Overview

In today’s rapidly evolving financial landscape, modular banking stands out as a transformative solution for modern financial institutions. We recognize that enhanced customization, operational efficiency, and the agility to respond swiftly to market fluctuations and regulatory demands are paramount. By integrating only the necessary components, we streamline processes and ensure compliance with ever-changing regulations. This approach not only leads to improved customer satisfaction but also results in significant cost savings.

What’s holding your institution back from embracing this innovative model? Let us guide you in harnessing the full potential of modular banking to elevate your operations and meet the challenges of the future.

Introduction

In today’s rapidly evolving landscape of financial services, we recognize the imperative for banks to modernize their operations while ensuring security and compliance. Avato’s hybrid integration platform stands out as a transformative solution, enabling financial institutions to seamlessly connect legacy systems with cutting-edge technologies. This innovative approach not only enhances operational efficiency but also positions us to adapt to changing consumer preferences, such as the growing shift towards mobile wallets.

As the industry grapples with the complexities of digital transformation, the integration of modular banking solutions offers a pathway for us to not just survive but thrive in a competitive marketplace, driving innovation and improving customer experiences.

What’s holding your team back from embracing this change? Let us guide you through this journey to success.

Avato: Transform Your Banking Operations with a Secure Hybrid Integration Platform

We recognize the pressing need for financial institutions to adopt modular banking to modernize operations without sacrificing security. Avato’s hybrid connectivity platform is engineered to seamlessly link diverse financial systems, empowering institutions to innovate rapidly through modular banking. Our platform for modular banking, developed by a dedicated team of enterprise architects, effectively integrates legacy systems with contemporary applications, all while adhering to stringent regulatory standards. This capability is crucial in modular banking, where data security and operational efficiency are paramount. With Avato, our clients gain a comprehensive view of their operations, significantly enhancing decision-making processes and customer service.

What if we told you that within five years, half of today’s smartphone users will prefer mobile wallets for payments? This trend underscores the urgency for financial institutions to adapt swiftly to evolving consumer preferences. Moreover, internal APIs are instrumental in streamlining workflows, automating procedures, and improving inter-department communication—elements essential for operational success.

Our platform also provides real-time monitoring and alerts on system performance, enabling financial institutions to proactively manage their operations. Case studies illustrate that Avato has been pivotal in simplifying complex project implementations for clients in the banking sector, delivering results within expected time frames and budget constraints. This efficiency not only reduces costs but also enhances operational capabilities in modular banking, allowing financial institutions to remain competitive in an ever-changing landscape.

Experts emphasize the importance of secure connection solutions, with industry analysts noting that the ability to accept various payment methods, including cryptocurrencies, is becoming increasingly vital for financial institutions. As Jordan McKee, Senior Analyst at Yankee Group, remarked, “MIT bookstores are now accepting Bitcoins. Micro merchants can go cashless via cryptocurrency.” As our clients navigate the challenges of digital transformation, Avato stands out as a reliable partner in achieving seamless integration and operational excellence. Furthermore, recent statistics indicate that hybrid integration platforms are projected to enhance operational efficiency by [insert relevant statistic for 2025], further underscoring their importance in the financial sector.

Customization and Flexibility: Key Benefits of Modular Banking Solutions

We believe that the key advantages of modular banking solutions include unparalleled customization, enabling financial institutions to tailor their services precisely to client needs. By adopting a modular banking approach, we can selectively integrate only the components we require, enabling rapid responses to the ever-evolving market demands. This flexibility not only boosts customer satisfaction but also significantly reduces operational expenses, as we can eliminate unnecessary features and concentrate on what truly matters to our clients. Furthermore, the ability to seamlessly swap or upgrade modules ensures that we maintain a competitive edge in a dynamic environment.

Recent insights reveal that product modularization effectively mediates the relationship between customization needs and financial performance, underscoring its strategic importance in developing tailored products. Our hybrid connectivity platform enhances this modularity by guaranteeing 24/7 uptime for critical linkages, reinforcing the necessity of reliability in elevating customer satisfaction and operational capabilities. Additionally, the integration of generative AI into these solutions has resulted in a remarkable 60% increase in customer experience enhancements, particularly through advanced chatbots and virtual assistants. As Gustavo Estrada noted, ‘Avato has simplified complex projects and delivered results within desired time frames and budget constraints,’ highlighting the effectiveness of our flexible solutions in enhancing operational efficiency.

Moreover, the growing adoption of generative AI in financial services, as indicated by recent surveys, emphasizes its significance in driving innovation and improving service delivery across the industry. What’s holding your team back from leveraging these advancements? We invite you to explore how our services can transform your operations and elevate your service delivery through modular banking.

Enhanced Customer Experience: How Modular Banking Leverages Technology

Modular finance is revolutionizing customer experiences through the harnessing of advanced technologies. By utilizing APIs and flexible components, we empower financial institutions to offer customized services tailored to individual preferences. For instance, customers can select specific financial products that align with their personal objectives, creating a more engaging and satisfying financial journey. Moreover, our commitment to real-time data analysis enables financial institutions to anticipate client needs, facilitating proactive support that enhances loyalty and trust.

The impact of flexible finance on client experience is profound. Institutions such as Monzo and Revolut exemplify this trend by providing personalized budgeting tools and spending insights, which not only elevate engagement but also significantly enhance customer satisfaction. By 2025, statistics indicate that institutions leveraging flexible financial technologies will witness a notable improvement in customer experience metrics, with many reporting increased retention rates and positive customer feedback. Furthermore, the reliability of these solutions is underscored by our dedication to ensuring 24/7 availability for critical connections, which is essential for maintaining service continuity in the banking sector. Additionally, the importance of APIs in modular banking cannot be overstated. They facilitate seamless integration of diverse services, allowing financial institutions to create a cohesive ecosystem that enriches customer interactions. Expert opinions consistently affirm that APIs are vital for delivering personalized services, as they enable banks to connect disparate systems and provide a unified experience. This adaptability is essential in a rapidly evolving financial landscape, where client expectations are continuously rising, particularly as we move towards modular banking, where strategic integration methods become imperative. Our hybrid unification platform plays a pivotal role in transforming business operations by enhancing customer experience and accelerating legacy system connections. By effectively mobilizing stakeholders and modeling new business processes, financial institutions can future-proof their systems to incorporate new tools alongside existing assets. It is equally important to ensure that integration solutions comply with stringent security standards and that the selection of solution providers is made judiciously to foster enduring partnerships.

Case studies further illustrate the effectiveness of flexible financial systems in enhancing customer experience. For example, regulatory changes, such as the introduction of open financial regulations in over 60 nations, have spurred financial institutions to innovate and improve their service offerings. These advancements not only bolster consumer safety but also stimulate competition, encouraging financial institutions to adopt flexible solutions focused on customer satisfaction. As Inese observed, ‘Through a strategic and forward-thinking UX approach, we expanded the Liv ecosystem to three groundbreaking solutions…’ This highlights how innovative UX strategies can significantly enhance customer engagement. In summary, the integration of modular banking solutions is reshaping the services landscape, enabling us to meet the diverse needs of our clients while fostering deeper engagement and loyalty.

Operational Efficiency: Streamlining Processes Through Modular Banking

We recognize that modular banking enhances operational efficiency by deconstructing complex systems into manageable components. This strategic approach empowers financial institutions to automate routine tasks, significantly decreasing manual errors and enhancing overall productivity. For instance, the incorporation of flexible payment processing systems has been shown to speed up transaction times while improving accuracy. In 2025, banks utilizing these flexible solutions reported operational efficiency enhancements of up to 30%, demonstrating the tangible benefits of this approach.

By optimizing workflows and eliminating redundancies, we can help financial institutions achieve substantial cost savings and elevate service delivery standards. AON, for example, has shifted to completing projects in days instead of months, showcasing the swift impact of flexible solutions on operational timelines. This case study illustrates how flexible financial systems can significantly enhance project efficiency and responsiveness in a competitive market.

Moreover, industry specialists stress that adopting flexible financial systems is crucial for remaining competitive in a rapidly changing environment. As Jack Welch aptly stated, ‘Change before you have to,’ underscoring the necessity for proactive adaptation in the financial sector, particularly as modular solutions become increasingly vital.

Our dedicated hybrid unification platform plays a crucial role in this transformation, simplifying the connection of disparate systems and enhancing business value. By seamlessly integrating isolated data and systems, we empower financial institutions to future-proof their operations, ensuring they remain agile and responsive to market demands.

The integration of innovative technologies, such as blockchain, is also transforming financial operations. Case studies indicate that blockchain can streamline cross-border payments, enhancing transaction security and transparency while significantly reducing costs and processing times. As flexible finance continues to evolve, its role in improving operational efficiency through modular banking will be essential for contemporary financial organizations striving to meet the demands of a progressively digital environment. Furthermore, solutions such as those provided by FlowForma offer user-friendly interfaces tailored to the unique requirements of the financial sector, facilitating the deployment of flexible systems and further enhancing operational improvements.

Regulatory Compliance: Adapting Swiftly with Modular Banking Frameworks

We recognize that modular banking is specifically engineered to swiftly adapt to evolving regulatory requirements. By leveraging modular banking components, we can implement compliance measures with remarkable efficiency, ensuring adherence to legal obligations without necessitating a complete system overhaul. For instance, we can seamlessly integrate a new compliance module focused on KYC (Know Your Customer) regulations, allowing us to maintain ongoing operations without disruption. This adaptability not only reduces the risk of non-compliance but also enables us to proactively tackle emerging regulations as they arise.

In 2025, as open banking continues to grow, the significance of ensuring that third-party partners adhere to regulations and use customer data responsibly becomes crucial. A significant 52% of compliance experts have indicated that insufficient data about partners exposes businesses to third-party risks, highlighting the critical need for robust compliance frameworks. Furthermore, 34% of organizations have established compliance departments dedicated to overseeing all aspects of third-party risk management, underscoring the growing emphasis on regulatory adherence, with the profound impact of modular banking on compliance efficiency. By allowing us to adapt to regulatory changes without extensive delays, these frameworks enhance our operational agility.

Our hybrid integration platform accelerates the integration of isolated systems and fragmented data, providing the connected foundation we need to simplify, standardize, and modernize our operations. For instance, despite ongoing concerns about cryptocurrencies—68% of bankers express apprehension regarding their implications for financial crime—our modular banking solutions allow us to remain aligned with regulatory guidance as the landscape evolves. This adaptability is essential for maintaining a competitive edge in an increasingly complex regulatory environment.

Furthermore, since 67% of global executives think ESG regulation is overly complicated, flexible frameworks can streamline compliance processes, facilitating our management of these challenges. We encourage banking IT managers to consider implementing modular banking frameworks, enhanced by our solutions, as a proactive measure to improve regulatory compliance and operational efficiency. Our dedicated team of integration experts is committed to delivering results that empower financial institutions to thrive in this dynamic landscape.

Innovation Enablement: How Modular Banking Fosters New Financial Services

Modular banking acts as a catalyst for innovation, enabling us to experiment with new products and services while minimizing risk. By employing flexible elements, we can swiftly create and launch offerings like digital wallets or customized investment platforms. This agility not only reduces our time-to-market but also enables us to enhance our products based on real-time customer feedback, ensuring we remain competitive in a fast-paced financial environment.

Statistics indicate that by 2025, banks utilizing modular banking solutions will be more likely to launch new financial services, thereby enhancing our operational capabilities and generating new revenue streams. Specifically, APIs in banking are projected to help generate new customer insights and revenue streams, further supporting this trend.

Case studies reveal that institutions utilizing Avato’s hybrid integration platform have successfully simplified complex integration projects, achieving desired outcomes within budget and time constraints. For instance, our collaboration with Coast Capital exemplifies how the platform can facilitate major system transitions with minimal downtime, showcasing its reliability and speed.

As Tony LeBlanc from the Provincial Health Services Authority stated, ‘Good team. Good people to work with. Extremely professional. Extremely knowledgeable.’ This method encourages innovation and guarantees that we can effectively adjust to changing market needs. Furthermore, our emphasis on a reliable, future-proof technology stack is crucial, enabling us to adapt to evolving demands and maintain a competitive edge.

What’s holding your team back from embracing this opportunity?

Cost-Effectiveness: Financial Benefits of Adopting Modular Banking Solutions

Implementing flexible financial solutions is a game-changer for financial organizations, offering significant cost reductions. By leveraging a pay-as-you-grow model, we can selectively invest in only the necessary modules, avoiding unnecessary expenditures on features that don’t align with our strategic objectives. This targeted investment approach minimizes upfront costs and allows for scalability as our needs evolve.

Furthermore, the streamlined operations and enhanced efficiency linked to flexible banking significantly lower operational costs, enabling us to allocate resources more effectively. This financial flexibility is essential for maintaining a competitive edge in an increasingly challenging market.

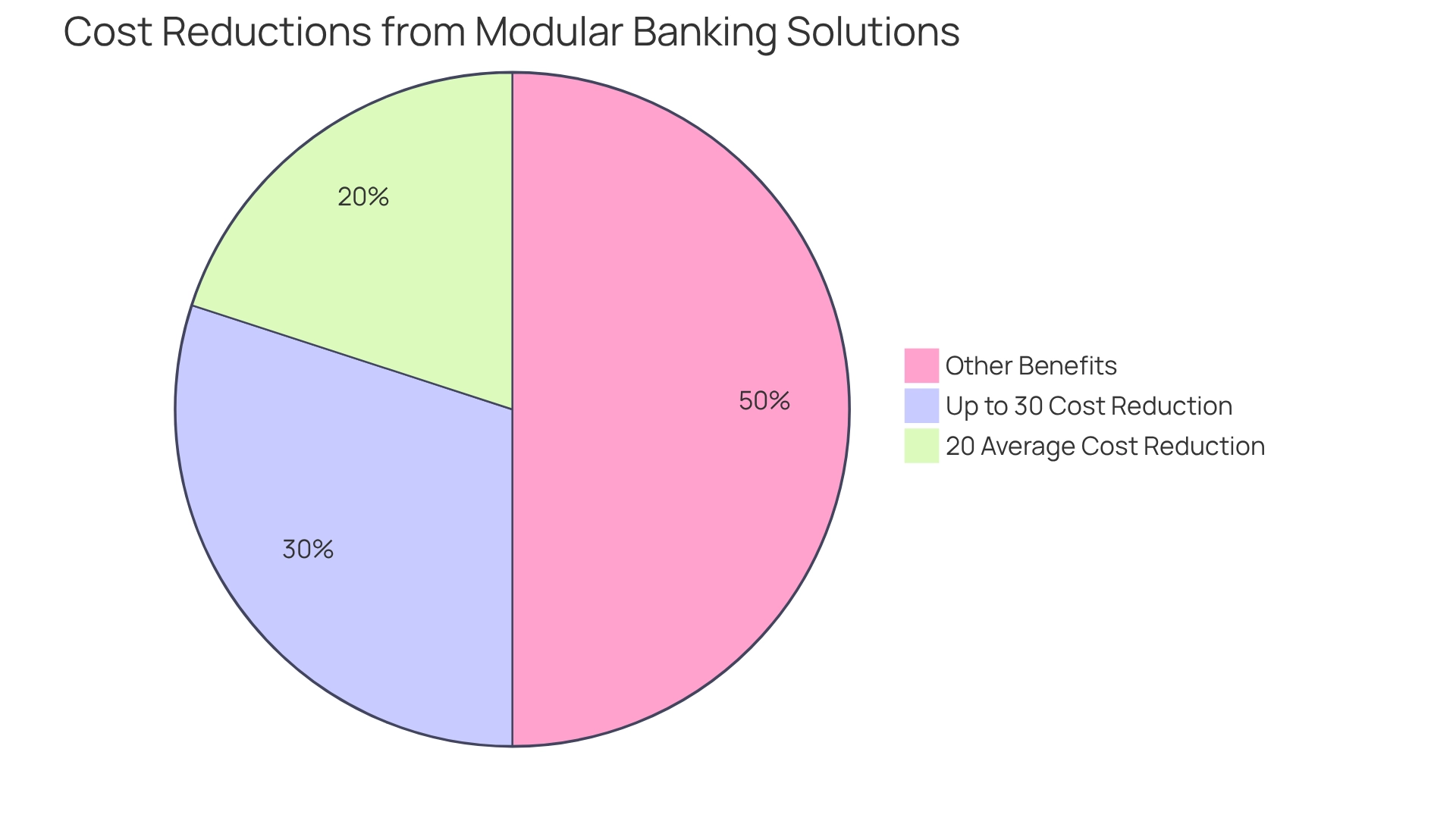

In 2025, institutions that embrace modular banking solutions report an average cost reduction of 20% in operational expenses, underscoring the financial benefits of this innovative approach. Notably, Avato, established in 2010, exemplifies this achievement with its Hybrid Platform, which has been commended for streamlining intricate projects and delivering outcomes within budget constraints, guaranteeing 24/7 availability for essential connections.

Since its inception, Avato has successfully implemented hybrid connection solutions across various financial institutions, demonstrating our capability to manage complex linkages with speed and reliability. Case studies reveal that organizations adopting modular banking have successfully reached their integration objectives, with some reporting operational cost decreases of up to 30%, further confirming the cost-efficiency of these solutions.

What’s holding your team back from harnessing these benefits? We invite you to explore how our solutions can transform your financial operations.

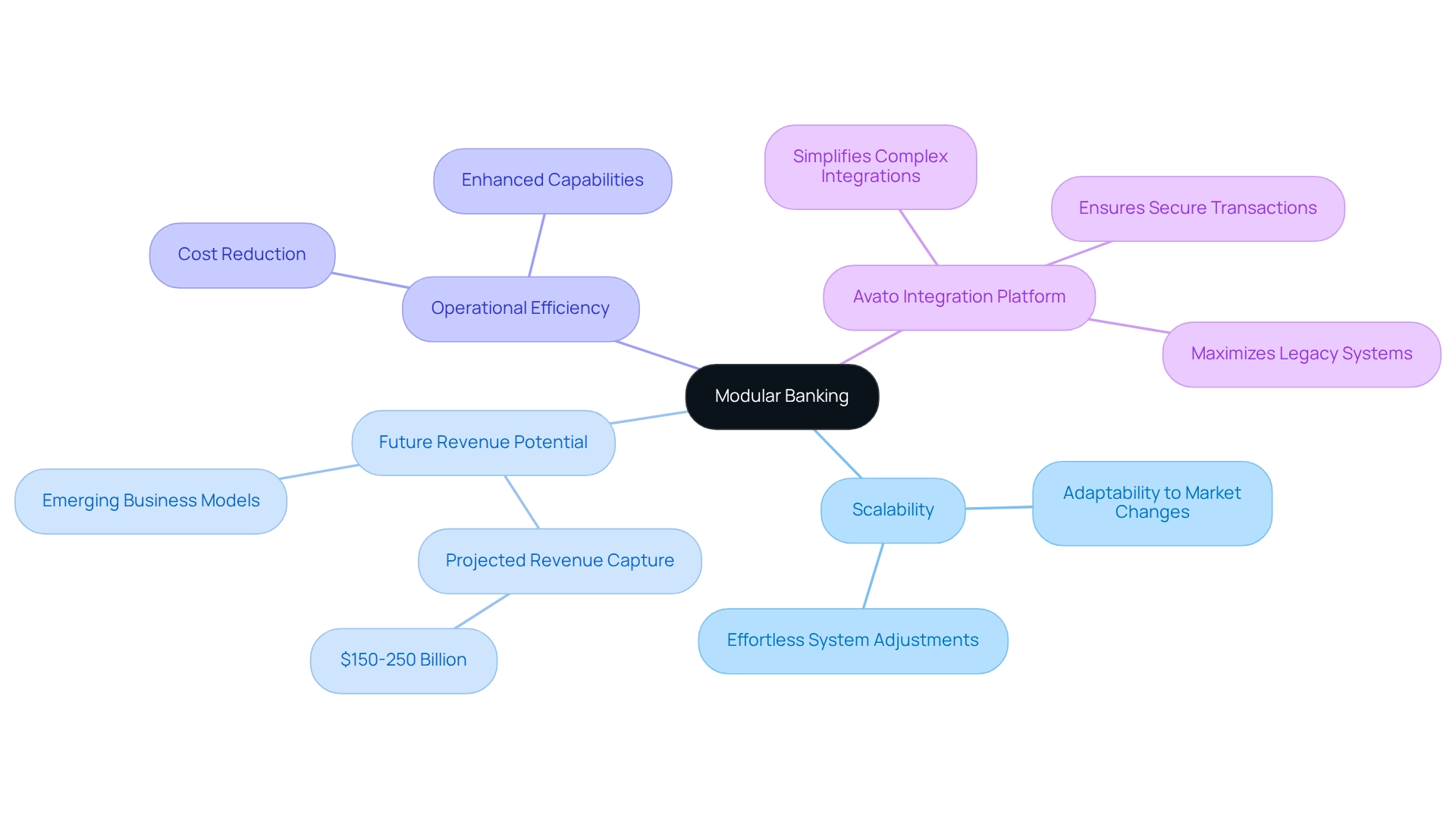

Scalability: Growing with Market Demands Through Modular Banking

Modular banking offers the essential scalability that we, as financial institutions, require to align with evolving market demands. As customer preferences shift, we can effortlessly adapt our systems with modular banking by adding or removing modules, thereby enhancing our agility and responsiveness. This adaptability becomes vital during periods of rapid expansion or when entering new markets, allowing us to leverage modular banking to adjust our offerings swiftly without the burden of extensive system overhauls.

By embracing modular banking as a flexible architecture, we not only secure our operations for the future but also position ourselves to seize emerging opportunities within the financial landscape. In 2025, the scalability advantages of flexible financial solutions will be underscored by the potential for new business models to capture $150-250 billion of current revenues in financial services, as projected by industry specialists.

Furthermore, organizations like ours that leverage modular banking solutions can significantly reduce costs while enhancing their operational capabilities. Avato’s hybrid integration platform plays a pivotal role in this transformation, simplifying complex integrations and ensuring secure transactions across finance, healthcare, and government sectors.

As Gustavo Estrada has noted, Avato simplifies intricate projects and delivers outcomes within preferred timelines and financial limits, demonstrating how component-based systems can enhance our operations. This strategic approach ensures that we can thrive in a dynamic environment, effectively meeting customer needs while maintaining a competitive edge.

What’s holding your team back from embracing this transformative potential? Let us guide you toward a future where flexibility and responsiveness define your success.

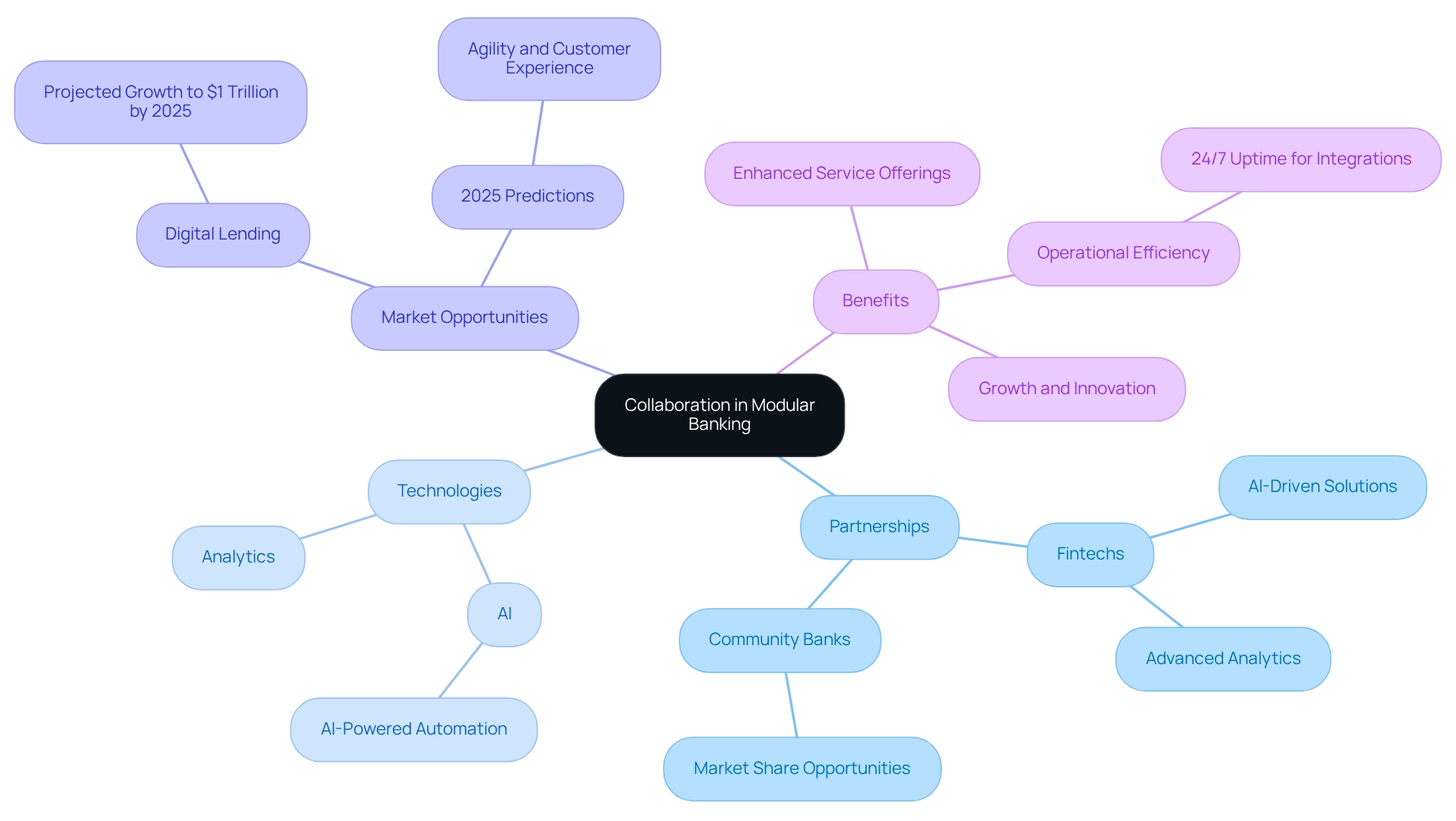

Collaboration Opportunities: Partnering with Fintechs in Modular Banking

Modular banking presents a transformative opportunity for collaboration between conventional financial institutions and fintech companies. By adopting a modular banking approach, we can seamlessly integrate third-party services, significantly enhancing our product offerings without the burden of extensive internal development. This strategic partnership enables us to leverage the innovative capabilities of fintechs, including advanced analytics and AI-driven solutions, which are crucial for elevating customer experiences and optimizing operational efficiency. As the financial landscape evolves, these collaborations empower us to remain competitive and responsive to the ever-changing demands of our customers.

Looking ahead to 2025, the integration of external services is poised to become a pivotal factor for success in the financial industry. Experts agree that agility and customer experience will be paramount, with predictions indicating a transformative year for financial services, particularly through AI-driven automation. According to the NVIDIA 2025 State of AI in Financial Services survey, nearly 70% of companies reported at least a 5% revenue increase linked to AI implementations, underscoring the potential for us to enhance our offerings through strategic AI integration. As G+D Netcetera states, “Our flexible digital finance platform equips financial organizations for the challenges of digital change,” emphasizing the importance of these partnerships.

Furthermore, community banks stand ready to seize market share as larger institutions withdraw from commercial real estate lending, creating additional avenues for collaboration. Successful case studies illustrate the promise of digital peer-to-peer lending, projected to reach a market size of $1 trillion by 2025, demonstrating the growing adoption of fintech solutions. These examples underscore the significance of modular banking in fostering collaborations that not only enhance service offerings but also drive growth and innovation within the financial industry. Additionally, we at Avato ensure 24/7 uptime for critical integrations, highlighting the reliability of modular banking solutions in sustaining operational efficiency and supporting the transformative impact of AI on trading, customer engagement, and security. Our commitment to providing a robust foundation for digital transformation initiatives further reinforces the value of these collaborations.

Data-Driven Decisions: Leveraging Analytics in Modular Banking

Modular financial systems empower data-driven decision-making by embedding advanced analytics capabilities within our frameworks. By harnessing real-time data from diverse modules, we enable financial institutions to extract meaningful insights into customer behavior, operational efficiency, and emerging market trends. This analytical approach not only facilitates informed decision-making but also enhances customer satisfaction and drives profitability. For instance, we can examine transaction data to reveal spending trends, allowing us to offer customized financial guidance that enhances customer interaction and loyalty.

As we prepare for open financial systems, the advancement of data analytics becomes crucial. It allows us to refine our operations and benchmark performance against industry standards. A case study on enhancing financial institution performance through data analytics illustrates how we can leverage these insights to improve customer retention by monitoring digital engagement metrics and identifying new revenue opportunities. Specifically, financial institutions that utilized data analytics reported a significant increase in customer retention rates, demonstrating the effectiveness of these strategies. Furthermore, statistics indicate that payments and cash management data can reveal underutilized financial products, which are crucial for decision-making. By examining transaction trends, we can recognize products that clients are not fully taking advantage of, enabling us to customize marketing approaches and enhance product selections.

However, as we prepare for open financial services and implement modular banking systems, it is crucial to utilize existing legacy systems instead of eliminating them. Employing a middle layer for data translation can ease connection across different platforms, ensuring that valuable legacy data is not lost. Furthermore, we must not overlook the security implications of open financial integration. As Hilary Mason emphasizes, the human element of data analytics is essential for interpreting data effectively, particularly when considering the increased security needs of open financial services. As we continue to adopt modular banking systems and prepare for open banking, the effective use of analytics will be crucial in driving our decision-making processes, ultimately enhancing our operational capabilities and fostering long-term client relationships.

Conclusion

Embracing a hybrid integration platform like Avato is not just beneficial; it is essential for financial institutions striving to modernize operations while ensuring compliance and security. The seamless connection of legacy systems with innovative technologies empowers us to enhance operational efficiency and respond adeptly to the evolving demands of consumers, particularly given the increasing popularity of mobile wallets. This adaptability is crucial in a competitive landscape where customer expectations are continuously rising.

The advantages of modular banking are evident: it enables us to customize services, streamline workflows, and enhance customer experiences through advanced technologies and real-time data analytics. By implementing these solutions, we not only reduce operational costs but also position ourselves to innovate and launch new financial services rapidly. Furthermore, our ability to integrate with fintech partners expands our capabilities, allowing us to stay ahead of industry trends and customer needs.

Ultimately, our journey towards modernization and operational excellence in the banking sector is driven by strategic integration and a commitment to embracing change. As we navigate the complexities of digital transformation, leveraging modular banking solutions with Avato’s hybrid integration platform will be pivotal in achieving sustainable growth and enhancing customer satisfaction. The time to act is now—embracing this transformative approach will not only secure a competitive edge but also foster long-term success in the dynamic financial services landscape.