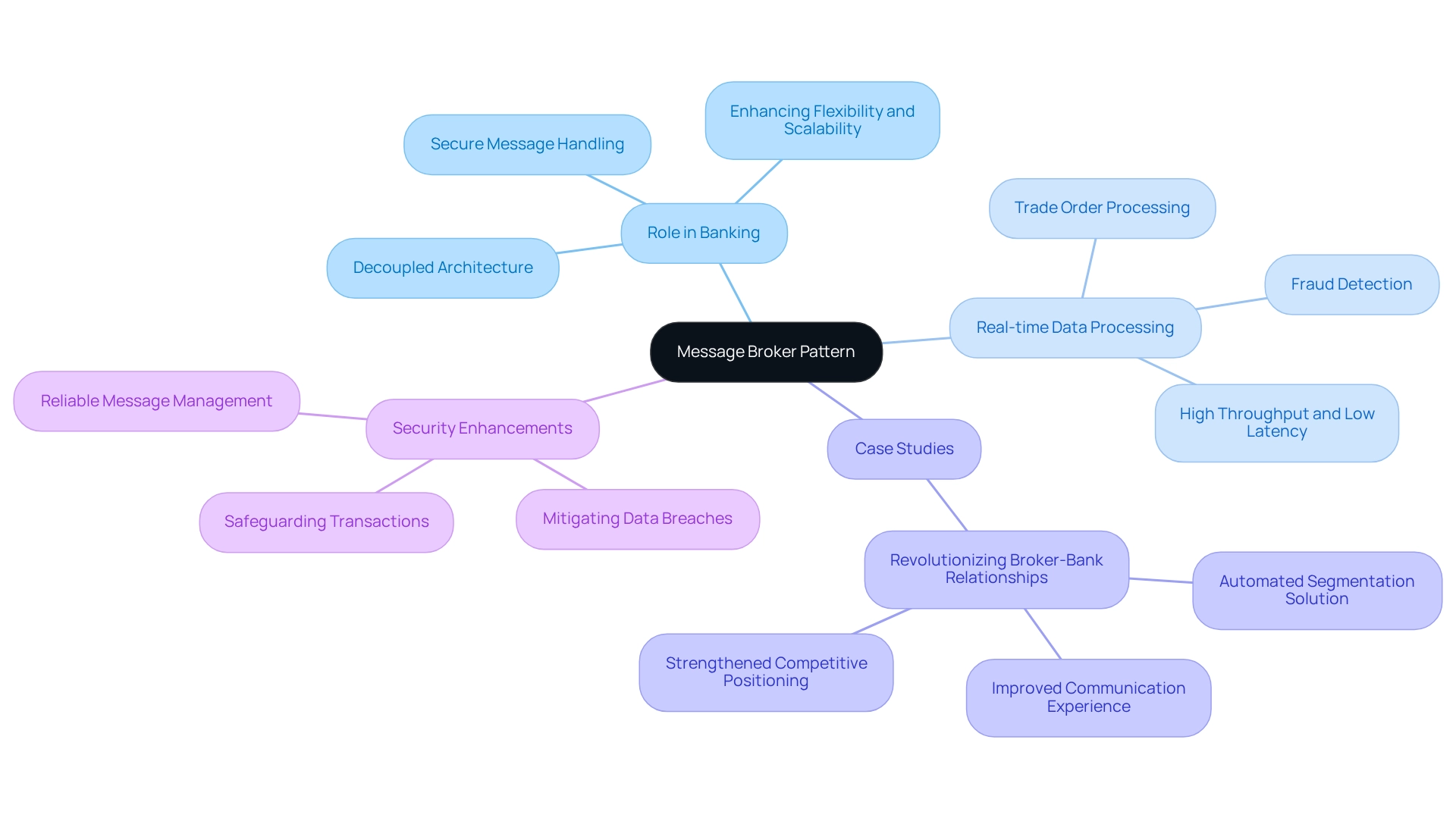

Message Broker Pattern: Managing and Routing Messages Effectively

The Message Broker Pattern serves as a critical intermediary that efficiently oversees and directs messages between distinct entities, fostering a decoupled architecture that enhances flexibility and scalability in integrations. In the banking sector, we recognize that message brokers are vital in processing various transaction types, ensuring messages are handled securely and efficiently. This capability is essential for maintaining customer trust and adhering to stringent regulatory compliance standards.

Recent statistics reveal that financial institutions increasingly depend on message brokers for real-time data processing, particularly in applications such as fraud detection and trade order processing. These systems are designed to ensure high throughput and low latency, which are crucial for operational success in today’s fast-paced financial environment.

Consider a notable case study titled “Revolutionizing Broker-Bank Relationships.” This initiative illustrates the successful implementation of an automated segmentation solution that enhances communication between brokers and banks. Not only did this improve the communication experience, but it also solidified the competitive positioning of the involved parties, demonstrating the effectiveness of message brokers in fostering collaboration and efficiency.

The role of message brokers in financial integrations extends beyond mere message routing; they also play a crucial part in safeguarding transactions. By providing a reliable structure for message management, these solutions mitigate risks associated with data breaches and ensure that confidential information remains secure throughout the process lifecycle. Industry leaders acknowledge the significance of this technology, with many emphasizing its role in enabling secure and efficient financial operations.

In summary, we assert that the Message Broker Pattern is an essential example of enterprise integration patterns, integral to contemporary financial systems, offering a robust solution for managing and routing messages while enhancing security and operational efficiency. As financial institutions continue to evolve, we anticipate that the adoption of message brokers will rise, further solidifying their role as a cornerstone of secure processing.

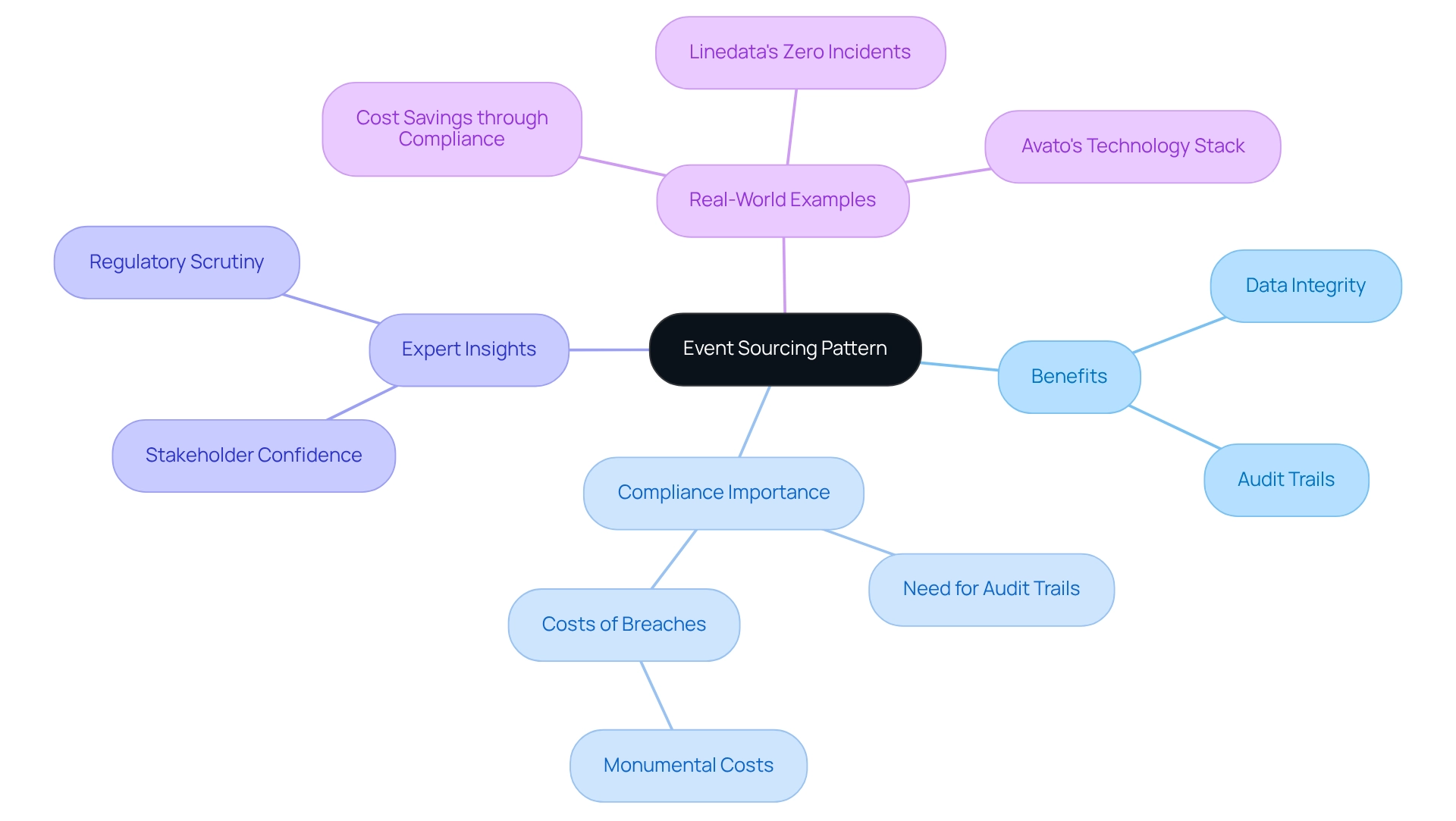

Event Sourcing Pattern: Capturing State Changes as Events

We recognize the Event Sourcing Pattern as a powerful methodology that captures all changes to an application’s state as a sequence of events. This approach not only enables us to reconstruct past states but also provides a comprehensive audit trail, crucial for compliance and regulatory requirements in the banking sector. By implementing event sourcing, we enhance data integrity, ensuring that every transaction is traceable and verifiable.

In 2025, we cannot overstate the importance of event sourcing for financial audits. As regulatory scrutiny intensifies, financial institutions are increasingly adopting event sourcing patterns to maintain compliance. For instance, Linedata reported achieving 24/7 application uptime with zero incidents in the past year, showcasing the reliability of systems that utilize this pattern.

Expert insights highlight that capturing state changes as events not only aids in compliance but also strengthens stakeholder confidence. Compliance experts emphasize the necessity of robust audit trails in finance, noting that “the costs associated with a breach are monumental,” underscoring the financial implications of inadequate compliance measures.

Real-world examples illustrate the effectiveness of event sourcing in banking compliance. Organizations embracing this pattern report significant cost savings through enhanced compliance protocols, helping avoid the exorbitant costs associated with data breaches and audits. By proactively managing compliance, we can mitigate risks while ensuring operational efficiency and regulatory adherence. Moreover, Avato’s dependable technology stack, trusted by financial institutions, healthcare, and government, facilitates the implementation of event sourcing, allowing us to adapt to changing demands and maintain a competitive advantage. Avato’s capabilities, including support for 12 levels of interface maturity, further enhance our integration solutions, ensuring that banks can effectively manage their compliance needs.

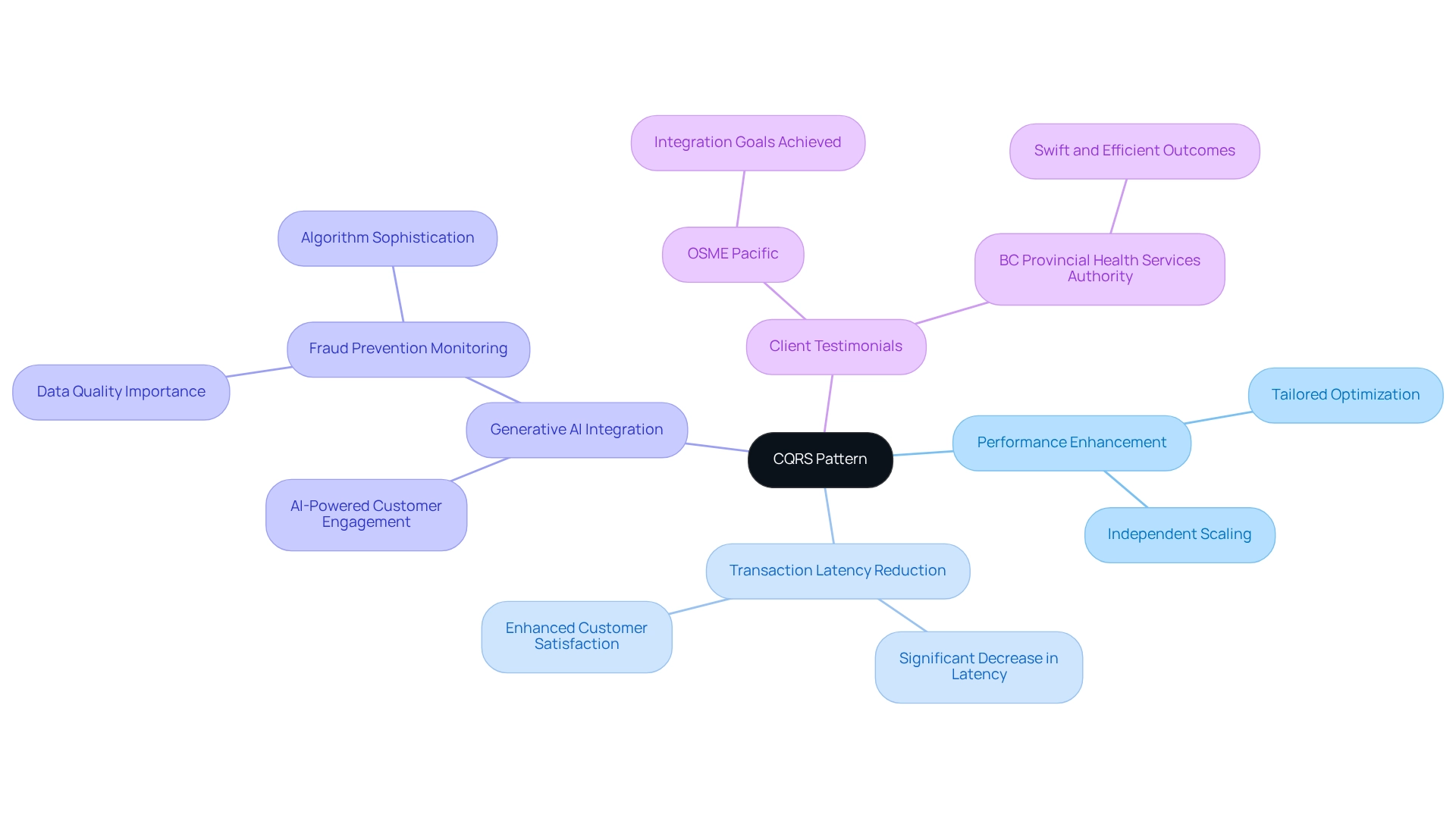

CQRS Pattern: Enhancing Performance Through Separation of Operations

The Command Query Responsibility Segregation (CQRS) pattern effectively separates read and write operations within a system, allowing for tailored optimization of each function. In the realm of financial applications, this separation considerably improves processing speed and overall user experience. By enabling independent scaling of read operations from write operations, we can achieve remarkable efficiency gains. A recent study emphasized that financial institutions implementing CQRS can anticipate a significant decrease in transaction latency, resulting in enhanced customer satisfaction and operational efficiency.

Furthermore, the incorporation of generative AI into our banking frameworks is transforming customer engagement and operational procedures. With a notable increase in the use of generative AI for customer experience, particularly through sophisticated chatbots and virtual assistants, we can further enhance our service delivery. Industry leaders emphasize that the future effectiveness of monitoring systems, particularly in fraud prevention, hinges on the quality of data and the sophistication of algorithms used in conjunction with enterprise integration patterns examples like CQRS. As we increasingly view activity monitoring as a strategic asset, the implementation of CQRS becomes crucial in optimizing performance and ensuring robust risk management.

Customer testimonials from organizations such as OSME Pacific and BC Provincial Health Services Authority further illustrate the tangible benefits of CQRS. These clients have reported significant improvements in their integration processes, achieving their goals swiftly and efficiently through the implementation of CQRS. As the financial sector continues to evolve with increasing demands for efficiency and security, leveraging the CQRS pattern alongside generative AI will be essential for institutions like ours aiming to enhance performance and maintain a competitive edge in 2025 and beyond.

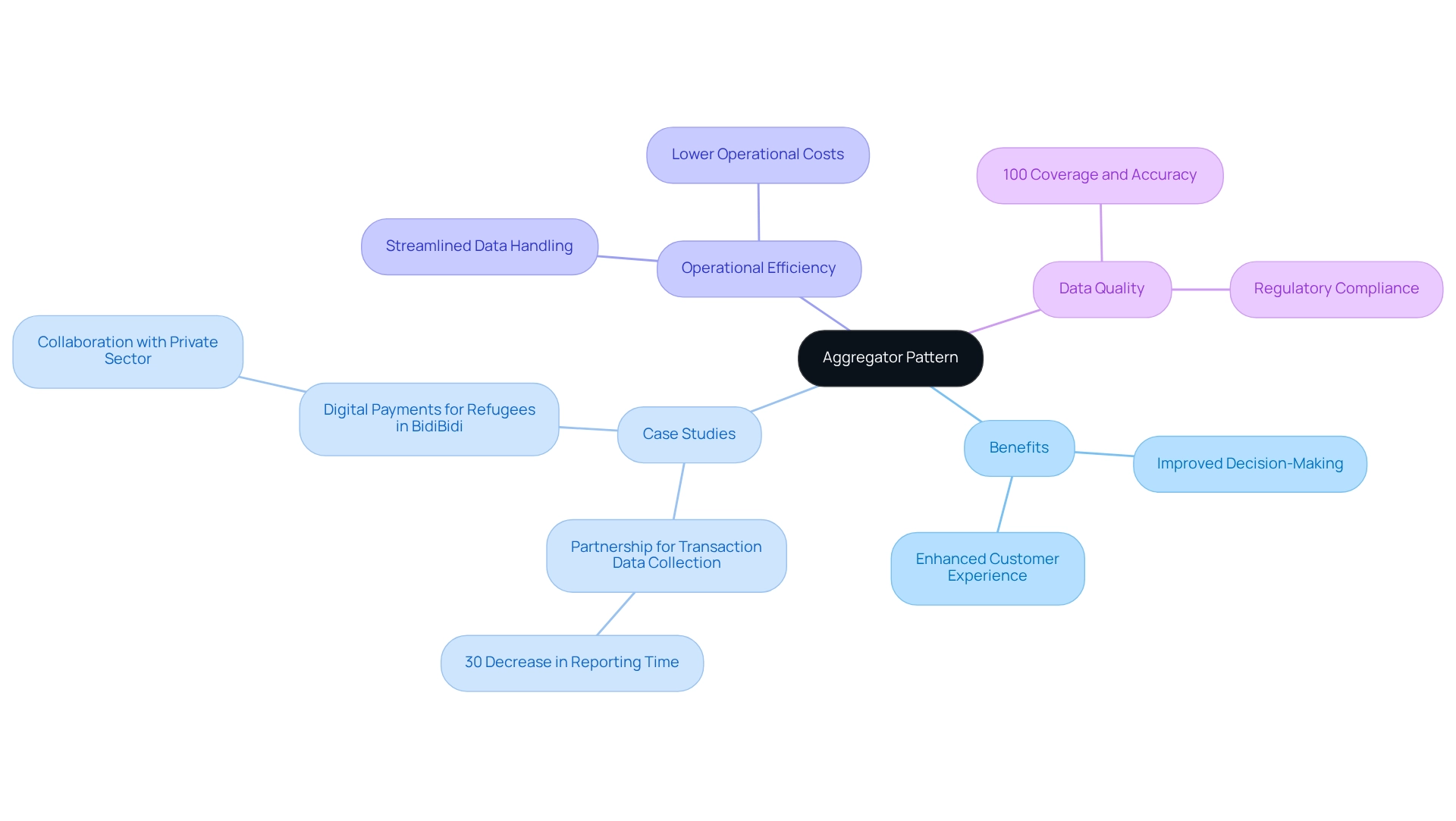

Aggregator Pattern: Combining Messages for Simplified Data Handling

The Aggregator Pattern stands as a formidable tool that consolidates messages from multiple sources into a single, coherent message. In the financial sector, where diverse transaction data must be integrated for effective reporting and analysis, this pattern proves invaluable. By employing the aggregator pattern, we can significantly streamline our data handling processes, minimizing complexity and enhancing the speed of data retrieval.

As we look ahead to 2025, the emphasis on data quality remains paramount; our ideal state is 100% coverage and accuracy. Implementing the aggregator pattern not only aids in achieving this goal but also improves our operational efficiency. For instance, financial entities that have embraced this method report significant improvements in reporting efficiency, facilitating faster decision-making and better adaptability to market fluctuations, with enterprise integration patterns examples like the aggregator pattern demonstrating their effectiveness in finance.

A notable case study features a partnership among various financial institutions to develop a cohesive platform for transaction data collection, resulting in a 30% decrease in reporting time. We have observed that simplifying data processes through aggregation not only lowers operational costs but also enhances the overall customer experience. Expert insights indicate that the aggregator pattern is vital for contemporary financial operations, as it promotes better data management and assists in meeting regulatory requirements. By leveraging this pattern, we can ensure that we remain competitive in an increasingly data-driven landscape, ultimately leading to improved service delivery and customer satisfaction.

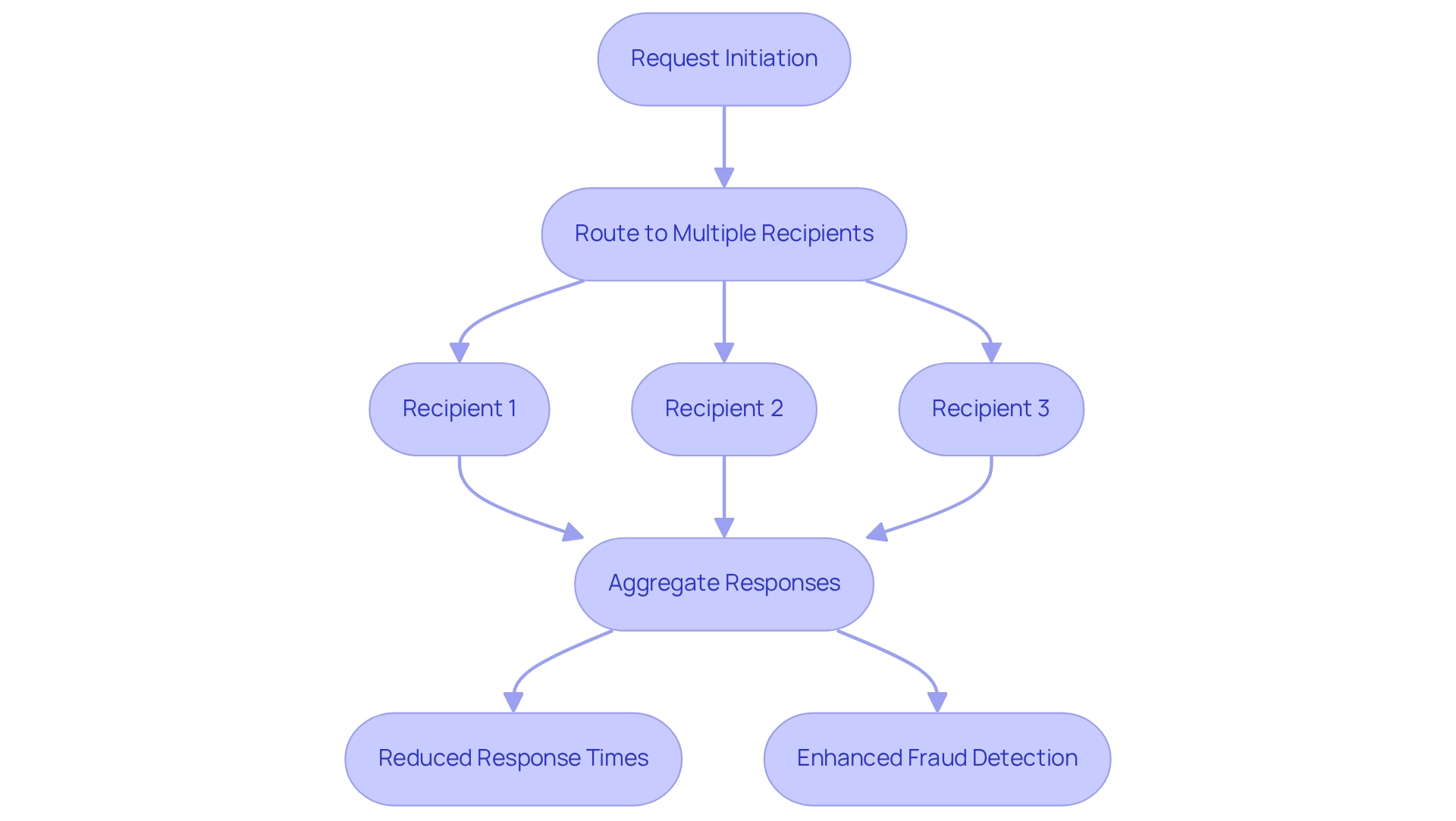

Scatter-Gather Pattern: Parallel Processing of Requests

The Scatter-Gather Pattern serves as one of the enterprise integration patterns examples, representing a transformative integration technique that adeptly routes a request message to multiple recipients while aggregating their responses. This parallel processing method is particularly advantageous for financial institutions, especially during critical operations like fraud detection and risk evaluation. By simultaneously querying multiple data sources, we can significantly reduce response times, thus enhancing our overall operational efficiency.

For instance, our successful implementation of hybrid integration solutions in financial institutions, such as Coast Capital, exemplifies the effectiveness of this pattern. A notable achievement occurred in June 2016, when we facilitated the transition of Coast Capital’s entire telephone banking and contact center telephony system with merely a 63-second disruption. A recent case study further illustrated the application of the Scatter-Gather Pattern in fraud detection, where a fuzzy logistic regression framework attained a fraud detection rate of 90.9%. This performance underscores the robustness of the Scatter-Gather Pattern in addressing class imbalances, as only 0.39% of 555,000 transactions were fraudulent, indicating a remarkable 99.6% prevalence of non-fraudulent transactions.

Moreover, industry leaders have recognized that embracing parallel processing not only refines operations but also enhances the accuracy of fraud detection mechanisms. As Gustavo Estrada, one of our customers, remarked, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” which highlights the tangible benefits of our integration solutions.

By leveraging the Scatter-Gather Pattern, which is one of the enterprise integration patterns examples, we empower financial institutions to bolster their operational capabilities while ensuring swift responses to potential threats, ultimately fostering a more secure financial environment. We encourage banking IT managers to consider integrating this pattern into their frameworks for improved fraud detection.

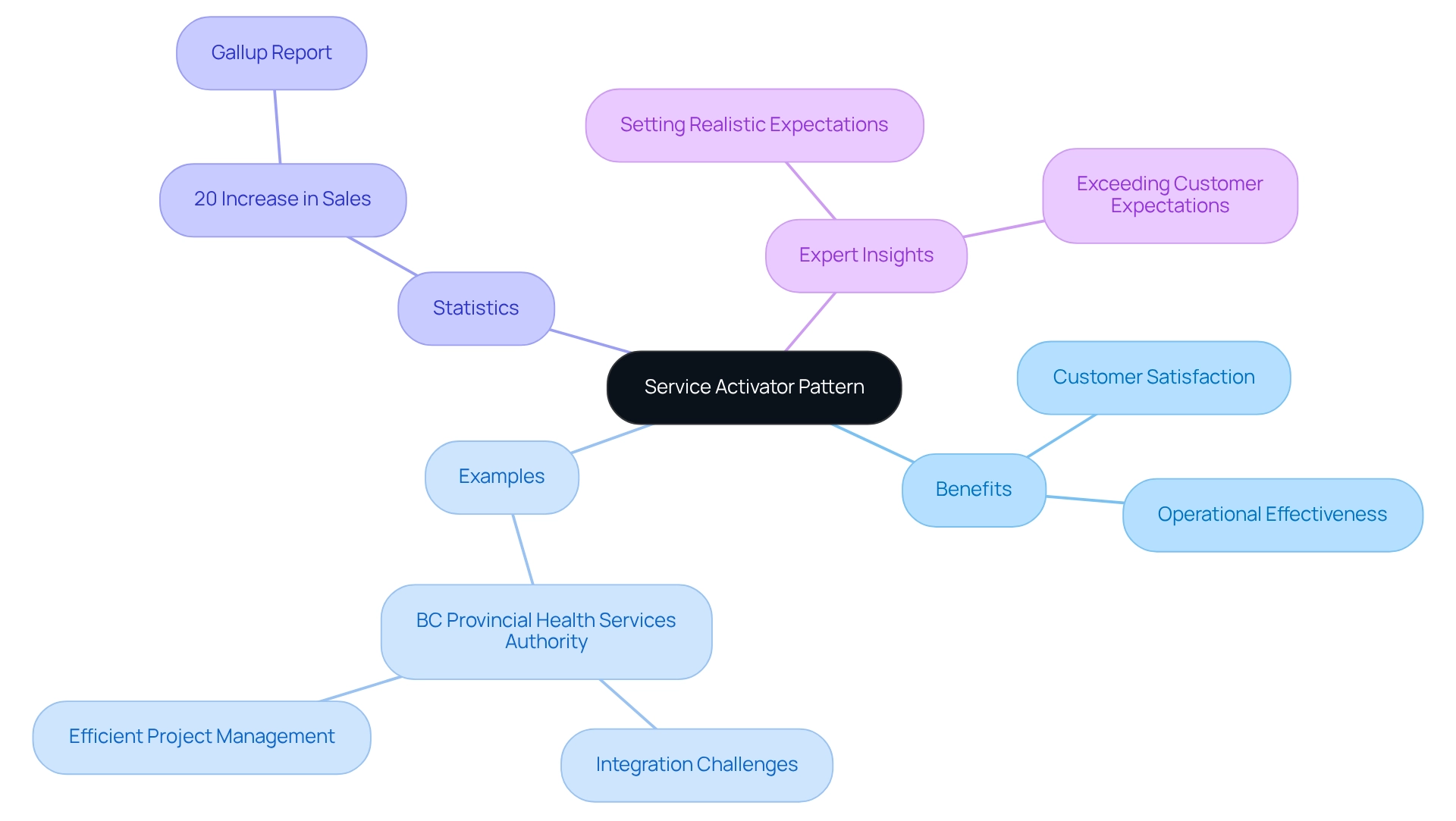

Service Activator Pattern: Invoking Services in Response to Messages

The Service Activator Pattern is indispensable for responding to incoming messages, particularly in financial systems where swift reactions to transactions and inquiries are essential. By implementing service activators, we can significantly enhance our responsiveness, ensuring that customer requests are handled with utmost efficiency. This advancement not only improves operational effectiveness but also elevates customer satisfaction, as motivated employees are more inclined to deliver exceptional service.

As we approach 2025, the critical role of service activation in financial services has become increasingly apparent. Organizations are leveraging this pattern to streamline operations effectively. For instance, Gustavo Estrada from BC Provincial Health Services Authority highlighted how Avato’s platform empowered them to tackle complex integration challenges, underscoring the importance of timely service activation. Statistics reveal that organizations employing service activator patterns in financial services have witnessed a notable increase in customer engagement, with Gallup reporting a 20% rise in sales within highly engaged workplaces. This data highlights the direct link between responsive service invocation and enhanced customer experiences, while enterprise integration patterns examples further demonstrate how service activators have revolutionized banking services. Institutions that have embraced this pattern report elevated customer satisfaction levels, as they can promptly address inquiries and transactions. Expert insights stress that the key to success lies in establishing realistic customer expectations and consistently exceeding them—a principle that aligns seamlessly with the capabilities offered by service activators.

In conclusion, the Service Activator Pattern transcends mere technical implementation; it represents a strategic approach that empowers us to respond effectively to customer needs, ultimately fostering improved satisfaction and loyalty.

Conclusion

We understand that the integration of advanced technologies and methodologies is essential for banking institutions striving to modernize and remain competitive in today’s digital landscape. The exploration of various integration patterns, including the Avato hybrid integration platform, illustrates how we can overcome the challenges posed by legacy systems and evolving customer demands.

Key strategies such as the Message Router, Event Sourcing, and CQRS not only streamline our operations but also enhance compliance and customer satisfaction. By utilizing these patterns, we can improve transaction processing times, maintain rigorous audit trails, and optimize performance through the separation of read and write operations. Furthermore, the incorporation of generative AI amplifies these benefits, enabling enhanced customer engagement and operational efficiency.

As we continue to navigate the complexities of integration, embracing these advanced methodologies is crucial. Our ongoing commitment to leveraging innovative patterns will not only facilitate secure and efficient transactions but also empower us to adapt to an ever-changing market landscape. What’s holding your team back? Now is the time for us to take decisive action in implementing these integration strategies, ensuring we remain at the forefront of the industry while delivering exceptional value to our customers.