Overview

Applications integration significantly enhances our banking efficiency by streamlining processes, improving data accessibility, and fostering collaboration across departments. This integration is not just a technical upgrade; it is a strategic imperative. By adopting such solutions, we can:

- Reduce operational costs

- Enhance customer experiences

- Ensure better compliance with regulatory standards

Ultimately, this positions us to adapt swiftly to market changes and innovate effectively. What’s holding your team back from embracing this transformation?

Introduction

In the rapidly evolving landscape of banking technology, we recognize that the need for secure and efficient integration solutions has never been more critical.

Our hybrid integration platform stands out as a transformative tool, designed to connect legacy systems with modern applications while ensuring compliance and data security.

As financial institutions navigate the complexities of digital transformation, they face the challenge of enhancing operational efficiency without compromising the integrity of sensitive information.

With a staggering number of cybersecurity positions unfilled globally, the urgency for robust security measures is palpable.

We address these needs by:

- Streamlining processes

- Improving data accessibility

- Fostering collaboration across departments

This article delves into the myriad benefits of our integration platform, illustrating how we empower banks to adapt to market changes, reduce operational costs, and ultimately enhance customer experiences through seamless interactions.

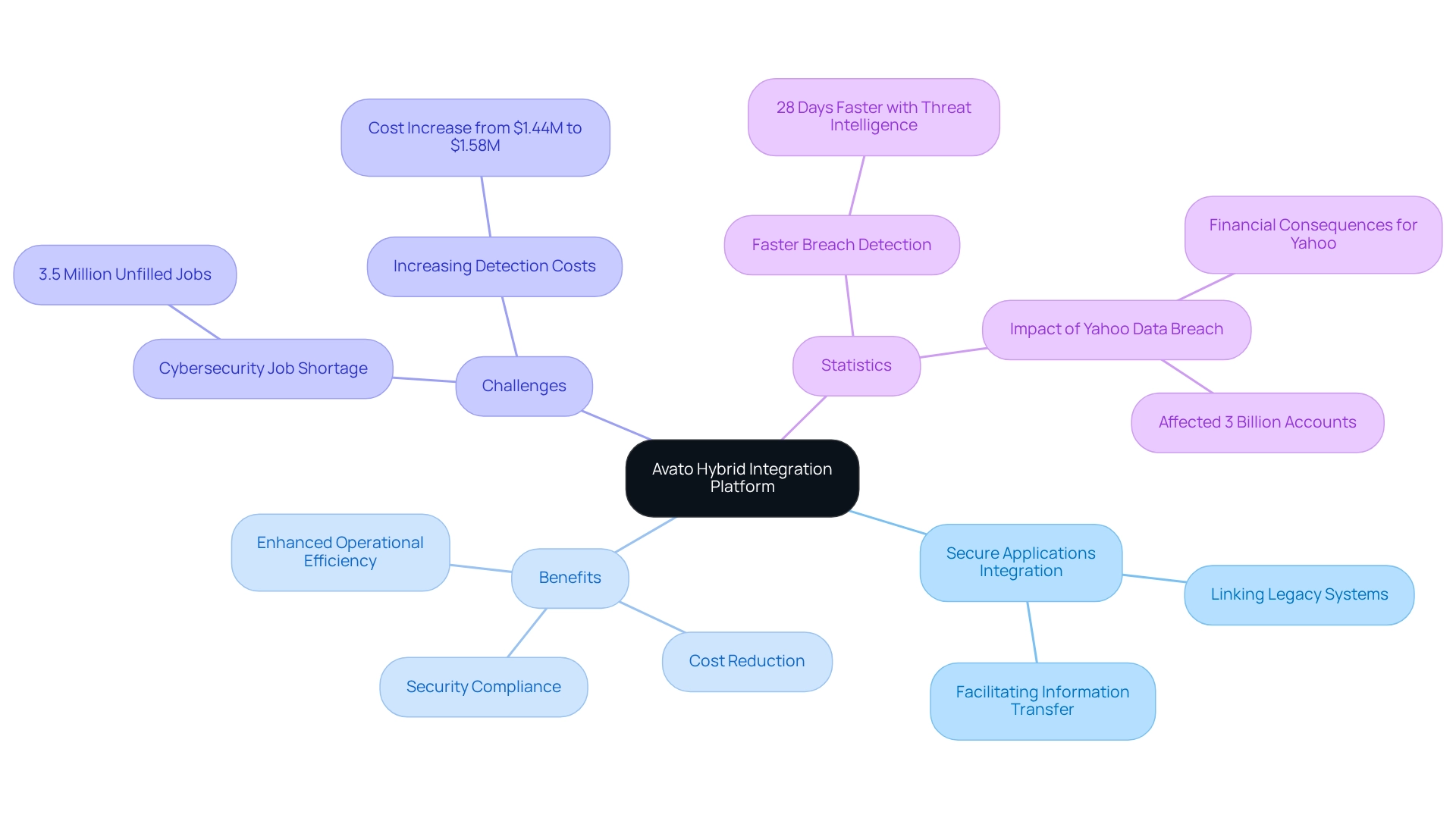

Avato: Secure Hybrid Integration Platform for Reliable System Connections

At Avato, we recognize the critical need for secure integration within banking institutions. Our hybrid integration platform is meticulously designed to enable applications integration, linking various networks and facilitating seamless information transfer between legacy systems and modern applications. This empowers banks to enhance operational efficiency while rigorously upholding security standards. In an era where financial institutions strive to modernize without compromising information integrity, our solution is indispensable.

In 2023, the global landscape revealed a staggering 3.5 million unfilled cybersecurity jobs, underscoring the urgent need for robust security measures in banking. As organizations increasingly adopt cloud technologies, enhancing cloud security protocols has become paramount. We tackle these challenges head-on by offering a secure applications integration solution that mitigates risks associated with digital transformation, significantly reducing costs while enhancing the value of legacy systems. Our platform’s ability to enable secure applications integration is further supported by expert insights that emphasize the importance of protecting sensitive financial information. Successful implementations of our unification solutions in financial institutions have demonstrated substantial improvements in operational efficiency and security compliance. For instance, entities utilizing threat intelligence services have detected breaches 28 days faster, highlighting the critical role of timely data amalgamation in bolstering security responses.

Moreover, our hybrid platform features real-time monitoring and alerts on performance—essential for maintaining operational integrity and swiftly addressing potential issues. This proactive approach to applications integration and system management ensures that financial institutions can operate effectively while minimizing risks. Our commitment to providing a reliable and secure hybrid integration platform positions us as a leader in the financial sector. We empower organizations to navigate the complexities of modern connectivity while maintaining a competitive edge. We invite banking IT managers to consider our platform as a strategic solution to enhance their integration efforts and safeguard their operations against evolving threats.

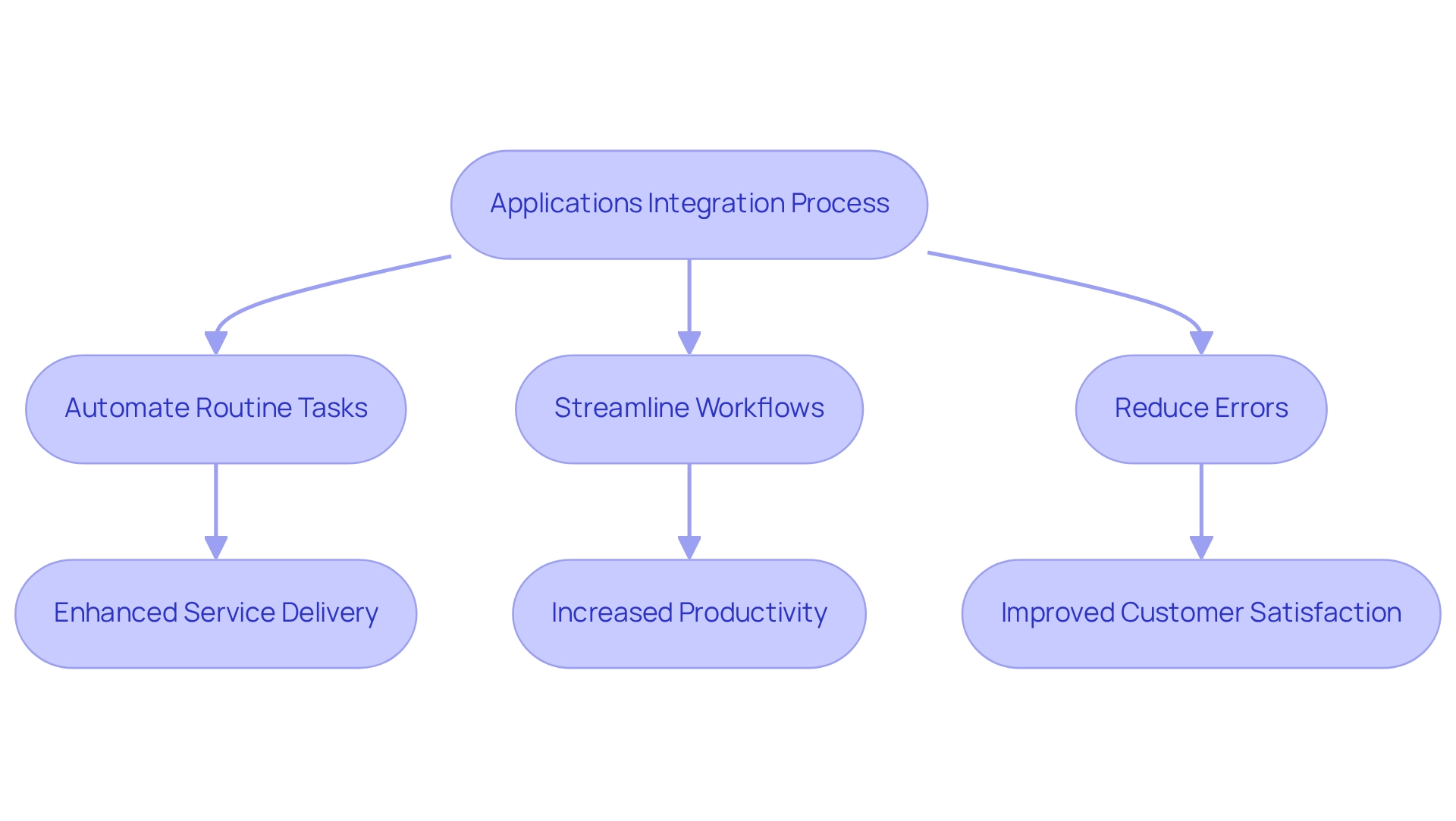

Increased Operational Efficiency Through Streamlined Processes

The applications integration process empowers us as financial institutions to automate routine tasks and streamline workflows, drastically reducing the time and effort required for various operations. Consider this: institutions leveraging automated data entry and transaction processing have reported up to a 98% decrease in errors, significantly enhancing service delivery and accelerating response times. This operational efficiency not only boosts our productivity but also enables us to allocate resources more strategically, ultimately elevating customer satisfaction.

Looking ahead to 2025, we anticipate that institutions embracing automation will experience substantial time savings, with many organizations highlighting improved accuracy and compliance as primary advantages of finance automation. Case studies reveal that banks adopting applications integration have achieved operational efficiencies that enhance data quality for decision-making and reduce human error, underscoring the strategic importance of automation in the banking sector.

Furthermore, a recent NVIDIA survey indicates that nearly 70% of firms reported at least a 5% revenue increase attributable to AI implementations, showcasing AI’s dual role as both a revenue generator and an efficiency enhancer. Innovations such as Avato’s hybrid connectivity platform are crucial in this context, as they facilitate secure connections for banking, healthcare, and government sectors. By simplifying complex integrations, Avato enables us to effectively harness generative AI tools, enhancing customer experience and operational visibility.

To implement these automation strategies effectively, we must identify key processes for automation, ensuring a smoother transition towards enhanced operational efficiency.

Enhanced Data Accessibility for Informed Decision-Making

Applications integration through our integrated systems empowers us to provide financial institutions with real-time information across various departments, facilitating informed decision-making. This capability offers timely insights into customer behavior, market trends, and operational performance. For instance, we enable banks to swiftly analyze transaction information, uncovering spending patterns that significantly influence marketing strategies and product development.

By 2025, the importance of immediate information availability is underscored by our IT teams’ ability to manage transaction environments and identify issues 75% faster. This illustrates our commitment to enhancing operational flexibility and streamlining complex connectivity projects through applications integration. Our hybrid integration platform not only simplifies banking operations but also protects infrastructures, enabling applications integration of new tools with existing assets.

Such improved information accessibility fosters a responsive approach to customer needs and market dynamics, ultimately leading to better decision-making outcomes. As one of our customers, Gustavo Estrada, noted, ‘Avato has simplified complex projects and delivered results within desired time frames and budget constraints,’ validating the impact of our platform on banking efficiency.

Furthermore, the growing trend of information collaboration, bolstered by generative AI technologies, is transforming banking operations, highlighting the necessity for applications integration that can adapt to evolving market demands and sustain a competitive advantage.

Improved Collaboration Across Departments

Applications integration is essential for fostering improved cooperation among various departments within our bank, as it creates a unified platform for communication and information sharing. For instance, our customer service, marketing, and compliance teams can seamlessly access the same data, ensuring alignment across functions. This cooperative environment not only simplifies our internal procedures but also significantly enhances the customer experience by delivering consistent and knowledgeable service through applications integration.

Statistics indicate that organizations leveraging interconnected frameworks witness a marked increase in collaboration. Specifically, 29% of support teams across sectors, including banking, are planning to invest in knowledge base enhancements in 2024. This reflects a growing recognition of the importance of shared information in improving collaboration, service delivery, and applications integration.

As John Restrick, CTO for Room Systems at Cisco, points out, the modern workforce is increasingly comfortable with integrated technologies that facilitate smoother interactions. In the context of banking, this means that applications integration through integrated networks can help our teams communicate more effectively, leading to faster decision-making and enhanced service.

Our Avato hybrid integration platform exemplifies this approach, designed to expedite secure applications integration for the banking, healthcare, and government sectors. By providing a robust foundation for applications integration in digital transformation initiatives, we enable organizations to enhance operational visibility and improve issue resolution.

Case studies demonstrate these benefits in action. For example, banks that have adopted integrated communication platforms, like Gorgias, report improved interdepartmental communication, resulting in quicker response times and heightened customer satisfaction. Deja Jefferson, Customer Experience Manager at Topicals, emphasized how monitoring customer satisfaction ratings through integrated platforms has improved internal performance evaluations and helped identify areas for enhancement.

By breaking down barriers, applications integration not only boosts operational efficiency but also empowers our teams to collaborate effectively, ultimately leading to better outcomes for both employees and customers.

To implement these cohesive frameworks, we encourage banking IT managers to advocate for the use of unified communication platforms that support applications integration, data sharing, and collaboration. This can be accomplished by conducting a needs assessment within their departments to pinpoint specific integration opportunities that align with their operational goals.

Moreover, leveraging generative AI within these integrated systems can significantly enhance customer experience and operational efficiency, as evidenced by the transformative impact of AI on financial services highlighted in the NVIDIA 2025 survey. By integrating AI-driven solutions, we can revolutionize trading, customer engagement, and security, positioning ourselves at the forefront of the industry.

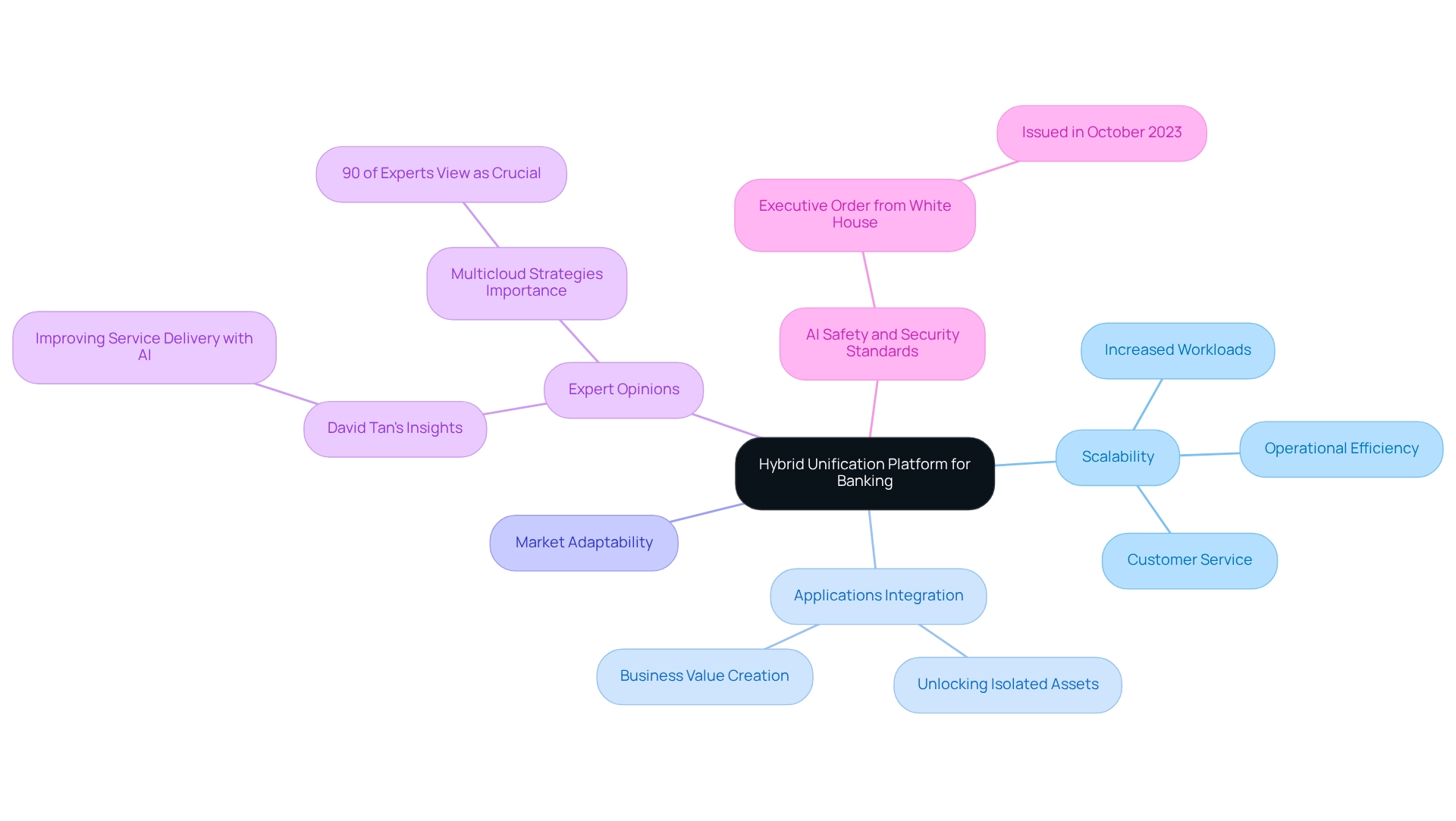

Greater Scalability to Adapt to Market Changes

We recognize that a hybrid unification platform like Avato significantly enhances the scalability of banking operations through applications integration, empowering institutions to swiftly adapt to evolving market demands. This agility is essential, especially during peak transaction periods when applications integration enables integrated systems to effectively handle increased workloads, ensuring uninterrupted customer service.

Avato, developed from our commitment to crafting innovative technology solutions, enables applications integration for financial institutions to unlock isolated assets and create business value through its hybrid connection platform. A recent report indicates that over 90% of banking experts regard multicloud strategies as a crucial or highly significant strategic issue, underscoring the necessity of unification for maintaining a competitive edge.

As financial institutions face the dual challenge of leveraging technology while ensuring cybersecurity, the ability to achieve applications integration and rapidly adjust systems and processes without substantial downtime or resource allocation is vital.

David Tan, CTO of CrushBank Technology, Inc., emphasizes this, stating, “We are especially interested in using the summarization features in watsonx.ai to greatly improve service delivery.”

By embracing hybrid unification, we can not only respond to market fluctuations but also enhance our operational capabilities, ultimately fostering efficiency and boosting customer satisfaction. Moreover, with the recent Executive Order from the White House concerning AI safety and security standards, the integration of advanced technologies becomes even more critical in navigating the complexities of modern banking.

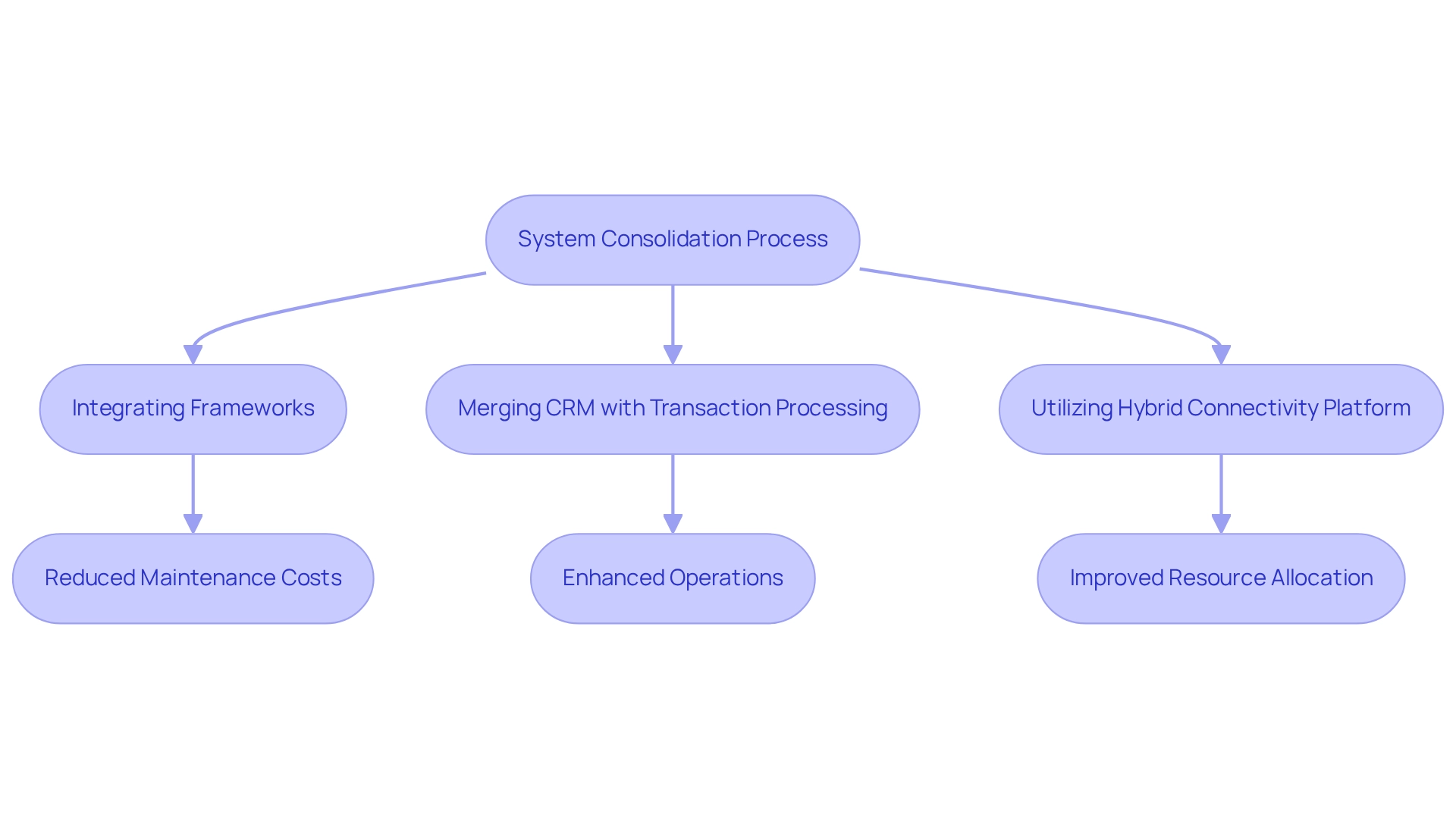

Reduced Operational Costs Through System Consolidation

Integrating frameworks is essential for banks aiming to significantly reduce operational expenses. By streamlining the number of platforms we utilize, we can lower maintenance costs, decrease licensing fees, and minimize the training required for our staff.

For example, merging customer relationship management (CRM) with transaction processing systems eliminates unnecessary processes, enhances operations, and leads to substantial long-term cost savings. Statistics reveal that banks embracing consolidation have seen operational costs decrease by as much as 30%, underscoring the financial viability of such strategies.

Furthermore, outdated infrastructure often leads to technological limitations and scalability issues, making connectivity not just beneficial but vital for modern banking operations. Our dedicated hybrid connectivity platform empowers businesses to future-proof their operations through seamless data and applications integration, enhancing overall efficiency and enabling better resource allocation.

Additionally, the digital adoption rate has surged from 35-45% with traditional frameworks to 70-85% with modern core platforms, highlighting the broader impact of unification on operational efficiency and digital transformation within financial institutions.

Case studies demonstrate that organizations prioritizing integrated systems not only cut maintenance costs but also boost overall efficiency, allowing for more effective resource distribution. This strategic approach to applications integration enhances operational capabilities and enables financial institutions to respond swiftly to market shifts, ultimately fostering a more sustainable financial landscape.

As noted in the NVIDIA 2025 survey, nearly 70% of companies reported at least a 5% revenue growth associated with AI implementations, emphasizing the transformative potential of AI in banking and the importance of collaboration in achieving these goals.

Enhanced Customer Experience Through Seamless Interactions

Unified platforms empower us to provide a seamless customer experience, ensuring that every interaction is smooth and efficient. When a customer reaches out for support, our representatives can instantly access their complete transaction history and preferences, enabling personalized service. This immediate access not only boosts customer satisfaction but also cultivates loyalty, as clients feel recognized and valued.

By prioritizing customer-centric strategies, we can transform our clients into advocates, which is crucial in a competitive market where products and services can be easily replicated. Insights indicate that it generally requires a minimum of five years for companies to observe a measurable effect on customer experience, highlighting the long-term dedication necessary for effective implementation. This commitment is essential, as customer service is a continuous process that requires our dedication and care.

Furthermore, banks that effectively adopt applications integration report greater customer satisfaction levels, showcasing the vital role of smooth interactions in nurturing positive relationships with clients. As noted by Gustavo Estrada, a client, ‘Avato has streamlined intricate projects and provided outcomes within preferred time frames and financial limitations,’ demonstrating the concrete advantages of unification.

Our hybrid connectivity platform accelerates secure connections for banking, healthcare, and government, ensuring that institutions can meet the changing requirements of 2025 and beyond. Additionally, the challenges faced by GCC banks due to failing legacy systems underscore the necessity of applications integration to overcome current industry obstacles.

By leveraging insights from the case study titled ‘Competitive Advantage through Customer Experience,’ it becomes clear that focusing on customer-centric strategies not only enhances satisfaction but also ensures retention and advocacy in a competitive landscape. Moreover, the integration of generative AI technologies, such as chatbots and virtual assistants, further enhances customer experience and operational efficiency, streamlining processes and improving productivity across various departments.

Support for Regulatory Compliance and Data Security

Integration platforms like Avato are indispensable for applications integration, which fortifies compliance and information security within the banking sector. By centralizing data management and facilitating secure applications integration for data transfers, we significantly reduce the risks associated with data breaches and regulatory non-compliance.

Automated compliance checks are part of applications integration that seamlessly connect with transaction processing systems, ensuring that all operations adhere to regulatory standards without the need for manual oversight. This proactive strategy not only boosts operational efficiency but also strengthens the overall security posture of financial institutions, and our applications integration through unifying platforms has shown measurable enhancements in regulatory compliance.

Statistics indicate that organizations utilizing such technologies for applications integration experience a significant reduction in compliance-related incidents, with numerous financial institutions reporting a decrease in data security breaches following applications integration. We guarantee round-the-clock availability for crucial connections, which is vital for sustaining operational reliability and compliance.

Case studies emphasize how financial institutions, like Coast Capital, have effectively navigated intricate regulatory frameworks by employing our applications integration solutions, showcasing the efficiency of these platforms in ensuring compliance while enhancing performance.

As the regulatory landscape continues to evolve in 2025, the importance of robust applications integration strategies cannot be overstated. Experts emphasize that a comprehensive strategy for applications integration is crucial for financial institutions striving to stay ahead of regulatory obligations. By investing in advanced technologies for applications integration, such as those we provide at Avato, financial institutions not only safeguard their operations but also enhance their ability to respond to regulatory changes swiftly and efficiently.

Improved Analytics Capabilities for Strategic Insights

Unified frameworks empower us to harness advanced analytical tools, enabling us to extract profound insights into our operations and client behaviors. By leveraging Avato’s Hybrid Integration Platform, we can enhance and extend the value of our legacy systems while simplifying applications integration. This platform provides real-time tracking and notifications regarding system performance, significantly reducing management-related costs. By analyzing transaction data across diverse channels, we can uncover trends and patterns that inform our strategic decision-making. This analytical capability not only optimizes our product offerings but also fortifies our risk management practices and elevates our overall performance.

With disorganized information comprising 80%-90% of the total data generated, our ability to analyze such content becomes crucial for identifying market trends and consumer behaviors. Efficient information analysis tools, supported by Avato’s platform, are essential for managing this unstructured data, allowing us to derive insights that shape our strategies. As we increasingly recognize data collaboration as a competitive necessity, applications integration of analytics into our frameworks is now vital for maintaining a strategic edge in the sector.

Moreover, harnessing analytics capabilities can greatly enhance our decision-making processes and operational improvements, enabling us to respond swiftly to emerging challenges and opportunities. Recent findings highlight that generative AI is revolutionizing customer experience in financial services, with over half of financial professionals employing it for document processing and report generation. This shift reinforces the imperative of incorporating advanced analytics and AI capabilities into our banking systems.

As Hilary Mason, a data scientist and founder of Fast Forward Labs, aptly states, ‘At the core of data analytics and data science is curiosity and learning; finding patterns, telling stories, and deepening your understanding of the world around you.

Facilitated Innovation Through Quick Technology Implementation

Integration platforms are essential for financial institutions seeking applications integration to rapidly adopt new technologies and foster a culture of innovation. When faced with new regulatory requirements, we can seamlessly integrate compliance solutions into our existing systems, minimizing downtime. This agility not only ensures compliance but also facilitates applications integration, enabling us to introduce new products and services that meet evolving customer needs, thereby maintaining a competitive edge in a fast-paced market.

Statistics reveal that banks leveraging connection platforms, such as Avato’s hybrid connection platform, achieve implementation speeds that significantly outpace traditional methods. Organizations utilizing Avato’s solutions report markedly higher innovation rates, with many adapting to new technologies within weeks instead of months. This swift implementation capability is crucial as the banking landscape evolves, where data literacy is becoming as vital as financial expertise for banking professionals.

Case studies underscore the tangible benefits of this approach. For instance, DBS Bank successfully reduced compliance costs by 26% through automated regulatory reporting, illustrating how unification can streamline operations and enhance efficiency. Additionally, an operational capacity enhancement initiative at a major financial institution demonstrated that aligning branch objectives with corporate strategy, supported by effective coordination, led to increased transparency and a culture of continuous improvement.

Expert opinions emphasize the importance of innovation through applications integration in banking. Renoir observed, “Enhanced customer service oversight led to 86% of clients stating they would recommend the institution to their friends and colleagues,” highlighting the impact of unification on customer satisfaction. As the industry faces mounting pressure to adapt, our ability to swiftly implement new technologies will be a defining factor for success. We encourage banking IT managers to assess their current systems and consider adopting Avato’s hybrid connection solutions, which offer features like 24/7 uptime and support for 12 levels of interface maturity, to enhance operational capabilities. By facilitating innovation, applications integration platforms not only bolster our operational capabilities but also position us to thrive in an increasingly competitive environment.

Conclusion

The advantages of adopting a hybrid integration platform like Avato are profound and far-reaching for banking institutions. By securely connecting legacy systems with modern applications, we enhance operational efficiency while fortifying compliance and data security, addressing the urgent need for robust cybersecurity measures in an industry facing significant talent shortages.

Through streamlined processes, we can automate routine tasks, leading to dramatic reductions in errors and improvements in service delivery. The ability to access real-time data across departments fosters informed decision-making, while enhanced collaboration ensures that our teams work cohesively towards common goals, ultimately enriching the customer experience. Moreover, the scalability of Avato’s platform allows financial institutions to adapt swiftly to market changes, ensuring they remain competitive during peak transaction periods.

Cost reductions through system consolidation are another compelling benefit, with banks reporting operational savings that can reach up to 30%. This financial viability, coupled with improved analytics capabilities, empowers us to extract valuable insights that drive strategic decisions and foster innovation. By integrating advanced technologies, including AI, we can not only meet evolving regulatory requirements but also enhance customer interactions, cultivating loyalty and satisfaction.

In summary, Avato’s hybrid integration platform emerges as a vital solution for banks aiming to navigate the complexities of modern banking. By embracing this technology, we can enhance operational efficiency, ensure compliance, and ultimately deliver a superior customer experience, positioning ourselves for sustained success in an increasingly competitive landscape.